Unit 6: Dissolution of Partnership Firms and LLPs Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Introduction

- Dissolution of Partnership: When a partnership faces changes in profit-sharing ratios, admits new partners, or experiences the retirement or death of a partner, it may lead to the dissolution of the partnership firm.

- Closing Books of Accounts: This unit focuses on the accounting procedures required to close the books of accounts in the event of a partnership dissolution.

- Circumstances for Dissolution: We will explore the various circumstances that can lead to the dissolution of a partnership firm and the necessary accounting treatments.

- Insolvency of Partners: Special problems related to the insolvency of partners and the settlement of the partnership's liabilities will also be discussed.

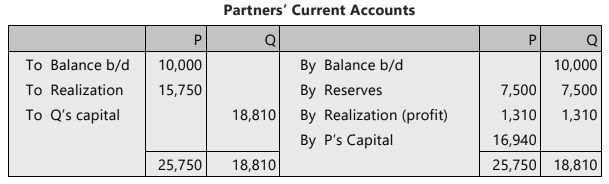

Circumstances Leading to Dissolution of Partnership

A partnership comes to an end or is dissolved under the following circumstances:

- Expiry of Term: When the specified duration for which the partnership was formed expires.

- Completion of Venture: Upon the completion of the specific project or venture for which the partnership was established.

- Death of a Partner: The partnership may be dissolved upon the death of a partner.

- Insolvency of a Partner: If a partner becomes insolvent, it may lead to the dissolution of the partnership.

However, the remaining partners may continue the business, forming a new partnership while the firm continues. The firm is only considered dissolved when the business itself comes to an end.

A firm stands dissolved in the following cases:

- The partners mutually agree to dissolve the firm.

- All partners, except one, become insolvent.

- The business activities of the firm become illegal.

- In a partnership at will, if a partner gives notice of their intention to dissolve the partnership.

- A court orders the dissolution of the firm.

The court can order dissolution in the following circumstances:

- When a partner is declared of unsound mind.

- If a partner suffers from a permanent incapacity that hinders their ability to participate in the partnership.

- When a partner engages in misconduct related to the business.

- If a partner consistently disregards the terms of the partnership agreement.

- When a partner transfers their interest or share in the partnership to a third party without consent.

- If the business cannot be conducted without incurring losses.

- When the dissolution is deemed just and equitable under the circumstances.

Consequences of Dissolution

- Realization of Assets: Upon dissolution, the firm's assets, including goodwill, are realized.

- Application of Proceeds: The amount realized is applied as follows:

- Repayment of Liabilities: First, to repay liabilities to outsiders and loans taken from partners.

- Repayment of Capital: After liabilities are settled, the capital contributed by partners is repaid.

- Distribution of Surplus: If there is a surplus after repaying capital, it is distributed among partners in their profit-sharing ratio.

- Deficiency in Capital: If the assets are insufficient to repay the capital contributed by each partner, the deficiency is borne by the partners in their profit-sharing ratio.

- Order of Payment of Losses: Losses and deficiencies of capital are paid in the following order:

- From Profits: First out of profits.

- From Capital: Next out of capital.

- By Partners: Lastly, by partners individually in the proportion in which they are entitled to share profits.

- Application of Assets: The assets of the firm are applied in the following order:

- Payment of Debts: In paying the debts of the firm to third parties.

- Payment of Advances: In paying to each partner rateably what is due to him from the firm in respect of advances as distinguished from capital.

- Payment of Capital: In paying to each partner what is due to him on account of capital.

- Residue: The residue, if any, is divided among the partners in the proportion in which they are entitled to share profits.

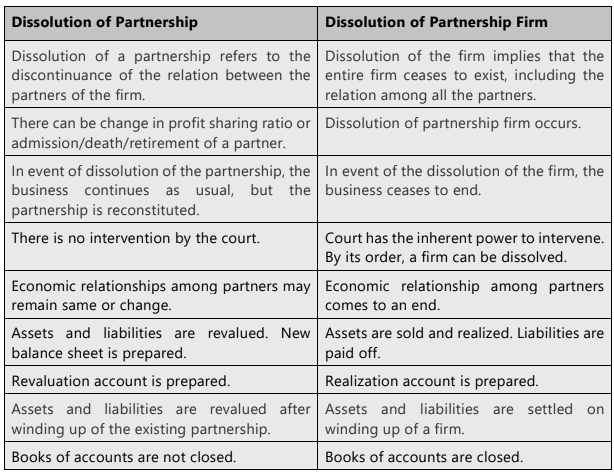

Distinction between Dissolution of Partnership and Dissolution of Partnership Firm

Dissolution before the expiry of a fixed term

Refund of Premium by a New Partner

- When a new partner joins a firm and pays a premium to the existing partners, there may be an agreement that the firm will not be dissolved for a certain period. If the firm is dissolved before this period ends, the new partner may be entitled to a refund of the premium, either in full or in part.

- However, there are situations where no claim for a refund will arise:

- If the firm is dissolved due to the death of a partner,

- If the dissolution is primarily caused by the misconduct of the partner requesting the refund, or

- If the dissolution is in accordance with an agreement that does not provide for the return of the premium.

- The amount to be refunded will be determined based on the terms of the admission and the agreed-upon period, taking into account how much time has already passed. Any refunds due will be the responsibility of the other partners, who will bear the cost in their profit-sharing ratio.

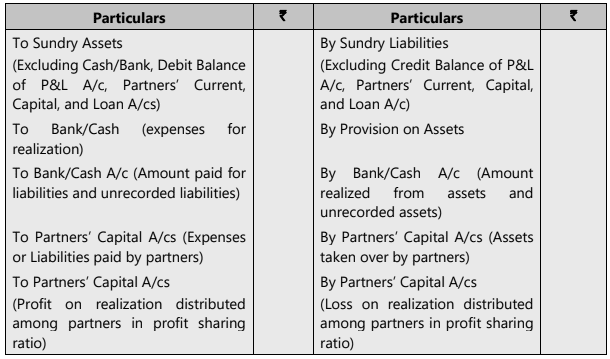

Closing of Partnership Books on Dissolution

To close books of accounts of Partnership Firm. We need to transfer all the assets and liabilities to Realization Account. Given below is the specimen of the Realization Account.

Treatment of Goodwill at the time of dissolution of Firm

- If Goodwill is listed on the Balance Sheet, it is recognized as purchased Goodwill and treated like any other asset, which means it will be moved to the Realization Account.

- If Goodwill is not found on the Balance Sheet, then there is no need to make any entry regarding it.

- When Goodwill is realized or if any partner buys Goodwill, the process involves either debiting the Cash Account or debiting the Partner’s Capital Account, and at the same time, crediting the Realization Account.

