Unit 4: Unpaid Seller Chapter Notes | Business Laws for CA Foundation PDF Download

Overview

Introduction

A contract consists of mutual promises. In a sales contract, when the seller is obligated to deliver goods, the buyer is required to make payment. If the buyer fails or refuses to pay, the seller, as an unpaid seller, is entitled to certain rights.

As per Section 45(1) of the Sale of Goods Act, 1930, a seller is considered an 'Unpaid Seller' in the following situations:

(a) When the full price has not been paid or offered, and the seller has the immediate right to claim the price.

(b) When a bill of exchange or another negotiable instrument is received as conditional payment, and the condition has not been met due to the dishonor of the instrument or other reasons.

The term 'seller' includes anyone in the position of a seller, such as a seller's agent with an endorsed bill of lading, or a consignor or agent who has paid or is directly responsible for the price. [Section 45(2)]

Example 1: If X sells goods to Y for ₹ 50,000, and Y pays ₹ 40,000 but fails to pay the remaining balance, X is considered an unpaid seller.

Example 2: If P sells goods to R for ₹ 60,000 and receives a cheque for the full amount, but the cheque is dishonored by the bank upon presentation, P is an unpaid seller.

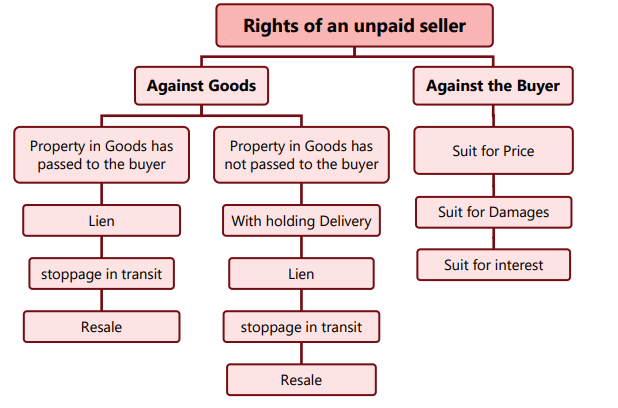

Rights of an Unpaid Seller

Unpaid seller’s right (Section 46): - Subject to the provisions of this Act and any applicable law, the unpaid seller of goods has certain rights by implication of law, even if the property in the goods has passed to the buyer.

These rights include:

- A lien on the goods for the price while in possession of them.

- In case of the buyer's insolvency, the right to stop the goods in transit after parting with possession.

- A right of re-sale as limited by this Act.

- If the property in goods has not passed to the buyer, the unpaid seller has the right to withhold delivery, which is similar to and co-extensive with the rights of lien and stoppage in transit where the property has passed to the buyer.

- The unpaid seller has rights against both the goods and the buyer personally, which are discussed further below.

Rights of an unpaid seller against the goods:

The right of unpaid seller against goods can be categorized under two headings.

Rights of Unpaid Seller Against the Goods

1. Seller’s Lien (Section 47)Rights of Lien: An unpaid seller has the right to retain possession of goods and refuse to deliver them until the price is paid or tendered. This right applies when the seller is in possession of the goods.

The unpaid seller’s lien is a possessory lien , meaning it can be exercised as long as the seller remains in possession of the goods.

The right of lien can be exercised in the following situations:

- When goods are sold without any credit stipulation (cash sale).

- When goods are sold on credit, but the credit term has expired.

- When the buyer becomes insolvent.

Example 3: If A sells goods worth ₹ 50,000 to B with a one-month credit period, and B becomes insolvent during this period, A can exercise his right of lien.

The seller can exercise the right of lien even if he is holding the goods as an agent or bailee for the buyer.

In legal terms, a person is considered insolvent if they are unable to pay their debts as they become due, regardless of any formal acts of insolvency.

Part Delivery (Section 48): If an unpaid seller has made part delivery of goods, he can exercise his right of lien on the remaining goods, unless the part delivery was made under circumstances indicating an agreement to waive the lien.

Termination of Lien (Section 49): The unpaid seller loses his right of lien in the following situations:

- When he delivers the goods to a carrier or other bailee for transmission to the buyer without reserving the right of disposal.

