Financial Statements with Adjustments (Part - 2) - Commerce PDF Download

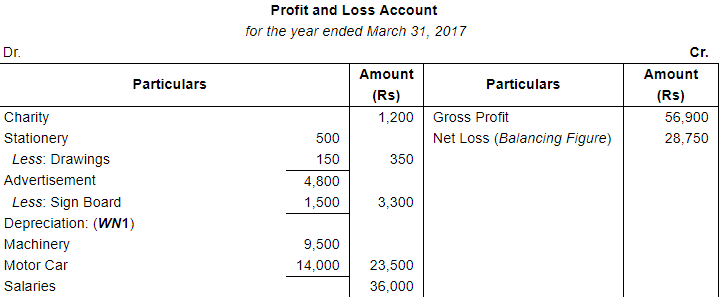

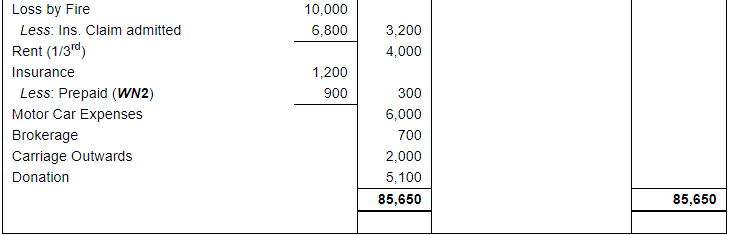

Page No 22.90:

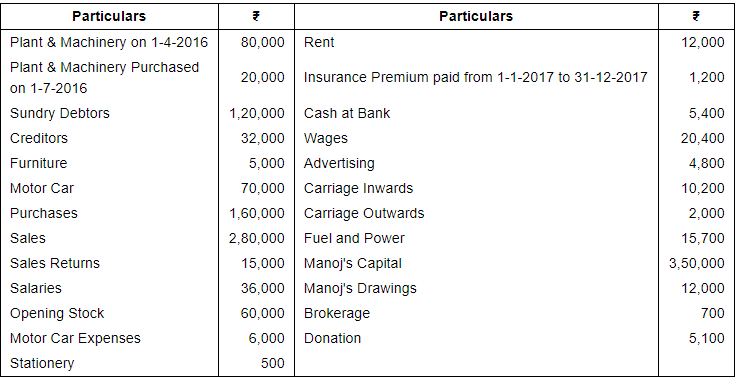

Question 11(B):

From the following particulars taken out from the books of Subhash General Store, prepare Trading and Profit & Loss Account for the year ended 31st March, 2017 and Balance Sheet as at the date:-

The following information is relevant:-

1. Closing Stock ₹ 55,000. Stock valued at ₹ 10,000 was destroyed by fire on 18th March, 2017 but the Insurance Company admitted a claim of ₹ 6,800 only which was received in April, 2017.

2. Stationery for ₹ 150 was consumed by the Proprietor.

3. Goods costing ₹ 1,200 were given away as charity.

4. A new Signboard costing ₹ 1,500 is included in Advertising.

5. Rent is to be allocated 2/3rd to Factory and 1/3rd to Office.

6. Depreciate machinery by 10% and Motor Car by 20%.

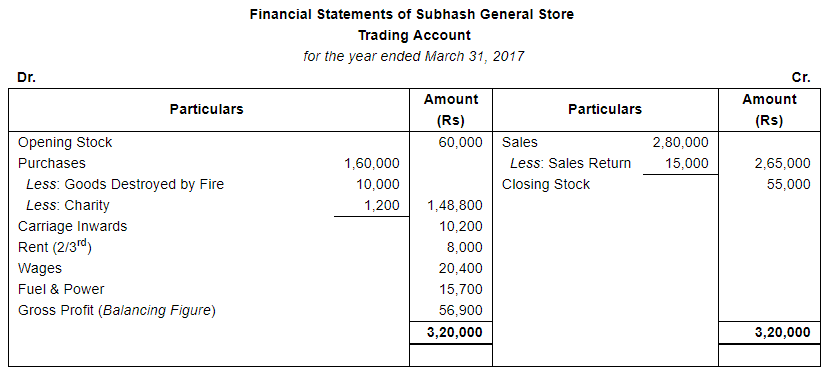

ANSWER:

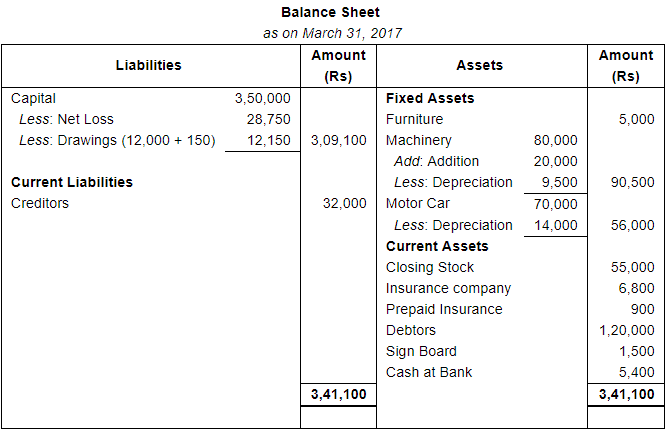

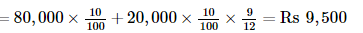

Working Notes:

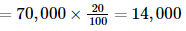

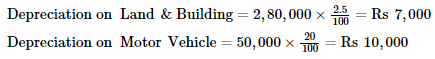

WN1: Calculation of Depreciation

Depreciationon Plant & Machinery

Depreciationon Motor Car

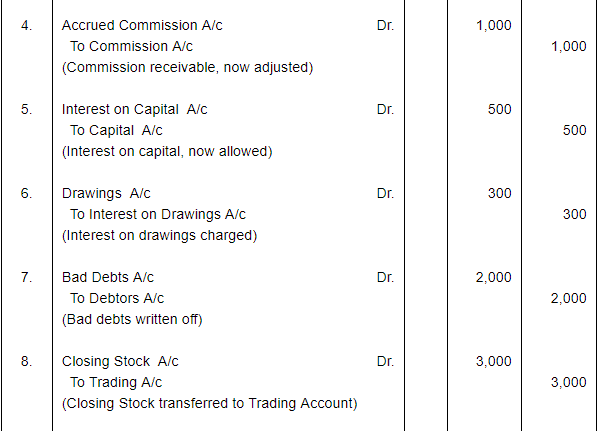

WN2: Calculation of Prepaid Insurance

Page No 22.91:

Question 12:

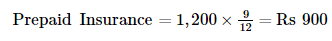

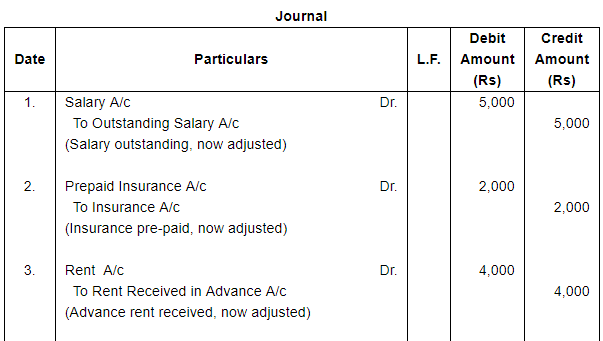

Give journal entries for the following adjustments in final accounts:

(i) Salaries ₹ 5,000 are outstanding.

(ii) Insurance amounting to ₹ 2,000 is paid in advance.

(iii) ₹ 4,000 for rent have been received in advance.

(iv) Commission earned but not received ₹ 1,000.

(v) Interest on capital ₹ 1,500.

(vi) Interest on Drawings ₹ 300.

(vii) Write off ₹ 2,000 as further bad-debts.

(viii) Closing Stock ₹ 3,000.

ANSWER:

Page No 22.91:

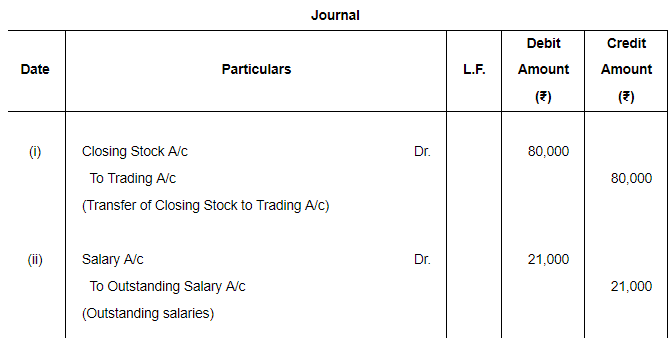

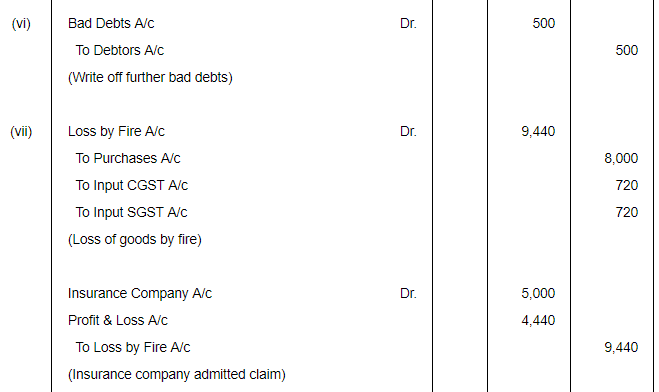

Question 13:

Give journal entries for the following adjustments in final accounts assuming CGST and SGST @ 9% each:

(i) Closing Stock ₹ 80,000.

(ii) Outstanding salaries ₹ 21,000.

(iii) Insurance premium amounting to ₹ 15,000 is paid in advance.

(iv) ₹ 9,000 received for rent related to the next accounting period.

(v) Commission accrued but not received during the accounting year ₹ 1,500.

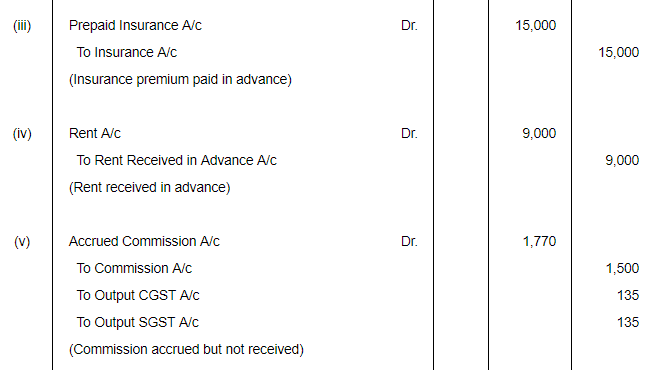

(vi) Write off ₹ 500 as further bad debts.

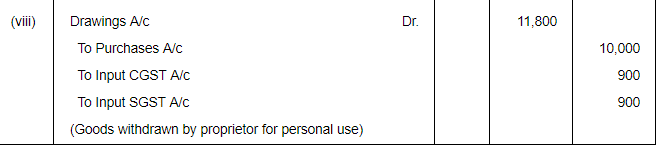

(vii) Goods costing ₹ 8,000 destroyed by fire and insurance company admitted a claim for ₹ 5,000 only.

(viii) Goods costing ₹ 10,000 (Market value ₹ 11,000) were taken by proprietor for personal use.

ANSWER:

Page No 22.92:

Question 14:

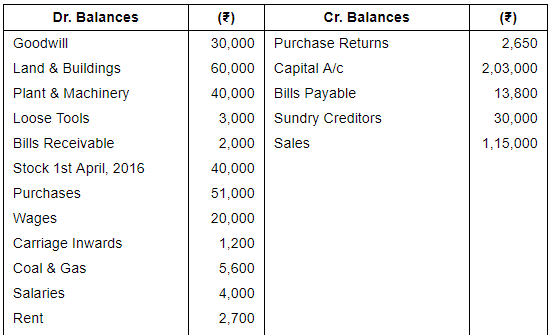

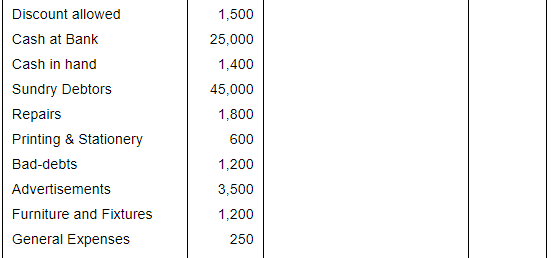

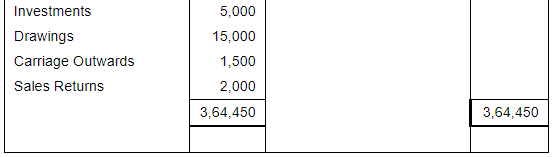

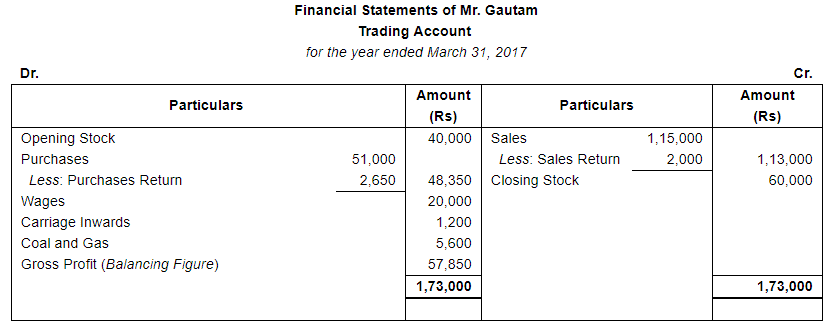

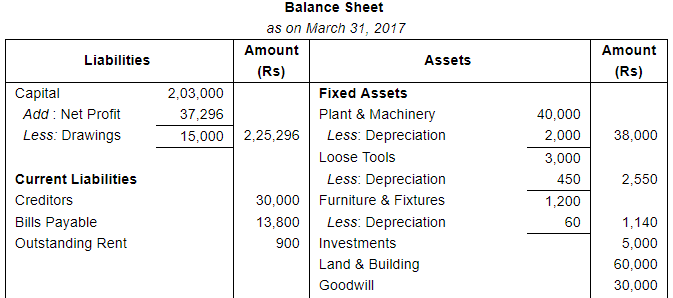

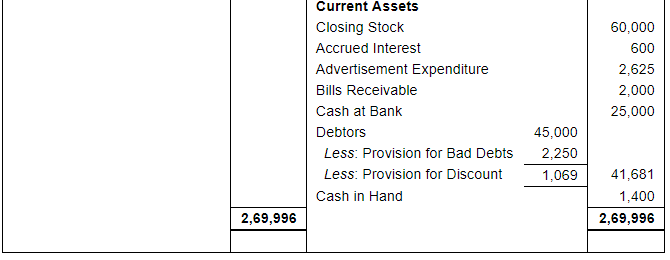

Following is the Trial Balance of Mr. Gautam as at 31st March, 2017:

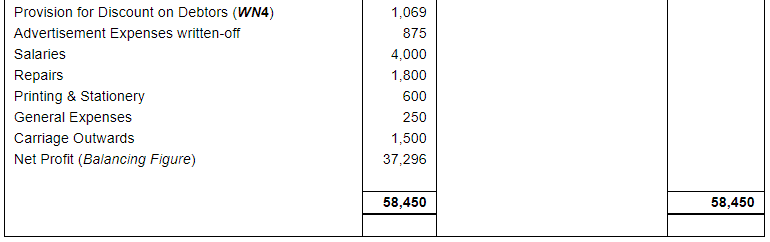

You are required to prepare Final Accounts after taking into account the following adjustments:

(a) Closing Stock on 31st March, 2017 was ₹ 60,000.

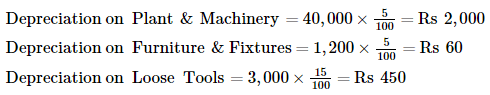

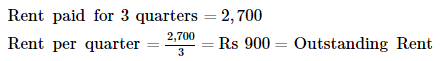

(b) Depreciate Plant and Machinery at 5%, Loose Tools at 15% and Furniture and fixtures at 5%.

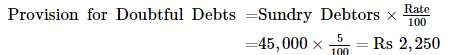

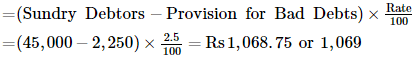

(c) Provide  for discount on Sundry Debtors and also provide 5% for Bad and Doubtful Debts on Sundry Debtors.

for discount on Sundry Debtors and also provide 5% for Bad and Doubtful Debts on Sundry Debtors.

(d) Only three quarter's rent has been paid, the last quarter's rent being outstanding.

(e) Interest earned but not received ₹ 600.

(f) Write off 1/4th of Advertisement expenses.

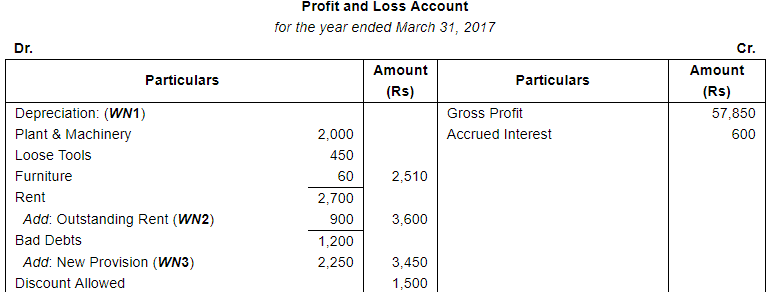

ANSWER:

Working Notes:

WN1: Calculation of Depreciation

WN2: Calculation of Outstanding Rent

WN3: Calculation of Provision for Doubtful Debts

WN4: Calculation of Provision for Discount on Debtors

Page No 22.93:

Question 15:

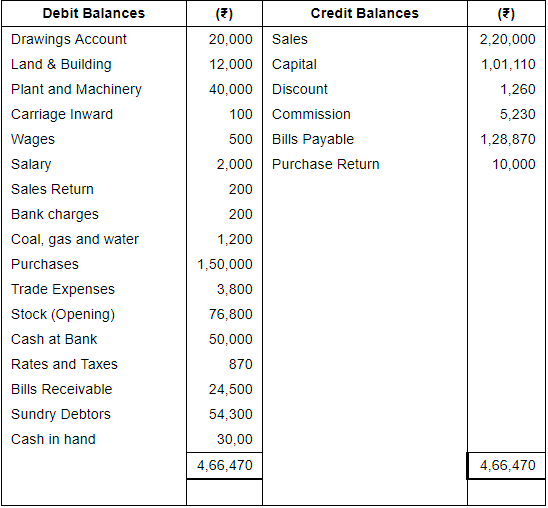

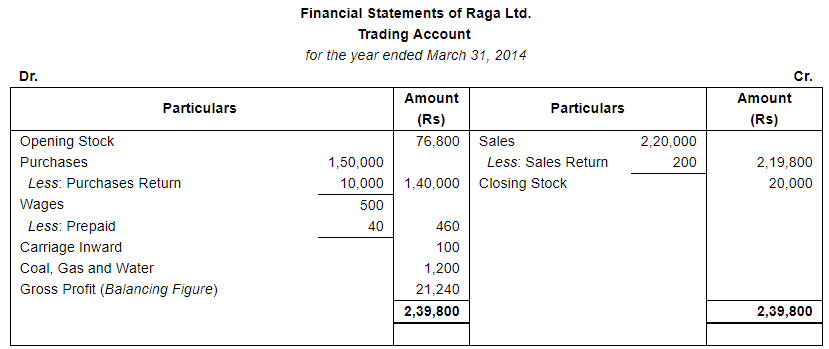

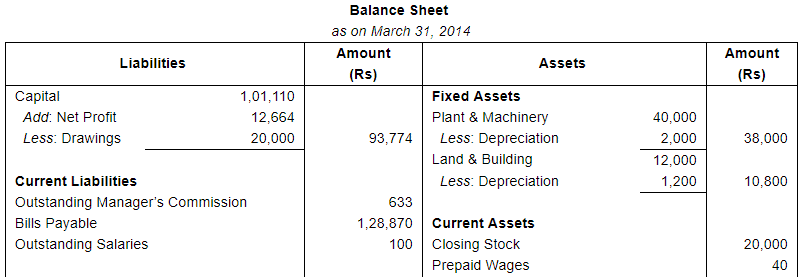

From the following Trial Balance, extracted from the books of Raga Ltd., prepare a Profit and Loss Account for the year ended 31st March, 2014 and a Balance Sheet as at that date:

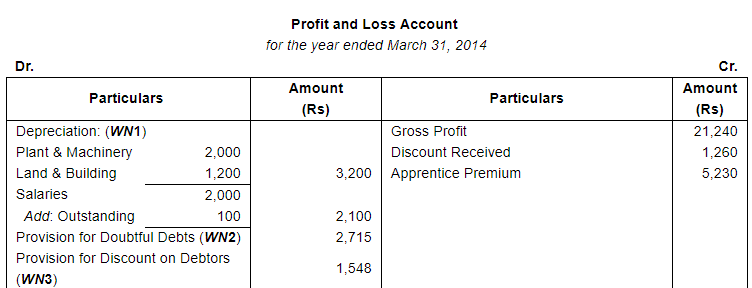

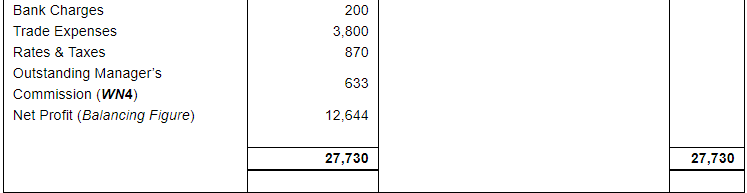

The additional informations are as under:

(i) Closing stock was valued at the end of the year at ₹ 20,000.

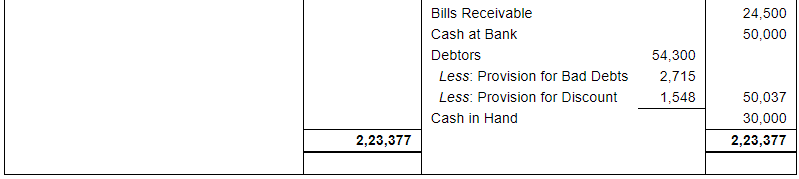

(ii) Depreciation on Plant and Machinery charged at 5% and on Land and Building at 10%.

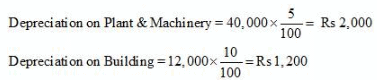

(iii) Make a provision for discount on debtors at 3%.

(iv) Make a provision at 5% on debtors for Bad-debts.

(v) Salary outstanding was ₹ 100 and Wages prepaid were ₹ 40.

(vi) The manager is entitled to a Commission of 5% on Net Profit after charging such Commission.

ANSWER:

Working Notes:

WN1: Calculation of Amount of Depreciation

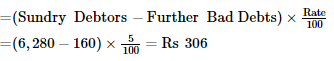

WN2: Calculation of Provision for Doubtful Debts WN3: Calculation of Provision for Discount on Debtors

WN3: Calculation of Provision for Discount on Debtors

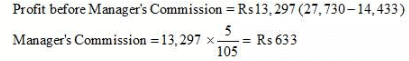

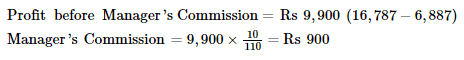

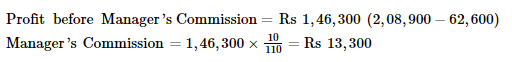

WN4: Calculation of Manager’s Commission

Page No 22.94:

Question 16:

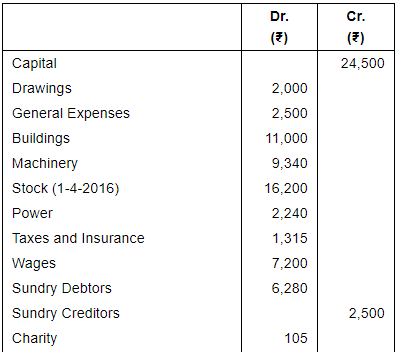

The following balances were extracted from the books of Shri Krishan Kumar as at 31st March, 2017:

Adjustments:-

(i) Stock on 31st March, 2017 was valued at ₹ 23,500.

(ii) 1\5th of general expenses and taxes & insurance to be charged to factory and the balance to the office.

(iii) Write off a further Bad-debts of ₹ 160 and maintain the provision for Bad-debts at 5% on Debtors.

(iv) Depreciate Machinery at 10% and Scooter by ₹ 240.

(v) Provide ₹ 700 for outstanding interest on Bank Overdraft.

(vi) Prepaid Insurance is to the extent of ₹ 50.

(vii) Provide for Manager's Commission at 10% on the Net Profit after charging such Commission.

Prepare final accounts for the year ended 31st March, 2017 after giving effect to the above adjustments.