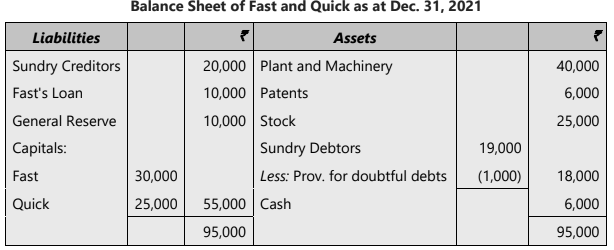

We will understand how to close the books of accounts through illustration the required journal entries to be made for closing the books of a firm with the example given below:

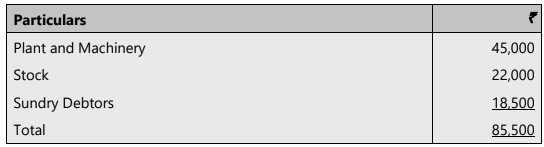

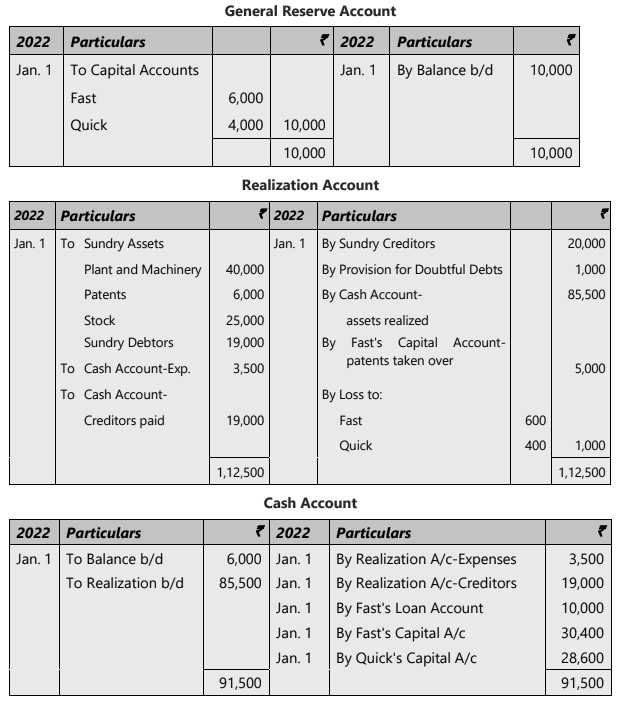

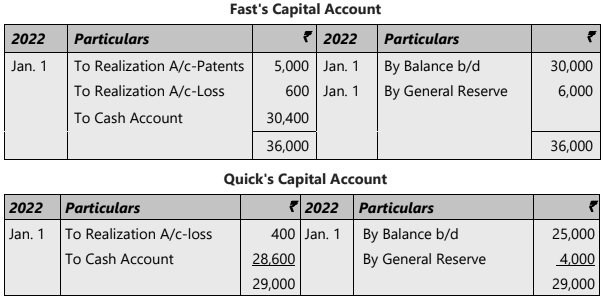

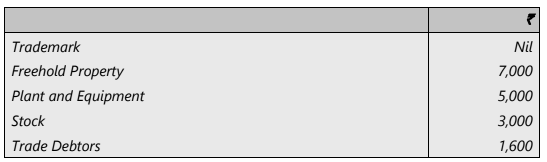

Fast and Quick share profits in the ratio of 3:2. On 1st January, 2022 the firm was dissolved. Fast took over the patents at a valuation of ₹ 5,000. The other assets realized as under:

The Sundry Creditors were paid off at a discount of 5%. The expense amounted to ₹ 3,500. The steps to close the books are given below:

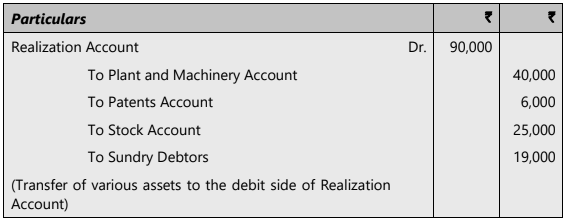

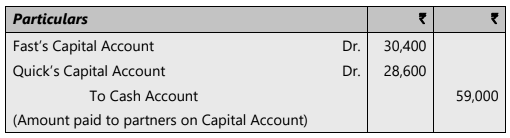

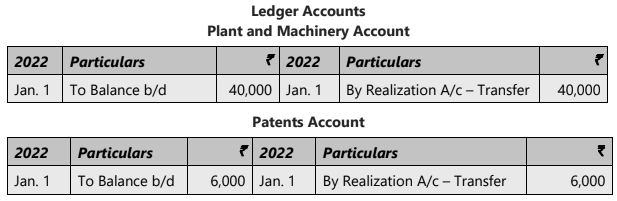

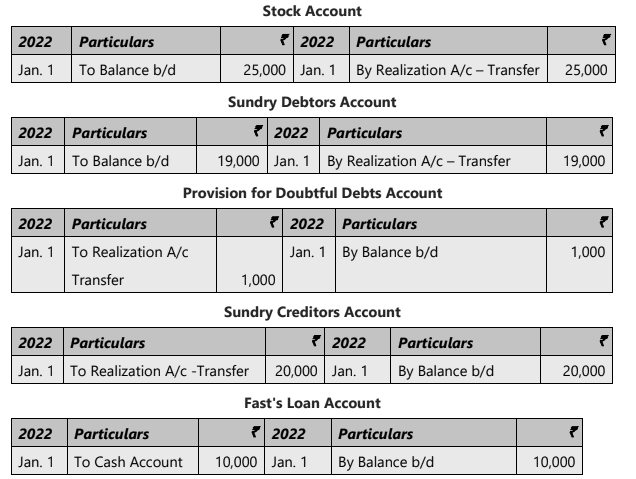

I. Open a Realization Account and transfer all assets except cash in hand or at a bank at book values. Realization Account is debited and the various assets are credited and thus closed. It should be remembered that Sundry Debtors and Provisions for Bad Debts Accounts are two separate accounts and the gross amount of debtors should be transferred. In the above example the entry will be:

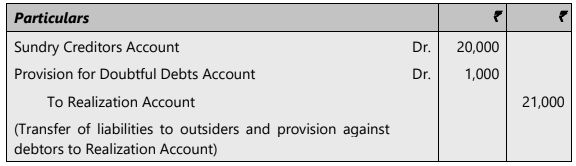

II. Transfer of liabilities to outsiders and provisions and reserves against assets (e.g., Provision for Doubtful Debts) to the credit side of Realization account. The accounts of the liabilities and provisions will be debited and thus closed. The entry should be at book figures. The entry will be:

Note: Accounts denoting accumulated losses or profits should not be transferred to the Realization Account.

