Economic Development: June 2022 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

| Table of contents |

|

| Sustainable Fashion |

|

| Salt Sector Crisis |

|

| Stagflation |

|

| Bad Bank |

|

| Way Forward |

|

| Neobanks |

|

Sustainable Fashion

Why in News?

Responsible production and consumption — the United Nations’ Sustainable Development Goal 12 — has become an increasingly important conversation within the ‘slow fashion’ movement, especially since the 2013 Rana plaza Tragedy in Bangladesh.

On 24th April 2013, the collapse of the Rana Plaza building in Dhaka, Bangladesh, which housed five garment factories, killed at least 1,132 people and injured more than 2,500. It brought the attention of the international community and consumers towards the conditions of workers and sustainable fashion.

What is Slow Fashion Movement?

- Slow Fashion is an approach to producing clothing which takes into consideration all aspects of the supply chain and in doing so, aims to respect people, the environment, and animals.

- It also means spending more time on the design process, ensuring that each piece of apparel is quality made.

- Fast Fashion retailers have taught us that more is better, and thereby have created a huge consumption issue. The fast fashion industry is driving down quality, exploiting the environment and their workers to create cheap garments that do not last.

- Slow fashion is the exact opposite of this. It's about creating mindful, curated collections based on quality finishes, versus pumping out large quantities of seasonal and trendy clothing.

What is the significance of Sustainable Fashion?

- Textiles and clothes contribute USD 2.4 trillion to global manufacturing.

- It provides employment to 300 million people worldwide along the value chain around the world, many of them are women.

- It is responsible for 2-6 % greenhouse gases emissions of the world.

- It consumes around 215 billion litres of water per year.

- It faces annual material loss of USD 100 billion due to underutilization.

- Textiles account for approximately 9% microplastics losses to the ocean.

What are the Initiatives for Sustainable Fashion?

At Global level:

United Nations Alliance for Sustainable Fashion:

- It is an initiative of United Nations agencies and allied organizations designed to contribute to the Sustainable Development Goals through coordinated action in the fashion sector.

- Specifically, the Alliance works to support coordination between UN bodies working in fashion and promoting projects and policies that ensure that the fashion value chain contributes to the achievement of the Sustainable Development Goals’ targets.

- Traceability for Sustainable Garment and Footwear: As part of this initiative, UNECE (United Nations Economic Commission for Europe) has launched “The Sustainability Pledge” inviting governments, garment and footwear manufacturers and industry stakeholders to pledge to apply toolkit of measures and take a positive step towards improving the environmental and ethical credentials of the sector.

- World Cotton Day (7th October): It creates awareness of the need of market access for cotton and cotton related products from least developed countries, fosters sustainable trade policies and enables developing countries to benefit more from every step of the cotton value chain.

At National Level:

Project SU.RE: SU.RE stands for ‘Sustainable Resolution’. It is the first ever holistic effort towards gradually introducing a broader framework for establishing critical sustainability goals for the Indian textile industry. It was launched in 2020.

Objective: The project aims to move towards sustainable fashion that contributes to a clean environment.

- Khadi Promotion: Khadi and Village Industries Commission (KVIC) promotes khadi products. They have tied up with leading brands—Arvind Mills and Raymonds—and are also working with Air India to promote khadi products.

- Bamboo Promotion: NITI Aayog’s Forum for North East has highlighted the role of bamboo in development of the North East region. Over 60% of India’s bamboo is grown in the North East.

- Brown Cotton: Brown Cotton, is a local (to Karnataka) indigenous variety of desi cotton that is recognised for its natural brown colour. This effort is a larger encompassing exercise that involves the environment, the economy as well as local communities.

What are the challenges associated with sustainable Fashion?

Economic and financial barriers.

- A new categorization of barriers: human perceptions, resource constraints and weak legislation.

- Issues in finding an eco-friendly and ethical alternative to the standard manufacturing process.

- Lack of Technological advantage.

- Increase in cost of manufacturing due to increase in investment in environment saving efforts and hike in wages of labourers.

- Eco-Friendly brands find it challenging to deal with issues like waste accumulation, water pollution, waste management etc.

Since Sustainable fashion is a part of Sustainability, here's a document to clear your concepts on the same here: Ramesh Singh: Summary of Sustainability & Climate Change: India and The World

Salt Sector Crisis

Why in News?

