ICAI Notes: Framework for Preparation and Presentation of Financial Statements | Advanced Accounting for CA Intermediate PDF Download

Introduction

The development of Accounting Standards is based on certain fundamental principles. To ensure consistency and clarity in financial reporting, the Accounting Standards Board (ASB) of the Institute of Chartered Accountants of India (ICAI) introduced a framework in July 2000. This framework serves as a foundation for both creating new standards and reviewing existing ones.

It covers the following key areas:

- Components of financial statements

- Objectives of financial statements

- Assumptions underlying financial statements

- Qualitative characteristics of financial statements

- Elements of financial statements

- Criteria for recognizing elements in financial statements

- Principles for measuring financial elements

- Concepts of Capital and Capital Maintenance

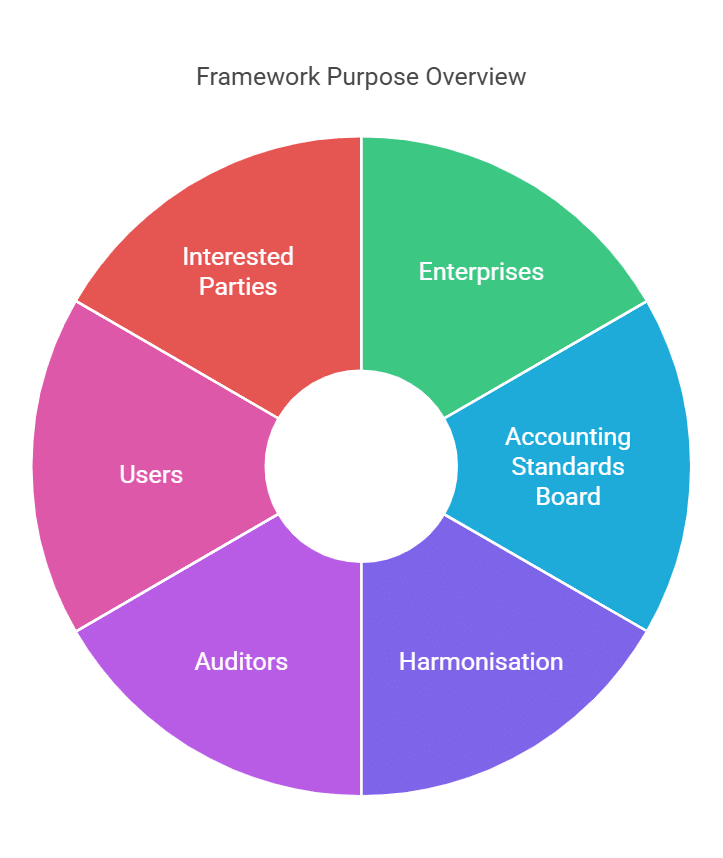

Purpose of the Framework

The framework explains the basic concepts behind preparing and presenting general-purpose financial statements for external users.  It mainly helps in the following ways:

It mainly helps in the following ways:

- Enterprises: It guides businesses in preparing their financial statements as per Accounting Standards and handling topics that are not yet covered by any specific standard.

- Accounting Standards Board (ASB): It supports ASB in developing and reviewing Accounting Standards.

- Harmonisation: It helps ASB in promoting consistency in regulations, Accounting Standards, and procedures, reducing the number of different accounting methods allowed.

- Auditors: It assists auditors in assessing whether financial statements follow the Accounting Standards.

- Users: It helps people who use financial statements to understand and interpret them correctly.

- Interested Parties: It provides useful information to those interested in ASB’s approach to forming Accounting Standards.

Status and Scope of the Framework

- The framework applies to general-purpose financial statements (referred to as 'financial statements') prepared annually for external users by all commercial, industrial, and business enterprises, whether in the public or private sector.

- Special-purpose financial reports, such as those prepared for tax purposes, are outside the scope of the framework.

- The framework may be applied to special-purpose reports to the extent that it does not conflict with their requirements.

- The framework does not override any specific Accounting Standard.

- In case of a conflict between an Accounting Standard and the framework, the requirements of the Accounting Standard will prevail.

