Financial & Accounting Systems: Notes (Part - 1) | Financial Management & Strategic Management for CA Intermediate PDF Download

Chapter Overview

Introduction

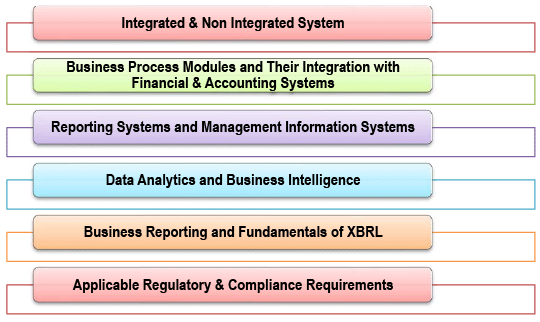

This chapter is meant for providing an insight to Financial and Accounting Systems, its working, audit and its use for business management and development. Financial and Accounting Systems forms an integral part of any business and acts as a backbone for it. Financial and Accounting systems may include other aspects of business management like human resource, inventory, Customer Relationship Management (CRM), etc. After going through this chapter, a student is expected to understand about–

- What is a system?

- What is ERP System?

- What is a Financial and Accounting system?

- How to use it for different purposes like accounting, auditing, business management, etc.?

- How to assess risks and controls of any Financial and Accounting System?

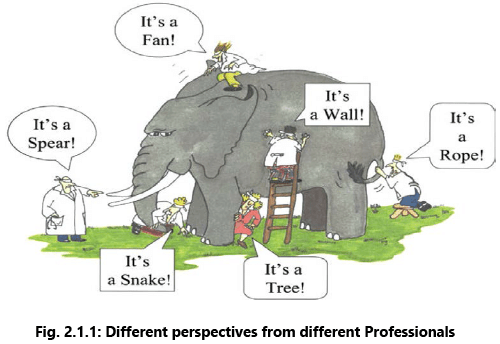

In the process of learning about Financial and Accounting systems, there can be different angles to view the same thing and to understand it in a better way, we shall be viewing Financial and Accounting Systems from many different angles. At time of understanding the system from one angle, another angle must be kept in mind and cannot be ignored. Chartered Accountants are supposed to be experts in financial as well as accounting systems. Financial and Accounting Systems does not necessarily mean Software or Computerized Systems only. It may include many other aspects also.

Fig. 2.1.1 depicts different perspectives of the same view through different Professionals.

Different Requirements from Different Persons

- Accountants View – Balance Sheet and Profit & Loss Account must be prepared easily without putting much time / efforts.

- Auditors View – Balance Sheet and Profit & Loss Account must be correct at any point of time.

- Business Manager / Owner’s View – I need right information at right point of time for right decision making.

It is the job of any Financial and Accounting System to cater to needs of all the users simultaneously. Hence, we shall discuss Financial and Accounting Systems from all the possible angles.

ERP and Non-Integrated Systems

What is a System?

What is a system and how this word relates to Financial and Accounting aspect? This is important for us to understand. Many a times this word is mistakenly understood as something relating to computer / software / information technology etc. Here it is suggested to make this point very clear that a system may or may not be related with computer / software / information technology etc. Software / Computer / Hardware may or may not form part of overall system.

Dictionary meaning of the word System is -

“A set of principles or procedures per which something is done; an organized scheme or method”

or

“A set of things working together as parts of a mechanism or an interconnecting network; a complex whole”

The word “System” can be explained in a simple way as, “a set of detailed methods, procedures and routines created to carry out a specific activity, perform a duty, or solve a problem”. It is an organized, purposeful structure that consists of interrelated and interdependent elements (components, entities, factors, members, parts etc.).These elements continually influence one another (directly or indirectly) to maintain their activity and the existence of the system, to achieve the goal of the system. All systems generally have -

(a) Inputs, outputs and feedback mechanisms;

(b) Maintain an internal steady-state despite a changing external environment; and

(c) Have boundaries that are usually defined by the system observer.

Systems may consist of sub-system also which area part of a larger system. Systems stop functioning when an element is removed or changed significantly. Together, they allow understanding and interpretation.

Human body is natural and a complete system. We know about the word “Eco System”. Every human body is a part of Ecosystem. An ecosystem includes all the living things (plants, animals and organisms) in each area, interacting with each other, and with their non-living environments (weather, earth, sun, soil, climate, and atmosphere). In an ecosystem, each organism has its’ own niche or role to play. In another example, a business is said to be system as it contains input such as people, machine, money, materials etc. which undergo different processes such as production, marketing, finance etc. and produces output like goods and services depending on the nature of business.

In this chapter, we are discussing system for business finance and accounting.

A system includes defined methods and process to perform an activity. So basically, processes are important components in any system.

