Financial Statements of Not for Profit Organisations (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 1.58:

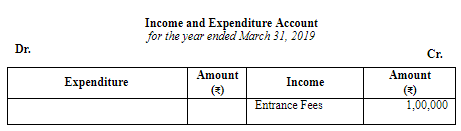

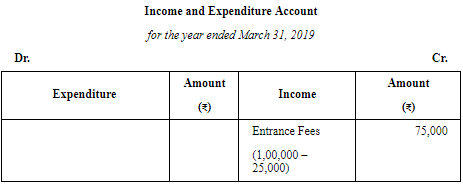

Question 11:How is Entrance Fees dealt with while preparing the final accounts for the year ended 31st March, 2019 in each of the following alternative cases?

Case I During the year ended 31st March, 2019, Entrance Fees received was ₹ 1,00,000.

Case II During the year ended 31st March, 2019, Entrance Fees received was ₹ 1,00,000.Out of this, ₹ 25,000 was received from individuals whose membership is not yet approved.

ANSWER:

Case 1

Case 2

Page No 1.58:

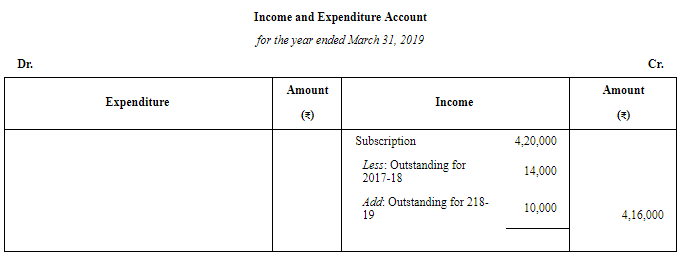

Question 12: In the year ended 31st March, 2019, subscriptions received by the Jaipur Literary Society were ₹ 4,20,000. These subscriptions include ₹ 14,000 received for the year ended 31st March, 2018. On 31st March, 2019, subscriptions due but not received were ₹ 10,000. What amount should be credited to Income and Expenditure Account for the year ended 31st March, 2019 as subscription?

ANSWER:

Page No 1.58:

Question 13:

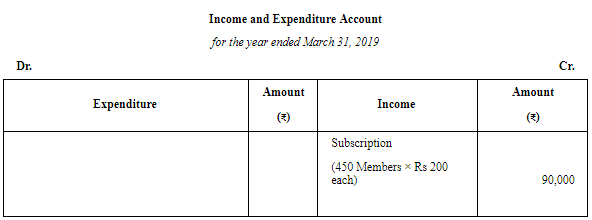

There are 450 members, each paying an annual subscription of ₹ 200; ₹ 1,800 were in arrears for the year ended 31st March, 2018.

Calculate amount of subscriptions to be credited to Income and Expenditure Account for the year ended 31st March, 2019.

ANSWER:

Page No 1.58:

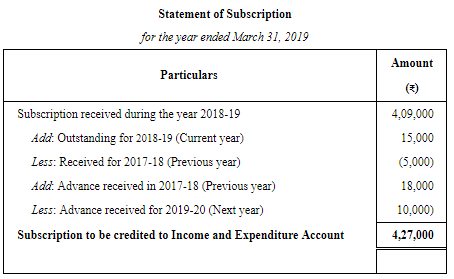

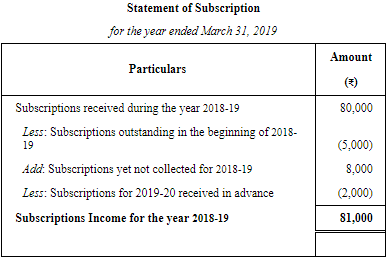

Question 14: In the year ended 31st March, 2019, subscriptions received by Kings Club, Delhi were ₹ 4,09,000 including ₹ 5,000 for the year ended 31st March, 2018 and ₹ 10,000 for the year ended 31st March, 2020. At the end of the year ended 31st March, 2019, subscriptions outstanding for the year ended 31st March, 2019 were ₹ 15,000. The subscriptions due but not received at the end of the previous year, i.e., 31st March, 2018 were ₹ 8,000, while subscriptions received in advance on the same date were ₹ 18,000.

Calculate amount of subscriptions to be credited to Income and Expenditure Account for the year ended 31st March, 2019.