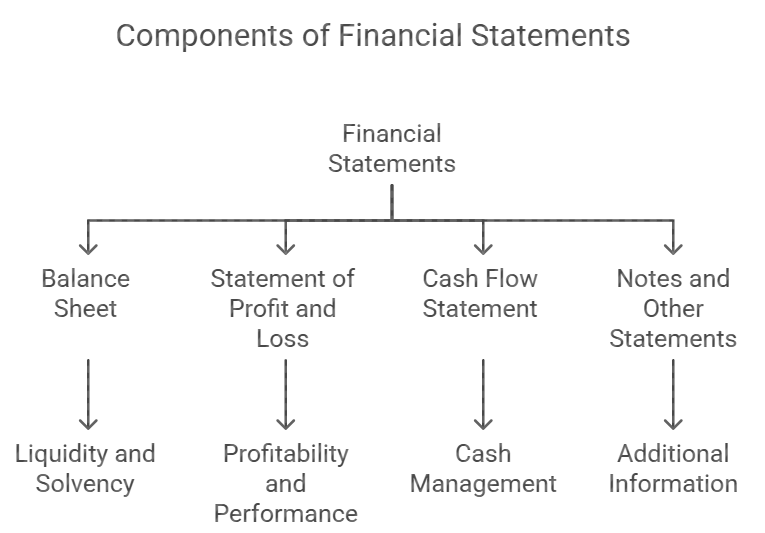

Components of Financial Statements

A complete set of financial statements typically includes a Balance Sheet, a Statement of Profit and Loss, and a Cash Flow Statement, along with accompanying notes, other statements, and explanatory materials that form an integral part of the financial statements.

All components of the financial statements are interrelated, as they reflect different aspects of the same transactions or events. While each statement provides distinct information, no individual statement can fully serve any single purpose, nor can it provide all the information needed by a user.  The key information provided by the different components of financial statements is as follows:

The key information provided by the different components of financial statements is as follows:

- Balance Sheet shows the value of economic resources controlled by an enterprise and provides details about its liquidity and solvency, helping to assess the enterprise's ability to meet its financial commitments as they become due.

- Statement of Profit and Loss reflects the results of the operations of an enterprise over an accounting period, specifically highlighting its profitability and overall performance.

- Cash Flow Statement outlines how an enterprise has generated and used cash during an accounting period, providing insights into its investing, financing, and operating activities.

- Notes and other statements offer additional information that explains various items in the financial statements, such as accounting policies, segment reporting, related party disclosures, and earnings per share, ensuring that users have the relevant details for informed decision-making.

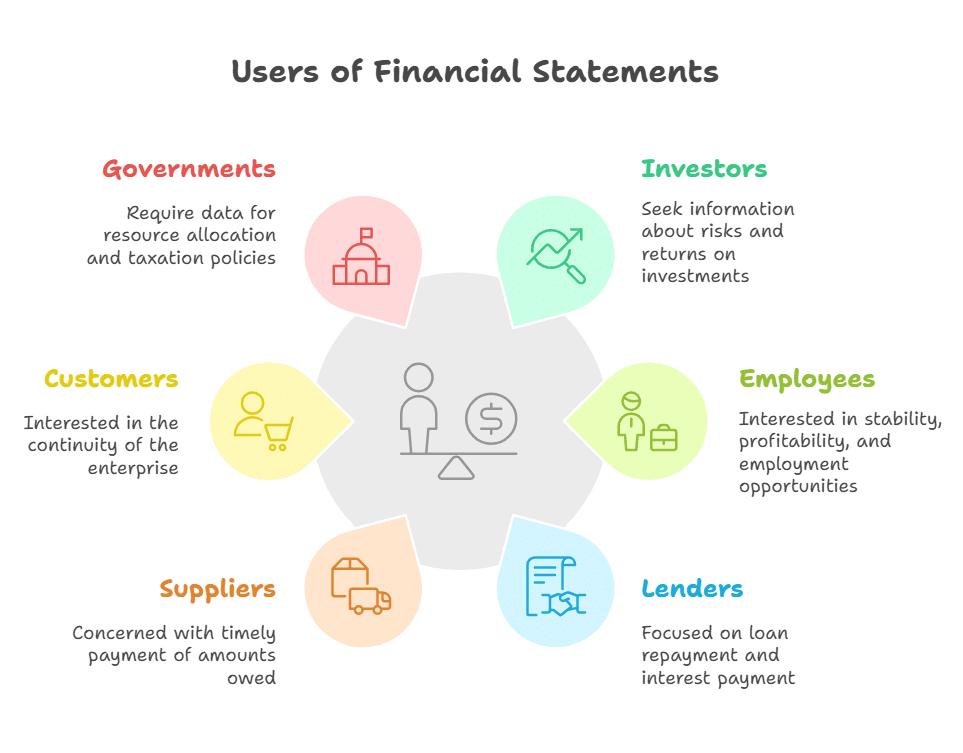

Objectives and Users of Financial Statements

The primary objective of financial statements is to provide information about an enterprise’s financial position, performance, and cash flows, which is valuable to a wide range of users for making informed economic decisions. The framework identifies seven broad groups of users of financial statements.

