Ledger (Part - 2) - Commerce PDF Download

Page No 13.60:

Question 5:

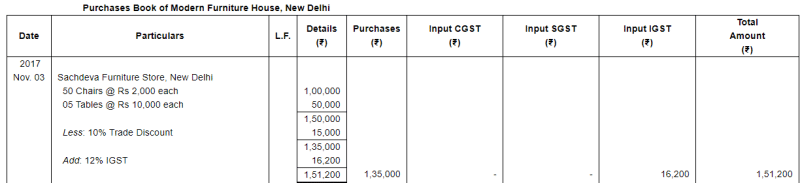

Record the following transaction in the Purchases Book of Modern Furniture House, New Delhi assuming CGST @ 6% and SGST @ 6% and post it into Ledger:

| 2017 | |

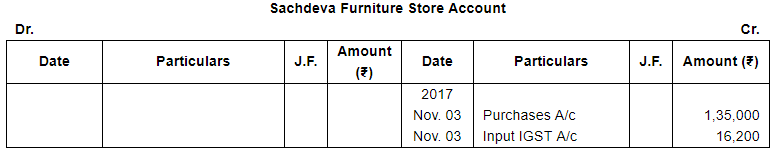

| Nov. 3 | Purchased goods from Sachdeva Furniture Store, New Delhi : |

50 Chairs @ ₹ 2,000 each | |

5 Tables @ ₹ 10,000 each | |

Less: 10% Trade Discount | |

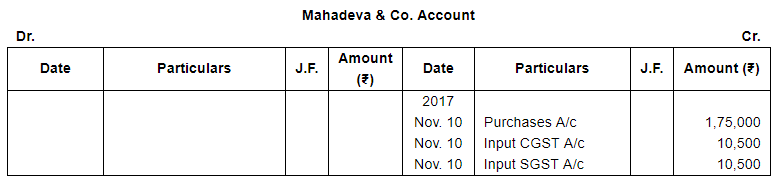

| 10 | Purchased furniture from Mahadeva & Co., Jaipur (Rajasthan) valued ₹ 2,00,000, less  Trade Discount. Trade Discount. |

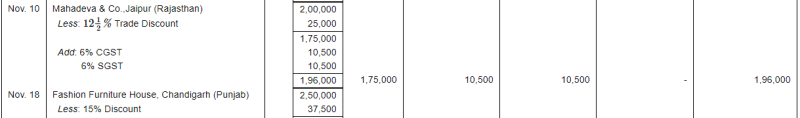

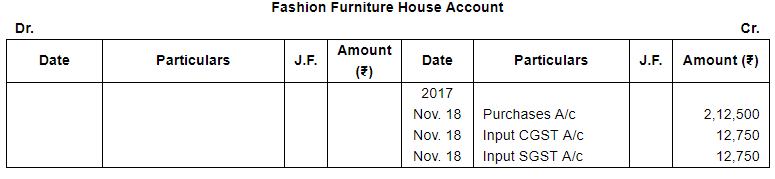

| 18 | Purchased furniture from Fashion Furniture House, Chandigarh of the list price of ₹ 2,50,000, less 15%. |

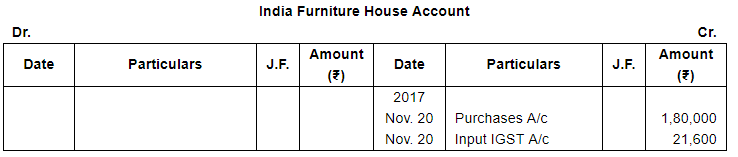

| 20 | Purchased from India Furniture House, New Delhi : |

100 Chairs @ ₹ 1,800 each | |

| 25 | Purchased from Mohan Lal & Sons furniture of the value of ₹ 20,000 for cash. |

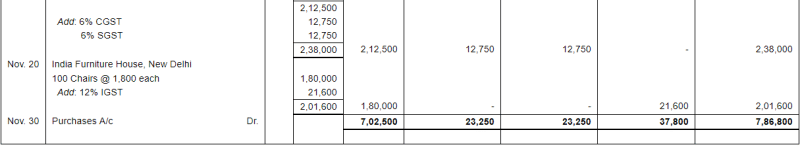

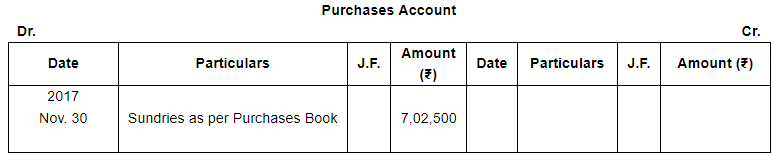

ANSWER:

Note: Transaction on Nov. 25 will not be recorded in the Purchases Book as it is a cash transaction.