What is a Process?

In the systems engineering arena, a Process is defined as a sequence of events that uses inputs to produce outputs. This is a broad definition and can include sequences as mechanical as reading a file and transforming the file to a desired output format; to taking a customer order, filling that order, and issuing the customer invoice.

From a business perspective, a Process is a coordinated and standardized flow of activities performed by people or machines, which can traverse functional or departmental boundaries to achieve a business objective and creates value for internal or external customers.

Concepts in Computerized Accounting Systems

As we are discussing about Financial & Accounting Systems, it is necessary to discuss some concepts to understand Financial and Accounting systems in a better way.

I. Types of Data

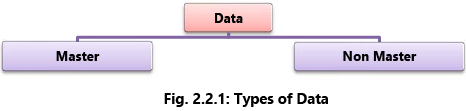

Every accounting systems stores data in two ways: Master Data and Non-Master Data (or Transaction Data) as shown in the Fig. 2.2.1.

- Master Data: Relatively permanent data not expected to change frequently.

- Non-Master Data: Non-permanent data and expected to change frequently.

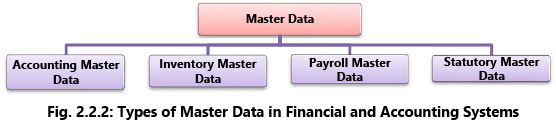

A. Master Data: As defined above, master data is relatively permanent data that is not expected to change again and again. It may change, but not again and again. In accounting systems, there may be following type of master data as shown in the Fig. 2.2.2.

- Accounting Master Data – This includes names of ledgers, groups, cost centres, accounting voucher types, etc. E.g. Capital Ledger is created once and not expected to change frequently. Similarly, all other ledgers like sales, purchase, expenses and income ledgers are created once and not expected to change again and again. Opening balance carried forward from previous year to next year is also a part of master data and not expected to change.

- Inventory Master Data – This includes stock items, stock groups, godowns, inventory voucher types etc. Stock item is something which bought and sold for business purpose, trading goods. E.g. If a person is into the business of dealing in white goods, stock items shall be Television, Fridge, Air Conditioner, etc. For a person running a medicine shop, all types of medicines shall be stock items for him/her.

- Payroll Master Data – Payroll is another area connecting with Accounting Systems. Payroll is a system for calculation of salary and recording of transactions relating to employees. Master data in case of payroll can be names of employees, group of employees, salary structure, pay heads, etc. These data are not expected to change frequently. E.g. Employee created in the system will remain as it is for a longer period of time, his/her salary structure may change but not frequently, pay heads associated with his/her salary structure will be relatively permanent.

- Statutory Master Data – This is a master data relating to statute/law. It may be different for different type of taxes. E.g. Goods and Service Tax (GST), Nature of Payments for Tax Deducted at Source (TDS), Tax Collected at Source (TCS) etc. This data also shall be relatively permanent. We don’t have any control on this data as statutory changes are made by Government and not by us. In case of change in tax rates, forms, categories, we need to update/change our master data.

All business process modules must use common master data.

B. Non-Master Data: It is a data which is expected to change frequently, again and again and not a permanent data. E.g. Amounts recorded in each transaction shall be different every time and expected to change again and again. Date recorded in each transaction is expected to change again and again and will not be constant in all the transactions.

Example 1: To understand the concept of master data and non-master data in a simple way, let us co-relate this with ourselves using following example.

Our Personal Master Data – Our Name, Name of Parents, Address, Blood Group, Gender, Date of Birth, etc. is a personal master data and not expected to change. Our address may change, but not frequently.

Our Personal Non-Master Data – Contrary to this, there may be some information about us which may fall in the category of non- master data, i.e. not a permanent data. E.g. Date of Birth is master data but age is a non- master data, weight is a non-master data, our likes, dislikes again is a non-master data.

C. Why Master and Non-Master Data?

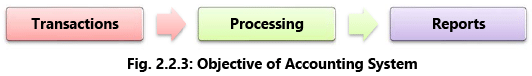

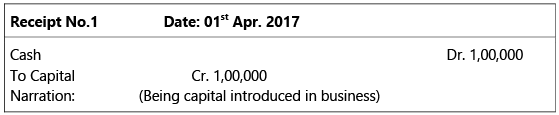

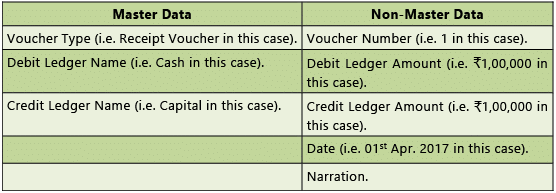

Basic objective of accounting system is to record input in the form of transactions and generate output in the form of reports as shown in the Fig. 2.2.3. Let us consider a simple transaction of capital introduction in business in cash ₹ 1,00,000. This transaction is recorded as under in Table 2.2.1.

