Introduction to Company Law | Company Law - B Com PDF Download

| Table of contents |

|

| Introduction |

|

| Meaning of Company |

|

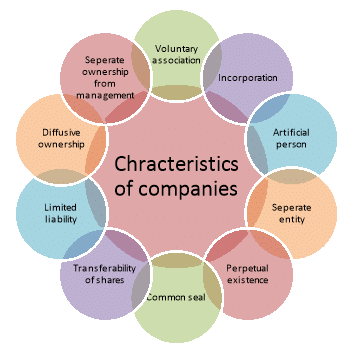

| Characteristics of a Company |

|

| Distinction Between Company and Partnership |

|

| Types of Companies |

|

| Summary |

|

Introduction

The industrial revolution brought about the rise of large-scale business organizations. These organizations require substantial investments and entail significant risks. Partnerships face two major limitations: limited resources and unlimited liability of partners, making it challenging for them to undertake big business ventures.

The Joint Stock Company form of business organization has gained immense popularity as it addresses the limitations of partnerships. Multinational companies like Coca-Cola and General Motors have investors and customers spread across the globe. In India, giant companies such as Reliance, Tata, Bajaj Auto, Infosys Technologies, Hindustan Lever Ltd., Ranbaxy Laboratories Ltd., and Larsen and Toubro have made a significant impact.

Meaning of Company

- A company, as defined in Section 3 (1) (i) of the Companies Act, 1956, is “a company formed and registered under this Act or an existing company.” An existing company, according to Section 3(1) (ii) of the Act, refers to a company formed and registered under any of the previous companies laws.

- This legal definition, however, does not capture the unique characteristics of a company. Chief Justice Marshall of the USA described a company as an artificial, invisible, and intangible person, existing only in the eyes of the law. It possesses only those properties granted to it by law, either explicitly or implicitly.

- Lord Justice Lindley provided a clearer definition, stating that a company is an association of individuals who contribute money or assets to a common fund for the purpose of conducting trade or business, sharing the profits and losses. The contributed capital, represented in money, constitutes the company’s capital, and the contributors are members. Each member’s share is proportional to their capital contribution, and shares are transferable, though the right to transfer may be restricted.

- Haney described a joint-stock company as a voluntary association of individuals for profit, with capital divided into transferable shares, ownership of which is a condition of membership.

- From these definitions, a company can be understood as a registered association that is an artificial legal person with an independent legal entity, perpetual succession, a common seal for signatures, a common capital made up of transferable shares, and limited liability.

Characteristics of a Company

A company possesses several key characteristics that define its nature and functioning. These include:

1. Incorporated Association

- A company is formed when it is registered under the Companies Act, and it comes into existence from the date specified in the certificate of incorporation.

- According to Section 11 of the Act, associations of more than ten persons engaged in banking or more than twenty persons in any other business must be registered, or they are deemed illegal.

- For a public company, at least seven people are required to form it, while a private company needs a minimum of two. These individuals must subscribe to the Memorandum of Association and fulfill other legal requirements for registration.

2. Artificial Legal Person

- A company is considered an artificial legal person. It is not a natural person and exists in the eyes of the law. It cannot act on its own and must operate through a board of directors elected by the shareholders.

- The board of directors is referred to as the "brains" of the company, as it is the only entity through which the company can act.

- For many legal purposes, a company has similar rights to a natural person, such as the ability to acquire and dispose of property, enter into contracts, and sue or be sued in its own name.

- However, a company is not a citizen and does not enjoy the same rights under the Constitution of India or the Citizenship Act. It does not possess fundamental rights but is still considered a legal person.

- A company can enter into contracts with its directors, members, and outsiders. Even if all its members are Indian citizens, the company itself is not considered a citizen of India.

3. Separate Legal Entity

- A company has a distinct legal identity, separate from its members. Creditors can only recover debts from the company and its assets, not from individual members.

- Similarly, the company is not responsible for the personal debts of its members. The company's assets are meant for its benefit, not for the personal gain of shareholders.

- Shareholders cannot claim ownership rights over the company's assets, either individually or collectively, while the company exists or during its winding-up process.

- Members can enter into contracts with the company, just like any other individual. The Income Tax Act also recognizes the separate legal entity of a company.

- When a company pays income tax on its profits and distributes these profits as dividends to shareholders, the shareholders must pay income tax on their dividends as well. This illustrates that the company and its shareholders are distinct entities.

- The principle of separate legal entity was highlighted in the case of Salomon v. Salomon & Co. Ltd. In this case, Mr. Salomon sold his successful shoe business to Salomon and Co. Ltd., a company he formed with his family.