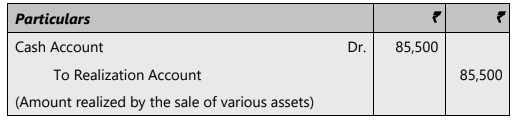

III. (i) The Realization Account should be credited with the actual amount realized by the sale of assets. This should take no note of the book figures. of course, Cash (or Bank) Account will be debited. Thus:

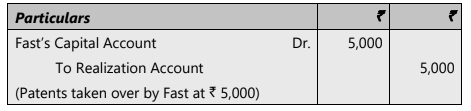

(ii) If a partner takes over an asset, his Capital Account should be debited and Realization Account credited with the value agreed upon, Thus:

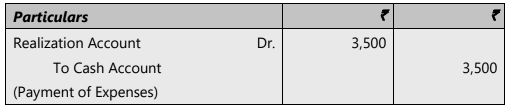

IV. Expenses of dissolution or realization of assets are debited to the Realization Account and credited to Cash Account. Thus

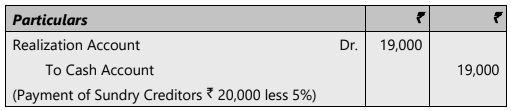

V. (i) The actual amount paid to creditors should be debited to the Realization Account and Cash Account is credited:

(ii) If any liability is taken over by a partner, his Capital Account should be credited and Realization Account debited with the amount agreed upon.

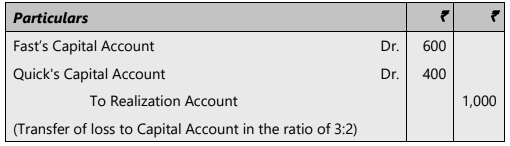

VI. At this stage, the Realization Account will show profit or loss. If the debit side is bigger, there is a loss; if the credit side is bigger, there is a profit. Profit or loss is transferred to the Capital Accounts of partners in the profit-sharing ratio. In the case of profit, Realization Account is debited and Capital Accounts are credited. The entry for loss is, naturally, reverse of this entry. The Realization Account in the example given above shows a loss of ` 1,000 (see account below).

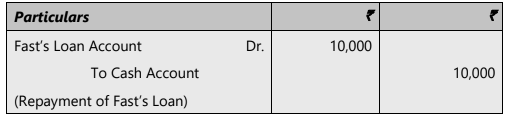

VII. Partner's Loans if any, should now be paid. The entry is to debit the Loan Account and credit Cash Account. Thus:

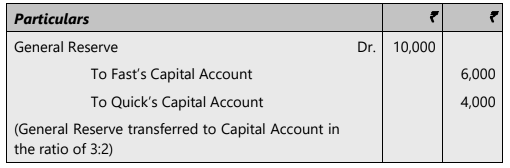

VIII. Any reserve of accumulated profit or loss lying in the books (as shown by the Balance Sheet) should be transferred to the Capital Account in the profit-sharing ratio. Thus:

IX. At this stage the Capital Accounts of partners will show how much amount is due to them or from them. The partner owing money to the firm will pay; Cash Account will be debited and his Capital Account credited and thus closed. Money owing to a partner will be paid to him; his Capital Account will be debited and the Cash Account credited. This will close the Capital Accounts’ as well as the Cash Account. The entry in the above example is seen in the Capital Accounts below:

Note:

- If a partner takes over any assets at a price agreed upon by both partners, debit the Partner’s Capital Account and credit the Realization Account for the value of the asset taken over.

- To pay off liabilities, credit cash and debit the liability accounts. The difference between the book value and the amount paid should be transferred to the Realization Account.

- Liabilities owed to outsiders can also be put into the Realization Account. In this case, the amount paid in cash for these liabilities should be debited to the Realization Account, with cash being credited. If a partner takes over a liability, the Realization Account should be debited, and the Partners’ Capital Accounts should be credited for the agreed amount.

- The remaining balance in the Realization Account will show either a profit or a loss from the realization. This amount should be split among the partners based on how they share profits and losses. If there is a loss, credit the Realization Account and debit the respective Partners’ Capital Accounts; do the reverse if there is a profit.

- Pay back any loans or advances made by the partners that are separate from their capital contributions. Make sure to consider any negative balance in the capital account of that partner before payment.

- At the end, the balance in the cash account should match the balance in the capital accounts, assuming both are positive. To close their accounts, credit cash and debit the partners’ capital account for the amount owed to them.

ILLUSTRATION 1

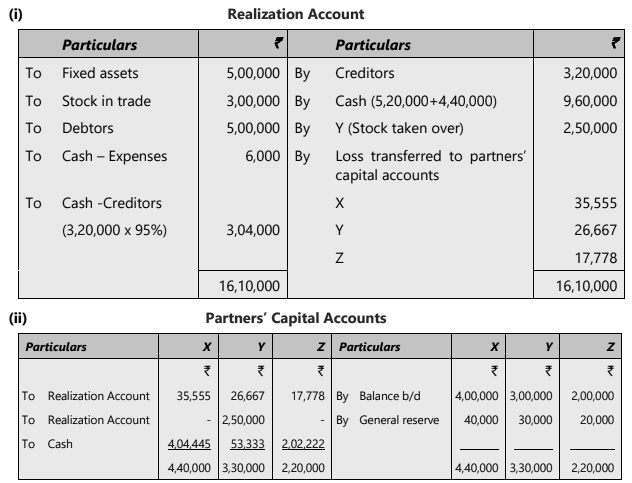

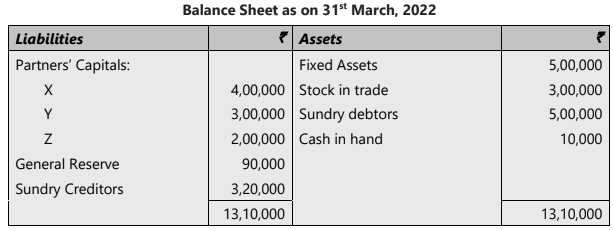

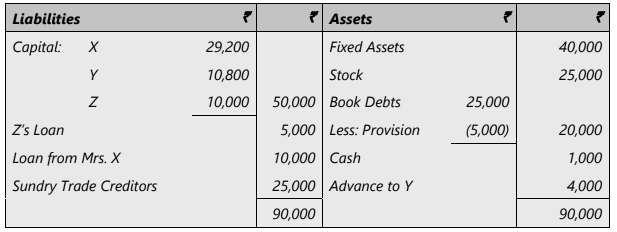

X, Y, and Z are partners of the firm XYZ and Co., sharing Profits and Losses in the ratio of 4: 3: 2. Following is the Balance Sheet of the firm as on 31st March, 2022:

Partners of the firm decided to dissolve the firm on the above-said date.

Fixed assets realized ₹ 5,20,000 and book debts ₹ 4,40,000.

Stocks were valued at ₹2,50,000 and it was taken over by partner Y.

Creditors allowed discount of 5% and the expenses of realization amounted to ₹ 6,000.

You are required to prepare:

(i) Realization account;

(ii) Partners capital account; and

(iii) Cash account.

SOLUTION

Consequences of Partner's Insolvency

When a partner in a firm becomes insolvent, several important consequences follow, especially regarding the financial and operational aspects of the partnership.

- Capital Account Deficit: If a partner's capital account shows a deficit after adjusting their share of profit or loss, it indicates that the firm lacks sufficient cash or assets to settle amounts owed to other partners. This situation persists until the partner with the deficit repays the amount.

