Unit 1: Meaning and Scope of Accounting - 1 Chapter Notes | Accounting for CA Foundation PDF Download

Introduction

Economic activity is a part of everyone’s life. A salaried person earns income and spends it on essentials like food, clothing, education, or housing. Economic activities can take many forms — from a sports club run by enthusiasts, to a small business, a large telecom company, local municipal bodies, and even State or Central Government operations.

Not all economic activities aim for personal profit; many provide social benefits for the public at large. Still, whether profit-driven or service-oriented, these activities involve transactions and events.

A transaction is a business act, agreement, or exchange, such as buying goods, paying rent, or receiving a grant.

An event is the outcome of one or more transactions, such as earning a surplus, holding inventory, or recording a deficit.

Example:

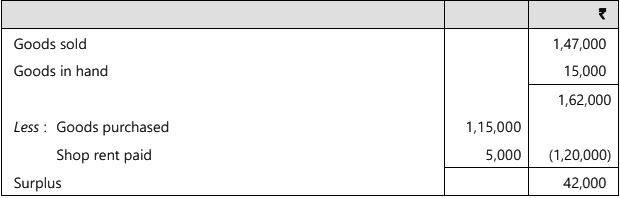

An individual invests ₹ 2,00,000 to run a stationery business. On 1st January, he purchases goods for ₹ 1,15,000 and sells them for ₹ 1,47,000 during the month of January. He pays shop rent for the month ₹5,000 and finds that he still has goods worth ₹ 15,000 in hand. The individual performs an economic activity. He carries on a few transactions and encounters some events. Is it not logical that he will want to know the result of his activity?

We see that the individual, who runs the stationery business, earns a surplus of ₹ 42,000.

Earning of ₹ 42,000 surplus is an event; also, having the inventories in hand is another event, while the purchase and sale of goods, investment of money and payment of rent are transactions. Similarly, a municipal corporation got a government grant ₹ 500 lakhs for adult education; it spent ₹ 250 lakhs on purchasing literacy kits, paid ₹ 200 lakhs to the tutors and is left with a balance of ₹ 50 lakhs. These are also transactions and events.

The Central Government generates revenue through taxes, pays salaries, and funds development projects. A surplus arises when receipts exceed expenses; a deficit occurs when the reverse happens. Fund-raising activities are transactions, while the resulting surplus or deficit is an event.

Similarly, in a telecom company, every customer activity — calls, messages, or data use — is an economic event. Accurate records ensure timely billing for post-paid users and correct balances for pre-paid users.

Maintaining records of transactions and events is vital for understanding economic activities and making informed decisions. Accounting meets this need by measuring the inflow and outflow of resources and providing useful information for decision-making.

While applicable to all forms of economic activity, this study material focuses on business accounting. Accounting records business transactions, communicates financial information, and supports sound decision-making, earning it the title 'language of business'.

Meaning of Accounting

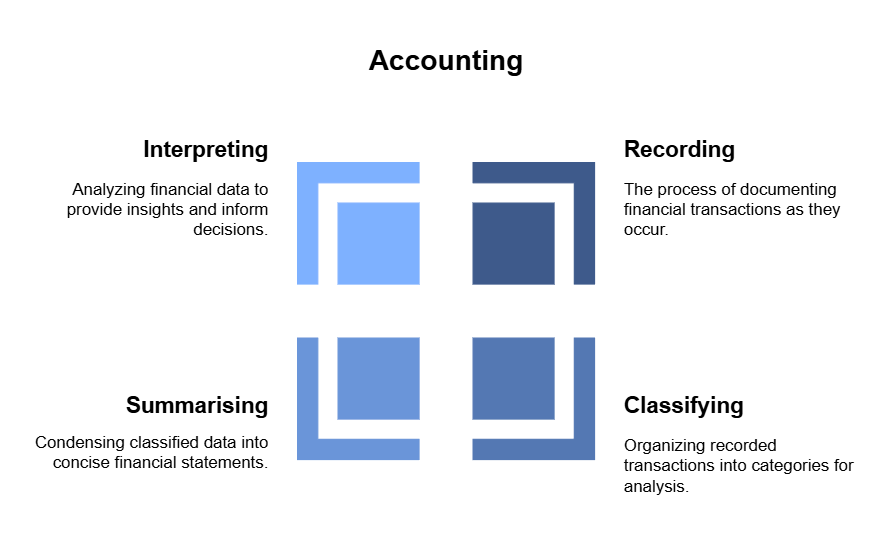

The Committee on Terminology established by the American Institute of Certified Public Accountants provided the following definition of accounting in 1961:“Accounting is the art of recording, classifying, and summarising in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the result thereof.”

