B Com Exam > B Com Notes > Cost Accounting > Integral Accounting

Integral Accounting | Cost Accounting - B Com PDF Download

| Table of contents |

|

| Introduction |

|

| Features of Integrated Accounting System |

|

| Advantages of integrated accounting system |

|

| Essential pre-requisites for integrated accounts |

|

Introduction

The term "integrated accounting system" refers to an accounting system in which both cost and financial accounts are maintained within a single set of books. In this arrangement, there is no distinct set of books specifically designated for costing and financial records. Integrated accounts serve the purpose of supplying the necessary information for both costing and financial accounts.

Features of Integrated Accounting System

- Complete analysis of costs and sales are kept.

- Complete details of all payments in cash are kept.

- Complete details of all assets and liabilities are kept and this system does not use a notional accounts to represent all impersonal accounts.

- Under this system, general ledger adjustment is not at all maintained and detailed accounts of assets and liabilities are maintained.

Advantages of integrated accounting system

The main advantages of integrated accounts are as follows

- No need for Reconciliation: The question of reconciling costing profit and financial profit does not arise, as there is one figure of profit only

- Significant saving in the clerical efforts, as only one set of books is maintained.

- Retrieving of information is easy & quick

- It is economical also as it is based in the concept of centralization of accounting function

Essential pre-requisites for integrated accounts

The essential pre-requisites for integrated accounts include the following steps

- The managements decision about the extent of integration of the two sets of books, some concerns find it useful to integrate upto the stage of primary cost or factory cost, while others prefer full integration of the entire accounting records.

- A suitable coding system must be made available so as to serve the accounting purposes of financial and cost accounts.

- An agreed routine, with regard to the treatment of provision for accruals, prepaid expenses, other adjustment necessary for preparation of interim accounts.

- Perfect coordination should exist between the staff responsible for the financial and cost aspects of the accounts and an efficient processing of accounting documents should be ensured.