- Insolvency Impact: In the event of insolvency, the deficit amount from the partner's capital account may not be recoverable. This deficiency must then be absorbed by the solvent partners.

- Garner vs. Murray Principle: The method of sharing the deficiency among solvent partners can vary. According to the principle established in the Garner vs. Murray case, the deficiency can be divided among solvent partners in proportion to their capital contributions rather than their profit-sharing ratio.

- Ceasing Partnership: When a partner is declared insolvent, they cease to be a partner from the date of the adjudication order.

- Dissolution of Firm: The firm is automatically dissolved on the date of the adjudication order, unless there is a prior agreement stating otherwise.

- Liability of Estate: The estate of the insolvent partner is not responsible for any actions of the firm that occur after the date of the adjudication order.

- Liability of Firm: The firm cannot be held accountable for any actions of the insolvent partner that take place after the date of the adjudication order.

Loss Arising from Insolvency of a Partner

- When a partner in a firm is unable to pay their debts to the firm, they are considered insolvent. In such cases, the loss resulting from this insolvency must be borne by the other solvent partners. This principle is based on the legal precedent set in the English case of Garner vs. Murray.

- According to the Garner vs. Murray decision:

- Solvent partners are responsible for covering the loss caused by a partner's insolvency.

- The normal loss from the realization of assets is shared by all partners (including the insolvent partner) according to their profit-sharing ratio.

- However, the loss due to a partner's insolvency is distributed among the solvent partners based on their capital ratio.

- The capital ratio is determined by the relative amounts of capital that each solvent partner has in the firm.

- The Indian Partnership Act does not contradict the Garner vs. Murray rule.

- If the partnership agreement specifies a different method for handling a partner's insolvency, that method should be followed.

Capital Ratio on Insolvency

- Fixed Capitals: If partners maintain fixed capitals, adjustments related to profits, interest, drawings, etc., are made through Current Accounts. In this case, insolvency loss is distributed according to the ratio of fixed capitals.

- Fluctuating Capitals: If partners do not have fixed capitals and all transactions are recorded in Capital Accounts, the Balance Sheet should not display Current Accounts. The capital ratio is determined after adjusting reserves, accumulated profits, drawings, interest on capitals and drawings up to the date of dissolution, but before considering the profit or loss from the Realization Account.

- Debit Balance in Capital Account: If a partner has a debit balance in their Capital Account but is not insolvent, they cannot be held responsible for bearing the loss due to another partner's insolvency.

Insolvency of All Partners

- Definition: All partners are considered insolvent when the firm's liabilities cannot be fully settled with the firm's assets and the personal assets of the partners.

- Accounting Treatment: In such cases, it is advisable not to transfer the creditors' amounts to the Realization Account. Instead, the balance of the creditors' accounts should be transferred to the Deficiency Account.

- Payment to Creditors: Creditors may be paid the amounts available, which can include contributions from the partners.

- Transfer to Capital Accounts: The unsatisfied portion of the creditor accounts is transferred to the Capital Accounts of the partners in the profit-sharing ratio. After this transfer, the Capital Accounts are closed.

- Closing Capital Accounts: When closing the Capital Accounts, start with the account in the worst position. The last account will be automatically closed.

ILLUSTRATION 2

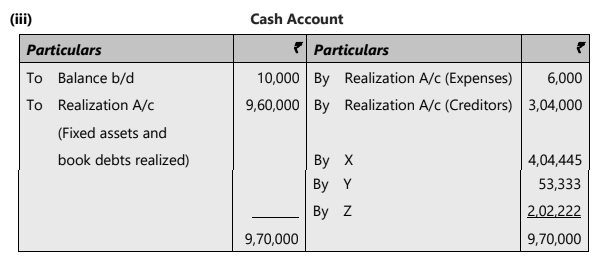

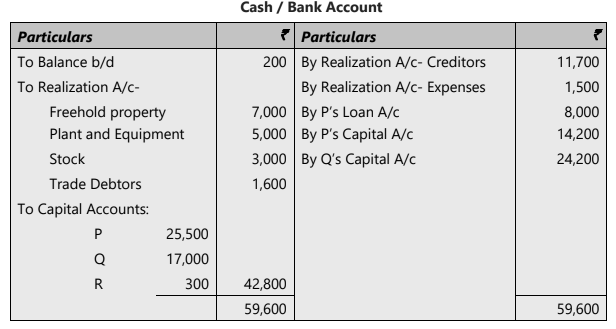

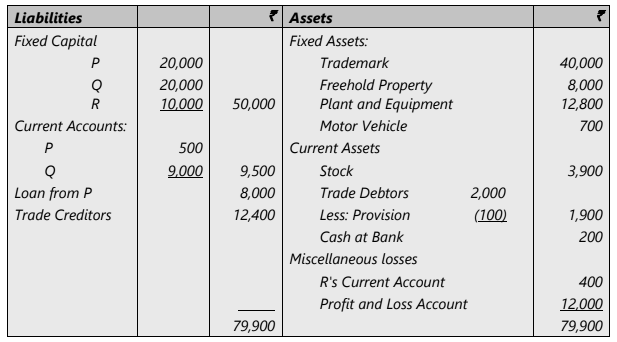

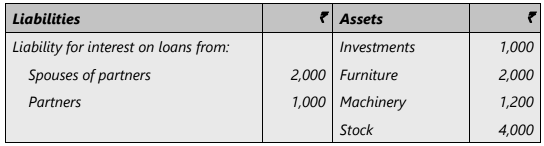

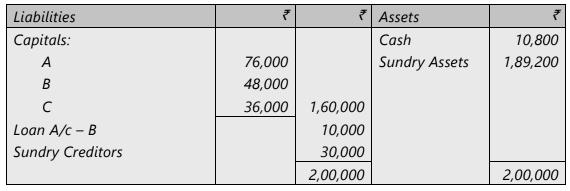

P, Q, and R were partners sharing profits and losses in the ratio of 3: 2: 1, no partnership salary or interest on capital being allowed. Their balance sheet on 30th June, 2022 is as follows:

On 1st July, 2022 the partnership was dissolved. Motor Vehicle was taken over by Q at a value of ₹ 500 but no cash passed specifically in respect of this transaction. Sale of other assets realized the following amounts:

Trade Creditors were paid ₹ 11,700 in full settlement of their debts. The costs of dissolution amounted to ₹ 1,500. The loan from P was repaid, P and Q were both fully solvent and able to bring in any cash required but R was forced into bankruptcy and was only able to bring 1/3 of the amount due.

