Class 12 Economics Solved Paper (2018) | Economics for Grade 12 PDF Download

Ques 1: When the total fixed cost of producing 100 units is Rs. 30 and the average variable cost Rs. 3, total cost is: (Choose the correct alternative)

(a) Rs. 3

(b) Rs. 30

(c) Rs. 270

(d) Rs. 330

Ans: (d) Rs. 330

Ques 2: When the Average Product (AP) is maximum, the Marginal Product (MP) is: (Choose the correct alternative)

(a) Equal to AP

(b) Less than AP

(c) More than AP

(d) Can be any one of the above

Ans: (a) Equal to AP

Ques 3: State one example of positive economics.

Ans: Increasing the interest rate to encourage people to save is an example of positive economics.

Ques 4: Define fixed cost.

Ans: Fixed costs are those costs which do not vary with the level of output. For Ex. Rent of factory.

Ques 5: Explain the central problem of 'choice of technique'.

Or

Explain the central problem of 'for whom to produce'.

Ans: How to Produce: This is the second major central problem faced by the economy ever. Basically, there are, two choices of techniques i.e.,

(i) Capital intensive technique. This is the technique, in which capital is required more than the labour.

(ii) Labour intensive Technique. This is the technique, in which labour is required more than the capital.

Or

For whom to produce: An economy faces major central problem i.e., for whom the production is to be done. Production/Income is distributed among.

(i) Functional Distribution

(ii) Personal Distribution.

Ques 6: What is meant by inelastic demand? Compare it with perfectly inelastic demand.

Ans: Elasticity is a measure of the responsiveness of the quantity demanded to a change in price. Inelastic demand means elasticity less than 1.

There, percentage change in quantity demanded is less than a percentage change in price.

For Ex. Percentage change in quantity demanded is 10%, Percentage change in price = 20%

So, Elasticity (Ed < 1) = 0.5

Perfectly inelastic demand.

When increase are decrease in price does not-effect the quantity demanded, it is known as perfectly inelastic demand.

For Ex. - Price change by 10% but quantity demanded remains the same i.e.,

Percentage change in quantity demand = 0

Percentage change in price = 20%

So, elasticity is 0.

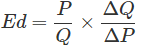

Ques 7: When the price of a commodity changes from Rs. 4 per unit to Rs. 5 per unit, its market supply rises from 100 units. Calculate the price elasticity of supply elastic? Given reason.

Ans:

=0.8

It is not elastic, as elasticity is less than one.

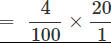

Ques 8: What is meant by price ceiling? Explain its implications.

Ans: Definition of ?Price Ceiling?: Price ceiling is a situation when the price charged is more than or less than the equilibrium price determined by market forces of demand and supply. It has been found that higher price ceilings are ineffective. Price ceiling has been found to be of great importance in the house rent market.

Implications of Price Ceiling

(i) Price ceiling enables the availability of basic goods at reasonable price to the poor. This enable to increases the welfare of the people.

(ii) When there is a fall in the price level, the demand for a good increases more than the supply of the good. Hence, it creates an excess demand for the good.

Ques 9: Given the price of a good, how will a consumer decide as to how much quantity to buy of that good? Explain.

Or

What is Indifference Curve? State three properties of indifference curves.

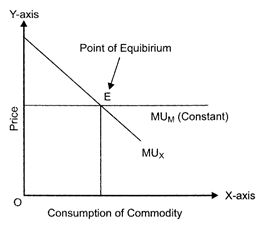

Ans: Consumer equilibrium: Consumer equilibrium is the situation through which a consumer decides how many units of the goods to consume.

It refers to the situation when consumer sets maximum satisfaction/utility from the goods it consumes.

Price retains constant, when MU of Goods is more than its price, then consumer will decide not to purchase that good. Also, when MU is less than its price, then also consumer will give up its consumptions.

A consumer will consume only when, MU is equal to price.

MUx = Px

In the diagram,

X-axis = Consumption

Y-axis = Price

E = Consumer Equilibrium

Or

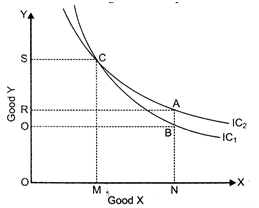

Indifference Curve

A curve on a graph (the axis of which represent quantities of two commodities) linking those combinations of quantities which the consumer regards as of equal value.