Let us consider a simple transaction of capital introduction in business in cash ₹ 1,00,000. This transaction is recorded as under in Table 2.2.1.

Table 2.2.1: Data Sample Transaction Above information is stored in Accounting Information Systems in two ways, in the form of Master Data and Transaction Data. Let us understand what is stored in the system through Table 2.2.2.

Above information is stored in Accounting Information Systems in two ways, in the form of Master Data and Transaction Data. Let us understand what is stored in the system through Table 2.2.2.

Table 2.2.2: Data Stored in Forms Please note:

Please note:

- Master data is generally not typed by the user; it is selected from the available list. E.g. Debit Ledger name is selected from the available list of ledgers. If ledger is not created, user needs to create it first to complete the voucher entry.

- Master data entry is usually done less frequently say once a year or when there is a need to update. For example - prices are contracted with Vendors after deliberations and the agreed prices are updated in the Vendor master when new prices are negotiated. Generally, these are not done as frequently as the transactions with the Vendor itself. Effective controls over master data entry would be a ‘four eye’ check, where, there is another person who independently checks whether the master data entry is accurately done in the financial system of the company.

- Non-master data is typed by the user and not selected from available list as it is a non-permanent and it keeps on changing again and again.

- Sometimes transactional data could also be selected from a drop down list of inputs available to the user. For example, when a GRN (Goods Receipt Note) is created by the Stores/Warehouse personnel, they might only select the open purchase orders available in the system and input actual quantities received. In this case, many fields required to complete the transaction is pre-filled by the system and the user is not allowed to edit those fields.

- Master data is selected from the available list of masters (e.g. Ledgers) to maintain standardization as we need to collect all the transactions relating to one master data at one place for reporting. E.g. all cash transactions are collected in Cash Ledger for reporting purpose all transactions relating to capital are collected in Capital Ledger for reporting purpose.

- While inputting the information, user is forced to select master data from the available list just to avoid confusion while preparing reports. For example - same ledger name may be written differently.

II. Voucher Types

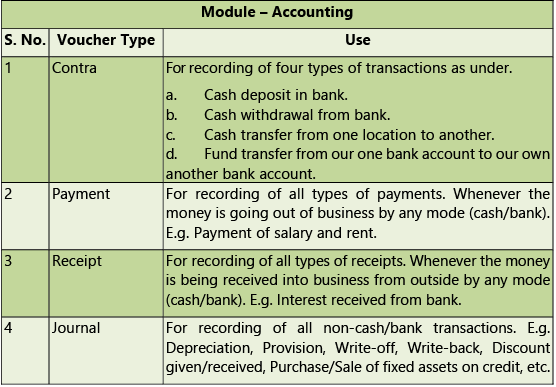

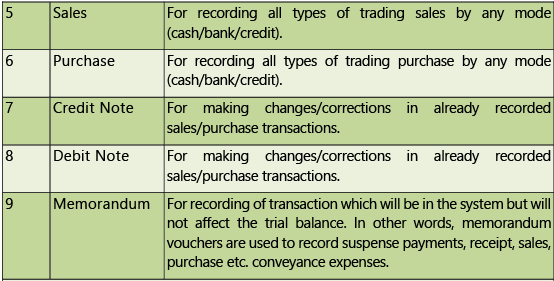

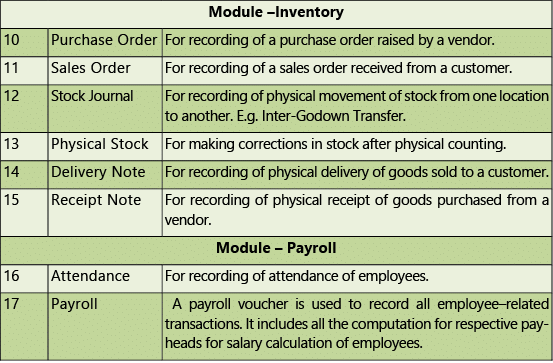

In accounting language, a Voucher is a documentary evidence of a transaction. There may be different documentary evidences for different types of transactions. E.g. Receipt given to a customer after making payment by him/her is documentary evidence of amount received. A sales invoice, a purchase invoice, is also a documentary evidence of transaction. Journal voucher is a documentary evidence of a non-cash/bank transaction. In accounting, every transaction, before it is recorded in the accounting system, must be supported by a documentary proof. In computer language, the word voucher has got a little different meaning. Voucher is a place where transactions are recorded. It is a data input form for inputting transaction data. In accounting, there may be different types of transactions; hence we use different voucher types for recording of different transactions. Generally following types of vouchers are used in accounting systems as shown in Table 2.2.3.

