Unit 5: Death of a Partner Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Introduction

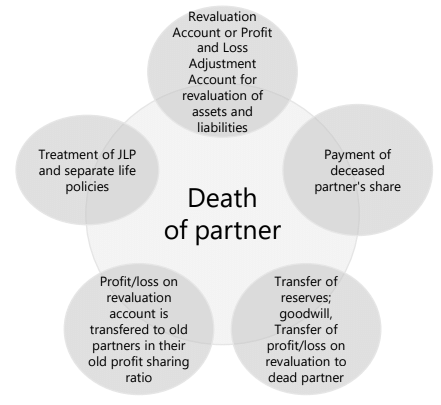

A partnership firm does not necessarily come to an end when a partner passes away; instead, it undergoes a process known as reconstitution. The remaining partners continue to operate the business, and the situation is similar to that of a partner retiring.- Revaluation of Assets and Liabilities: Upon the death of a partner, the firm’s assets and liabilities need to be revalued. Any resulting profit or loss from this revaluation is then transferred to the capital accounts of all partners, including the deceased partner.

- Goodwill: The treatment of goodwill in the event of a partner’s death is handled in the same manner as it would be during a retirement, as discussed in previous units.

- Joint Life Policy: The joint life policy is treated similarly to how it would be in the case of a retirement. However, in the event of a partner’s death, the firm receives the value of the joint policy.

Right of Outgoing Partner in Certain Cases to Share Subsequent Profits

Section 37 of the Indian Partnership Act addresses the situation when a partner in a firm passes away or ceases to be a partner, and the remaining partners continue the business without finalizing accounts with the outgoing partner or their estate.

- In such cases, unless there is a contract stating otherwise, the outgoing partner or their estate is entitled to a share of the profits made after their departure. This share is based on the use of their share of the firm's property or interest at 6% per annum on the value of their share in the property.

- However, if the remaining partners have a contract allowing them to purchase the interest of a deceased or outgoing partner and they exercise this option, the outgoing partner's estate is not entitled to any further share of profits.

- If the remaining partners do not comply with the terms of the option in a material way, they may be liable to account for profits under the previous provisions.

- It is important to note that the outgoing partner is not obligated to make a decision until their share of the profits has been determined.

For example, A, B and C are in a partnership business-sharing profits and losses equally. C died on 31st October, 2021. The capitals of the partners, after all necessary adjustments stood at ₹ 50,000, ₹75,000 and ₹ 1,20,000 respectively. A and B continued to carry on the business further without settling the accounts of C. Final payment to C is made on February 1, 2022. The profit made during the period of three months amounts to ₹ 28,000.

Under Section 37 of the Partnership Act, C can exercise any of the following two options.

(i) Share in subsequent profits of firm:

Profit made—₹ 28,000

C’s share – 28,000 × 1,20,000 / 2,45,000 = ₹ 13,714

(ii) Interest at 6% p.a.

1,20,000 × 6/ 100 x 3 /12 = ₹ 1,800

Since, (i) option is beneficial for C, he will necessarily go for his proportionate share in profits.

Amount Payable to Legal Representatives of Deceased Partner

- When a partner in a firm passes away, the amount due to them is paid to their legal representatives.

- The legal representatives are entitled to various payments as per the partnership agreement and the law.

Entitlements of Legal Representatives:

- Capital Account Balance: The amount credited to the capital account of the deceased partner.

- Interest on Capital: Interest on capital, if specified in the partnership deed, up to the date of death.

- Share of Goodwill: The deceased partner's share of the firm's goodwill.

- Undistributed Profits or Reserves: Share of any undistributed profits or reserves.

- Revaluation Profits: Share of profit from the revaluation of assets and liabilities.

- Profit Share up to Date of Death: Share of profit earned up to the date of death.

- Joint Life Policy: Share of the Joint Life Policy, if applicable.

Liabilities of Legal Representatives:

- Drawings: Any drawings made by the deceased partner.

- Interest on Drawings: Interest on drawings made by the deceased partner.

- Revaluation Losses: Share of loss from the revaluation of assets and liabilities.

- Pre-Death Losses: Share of losses incurred up to the date of death.

