GlobaPharm Case Interview | Case Studies - Interview Preparation PDF Download

Client Goal

Our client is GlobaPharm, a major pharmaceutical company (pharmaco) with $10 billion a year in revenue. Its corporate headquarters and primary research and development (R&D) centers are in Germany, with regional sales offices worldwide.

Situation description

GlobaPharm has a long, successful tradition in researching, developing, and selling “small molecule” drugs. This class of drugs represents the vast majority of drugs today, including aspirin and most blood-pressure or cholesterol medications. GlobaPharm is interested in entering a new, rapidly growing segment of drugs called “biologicals.” These are often proteins or other large, complex molecules that can treat conditions not addressable by traditional drugs.

R&D for biologicals is vastly different from small-molecule R&D. To gain these capabilities, pharmacos have three options: they can build them from scratch, partner with existing start-ups, or acquire the start-ups. Since its competitors are already several years ahead of GlobaPharm, GlobaPharm wants to jumpstart its biologicals program by acquiring BioFuture, a leading biologicals start-up based in the San Francisco area. BioFuture was founded 12 years ago by several prominent scientists and now employs 200 people. It is publicly traded and at its current share price the company is worth about $1 billion in total.

McKinsey's Study

GlobaPharm has engaged McKinsey to evaluate the BioFuture acquisition and to advise on its strategic fit with GlobaPharm's biologicals strategy. Our overall question today, therefore, is “Should GlobaPharm acquire BioFuture?”

Helpful hints

- Write down important information.

- Feel free to ask the interviewer for an explanation of any point that is not clear to you.

- Remember that calculators are not allowed - you may write out your calculations on paper during the interviews.

Q.1. What factors should the team consider when evaluating whether GlobaPharm should acquire BioFuture?

One of the main factors that GlobaPharm should consider when evaluating the acquisition of BioFuture is the value of BioFuture's drug pipeline, which includes the number of drugs currently in development, the quality of the drugs, and the potential revenues and profits that could be generated.

Other key factors to consider include:

BioFuture's R&D capabilities, including their future drug pipeline, scientific talent, intellectual property, and facilities.

(i) BioFuture's marketing and sales capabilities, and how they plan to promote their biological products, including their relationships with key opinion leaders.

(ii) The acquisition price, which will need to be evaluated in terms of the potential return on investment.

(iii) BioFuture's existing partnerships or other relationships with pharmaceutical companies.

(iv) Any capability gaps that GlobaPharm may have in biologicals, R&D, sales, or marketing, and how the acquisition of BioFuture could address those gaps.

(v) Alternative companies that GlobaPharm could acquire instead of BioFuture.

(vi) Other strategies for entering the biologicals segment, such as partnerships or pursuing other strategies besides acquisitions.

Q.2. The team wants to explore BioFuture’s current drug pipeline. The team decides to focus first on evaluating the value of BioFuture’s current drug portfolio. What issues should the team consider when evaluating the value of BioFuture’s existing drug pipeline?

When evaluating the potential of a new drug, there are several key factors to consider:

(i) R&D costs: It's important to factor in the cost of further research and development that may be needed before the drug is ready to be sold.

(ii) Potential value: The potential revenue and profits that could be generated by selling the drug should be estimated, based on factors such as market size and pricing.

(iii) Market size: The size of the patient population and the demand for the drug are key considerations in assessing its potential value.

(iv) Market share: The number of competitive drugs in R&D or on the market, as well as factors such as side effects and dosing schedules, can affect the market share that the new drug is able to capture.

(v) Manufacturing and selling cost: The cost of marketing, distribution, and other expenses associated with manufacturing and selling the drug should be taken into account.

(vi) Press coverage: Public perception of the drug, as well as the opinions of key opinion leaders such as doctors and researchers, can also play a role in its success.

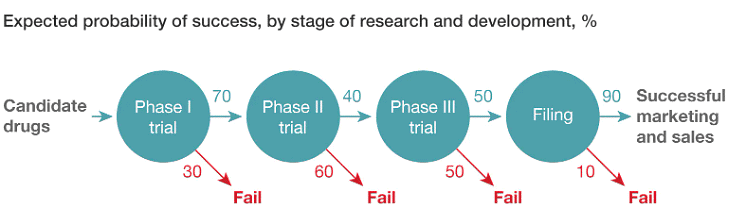

Q.3. Below is a description of expected probability of success, by stage, in the Pharma R&D pipeline.

Note: “Filing” is the process of submitting all of the clinical and safety evidence from Phase I, II, and III trials, and asking for regulatory approval to actually sell the drug.

GlobaPharm believes that the likelihood of success of BioFuture’s primary drug candidate can be improved by investing an additional $150 million in a larger Phase II trial. The hope is that this investment would raise the success rate in Phase II, meaning that more candidate drugs successfully make it to Phase III and beyond. By how much would the Phase II success rate need to increase in order for this investment to break even?

The interviewer would tell you to assume that if the drug is successfully marketed and sold, it would be worth $1.2 billion (that is, the present value of all future profits from selling the drug is $1.2 billion).

To make the $150 million investment in a candidate drug worthwhile, the probability of success in Phase II needs to increase from 40% to 80%, which is a 40 percentage point increase. To calculate this, it is assumed that a candidate drug that passes Phase II has a 45% chance of being successfully marketed and sold, with a value of $540 million. To break even, the value of the candidate drug would need to increase to $690 million, which is $540 million plus the $150 million investment.

In order to increase the value of the candidate drug to $690 million, the combined probability of success in Phase I and II would need to increase by 28 percentage points. Currently, the probability of success in Phase I and II is 28%, which is calculated as 70% multiplied by 40%. To increase the combined probability of success to 56%, the probability of success in Phase II would need to increase from 40% to 80%. This is a big challenge as it means that the current probability of 40% needs to double.

Q.4. Next, the team explores the potential setup with BioFuture after the acquisition. Although BioFuture's existing drug pipeline is relatively limited, GlobaPharm is highly interested in its ability to serve as a biological research “engine” that, when combined with GlobaPharm's existing R&D assets, will produce many candidate drugs over the next 10 years.

What are your hypotheses on the major risks of integrating the R&D functions of BioFuture and GlobaPharm?

There are several potential challenges that GlobaPharm may face in integrating BioFuture into their operations, including:

(i) Lack of collaboration: Scientists at BioFuture may not have the same disease interests or expertise as those at GlobaPharm, leading to difficulty in collaborating and working together effectively.

(ii) Cultural differences: BioFuture may have a more entrepreneurial culture that could clash with GlobaPharm's more process-driven approach, potentially leading to the loss of the factors that have contributed to BioFuture's success.

(iii) Language barriers: Communication and information sharing could be hindered by language barriers between the two companies.

(iv) Poor management: R&D operations that have a time difference of 9 hours could result in poor management and a lack of community within the organization.

(v) Talent retention: Key scientific talent at BioFuture may leave after the acquisition, either because they have become independently wealthy or because they do not want to be part of the new, larger organization.

|

16 docs

|