Introduction - Redemption of Debentures | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Meaning of Redemption of Debentures:

Redemption of debentures means repayment of the amount of debentures to debenture holders.

Sources of Finance for the Redemption of Debentures:

Amount required for the redemption of debentures may be managed by a Company from the following sources:

(1) Redemption from the proceeds of fresh issue of shares and debentures:

When a Company is in need of additional funds for the redemption of debentures, it may decide to issue new equity shares, preference shares or debentures. The proceeds of the fresh issue of share capital and debentures are utilised for redeeming the old debentures.

(2) Redemption of Debentures out of Capital:

- When no profits are set aside for redemption of debentures it is called redemption out of Capital.

- No profits are transferred to Debenture Redemption Reserve.

In view of Section 71 (4) of the Companies Act 2013 and the Securities and Exchange Board of India (SEBI), it is not possible to redeem debentures purely out of capital:

(3) Redemption of Debentures out of Profits:

- Redemption out of profits means that an amount equal to debentures issued (i.e., 100% of the amount of debentures) is transferred from Surplus in Statement of Profit and Loss to a newly opened account named 'Debenture Redemption Reserve Account'.

- It reduces the amount of profit available for dividend.

SEBI Guidelines for redemption of debentures:

(i) The creation of Debenture Redemption Reserve (i.e., DRR) is obligatory only for non convertible debentures and non-convertible portion of partly-convertible debentures.

(ii) A company shall create DRR equivalent to at least 25% of the amount of debentures issued before starting the redemption of debentures.

(iii) Every company is required to create DRR shall before the 30th day of April of each year, deposit or invest, a sum which shall not be less than 15% of the amount of its debentures maturing (to be redeemed) during the year ending on the 31 st March of the next year.

| Type of Companies | Type of Debentures | Percentage of DRR |

| 1. All India Financial Institutions regulated by Reserve Bank of IndiaBanking Companies. | Public as well as placed debentures. | No DRR is required. |

| 2. Non-banking Financial Companies (NBFC) and other Financial Institutions (For example LIC, UTI etc.) | Publicly issued debentures. Privately placed debenture. | 25% No DRR is required. |

Treatment of debenture redemption reserve:

- Debenture Redemption Reserve is shown on the Equity and Liabilities part of the Balance Sheet under the head 'Shareholders' Funds' and sub-head 'Reserves and Surplus'.

- When all the debentures have been redeemed, Debenture Redemption Reserve Account is closed by transferring the amount to General Reserve.

Exemptions to the Rule of Creating DRR:

Rule 18 (7) of Companies (Share Capital and Debentures) Rules, 2014 exempts the following types of Companies from creating DRR

(i) Banking Companies; and

(ii) All India Financial Institutions regulated by Reserve Bank of India.

Methods for redemption of debentures:

Following are the methods of redemption of debentures.

1. Lump-sum payment at the end of fixed period.

2. Redemption of Debentures in instalments (By draw of lots).

3. By the purchase of own debentures in the open market.

4. By conversion into shares.

Lump-sum

Under this method, the Company redeems whole of its debentures in one lump-sum at the expiry of a specified period, i.e., at maturity date of the debentures or earlier at the option of the company.

Redemption out of profits

It is necessary to transfer an amount equal to 25% of the face value of debentures issued from Surplus in Statement of P & L to a newly opened account called Debenture Redemption Reserve.

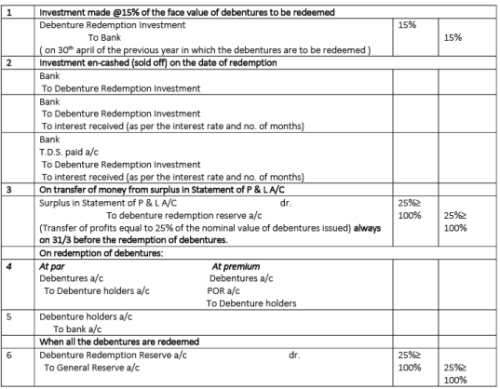

Important points for each entry

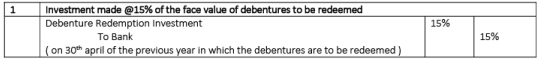

· Entry should be passed on 30th april of the previous year in which the debentures are to be redeemed.

For example– debentures are to redmeeed on 31st march 2014 then this entry will be passed on 30th april 2013.

· Entry should be passed by 15% of the face value of debentures to be redeemed.

For example– S ld . issues 1,000 10% debentures of Rs.100 and redeems them in lumpsum then this entry will be of 15% of Rs. 1,00,000 = Rs. 15000.

- R ld . issues 1,000 10% debentures of Rs. 100 and redeems 400 debentures then this entry will be of 15% of Rs. 40,000 = Rs. 6000.

· Entry should be passed on the date of redemption.

· Entry should be passed by 15% of the face value of debentures to be redeemed.

· And interest should be given as per the time period i.e. date on which invsetments were made and are sold off.

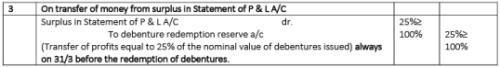

· Entry should be passed on 31/3 before the process of redemption of debentures begins.

· Entry should be passed with the minimum 25 % of the amount of the debentures which were issued.

For example– S ld . issues 1,000 10% debentures of Rs.100 and redeems them in lumpsum then this entry will be of 25% of Rs. 1,00,000 = Rs.25000 - R ld . issues 1,000 10% debentures of Rs.100 and redeems 400 debentures then this entry will be of 25% of Rs. 1,00,000 = Rs.25000.

If no information is available then it is assumed debentures are redeemed – 25% out of profits.

If debentures are to be redeemed fully out of profits - Entry should be passed with 100% of the amount of the debentures which were issued.

For transferring money to the General Reserve

· Entry is always on the date of redemption.

· Entry is always on the date of redemption · Entry is passed only when the process of redemption ends.

For example– S ld . issues 1,000 10% debentures of Rs.100 and redeems them in lumpsum then this entry will be of 25% of Rs. 1,00,000 = Rs. 25000 on the date redemption - R ld . issues 1,000 10% debentures of Rs. 100 and redeems 400 debentures then this entry will not be passed as all the debnetures had not been redeemed.

· If no information is available then it is assumed debentures are redeemed – 25% out of profits.

· If debentures are to be redeemed fully out of profits - Entry should be passed with 100% of the amount of the debentures which were issuedEntry is passed only when the process of redemption ends.

|

79 docs|43 tests

|

FAQs on Introduction - Redemption of Debentures - Crash Course of Accountancy - Class 12 - Commerce

| 1. What are debentures? |  |

| 2. What is the redemption of debentures? |  |

| 3. How can a company redeem its debentures? |  |

| 4. What is the difference between redemption at par and redemption at a premium? |  |

| 5. Can debentures be redeemed before the maturity date? |  |