Depreciation (Part - 1) - Commerce PDF Download

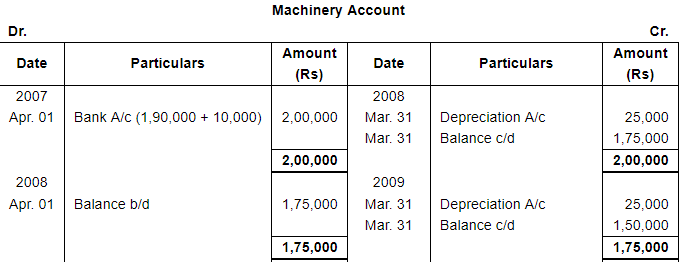

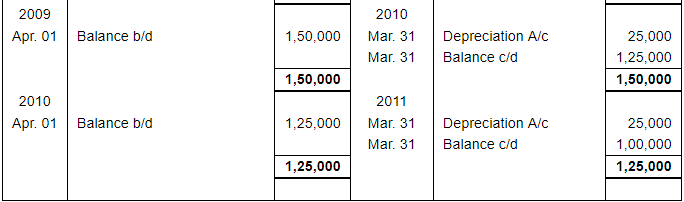

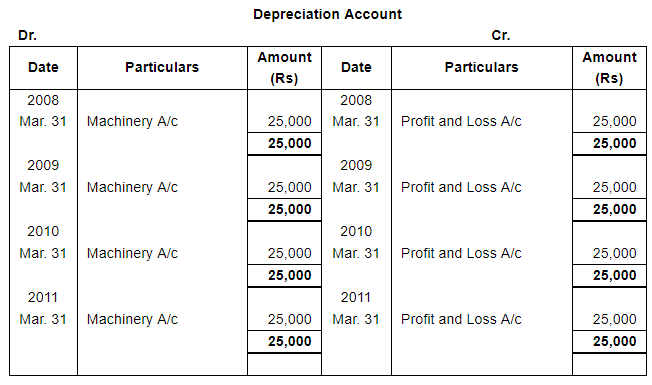

Page No 16.53:

Question 1:

On 1st April, 2007, a limited company purchased a Machine for ₹ 1,90,000 and spent ₹ 10,000 on its installation. At the date of purchase, it was estimated that the scrap value of the machine would be ₹ 50,000 at the end of sixth year.

Give Machine Account and Depreciation A/c in the books of the Company for 4 years after providing depreciation by Fixed Installment Method. The books are closed on 31st March every year.

ANSWER:

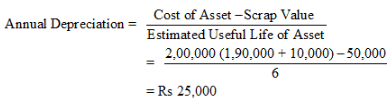

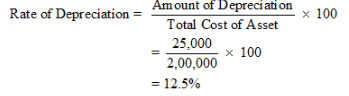

Working Note: Calculation of Depreciation

Question 2:

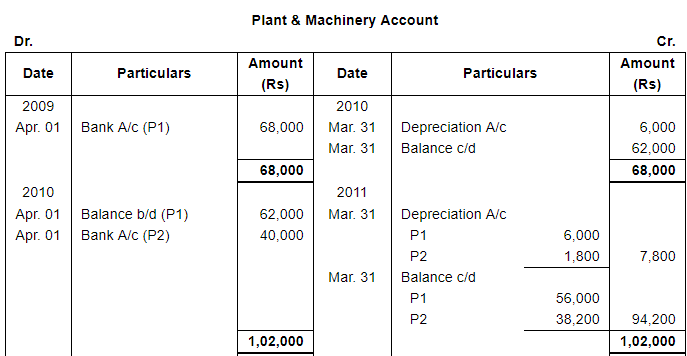

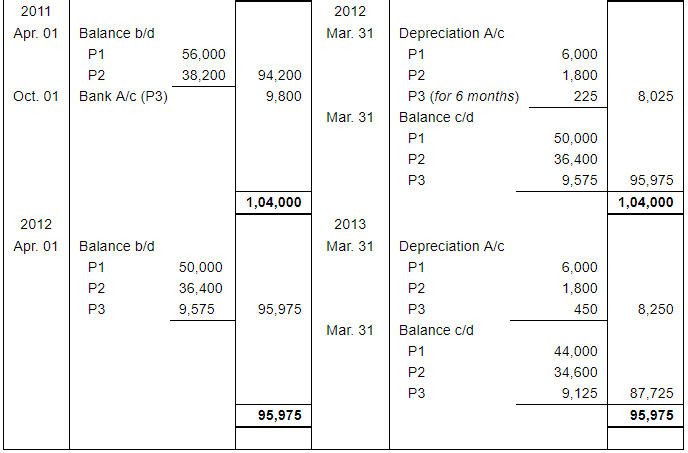

On 1st April, 2009, a Company bought Plant and Machinery costing ₹ 68,000. It is estimated that its working life is 10 years, at the end of which it will fetch ₹ 8,000. Additions are made on 1st April, 2010 to the value of ₹ 40,000 (Residual value ₹ 4,000). More additions are made on Oct. 1, 2011 to the value of ₹ 9,800 (Break up value ₹ 800). The working life of both the additional Plant and machinery is 20 years.

Show the Plant and Machinery account for the first four years, if depreciation is written off according to Straight Line Method. The accounts are closed on 31st March every year.

ANSWER:

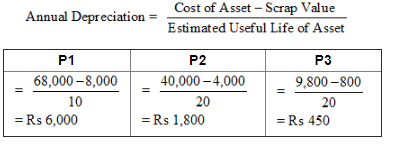

Working Note: Calculation of Depreciation

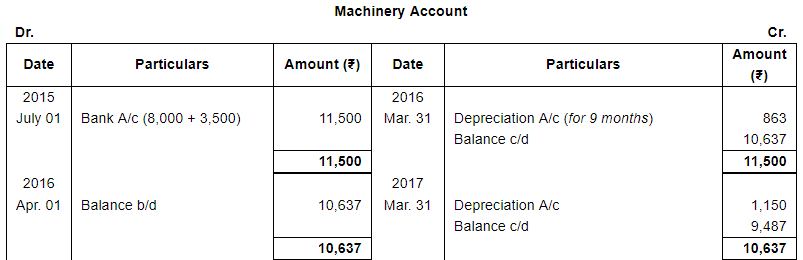

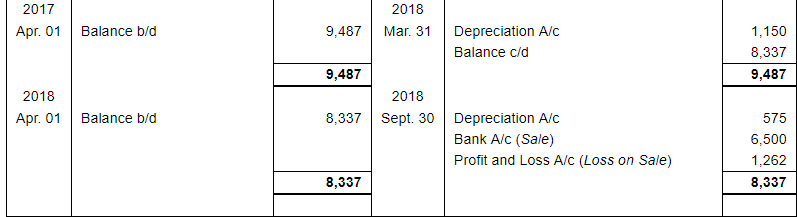

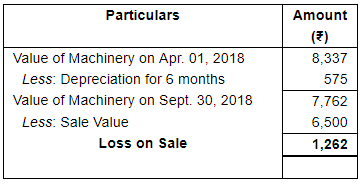

Question 3:

Chandra Ltd. purchased a second-hand machine for ₹ 8,000 plus CGST and SGST @ 6% each on 1st July, 2015. They spent ₹ 3,500 on its overhaul and installation.

Depreciation is written off 10% p.a. on the original cost. On 30th September, 2018, the machine was found to be unsuitable and sold for ₹ 6,500. Prepare the Machinery A/c for four years assuming that accounts are closed on 31st March.

ANSWER:

Working Note: Calculation of Profit or Loss on Sale

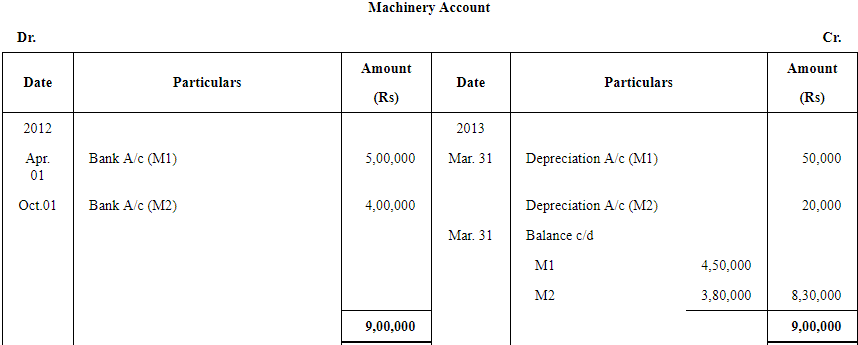

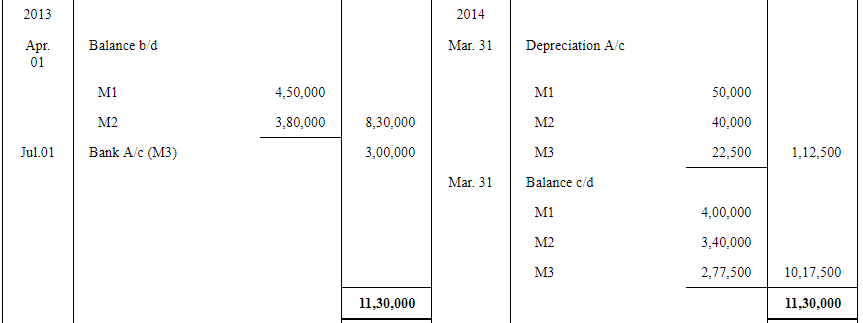

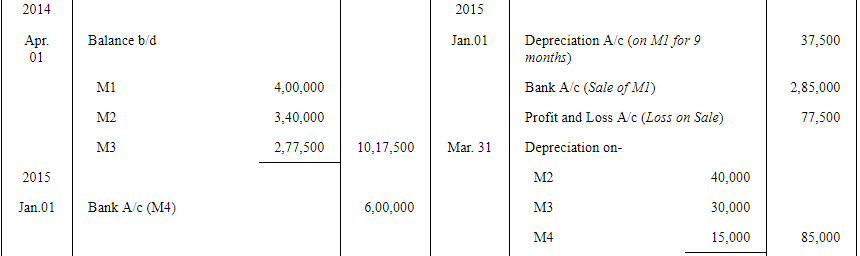

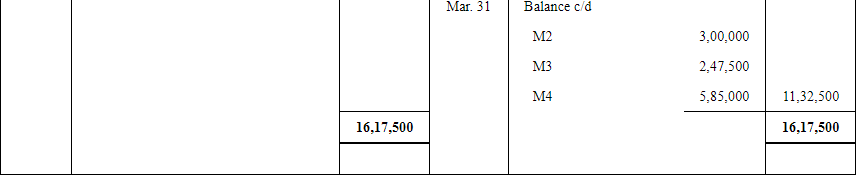

Question 4:

A Ltd. purchased a machine for ₹ 5,00,000 on 1st April, 2012. Further addition were made on 1st October 2012 and on 1st July 2013 for ₹ 4,00,000 and ₹ 3,00,000 respectively. On 1st January, 2015, 1st machine was sold for ₹ 2,85,000 and new machine was purchased for ₹ 6,00,000.

Prepare Machine A/c for three years ending 31st March, 2015 if depreciation is to be charged @ 10% p.a. on straight line basis.

ANSWER:

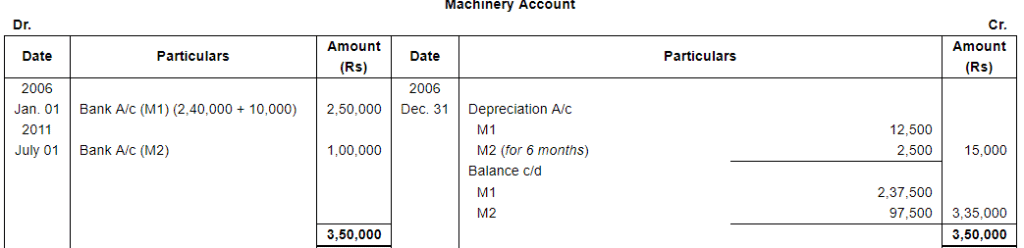

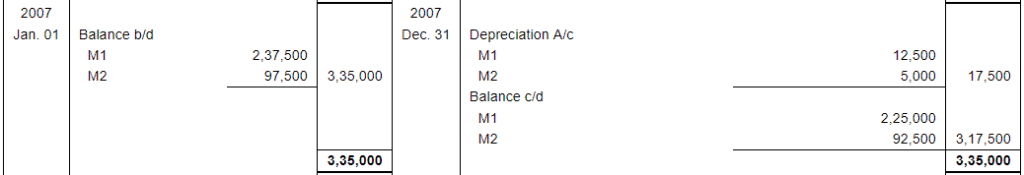

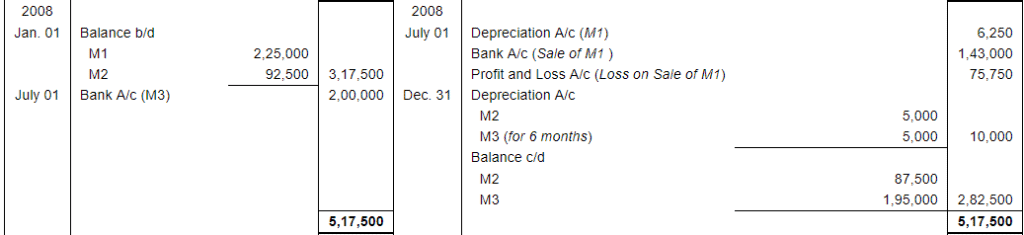

Question 5: On 1st January, 2006, A Ltd. Purchased a machine for ₹ 2,40,000 and spent ₹ 10,000 on its erection. On 1st July, 2006 an additional machinery costing ₹ 1,00,000 was purchased. On 1st July, 2008 the machine purchased on 1st January, 2006 was sold for ₹ 1,43,000 and on the same date, a new machine was purchased at a cost of ₹ 2,00,000.

Show the Machinery Account for the first three calendar years after charging depreciation at 5% by the Straight Line Method.

ANSWER:

Working Note: Calculation of Profit or Loss on Sale of M1

Page No 16.54:

Question 6:

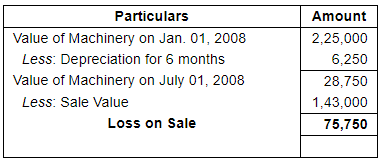

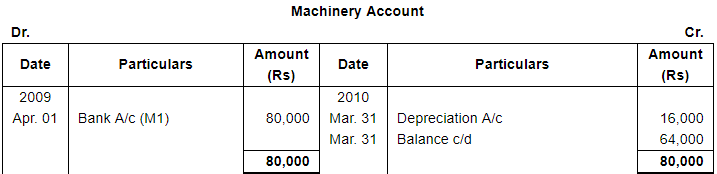

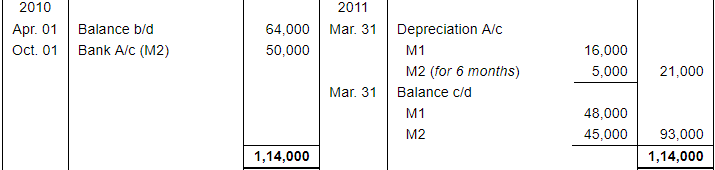

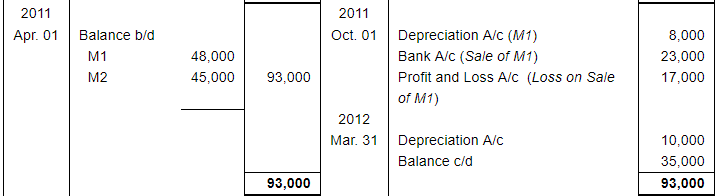

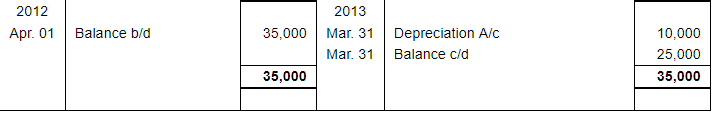

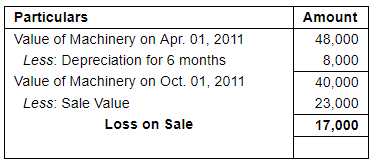

A company purchased on 1st April, 2009, a machinery for ₹ 80,000. On 1st October, 2010, it purchased another machine for ₹ 50,000 and on 1st October, 2011, it sold off the first machine purchased in 2009 for ₹ 23,000. Depreciation was provided on the machinery at the rate of 20% p.a. on the original cost annually.

Give the Machinery Account for four years commencing from 1st April, 2009.