(2) Input CGST, Input SGST and Input IGST according to text book are Rs.18,900, 18,900 and Rs.46,500 respectively while as per our calculation Input CGST, Input SGST and Input IGST are Rs.23,250, 2,250 and Rs.37,800 respectively

Page No 13.60:

Question 6:

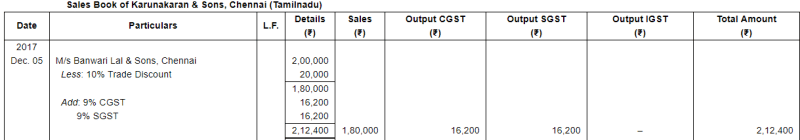

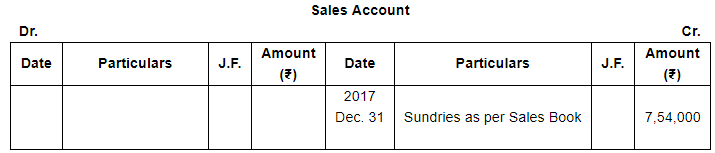

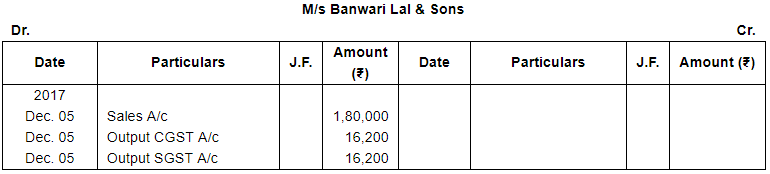

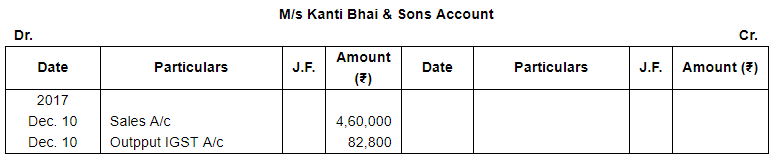

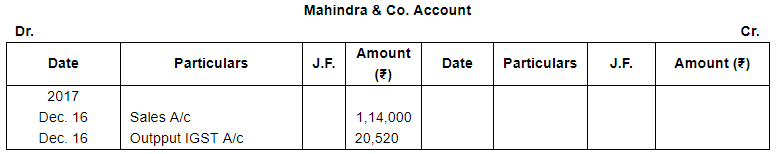

Record the following transaction in the Sales Book of Karunakaran & Sons, Chennai (Tamilnadu) assuming CGST @ 90% and SGST @ 9% and post them into Ledger:-

| 2017 | |

| Dec. 5 | Sold of M/s Banwari Lal & Sons, Chennai, goods valued at ₹ 2,00,000 less Trade Discount 10%. |

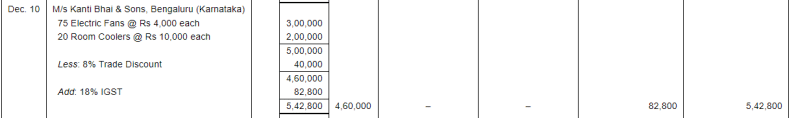

| 10 | Sold to M/s Kanti Bhai & Sons, Bengaluru (Karnataka) : |

| 75 Electric Fans @ ₹ 4,000 each | |

| 20 Room Coolers @ ₹ 10,000 each | |

| Less: Trade Discount 8% | |

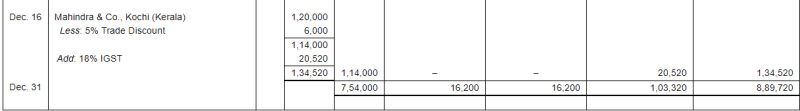

| 16 | Mahindra & Co., Kochi (Kerala) purchased from us goods of ₹ 1,20,000, less: 5%. |

| 24 | Sold goods for cash ₹ 60,000. |

ANSWER:

Note: Transaction on Dec. 24 will not be recorded in the Sales Book as it is a cash transaction.

