International Arbitrage & Multinational Capital Budgeting | UGC NET Commerce Preparation Course PDF Download

Understanding International Arbitrage Meaning

- Purchasing and selling equal amounts of assets in two different markets is known as international arbitrage.

- International arbitrage takes advantage of price differences caused by market inefficiencies.

- In international arbitrage, a trader buys a security at a low price from one market and sells it at a higher price in another market to make a risk-free profit.

- If both markets are in the same country, it's considered an arbitrage transaction.

- According to International Arbitrage Definitions, for it to be international arbitrage, the two markets must be in different countries.

- Opportunities for international arbitrage are rare because price differences balance out quickly once identified.

- In a market with price equilibrium, there is no room for international arbitrage to occur.

- The primary types of foreign arbitrage trading involve buying and selling ADRs, currencies, or the same stock listed in two countries.

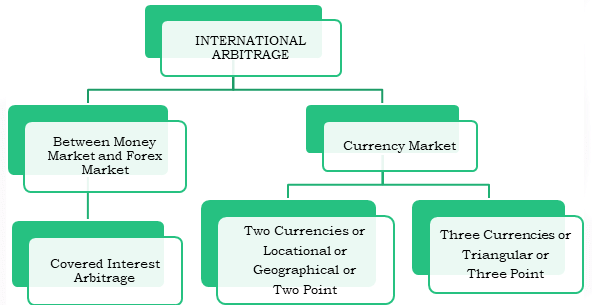

Types of International Arbitrage

Covered Interest Arbitrage:

- In covered interest arbitrage, traders use forward contracts to hedge against exchange rate risks while investing in higher-yielding currencies.

- This strategy involves mitigating currency fluctuations while taking advantage of interest rate differentials.

- Complex trading operations and sophisticated arrangements are necessary for covered interest arbitrage.

Triangle Arbitrage:

- Triangle arbitrage, a complex form of two-point arbitrage, involves three currencies or securities instead of two.

- It occurs when there are disparities in exchange rates between three different currencies, presenting an arbitrage opportunity.

- In this scenario, traders engage in a series of transactions involving three currencies to exploit pricing differences.

Two-Point Arbitrage:

- Two-point arbitrage is a trading strategy where traders buy and sell securities on different markets at varying prices.

- According to classical economic theory, exchange rates should be uniform globally, but factors like time zones and rate lags create price differentials.

- Traders can capitalize on these differences by executing transactions in markets where they stand to gain from more advantageous pricing.

- For a profit, the exchange rate must exceed the transaction costs involved.

International Arbitrage Example

International arbitrage involves taking advantage of price differences in the same asset across different markets. For instance, consider XYZ Inc. stock, which is traded on both the New York Stock Exchange and the National Securities Exchange. If XYZ's shares are priced at Rs. 500 on the National Stock Exchange and $10.5 on the NYSE, with a USD/INR exchange rate of 50, the price on the NYSE in INR would be 525.

An investor could potentially profit by buying and selling XYZ shares simultaneously on both exchanges, exploiting the Rs. 25 difference per share. However, transaction costs and exchange rate fluctuations need to be carefully considered, as they can impact the profitability of the arbitrage opportunity.

- Market Neutral Arbitrage: This strategy involves taking a long position in an undervalued asset while simultaneously shorting it. The goal is for the long position to increase in value and the short position to decrease by an equal amount.

- Cross-market Arbitrage: This strategy focuses on exploiting price differences of the same asset across multiple markets.

- ETF Arbitrage: This technique involves identifying differences between an ETF's value and its underlying assets to ensure the ETF's price aligns with its underlying assets.

- Cross-Asset Arbitrage: This strategy focuses on exploiting price differences between an asset and its underlying components.

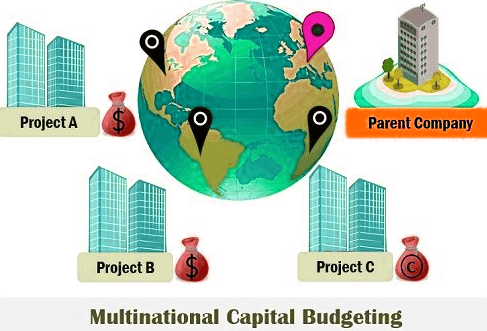

What is Multinational Capital Budgeting

Multinational corporations' capital budgeting involves investing in long-term assets like plants, equipment, and technology. When done by global firms operating across borders, it is called multinational capital budgeting. Global firms face more intricate capital budgeting decisions because they assess projects in various currencies, nations, and regulatory climates. They have to consider risks specific to foreign nations, like political, currency, legal, and transfer pricing issues affecting cash flows. Plans like net present value, internal rate of return, and payback period are still used, but discount rates must account for higher risks in some nations.

Factors Affecting Multinational Capital Budgeting

Factors to consider in multinational capital budgeting are diverse and crucial for successful international projects. Let's delve into these key factors:

- Regulatory Compliance: Projects in foreign nations must adhere to local laws and regulations, leading to increased costs and complexities that need careful consideration.