All users rely on these statements to provide useful information that aids in their decision-making. However, while financial statements cater to the common needs of most users, they are not designed to provide all the information required, especially non-financial data, even though such information may be relevant for decision-making.

The key users and their information needs are as follows:

- Investors: Providers of risk capital seek information about the risks and returns on their investments. They are also interested in assessing the enterprise’s ability to pay dividends.

- Employees: Employees and their representatives are interested in the stability and profitability of their employers. They also need information to assess the enterprise’s ability to provide remuneration, retirement benefits, and employment opportunities.

- Lenders: Lenders are focused on understanding whether the enterprise can pay back its loans and the interest on time.

- Suppliers and other trade creditors: Suppliers and creditors are concerned with whether amounts owed to them will be paid when due. Trade creditors usually have a shorter-term interest compared to lenders, unless they rely on the enterprise as a significant customer.

- Customers: Customers are interested in information about the continuity of the enterprise, especially if they depend on the enterprise for long-term supply of goods and services.

- Governments and their agencies: Governments require information to manage resource allocation, regulate enterprise activities, set taxation policies, and calculate national income and related statistics.

- Public: The public is impacted by the activities of enterprises, including economic contributions such as employment and local supply chains. Financial statements help the public understand trends and developments in the enterprise’s prosperity and activities.

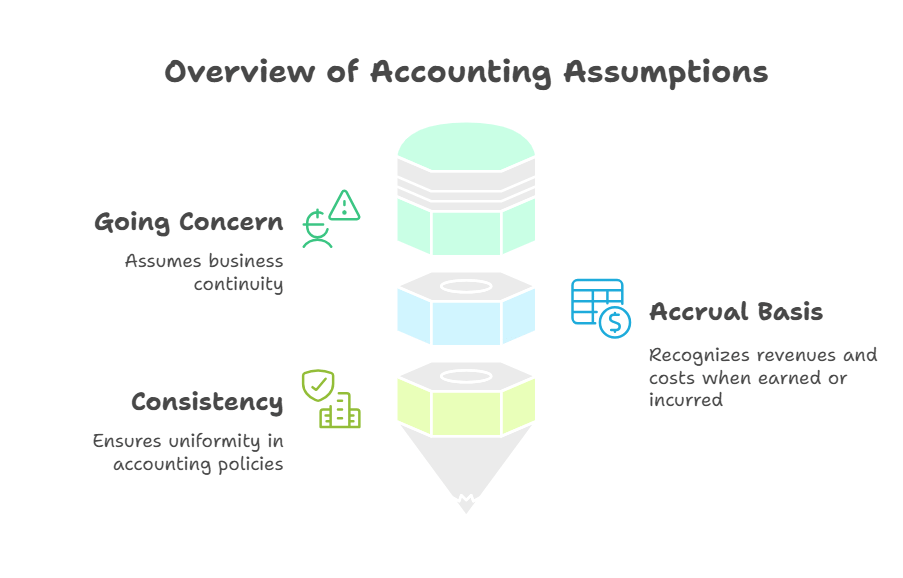

Fundamental Accounting Assumptions

As per the framework, there are three fundamental accounting assumptions that guide the preparation of financial statements. These assumptions are taken for granted by users of financial statements, meaning that if the financial statements comply with these assumptions, there is no need for separate disclosure. If nothing is mentioned about the fundamental accounting assumptions in the financial statements, it is assumed that they have been followed. However, if any assumption is not adhered to, it must be specifically disclosed.

Let's examine these assumptions in detail:

- Going Concern: Financial statements are generally prepared with the assumption that an enterprise will continue its operations in the foreseeable future, and there is no intention or need to significantly reduce its operations. When prepared on a going concern basis, the financial statements account for the retention of profits to replace assets used in operations and make provisions for settling liabilities. If the statements are prepared on a different basis (e.g., stating assets at net realizable values), this basis must be disclosed.

- Accrual Basis: Under accrual basis, revenues and costs are recognized when they are earned or incurred, not when cash is received or paid. This ensures that transactions are recorded in the financial statements in the periods to which they relate. Section 128(1) of the Companies Act, 2013 mandates companies to maintain accounts on an accrual basis. There is no need to explicitly mention this in the financial statements, but if any income or expense is recognized on a cash basis, this should be disclosed. The impact of both approaches can be understood through examples.