Page No 13.61:

Question 7:

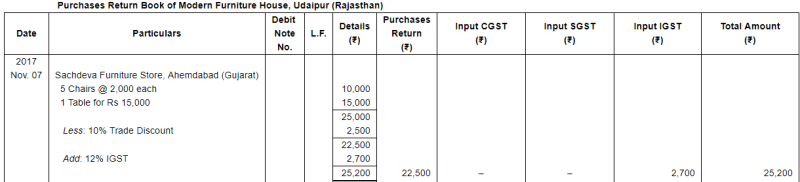

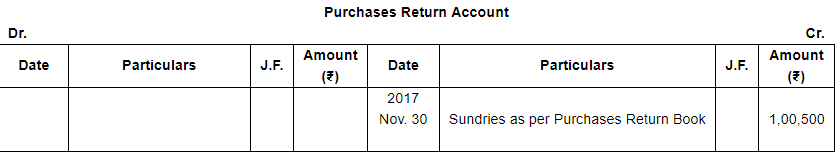

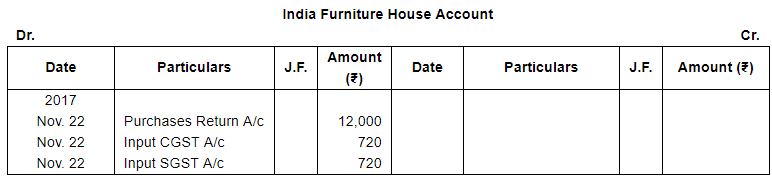

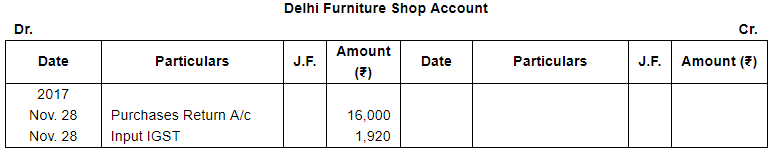

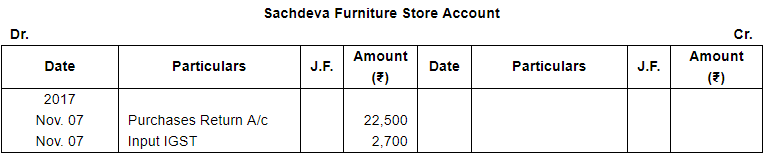

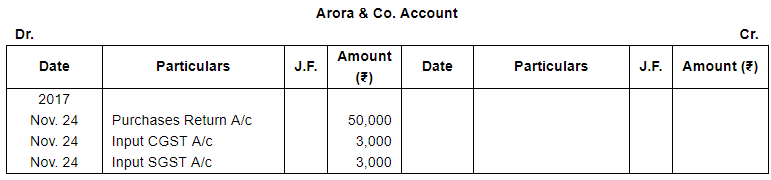

Enter the following transactions in Return Outward Book of Modern Furniture House, Udaipur (Rajasthan) assuming CGST @ 6% and SGST @ 6% and post it into Ledger:-

| 2017 | |

| Nov. 7 | Returned to Sachdeva Furniture Store, Ahmedabad (Gujarat) : |

| 5 Chairs @ ₹ 2,000 each | |

| 1 Table for ₹ 15,000 | |

| Less: 10% Trade Discount | |

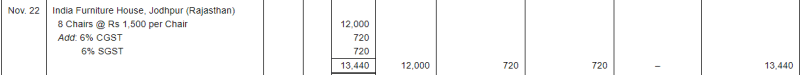

| 22 | Returned 8 Chairs to India Furniture House, Jodhpur (Rajasthan) @ ₹ 1,500 each, being not of specified quality. |

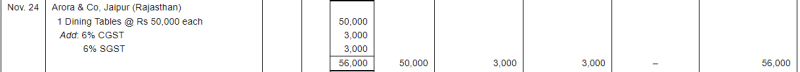

| 24 | Returned one Dining Table to Arora & Co., Jaipur (Rajasthan) being not according to sample ₹ 50,000. |

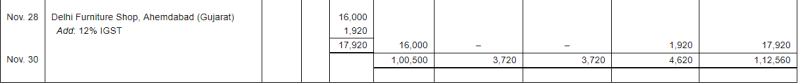

| 28 | Allowance claimed from Delhi Furniture Shop, Ahmedabad (Gujarat) on account of mistake in the invoice ₹ 16,000. |

ANSWER:

Question 8:

Question 8:

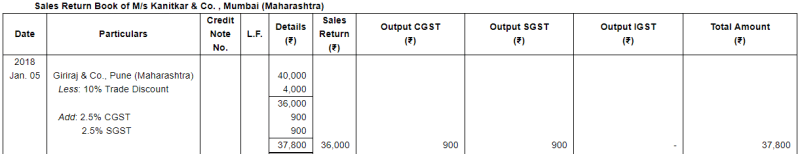

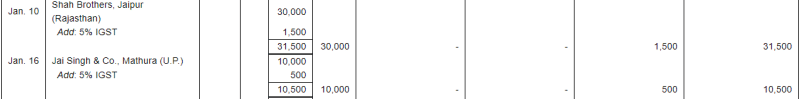

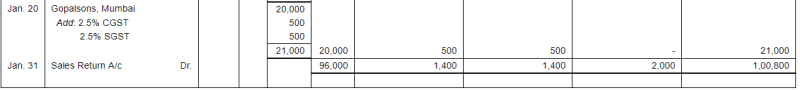

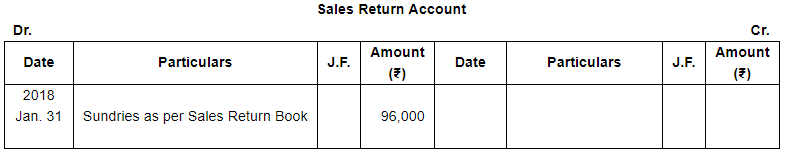

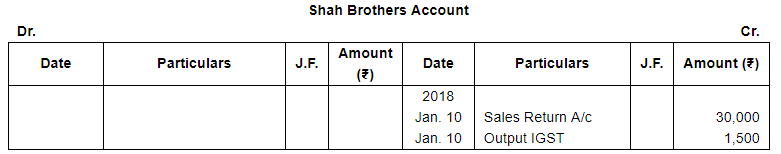

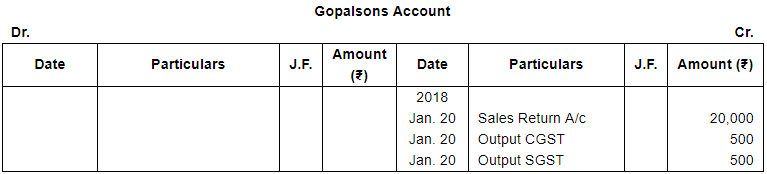

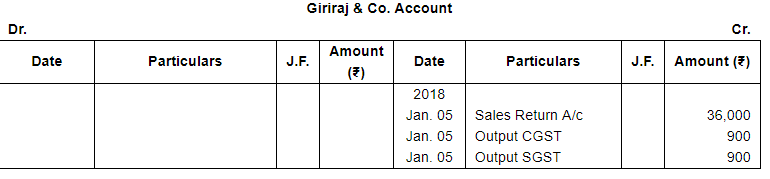

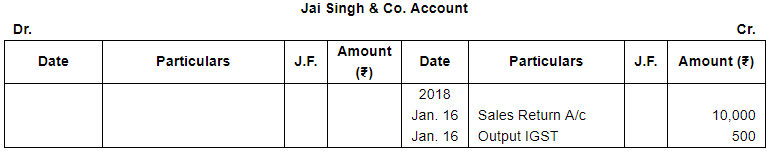

Enter the following transactions in Return Inward Book of M/s Kanitkar & Co. of Mumbai (Maharashtra) assuming CGST @ 2.5% and SGST @ 2.5% and post it into Ledger:

| 2018 | |

| Jan. 5 | Goods returned to us by Giriraj & Co., Pune (Maharashtra) worth ₹ 40,000, less 10% trade discount. |

| 10 | Shah Brothers, Jaipur (Rajasthan) returned goods, being not according to sample ₹ 30,000. |

| 16 | Allowance claimed by Jai Singh & Co., Mathura (U.P) on account of a mistake in the invoice ₹ 10,000. |

| 20 | Good returned by Gopalsons, Mumbai being defective ₹ 20,000. |

ANSWER:

Page No 13.61:

Question 9:

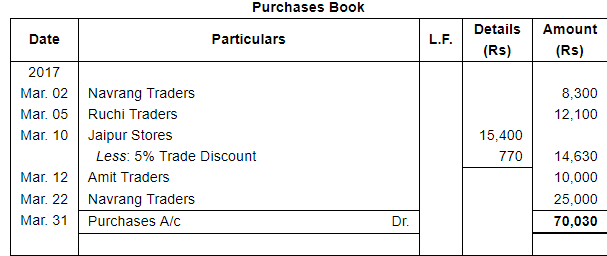

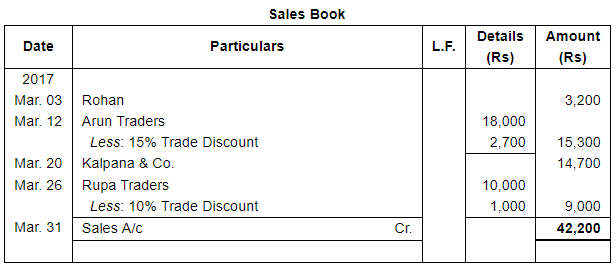

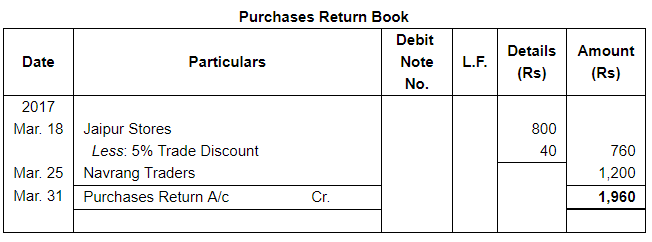

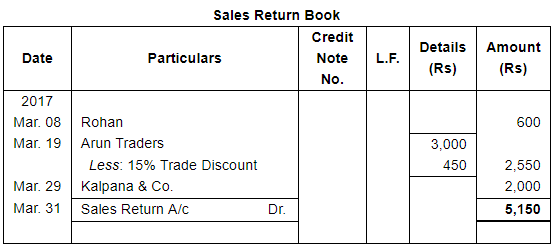

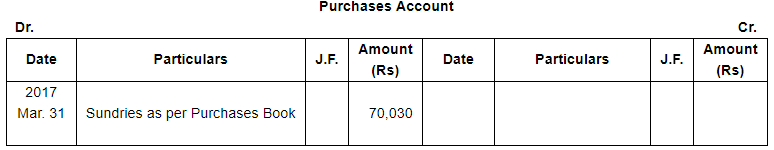

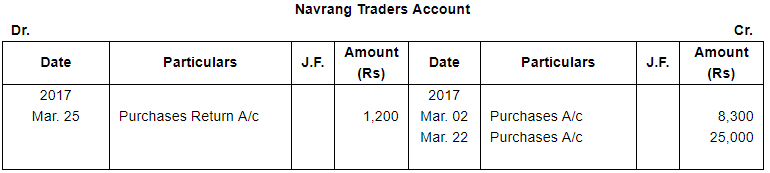

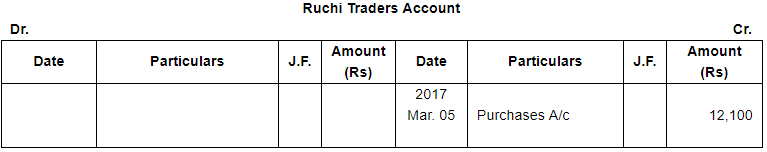

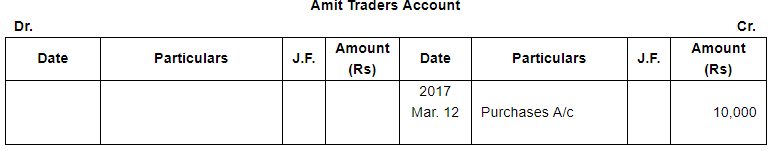

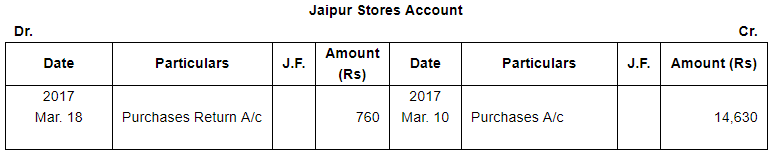

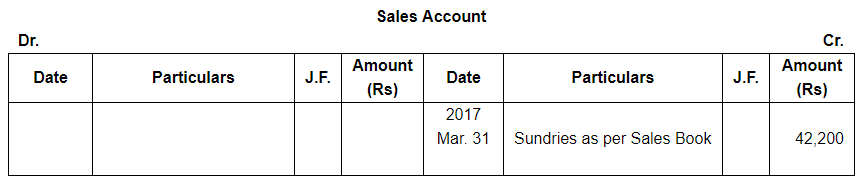

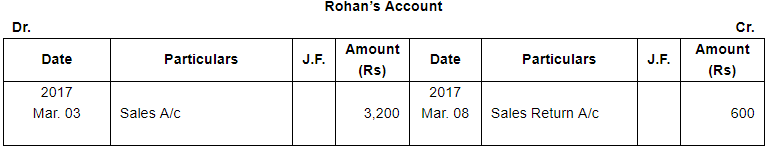

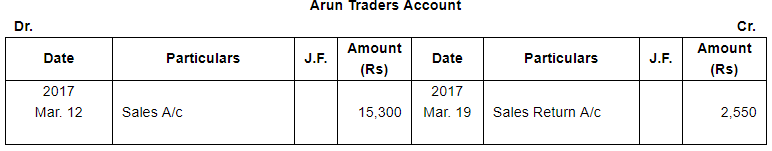

Enter the following transactions in proper Subsidiary Books and post them into Ledger:−

2017 | |

| March 2 | Purchased from Navrang Traders for ₹ 8,300 |

| 3 | Sold goods to Rohan for ₹ 3,200 |

| 5 | Bought of Ruchi Traders for ₹ 12,100 |

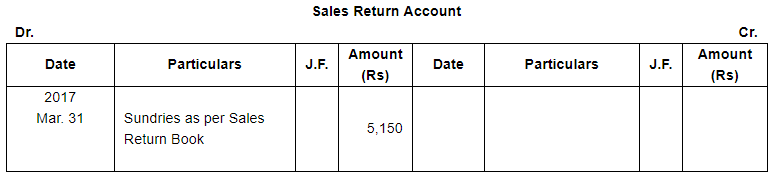

| 8 | Rohan returns the goods for ₹ 600 |

| 10 | Purchased goods from Jaipur Stores of the list price of ₹ 15,400 less 5% Trade Discount |

| 12 | Sold goods to Arun Traders for ₹ 18,000 less 15% Trade Discount |