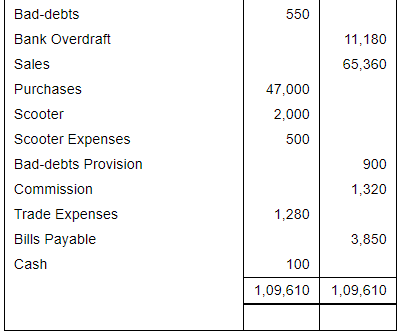

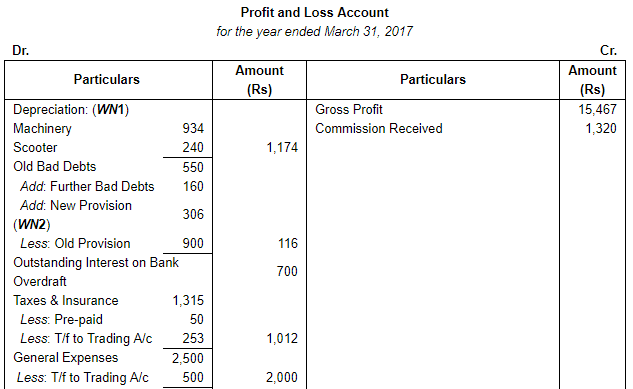

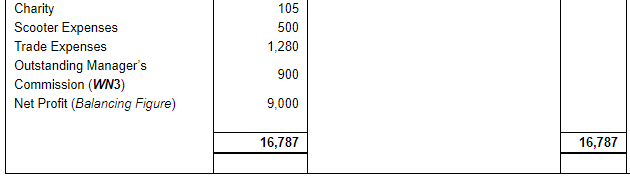

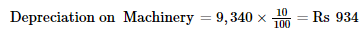

ANSWER:

Financial Statements of Shri Krishan Kumar

Trading Account

for the year ended March 31, 2017

Working Notes:

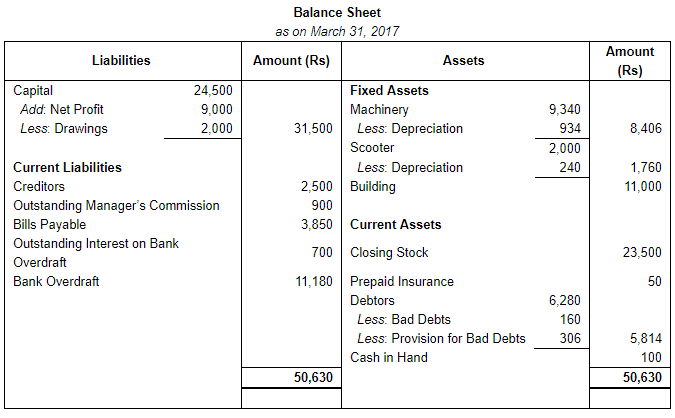

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

WN3: Calculation of Manager’s Commission

Page No 22.95:

Question 17(A):

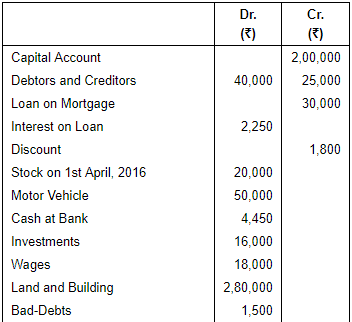

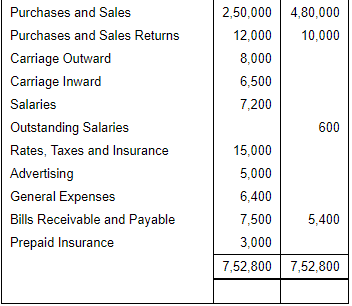

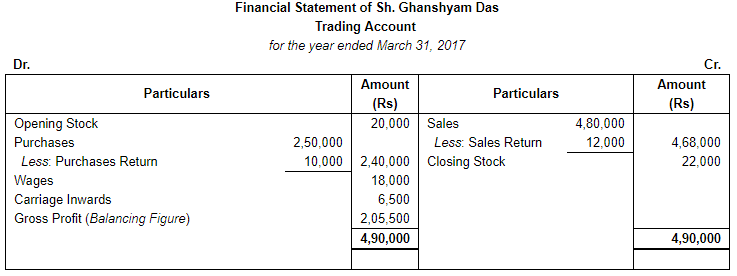

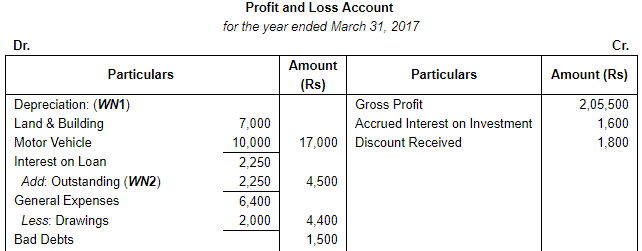

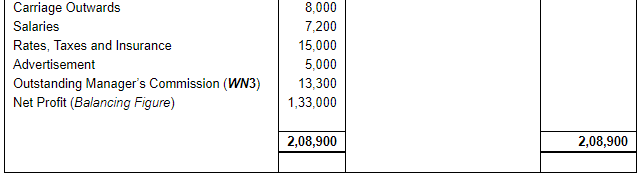

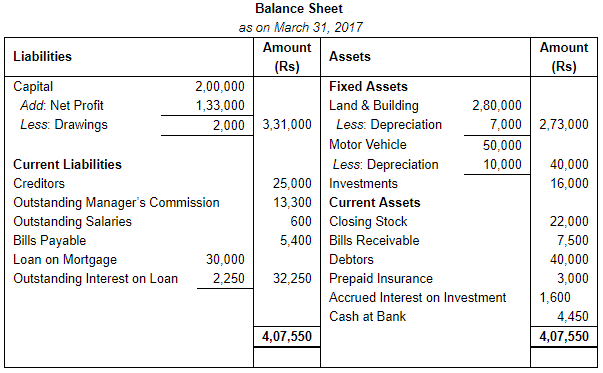

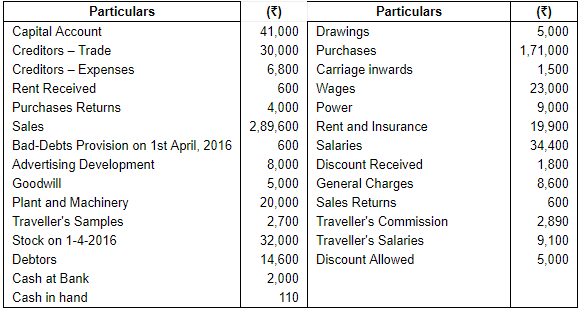

On 31st March, 2017 the following Trial Balance was extracted from the books of Sh. Ghanshyam Das:-