- When the company went into liquidation, unsecured creditors tried to claim priority over Mr. Salomon's debenture on the grounds that he and the company were the same entity. However, the House of Lords ruled that the company’s existence was independent of its members, and its assets should be used to pay its debts.

Features of a Company

The following are the main features of a company:

1. Separate Legal Entity: Company is considered a separate legal entity from its members. This means that the company has its own legal status, distinct from the individuals who own it. For example, in the case of Saloman v. Saloman & Co. Ltd. (1897), it was established that a registered company is a separate entity even if one person holds all the shares. The principle of separate legal entity applies regardless of the number of shareholders.

2. Perpetual Existence: Company has perpetual existence, meaning its life does not depend on the death, insolvency, or retirement of its members or directors. The company can continue to exist indefinitely, regardless of changes in its membership. For instance, during a war, a private company survived even when all its members were killed because the company itself continued to exist.

3. Common Seal: Company, being an artificial person, cannot sign documents like a natural person. Instead, it acts through its directors. To bind the company legally, documents must bear its common seal, which has the company's name engraved on it. The Articles of Association of a company may specify how the common seal is affixed to documents. If not, the provisions of Table-A, the model set of articles in the Companies Act, apply.

4. Limited Liability: Companies can be limited by shares or by guarantee. In a company limited by shares, members' liability is limited to the unpaid value of their shares. For example, if a share has a face value of Rs. 10 and a member has paid Rs. 7, they can be called to pay no more than Rs. 3 per share. In a company limited by guarantee, members' liability is limited to the amount they agree to contribute to the company's assets in case of winding up.

5. Transferable Shares: In a public company, shares are freely transferable. This means that shareholders can transfer their shares to others without restrictions, allowing for liquidity and flexibility in ownership.

7. Right to Transfer Shares

- The right to transfer shares is a legal right that cannot be taken away by a company's articles of association.

- However, the articles can specify how the transfer of shares will be conducted and may include reasonable restrictions on members' rights to transfer their shares.

- Absolute restrictions on members' rights to transfer shares are not allowed and are considered ultra vires (beyond the powers).

- In the case of a private company, the articles can restrict members' rights to transfer shares as per statutory definitions.

- To make the right to transfer shares more effective, shareholders can apply to the Central Government if a company refuses to register a transfer of shares.

8. Separate Property

- A company is a legal entity distinct from its members, which means it can own, enjoy, and dispose of property in its own name.

- Although shareholders contribute the company's capital and assets, they do not have private or joint ownership of the company's property.

- The company is the true owner of all its property, which is controlled, managed, and disposed of by the company itself.

9. Delegated Management

- A joint stock company is an independent and self-governing organization.

- Due to the large number of members, not all can participate in managing the company.

- Therefore, management is delegated to elected representatives called directors, who handle day-to-day operations.

- Shareholders, by majority vote, set the company's general policy, ensuring democratic management.

- Majority decisions and centralized management promote unity of action within the company.

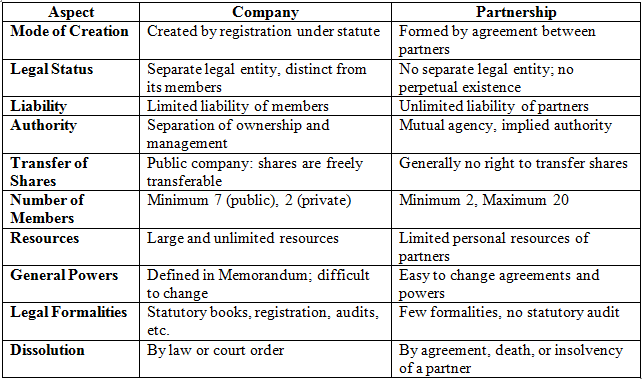

Distinction Between Company and Partnership

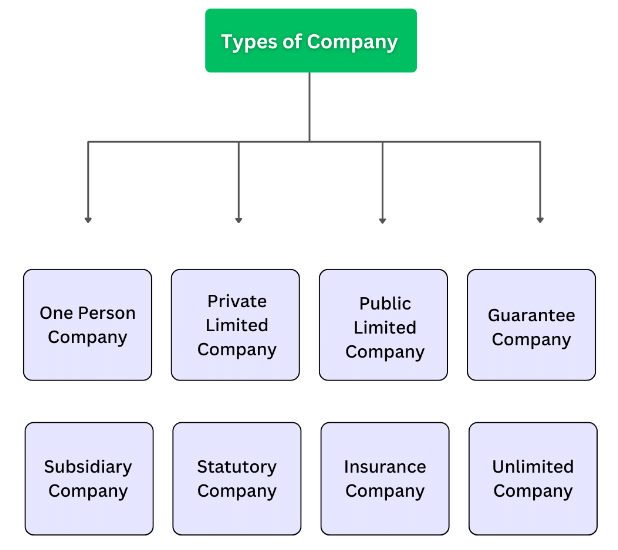

Types of Companies

1. Classification Based on Mode of Incorporation

- Chartered Companies: These companies are incorporated under a special charter granted by a monarch. Examples include the East India Company and the Bank of England. A chartered company has broad powers, including the ability to deal with property and enter contracts. If it deviates from its prescribed business, the monarch can revoke the charter and close the company. These companies no longer exist in India.