IC - Indifference Curve.

X-axis = good x

Y-axis = Good y

Properties;

(i) Higher IC gives higher level of satisfaction.

(ii) Two Indifference Curves never intersect each other.

(iii) Indifference curves is convex to the origin.

Ques 10: State three characteristics of monopolistic competition. Which of the characteristics separates it from perfect competition and why?

Or

Explain the implications of the following:

(a) Freedom of entry and exit of firms under perfect competition.

(b) Non-price competition under oligopoly.

Ans: The main features of monopolistic competition are as under:

(1) Large Number of Buyers and Sellers: There are large numbers of firms but not as large as under competition. That means each firm can control its price-output policy to some extent. It is assumed that any price-output policy of a firm will not get reaction from other firms that means each firm follows the independent price policy.

(2) Less Mobility: Under monopolistic competition both the factors of production as well as goods and services are not perfectly mobile.

(3) More Elastic Demand: Under monopolistic competition, demand curve is more elastic. In order to sell more, the firms must reduce its price.

The characteristics which separates monopolistic competition from perfect competition are:

(1) Nature of Firms: Under perfect competition an industry consists of a large number of firms. Each firm in the industry has a very little share in the total output. The firms have to accept the price determined by the industry. On the other hand, under monopolistic competition the number of firms is limited. The firms can influence the market price by their individual actions.

(2) Nature of Price and Output: Under perfect competition price is equal to marginal cost as well as marginal revenue whereas under imperfect competition it is not so. Although, under monopolistic competition marginal cost and marginal revenue are equal yet not equalising the price.

(3) Nature of Product: Under perfect competition, firms produce homogeneous products. The cross elasticity of demand among the goods is infinite. Under imperfect competition, all the firms produce differentiated products and the cross elasticity of demand among them is very small.

Or

(a) Freedom of entry and exit of firms under perfect completion: There is freedom of entry and exit of firms in perfect competition. This implies that under perfect competition, in long-run, firms earn only normal profits, so new firms does not enter or exit the market in long-run. The firms in this competition do not earn supernormal profits or losses in long-run. It is only in short-run that the firms enter or exit the market.

(b) Non-price competition under oligopoly: In an oligopoly market, firms do not compete each other with changes in the price. If the firm increases the price, rival firms may not increase it, so it will lead to a loss of the market.

Consumers will shift to rival firms. On the other hand, if the firm decreases the price, the rival firms may decrease it, so it will lead to a loss of total revenue. There will not be increase in the demand for the product. They take into consideration the decisions of rival firms, and hence, the price does not move freely and it leads to non-price competition. High selling cost prevails in the market, resources are not fully used and welfare is not maximised.

Ques 11: Explain the conditions of consumer's equilibrium using Indifference Curve Analysis.

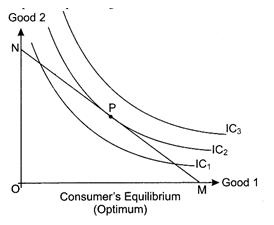

Ans: Consumer's equilibrium using indifference curve analysis-According to indifference curve analysis, a consumer attains equilibrium at a point where budget line is tangent to indifference curve. Consumer equilibrium is achieved where slope of indifference curve (MRS) = slope of budget line (Px/Py).

MRS=Px÷Py (Ratio of prices of two goods)

Given the indifference map (preference schedule) of the consumer and budget or price line, we can find out the combination which gives the consumer maximum satisfaction. The aim of the consumer is to obtain highest combination on his indifference map and for this he tries to go to the highest indifference curve with his given budget line. He would be in an equilibrium only at such point which is common point between budget line and the highest attainable indifference curve. A consumer is in equilibrium at a point where budget line is tangent to indifference curve. At this point, slope of indifference curve (called MRS) is equal to slope of budget line. In the above fig, P is equilibrium point at which budget line M just touches the highest attainable indifference curve IC2 within consumer budget. Combinations on IC3 are not affordable because his income does not permit whereas combinations on IC1gives lower satisfaction than IC2 Hence, best combination is at point P where budget line is tangent to the indifference curve IC2 It is at this point that consumer attains the maximum satisfaction at the state or equilibrium.

