Unit 6: Redemption of Debentures Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction |

|

| Redemption of Debentures |

|

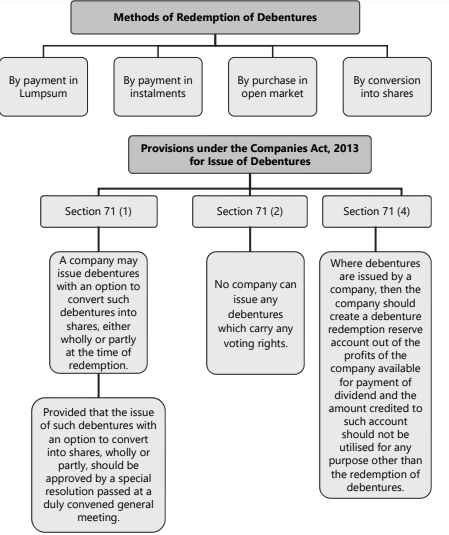

| Methods of Redemption of Debentures |

|

Unit Overview

Introduction

- A debenture is a formal document issued by a company, under its official seal, as an acknowledgment of a debt. It outlines the terms for repayment of the principal amount and interest.

- According to Section 71 (1) of the Companies Act, 2013, a company has the option to issue debentures that can be converted into shares, either fully or partially, at the time of redemption.

- However, this option must be approved by a special resolution during a duly convened general meeting.

- Section 71 (2) specifies that debentures cannot carry any voting rights.

- Section 71 (4) mandates the creation of a Debenture Redemption Reserve (DRR) account from the company’s profits when debentures are issued. The funds in this account are strictly for the redemption of debentures and cannot be used for any other purpose.

Basic Provisions

- When a charge is created on any asset or the entire assets of a company, the nature of the charge and the asset(s) charged are described in the debenture document.

- The charge is only valid if it is registered with the Registrar, and his certificate registering the charge is printed on the bond.

- In cases of mortgage debentures, it is customary to create a trusteeship in favor of one or more persons. The trustees of debenture holders have the powers of a mortgage of a property and can act as they see fit to protect the interests of debenture holders.

Note: The detailed discussion on the issue of debentures can be found in Unit 3 of Chapter 11.

Redemption of Debentures

Debentures can be redeemed either in cash or converted into equity shares after a specified period.

Modes of Redemption

- Fixed Redemption: Debentures may be redeemed after a predetermined number of years.

- Conditional Redemption: Redemption can occur any time after a specified period has elapsed since issuance.

- Notice-based Redemption: Redemption can be initiated by providing a specified notice period.

- Annual Drawing: Debentures may be redeemed through annual drawings.

Open Market Purchase

- Companies have the option to buy back their debentures from the open market.

- If debentures are trading at a discount on the Stock Exchange, it may be financially advantageous for the company to purchase and cancel them.

Debenture Redemption Reserve

- Definition:. Debenture Redemption Reserve (DRR) is a mandatory reserve account that companies must create from their profits when issuing debentures. The funds in this account are strictly designated for the redemption of debentures.

- Purpose: The primary purpose of the DRR is to ensure that the company has sufficient liquid funds available to redeem debentures when they become due.

- Annual Transfer: Companies are required to transfer an appropriate amount from their profits to the DRR every year until the debentures are redeemed.

- Investment of DRR Funds: The funds in the DRR can be invested in specified securities, such as deposits with scheduled banks, unencumbered government securities, or bonds issued by notified companies.

- Encashment and Use of DRR Investments: In the final year or at the time of debenture redemption, the investments made from the DRR are encashed, and the proceeds are used for redeeming the debentures.

Requirement to create Debenture Redemption Reserve

Section 71 of the Companies Act 2013 governs the requirement to create a Debenture Redemption Reserve (DRR) account. The key provisions are as follows:

- Annual Creation of DRR: Companies issuing debentures must create a DRR account from profits available for dividend distribution each year until the debentures are redeemed.

- Utilization of DRR Funds: Amounts credited to the DRR can only be used for the specified purpose of redeeming debentures.

- Compliance with Terms: Companies must pay interest and redeem debentures according to the terms and conditions of their issuance.

- Tribunal Intervention: If a company fails to redeem debentures on maturity or pay interest when due, the Tribunal can order immediate redemption upon application by debenture holders or trustees.