Table 2.2.3: Voucher Types

In some financial systems, instead of the word “Voucher”, the word “Document” is used. Above Table 2.2.3 shows an illustrative list of some of the voucher types. Different system may have some more voucher types. Also, user may create any number of new voucher types as per requirement. E.g. In Table 2.2.3, only “Payment” voucher type is mentioned. But user may create two different voucher types for making payment through two different modes, i.e. Cash Payment and Bank Payment.

In some financial systems, instead of the word “Voucher”, the word “Document” is used. Above Table 2.2.3 shows an illustrative list of some of the voucher types. Different system may have some more voucher types. Also, user may create any number of new voucher types as per requirement. E.g. In Table 2.2.3, only “Payment” voucher type is mentioned. But user may create two different voucher types for making payment through two different modes, i.e. Cash Payment and Bank Payment.

III. Voucher Number

A Voucher Number or a Document Number is a unique identity of any voucher/document. A voucher may be identified or searched using its unique voucher number. Let us understand some peculiarities about voucher numbering.

- Voucher number must be unique.

- Every voucher type shall have a separate numbering series.

- A voucher number may have prefix or suffix or both, e.g. ICPL/2034/17-18. In this case “ICPL” is the prefix, “17-18” is the suffix and “2034” is the actual number of the voucher.

- All vouchers must be numbered serially, i.e. 1,2,3,4,5,6 and so on.

- All vouchers are recorded in chronological order and hence voucher recorded earlier must have an earlier number, i.e. if voucher number for a payment voucher having date as 15th April, 2017 is 112, voucher number for all the vouchers recorded after this date shall be more than 112 only.

IV. Accounting Flow

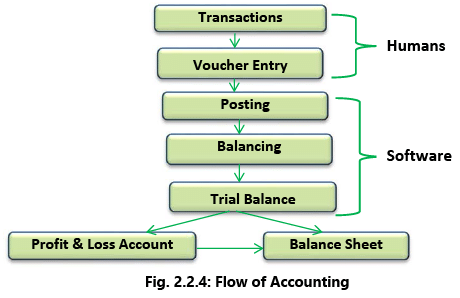

In introduction part, we have discussed accounting flow from the angle of an accountant. Now we are going to discuss accounting flow from the angle of software. As shown in the Fig. 2.2.4 regarding the flow of accounting, in all there are seven steps in accounting flow, out of which only first two steps require human intervention. Remaining five steps are mechanical steps and can be performed by software with high speed and accuracy. Also, these five steps, i.e. Posting, Balancing, Trial Balance preparation, Profit and Loss Account preparation and Balance Sheet preparation are time consuming jobs and require huge efforts.

As shown in the Fig. 2.2.4 regarding the flow of accounting, in all there are seven steps in accounting flow, out of which only first two steps require human intervention. Remaining five steps are mechanical steps and can be performed by software with high speed and accuracy. Also, these five steps, i.e. Posting, Balancing, Trial Balance preparation, Profit and Loss Account preparation and Balance Sheet preparation are time consuming jobs and require huge efforts.

In very few cases, voucher entry may be automated and performed by software automatically. E.g. Interest calculation and application on monthly basis by a bank can be done by software automatically at the end of the month. But largely, voucher entry has to be done by a human being only.

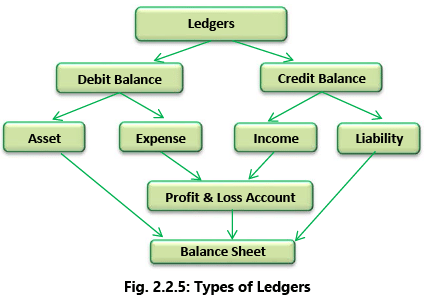

V. Types of Ledgers

In accounting, we have studied that there are three types of ledger accounts, i.e. Personal, Real and Nominal. But as far as Financial and Accounting Systems are concerned, ledgers may be classified in two types only Ledger having Debit Balance and Ledger having Credit Balance. Why this is so? Let us understand with the help of the Fig. 2.2.5. Please note –

Please note –

- Basic objective of accounting software is to generate two primary accounting reports, i.e. Profit & Loss Account and Balance Sheet. Ledger grouping is used for preparation of reports, i.e. Balance Sheet and Profit & Loss Account.

Hence every ledger is classified in one of the four categories, i.e. Assets, Expense, Income or Liability. It cannot be categorized in more than one category. The examples of Ledger account are as follows:

(a) Assets includes Cash, property plant and equipment, accounts receivable etc.