Calculation of Profit up to Date of Death

The profit up to the date of death of a partner is calculated through the Profit and Loss (P&L) Suspense account. After determining the amount due to the deceased partner, it should be credited to the Executor’s Account of the deceased partner.When a partner passes away during the year, their representatives are entitled to their share of profits earned up to the date of death. This profit can be ascertained using different methods:

(i) Time Basis

Under this method, it is assumed that profit is earned uniformly throughout the year. For example:

- If the total profit of the previous year is ₹2,25,000 and a partner dies three months after the close of that year, the profit for three months is ₹31,250 (i.e., ₹1,25,000 × 3/12).

- If the deceased partner had a 2/10 share of the profit, their share of profit until the date of death would be ₹6,250 (i.e., ₹31,250 × 2/10).

(ii) Turnover or Sales Basis

In this method, the profit and total sales of the previous year are considered. The profit up to the date of death is estimated based on the sales of the previous year, assuming that profit is earned uniformly at the same rate.

Example: Arun, Tarun and Neha are partners sharing profits in the ratio of 3:2:1. Neha dies on 31st May 2022. Sales for the year 2021-2022 amounted to ₹ 4,00,000 and the profit on sales is ₹ 60,000. Accounts are closed on 31 March every year. Sales from 1st April 2022 to 31st May 2022 is ₹ 1,00,000. The deceased partner’s share in the profit upto the date of death will be as follows.

Profit from 1st April 2022 to 31st May 2022 on the basis of sales:

If sales are ₹ 4,00,000, profit is ₹ 60,000

If the sales are ₹ 1,00,000 profit is: 60,000/4,00,000 × 1,00,000 = ₹ 15,000

Neha’s share = 15,000 × 1/6 = ₹ 2,500

Alternatively profit is calculated as

Rate of profit = 60,000 4,00,000 x 100 = 15%

Sale upto date of death = 1,00,000

Profit = 1,00,000 x 15/100 = ₹ 15,000

The above adjustments are made in the capital account of the deceased partner and then the balance in the capital account is transferred to an account opened in the name of his/her executor. The payment of the amount of the deceased partner depends on the agreement. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. on the amount due from the date of death till the date of final payment

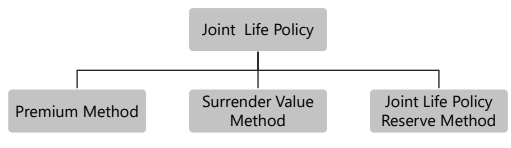

Special Transactions in Case of Death: Joint Life Policy

In case of Partnership, Partners generally get Joint Life Policy (JLP) in name of all partners. If partner expires, then partners are entitled for share in JLP.

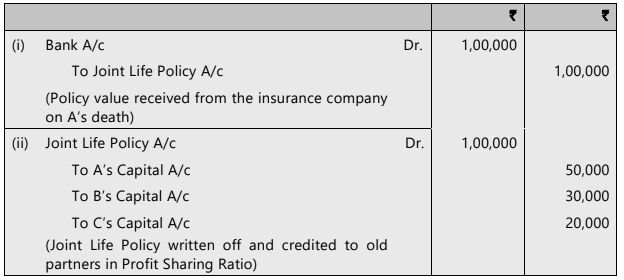

Method 1: If Joint Life Policy does not appear in the Balance Sheet, then the firm will gain on the death of a partner. For example, A, B and C are in partnership sharing profits and losses at the ratio of 5:3:2. They took a Joint Life Policy of ₹ 1,00,000. Now, if A dies, the firm will receive ₹ 1,00,000 from the insurance company.