Required

(a) Cash and Bank Account,

(b) Realization Account, and

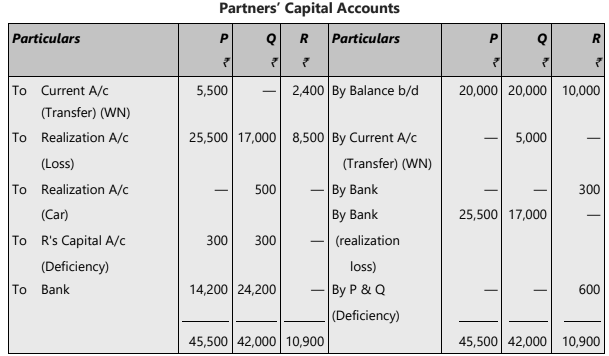

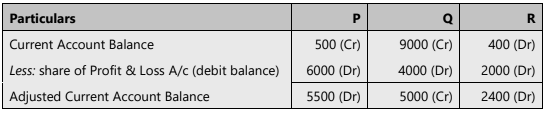

(c) Partners Fixed Capital Accounts (after transferring Current Accounts’ balances).

SOLUTION

Working Note:

Note:

1. P, Q, and R will bring cash to make good their share of the loss on realization. In actual practice they will not be bringing any cash; only a notional entry will be made.

2. On following Garner Vs. Murray rule, solvent partners P and Q have to bear the loss due to insolvency of a partner R in their fixed capital ratio.

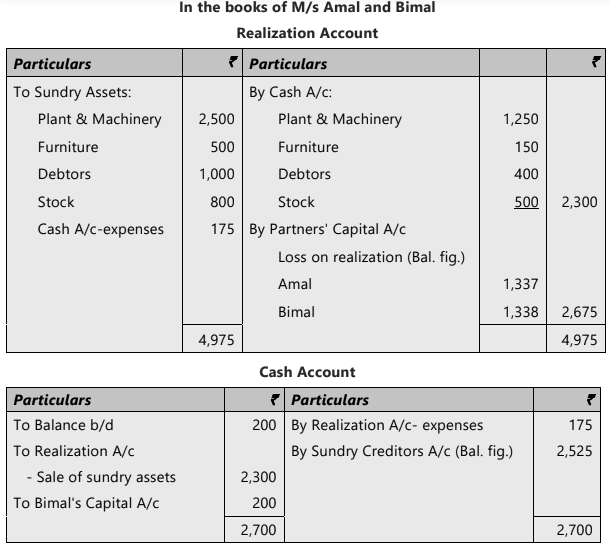

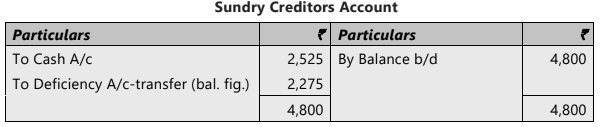

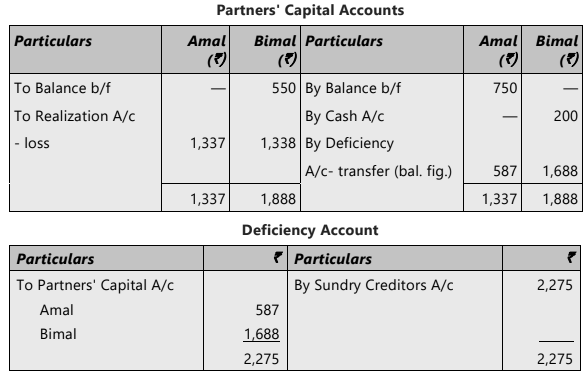

ILLUSTRATION 3

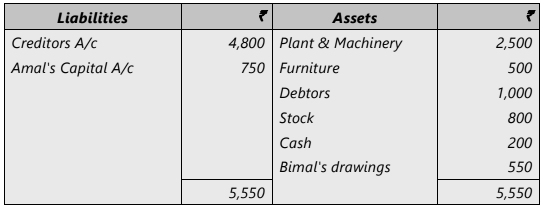

Amal and Bimal are in equal partnership. Their Balance Sheet stood as under on 31st March, 2021 when the firm was dissolved:

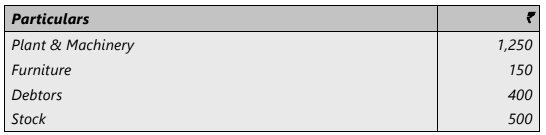

The assets realized as under:

The expenses of realization amounted to ₹ 175. Amal's private estate is not sufficient even to pay his private debts, whereas Bimal's private estate has a surplus of ₹200 only.

Show necessary ledger accounts to close the books of the firm.

SOLUTION

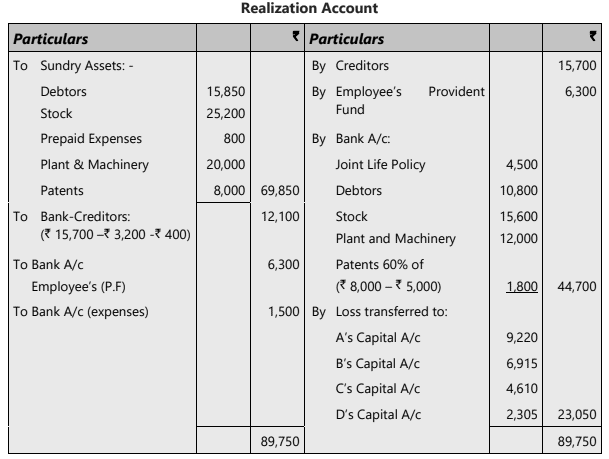

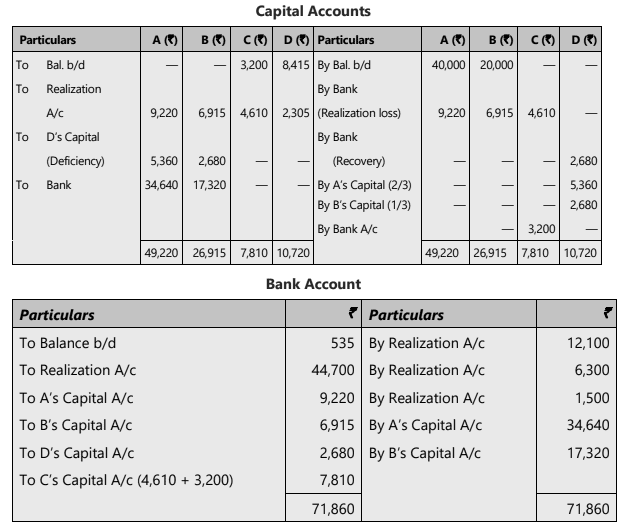

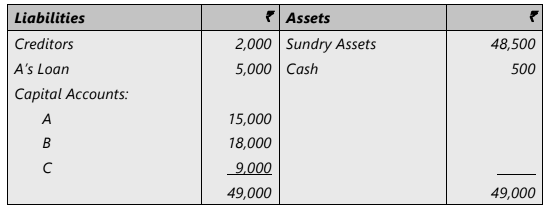

ILLUSTRATION 4

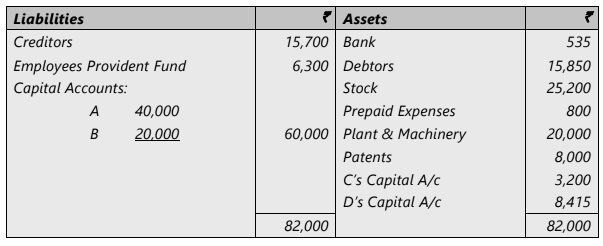

A, B, C, and D sharing profits in the ratio of 4:3:2:1 decided to dissolve their partnership on 31st March 2022 when their balance sheet was as under:

Following information is given to you: -

1. One of the creditors took some of the patents whose book value was ₹ 5,000 at a valuation of ` 3,200. Balance of the creditors were paid at a discount of ₹ 400.