The Salt Industry is facing enormous challenges in meeting the demand and handling the crisis faced by salt farmers and workers.

While farmers are facing low prices due to the nonavailability of minimum support prices, workers are also in distress due to lack of proper arrangements for wages and social security.

What is the position of Salt Sector?

India:

- India ranks third in the production of salt in the world next to the USA and China.

- Sea salt constitutes about 70% of the total salt production in the country.

- Salt manufacturing activities are carried out in the coastal states of Gujarat, Tamil Nadu, Andhra Mining produces hardly 0.5% salt. 99.5% of salt is produced either from sea water or from sub soil water and the whole process is done by seeding, farming and harvesting.

- Unseasonal rains and floods are resulting in demand for Minimum Support Price.

- Minimum Support Price (MSP) is a form of market intervention by the Government of India to insure agricultural producers against any sharp fall in farm prices.

- The major objectives are to support the farmers from distress sales and to procure food grains for public distribution.

Wages and Social Security:

- Companies have replaced cooperatives and they decide the wages of these workers and the production of farmers. Most of them are migrant labourers.

- The cooperative sector is more or less passive. Workers are going through serious health issues and economic distress with no minimum wages or social security.

12 workers died when the wall of a packing unit collapsed in Morbi. - Projects such as Rann Sarovar, a freshwater lake construction project in 5,000 square kilometers of this area, will render about 50,000 people jobless.

What is the Role of Government in Development of Salt Industries?

- Salt is a central subject listed as item number 58 of the Union List of the 7th Schedule of the Constitution. It is listed as a mining industry.

- The Government of India has de-licensed the Salt Industry by deleting provisions relating to Salt in the Central Excise & Salt Act, 1944.

- The Salt Commissioner’s Organization plays a facilitating role in overall growth and development of the Salt Industry in the country.

- A separate nodal agency with common rules and regulations regarding salt production is required.

- Minimum wages and social security must be ensured with a uniform policy for the entire country

Participatory Notes

Why in News?

- Investment in the Indian capital markets through Participatory notes (P-notes) dropped to Rs 86,706 crore till May-end, 2022.

- However, according to experts, foreign investors will reverse their selling stance and return to the country’s equities in the coming 1-2 quarters.

- In line with a decline in P-note investment, the assets under the custody of Foreign Portfolio Investors (FPIs) dropped 5% to Rs 48.23 trillion end-May, 2022 from Rs 50.74 trillion end-April,2022.

- This was the eighth consecutive month of net pull-out by FPIs from equities.

What are the Participatory Notes?

- P-notes are Offshore Derivative Instruments (ODIs) issued by registered Foreign Portfolio Investors (FPIs) to overseas investors who wish to be a part of the Indian stock markets without registering themselves directly.

- P-notes have Indian stocks as their underlying assets.

- FPIs are non-residents who invest in Indian securities like shares, government bonds, corporate bonds, etc.

- Though P-note holders have less stringent registration requirements, they have to go through a proper due diligence process of the Security and Exchange Board of India (SEBI).

What are the reasons for Declining P- Notes?

Uncertainty around Inflation Levels:

- There is still uncertainty around inflation levels and the US Federal Reserve’s (Fed’s) actions.

- Decline in P-Notes is being attributed due to the tightening of monetary policy by the US Fed which has been on a rate hiking spree to control inflation.

- Other central banks, including in Britain and the Eurozone, are following suit.

Currency correction:

- Currency correction has happened to a large extent.

- A correction is a price rebound which can be observed after every trend impulse. After a correction takes place, the price returns to the trend.

- A correction on the currency market takes place due to the overselling or overbuying of instruments at the current moment in time.

- A large part of this reduction to market correction in equity and debt portfolios.

What are the Expectations for P-Notes in the Future?

- Equity markets are offering some attractive valuations at these levels.

- Supply-chain and inflation issues should begin to subside in the months to come. Markets usually move ahead of the economic cycle.

- It is believed that the next one/two quarters, FPIs should be coming back to allocating capital towards Indian equities.

Since Participatory notes are a part of Money Market, here's a document to clear your concepts on the same here:

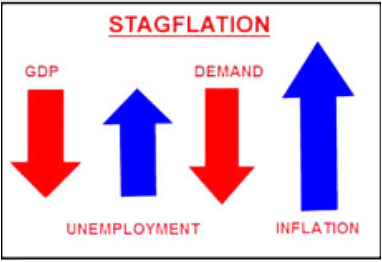

Stagflation

Why in News?