The journal entries will appear as follows:

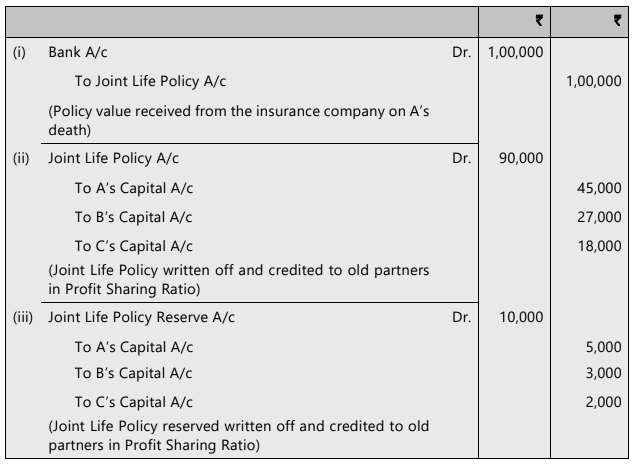

Method 2: If Joint Life Policy appears in the Balance Sheet at surrender value, then the firm will gain on the death of a partner. For example, A, B and C are in partnership sharing profits and losses at the ratio of 5:3:2. They took a Joint Life Policy of ₹ 1,00,000 which is appearing in the Balance Sheet at the surrender value of ₹ 10,000. Now, if A dies, the firm will receive ₹1,00,000 from the insurance company.

The journal entries will appear as follows:

Method 3: If Joint Life Policy appears in the Balance Sheet at surrender value along with Joint Life Policy Reserve, then the firm will gain on the death of a partner and reserve will be distributed among partners. For example, A, B and C are in partnership sharing profits and losses at the ratio of 5:3:2. They took a Joint Life Policy of ₹ 1,00,000 which is appearing in the Balance Sheet at the surrender value of ₹ 10,000,along with JLP reserve. Now, if A dies, the firm will receive ₹ 1,00,000 from the insurance company.

The journal entries will appear as follows:

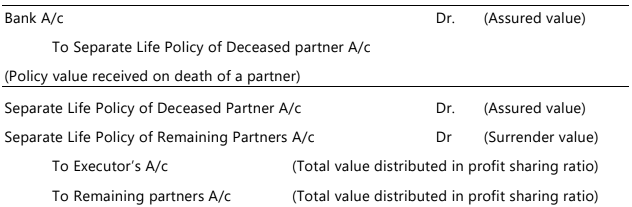

Special Transactions in Case of Death: Separate Life Policy

Instead of opting for a joint life policy covering all partners, individual life insurance policies can be taken out on the lives of each partner. Here’s how this arrangement works:- Premium Payments: The premium for these individual policies is charged to the profit and loss account.

- Death of a Partner: Upon the death of a partner, only the amount insured for the deceased partner will be claimed from the insurance company.

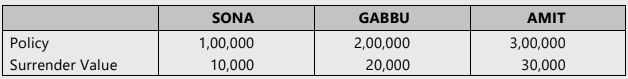

- Policies of Surviving Partners: The policies of the surviving partners will remain in force. However, the surrender value of these policies will be considered when calculating the amount payable to the legal representatives of the deceased partner.

- Surrender Value Distribution: The legal representatives of the deceased partner will be entitled to a share of the surrender value equivalent to the profit-sharing ratio of the deceased partner.

(Being the total of assured value of deceased partner’s life policy and surrender value of other partners’ life policy(s) distributed in the profit and loss sharing ratio)

(Being the total of assured value of deceased partner’s life policy and surrender value of other partners’ life policy(s) distributed in the profit and loss sharing ratio)

Example: Sona, Gabbu and Amit are partners sharing profits in the ratio of 3:1:1.

If Amit dies, then, Amit's executives will get 3,00,000 x 1/5 and 1/5(10,000+20,000) = 60,000+6,000 = 66,000

Special Transactions in Case of Death: Payment of Deceased Partner's Share

- When a partner passes away, there is a key difference between their death and retirement in terms of finalizing the amount payable to the executor of the deceased partner's estate.

- In the case of retirement, the calculation is straightforward, but in the case of death, the executor is entitled to the deceased partner's share of profits up to the date of death.

- While the revaluation of goodwill is done similarly in both cases, the executor's entitlement to profits up to the date of death is an important distinction.

For Example:

- A, B, and C are in a partnership, sharing profits and losses in the ratio of 2:2:1.

- A passed away on 15th April 2022.

- The firm's financial records are closed annually on 31st December.

