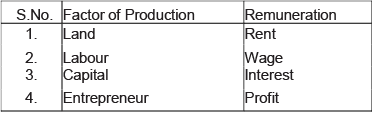

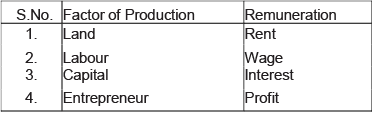

Q.1. What are the four factors of production and what are the remunerations to each of these called?

Ans. Following are the four factors of production and their respective remunerations:

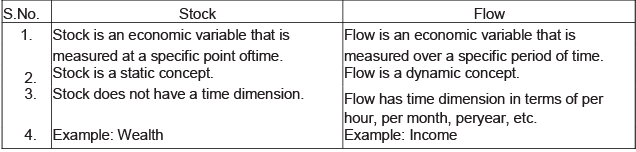

Q.2. Distinguish between stock and flow. Between net investment and capital, which is a stock and which is a flow? Compare net investment and capital with flow of water into a tank.

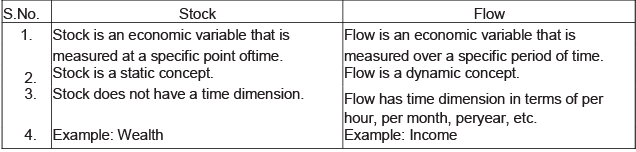

Ans. Following are the points of difference between stock and flow:

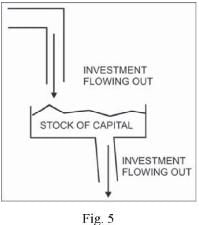

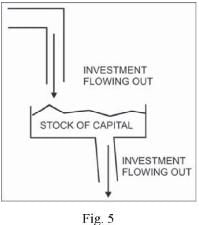

Net investment is a flow while capital is a stock.

Net investment is a flow variable because its magnitude is measured over a period of time, say, one year. Capital is a stock because its magnitude is measured at a point of time, say, on 31st March, 2007. Net investment and capital can be compared with flow of water into a tank.

Capital is like water in tank while net investment is the water flowing in to and out of the tank. Flow of water into tank is measured over a period of time while water in the tank is measured at a particular point of time.

Q.3. What is the difference between planned and unplanned inventory accumulation? Write down the relation between change in inventories and value added of a firm.

Ans. The change in inventories may be planned or unplanned. Following points explain the difference between the two:

S.No.

| Planned Inventory | Unplanned Inventory |

| 1 | Planned inventories refer to the changes in the stock of inventories, which take place in an anticipated way. | Unplanned inventories refer to the changes in the stock of inventories, which take place in an unanticipated manner.

|

| 2 | In a situation of planned inventory accumulation, firm plans to raise its inventories. | In case of an unexpected fall in sales, the firm will have unsold stock of goods, which it had not anticipated. Hence, there will be unplanned accumulation of inventories

|

| 3 | In a situation of planned inventory dispersal, firm plans to reduce its inventories. | In case of an unexpected rise in sales, the firm will fall short of stock of goods. Hence, there will be unplanned dispersal of inventories

|

Value added is the difference between the value of the total output and the value of intermediary goods used by each production unit in an economy. It includes the change in firm’s stock of inventories.

Thus,

Gross Value Added of firm = Value of sales by the firm + Value of change in inventories - Value of intermediate goods used by the firm

GVA = V + A - Z

The change in inventories means difference between opening inventories and closing inventories. The change in inventories affects the Gross Value Added. It is derived from the production and sales of the firm.

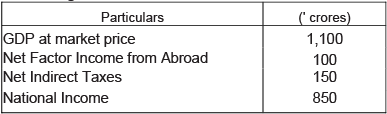

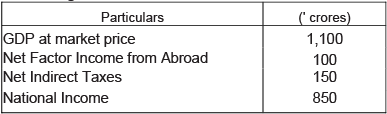

Q.4. Suppose the GDP at market price of a country in a particular year was ' 1,100 crores. Net Factor Income from Abroad was ' 100 crores.The value of indirect taxes - subsidies was ' 150 crores and National Income was ' 850 crores. Calculate the aggregate value of depreciation.