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2017 and Balance Sheet as at that date, after making adjustments for the following matters:

1. Depreciate Land and Building at 2.5% and Motor Vehicles at 20%.

2. Interest on Loan at 15% p.a. is unpaid for six months.

3. Ghanshyam Das withdrew ₹ 2,000 for his private use. This amount was included in general expenses.

4. Interest on Investments is receivable for full year @ 10%.

5. Provide for Manager's Commission at 10% on Net Profit after charging such commission.

6. Stock in hand on 31st March, 2017 was valued at ₹ 25,000 (Realisable value ₹ 22,000).

ANSWER:

Working Notes:

WN1: Calculation of Amount of Depreciation

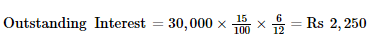

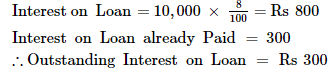

WN2: Calculation of Outstanding Interest on Loan

WN3: Calculation of Manager’s Commission

Page No 22.96:

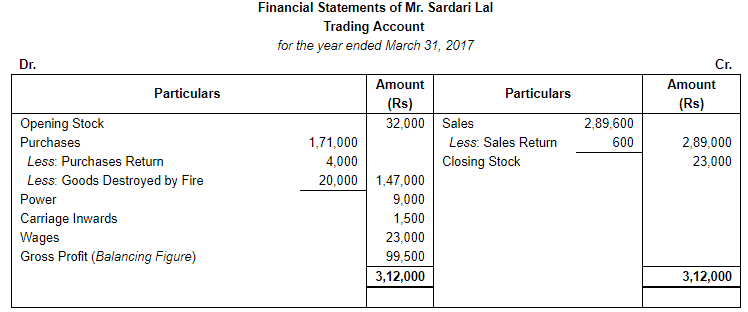

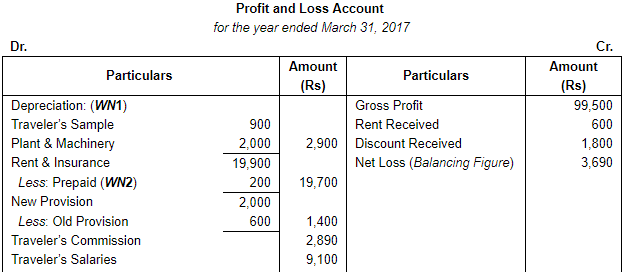

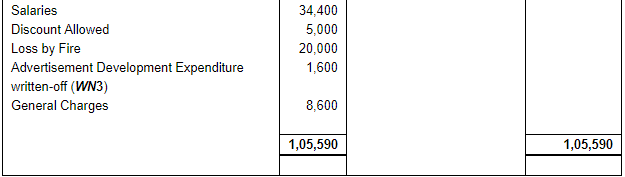

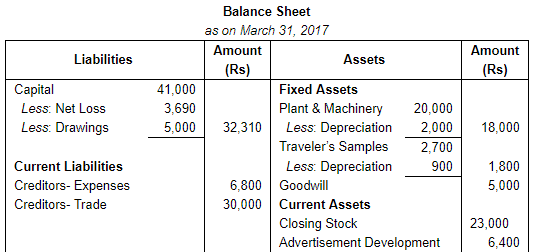

Question 17(B):

Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2017 from the following Balances of Mr. Sardari Lal:

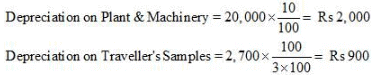

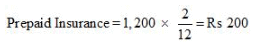

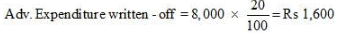

Adjustments:- The Closing stock was ₹ 23,000 but there has been a loss by fire on 20th March, 2017, to the extent of ₹ 20,000, not covered by insurance. Depreciate Plant and Machinery by 10% and Traveller's Samples by  . Increase the Bad-debts Provision to ₹ 2,000. Write 20% off Advertising Development Account. Annual premium on insurance expiring 1st June, 2017 was ₹ 1,200. Provide for Manager's commission @ 5% on Net Profits after charging such Commission.

. Increase the Bad-debts Provision to ₹ 2,000. Write 20% off Advertising Development Account. Annual premium on insurance expiring 1st June, 2017 was ₹ 1,200. Provide for Manager's commission @ 5% on Net Profits after charging such Commission.

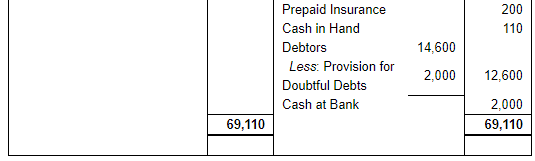

ANSWER:

Working Notes:

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Prepaid Insurance

WN3: Calculation of Advertisement Expenditure Written-off

WN4: Calculation of Manager’s Commission

Manager will not be entitled to any commission because there is a net loss.

Page No 22.97:

Question 18:

State with reasons whether the following are capital or revenue expenditures:

(i) A new machine is purchased for ₹ 60,000, ₹ 800 were spent on its carriage and ₹ 1,500 were paid as wages for its installation.

(ii) A sum of ₹ 40,000 was spent on painting the new factory.

(iii) ₹ 6,000 were paid for annual insurance premium.

(iv) ₹ 20,000 were spent on repairs before using a second hand generator purchased recently.

(v) ₹ 5,000 were spent on the repair of a machinery.

(vi) ₹ 50,000 were spent for airconditioning of the office of the manager.