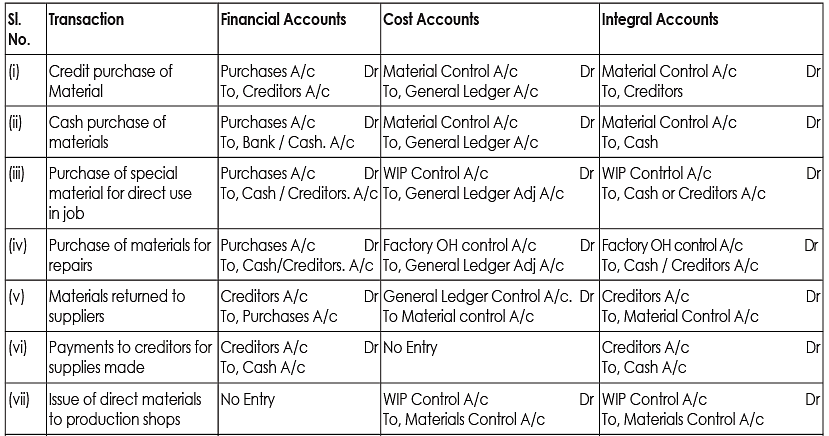

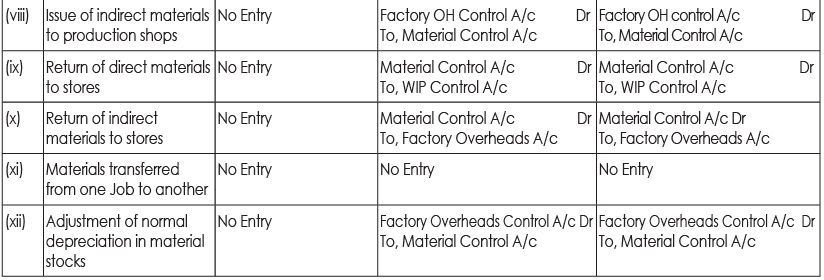

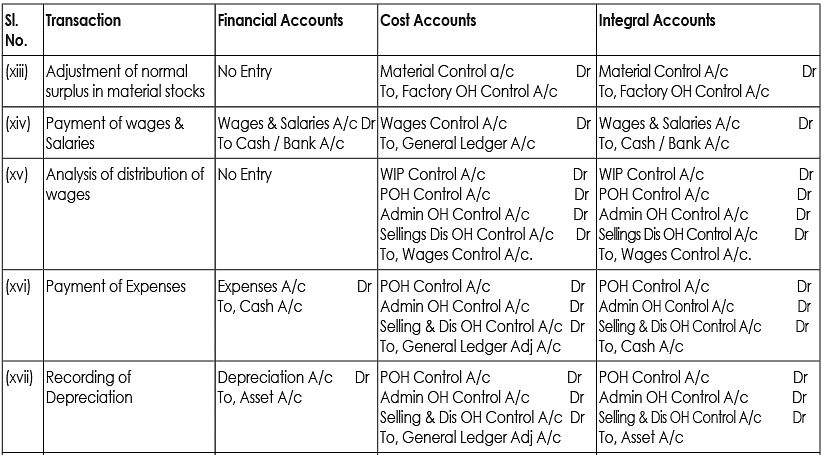

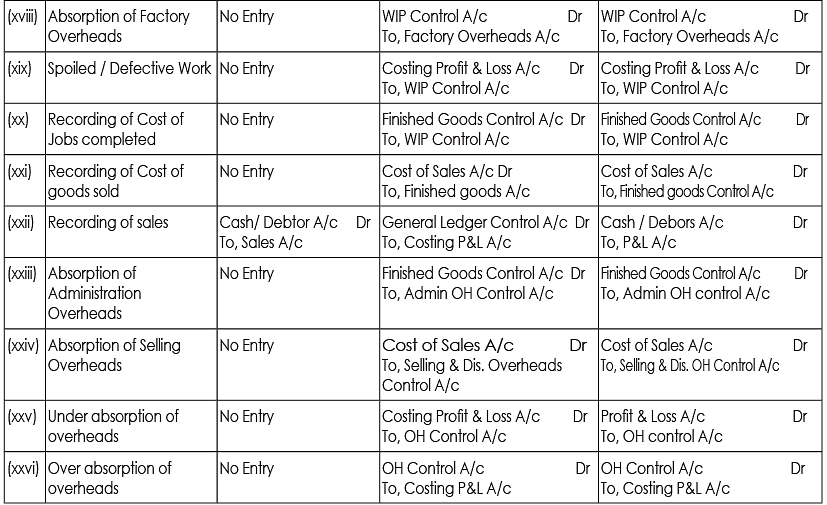

The following table shows the comparative journal entries in financial accounts, cost accounts and integral accounts:

The document Integral Accounting | Cost Accounting - B Com is a part of the B Com Course Cost Accounting.

All you need of B Com at this link: B Com

|

103 videos|131 docs|14 tests

|

FAQs on Integral Accounting - Cost Accounting - B Com

| 1. What is an integrated accounting system? |  |

An integrated accounting system is a software or platform that combines various accounting functions into a single system. It allows businesses to manage their financial transactions, recordkeeping, and reporting in a seamless and efficient manner.

| 2. What are the features of an integrated accounting system? |  |

Some key features of an integrated accounting system include:

- General ledger: It provides a central repository for recording and tracking financial transactions.

- Accounts payable and receivable: It helps in managing and tracking payments to suppliers and receipts from customers.

- Inventory management: It allows businesses to track and manage their inventory levels in real-time.

- Financial reporting: It generates various financial reports, such as income statements, balance sheets, and cash flow statements.

- Tax compliance: It helps businesses in meeting their tax obligations by providing accurate and up-to-date financial data.

| 3. What are the advantages of using an integrated accounting system? |  |

Using an integrated accounting system offers several advantages, including:

- Time and cost savings: It eliminates the need for manual data entry and reconciliation, reducing the time and effort required for accounting tasks.

- Improved accuracy: By automating various accounting processes, the system minimizes the risk of human error and ensures accurate financial records.

- Real-time visibility: Businesses can access up-to-date financial information and reports, enabling them to make informed decisions.

- Streamlined workflows: Integrated accounting systems facilitate smooth communication and data sharing between different departments, enhancing overall efficiency.

- Scalability: These systems can accommodate the growing needs of businesses, allowing them to expand without major disruptions to their accounting processes.

| 4. What are the essential pre-requisites for implementing an integrated accounting system? |  |

Some essential pre-requisites for implementing an integrated accounting system include:

- Clear understanding of business requirements: It is important to define the specific accounting functions and features needed to meet the business's unique needs.

- Adequate hardware and software infrastructure: The system requires compatible hardware and software components, such as servers, computers, and operating systems.

- Data migration and integration: Existing financial data should be carefully migrated and integrated into the new system to ensure a smooth transition.

- User training and support: Employees should receive proper training on how to use the system effectively, and ongoing support should be available to address any issues or questions.

| 5. How can an integrated accounting system benefit small businesses? |  |

Integrated accounting systems can be particularly beneficial for small businesses by:

- Automating routine accounting tasks, freeing up time for business owners to focus on other important aspects of their operations.

- Providing accurate and timely financial information, enabling small businesses to make informed decisions and plan for growth.

- Streamlining invoicing and payment processes, reducing the risk of late payments and improving cash flow management.

- Enhancing collaboration and communication between different departments, leading to improved efficiency and productivity.

- Simplifying tax compliance and reporting, ensuring that small businesses meet their regulatory obligations without excessive time or effort.

Related Searches