- Consistency: It is assumed that accounting policies remain consistent from one period to another, ensuring comparability of financial statements over time. Consistency helps maintain uniformity in reporting. However, accounting policies can be changed if required by:

(a) A statute,

(b) An Accounting Standard,

(c) Or to provide a more appropriate presentation of financial statements.

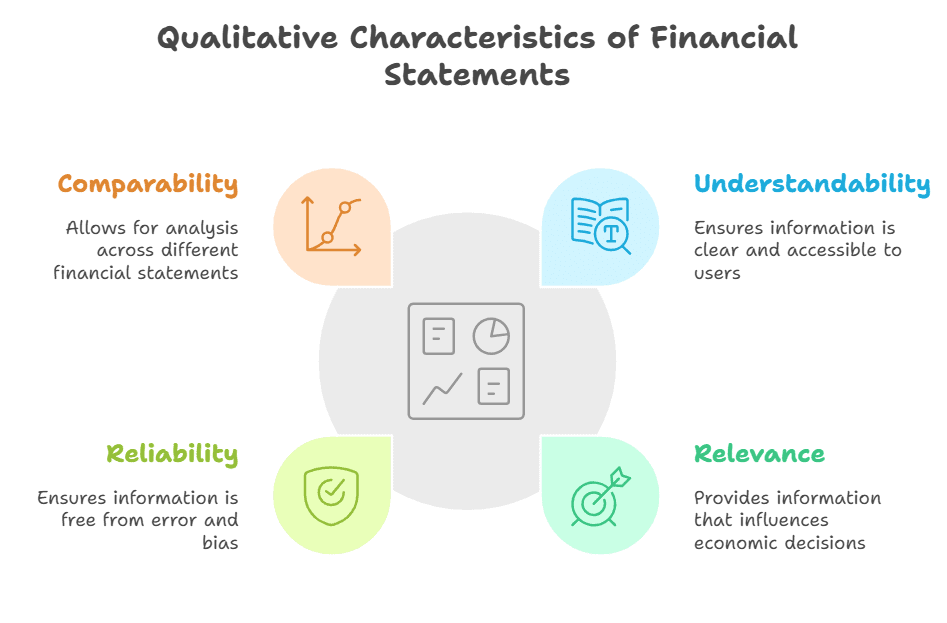

Qualitative Characteristics of Financial Statements

The qualitative characteristics enhance the usefulness of the information provided in financial statements. The framework suggests that the financial statements should adhere to the following four qualitative characteristics, as far as possible, within reasonable cost/benefit limits.

These characteristics can be explained as:

- Understandability: The financial statements should present information in a way that is easily understandable to users who have a reasonable knowledge of business, economic activities, and accounting.

- Relevance: More information is not always better. Too much irrelevant information can create confusion and be more harmful than not disclosing anything at all. Financial statements should only contain relevant information, which can influence the economic decisions of users. Relevant information helps users evaluate past, present, or future events or confirm or correct past evaluations. The materiality of information determines its relevance—information is considered material if its omission or misstatement could influence decisions based on financial data. Materiality is based on the size and nature of the error in the context of its misstatement. It serves as a threshold for useful information rather than being a primary characteristic.

Constraints on Relevance and Reliability:

(a) Timeliness: Information must be reported without undue delay to maintain its relevance. If delayed, the information may lose its relevance even though it is highly reliable. A balance is required between timely reporting and the reliability of the information.

(b) Balance between Benefit and Cost: The benefits of providing information should exceed the costs. Evaluating the benefit and cost is largely subjective, and both preparers and users of financial statements must be aware of this constraint. - Reliability: For information to be useful, it must be reliable—free from material error and bias. Information is not likely to be reliable unless:

(a) Transactions and events are faithfully represented.

(b) Transactions are reported following the principle of substance over form.

(c) The reporting is neutral, free from bias.

(d) Prudence is exercised, especially in uncertain outcomes.

(e) The information in the financial statements is complete. - Comparability: The ability to compare financial statements is a vital tool for analysis. Financial statements should allow for both inter-firm and intra-firm comparison. A key requirement for comparability is the disclosure of the financial effects of changes in accounting policies. However, comparability should not be confused with uniformity. It should not hinder improvements in accounting standards. If an enterprise’s accounting policies are outdated or no longer relevant, they should not be continued just for the sake of comparability. Instead, more relevant and reliable alternatives should be adopted.

True and Fair View

- Financial statements must present a true and fair view of an enterprise’s performance, financial position, and cash flows.

- The framework does not directly address the concept of a true and fair view.