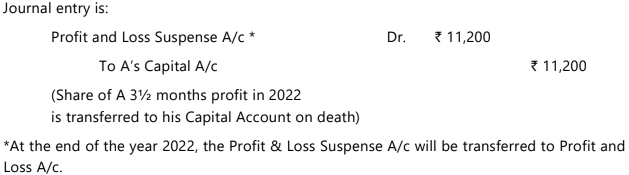

- A's executor is entitled to 3½ months of profits.

- If A's share is paid out immediately, the profit for 2021 will be used to calculate the 3½ months profit for the year 2022.

- The partnership, M/s. A, B & C, earned ₹ 96,000 in 2021.

- Therefore, the profit for 3½ months is ₹ 28,000.

- A's share from this amount is ₹ 28,000 multiplied by 2/5, which equals ₹ 11,200.

ILLUSTRATION 1

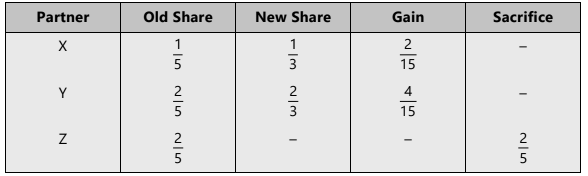

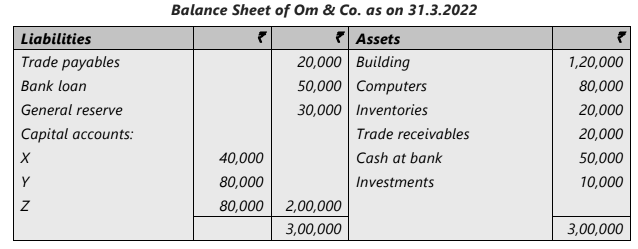

The following was the Balance Sheet of Om & Co. in which X, Y, Z were partners sharing profits and losses in the ratio of 1:2:2 as on 31.3.2022. Mr. Z died on 31st December, 2022. His account has to be settled under the following terms.

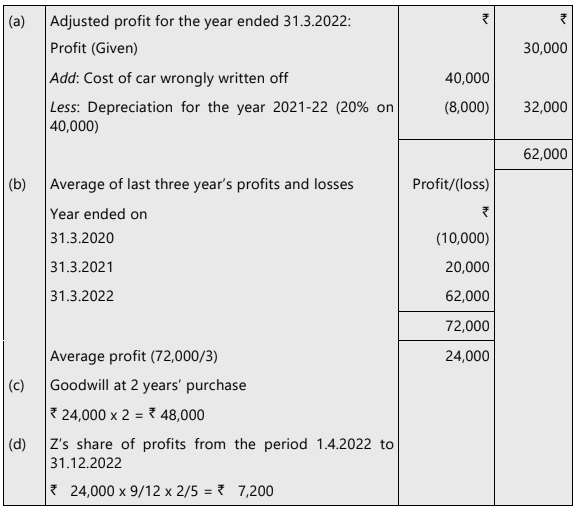

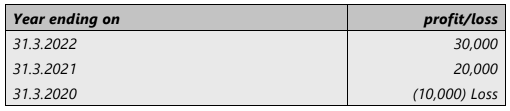

Goodwill is to be calculated at the rate of two years purchase on the basis of average of three years’ profits and losses. The profits and losses for the three years were detailed as below:

Profit for the period from 1.4.2022 to 31.12.2022 shall be ascertained proportionately on the basis of average profits and losses of the preceding three years.

During the year ending on 31.3.2022 a car costing ₹ 40,000 was purchased on 1.4.2021 and debited to traveling expenses account on which depreciation is to be calculated at 20% p.a. at written down value method. This asset is to be brought into account at the depreciated value.

Other values of assets were agreed as follows:

Inventory at ₹ 16,000, building at ₹ 1,40,000, computers at ₹ 50,000; investments at ₹ 6,000. Trade receivables were considered good.

Required:

(i) Calculate goodwill and Z’s share in the profits of the firm for the period 1.4.2022 to 31.12.2022.