Ans. The following information is given:

National Income (NNPFC) = GDPMp + Net Factor Income from Abroad - Net Indirect Taxes -Depreciation

Substituting appropriate values from the table, we get:

850 = 1,100 + 100 - 150 - Depreciation

Depreciation = 1,100 + 100 - 150 - 850 - 1,200 -1000 = 200

Thus, the aggregate value of depreciation is ' 200 crores.

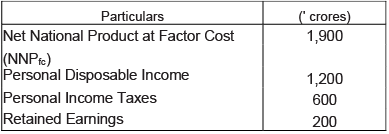

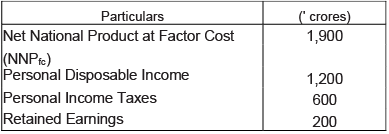

Q.5. Net National Product at Factor Cost of a particular country in a year is ' 1,900 crores. There are no interest payments made by the households to the firms/ government, or by the firms/ governments to the households. The Personal Disposable Income of the households is ' 1,200 crores. The personal income taxes paid by them ' 600 crores and the value of retained earnings of the firms and government is valued at' 200 crores. What is the value of transfer payments made by the government and firms to the households?

Ans. The following information is given:

Personal Disposable Income

= NNPfc- Retained Earnings - Personal Taxes + Transfer Payments from the Government and the Firms Substituting appropriate values from the table,

we get: 1,200 = 1,900 - 200 - 600 + Transfer Payments from the Government and the Firms

Transfer payments from the Government and the firms

- 1,200 + 600 + 200 - 1,900

- 2,000 - 1,900

- 100

Thus, the value of transfer payments made by the government and firms to the households is ' 100 crores.

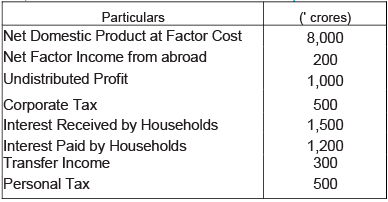

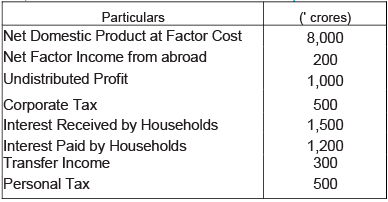

Q.6. From the following data, calculate Personal Income and Personal Disposable Income.

Ans. Personal Income

= Net Domestic Product at Factor Cost + Net Factor Income from Abroad -Undistributed Profit - Corporate Tax + Interest Received by Households + Transfer Income - Interest paid by Households

- 8,000 + 200 - 1,000 - 500 + 1,500 + 300 - 1,200

- 10,000 - 2,700

- 7,300

Personal Disposable Income

= Personal Income - Personal Tax

- 7,300 - 500

- 6,800

Thus, the Personal Income is ' 7,300 crores and Personal Disposable Income is ' 6,800 crores.

Q.7. Distinguish between the following giving suitable examples in support of your answer:

(i) Domestic product and national product

(ii) Intermediate product and final product

Ans. (i) Domestic product and national product Domestic product is defined as the market value of all the final goods and services produced by the factors of production located in the country during a period of one year.

On the other hand, national product is the market value of all the final goods and services produced by the factors of production located in the country during a period of one year plus Net Factor Income from Abroad (NFIA). NFIA is the difference between the incomes of residents for factor services to the rest of the world and payments to the factor services of non-residents in the domestic territory during a period of one year.

National Product = Domestic Product + NFIA

Example: If the domestic product is ' 5,000 and Net Factor Income from Abroad is ' 100, then the National product will be:

National Product = ' 5000 + ' 100 = ' 5100

(ii) Intermediate product and final product Intermediate products are those products which are not meant for final consumption. These are raw materials used in the production of other goods and services.

Final products are those products which are ready for consumption or capital formation by final users.

Example: A chair is a final good, but wood, cane, foam, cloth, etc. used to produce chair are all intermediary goods.