- When the buyer or his agent lawfully obtains possession of the goods.

- When the seller waives the right of lien.

- By estoppel, where the seller’s conduct leads third parties to believe that the lien does not exist.

Exception: The unpaid seller does not lose his lien merely because he has obtained a decree for the price of the goods. This means that even if the seller has secured a court order for the price, he can still exercise his right to lien on those goods.

Example 4: A, sold a car to B for ₹ 1,00,000 and delivered the same to the railways for the purpose of transmission to the buyer. The railway receipt was taken in the name of B and sent to B. Now A cannot exercise the right of lien.

2. Right of Stoppage in Transit (Section 50 to 52)

Meaning of Right of Stoppage in Transit (Section 50):

- The right of stoppage in transit refers to the seller's ability to stop goods in transit and regain possession of them until full payment is received.

- This right comes into play when the unpaid seller has entrusted goods to a carrier and the buyer is insolvent. In such cases, the seller can request the carrier to return the goods or refrain from delivering them to the buyer.

- Essentially, this right extends the seller's ability to reclaim possession of goods even after they have been handed over to a third party, like a carrier.

Conditions for Exercising the Right:

- The seller must be unpaid for the goods.

- The seller must have relinquished possession of the goods.

- The goods must be in transit at the time.

- The buyer must have become insolvent.

- The exercise of this right is subject to the provisions of the relevant legal Act (Section 50).

Example 5:

- A, a seller in Mumbai, sold goods to B in Delhi and entrusted the goods to C, a common carrier, for delivery to B.

- Before the goods reached B, if B became insolvent, A has the right to stop the goods in transit by notifying C.

Duration of Transit (Section 51):

- Goods are considered to be in transit from the moment they are delivered to a carrier or other bailee for the purpose of transmission to the buyer until the buyer or their agent takes delivery of the goods from the carrier or bailee.

Termination of Transit and the Right of Stoppage

The right of stoppage in transit is forfeited when transit concludes. Transit comes to an end in the following scenarios:

- Delivery to Buyer or Bailee: When the buyer or another bailee receives delivery of the goods.

- Buyer’s Interception: When the buyer intercepts the goods before they reach their destination, which can occur with or without the carrier's consent.

- Acknowledgment by Carrier: When the carrier or another bailee acknowledges to the buyer or their agent that they are holding the goods, unless the seller has reserved the right to dispose of the goods.

- Wrongful Refusal by Carrier: If the carrier unlawfully refuses to deliver the goods to the buyer.

- Delivery to Buyer-Hired Carrier: When goods are delivered to a carrier hired by the buyer, transit concludes.

- Partial Delivery: When part of the delivery has been made to the buyer, transit ends for the remaining goods still in transit.

- Delivery to Buyer-Hired Ship: When goods are delivered to a ship chartered by the buyer, transit comes to an end. [section 51]

Stoppage in Transit (Section 52)

The unpaid seller has the right to stop goods in transit under Section 52 of the Sale of Goods Act. This can be done in two ways:

- Actual Possession: The seller can take physical possession of the goods from the carrier or bailee.

- Notice to Carrier: The seller can give notice of the stoppage to the carrier or bailee in possession of the goods.

Giving Notice: When giving notice, the seller can notify either the person in actual possession of the goods or their principal. If notifying the principal, the notice must be given in such a way that the principal can communicate it to their agent in time to prevent delivery to the buyer.

Carrier's Obligation: When the carrier or bailee receives notice of stoppage in transit, they are obligated to re-deliver the goods according to the seller's directions. The seller is responsible for any expenses related to this re-delivery.

Difference between Right of Lien and Right of Stoppage in Transit

The right of lien involves retaining possession of goods, while the right of stoppage in transit involves regaining possession of goods.

Right of Lien:

- The seller retains possession of the goods.

- Can be exercised even if the buyer is not insolvent.

- Ends when the goods leave the seller's possession.

Right of Stoppage in Transit:

- The seller has parted with possession of the goods.

- Possession is with a carrier, and the buyer has not yet acquired possession.

- Typically invoked when the buyer is insolvent.