ANSWER:

| 1. Capital Expenditure Reason: When a fixed asset is purchased, then all the expenses up to the date at which the asset is put to use are capitalised. So, expenses incurred on carriage and installation of new machinery will be considered as capital expenditure. |

| 2. Capital Expenditure Reason: Whitewashing (or painting) expenses incurred on the building will increase the revenue generating capacity of the building, thus, it will be capitalised and treated as capital expenditure. |

| 3. Revenue Expenditure Reason: Annual insurance premium is a recurring expenditure to carry on day-to-day business activities. Thus, it is a revenue expense. |

| 4. Capital Expenditure Reason: Expenditure incurred once in many years to increase the working capacity and revenue generating capacity of the asset, and then it is termed as capital expenditure. Thus, repairs made to the second hand machinery (purchased recently) are a one-time expense and thus, will be capitalised and treated as capital expenditure. |

| 5. Revenue Expenditure Reason: The amount spent on repairs of machinery is a recurring expenditure and helps in increasing the working capacity of the machinery but does not add value to it. Thus, it is a revenue expense. |

| 6. Capital Expenditure Reason: Expenditure incurred once in many years to increase the working capacity and revenue generating capacity of the asset, and then it is termed as capital expenditure. Thus, amount spent for air conditioning of the manager’s will increase the value of the asset and thus, it is a capital expenditure. |

Page No 22.97:

Question 19:

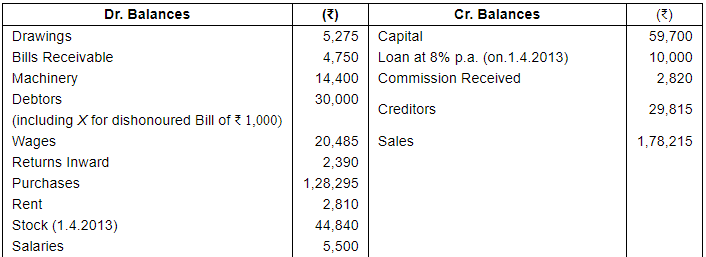

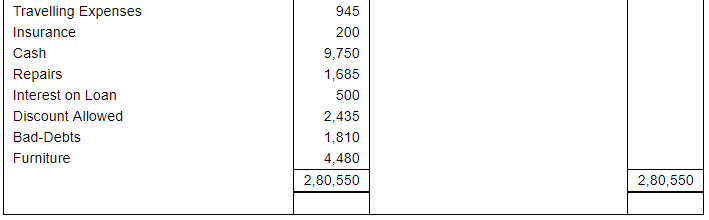

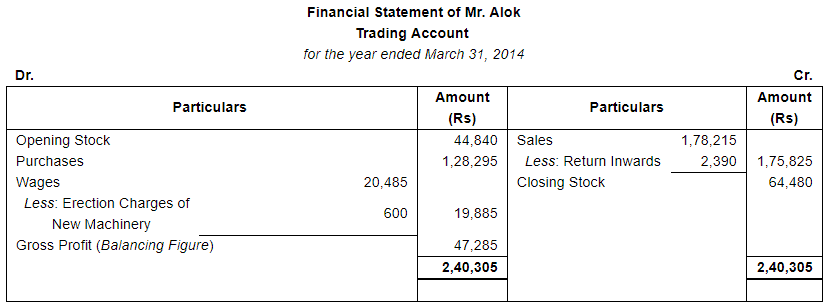

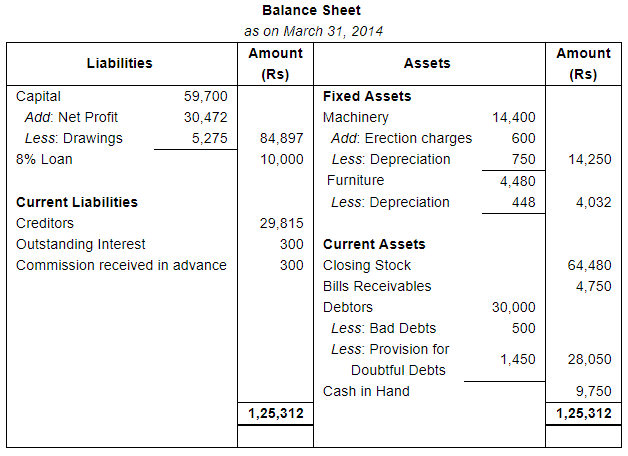

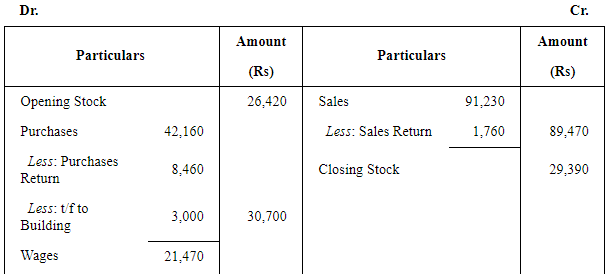

From the following Trial Balance of Mr. Alok, prepare Trading and Profit & Loss Account for the year ending 31st March, 2014, and a Balance Sheet as at that date:-

The following adjustments are to be made:

(i) Stock in the shop on 31st March, 2014 was ₹ 64,480.

(ii) Half the amount of X's Bill is irrecoverable.

(iii) Create a provision of 5% on other debtors.

(iv) Wages include ₹ 600 for erection of new Machinery.

(v) Depreciate Machinery by 5% and Furniture by 10%.

(vi) Commission includes ₹ 300 being Commission received in advance.

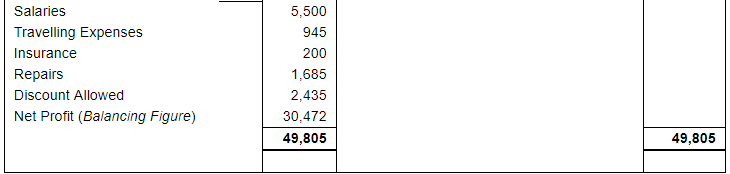

ANSWER:

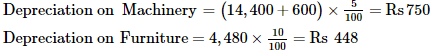

Working Notes:

WN1: Calculation of Amount of Depreciation

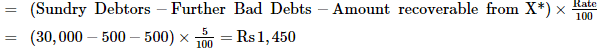

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

WN3: Calculation of Outstanding Interest on Loan

Page No 22.98:

Question 20:

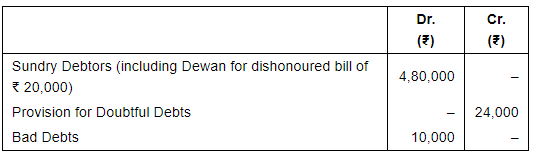

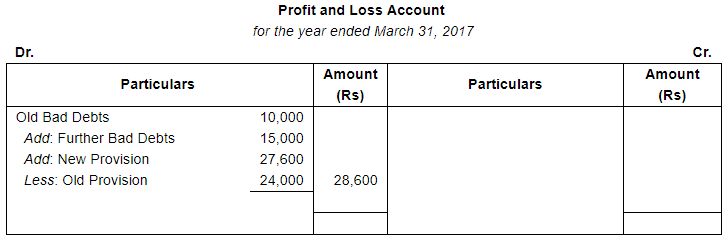

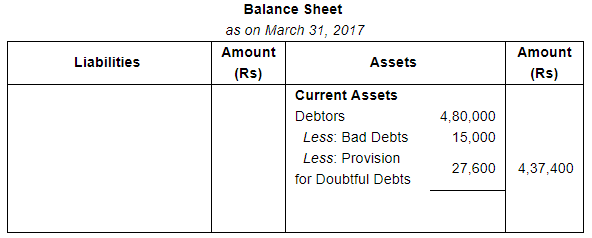

Extracts of Trial Balance as at 31st March, 2017:

Adjustments:

(i) 3/4th of Dewan's bill is irrecoverable.