2. There was a joint life policy of ₹ 20,000 (not mentioned in the balance sheet) and this was surrendered for ₹ 4,500.

3. The remaining assets were realized at the following values: - Debtors ₹ 10,800; Stock ₹ 15,600; Plant and Machinery ₹ 12,000; and Patents at 60% of their book-values. Expenses of realization amounted to ₹ 1,500.

D became insolvent and a dividend of 25 paise in a rupee was received in respect of the firm's claim against his estate. Prepare necessary ledger accounts.

SOLUTION

Working Note:

D’s loss will be borne by A and B only because only solvent partners having credit balance has to bear the loss on account of insolvency. C will bring his share of loss in cash.

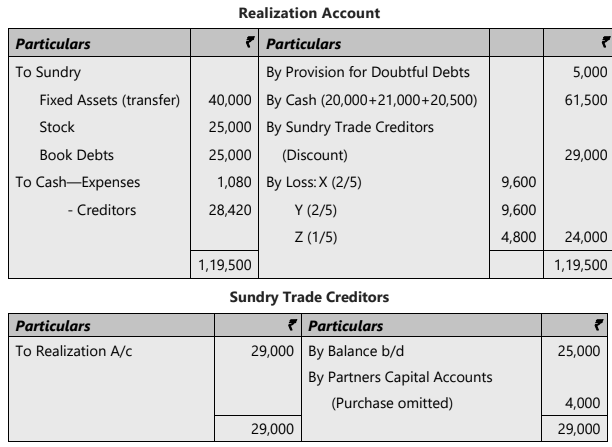

ILLUSTRATION 5

M/s X, Y, and Z who were in partnership sharing profits and losses in the ratio of 2:2:1 respectively, had the following Balance Sheet as on December 31, 2022:

The firm was dissolved on the date mentioned above due to continued losses. After drawing up the balance sheet given above, it was discovered that goods amounting to ₹ 4,000 have been purchased in November, 2022 and had been received but the purchase was not recorded in books.

Fixed assets realized ₹ 20,000; Stock ₹ 21,000 and Book Debt ₹ 20,500. Similarly, the creditors allowed a discount of 2% on average. The expenses of realization come to ₹ 1,080. X agreed to take over the loan of Mrs. X. Y is insolvent, and his estate is unable to contribute anything.

Give accounts to close the books; work according to the decision in Garner vs. Murray.

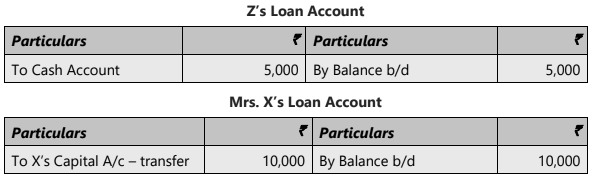

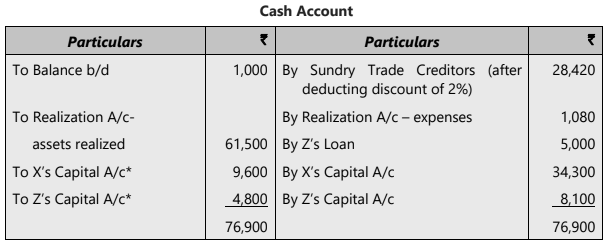

SOLUTION

*X and Z bring these amounts to make good their share of the loss on realization. In actual practice they will not be bringing any cash; only a notional entry will be made.

Note: Y’s deficiency comes to ₹ 4,400 (difference in the two sides of his Capital Account); this has been debited to X and Z in the ratio of 27,600: 9,200 i.e., capital standing up just before dissolution but after correction of error committed while drawing up the accounts for 2022.

Piecemeal Payments

When a partnership dissolves, the assets are often sold in small installments over time. In such cases, the partners face a choice: either to distribute whatever is collected so far or to wait until the entire amount is collected. Typically, the first option is chosen.To ensure that the cash distribution among partners reflects their interest in the partnership, one of two methods can be used to determine the order of payments.

Maximum Loss Method

- Under this method, each installment received is treated as the final payment. This means that any remaining assets and claims are considered worthless at the time of distribution.

- Partners' accounts are adjusted based on this assumption each time a distribution is made, following either the Garner vs. Murray Rule or the profit-sharing ratio rule.

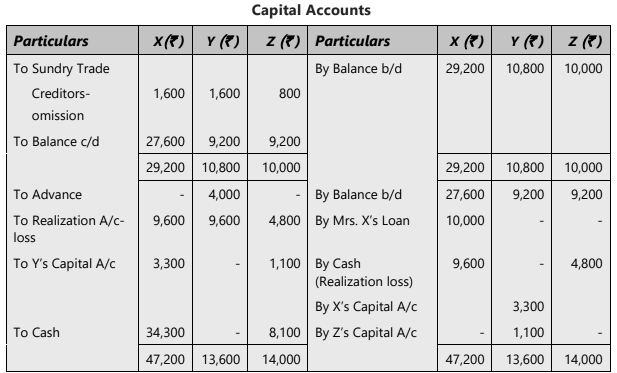

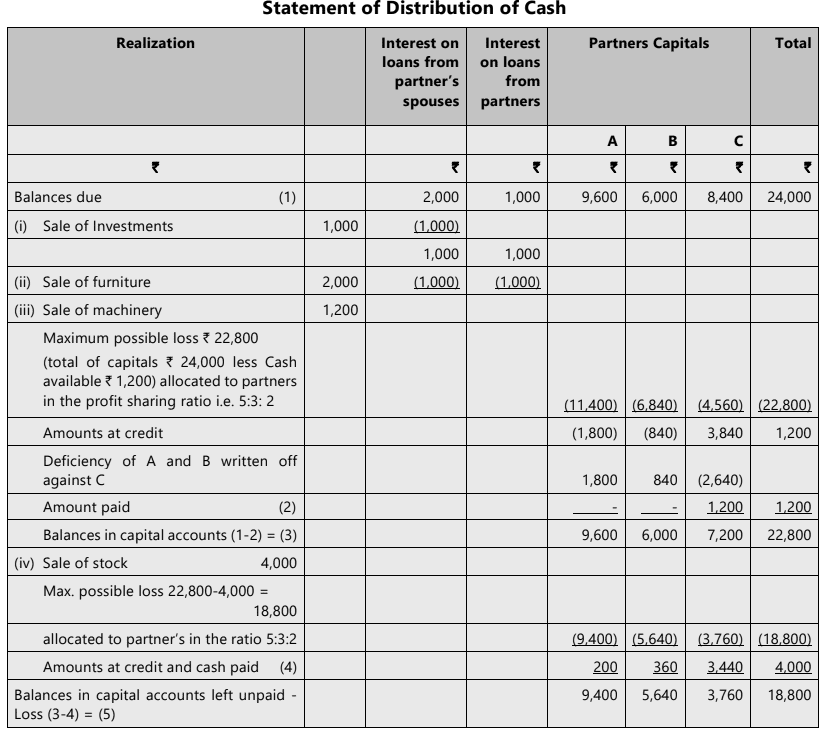

ILLUSTRATION 6

A, B, and C are partners sharing profits and losses in the ratio of 5:3:2. Their capitals were ₹ 9,600, ₹ 6,000 and ₹ 8,400 respectively.