(b) Expense includes salary, insurance, utilities etc.

(c) Income includes sales, interest income, rent income and other operating income etc.

(d) Liabilities includes Debt/loans, accounts payable, outstanding expenses etc. - Difference between Total Income and Total Expenses, i.e. Profit & Loss, as the case may be, is taken to Balance Sheet. So, everything in accounting software boils down to Balance Sheet. Balance Sheet is the last point in accounting process.

- Income and Expense ledgers are considered in Profit & Loss Account and Asset and Liability ledgers are considered in Balance Sheet.

- Accounting software does not recognize any ledger as Personal, Real or Nominal, instead it recognizes it as an Asset, Liability, Income or Expense Ledger.

VI. Grouping of Ledgers

At the time of creation of any new ledger, it must be placed under a particular group. There are four basic groups in Accounting, i.e. Income, Expense, Asset, Liability. There may be any number of sub groups under these four basic groups. Grouping is important as this is way to tell software about the nature of the ledger and where it is to be shown at the time of reporting.

E.g. Cash ledger is an asset ledger and should be shown under current assets in Balance Sheet. If we group cash ledger under indirect expenses, it shall be displayed in profit and loss account as expenditure. Software cannot prevent incorrect grouping of ledger.

Technical Concepts

As now-a-days, almost all the Financial and Accounting Systems are computerized, it is necessary to understand how does it work? We are going to understand technical concepts from the perspective of a non-technical person or a layman who does not understand technicalities and does not want to go into technical details.

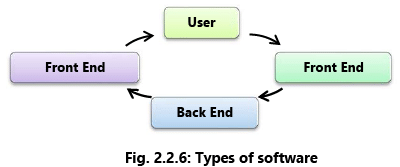

A. Working of any software (Refer Fig. 2.2.6)

(i) Front End & Back End

(i) Front End & Back End These two words are used by software people again and again. Let us understand these two words in a simple language.

- Front End – It is part of the overall software which actually interacts with the user who is using the software.

- Back End – It is a part of the overall software which does not directly interact with the user but interact with Front End only. If a user wants to have some information from the system, i.e. Balance Sheet-

- User will interact with Front End part of the software and request front end to generate the report.

- Front End will receive the instruction from user and pass it on to the back end.

- Back End will process the data, generate the report and send it to the front end. Front end will now display the information to user.

- This is how the process gets completed each and every time.

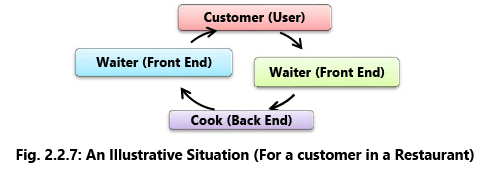

To understand this concept in a better way, let us try to co-relate this with a situation in a restaurant as shown in the Fig. 2.2.7.

- A customer will place an order with waiter (Front End) and not with a cook (Back End) directly.

- Waiter will receive the order and pass it, to the cook in the kitchen.

- Cook will process the food as per requirement and had it over to the waiter.

- Waiter will serve the food to the customer.

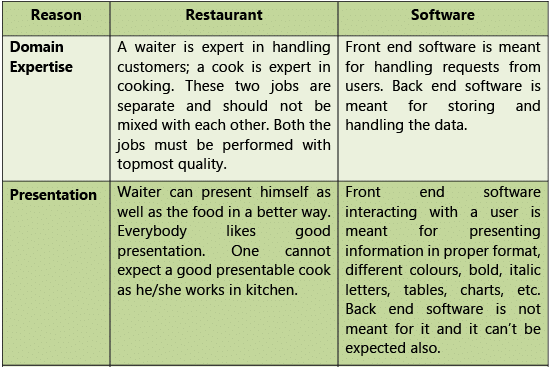

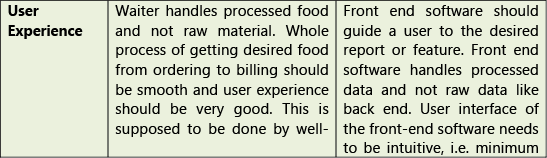

(ii) Why separate Front End and Back End Software? Why not only one?

Reasons behind this can be summarized as under in the Table 2.2.4.

Table 2.2.4: Front End and Back End for Situation (cited in Fig. 2.2.7)

(iii) Application Software

As already discussed in the previous chapter, application software performs many functions such as receiving the inputs from the user, interprets the instructions and performs logical functions so a desired output is achieved. Examples of application software would include SAP, Oracle Financials, MFG Pro etc.

In most software, there are three layers which together form the application namely; an Application Layer, an Operating System Layer and a Database Layer. This is called Three Tier architecture.