Central banks across the World are trying to formulate policies to ensure that Inflation, in some advanced economies including the U.S., is cooled without triggering a Recession, since some of the experts are seeing Stagflation in the near future.

What is Stagflation?

About:

- Stagflation means a situation characterized by simultaneous increase in prices and stagnation of economic growth.

- The term Stagflation was coined by Iain Macleod, a Conservative Party MP in the United Kingdom, in November 1965.

- It is described as a situation in the economy where the growth rate slows down, the level of unemployment remains steadily high and yet the inflation or price level remains high at the same time.

- It is Dangerous for the economy

- In a usually low growth situation, central banks and governments try to stimulate the economy through higher public spending and low interest rates to create demand.

- These measures also tend to elevate prices and cause inflation. So, these tools cannot be adopted when inflation is already running high, which makes it difficult to break out of the low growth-high inflation trap.

Case of Stagflation:

- In the early and mid-1970s when OPEC (The Organisation of Petroleum Exporting Countries), which works like a cartel, decided to cut supply and sent oil prices soaring across the world.

- On the one hand, the rise in oil prices constrained the productive capacity of most western economies that heavily depended on oil, thus hampering economic growth. On the other hand, the oil price spike also led to inflation and commodities became more costly.

- For instance, in 1974, the oil prices went up by almost 70% and it leads to a consequent rise in inflation.

What has sparked the latest concerns about stagflation?

- Covid-19 and Subsequent Fiscal and Monetary Measures:

- While the outbreak of the Covid-19 pandemic and the curbs imposed to contain the spread of the virus caused the first major recent economic slowdown worldwide, the subsequent fiscal and Monetary Measures taken to address the downturn, including substantial increases in liquidity in most of the advanced economies, fuelled a sharp upsurge in inflation.

- Russia- Ukraine Situation and Sanctions on Moscow:

- While the Fed and the Bank of England are among central banks that have started raising interest rates to cool soaring prices, the ongoing war in Ukraine following Russia’s invasion of its southern neighbour and the consequent Western sanctions on Moscow have caused a fresh and as yet hardto-quantify ‘supply shock’.

Supply Factors:

- With the prices of commodities ranging from oil and gas to food grains, edible oils and fertilizers all surging sharply in the wake of the conflict, authorities face an uphill battle to contain inflation that is now less a function of demand (and so can be controlled by regulating credit) and almost entirely caused by supply factors that are far harder to manage.

Since Stagflation is part of Inflation, here's a document to clear your concepts on the same here:

Bad Bank

Why in News?

Recently, the Ministry of Finance has announced that the National Asset Reconstruction Company (NARCL) along with the India Debt Resolution Company (IDRCL) will take over the first set of bad loans from banks and try to resolve them.

The health of the balance sheets of Indian banks has improved significantly over the last few years with their Gross Non-Performing Assets (GNPA) ratio declining from a peak of 11.2% in FY18 to 6.9% in Q2FY22.

NARCL has been set up by banks to aggregate and consolidate stressed assets for their subsequent resolution. PSBs will maintain 51% ownership in NARCL.

IDRCL is a service company/operational entity which will manage the asset and engage market professionals and turnaround experts. Public Sector Banks (PSBs) and Public FIs will hold a maximum of 49% stake and the rest will be with private sector lenders.

The government had already announced sovereign guarantees of Rs 30,600 crore for Security Receipts (SRs) to be issued by NARCL, which will be buying Rs 2 lakh crore non-performing loans from banks.

What is a Non-Performing Asset?

- NPA refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest.

- In most cases, debt is classified as non-performing, when the loan payments have not been made for a minimum period of 90 days.

- Gross non-performing assets are the sum of all the loans that have been defaulted by the individuals who have acquired loans from the financial institution.

- Net non-performing assets are the amount that is realised after provision amount has been deducted from the gross non-performing assets.

What is a Bad Bank?

A bad bank is a financial entity set up to buy NonPerforming Assets (NPAs), or Bad Loans, from banks.

The aim of setting up a bad bank is to help ease the burden on banks by taking bad loans off their balance sheets and get them to lend again to customers without constraints.

After the purchase of a bad loan from a bank, the bad bank may later try to restructure and sell the NPA to investors who might be interested in purchasing it.