Balance in Debenture Redemption Reserve (DRR)

Initial Creation of DRR: When a company establishes a Debenture Redemption Reserve (DRR) Account, the amount specified in the DRR tables is credited to the DRR account and debited to the profit and loss account. This reflects the company’s intention to set aside funds for redeeming debentures.

Immediate Investment: Along with creating the DRR, the company should promptly purchase outside investments. This involves debiting the Debenture Redemption Reserve Investments account and crediting the Bank account.

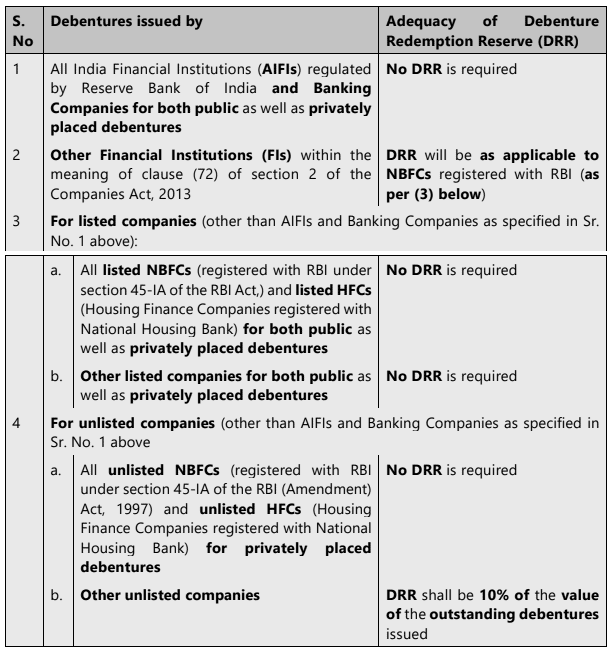

Adequacy of Debenture Redemption Reserve (DRR)

Introduction: Rule 18 (7) of the Companies (Share Capital and Debentures) Amendment Rules, 2019 outlines the requirements for Debenture Redemption Reserve (DRR) and investment or deposit for debentures maturing during the year ending on the 31st day of March of the next year.

Adequacy of DRR and Investment/Deposit: The adequacy of DRR and investment or deposit varies based on the type of debentures and the issuing companies, as detailed in the following table:

Table: Adequacy of Debenture Redemption Reserve

Investment of Debenture Redemption Reserve (DRR) Amount

As per Rule 18 (7) of the Companies (Share Capital and Debentures) Amendment Rules, 2019, specific companies are required to deposit or invest a sum not less than 15% of the amount of debentures maturing during the year ending on the 31st day of March of the next year. This requirement applies to the following companies:

- All listed NBFCs

- All listed HFCs

- All other listed companies (excluding AIFIs, Banking Companies, and Other Financial Institutions)

- All unlisted companies that are not NBFCs and HFCs

Methods of Deposit or Investment: The required amount can be deposited or invested in any one or more of the following methods:

- Deposits: In deposits with any scheduled bank, free from charge or lien.

- Government Securities: In unencumbered securities of the Central Government or any State Government.

- Trust Securities: In unencumbered securities mentioned in clauses (a) to (d) and (ee) of Section 20 of the Indian Trusts Act, 1882.

- Company Bonds: In unencumbered bonds issued by notified companies under clause (f) of Section 20 of the Indian Trusts Act, 1882.

Utilization of Deposits or Investments: The deposited or invested amount should be utilized solely for the redemption of debentures maturing during the specified year. Additionally, the remaining amount should not fall below 15% of the maturing debentures at any time.

Partly Convertible Debentures: In the case of partly convertible debentures, DRR should be created for the non-convertible portion of the debenture issue.

Utilization of DRR Funds: The amount credited to DRR should only be used for the redemption of debentures.

Timing of Appropriation: Appropriation to DRR can be made any time before redemption, and investments in specified securities can be done before 30th April for the maturing debentures. However, it is advisable to make the appropriation and investment immediately after debenture allotment, assuming sufficient profits.