- Statutory Companies: These companies are created by an Act of Parliament or the State legislature. Examples include the Reserve Bank of India, the State Bank of India, and the Life Insurance Corporation. Statutory companies do not have a memorandum or articles of association. They derive their powers from the Act that establishes them and can undergo changes through legislative amendments. They are typically formed to meet social needs rather than for profit-making.

- Registered or Incorporated Companies: These companies are formed under the Companies Act, 1956, or previous legislation. They come into existence once registered with the Registrar of Companies and receive a certificate of incorporation. Registered companies can be further divided into the following categories:

- Companies Limited by Shares: These companies have a share capital, and the liability of each member is limited to the unpaid amount on their shares. This is the most common type of company, and it can be either a public or private company.

- Companies Limited by Guarantee: These companies may or may not have share capital. Members guarantee to pay a specific amount in case of liquidation. Such companies are usually non-profit and formed to promote culture, science, charity, or similar causes.

- Unlimited Companies: These companies have no limit on the liability of their members. They may or may not have share capital and can be either a public or private company.

2. Classification Based on Number of Members

Private Company: According to the Indian Companies Act, 1956, a private company is one where:

- The number of members does not exceed fifty (excluding employees or ex-employees who are members).

- The right to transfer shares is restricted.

- Public subscription for shares is prohibited. Private companies must have at least two members and use the term “Pvt” in their name. They have the advantage of certain restrictions and privileges, such as limited share transferability and exemption from issuing a prospectus.

Public Company: A public company, under Section 3 (1)(iv) of the Companies Act, 1956, is not a private company. It:

- Does not restrict the transfer of shares.

- Has no limit on the number of members.

- Can invite the public to purchase shares and debentures. The minimum number of members required to form a public company is seven.

Differences Between a Public and Private Company:

- Minimum Members: A public company requires at least seven members, whereas a private company needs only two.

- Transfer of Shares: In a public company, shares can be freely transferred, but in a private company, the transfer is restricted.

- Directors: A public company must have at least three directors, while a private company needs only two.

- Invitation to Public: Public companies can invite the public to subscribe for shares, but private companies cannot.

- Quorum for Meetings: A public company needs five members for a quorum, while a private company only requires two.

- Commencement of Business: A private company can start its business immediately after receiving a certificate of incorporation, while a public company requires a certificate of commencement of business.

3. Classification Based on Control

- Holding Company: A holding company has control over another company (its subsidiary). It can control its subsidiary by holding more than 50% of the shares or voting rights, or by having the right to appoint the majority of directors.

- Subsidiary Company: A subsidiary company is controlled by a holding company. While both companies remain separate legal entities, the holding company manages and controls the affairs of the subsidiary.

4. Classification Based on Ownership

- Government Companies: A government company is one where at least 51% of the paid-up capital is held by the Central or State Government. Examples include Mahanagar Telephone Corporation and Bharat Heavy Electricals Limited. These companies are not agents of the government, although they are owned or controlled by it.

- Non-Government Companies: These are companies not owned or controlled by the government. They do not meet the criteria of a government company.

5. Classification Based on Nationality

- Indian Companies: These companies are registered in India under the Companies Act, 1956, and have their registered office in India. The nationality of the members is irrelevant.

- Foreign Companies: A foreign company is one that is incorporated outside India but has a place of business in India. This includes companies that have an office, warehouse, or other premises in India.

Summary

A company is a group of people coming together to achieve a common goal. When a company is formed and registered under the Companies Act, it comes with specific features that indicate its nature. These features are often referred to as the advantages of a company because they offer benefits compared to other business organizations. Companies can be categorized into five types based on:

- Mode of incorporation

- Number of members

- Control

- Ownership

- Nationality

|

112 docs|32 tests

|

FAQs on Introduction to Company Law - Company Law - B Com

| 1. What are the key provisions of the Companies Act related to corporate governance? |  |

| 2. How does Company Law regulate the formation and dissolution of companies? |  |

| 3. What are the legal requirements for holding annual general meetings (AGMs) under Company Law? |  |

| 4. How does Company Law protect the interests of shareholders in a company? |  |

| 5. What role does the Registrar of Companies play in enforcing Company Law regulations? |  |