- The Application Layer receives the inputs from the users and performs certain validations like, if the user is authorized to request the transaction.

- The Operating System Layer carries these instructions and processes them using the data stored in the database and returns the results to the application layer.

- The Database Layer stores the data in a certain form. For a transaction to be completed, all the three layers need to be invoked. Most application software is built on this model these days.

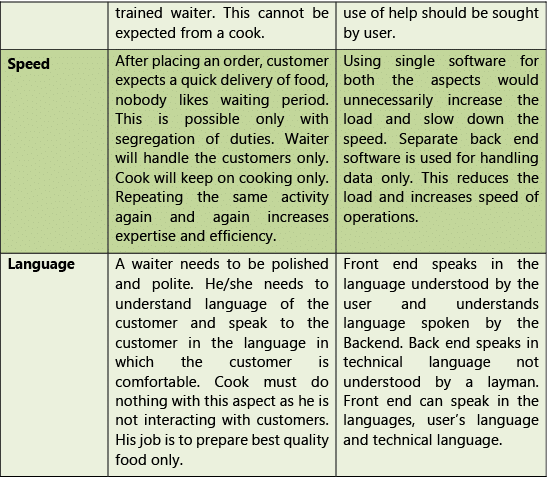

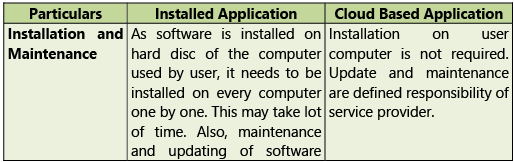

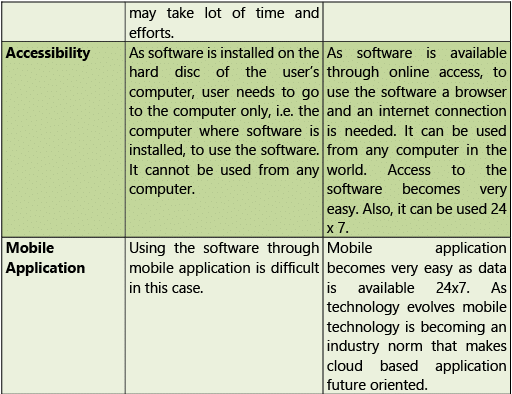

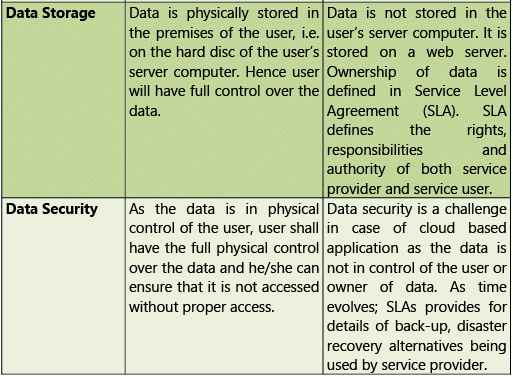

B. Installed Applications v/s Cloud-based Applications

There are the two ways (as shown in the Table 2.2.5) of using a software including Financial & Accounting Software.

- Installed Applications: These are programs that are installed on the hard disc of the user’s computer.

- Cloud Applications: Web Applications are not installed on the hard disc of the user’s computer and are installed on a web server and accessed using a browser and internet connection. As technology and internet connectivity improved virtually, all web-based applications have moved to cloud-based applications. These days many organizations do not want to install Financial Applications on their own IT infrastructure. For many organizations, the thought process is that it is not their primary function to operate complex IT systems and to have a dedicated IT team and hardware which requires hiring highly skilled IT resources and to maintain the hardware and software to run daily operations. The costs may become prohibitive. Thus, organizations increasingly are hosting their applications on Internet and outsource the IT functions. There are many methods through which this can be achieved. Most common among them being SaaS – Software as a Service or IaaS – Infrastructure as a Service of Cloud Computing.

(The details of Cloud computing Service models are discussed in the Chapter 4 of the study material.)

Table 2.2.5: Installed and Cloud Based Applications

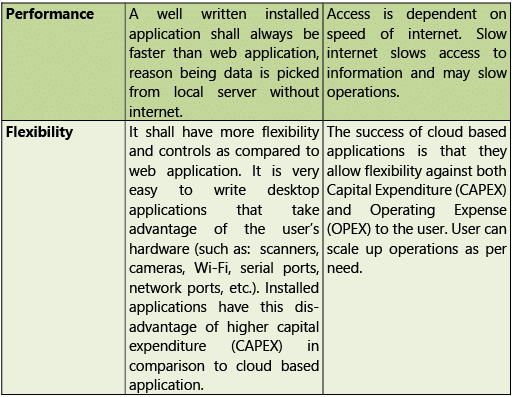

Non-Integrated System

A Non-Integrated System is a system of maintaining data in a decentralized way. Each department shall maintain its own data separately and not in an integrated way. This is the major problem with non-integrated systems.