- Begins when the right of lien ends.

- Comes to an end when the goods are delivered to the buyer.

Sub-Sale or Pledge by Buyer (Section 53):

- The right of lien or stoppage in transit is not affected by the buyer selling or pledging the goods unless the seller has agreed to it.

- A second buyer cannot have a better position than the first buyer (the seller).

Example 6:

- A sold goods to B, and the goods were handed over to the railways for transmission to B.

- B sold the goods to C before receiving them, but B became insolvent.

- A can still exercise his right of stoppage in transit because he did not agree to the sub-sale.

Defeat of Right of Stoppage:

- The right of stoppage is defeated if the buyer transfers the document of title or pledges the goods to a sub-buyer in good faith and for consideration.

Situations Where Unpaid Seller's Right of Lien and Stoppage in Transit are Invalidated

1. Seller's Assent to Buyer's Disposition: The unpaid seller's right of lien and stoppage in transit is defeated when the seller has agreed to the sale, mortgage, or other disposition of the goods by the buyer.

Example 7: In the case of Mount D. F. Ltd. vs Jay & Jay (Provisions) Co. Ltd, A entered into a contract to sell cartons in the possession of a wharfinger to B. A agreed with B that the price would be paid from the sale proceeds recovered from B's customers. When B sold the goods to C and received payment, but failed to pay A, A attempted to exercise his right of lien. However, the court held that A's right was defeated because he had assented to B's resale of the goods.

2. Transfer of Document of Title: The right of lien or stoppage in transit is also defeated when a document of title to goods has been transferred to the buyer, and the buyer subsequently transfers the documents to a third party who purchases the goods in good faith and for value.

a. If the transfer is by way of sale: The right of lien or stoppage in transit is defeated.

b. If the transfer is by way of pledge: The unpaid seller's right of lien or stoppage can only be exercised subject to the rights of the pledgee. The pledgee may be required by the unpaid seller to use other goods or securities of the pledger to satisfy claims before using the pledged goods.

3. Effect of Stoppage in Transit: When the seller exercises the right of stoppage in transit, the contract of sale remains in effect. The buyer still has the right to request delivery of the goods upon payment.

Right of Re-sale:

1. Definition: The right of re-sale is a crucial right granted to an unpaid seller. It allows the seller to sell the goods again under certain conditions. Without this right, the unpaid seller's other rights, such as lien and stoppage in transit, would be less effective.

2. Conditions for Exercising Right of Re-sale:

a. Perishable Goods: If the goods are perishable, the seller does not need to inform the buyer before re-selling them.

b. Non-Perishable Goods: For non-perishable goods, the seller must give notice to the buyer of his intention to re-sell. If the buyer fails to pay or tender the price within a reasonable time after receiving the notice, the seller may proceed with the re-sale.

3. Entitlement on Resale: When the seller resells the goods, he is entitled to recover the following:

- The original price of the goods.

- Any additional expenses incurred by the seller in relation to the resale.

4. Importance of Right of Re-sale: The right of re-sale is important because it provides the unpaid seller with a way to mitigate losses in case the buyer defaults. It gives the seller the ability to recoup their losses by selling the goods to another buyer.

Recovering Damages and Profits from Resale

- Recovering Damages: If the resale price is lower than the contract price, the seller can claim the difference as damages from the original buyer.

- Retaining Profits: If the resale price is higher than the contract price, the seller can keep the profit.

Conditions for Recovery: The seller can only recover damages and retain profits if the goods are resold after notifying the original buyer of the resale.

- Notice Requirement: If the seller resells the goods without notifying the buyer, they cannot claim any loss from the resale. Conversely, if there is a profit from the resale, the seller must return it to the original buyer.

- Section 54(2): This legal provision outlines the seller's rights regarding resale and profit retention.

Title Transfer in Resale

- Title Transfer: When an unpaid seller exercises their right of lien or stoppage in transit and resells the goods, the subsequent buyer obtains title to the goods against the original buyer. This holds true even if the seller does not give notice of the resale to the original buyer.