After paying creditors, the liabilities and assets of the firm were:

The assets realized in full in the order in which they are listed above. B is insolvent.

You are required to prepare a statement showing the distribution of cash as and when available, applying the maximum possible loss procedure.

SOLUTION

ILLUSTRATION 7

The following is the Balance Sheet of A, B, C on 31st December, 2022 when they decided to dissolve the partnership:

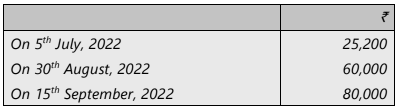

The assets realize the following sum of installments:

The expenses of realization were expected to be `₹ 500 but ultimately amounted to ₹ 400 only. Show how at each stage the cash received should be distributed between partners. They share profits in the ratio of 2:2:1.

SOLUTION

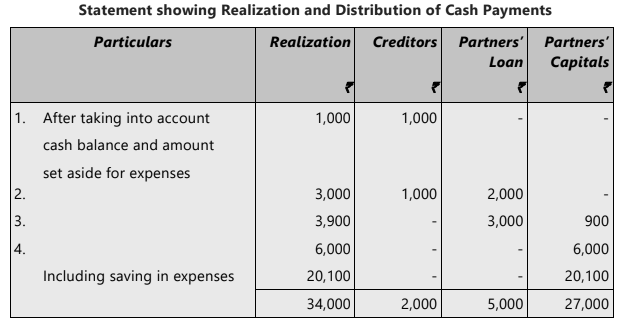

First of all, the following table will be constructed to show the amounts available for distribution among the various interests:

To ascertain the amount distributable out of each installment realized among the partners, the following table will be constructed:

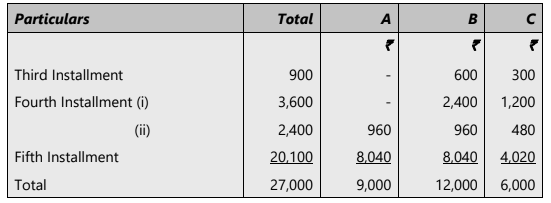

Statement of Distribution on Capital Accounts

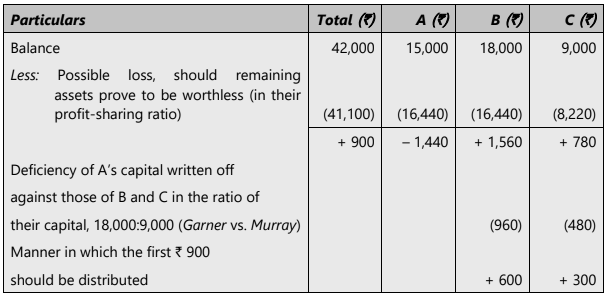

(1) Calculation to determine the mode of distribution of ₹ 900

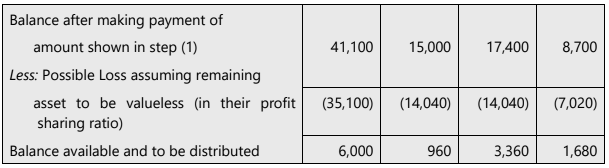

(2) Distribution of ₹ 6,000

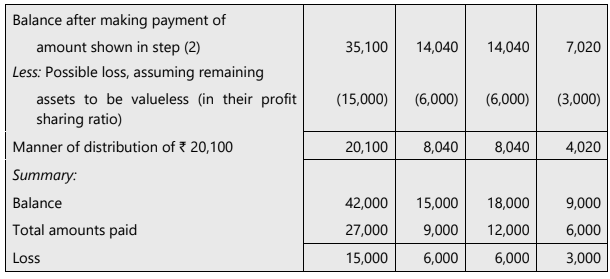

(3) Distribution of ₹ 20,100

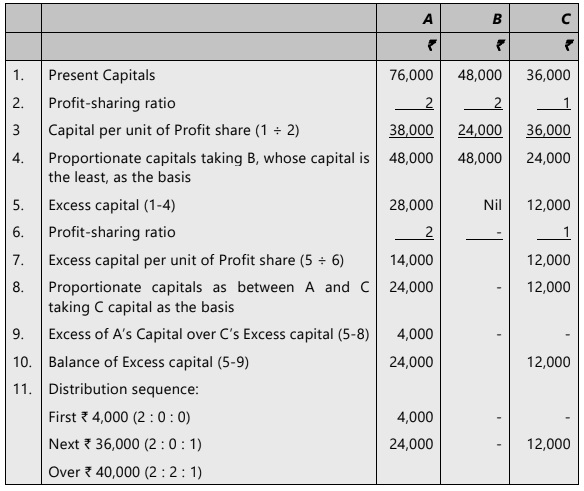

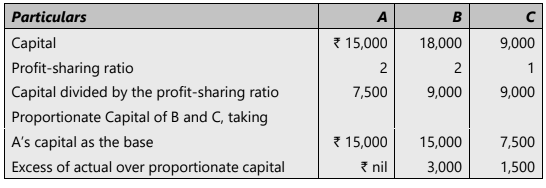

Highest Relative Capital Method

This method focuses on paying off partners based on their relative capital in proportion to their profit-sharing ratio. Here’s how it works:- Determine Relative Capital: Calculate each partner's capital in relation to their profit-sharing ratio. This helps identify who has excess capital.

- Identify Basic Capital: Divide the partners' capitals by figures proportional to their profit-sharing ratio. The smallest quotient indicates the basic capital.

- Calculate Hypothetical Capitals: Once the partner with the smallest basic capital is identified, calculate the hypothetical capitals for other partners. This represents the capital they would have based on the basic capital partner's ratio.

- Find Excess Capital: Subtract each partner's hypothetical capital from their actual capital to determine excess capital.

- Repeat as Necessary: If multiple partners have excess capital, repeat the process until the excess amounts are determined.

- Payment Order: Start by paying the partner with the largest excess capital first, then proceed to others in order of their excess until all partners' capitals are reduced to their profit-sharing ratios.

This method ensures that partners are paid off fairly based on their relative capital contributions while aligning with their profit-sharing agreements.

The illustration given above is now worked out according to this method.

This indicates that A should not get anything till ₹ 3,000 is paid to B and ₹ 1,500 is paid to C. Since capital of B and C are already according to their mutual profit-sharing ratio (2:1), they will share the available cash in this ratio.