- Rivalry in Global Markets: The competitive landscape in global markets varies significantly, requiring firms to evaluate project risks based on the unique profiles of competitors in each nation.

- Culture and Language Differences: Cultural and linguistic disparities between home and host nations can present challenges in initiating and managing global projects effectively.

- Supply Chain Risks: Dependence on global suppliers for inputs introduces risks that must be integrated into cost and cash flow projections.

- Human Resource Challenges: Recruiting and retaining competent local staff for projects in foreign countries can be arduous, impacting project schedules and budgets.

- Trade Barriers: Tariffs, import quotas, and trade restrictions in host nations can influence project costs and market potential, necessitating careful evaluation.

- Lack of learning: Nations may lack venture operating in specific foreign markets, making it hard to accurately budget for projects initially.

- Ownership Rules: Certain nations may impose restrictions on foreign ownership in specific firms, posing risks for global assets that need to be considered.

- Infrastructure Deficiencies: Inadequate infrastructure in certain countries can escalate project production costs and timelines, impacting overall project feasibility.

- Exchange Rate Volatility: Fluctuations in currency exchange rates can significantly affect cash flows and profitability of global projects, creating additional challenges for multinational firms.

- Political Risk: Shifts in government policies, rules, and laws in foreign nations pose risks to the viability and success of projects there. This is a major concern for global firms.

- Nation Risk: A nation's overall economic and political stability affects the riskiness of projects found there. Firms assess national risk while studying global assets.

- Transfer Pricing: The transfer of goods, services, and intangibles across borders must adhere to transfer pricing rules. This impacts the profitability and cash flows crucial for capital budgeting decisions.

- Tax Differentials: Variations in corporate tax rates across nations influence the after-tax cash flows and returns of global projects. Firms need to consider these differences.

- Government Incentives: Foreign governments may offer incentives such as tax breaks, subsidies, or reduced tariffs to attract investments. Companies take these incentives into account in their analyses.

- Cost of Capital: Multinational corporations must select appropriate discount rates for projects in other countries based on country-specific risks. This can be more complex than for domestic projects.

- Data Gaps: Multinational firms often face challenges due to the lack of accurate and timely data about foreign projects, introducing uncertainties and complexities into capital budgeting decisions.

The Objective of Multinational Capital Budgeting

Multinational capital budgeting, also referred to as international capital budgeting, focuses on making informed investment decisions involving projects or assets in different countries or currencies. It takes into account the unique complexities and risks associated with global assets. The main aim of multinational capital budgeting is to enhance shareholder value and ensure the effective distribution of financial resources across borders. Below are the key objectives of multinational capital budgeting:

Maximize Shareholder Wealth:

- The primary objective of multinational capital budgeting is to maximize shareholders' wealth by selecting projects with positive net present value (NPV) or return on investment (ROI).

Risk Oversight:

- It involves identifying and managing risks related to global assets such as currency fluctuations, political instability, regulatory changes, and economic uncertainties to safeguard the organization's financial well-being.

Optimal Allocation of Capital:

- Efficient allocation of financial resources across various projects and locations is crucial. Multinational capital budgeting helps in prioritizing investments that offer high returns in relation to associated risks.

Currency Exposure Management:

- Evaluating the impact of currency exchange rate fluctuations on cash flows and profits is essential. Strategies like hedging are employed to mitigate currency risk and ensure the stability of expected cash flows.

Compliance and Regulatory Reviews:

- Compliance with global laws, tax regulations, and accounting standards is imperative when making cross-border investment decisions. Understanding tax implications and legal requirements of operating in different countries is essential.

Cost of Capital:

- Selecting the appropriate cost of capital for global assets involves considering factors like national risk, inflation rates, and market conditions. The goal is to use an accurate cost of capital to discount cash flows for NPV calculations.

Long-Term Strategic Alignment:

- Aligning global investments with the firm's long-term strategic objectives is vital. This ensures that assets contribute to the overall growth and competitiveness of the organization on a global scale.

Resource Share:

- Efficiently allocate resources among subsidiaries or divisions based on their potential for creating value. Factors considered include growth opportunities, market demand, and competitive advantages.

Assess Expansion Options:

- Evaluate the feasibility of expanding operations into new markets or countries. Make decisions on whether entering a new market or acquiring a foreign subsidiary aligns with financial viability and the firm's objectives.

Ensure Financial Sustainability:

- Analyze the sustainability of global investments by examining their impact on cash flow, profitability, and the overall financial health of the firm. The aim is to prevent surpassing financial resources.

Strategic Hedging:

- Utilize financial instruments like options or forward contracts to mitigate risks associated with adverse currency movements that could negatively affect global investments. The goal is to safeguard against potential losses due to currency fluctuations.