- Accounting is fundamentally the art of maintaining records, starting with identifying and documenting financial transactions and events. For example, a telecom company records activities like invoicing, payments, and expenses, while a stationery shop tracks its business dealings.

- Transactions are first entered in journals or subsidiary books (primary books), then classified and summarised for easy reference. They are later transferred to the ledger, where they are grouped as income, expenses, assets, or liabilities, and summarised in the profit and loss account and balance sheet.

- All transactions must be measured in monetary terms using the local currency and should have a financial character — for instance, selling a business is a financial event, while inaugurating a branch is not.

- While earlier definitions ended with interpreting recorded data, modern accounting also focuses on communicating results, driven by globalisation, diverse ownership, and growing public interest in business operations.

As a result, the necessity for communication and facilitating informed judgment has become part of accounting, as reflected in the widely accepted definition provided by the American Accounting Association in 1966, which states:

“The process of identifying, measuring and communicating economic information to permit informed judgments and decisions by the users of accounts.”

In 1970, the Accounting Principles Board (APB) of the American Institute of Certified Public Accountants (AICPA) outlined the functions of accounting as follows:

“The function of accounting is to provide quantitative information, primarily of financial nature, about economic entities, that is needed to be useful in making economic decisions.”

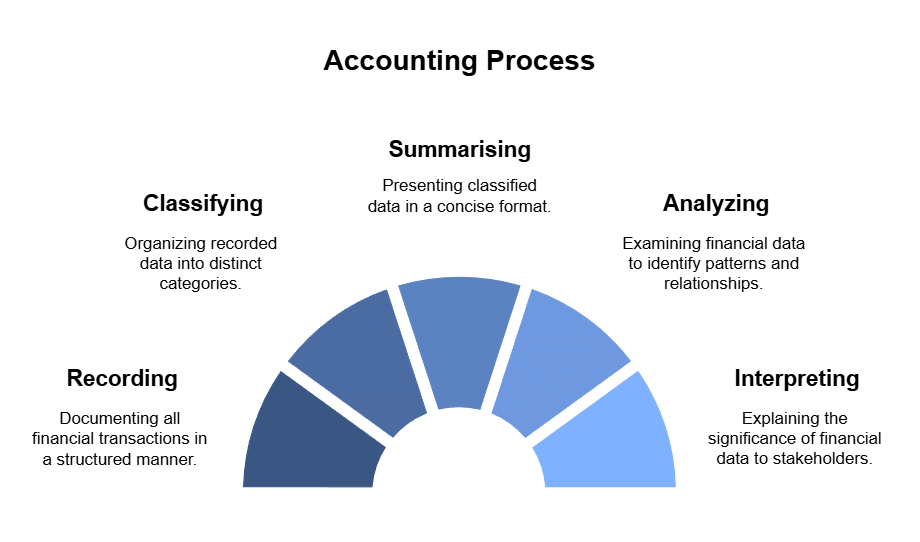

Accounting is the process of recording, classifying, summarising, analysing, interpreting financial transactions, and communicating results to stakeholders. This role goes beyond bookkeeping, requiring accountants to deliver clear, accessible, and decision-useful information to users.

Procedural aspects of Accounting

On the basis of the above definitions, the procedure of accounting can be basically divided into two parts:(i) Generating financial information and

(ii) Using the financial information.

Generating Financial Information

- Recording – Document all financial transactions in the “Journal,” supported by source documents like sales bills, passbooks, and salary slips. Depending on the business, journals may be divided into subsidiary books.

- Classifying – Organise recorded data into similar categories in the “Ledger,” with separate accounts for items like Salaries, Rent, or Advertisement, making it easier to track totals for each.

- Summarising – Present classified data in a useful form for internal and external users, leading to the preparation of financial statements.

- Analysing – Group related items (e.g., fixed assets, current assets) and establishing relationships between Profit and Loss and Balance Sheet items, forming the basis for interpretation.

- Interpreting – Explain the meaning of analysed data to assess financial health and profitability, and predict possible future outcomes.

- Communicating – Share summarised, analysed, and interpreted results with users through reports such as the profit and loss account, balance sheet, and supporting information like ratios or fund flow statements.

The initial two steps of generating financial information, along with preparing the trial balance, fall under bookkeeping, while the preparation of financial statements, their analysis, interpretation, and communication to various users are considered accounting stages. In upcoming topics, students will learn the distinction between bookkeeping and accounting.

Using the Financial Information

Initially, accounting was seen as serving only business owners, as businesses were smaller and simpler. Today, it is recognised that users also include management, investors, employees, lenders, suppliers, customers, government agencies, and the public. For example, in an airline business, banks, oil companies, customers, and employees all have a stake in its performance and need to know if it is thriving or struggling.