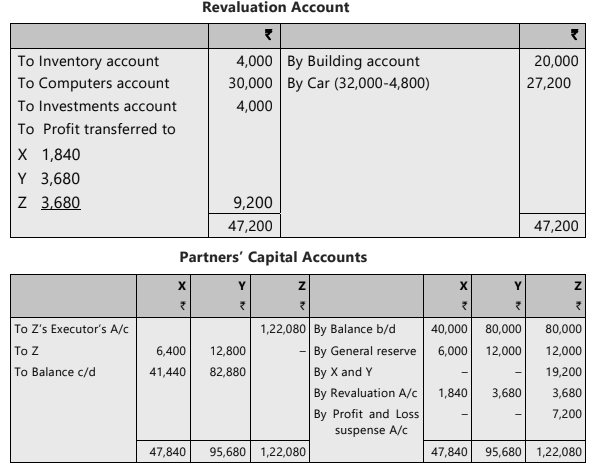

(ii) Prepare revaluation account assuming that other items of assets and liabilities remained the same.

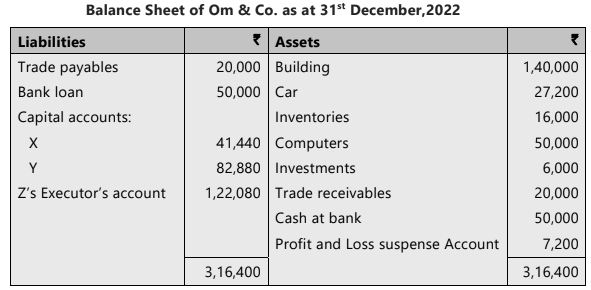

(iii) Prepare partners’ capital accounts and balance sheet of the firm Om & Co. as on 31.12.2022.

SOLUTION

(i) Calculation of goodwill and Z’s share of profit

(ii)

Working Note:

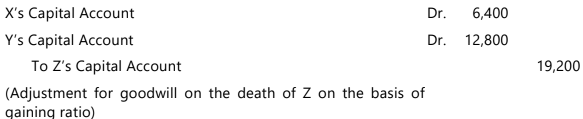

Goodwill calculated at the time of death of partner Z ₹ 48,000

Adjusting entry:

ILLUSTRATION 2

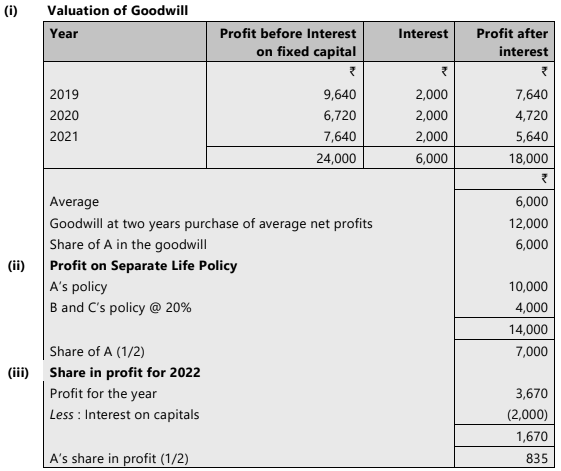

The partnership agreement of a firm consisting of three partners - A, B and C (who share profits in proportion of ½, ¼ and ¼ and whose fixed capitals are ₹ 10,000; ₹ 6,000 and ₹ 4,000 respectively) provides as follows:

(a) That partners be allowed interest at 10 per cent per annum on their fixed capitals, but no interest be allowed on undrawn profits or charged on drawings.

(b) That upon the death of a partner, the goodwill of the firm be valued at two years’ purchase of the average net profits (after charging interest on capital) for the three years to 31st December preceding the death of a partner.

(c) That an insurance policy of ₹ 10,000 each to be taken in individual names of each partner, the premium is to be charged against the profit of the firm.

(d) Upon the death of a partner, he is to be credited with his share of the profits, interest on capitals etc. calculated upon 31st December following his death.

(e) That the share of the partnership policy and goodwill be credited to the deceased partner as on 31st December following his death.

(f) That the partnership books be closed annually on 31st December.

A died on 30th September 2022, the amount standing to the credit of his current account on 31st December, 2021 was ₹ 450 and from that date to the date of death he had withdrawn ₹3,000 from the business.

An unrecorded liability of ₹ 2,000 was discovered on 30th September, 2022. It was decided to record it and be immediately paid off.