After paying off creditors and A’s loan, the available amount will be distributed as below in this method:

Total payment made to each partner will, of course be same under both the methods.

ILLUSTRATION 8

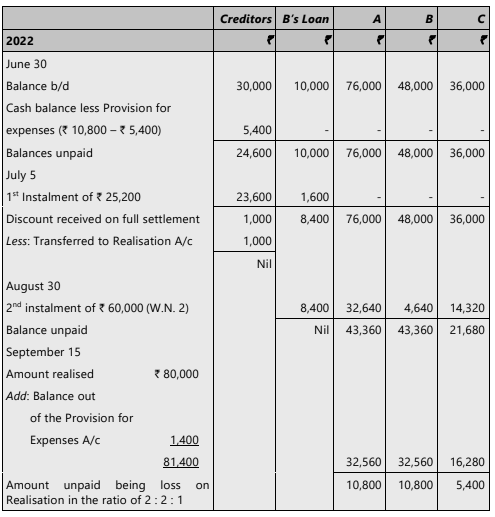

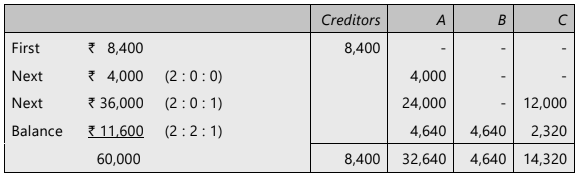

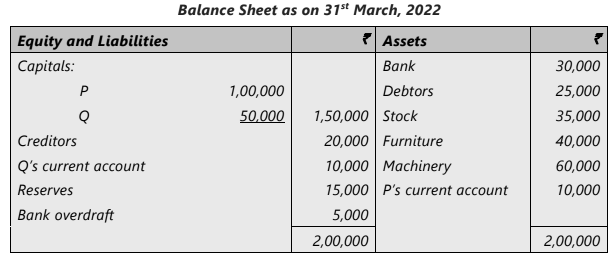

A partnership firm was dissolved on 30th June, 2022. Its Balance Sheet on the date of dissolution was as follows:

The assets were realized in instalments and the payments were made on the proportionate capital basis. Creditors were paid ₹ 29,000 in full settlement of their account. Expenses of realization were estimated to be ₹ 5,400 but actual amount spent was ₹ 4,000. This amount was paid on 15th September. Draw up a statement showing distribution of cash, which was realized as follows:

The partners shared profits and losses in the ratio of 2 : 2 : 1. Prepare a statement showing distribution of cash amongst the partners by ‘Highest Relative Capital’ method.

SOLUTION

Statement showing distribution of cash amongst the partners

Working Notes:

1. Highest relative capital basis

2. Distribution of Second instalment

Winding Up of a Limited Liability Partnership (LLP)

Winding up of a Limited Liability Partnership (LLP) can be either voluntary or by the Tribunal. Once wound up, the LLP can be dissolved.Winding Up by Tribunal

Winding up of a LLP may be initiated by Tribunal if:

- The LLP wishes to wind up;

- The LLP has less than 2 partners for more than 6 months;

- The LLP is unable to pay its debts;

- The LLP has not acted in the interest of the sovereignty and the integrity of India;

- The LLP has failed to submit with the statements of accounts and solvency or the LLP annual returns for more than five consecutive financial years with the Registrar;

- The Tribunal thinks that it is Just and Equitable that the LLP should be wound up.

The Central Government may make rules for the provisions in relation to winding up and dissolution of LLP.

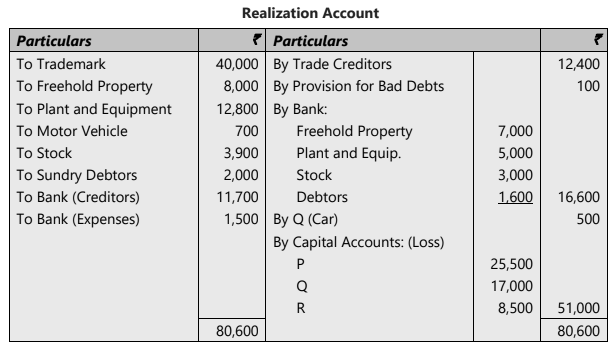

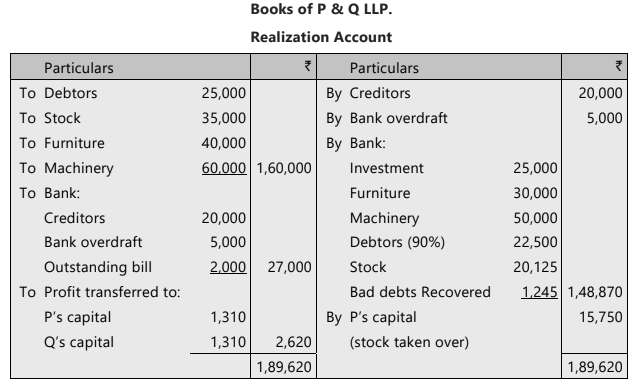

ILLUSTRATION 9

P and Q were partners sharing profits equally in LLP. Their Balance Sheet as on March 31, 2022 was as follows:

The firm was dissolved on the above date:

P took over 50% of the stock at 10% less on its book value, and the remaining stock was sold at a gain of 15%. Furniture and Machinery realized for ₹ 30,000 and ₹ 50,000 respectively; There was an unrecorded investment which was sold for ₹ 25,000; Debtors realized 90% only and ₹ 1,245 were recovered for bad debts written off last year. There was an outstanding bill for repairs which had to be paid for ₹ 2,000.

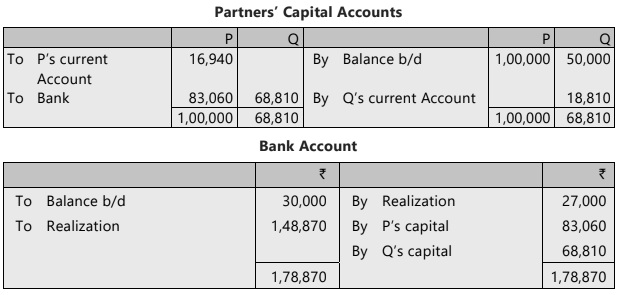

You are required to prepare Realization Account, Partners’ capital accounts (including transfer of current account balances) and Bank Account in the books of the firm.

SOLUTION

Working Note:

|

68 videos|265 docs|83 tests

|

FAQs on Unit 6: Dissolution of Partnership Firms and LLPs Chapter Notes - Accounting for CA Foundation

| 1. What are the primary circumstances that can lead to the dissolution of a partnership? |  |

| 2. What are the consequences of dissolving a partnership? |  |

| 3. How are the partnership books closed during dissolution? |  |

| 4. What happens if a partner becomes insolvent during the dissolution process? |  |

| 5. What is the Highest Relative Capital Method in piecemeal payments during dissolution? |  |