- By applying the principal qualitative characteristics and appropriate accounting standards, financial statements generally portray a true and fair view.

- This ensures that the financial statements provide an accurate and fair representation of the enterprise’s financial information.

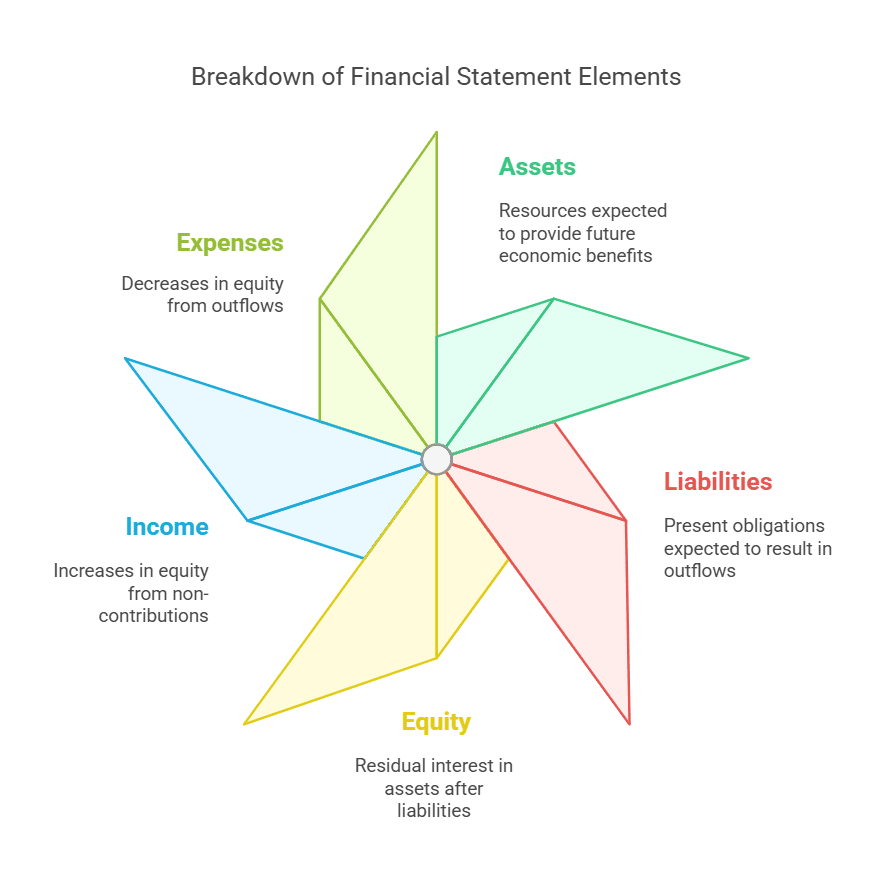

Elements of Financial Statements

The framework classifies items in financial statements into five broad groups based on their economic characteristics.

Gains and losses are different from income and expenses because they may not always arise in the ordinary course of business. Despite this difference, the economic characteristics of gains are similar to income, and those of losses are similar to expenses. Due to this similarity, gains and losses are not recognised as separate elements in financial statements.

Let's now discuss each element of the financial statement in detail:

1. Asset

An asset is a resource controlled by the enterprise due to past events, from which future economic benefits are expected to flow. The following points must be considered when recognizing an asset:

- Physical Substance Not Required: An asset does not need to have physical substance. It could represent a right that generates future economic benefit, such as patents, copyrights, or trade receivables. An asset without physical substance can be either an intangible asset (e.g., patents and copyrights) or a monetary asset (e.g., trade receivables), which are money held or to be received in fixed or determinable amounts.

- Control of Resource: The resource must be controlled by the enterprise. Legal ownership is not always necessary for recognition as an asset. For example, in a financial lease, the lessee recognizes the asset even though ownership remains with the lessor. The lessor does not recognize the leased asset as theirs because they do not control it.

- Sufficient Control: A resource cannot be recognized as an asset if the control is insufficient. For example, the specific management or technical talent of an employee cannot be recognized as an asset because the control is not sufficient. However, a resource protected by a legal right, like a copyright, can be recognized as an asset.

- Probable Future Economic Benefits: To qualify as an asset, it must be probable that the resource will generate future economic benefits. If the benefits are expected to expire within the current accounting period, it is not an asset. For example, the profit on sale of machinery bought by an enterprise dealing in machinery is expected to expire within the current period, so it is booked as an expense rather than capitalized. However, if articles purchased by a dealer remain unsold at the end of the period, they are recognized as assets (i.e., closing stock) because the sale and profit are expected to occur in the next period.