Journal Entries for Debenture Redemption

1. After Allotment of Debentures

(a) Setting Aside Profit for Redemption

- Debit: Profit and Loss Account

- Credit: Debenture Redemption Reserve Account

(b) Investing Amount for Redemption

- Debit: Debenture Redemption Reserve Investment Account

- Credit: Bank Account

(c) Receipt of Interest on Debenture Redemption Reserve Investments

- Debit: Bank Account

- Credit: Interest on Debenture Redemption Reserve Investment Account

(d) Transfer of Interest on Debenture Redemption Reserve Investments

- Debit: Interest on Debenture Redemption Reserve Investment Account

- Credit: Profit and Loss Account

2. At the Time of Redemption of Debentures

(a) Encashment of Debenture Redemption Reserve Investments

- Debit: Bank Account

- Credit: Debenture Redemption Reserve Investment Account

(b) Amount Due to Debentureholders on Redemption

- Debit: Debentures Account

- Credit: Debentureholders Account

(c) Payment to Debentureholders

- Debit: Debentureholders Account

- Credit: Bank Account

(d) Transfer of Debenture Redemption Reserve to General Reserve

- Debit: Debenture Redemption Reserve Account

- Credit: General Reserve Account

Methods of Redemption of Debentures

- Redemption of debentures should be carried out according to the terms set during the issuance of debentures. Any deviation from these terms will be considered a default by the company.

- There are three methods for redeeming debentures:

1. Payment in Lump Sum

- In this method, the entire amount of the debenture is paid at once, either at maturity or after a specified period.

- Alternatively, payment can be made before the end of the specified period.

2. Payment in Instalments

- This method involves paying a specified portion of the debenture in instalments at predetermined intervals.

3. Purchase of Debentures in Open Market

- Sometimes, debentures are bought back from the open market.

- However, this method is not included in the current syllabus at the Foundation level.

ILLUSTRATION 1

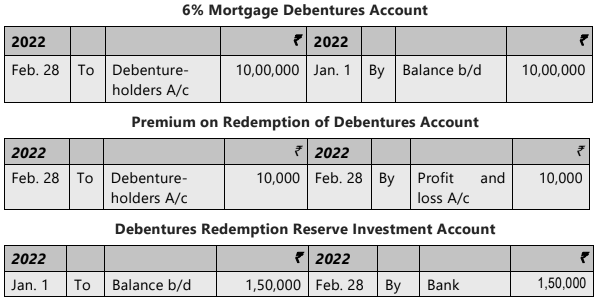

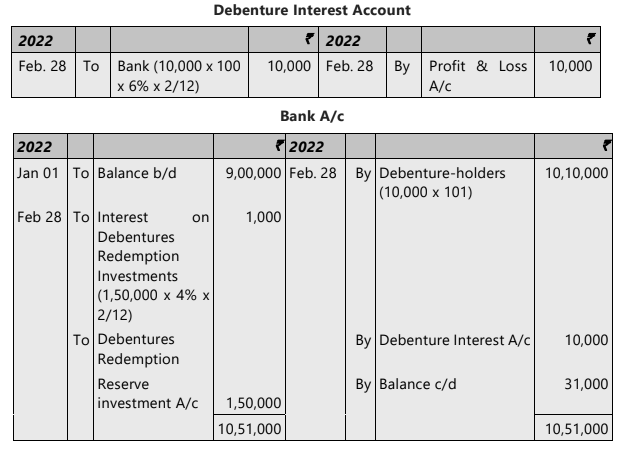

The following balances appeared in the books of a company (unlisted company other than AIFI, Banking company, NBFC and HFC) as on December 31, 2021: 6% Mortgage 10,000 debentures of ₹ 100 each; Debenture Redemption Reserve (for redemption of debentures) ₹ 50,000; Investments in deposits with a scheduled bank, free from any charge or lien ₹1,50,000 at interest 4% p.a. receivable on 31st December every year. Bank balance with the company is ₹ 9,00,000.

The Interest on debentures had been paid up to December 31, 2021.

On February 28, 2022, the investments were realised at par and the debentures were paid off at 101, together with accrued interest.

Write up the concerned ledger accounts (excluding bank transactions). Ignore taxation.

SOLUTION

Note: Amount to be transferred to DRR before the redemption = ₹ 1,00,000 [i.e. 10% of (10,000 X 100)].