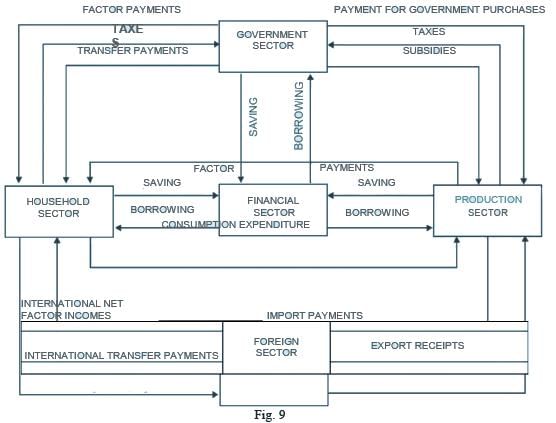

Q.8. Explain the circular flow of an open economy.

Ans. Four-sector economy model is also known as an open economy model. The circular flow in this type ' of economy can be explained with the help of the following diagram:

The above diagram shows that the four sector model of the economy demonstrates the overall macro-economic condition of income and output in the form of following identity:

Y = C + I + G + (X-M)

Where,

Y= Income or output

C = Private consumption expenditure on consumer goods

I = Investment expenditure by production sector

G = Government expenditure X = Exports M = Imports

The activities of different sectors can be explained as below.

(i) Household Sector: Household sector receives factor incomes from the production sector, the government sector and the foreign sector. Further, the household sector also receives transfer payments from the government sector and the foreign sector. This sector incurs expenditure on purchase of final goods and services from the production sector and also pays taxes to the government sector. Household sector sometimes invests funds in and borrows funds from the financial sector.

(ii) Production Sector: Production sector receives payments for the goods and services produced by it from the household sector and the government sector. In addition, the foreign sector makes payments for the imports from production sector. Production sector makes payment to the household sector for factor services, to the government in the form of taxes and to the foreign sector for imports. Production sector also invests funds in and borrows funds from the financial sector.

(iii) Government Sector: Government sector receives payments from household and production sectors in the form of taxes. This sector makes transfer payments to the household sector and provides subsidies to the production sector. Government sector makes payment to the household sector for factor services and to the production sector for purchase of final goods and services Government sector also invests funds in and borrows funds from the financial sector.

(iv) Foreign Sector: Foreign sector receives payments for exports to the production sector and makes payment for its imports. This sector makes payment for factor services and also makes transfer payments to the household sector.

In this way, the total production of goods and services remains equal to the total consumption of goods and services. Similarly, factor payments and factor income also remain equal in this circular flow.

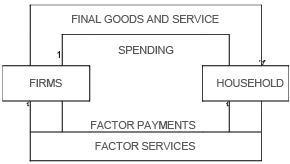

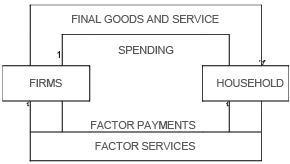

Q.9. With the help of a circular flow model, show that income and expenditure flows are equal.

Ans. The aggregate final expenditure of an economy is always equal to the aggregate factor payments (or incomes) because of the circular flow of income. The final expenditure and aggregate factor payments are two sides of the same coin. The firms hire or purchase factor services from households and use them to produce goods and services. Factor payments made by the firms become factor incomes in the hands of households. Households spend their income on purchase of goods and services which are produced by firms. Expenditure by household implies income to the firms. Thus, the income of economy goes through the two sectors, firms and households, in a circular way. This is represented in the following figure:

In the figure, the uppermost arrow moving from the households to the firms represents the spending of households on goods and services produced by the firms. The second arrow moving from the firms to the households is the counterpart of the arrow above. It stands for the goods and services which are flowing from the firms to the households.

Similarly, the two arrows at the bottom of the diagram represent the factor of the production market. The lowermost arrow moving from the households to the firms symbolises the services that the households are rendering to the firms. Using these services the firms are manufacturing the output. The arrow above this, moving from the firms to the households, represents the payments made by the firms to the households for the services provided by the latter.

Thus, there is no leakage from this circular flow of income between households and firms. That is, the money spent by the firms on factor services is exactly equal to the money they receive for the goods and services sold to the households.

Q.10. Will the following be included in domestic factor income of India? Give reasons for your answer.