ANSWER:

Page No 1.58:

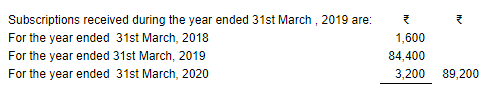

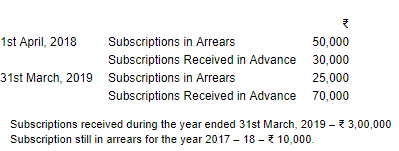

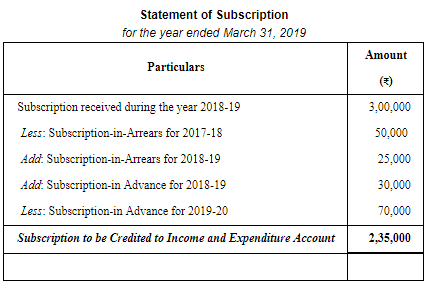

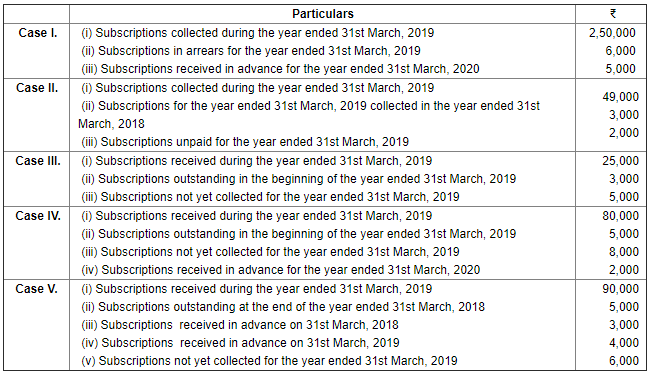

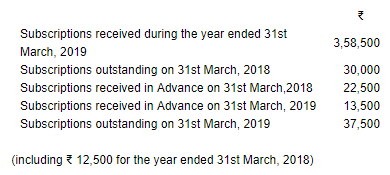

Question 15: From the following information, calculate amount of subscriptions to be credited to the Income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

Page No 1.59:

Question 16: Calculate amount of subscriptions which will be treated as income for the year ended 31st March, 2019 for each of the following cases:

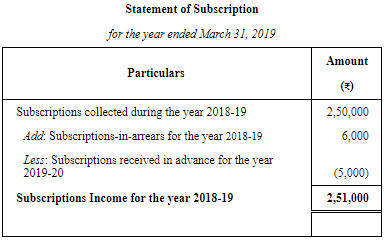

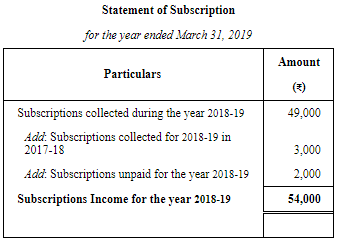

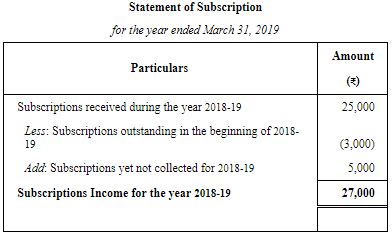

ANSWER:

Case 1

Case 2

Case 3

Case 4

Case 5

Page No 1.59:

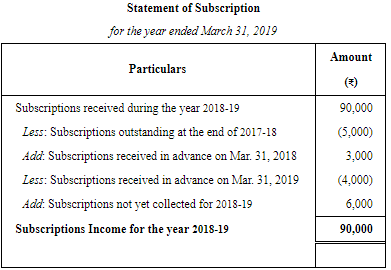

Question 17: From the following particulars, calculate amount of subscriptions to be credited to the Income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

Page No 1.59:

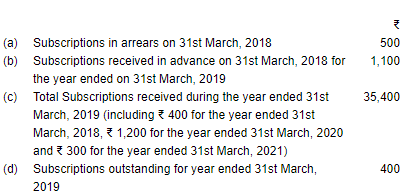

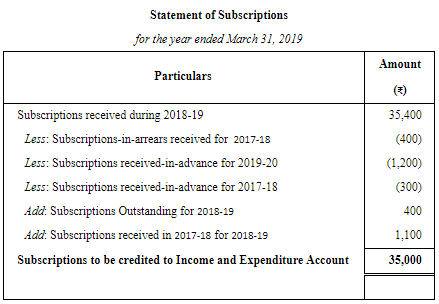

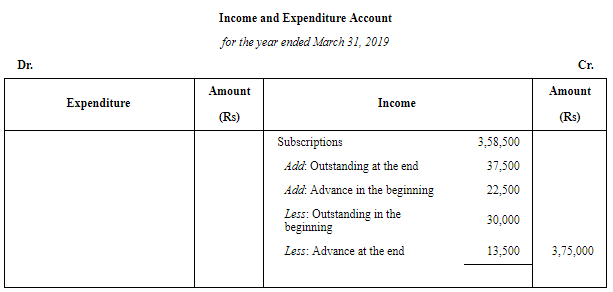

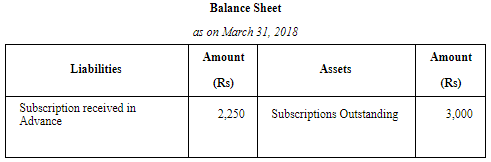

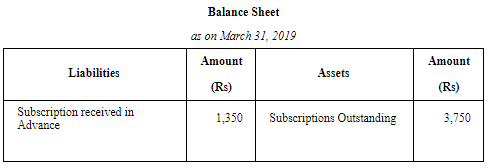

Question 18: How are the following items of subscriptions shown in the Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheets as at 31st March, 2018 and 2019?

ANSWER:

Page No 1.60:

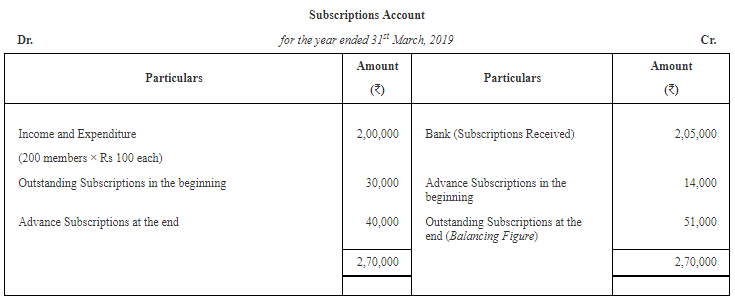

Question 19: From the following information, calculate amount of subscriptions outstanding for the year ended 31st March, 2019:

A club has 200 members each paying an annual subscription of ₹ 1,000. The Receipts and Payments Account for the year showed a sum of ₹ 2,05,000

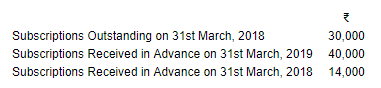

received as subscriptions. The following additional information is provided :

ANSWER:

Page No 1.60:

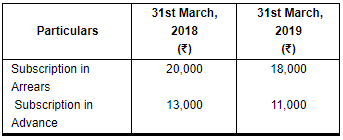

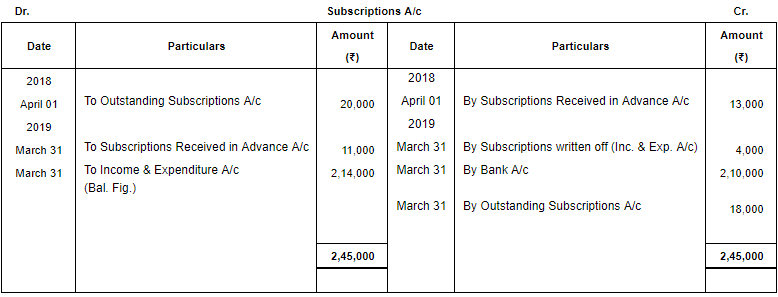

Question 20: From the following information, prepare Subscription Account for the year ending 31st March, 2019:

In the year ending 31st March, 2019, subscription received were ₹ 2,10,000 (including ₹ 6,000 of arrears from previous year) and subscription arrears of previous year were written off ₹ 4,000.

ANSWER:

Page No 1.60:

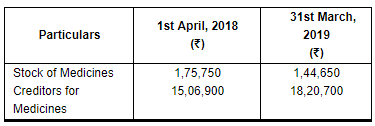

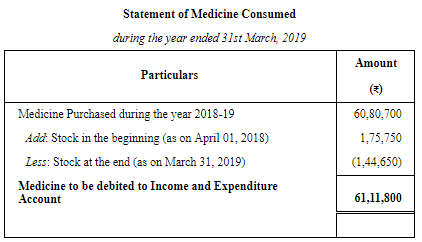

Question 21: On the basis of information given below, calculate the amount of medicines to be debited to the Income and Expenditure Account of Good Health Hospital for the year ended 31st March, 2019:

Medicines purchased during the year ended 31st March, 2019 were ₹ 60,80,700.