The trading result of the firm (before charging interest on capital) had been as follows: 2019 Profit ₹ 9,640; 2020 Profit ₹ 6,720; 2021 Profit ₹ 7,640; 2022 Profit ₹ 3,670.

Assuming the surrender value of the policy to be 20 percent of the sum assured.

Required

Prepare an account showing the amount due to A’s legal representative as on 31st December, 2022.

SOLUTION

Working Notes:

(iv) As unrecorded liability of ₹ 2,000 has been charged to Capital Accounts through Profit and Loss Adjustment Account, no further adjustment in current year’s profit is required.

(v) Profits for 2019, 2020 and 2021 have not been adjusted (for valuing goodwill) for unrecorded liability for want of precise information.

ILLUSTRATION 3

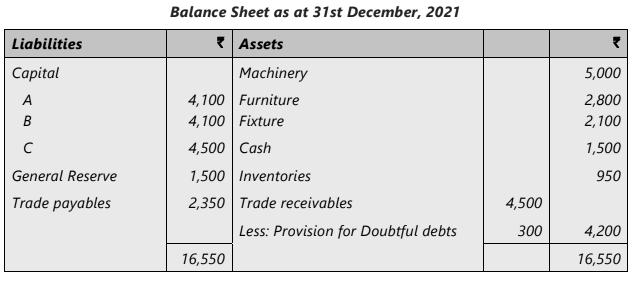

The following is the Balance Sheet of M/s. ABC LLP as at 31st December, 2021.

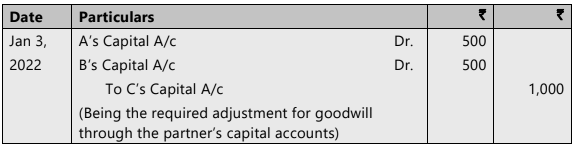

C died on 3rd January, 2022 and the following agreement was to be put into effect.

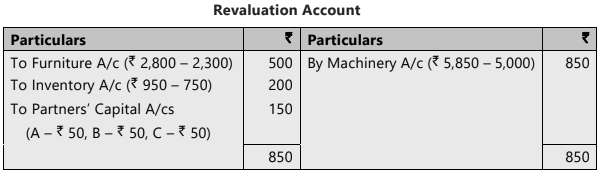

(a) Assets were to be revalued: Machinery to ₹ 5,850; Furniture to ₹ 2,300; Inventory to ₹ 750.

(b) Goodwill was valued at ₹ 3,000 and was to be credited with his share, without using a Goodwill Account

(c) ₹ 1,000 was to be paid away to the executors of the dead partner on 5th January, 2022.

Required

(i) The Journal Entry for Goodwill adjustment.

(ii) The Revaluation Account and Capital Accounts of the partners.

(iii) Which account would be debited and which account credited if the provision for doubtful debts in the Balance Sheet was to be found unnecessary to maintain at the death of C.

SOLUTION

(i) Journal Entry in the books of the firm

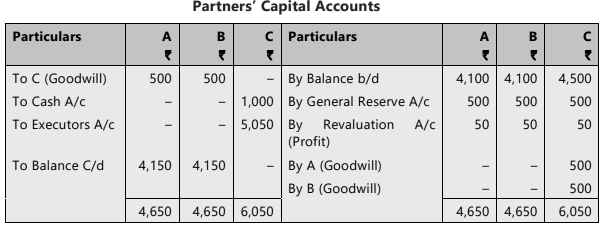

(ii)

(iii) Provision for Doubtful Debts Account is a credit balance. To close, this account is to be debited. It becomes a gain for the partners. Therefore, either Partners’ Capital Accounts (including C) or Revaluation Account is to be credited.

Working Note:

Profit sharing ratio is equal before or after the death of C because nothing has been mentioned in respect of profit-sharing ratio.

ILLUSTRATION 4

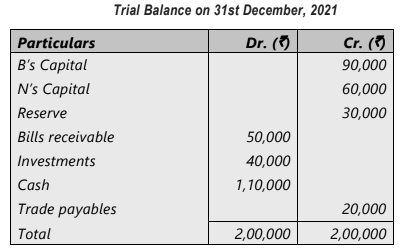

B and N were partners. The partnership deed provides inter alia:

(i) That the accounts be balanced on 31st December each year.