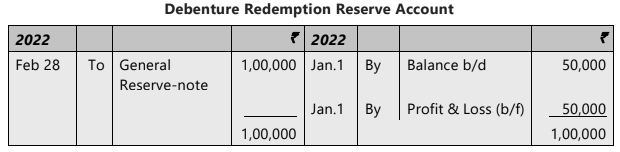

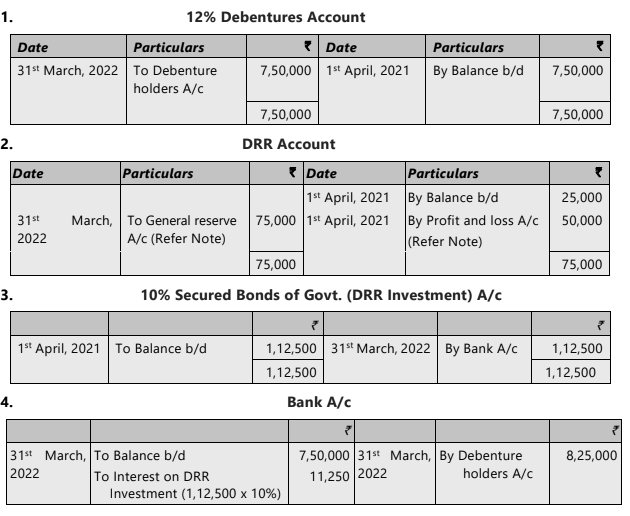

ILLUSTRATION 2

The following balances appeared in the books of Paradise Ltd (unlisted company other than AIFI, Banking company, NBFC and HFC) as on 1-4-2021:

(i) 12 % Debentures ₹7,50,000

(ii) Balance of DRR ₹ 25,000

(iii) DRR Investment 1,12,500 represented by 10% ₹1,125 Secured Bonds of the Government of India of ₹ 100 each.

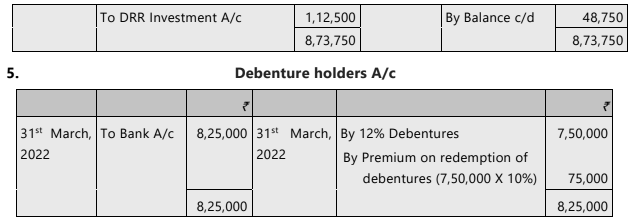

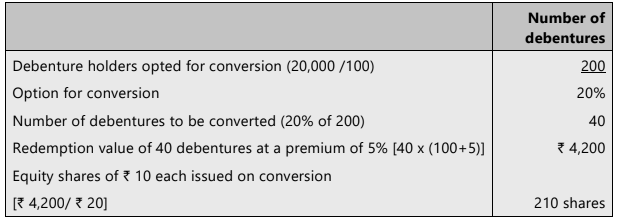

Annual contribution to the DRR was made on 31st March every year. On 31-3-2022, balance at bank was ₹ 7,50,000 before receipt of interest. The investment were realised at par for redemption of debentures at a premium of 10% on the above date.

You are required to prepare the following accounts for the year ended 31st March, 2022:

(1) Debentures Account

(2) DRR Account

(3) DRR Investment Account

(4) Bank Account

(5) Debenture Holders Account.

SOLUTION

Note –

Calculation of DRR before redemption = 10% of ₹ 7,50,000 = 75,000

Available balance = ₹ 25,000

DRR required = 75,000 – 25,000 = ₹ 50,000.

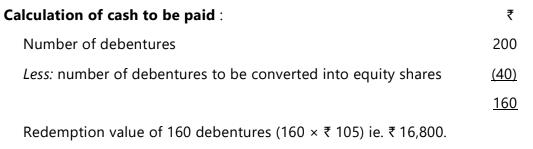

ILLUSTRATION 3

XYZ Ltd. has issued 1,000, 12% convertible debentures ₹100 each redeemable after a period of five years. According to the terms & conditions of the issue, these debentures were redeemable at a premium of 5%. The debenture holders also had the option at the time of redemption to convert 20% of their holdings into equity shares of ₹ 10 each at a price of ₹20 per share and balance in cash. Debenture holders amounting ₹ 20,000 opted to get their debentures converted into equity shares as per terms of the issue. You are required to calculate the number of shares issued and cash paid for redemption of ₹ 20,000 debenture holders.