Accounting presents information methodically, focusing on economic substance over technicality. It must be relevant, unbiased, and reliable so users can compare results with alternatives and past data. Internal users (owners, management) need detailed reports for decision-making, while external users rely on summarised financial statements showing assets, liabilities, and capital.

Evolution of Accounting as A Social Science

History & Development of Accounting

- Accounting has its origins dating back to around 4000 BC when Egyptians utilised some form of accounting for their treasuries.

- The treasury officials were required to submit daily reports to their superiors, known as Wazirs, and monthly reports to the kings.

- In Babylonia, recognised as the centre of commerce, accounting was employed to track business losses related to fraud and inefficiency.

- Greece utilised accounting to allocate revenues among treasuries, keeping records of receipts, payments, and government financial transactions.

- Romans maintained a memorandum or daybook for recording receipts and payments (700 B.C. to 400 A.D.).

- China developed advanced government accounting practices as early as 2000 B.C.

- In India, accounting practices can be traced to the time of Kautilya, a minister in Chandragupta’s kingdom, who authored the book Arthashasthra, detailing the maintenance of accounting records.

- Luca Pacioli, a Franciscan friar from the merchant class, published his book Summa de Arithmetica, Geometria, Proportionality in Venice (1494), which is regarded as the first text on double-entry bookkeeping.

- This book included business and bookkeeping knowledge, introducing the terms Debit (Dr.) and Credit (Cr.) from Italian and Latin origins—debit meaning owed and credit denoting trust or belief in the proprietor.

- Pacioli explained that all entries must be double entries; for every credit, there must be a corresponding debit.

- He emphasised the merchant's ethical duty to honour God in their business dealings and to achieve profitability.

- He elaborated on the concepts of memorandums, journals, ledgers, and specialised accounting methods.

- Initially, accounting served stewards in fulfilling their management duties.

- Wealthy individuals employed stewards to oversee their assets, who, in turn, provided periodic accounts of their management—this practice, known as 'Stewardship Accounting', was the foundation of the financial accounting system.

- Stewardship accounting remained prevalent until the rise of large-scale enterprises like public limited companies.

- The second phase saw the emergence of financial accounting alongside the concept of joint-stock companies, which separated ownership from management.

- To protect shareholder interests, laws require disclosure of financial statements, such as profit and loss accounts and balance sheets.

- These statements offered periodic performance reports and financial positions at the end of reporting periods, gaining legal recognition due to changing relationships among owners, economic entities, and managers.

- With societal democratisation, the dynamics between enterprises and stakeholders evolved, prompting investors and business contacts to seek extensive information before engaging in transactions.

- Consequently, financial accounting developed as an information system to identify, measure, and communicate relevant information for informed judgments and decisions.

- The third phase introduced Management Accounting, a development of the 20th century, aimed at enhancing the quality of management decisions across various spheres.

- Finally, Social Responsibility Accounting is currently developing, focusing on accounting for the social costs incurred by businesses and the social benefits they create.

- This evolution reflects a growing awareness of the negative consequences of economic activities.

- In the pursuit of profits, businesses often incur social costs such as pollution and resource usage.

- Therefore, it is expected that businesses also generate social benefits, including job creation, recreational opportunities, and improved product quality at reasonable prices.

- As such, the accounting system is called upon to report on the social costs incurred and the social benefits generated.

- Social Science examines individuals as members of society, focusing on social processes and the outcomes of social relationships.

- The overall benefit of accounting to society is the primary criterion for considering it a social science.

- While individuals may gain from accounting information, the system ultimately produces information for the greater social good, contributing to social progress and adapting to societal changes.

- Hence, accounting is recognised as a social science.

Objectives of Accounting

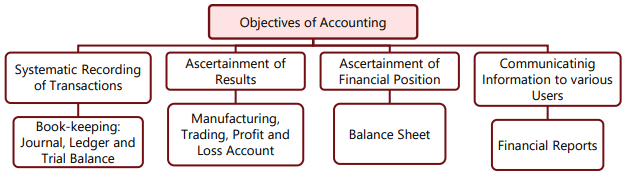

The objectives of accounting can be summarised as follows:

- Systematic recording of transactions: The primary goal of accounting is to systematically document the financial aspects of business transactions, which refers to bookkeeping. These recorded transactions are subsequently classified and summarised logically to prepare financial statements for analysis and interpretation.

- Ascertainment of results of recorded transactions: Accountants generate profit and loss accounts to determine the outcomes of business operations over a specific period. If revenue (Sales) exceeds expenses, the business is deemed profitable; conversely, if expenses surpass revenue, the business incurs a loss. The profit and loss account aids management and stakeholders in making informed decisions. For instance, if the business is not profitable, management can investigate the reasons and take corrective actions.