A bad bank makes a profit in its operations if it manages to sell the loan at a price higher than what it paid to acquire the loan from a commercial bank.

However, generating profits is usually not the primary purpose of a bad bank — the objective is to ease the burden on banks, of holding a large pile of stressed assets, and to get them to lend more actively

What are the Pros and Cons of a Bad bank?

Pros:

- Single Exclusive Entity:

- It can help consolidate all bad loans of banks under a single exclusive entity.

- The idea of a bad bank has been tried out in countries such as the U.S., Germany, Japan and others in the past.

- The troubled asset relief program, also known as TARP, implemented by the U.S. Treasury in the aftermath of the 2008 financial crisis, was modelled around the idea of a bad bank.

- Freedom to Use Freed-up Capital:

- By taking bad loans off the books of troubled banks, a bad bank can help free capital of over Rs 5 lakh crore that is locked in by banks as provisions against these bad loans.

- This will give banks the freedom to use the freed-up capital to extend more loans to their customers.

- Improving Capital Buffer:

- It can help improve bank lending not by shoring up bank reserves but by improving banks’ capital buffers.

- To the extent that a new bad bank set up by the government can improve banks’ capital buffers by freeing up capital, it could help banks feel more confident to start lending again.

Cons:

- Merely Shifts one Pocket of Government to another:

- Bad bank backed by the government will merely shift bad assets from the hands of public sector banks, which are owned by the government, to the hands of a bad bank, which is again owned by the government.

- There is little reason to believe that a mere transfer of assets from one pocket of the government to another will lead to a successful resolution of these bad debts when the set of incentives facing these entities is essentially the same.

- Nature of Ownership:

- Unlike private banks, which are owned by individuals who have strong financial incentives to manage them well, public sector banks are managed by bureaucrats who may often not have the same commitment to ensuring these lenders’ profitability.

- To that extent, bailing out banks through a bad bank does not really address the root problem of the bad loan crisis.

- Risk of Moral Hazard:

- Commercial banks that are bailed out by a bad bank are likely to have little reason to mend their ways.

- After all, the safety net provided by a bad bank gives these banks more reason to lend recklessly and thus further exacerbate the bad loan crisis.

What are the Associated Challenges?

- Mobilising Capital:

- Finding buyers for bad assets in a pandemic hit economy will be a challenge, especially when governments are facing the issue of containing the fiscal deficit.

- Not Addressing the Underlying Issue:

- Without governance reforms, the Public sector banks (accounted for 86%, of the total NPAs) may go on doing business the way they have been doing in the past and may end up piling-up of bad debts again.

- Also, the bad bank idea is like shifting loans from one government pocket (the public sector banks) to another (the bad bank).

- Provisioning Issue Tackled Through Recapitalization:

- Union Government, in the last few years, has infused nearly Rs 2.6 lakh crore in banks through recapitalisation.

- Those who oppose the concept of bad banks hold that the government has on its part recapitalised the banks to compensate for the write-offs and hence, there is no need for a bad bank.

- Market-related Issues:

- The price at which bad assets are transferred from commercial banks to the bad bank will not be market-determined and price discovery will not happen.

Way Forward

So long as Public Sector Banks’ managements remain beholden to politicians and bureaucrats, their deficit in professionalism will remain and subsequently, prudential norms in lending will continue to suffer. Therefore, a bad bank is a good idea, but the main challenge lies with tackling the underlying structural problems in the banking system and announcing reforms accordingly.

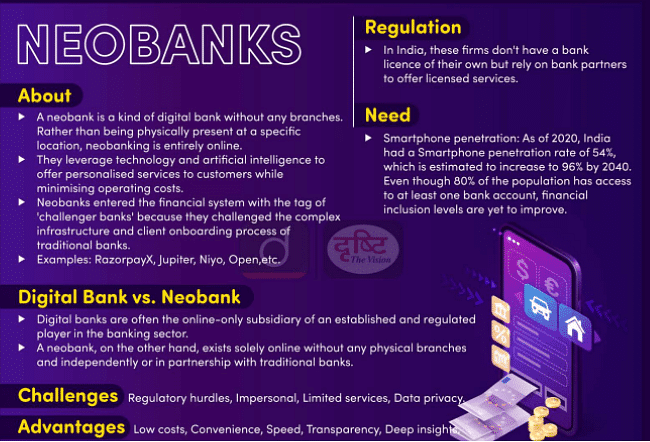

Neobanks

Why in News?