Express Right of Resale

- Express Agreement: In certain cases, the seller and buyer may explicitly agree that if the buyer fails to pay the price, the seller has the right to resell the goods to another party.

- Right of Resale: When this right is reserved, the seller can resell the goods without notifying the original buyer in case of default.

- Damages Recovery: The seller can still recover damages from the original buyer even if no notice of resale is given.

Quasi-Lien Right

- Withholding Delivery: When the property in goods has not transferred to the buyer, the unpaid seller has the right to withhold delivery of the goods. This right is similar to a lien and is referred to as “quasi-lien.”

- Application: Quasi-lien is an additional right used in cases of an agreement to sell, providing the seller with further remedies.

Rights of Unpaid Seller Against the Buyer

The rights of the unpaid seller against the buyer are called seller’s remedies for breach of contract of sale.

- Rights in Personam: These rights are in addition to the seller's rights against the goods and are aimed at the buyer personally.

- Suit for Price (Section 55): If the property in the goods has passed to the buyer and the buyer refuses to pay as per the contract, the seller can sue for the price. This is applicable in a contract of sale.

1. Suit for Price (Section 55(2))

- In a contract of sale where the price is due on a specific day regardless of delivery, if the buyer wrongfully refuses to pay, the seller can sue for the price even if the goods have not been transferred or set aside for the contract.

2. Suit for Damages for Non-Acceptance (Section 56)

- If the buyer wrongfully refuses to accept and pay for the goods, the seller can sue for damages for non-acceptance.

- The measure of damages is governed by Section 73 of the Indian Contract Act, 1872.

3. Repudiation of Contract Before Due Date (Section 60)

- If the buyer repudiates the contract before the delivery date, the seller can treat the contract as rescinded and sue for damages for breach.

- This principle is known as the "rule of anticipatory breach of contract."

4. Suit for Interest (Section 61)

- If there is a specific agreement between the seller and buyer regarding interest on the price from the due date, the seller can recover interest from the buyer.

- If no such agreement exists, the seller can charge interest from the date of notification to the buyer.

- In the absence of a contrary contract, the court may award interest to the seller at a reasonable rate from the date of tender or from the date the price was payable.

Remedies of Buyer Against the Seller

Breach of Contract by Seller

Breach of contract by seller, where he-

- Fails to deliver the goods at the time or in the manner prescribed

- Repudiates the contract

- Delivers non-conforming goods and the buyer rejects and revokes acceptance

Rights of Buyer

- Damages for non-delivery

- Suit for specific performance

- Suit for breach of warranty

- Suit for anticipatory breach

Damages for non-delivery [Section 57]:

Where the seller wrongfully neglects or refuses to deliver the goods to the buyer, the buyer may sue the seller for damages for non-delivery.

Example 8:

- ‘A’, a shoe manufacturer, agreed to sell 100 pairs of shoes to ‘B’ at the rate of ₹ 10,500 per pair. ‘A’ knew that ‘B’ wanted the shoes for further reselling them to ‘C’ at ₹ 11,000 per pair.

- On the due date of delivery, ‘A’ failed to deliver the shoes to ‘B’.

- Consequently, ‘B’ could not perform his contract with 'C’ for the supply of 100 pairs of shoes.

- In this case, 'B’ can recover damages from ‘A’ at the rate of ₹ 500 per pair (the difference between the contract price and resale price).

Suit for Specific Performance (Section 58):

- If the seller breaches the contract of sale, the buyer may appeal to the court for specific performance.

- The court can order specific performance only when the goods are ascertained or specific.

- This remedy is allowed by the court subject to the provisions of the Specific Relief Act of 1963.

- Specific performance may be granted if the goods are of special nature or are unique.

Example 9:

- ‘A’ agreed to sell a rare painting of the Mughal period to ‘B’.

- When ‘A’ refused to sell the painting on the due date of delivery, ‘B’ may file a suit against ‘A’ for obtaining an order from the court to compel ‘A’ to perform the contract (i.e., to deliver the painting to ‘B’ at the agreed price).

Suit for Breach of Warranty (Section 59):

- Where there is a breach of warranty on the part of the seller, or where the buyer elects to treat a breach of condition as a breach of warranty, the buyer is not entitled to reject the goods only on the basis of such breach of warranty.