SOLUTION

ILLUSTRATION 4

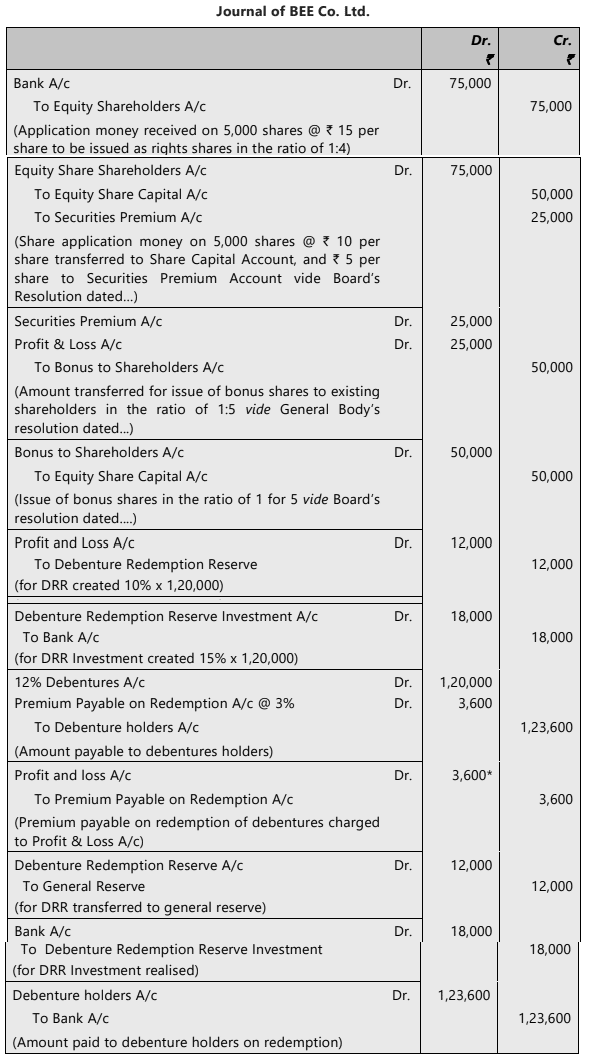

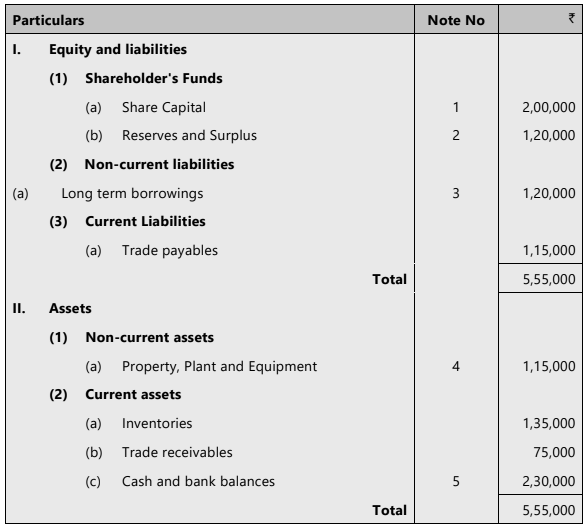

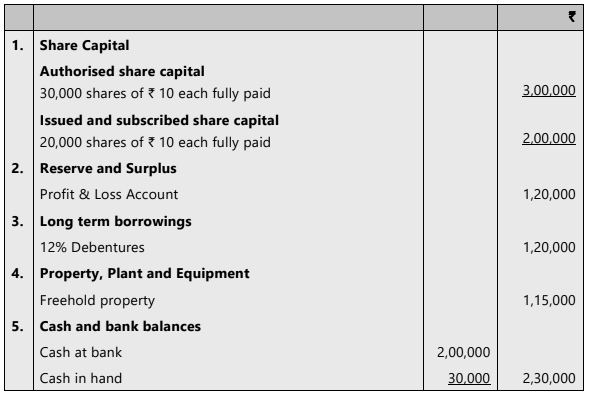

The Balance Sheet of BEE Co. Ltd. (unlisted company other than AIFI, Banking company, NBFC and HFC) as at 31st March, 2021 is as under:

Notes to Accounts

At the Annual General Meeting, it was resolved:

(a) To give existing shareholders the option to purchase one ₹ 10 share at ₹ 15 for every four shares (held prior to the bonus distribution). This option was taken up by all the shareholders.

(b) To issue one bonus share for every five shares held.

(c) To repay the debentures at a premium of 3%. The DRR Investments realised at par as per existing Book value.

Give the necessary journal entries for these transactions.

SOLUTION

* In the absence of details of the term of debentures (redemption period), the entire redemption premium was charged to profit & loss A/c of the year.

|

68 videos|265 docs|83 tests

|

FAQs on Unit 6: Redemption of Debentures Chapter Notes - Accounting for CA Foundation

| 1. What is meant by the redemption of debentures? |  |

| 2. What are the different methods of redemption of debentures? |  |

| 3. Why is the redemption of debentures important for a company? |  |

| 4. How does the method of redemption affect the financial statements of a company? |  |

| 5. What factors should a company consider when deciding on the method of redemption? |  |