Investment Portfolio Diversification:

- Incorporate global investments into a diversified portfolio strategy to spread risk and achieve a more balanced risk-return profile overall.

Summary

The objective of multinational capital budgeting is to make investment choices that enhance shareholder value, taking into account the complexities and risks of global markets. It entails a thorough examination of cash flows, risk assessment, management of currency exposure, and strategic alignment with the organization's global objectives and principles.

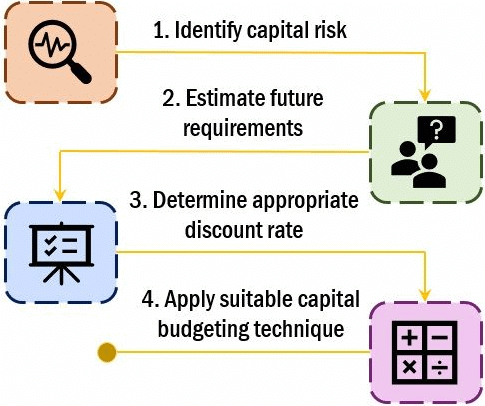

Steps of Multinational Capital Budgeting

Multinational capital budgeting is the process of evaluating and deciding on investments for projects or assets in different countries or currencies. This evaluation is crucial due to factors like exchange rate risks, political stability, and international regulations. Below are the steps involved in multinational capital budgeting:

Project Identification:

- The process initiates by identifying potential asset projects or opportunities in foreign countries that align with the organization's strategic objectives and growth plans.

Cash Flow Estimation:

- Estimate the cash flows linked with each investment project throughout its anticipated lifespan. This involves predicting revenues, expenses, and any anticipated capital outlays.

- Consider the cash flows in local currency and their potential conversion into the reporting currency of the firm.

Risk Assessment:

- Evaluate the diverse risks connected with each project, including currency exchange rate risks, political uncertainties, economic factors, regulatory challenges, and market risks.

- Analyze how these risks could impact the project's cash flows.

Currency Risk Management:

- Develop strategies to mitigate currency exchange rate risks, potentially involving the use of financial instruments such as forward contracts or options to hedge against unfavorable currency movements.

Cost of Capital Determination:

- Determine the appropriate cost of capital for each project, taking into account country-specific factors like nation risk premiums, inflation rates, and the cost of debt or equity in the local market.

Discounted Cash Flow (DCF) Analysis:

- Compute the Net Present Value (NPV) or other relevant financial metrics for each project using the estimated cash flows and the cost of capital.

- Discount cash flows to their present value in the reporting currency.

Sensitivity Analysis:

- Conduct sensitivity analysis to understand how variations in key variables, such as exchange rates, interest rates, or sales volumes, could affect the project's financial viability. This aids in assessing the project's resilience in different scenarios.

Ranking and Prioritization:

- Rank the investment projects based on their NPVs or other pertinent financial measures. Prioritize projects that offer the highest returns relative to their associated risks.

Strategic Alignment:

- Ensure that the selected projects align with the long-term strategic goals and plans of the organization. Evaluate how each project contributes to the firm's growth and competitiveness on a global scale.

Legal and Regulatory Compliance:

- Assess the legal and regulatory requirements in each country where investments will be made. Ensure compliance with local laws, tax regulations, and accounting standards.

Due Diligence:

- Conduct thorough due diligence on potential projects, including market research, competitive analysis, and evaluation of local partners or suppliers. Verify the feasibility of successfully executing the project.

Investment Decision:

- Make informed investment decisions based on the outcomes of the analysis. Approve projects that meet the financial criteria and strategic objectives of the firm.

Monitoring and Control:

- Implement a system for monitoring and managing the performance of global projects. Continuously track actual cash flows, compare them with projections, and adjust strategies as required.

Reporting and Communication:

- Communicate the results of the multinational capital budgeting analysis to key stakeholders, including senior management and the board of directors. Provide regular updates on the progress and performance of global investments.

Post-Investment Evaluation:

- Following project execution, conduct post-investment evaluations to determine if the expected returns and objectives are being achieved. Make necessary adjustments if deviations are observed.

Conclusion

Though the core ideas remain the same, handling finances across borders for businesses is more challenging because of currency uncertainties, political setbacks, tax complexities, and data gaps related to assets in different countries. For successful financial planning across borders, companies must understand and effectively deal with these risks and challenges. While managing finances within one country and its currency is domestic financial planning, dealing with multiple sets of rules, risks, and currencies is what makes financial planning across borders more difficult.

|

235 docs|166 tests

|

FAQs on International Arbitrage & Multinational Capital Budgeting - UGC NET Commerce Preparation Course

| 1. What is the difference between international arbitrage and multinational capital budgeting? |  |

| 2. Can you provide an example of international arbitrage? |  |

| 3. What are the factors that affect multinational capital budgeting decisions? |  |

| 4. What is the objective of multinational capital budgeting? |  |

| 5. What are the steps involved in multinational capital budgeting? |  |