In the above fig, P is equilibrium point at which budget line M just touches the highest attainable indifference curve IC2 within consumer budget. Combinations on IC3 are not affordable because his income does not permit whereas combinations on IC1gives lower satisfaction than IC2 Hence, best combination is at point P where budget line is tangent to the indifference curve IC2 It is at this point that consumer attains the maximum satisfaction at the state or equilibrium.

For consumer's equilibrium, two conditions are necessary:

(a) Budget line should be tangent to indifference curve (MRS = Px/Py).

(b) Indifference curve should be convex to the point of origin (i.e., MRS should be diminishing at a point of equilibrium.)

Ques 12: Explain the conditions of producer's equilibrium in terms of marginal revenue and marginal cost.

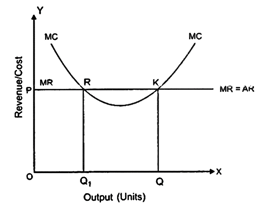

Ans: Producer's equilibrium refers to the state in which a producer earns his maximum profit or minimise its losses. According to MR-MC approach, the producer is at equilibrium, when the Marginal Revenue (MR) is equal to the Martinal Cost (MC) and Martinal Cost curve must on the Marginal Reveneu curve from below:

Two conditions under this approach are:

(i) MR=MC

(ii) MC curve should cut the MR curve from below, or MC should be rising.

MR is the addition to TR from the sale of one more unit of output and MC is the addition to TC for increasing the production by one unit. In order to maximise profits, firms compare its MR with its MC.

As long as the addition to revenue is greater than the addition to cost. It is profitable for a firm to continue producing more units of output. In the diagram, output is shown on the X-axis and revenue and cost on the Y-axis.

The Marginal Cost (MC) curve is U-shaped and P = MR = AR, is a horizontal line parallel to X-axis.

MC = MR at two points R and K in the diagram, but profits are maximised at point K, corresponding to OQ level of output. Between OQ and OQ levels of output, MR exceeds MC. Therefore, firm will not stop at point R but will continue to produce to take advantage of additional profit. Thus, equilibrium will be at point K, where both the conditions are satisfied.

Situation beyond OQ level.

MR < MC when output level is more than OQ, MR < MC, which implies that firm is making a loss on its last unit of output. Hence, in order to maximise profit a rational producer decreases output as long as MC > MR. Thus, the firm moves towards producing OQ units of output.

Ques 13: Define money supply.

Ans: Money supply is the total amont of money in circulation or in existence in a counter at a specific time.

Ques 14: Which of the following affects national income? (Choose the correct alternative)

(a) Goods and Services tax

(b) Corporation tax

(c) Subsidies

(d) None of the above

Ans: (d) None of the above.

Ques 15: Why does consumption curve not start from the origin?

Ans: As consumption includes autonomous consumption and autonomous consumption can never be zero.

Ques 16: The central bank can increase availability of credit by: (Choose the correct alternative).

(a) Raising repo rate

(b) Raising reverse repo rate

(c) Buying government securities

(d) Selling government securities

Ans: (c) Buying government securities.

Ques 17: Given nominal income, how can we find real income? Explain.

Or

Which among the following are final goods and which are intermediate goods? Given reasons.

(a) Milk purchased by a tea stall

(b) Bus purchased by a school

(c) Juice purchased by a student from the school canteen

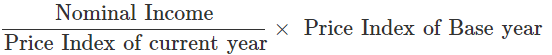

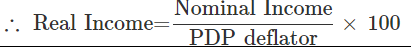

Ans: Real income can be calculated by applying the following formula:

Real Income =

Consider price index of base year as 100

When nominal income is given, we can convert it into real income with the help of GDP deflator.

Or

(i) It is a intermediate good decause it is used by producer during production process that is making tea and nor for final consumption.

(ii) It is a final good as, it is purchased by school for final consumption.

(iii) It is a final good as, it is purchased by a student for final consumption.

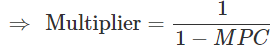

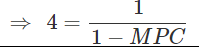

Ques 18: Define multiplier. What is relation between marginal propensity to consume and multiplier? Calculate the marginal propensity to consume if the value of multiplier is 4.

Ans: In economics a multiplier is the factor by which gains in total output are greater than the change in spending that caused it. It is usually used in reference to the relationship between investment and total national income.

Relationship between marginal propensity to consume and multiplier.

