Unit 5: Accounting Policies Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Understanding Accounting Policies |

|

| Selection of Accounting Policies |

|

| Change in Accounting Policies |

|

Unit Overview

Understanding Accounting Policies

Accounting Policies refer to the specific principles and methods that an enterprise adopts in preparing and presenting its financial statements. These policies are based on various accounting concepts, principles, and conventions, and are not one-size-fits-all; different enterprises may have different policies based on their unique circumstances.

The choice of accounting policy requires careful judgment by management, and the Institute of Chartered Accountants of India (ICAI) has been working to streamline acceptable accounting policies through Guidance Notes and Accounting Standards.

Areas with Frequently Encountered Accounting Policies

1. Valuation of Inventories

2. Valuation of Investments

Example: Valuation of Investments

Suppose an enterprise holds shares of a company as investments at the end of an accounting period. For valuing these shares, the enterprise might choose methods like FIFO (First In, First Out) or the average method. The method selected for valuation is an example of an accounting policy.

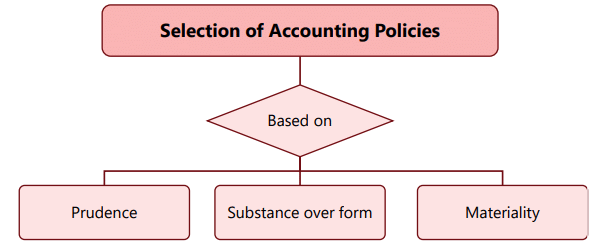

Selection of Accounting Policies

- The choice of accounting policy is a crucial decision that impacts both the performance measurement and financial position of a business entity. Selecting an inappropriate accounting policy can result in either an understatement or overstatement of performance and financial position. Therefore, accounting policies should be chosen with care, considering their effect on the financial performance of the business from the perspective of various users of accounts.

- It is believed that no single and exhaustive list of accounting policies can be suggested for universal application. However, there are three major characteristics that should be considered when selecting and applying accounting policies: Prudence, Substance over form, and Materiality. Financial statements should be prepared based on accounting policies that present a true and fair view of the state of affairs in the Balance Sheet and the Profit & Loss Account.

Here are some examples where a selection from a set of accounting policies is made:

- Inventories are valued at cost, with exceptions for finished goods and by-products. Finished goods are valued at the lower of cost or market value, while by-products are valued at net realizable value.

- Long-term investments are valued at their acquisition cost, with provisions for permanent diminution in value made where necessary.

Sometimes, a wrong or inappropriate treatment is adopted for items in the Balance Sheet, Profit & Loss Account, or other statements. While disclosure of the treatment adopted is necessary, it cannot rectify a wrong or inappropriate treatment.

Change in Accounting Policies

Changes in accounting policies should be made under the following circumstances:

(a) When required by law or to comply with an Accounting Standard.

(b) When the change results in a more appropriate presentation of the financial statements.

Changes in accounting policies can significantly impact financial statement items. For instance, altering the inventory valuation method from weighted average to FIFO, capitalizing interest that was not previously capitalized, or changing the proportion of interest allocated to inventory can affect net profit. It is essential to quantify the effects of such changes on assets, liabilities, and profit/loss to ensure the financial statements are useful to users.

For example, if Omega Enterprises revises its accounting policy for inventory valuation to include applicable production overheads, it believes this change will lead to a more accurate presentation of its financial statements.

|

68 videos|265 docs|83 tests

|

FAQs on Unit 5: Accounting Policies Chapter Notes - Accounting for CA Foundation

| 1. What are accounting policies and why are they important? |  |

| 2. How does an organization select its accounting policies? |  |

| 3. What are the effects of changing accounting policies on financial statements? |  |

| 4. Can an organization change its accounting policies at any time? |  |

| 5. What is the role of regulatory bodies in accounting policies? |  |