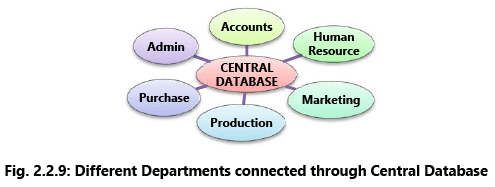

The Fig. 2.2.8 shows a typical non-integrated environment where all the departments are working independently and using their own set of data. They need to communicate with each but still they use their own data. This results in two major problems - Communication Gaps and Mismatched Data. Communication between different business units is a major aspect for success of any organization.

The Fig. 2.2.8 shows a typical non-integrated environment where all the departments are working independently and using their own set of data. They need to communicate with each but still they use their own data. This results in two major problems - Communication Gaps and Mismatched Data. Communication between different business units is a major aspect for success of any organization.

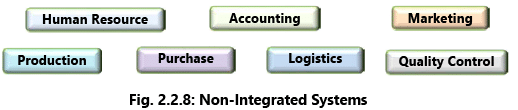

Example 2: Let us consider an example of mismatched master data. A customer record created by different departments for one customer named Ms. Jayshree Jadhao is shown in following Table 2.2.6 showing same customer name written differently.

Table 2.2.6: Example 2.2 with same customer name written differently In the above case, we have considered first name and last name only. Had we used middle name also, few more permutations would have been possible. This may lead to total confusion in the organization at the time of inter-department communication.

In the above case, we have considered first name and last name only. Had we used middle name also, few more permutations would have been possible. This may lead to total confusion in the organization at the time of inter-department communication.

Enterprise Resource Planning (ERP) Systems

- It is an overall business management system that caters need of all the people connected with the organization. Every organization uses variety of resources in achieving its organization goals. ERP is an enterprise-wide information system designed to coordinate all the resources, information, and activities needed to complete business processes such as order fulfilment or billing.

- Accounting and Finance function is considered as backbone for any business. Hence Financial & Accounting Systems are an important and integral part of ERP systems. ERP system includes so many other functions also. An ERP system supports most of the business system that maintains in a single database the data needed for a variety of business functions such as Manufacturing, Supply Chain Management, Financials, Projects, Human Resources and Customer Relationship Management.

- An ERP system is based on a common database and a modular software design. The common database can allow every department of a business to store and retrieve information in real-time. The information should be reliable, accessible, and easily shared. The modular software design should mean a business can select the modules they need, mix and match modules from different vendors, and add new modules of their own to improve business performance.

- Ideally, the data for the various business functions are integrated. In practice the ERP system may comprise a set of discrete applications, each maintaining a discrete data store within one physical database.

- The term ERP originally referred to how a large organization planned to use organizational wide resources. In the past, ERP systems were used in larger more industrial types of companies. However, the use of ERP has changed and is extremely comprehensive, today the term can refer to any type of company, no matter what industry it falls in. In fact, ERP systems are used in almost any type of organization – large or small.

- For a software system to be considered ERP, it must provide an organization with functionality for two or more systems. While some ERP packages exist that only cover two functions for an organization (QuickBooks: Payroll & Accounting), most ERP systems cover several functions.

- Today’s ERP systems can cover a wide range of functions and integrate them into one unified database. For instance - functions such as Human Resources, Supply Chain Management, Customer Relationship Management, Financials, Manufacturing functions and Warehouse Management were all once stand-alone software applications, usually housed with their own database and network, today, they can all fit under one umbrella – the ERP system. Some of the well-known ERPs in the market today include SAP, Oracle, MFG Pro, and MS Axapta etc.

- An ERP System is that system which caters all types of needs of an organization and provides right data at right point of time to right users for their purpose. Hence, definition of ideal ERP system may change for each organization. But generally, an ideal ERP system is that system where a single database is utilized and contains all data for various software modules. Fig. 2.2.9 showing different departments connecting with each other through central database.

- Data Warehouse is a module that can be accessed by an organization’s customers, suppliers and employees. It is a repository of an organization’s electronically stored centralized data. Data warehouses are designed to facilitate reporting and analysis. This classic definition of the data warehouse focuses on data storage.

- The process of transforming data into information and making it available to the user in a timely enough manner to make a difference is known as Data Warehousing. The means to retrieve and analyze data, to extract, transform and load data, and to manage the data dictionary are also considered essential components of a data warehousing system. An expanded definition of data warehousing includes business intelligence tools, tools to extract, transform, and load data into the repository, and tools to manage and retrieve metadata. In contrast, the data warehouses are operational systems which perform day-to-day transaction processing.