- Reliable Measurement: The resource must have a cost or value that can be measured reliably.

- Improbable Economic Benefit Beyond the Current Period: If it is unlikely that economic benefits will flow to the enterprise beyond the current accounting period, the expenditure should be recognized as an expense rather than an asset.

2. Liability

A liability is a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow of economic resources. The following points should be considered when recognizing a liability:

- Present Obligation: A liability is a present obligation, meaning its existence is probable based on the evidence available on the balance sheet date. For example, if an enterprise faces a damage suit and it is likely to lose the case, it should recognize a liability for the damages payable if the amount can be reasonably estimated. This liability should be recorded as a provision by charging it to profit. If the probability of losing the suit is uncertain, it would be reported as a contingent liability instead, as it does not meet the definition of a liability. Provisions are considered liabilities, but they can only be measured with a substantial degree of estimation.

- Provisions vs. Liabilities: Some provisions, such as those for doubtful debts, depreciation, and impairment losses, represent a decrease in the value of assets, not obligations. These provisions should not be treated as liabilities.

- Recognizing a Liability: A liability is recognized only when the outflow of economic resources in settlement of a present obligation can be anticipated, and the value of the outflow can be measured reliably. For example, a liability does not arise from a future commitment, such as a decision to acquire assets in the future. An obligation typically arises when the asset is delivered, or the enterprise enters into an irrevocable agreement to acquire the asset.

3. Equity

Equity is defined as the residual interest in the assets of an enterprise after all its liabilities have been deducted. It is important to differentiate equity from liabilities. Equity represents the excess of the total assets over the total liabilities of the enterprise. Essentially, equity is the owners' claim on the assets, consisting of capital and reserves, which are distinct from liabilities, or the claims of other parties.

The value of equity may change in the following ways:

- Through contributions from or distributions to the equity participants.

- Due to income earned or expenses incurred by the enterprise.

4. Income

Income refers to the increase in economic benefits during an accounting period in the form of inflows or enhancement of assets, or decreases in liabilities, that lead to an increase in equity (other than contributions from equity participants).

The concept of income includes both revenue and gains:

- Revenue is income that arises in the ordinary course of the enterprise’s activities, such as sales by a trader.

- Gains are income that may or may not arise from the ordinary activities of the enterprise, such as profit on the sale of Property, Plant, and Equipment.

Gains are shown separately in the Statement of Profit and Loss because this information is useful for assessing the enterprise’s performance. Income earned is always linked with an increase in assets or a reduction in liabilities. For example, a bank does not recognize interest earned on non-performing assets because the corresponding increase in advances cannot be recognized, as it is unlikely to bring economic benefits to the bank in the future.

Thus, the Balance Sheet of an enterprise can be expressed as:

A – L = E

Where:

- A = Aggregate value of assets

- L = Aggregate value of liabilities

- E = Aggregate value of equity

5. Expense

An expense is a decrease in economic benefits during an accounting period in the form of outflows or reductions of assets or increases in liabilities that result in a decrease in equity, other than those related to distributions to equity participants.

The definition of expenses includes:

- Expenses that arise in the ordinary course of the enterprise's activities, such as wages paid.

- Losses may or may not arise in the ordinary course of business, such as losses on the disposal of Property, Plant, and Equipment. Losses are shown separately in the Statement of Profit and Loss because they are useful in assessing the performance of the enterprise.

Expenses are always incurred simultaneously with either a reduction of assets or an increase in liabilities. Thus, expenses are recognized when the corresponding decrease in assets or increase in liabilities meets the recognition criteria stated above. Expenses are recorded in the Profit and Loss Account by matching them with the revenue generated.

- The matching concept ensures that expenses are recognized in the period in which the associated revenue is recognized, but it should not result in recognizing an item as an asset (or liability) if it does not meet the definition of an asset or liability.

If economic benefits are expected to arise over multiple accounting periods, expenses are recognized in the Profit and Loss Account based on a systematic and rational allocation procedure. An example is depreciation.

An expense is recognized immediately in the Profit and Loss Account when:

- It does not meet or ceases to meet the definition of an asset.

- No future economic benefits are expected from it.

- A liability is incurred without recognizing an asset, as in the case of a warranty liability arising from a product warranty.