(i) Profits earned by a foreign bank from its branches in India

(ii) Scholarships given by Government of India

(iii) Profits earned by a resident of India from his company in Singapore

(iv) Salaries received by Indians working in American Embassy in India

Ans. (i) Profits earned by a foreign bank from its branches in India will not be included in domestic factor income of India because it is the factor income of a foreign country or it is the income of nonresident in India.

(ii) Scholarships given by the government of India will not be included in domestic factor income because it is a transfer payment and does not contribute to the flow of goods and services.

(iii) Profits earned by a resident of India from his company in Singapore will not be included in domestic factor income of India because it is the income of the resident earned abroad.

(iv) Salaries received by Indians working in American Embassy in India will be included in domestic factor income of India because it is the income of the normal residents of India, earned within the domestic territory of India.

Q.11. How will you treat the following while estimating domestic product of India?

(i) Rent received by a Indian resident from his property in Singapore

(ii) Salaries to Indians working in Japanese Embassy in India

(iii) Profits earned by a branch of an American Bank in India

(iv) Salaries paid to Koreans working in Indian Embassy in Korea

Ans. (i) Rent received by a resident Indian from his property in Singapore will not be included in domestic product of India as this income is earned outside the domestic (economic) territory of India.

(ii) Salaries to Indians working in Japanese Embassy in India will not be a part of domestic product of India as embassy of Japan in India is not a part of domestic territory of India. Hence, this income is not earned within the domestic territory of India.

(iii) Profits earned by a branch of an American Bank in India will be included in domestic product of India as the branch of American bank is located within the domestic territory of India. Thus, it is the income earned within the domestic territory of India.

(iv) Salaries paid to Koreans working in Indian Embassy in Korea will be a part of domestic product of India because this income is earned within the domestic territory of India. Indian embassy in Korea is treated as located within the domestic territory of India.

Q.12. Giving reasons explain how should the following be treated in estimation of National Income:

(i) Expenditure by a firm on payment of fees to a chartered accountant

(ii) Payment of a corporate tax by a firm

(iii)Purchase of refrigerator by a firm for own use.

Ans. (i) Payment of fees to a chartered accountant by a firm is an income of a professional and hence, it will be included in National Income while its estimation.

(ii) Corporate tax is included in the National Income as a part of corporate profit, not separately

(iii)Expenditure on purchasing a refrigerator for use by a firm will be included while estimating National Income because the refrigerator is purchased by the firm for final use.

Q.13. Giving reasons explain how should the following be treated in estimation of National Income:

(i) Payment of interest by a firm to a bank

(ii) Payment of interest by a bank to an individual

(iii)Payment of interest by an individual to a bank

Ans. (i) The firm borrows from the bank to undertake productive activities. Hence, payment of interest by a firm to a bank will be included in National Income as the cost of borrowing funds.

(ii) Payment of interest by a bank to an individual will be included in National Income as the bank uses the individual’s savings for productive purpose, that is, for lending further to earn interest.

(iii)Payment of interest by an individual to a bank will be included in National Income if the individual has taken loan for productive purpose. However, if the individual has taken loan from bank for consumption purpose, the interest paid shall not be included in National Income

Q.14. Distinguish between ‘real’ gross domestic product and ‘nominal’ gross domestic product.Which of these is a better index of welfare of the people and why?

Ans. Following are the points of distinction between real and nominal Gross Domestic Product (GDP):

S.No.

| Real GDP | Nominal GDP |

| 1 | Real GDP is the value of GDP at constant prices. | Nominal GDP is the value of GDP at current prices. |

| 2 | Real GDP measures the value of output economy, adjusted for price changes.

| Nominal GDP is the market or money value of all final goods and services produced in a country during a year.

|

| 3 | Real GDP includes factor services provided by households, and final goods and services provided by the firms.

| Nominal GDP includes factor payments made by the firms for production resources and the payments made by the households for goods and services.

|

Real GDP offers a better perspective than nominal GDP when tracking economic output over a period of time. Real GDP increases only when there is an increase in the production of goods and services.

As a result, change in income and employment can be estimated. However, since nominal GDP is valued at current price, it can increase even if there is no change in the production of goods and service. It neglects the impact of inflation on production.