Accounts are closed on 31st March every year.

ANSWER:

Working Note: Calculation of Profit or Loss on Sale of M1

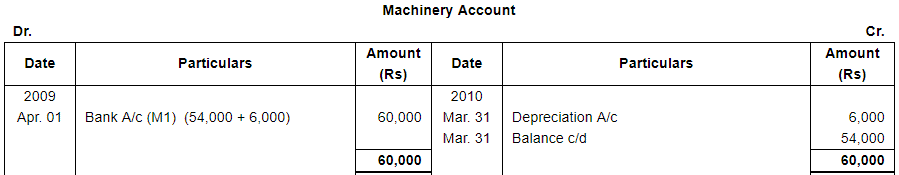

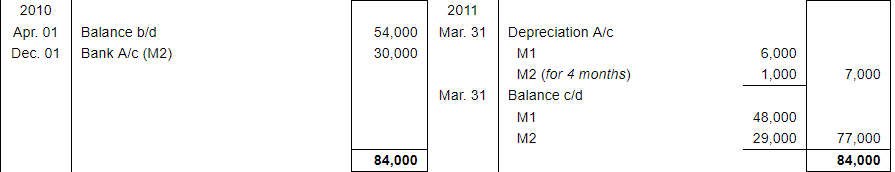

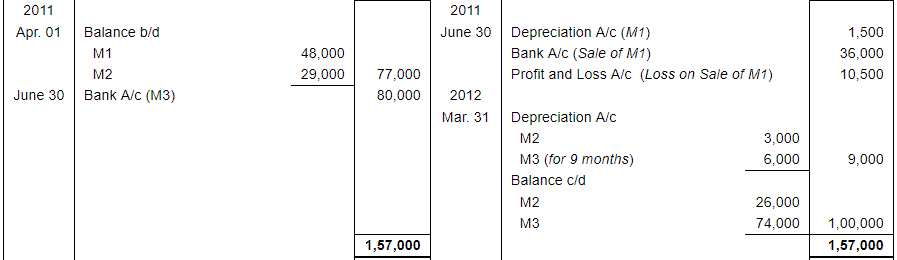

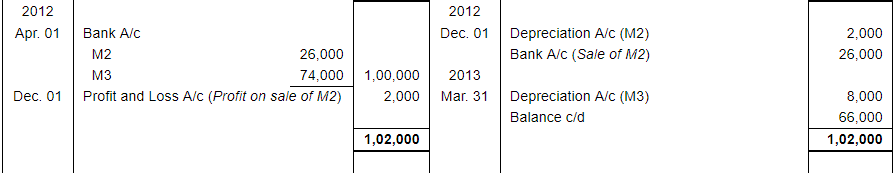

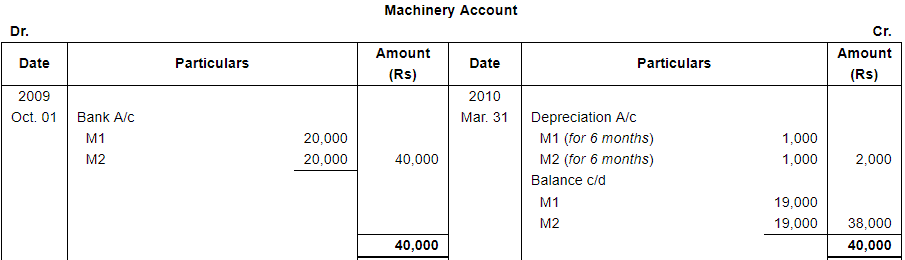

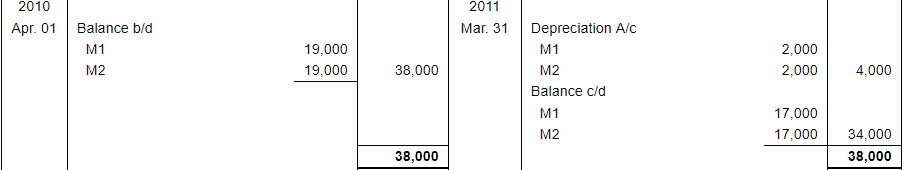

Question 7: Bhushan & Company purchased a Machinery on 1st April, 2009, for ₹ 54,000 and spent ₹ 6,000 on its installation. On 1st December, 2010, it purchased another machine for ₹ 30,000.