| 12 | Bought of Amit Traders for ₹ 10,000 |

| 16 | Purchased Machinery from Kirloskar Ltd. ₹ 20,000 |

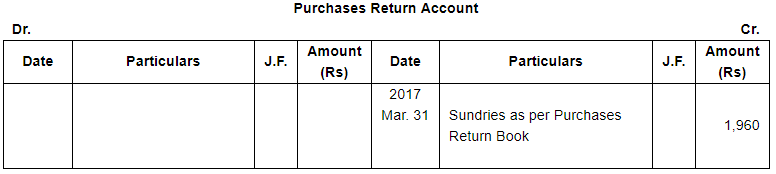

| 18 | Returned goods to Jaipur Stores for ₹ 800 less 5% Trade Discount. |

| 19 | Arun Traders returned goods for ₹ 3,000, less 15% Trade Discount |

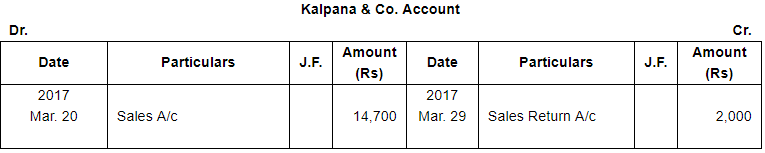

| 20 | Sales to Kalpna & Co. for ₹ 14,700 |

| 22 | Purchased goods from Navrang Traders ₹ 25,000 |

| 25 | Returns outward to Navrang Traders for ₹ 1,200 |

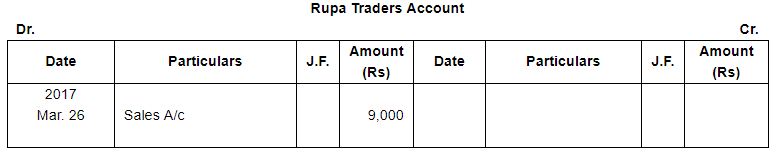

| 26 | Sales to Rupa Traders for ₹ 10,000 less 10% Trade Discount |

| 29 | Returns inward from Kalpana & Co. for ₹ 2,000 |

ANSWER:

FAQs on Ledger (Part - 2) - Commerce

| 1. What is a ledger in commerce? |  |

| 2. What are the types of ledgers used in commerce? |  |

| 3. How is a ledger different from a journal in commerce? |  |

| 4. What is the importance of a ledger in commerce? |  |

| 5. How can a ledger be maintained in commerce? |  |