(ii) That the profits be divided as follows:

B: One-half; N: One-third; and carried to Reserve Account: One-sixth

(iii) That in the event of death of a partner, his executor will be entitled to the following:

(a) the capital to his credit at the date of death; (b) his proportion of profit to date of death based on the average profits of the last three completed years; (c) his share of goodwill based on three years’ purchases of the average profits for the three preceding completed years.

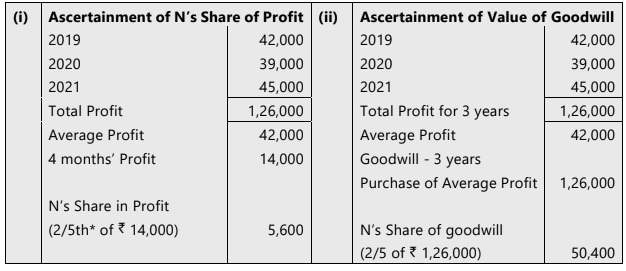

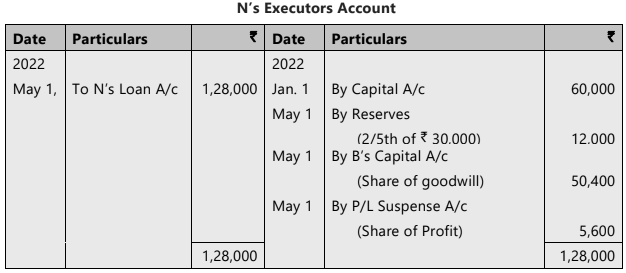

The profits for the three years were 2019: ₹ 42,000; 2020: ₹ 39,000 and 2021: ₹ 45,000. N died on 1st May, 2022. Show the calculation of N (i) Share of Profits; (ii) Share of Goodwill; (iii) Draw up N’s Executors Account as would appear in the firms’ ledger transferring the amount to the Loan Account.

SOLUTION

* Profit sharing ratio between B and N = 1/2; 1/3; = 3: 2, Therefore N’s share of Profit = 2/5

ILLUSTRATION 5

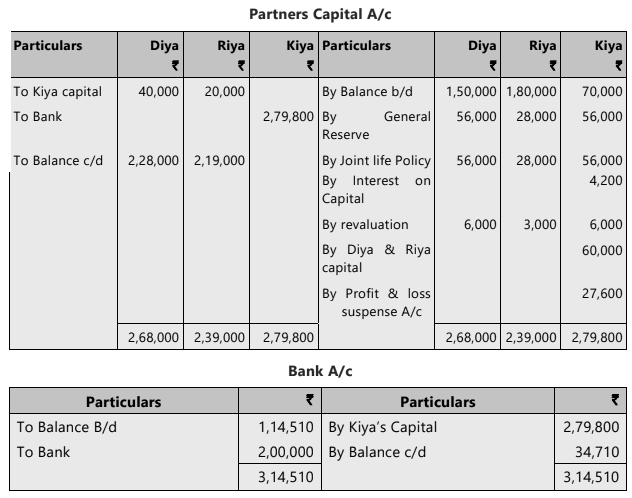

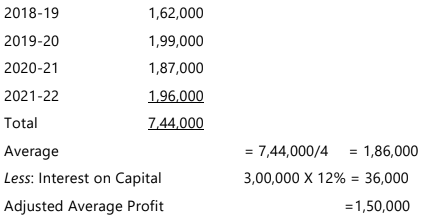

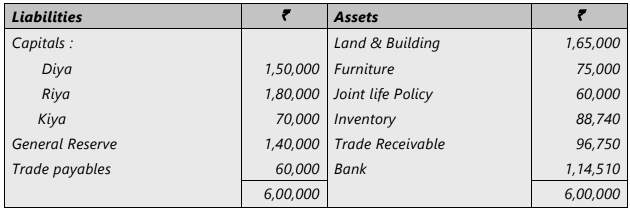

Diya, Riya & Kiya are partners of M/s. DRK Fabrics sharing profits and losses in the ratio of 2:1:2.