There is a direct relationship between MPC and Multiplier as, the higher the MPC, the higher the multiplier and vice versa.

⇒ MPC = 0.75

∴ MPC = 0.75

Ques 19: What is meant by inflationary gap? State three measures to reduce this gap.

or

What is meant by aggregate demand? State is I components.

Ans: An inflationary gap, in economics, is the amount by which the actual gross domestic product exceeds potential full-employment GDP. It is one type of output gap, the other being a recessionary gap.

Three measures to reduce this gap are:

1. Fiscal Policy: Fiscal policy is the expenditure and revenue (taxation) policy of the government to accomplish the desired objectives.

In case of excess demand (when current demand is more than agree gate supply at full employment), the objective of fiscal policy is to reduce agree gate demand.

2. Monetary Policy (Raise bank rate and CRR): Monetary policy of the central bank of a country to control money supply and credit in the economy. Therefore, it is also called Central Banks Credit Control Policy. Money broadly refers to currency notes and coins whereas credit generally means loans, i.e., finance provided to others at a certain rate of interest. Monetary measures (instruments) affect the cost of credit (i.e., rate of interest) and availability of credit. Thus, it helps in checking excess demand when credit availability is restricted and credit is made costlier.

3. Miscellaneous: Other anti-inflationary measures are import promotion, wage freeze, control and blocking of liquid assets, compulsory savings scheme for households, increase in production by utilising idle capacities, etc.

or

Aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It specifies the amount of goods and services that will be purchased at all possible price levels.

Components of aggregate demand

AD=C+1+G+(x+m)

1. Consumption

2. Investment

3. Government Spending

4. Net Export

1. Consumption: This is made by households, and sometimes consumption accounts for the larger portion of aggregate demand. An increase in consumption shifts the AD curve to the right.

2. Investment: Investment, second of the four components of aggregate demand, is spending by firms on capital, not households. However, investment is also the most volatile component of AD. An increase in investment shifts AD to the right in the short run and helps improve the quality and quantity of factors of production in the long run.

3. Government: Government spending forms a large total of aggregate demand, and an increase in government spending shifts aggregate demand to the right. This spending is categorized into transfer payments and capital spending. Transfer payments include pensions and unemployment benefits and capital spending is on things like roads, schools and hospitals. Governments spend to increase the consumption of health services, education and to re-distribute income. They may also spend to increase aggregate demand.

4. Net Exports: Imports are foreign goods bought by consumers domestically, and exports are domestic goods bought abroad. Net exports is the difference between exports and imports, and this component can be net imports too, if imports are greater than exports. An increase in net exports shifts aggregate demand to the right. The exchange rate and trade policy affects net exports.

Ques 20: The value of marginal propensity to consume is 0.6 and initial income in the economy is Rs. 100 crores. Prepare a schedule showing Income, Consumption and Saving. Also show the equilibrium level of income by assuming autonomous investment of Rs 80 crores.

Ans: Given that,

Marginal propensity to consume (MPC) =0.6

Initial income = Rs. 100 crores

Autonomous investment = Rs. 80 crores

C= +c(Y)

+c(Y)

C=0+0.6(Y)

| Consumption | Saving (Rs.) | Investment |

100 | 60 | 40 | 80 |

200 | 120 | 80 | 80 |

300 | 180 | 120 | 80 |

400 | 240 | 160 | 80 |

500 | 300 | 200 | 80 |

Aggregate Demand (AD) = Aggregate Supply (AS)

AD = C + 1 and AS = C + S

Therefore, the equilibrium level of income is Rs. 200 crores.

Ques 21: Explain the role of the Reserve Bank of India as the "lender of last resort".

Ans: A person or organisation which is ready to help the individual or organisation who is in need of immediate financial help to come out of the financial struggles is the lender of the last resort. It means that if a commercial bank fails to get financial accommodation from anywhere, it approaches the Reserve Bank as a last resort. Reserve Bank advances loan to such banks against approved securities. By offering loan to the commercial bank in situations of emergency, the Reserve Bank ensures that:

(i) The banking system of the country does not suffer from any set back.

(ii) Money market remains stable.

Ques 22: (a) Explain the impact of rise in exchange rate on national income.

(b) Explain the concept of 'deficit' in balance of payments.