The RBI (Reserve Bank of India) is taking a hard look at the neobank business model where fintechs plug into a conventional bank’s network and become customer facing banking service providers. The concern is that the digital model business can scale up very fast and could grow to be bigger than the underlying bank in terms of customers. Although neobank customers continue to be accountholders of the underlying bank, the only channel available to these users is the fintech-owned digital platform.

What are Neobanks?

- A neobank is a kind of digital bank without any branches. Rather than being physically present at a specific location, neobanking is entirely online.

- Neobanks are financial institutions that give customers a cheaper alternative to traditional banks.

- They leverage technology and artificial intelligence to offer personalised services to customers while minimising operating costs.

- Neobanks entered the financial system with the tag of ‘challenger banks’ because they challenged the complex infrastructure and client onboarding process of traditional banks.

- In India, these firms don’t have a bank licence of their own but rely on bank partners to offer licensed services.

- That’s because the RBI doesn’t allow banks to be 100% digital yet.

- The RBI remains resolute in prioritising banks’ physical presence, and has spoken about the need for digital banking service providers to have some physical presence as well.

- RazorpayX, Jupiter, Niyo, Open, etc are the examples of top Neobanks of India.

What are the Different Operating Models of Neobanks?

- Non-licensed FinTech (Financial Technology) firms that collaborate with conventional banks to have a mobile/Web platform and a wrapper around their partner banks’ products.

- Traditional banks that are undertaking their digital

- initiatives.

- Licensed neobanks (usually with digital banking licences in those countries that allow it)

What are the Differences Between Traditional Banks and Neobanks?

- Funding and customers’ trust: Traditional banks have many advantages over neobanks, such as funding and most importantly customers’ trust.

- However, legacy systems are weighing them down and they find it difficult to adapt to the growing needs of a tech-savvy generation.

- Innovation: While neobanks don’t have the funds or customer base to overthrow traditional banks, they have something special in their arsenal - innovation. They can launch features and develop partnerships to serve their customers much more quickly than traditional banks.

- Underserved by traditional banks: Neobanks cater to retail customers, and small and medium businesses, which are generally underserved by traditional banks. They leverage the mobile-first model to differentiate themselves by introducing innovative products and providing superior customer service.

- Venture capital and private equity investors: They have been keeping a keen eye on the market opportunities for such banks and are taking an increasing interest in them.

- Smartphone penetration: As of 2020, India had a Smartphone penetration rate of 54%, which is estimated to increase to 96% by 2040.

- Even though 80% of the population has access to at least one bank account, financial inclusion levels are yet to improve.

What are the Challenges for Neobanks?

Fulfilling the needs of a segment of the market: The key to their success lies in fulfilling the needs of a segment of the market, and adopting the right technology, business strategy and work culture. Regulatory hurdles: Since the RBI doesn’t yet recognise neobanks as such, officially customers may not have any legal recourse or a defined process in case of an issue.

Impersonal: Since neobanks don’t have a physical branch, customers don’t have access to in-person assistance.

Limited services: Neobanks generally offer fewer services than traditional banks.

What are the Advantages of Neobanks?

- Low costs: Fewer regulations and the absence of credit risk allow neobanks to keep their costs low. Products are typically inexpensive, with no monthly maintenance fees.

- Convenience: These banks offer customers the majority (if not all) of banking services through an app.

- Speed: Neobanks allow customers to set up accounts quickly and process requests speedily. Those that offer loans may skip the usual time-consuming application processes in favour of innovative strategies for evaluating credit.

- Transparency: Neobanks are transparent and strive to provide real-time notifications and explanations of any charges and penalties incurred by the customer.

- Deep insights: Most neobanks provide dashboard solutions with highly enhanced interfaces and easy to understand and valuable insights for services such as payments, payables and receivables, and bank statements.

|

136 videos|423 docs|144 tests

|

FAQs on Economic Development: June 2022 Current Affairs - Indian Economy for State PSC Exams - BPSC (Bihar)

| 1. What is sustainable fashion? |  |

| 2. What is the salt sector crisis? |  |

| 3. What is stagflation? |  |

| 4. What is a bad bank? |  |

| 5. What is the way forward for economic development? |  |