Benefits of an ERP System

- Information integration: The reason ERP systems are called integrated is because they possess the ability to automatically update data between related business functions and components. For example - one needs to only update the status of an order at one place in the order-processing system; and all the other components will automatically get updated.

- Reduction of Lead-time: The elapsed time between placing an order and receiving it is known as the Lead-time. The ERP Systems by virtue of their integrated nature with many modules like Finance, Manufacturing, Material Management Module etc.; the use of the latest technologies like EFT (Electronic Fund Transfer), EDI (Electronic Data Interchange) reduce the lead times and make it possible for the organizations to have the items at the time they are required.

- On-time Shipment: Since the different functions involved in the timely delivery of the finished goods to the customers- purchasing, material management production, production planning, plant maintenance, sales and distribution – are integrated and the procedures automated; the chances of errors are minimal and the production efficiency is high. Thus, by integrating the various business functions and automating the procedures and tasks the ERP system ensures on-time delivery of goods to the customers.

- Reduction in Cycle Time: Cycle time is the time between placement of the order and delivery of the product. In an ERP System; all the data, updated to the minute, is available in the centralized database and all the procedures are automated, almost all these activities are done without human intervention. This efficiency of the ERP systems helps in reducing the cycle time.

- Improved Resource utilization: The efficient functioning of the different modules in the ERP system like manufacturing, material management, plant maintenance, sales and distribution ensures that the inventory is kept to a minimum level, the machine down time is minimum and the goods are produced only as per the demand and the finished goods are delivered to the customer in the most efficient way. Thus, the ERP systems help the organization in drastically improving the capacity and resource utilization.

- Better Customer Satisfaction: Customer satisfaction means meeting or exceeding customers‘ requirement for a product or service. With the help of web-enabled ERP systems, customers can place the order, track the status of the order and make the payment sitting at home. Since all the details of the product and the customer are available to the person at the technical support department also, the company will be able to better support the customer.

- Improved Supplier Performance: ERP systems provide vendor management and procurement support tools designed to coordinate all aspect of the procurement process. They support the organization in its efforts to effectively negotiate, monitor and control procurement costs and schedules while assuring superior product quality. The supplier management and control processes are comprised of features that will help the organization in managing supplier relations, monitoring vendor activities and managing supplier quality.

- Increased Flexibility: ERP Systems help the companies to remain flexible by making the company information available across the departmental barriers and automating most of the processes and procedures, thus enabling the company to react quickly to the changing market conditions.

- Reduced Quality Costs: Quality is defined in many different ways- excellence, conformance to specifications, fitness for use, value for the price and so on. The ERP System’s central database eliminates redundant specifications and ensures that a single change to standard procedures takes effect immediately throughout the organization. The ERP systems also provide tools for implementing total quality management programs within an organization.

- Better Analysis and Planning Capabilities: Another advantage provided by ERP Systems is the boost to the planning functions. By enabling the comprehensive and unified management of related business functions such as production, finance, inventory management etc. and their data; it becomes possible to utilize fully many types of Decision Support Systems (DSS) and simulation functions, what-if analysis and so on; thus, enabling the decisionmakers to make better and informed decisions.

- Improved information accuracy and decision-making capability: The three fundamental characteristics of information are accuracy, relevancy and timeliness. The information needs to be accurate, relevant for the decisionmaker and available to the decision-makers when he requires it. The strength of ERP Systems- integration and automation help in improving the information accuracy and help in better decision-making.

- Use of Latest Technology: ERP packages are adapted to utilize the latest developments in Information Technology such as open systems, client/server technology, Cloud Computing, Mobile computing etc. It is this adaptation of ERP packages to the latest changes in IT that makes the flexible adaptation to changes in future development environments possible.

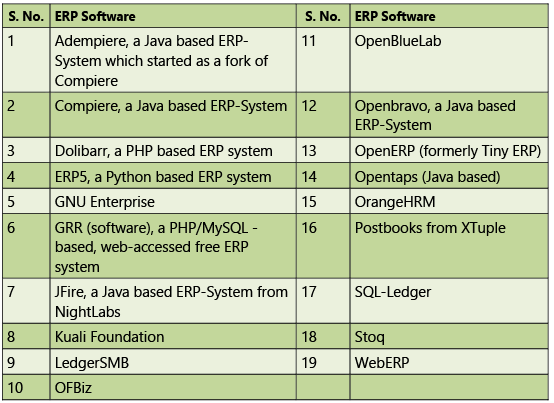

Example 3: Table 2.2.7 provides some examples of Free and Open Source ERP Software.

Table 2.2.7: Free and Open Source ERP software