Ans: (a) If the exchange rate of a country falls with respect to other country then its exports becomes cheap while imports become expensive. For example: If exchange rate wasUS$1=INR60, and if the exchange rate decreased to US $1=INR 70, then businesses that are selling their products in the US will receive more money. So, if my product was priced at US $5, I was receiving 5*60 = INR 300, now the exchange rate depreciated to INR 70, so for the same priced product in the US that is priced at US$5, I will be receiving 5*70 = INR 350. Similarly, for imports, as the exchange rate depreciated to INR 70 and if I want to purchase a Smartphone worth US$200; earlier I was paying 200*60 = INR 12,000. Now I will pay, 200*70 = INR 14,000.

Exactly opposite will happen when exchange rate will appreciate. For example: when US$1=INR60 will becomeUS$1=INR50.

(b) The deficit in the Balance of Payment (BOP) is governed by the balance of autonomous transactions in the BOP. The BOP would show a deficit if the autonomous receipts are lesser than the autonomous payments. As autonomous receipts implies a receipt of foreign exchange and autonomous payment implies a payment of foreign exchange, so, it can be said that BOP would show a deficit when the foreign exchange receipts are less than foreign exchange payment which also means that the BOP deficit would reflect depletion of foreign exchange reserves of the country.

Ques 23:

Calculate (a) Net National Product at market price, and (b) Gross Domestic Product at factor cost: | ||

(Rs in crores) | ||

(i) | Rent and interest | 6,000 |

(ii) | Wages and salaries | 1,800 |

(iii) | Undistributed profit | 400 |

(iv) | Net indirect taxes | 100 |

(v) | Subsidies | 20 |

(vi) | Corporation tax | 120 |

(vii) | Net factor income to abroad | 70 |

(viii) | Dividends | 80 |

(ix) | Consumption of fixed capital | 50 |

(x) | Social security contribution by employers | 200 |

(xi) | Mixed income | 1,000 |

Ans: NDPFC = Wages and salaries + SSC by employer + Rent and interest + Dividend + Corporation tax + Undistributed profit + Mixed income NDPFC = 1800 + 200 + 6000 + 80 + 120 + 400 + 1000 NDPFC = Rs. 9600 Crore

(a) NNPMP = NDPFC + NFIA + NIT

NNPMP=Rs. 9600+(−70)=100

NNPMP= Rs. 9630 Crores

(b) GDPFC = NDPFC + Consumption of fixed capital

GDPFC = Rs. 9600 + 50

GDPFC= Rs. 9650 Crores

Ques 24: Explain the meaning of the following:

(a) Revenue deficit

(b) Fiscal deficit

(c) Primary deficit

Or

Explain the following objectives of government budget:

(a) Allocation of resources

(b) Reducing income inequalities.

Ans: (a) Revenue Deficit: A revenue deficit occurs when the net income generated, revenues less expenditures, falls short of the projected net income. This happens when the actual amount of revenue received and/or the actual amount of expenditures do not correspond with budgeted revenue and expenditure figure.

(b) Fiscal Deficit: A fiscal deficit occurs when a government?s total expenditures exceed the revenue that it generates, excluding money from borrowings. Deficit differes from debt, which is an accumulation of yearly deficits.

(c) Primary Deficit: The deficit can be measured with or without including the interest payments on the debt as expenditures. The primary deficit is defined as the difference between current government spending on goods and services and total current revenue from all types of taxes net of transfer payments.

or

(a) Allocation of Resources: Government budget helps in allocating resources efficiently resources our scarce. Thus, budget allocate resources in such a manner. So that country attains economic growth.

(b) Reducing Income inequalities: Government budget make every possible effort to reduce income inequalities. Income inequalities are so much prevalent in an economy like India.

Thus, government budget reduces income inequalities.

|

105 videos|388 docs|72 tests

|

FAQs on Class 12 Economics Solved Paper (2018) - Economics for Grade 12

| 1. What are the key topics covered in the Class 12 Economics Solved Paper (2018)? |  |

| 2. How can I access the Class 12 Economics Solved Paper (2018)? |  |

| 3. Are the solutions provided in the Class 12 Economics Solved Paper (2018) accurate? |  |

| 4. How can I prepare for the Class 12 Economics exam based on the Class 12 Economics Solved Paper (2018)? |  |

| 5. Can the Class 12 Economics Solved Paper (2018) help in scoring better marks in the exam? |  |