ANSWER:

Page No 1.60:

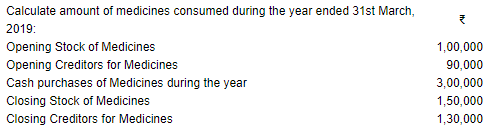

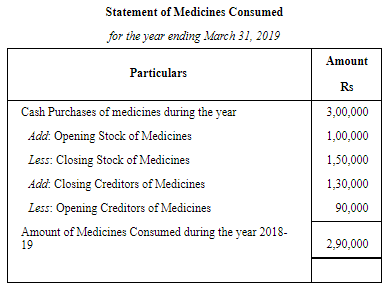

Question 22:

ANSWER:

Page No 1.60:

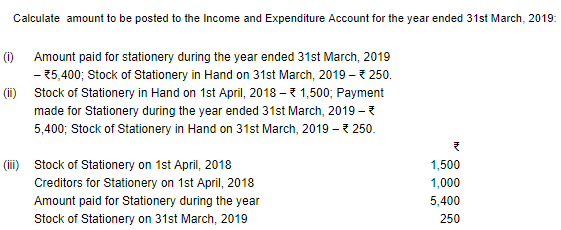

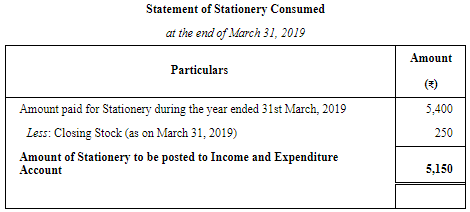

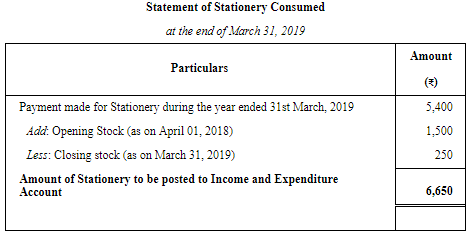

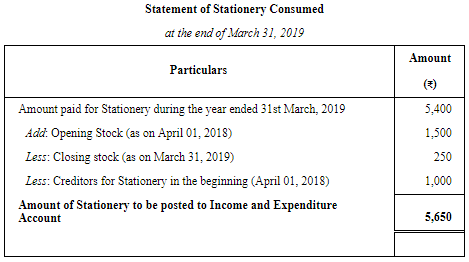

Question 23: Calculate amount to be posted to the Income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

(a)

(b)

(c)

Page No 1.61:

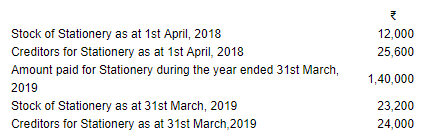

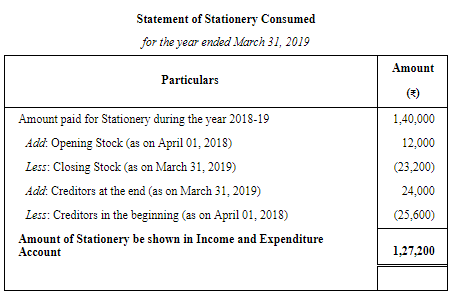

Question 24: On the basis of the following information, calculate amount that will appear against the term 'Stationery Used' in the Income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

Page No 1.61:

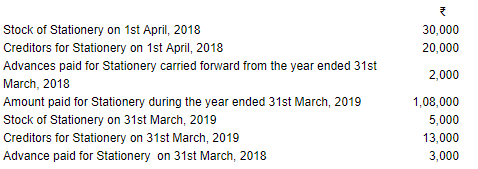

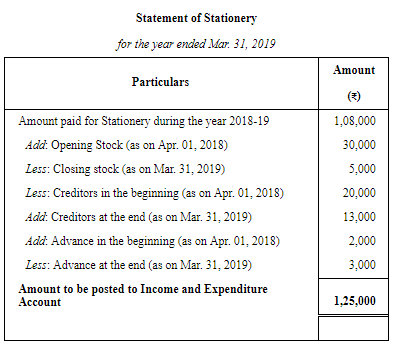

Question 25: Calculate the amount that will be posted to the income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Financial Statements of Not for Profit Organisations (Part - 2) - Accountancy Class 12 - Commerce

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. Why are financial statements important for not-for-profit organizations? |  |

| 3. How are financial statements of not-for-profit organizations different from those of for-profit organizations? |  |

| 4. What information is included in the statement of activities for not-for-profit organizations? |  |

| 5. How can financial statements of not-for-profit organizations be used for decision-making? |  |