On 31st March 2022 their Balance Sheet was as under:

Kiya died on 30th September, 2022.

The partnership deed provides as follows:

(a) That partners be allowed interest at 12% p.a. on their capitals, but no interest be charged on drawings.

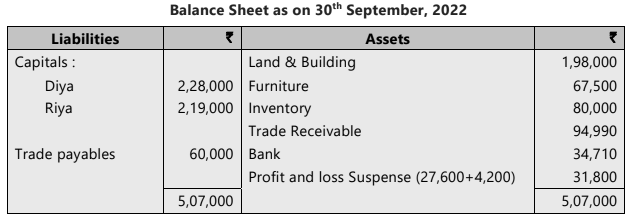

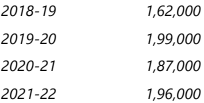

(b) Upon the death of a partner, the goodwill of the firm be valued at one years’ purchase of the average net profits (after charging interest on capital) for the four years to 31st March preceding the death of a partner. The profits of the firm before charging interest on capitals were:

Average capital during preceding four years may be assumed as ₹ 3,00,000.

(c) Profits till the date of death to be ascertained on the basis of average profit of previous four years.

(d) Upon the death of a partner, she is to be credited with her share of the profits, interest on capitals etc. calculated till the date of death.

After the death of Kiya

1. ₹2,00,000 was received from insurance company against Joint life Policy.

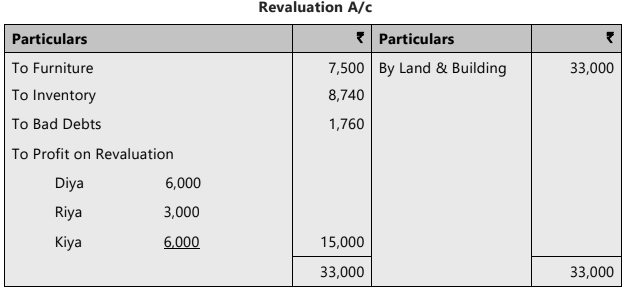

2. Land & Building was appreciated by 20%, Furniture to be depreciated by 10%, inventory to be revalued at ₹80,000. Bad debts amounted ₹1760.

3. Amount payable to Kiya was paid in cash.

You are required to prepare

1. Revaluation A/c

2. Partners’ Capital A/c

3. Balance Sheet as on 30th September 2022, assuming other Assets and liabilities remaining the same.

SOLUTION

Working Notes:

1. Goodwill valuation

2. Journal entry for adjustment of goodwill

3. Kiya’s share of profit till the date of death

Average profit for full year before interest on capital = 1,86,000

6 month’s profit = 93,000

Less: interest on capital 4,00,000 X 12% X 6/12 = 24,000

Adjusted profit till the date of death = 69,000

Kiya’s share 2/5th = 27,6004. The Joint life policy in this question is based on the surrender value method- where in the amount shown in the balance sheet shall be deducted from the JLP proceeds received from insurance co, on the death of a partner.

₹ 2,00,000- 60,000 (Balance Sheet value) = ₹ 1,40,000 (divided in profit sharing ratio between the partners.)NOTE: The ICAI through guidance note (August,2023 edition) has recommended the formats of financial statements for Limited Liability Partnerships (LLPs). This would enable these entities to communicate their financial performance and financial position in standardised formats thereby enhancing their consistency and comparability. The said format of financial statements is being given as Annexure – II at the end of the chapter for awareness of students. It may be noted that this format does not form part of syllabus and has been given here for the knowledge of students only.

|

68 videos|265 docs|83 tests

|

FAQs on Unit 5: Death of a Partner Chapter Notes - Accounting for CA Foundation

| 1. What happens to the profits of a partnership after the death of a partner? |  |

| 2. How is the amount payable to the legal representatives of a deceased partner calculated? |  |

| 3. What is the significance of a joint life policy in the case of a partner's death? |  |

| 4. How does a separate life policy differ from a joint life policy in terms of handling a deceased partner's share? |  |

| 5. What steps should be taken for the payment of a deceased partner's share to their legal representatives? |  |