(ii) Create a provision of 6% on Sundry Debtors.

Show the effect on Profit and Loss Account and Balance Sheet.

ANSWER:

Working Note:

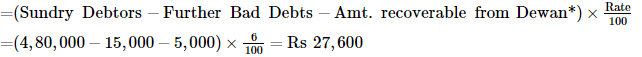

WN1: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

*Provision is to be maintained on Debtors other than Dewan

Page No 22.99:

Question 21:

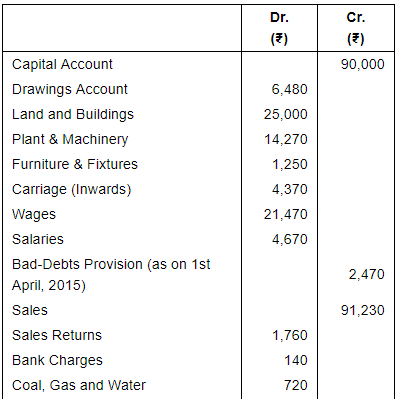

From the following Trial Balance extracted from the books of S. Sujan Singh, prepare a Trading and Profit & Loss Account for the year ended 31st March, 2016 and a Balance Sheet as at that date:

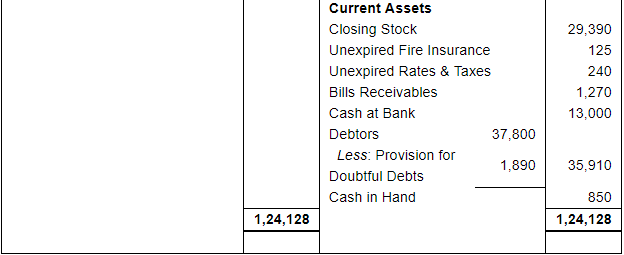

Adjustments:-

1. Carry forward the following unexpired amounts:-

(i) Fire Insurance - ₹ 125

(ii) Rates and Taxes - ₹ 240

2. Transfer to Building Account ₹ 3,000 from purchases and ₹ 2,000 from wages, representing cost of material and labour spent on additions to Building made during the year.

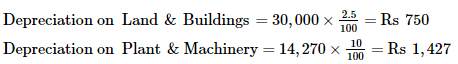

3. Charge Depreciation on Land and Buildings at 2.5% and on Plant & Machinery at 10%.

4. Make a Provision of 5% on Sundry Debtors for Bad-debts.

5. Charge 5% Interest on Capital but not on Drawings.

6. The value of Stock as on 31st March, 2016 was ₹ 29,390.

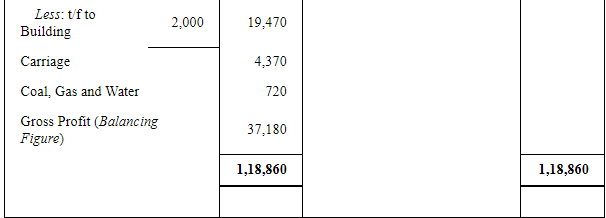

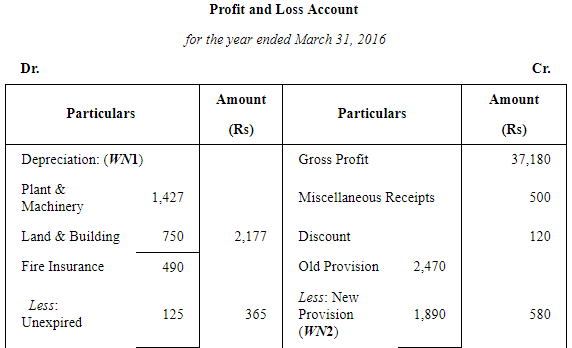

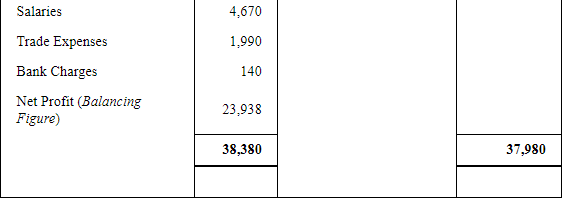

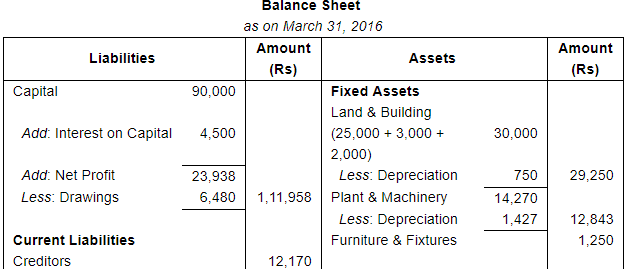

ANSWER:

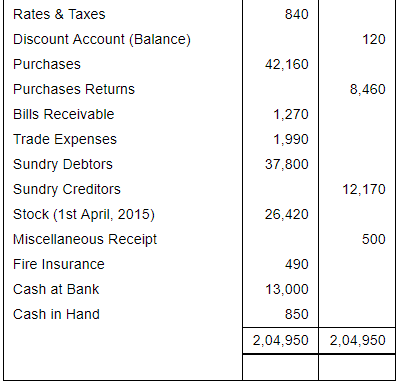

Financial Statements of S. Sujan Singh

Trading Account

for the year ended March 31, 2016

Working Notes:

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

FAQs on Financial Statements with Adjustments (Part - 2) - Commerce

| 1. What are financial statements with adjustments? |  |

| 2. Why are adjustments necessary in financial statements? |  |

| 3. What is the process of making adjustments in financial statements? |  |

| 4. What are the types of adjustments made in financial statements? |  |

| 5. What is the importance of financial statements with adjustments? |  |