- Ascertainment of the financial position of the business: Business owners are not only interested in the profit or loss results over a period, but also want to know their liabilities to outsiders and their assets at a specific date. To provide this information, accountants prepare a financial position statement, commonly known as the Balance Sheet. This statement outlines the assets and liabilities of the business at a certain moment, helping to assess its financial health.

- Providing information to users for rational decision-making: Accounting serves as the 'language of business' by communicating the financial results of an enterprise to various stakeholders through financial statements. It aims to satisfy the informational needs of decision-makers, facilitating rational decision-making.

- To know the solvency position: By preparing the balance sheet, management not only reveals the ownership and debts of the enterprise but also provides insights into its ability to fulfil its liabilities in the short term (liquidity position) and long term (solvency position) as they become due.

An overview of the objectives of accounting is depicted in the chart given below:

Functions of Accounting

The primary functions of accounting are as follows:- Measurement: Accounting evaluates the historical performance of the business entity and illustrates its current financial status.

- Forecasting: Accounting assists in predicting the future performance and financial condition of the enterprise by utilising past data and analysing trends.

- Decision-making: Accounting delivers pertinent information to users of accounts to facilitate informed decision-making.

- Comparison & Evaluation: Accounting measures performance achieved against targets and reveals information regarding accounting policies and contingent liabilities, which are crucial for predicting, comparing, and assessing financial results.

- Control: Accounting identifies weaknesses in the operational system and provides feedback on the effectiveness of measures implemented to address such weaknesses.

- Government Regulation and Taxation: Accounting supplies essential information to the government for controlling the entity and for tax revenue collection.

Book Keeping

- Bookkeeping is the systematic recording and classification of financial data, forming the procedural foundation of accounting. It produces financial statements such as the Profit and Loss Account, Balance Sheet, and Cash Flow Statement, along with supporting notes.

- Bookkeepers may manage all records or specific sections, with the goal of accurately tracking income, expenses, and related parties. Proper records are essential for monitoring creditors, reviewing outstanding amounts, and determining profit or loss at period-end.

- This curriculum focuses on bookkeeping and financial statement preparation, both of which have legal implications. Companies must comply with the Companies Act, while banks and insurers follow specific legislation. Sole proprietorships and partnerships, however, have no such legal requirements.

Objectives of Bookkeeping

- Complete Recording of Transactions – This involves a thorough and permanent record of all transactions in a systematic and logical manner to demonstrate their financial impact on the business.

- Ascertainment of Financial Effect on the Business – This pertains to understanding the overall impact of all transactions during the accounting period on the business's financial position.

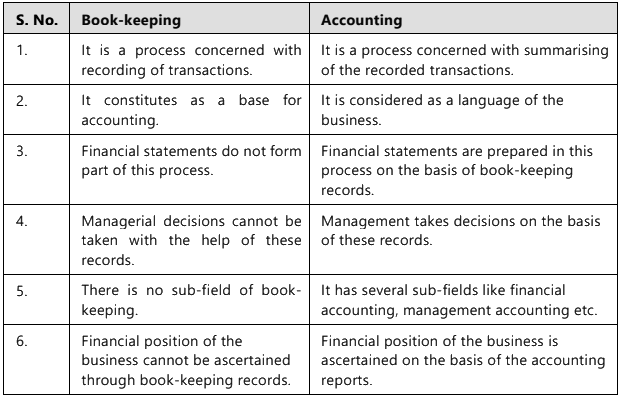

Distinction Between Book-Keeping and Accounting

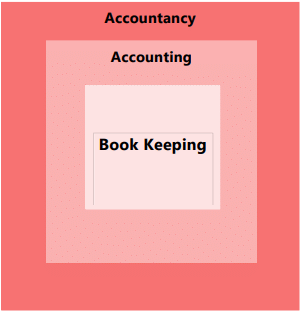

Many individuals confuse bookkeeping and accounting as identical concepts; however, they are distinct from one another. Accounting encompasses a wider scope, requiring a deeper comprehension of the records generated from bookkeeping, along with skills to analyse and interpret the information these records contain. Bookkeeping involves the recording stage, whereas accounting focuses on the summarisation stage of an accounting system. Bookkeeping supplies essential data for accounting, which begins where bookkeeping concludes.

The relationship of Accounting and Book-keeping can be depicted in the following chart as

|

68 videos|265 docs|83 tests

|

FAQs on Unit 1: Meaning and Scope of Accounting - 1 Chapter Notes - Accounting for CA Foundation

| 1. What is the meaning of accounting? |  |

| 2. How has accounting evolved as a social science? |  |

| 3. What are the main objectives of accounting? |  |

| 4. What are the key functions of accounting? |  |

| 5. What is the distinction between book-keeping and accounting? |  |