- The buyer may take necessary actions as per the provisions of the law.

Legal Actions for Breach of Warranty

- Claim Against Seller: A buyer can bring a claim against the seller for breach of warranty, seeking either a reduction in price or the total loss of the price.

- Lawsuit for Damages: The buyer can file a lawsuit against the seller to recover damages resulting from the breach of warranty.

Repudiation of Contract Before Due Date (Section 60):

- When either party involved in a contract of sale repudiates the agreement before the delivery date, the other party has options.

- The aggrieved party can choose to keep the contract active and wait for delivery, or they may treat the contract as rescinded.

- If the contract is treated as rescinded, the aggrieved party can sue for damages resulting from the breach.

Suit for Interest

The Act does not impact the rights of the seller or buyer to claim interest or special damages when they are legally recoverable. It also allows for the recovery of money paid when the reason for the payment has failed.

- In cases where there is no contrary agreement, the court has the discretion to award interest to the buyer at an appropriate rate on the price amount in cases of refund due to seller's breach, starting from the payment date.

- Example 10: In a situation where cigarettes sold were found to be mildewed and unsafe for consumption, damages were calculated based on the difference between the contract price and the resale price of the goods.

- Example 11: In the absence of title transfer or registration, the buyer is not entitled to claim damages for breaches of conditions and warranties related to the sale.

Auction Sale

Definition: An auction sale involves selling property by inviting public bids, with the property going to the highest bidder. An auctioneer, acting as an agent under the Law of Agency, typically represents the seller but can also represent the buyer in certain situations. The auctioneer may sell their own property without disclosing this fact.

Legal Rules of Auction Sale: Section 64 of the Sale of Goods Act, 1930 outlines the following rules for auction sales:

- Sale in Lots: When goods are sold in lots, each lot is presumed to be a separate contract of sale.

- Completion of Sale: The sale is considered complete when the auctioneer announces it, usually by the fall of the hammer. Until this announcement, bidders can retract their bids.

- Right to Bid: The seller can reserve the right to bid, allowing them or someone on their behalf to bid at the auction.

- Seller's Right to Bid: If the auction is not announced as subject to the seller's right to bid, the seller cannot bid themselves or employ someone to bid on their behalf. Violating this rule may render the sale fraudulent in the eyes of the buyer.

(a) Reserved price: The sale may be announced as subject to a reserved or upset price.

(b) Pretended bidding: If the seller uses pretended bidding to inflate the price, the sale becomes voidable at the buyer's option.

Example 12: P sold a car at auction, and it was sold to Q, who was required to provide a cheque and sign an agreement stipulating that ownership would not transfer until the cheque cleared. In the meantime, Q sold the car to R before the cheque was cleared. It was determined that ownership passed at the fall of the hammer, giving R a valid title to the car. Both Q and R had valid sales in their favor.

Inclusion of Increased or Decreased Taxes in Contract of Sale (Section 64A)

When there is a revision of taxes after a contract has been made but before it is performed, the parties are entitled to adjust the price of the goods accordingly. This applies in cases of increased, decreased, imposed, or remitted taxes on goods without specific stipulations regarding tax payment.

Examples of applicable taxes include:

- Any duty of customs or excise on goods

- Any tax on the sale or purchase of goods

If taxes increase, the buyer must pay the increased price, and if taxes decrease, the buyer may benefit from the reduction. The seller can add the increased taxes to the price. However, this provision can be excluded by mutual agreement, allowing parties to stipulate terms regarding taxation.

|

32 videos|185 docs|57 tests

|

FAQs on Unit 4: Unpaid Seller Chapter Notes - Business Laws for CA Foundation

| 1. What are the key rights of an unpaid seller against the goods? |  |

| 2. Under what situations can an unpaid seller's right of lien and stoppage in transit be invalidated? |  |

| 3. What remedies does a buyer have against an unpaid seller? |  |

| 4. How does an auction sale affect the rights of an unpaid seller? |  |

| 5. How are increased or decreased taxes incorporated into a contract of sale under Section 64A? |  |