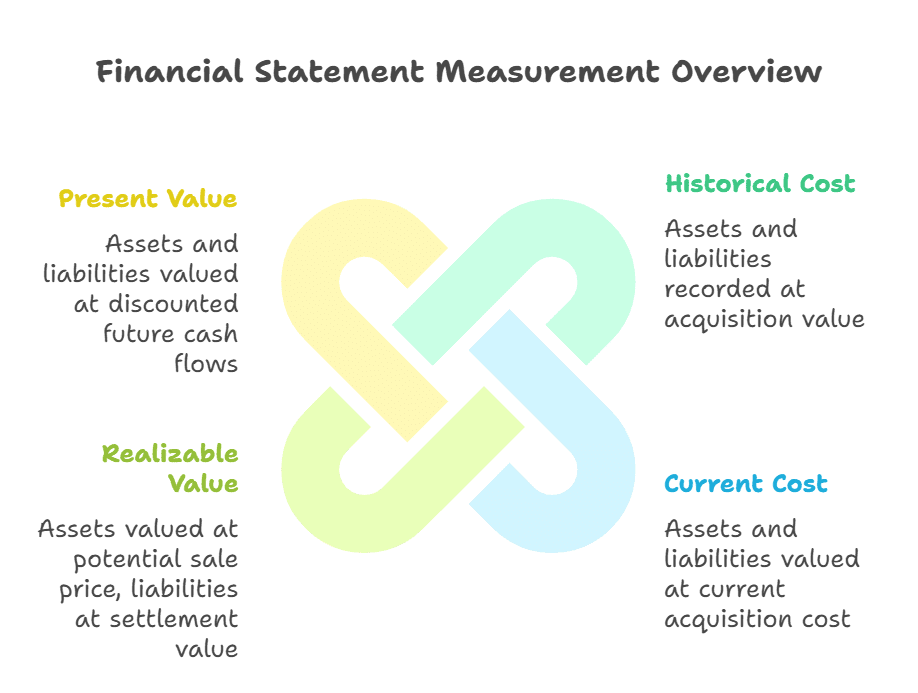

Measurement of Elements of Financial Statements

Measurement is the process of determining the monetary value at which an element is recognized in the balance sheet or statement of profit and loss. The framework recognizes four alternative measurement bases, which specifically relate to the valuation of assets and liabilities. The valuation of income or expenses (i.e., profit) is implied by the changes in the values of assets and liabilities.

In preparing financial statements, any combination of these measurement bases may be used to assign monetary values to items, in accordance with the requirements under Accounting Standards. However, it is important to note that Accounting Standards predominantly use the historical cost method for preparing financial statements. For some items, the use of other valuation methods is permitted. For example, inventory is recorded at historical cost when acquired, but at the year-end, it is valued at the lower of cost and net realizable value.

Here is a brief explanation of each measurement basis:

1. Historical Cost

- Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of acquisition.

- Liabilities are recorded at the amount of proceeds received in exchange for the obligation, or in some cases (e.g., income taxes), at the amounts of cash or cash equivalents expected to be paid to settle the liability in the normal course of business.

2. Current Cost

- Assets are carried at the amount of cash or cash equivalents that would need to be paid if the same or an equivalent asset were acquired currently.

- Liabilities are carried at the undiscounted amount of cash or cash equivalents that would be required to settle the obligation currently.

3. Realizable (Settlement) Value

- Assets are carried at the amount of cash or cash equivalents that could currently be obtained by selling the asset in an orderly disposal.

- Liabilities are carried at their settlement values, i.e., the undiscounted amounts of cash or cash equivalents expected to be paid to settle the liabilities in the normal course of business.

4. Present Value:

- Assets are carried at the present discounted value of the future net cash inflows that the asset is expected to generate in the normal course of business.

- Liabilities are carried at the present discounted value of the future net cash outflows expected to be required to settle the liabilities in the normal course of business.