On 30th June 2011, the first machine purchased on 1st April, 2009, is sold for ₹ 36,000 and on the same date it purchased a new machinery for ₹ 80,000.

On December 1, 2012, the second machine (purchased on December 1, 2010) was also sold off for ₹ 26,000.

Depreciation was provided on machinery @ 10% p.a. on Original Cost Method annually o 31st March. Give the machinery account for four years.

ANSWER:

Working Notes:

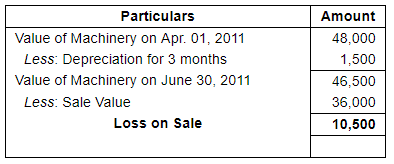

WN1: Calculation of Profit or Loss on Sale on M1

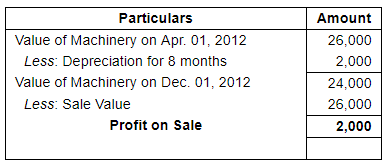

WN2: Calculation of Profit or Loss on Sale of M2

Question 8:

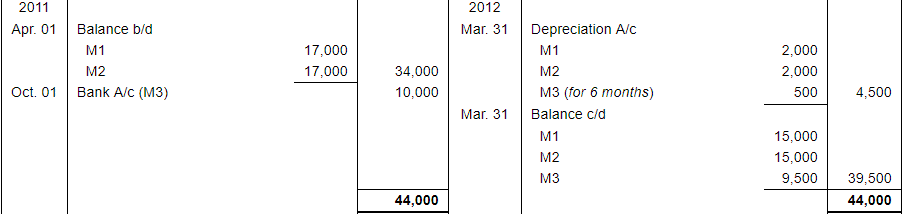

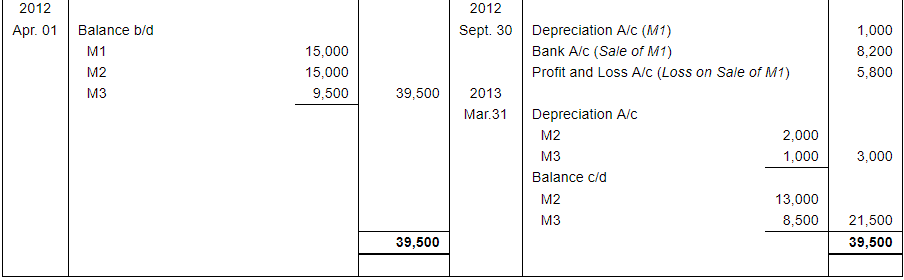

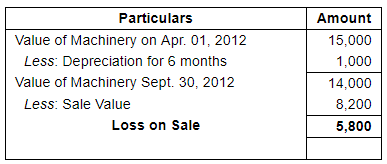

On 1st October, 2009, Raj & Co. purchased machinery worth ₹ 40,000. On 1st October, 2011, it buys additional machinery worth ₹ 10,000. On 30th September, 2012, half of the machinery purchased on 1st Oct., 2009, is sold for ₹ 8,200. The company writes off 10 per cent p.a. on the original cost. The accounts are closed every year on 31st March.

Show the Machinery Account for four years.

ANSWER:

Working Note: Calculation of Profit or Loss on Sale of M1

Note: In order to make easy calculation machinery purchased on October 01, 2009 has been divided into two parts i.e. M1 and M2

Thus, M1 represents the first part i.e. sold for Rs 8,200

M2 represents the second part, which remains in the business

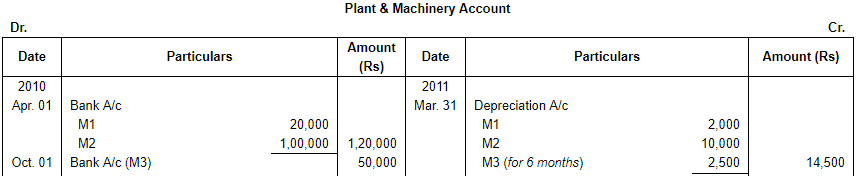

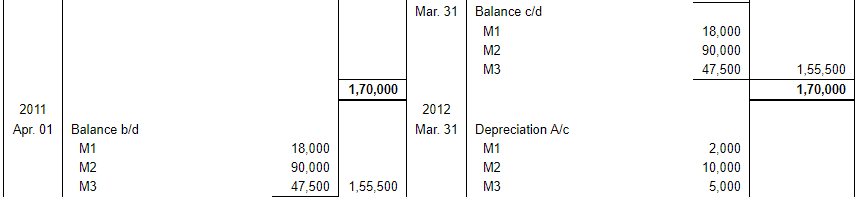

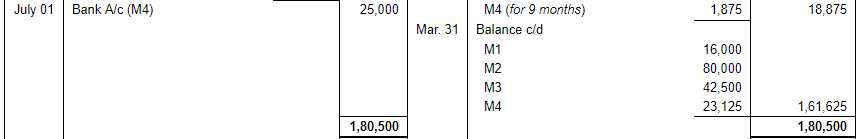

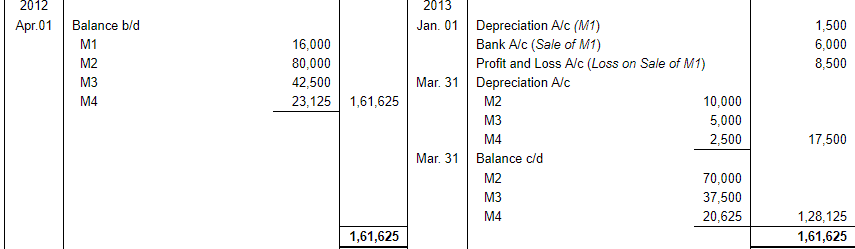

Question 9: On 1st April, 2010, Plant and Machinery was purchased for ₹ 1,20,000. New machinery was purchased on 1st Oct., 2010, for ₹ 50,000 and on 1st July, 2011, for ₹ 25,000.

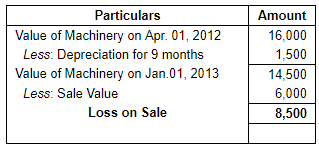

On 1st January, 2013, a machinery of the original value of ₹ 20,000 which was included in the machinery purchased on 1st April, 2010, was sold for ₹ 6,000. Prepare Plant & Machinery A/c for three years after providing depreciation at 10% p.a. on Straight Line Method. Accounts are closed on 31st March every year.

ANSWER:

Working Note: Calculation of Profit or Loss on Sale of M1

Note: In order to make easy calculation plant and machinery purchased on April 01, 2010 has been divided into two parts i.e. M1 and M2.

Thus, M1: Rs 20,000 (sold for Rs 6,000)

M2: Rs 1,00,000 (remains in the business)

Page No 16.55:

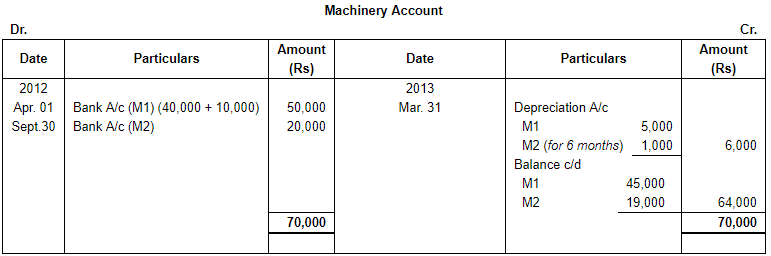

Question 10:

From the following transactions of a concern, prepare Machinery Account for the year ending 31st March, 2013 :-

| 2012 | ||

| April 1 | : | Purchased a second-hand machinery for ₹ 40,000. |

| April 1 | : | Spent ₹ 10,000 on repairs for making it serviceable. |

| Sept. 30 | : | Purchased additional new machinery for ₹ 20,000. |

| Dec. 31 | : | Repairs and renewals of machinery ₹ 2,000. |

| 2013 | ||

| March 31 | : | Depreciate the machinery at 10% p.a. |

ANSWER:

Note: Repair charges of Rs 2,000 are categorised under revenue expenditure because these are incurred on December 31, 2012 but machinery has been purchased on September 30, 2012.

FAQs on Depreciation (Part - 1) - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the purpose of depreciation? |  |

| 4. What are the effects of depreciation on a company's financial statements? |  |

| 5. Can all assets be depreciated? |  |