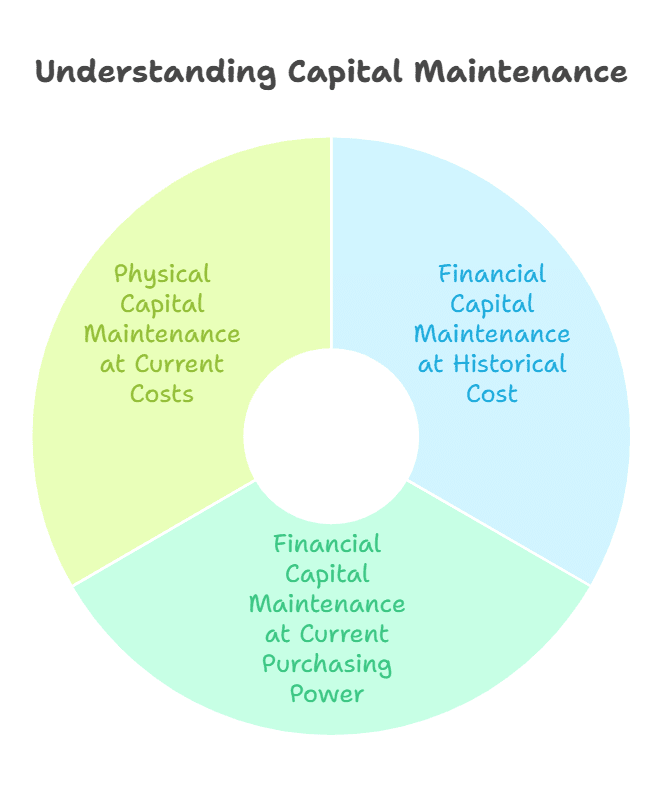

Capital Maintenance

Capital refers to the net assets of a business. Since a business uses its assets for operations, a fall in net assets generally indicates a reduction in activity level. Therefore, it is crucial for a business to maintain its net assets to ensure continued operations at least at the same level each year. This means that dividends should not exceed the profit after making appropriate provisions for the replacement of assets consumed in operations. To ensure this, the Companies Act prohibits the distribution of dividends without accounting for depreciation on Property, Plant, and Equipment. However, in cases of rising prices, this may not be sufficient.

The point is explained mathematically as follows:

- Profit (P) = (Closing Assets (CA) – Closing Liabilities (CL)) – (Opening Assets (OA) – Opening Liabilities (OL)) – Capital Introduced (C) + Dividends (D)

- Retained Profit (RP) = P - D = (CA – CL) – (OA – OL) – C

A business must ensure that the Retained Profit (RP) is not negative, which means that the closing equity should not be less than the capital to be maintained. This capital is the sum of opening equity and capital introduced. As shown, the value of retained profit depends on the valuation of assets and liabilities.

To check whether the capital is maintained and to ensure that retained profit is not negative, we can use any of the following three bases:

1. Financial Capital Maintenance at Historical Cost

- Opening and closing assets are stated at their respective historical costs.

- Retained profit is considered positive if it is greater than or equal to zero, meaning capital is maintained at historical costs.

- This method ensures the business has enough funds to replace its assets at their historical costs.

- Works well as long as prices do not rise, but may not be sufficient in case of inflation or rising asset prices.

2. Financial Capital Maintenance at Current Purchasing Power

- Opening and closing equity at historical costs are restated using average price indices for closing prices.

- Example: If opening equity is ₹ 3,00,000 with an index of 100, and the closing index is 120, the restated opening equity is ₹ 3,60,000.

- A positive retained profit indicates that the business has enough funds to replace assets at average closing prices.

- May not fully serve the purpose as prices of assets may not change uniformly (e.g., a machine may increase by 30%, while average increase is 20%).

3. Physical Capital Maintenance at Current Costs

- Opening and closing assets are restated at closing prices using specific price indices for each asset.

- Liabilities are restated based on the economic resources required to settle obligations at the current date.

- Opening and closing equity at current costs are calculated as the difference between the total current cost of assets and liabilities.

- A positive retained profit ensures the business retains enough funds to replace each asset at its respective closing prices.

Conclusion

In conclusion, the framework for the preparation of financial statements establishes a structured approach to ensure consistency, clarity, and comparability in financial reporting. By defining key areas such as the components, objectives, assumptions, and measurement bases of financial statements, the framework provides a solid foundation for both the creation of new accounting standards and the review of existing ones. It emphasizes the importance of maintaining capital, which ensures that businesses can continue operations without exhausting their net assets. Different measurement bases such as historical cost, current cost, and physical capital maintenance provide businesses with various methods to assess whether capital is adequately maintained and retained profits are positive. Ultimately, the goal of the framework is to enhance the usefulness of financial statements for users, from investors to auditors, ensuring they provide relevant, reliable, and understandable information for informed decision-making, while safeguarding the long-term sustainability of the business.

|

53 videos|134 docs|6 tests

|

FAQs on ICAI Notes: Framework for Preparation and Presentation of Financial Statements - Advanced Accounting for CA Intermediate

| 1. What is the purpose of the Framework for Preparation and Presentation of Financial Statements? |  |

| 2. Who are the primary users of financial statements? |  |

| 3. What are the fundamental accounting assumptions underlying financial statements? |  |

| 4. What are the qualitative characteristics that enhance the usefulness of financial statements? |  |

| 5. What does the term "True and Fair View" mean in the context of financial statements? |  |