Meaning, Scope & Objectives - Introduction to Cost Accounting, Cost Accounting | Cost Accounting - B Com PDF Download

Introduction

- Cost Accounting is a specific area of accounting focused on tracking, recording, and distributing costs related to products and services.

- It helps in figuring out the costs associated with making products or providing services and determining how profitable they are.

- Cost accounting includes creating regular reports and statements that help in managing costs and making business decisions.

- This unit will cover the following key topics:

- The nature and scope of cost accounting.

- The importance of cost accounting and why it is needed.

- What cost accounting is, including its definition and main goals.

- The differences between cost accounting and financial accounting.

- The benefits of using cost accounting.

- How to set up a costing system within a business.

Need for Costing

- Every economic activity, especially those that produce goods or provide services, involves some level of spending.

- This spending can include costs for materials, labor, and other direct or indirect expenses.

- The main goal of these activities in a business is to make a profit.

- Therefore, it is important to clearly identify all three parts of a transaction: cost, profit, and price.

- For instance, if a shoe factory introduces a new pair of sports shoes, it incurs the following costs:

- Rs. 20 for materials

- Rs. 30 for labor

- Rs. 25 for other expenses (overheads)

- The selling price of the shoes is set at Rs. 100 per pair.

- Thus, the total cost of producing one pair of shoes is Rs. 75 (which is 20 + 30 + 25).

- The selling price is Rs. 100, leading to a profit of Rs. 25 (calculated as 100 - 75).

- Management needs this information for every product made and every activity carried out to assist in planning, cost control, and decision-making.

- However, the records kept under financial accounting do not provide the needed details.

- To address this gap, accountants created a new method called cost accounting.

- This system keeps track of transactions in such a way that detailed cost information is easily accessible for each product, job, department, and process.

- The limitations and issues found in financial accounting highlighted the necessity for cost accounting.

Limitations of Financial Accounting

- It does not provide detailed operating information for each department, process, product, or other unit of activity within the organisation. It simply provides information in terms of income, expenses, assets and liabilities for the enterprise as a whole.

- It does not classify expenses into direct and indirect or fixed and variable. The costs are not assigned to the products at each stage of production so as to reveal controllable and uncontrollable items.

- It does not set up a proper system of control over the main elements of cost viz., materials and labour. Hence, the wastages and losses of materials go unchecked and utilisation of labour time remains uncontrolled.

- It does not establish standards or norms against which different cost items can be compared.

- It does not provide adequate costing information for fixation of selling price of various products manufactured or services provided by the organisation.

- It contains historical cost information which is compiled at the end of the accounting period. Hence, it becomes difficult to compile cost data at frequent intervals.

- Since product-wise cost and profit information is not available from financial accounts, the analysis of causes for profit or loss cannot be effectively done. Financial accounts are at best like a thermometer which can only indicate the temperature of the body but cannot help diagnosis or cause analysis of its health.

Costing and the Economy

Let us now analyse the need for costing in a relatively wider perspective. Modern economy has a few characteristic features which further establish the necessity of costing. These can be summarised as follows:

- Global Competition: There is a growing level of competition in the market from both inside and outside the organization. Only those producers who maintain strict control over their costs and implement effective pricing strategies will be able to succeed.

- Limited Resources: Resources are becoming increasingly scarce, which necessitates the need for effective and economical use. This means reducing waste and losses.

- Complex Management: Managing industrial organizations has turned into a very complicated task. It requires careful attention and action at every stage of the operation and in all areas of production.

- Fast Decisions: There is a need for quick and accurate decisions based on sufficient information that is backed by trustworthy data.

- Special Responsibility: Every business has a significant social duty to ensure proper product quality, fair pricing, and consistent supply among other responsibilities.

- Optimum Profit: The main goal of all business activities is to maximize profit, which relies heavily on effective performance in financial management, workforce management, production processes, and marketing efforts.

If we correlate the above factors, costing appears to be the only underlying link between different factors and the only unifying force behind business success. Costing aids pricing, checking of wastage, control of resources, management of processes, flow of data for decisions, discharge of social obligations and provides an opportunity for profit growth in the organisation. A large number of industrial establishments, therefore, have been showing an increasing confidence and reliance in the system of costing and have been applying it to the management of their different economic’ assignments.

Definitions of Costing and Cost Accounting

- The term ‘Costing’ refers to the method and process of determining costs. It includes principles and rules that are used to find out the costs of goods produced and services provided.

- The term ‘Cost Accounting’ is the process of keeping track of costs. It starts with recording all income and expenses and ends with creating regular statements and reports to help understand and control costs. Therefore, cost accounting is a broader term that includes costing. However, in practice, these two terms are often used the same way.

- Wheldon has elaborated on the definitions of ‘Costing’ and ‘Cost Accounting’ and provided a detailed definition of costing. He states that costing involves classifying, recording, and allocating spending appropriately to determine the costs of products or services. It also involves presenting organized data for management control and guidance.

- In the early development of cost accounting, the terminology published by the Institute of Cost and Management Accounts (ICMA) in the U.K. distinguished between ‘Cost Accounting’ and ‘Cost Accountancy’. The latter was defined as applying costing and cost accounting principles, methods, and techniques to manage costs, determine profitability, and present information for managerial decisions. However, today the term ‘Cost Accountancy’ is rarely used. Most authors use ‘Cost Accounting’ and do not usually recommend the term ‘Costing’.

- According to the latest terminology from the Institute of Cost and Management Accountants, ‘Cost Accounting’ is a part of management accounting that establishes budgets, standard costs, and actual costs of operations, processes, departments, or products. It also involves analyzing variances, profitability, and the effective use of funds.

- We can summarize the key points about cost accounting as follows:

- Cost accounting is a method of accounting for costs.

- It includes tracking income and expenses related to the production of goods or services.

- It provides statistical data that can be used for future estimates.

- It helps in determining and controlling the costs of products and services.

- It involves several functions:

(i) Analysis

(ii) Recording

(iii) Establishing budgets and standards

(iv) Comparison

(v) Reporting

Objects of Cost Accounting

The main objects of cost accounting are as follows:

- To ascertain the cost of products and services;

- To aid in fixation of selling price or quotation for tenders;

- To analyse and classify the different elements of cost which constitute the total cost;

- To identify causes of wastage and apply appropriate course of action for checking the wastage;

- To control costs by analysis and comparisons;

- To communicate to the management all information relating to costs and facilitate managerial decision-making;

- To judge the relative efficiency of different departments, branches, products, units, plants and machinery and devise means of increasing their productivity; and

- To produce cost statements as and when required by the management for an interim review of production, sales and profit or to plan future activities. Thus, the objects of costing establish the fact that it is an essential branch of accounting. It is the key to economy in cost of production and is an essential technique of ensuring efficiency in management.

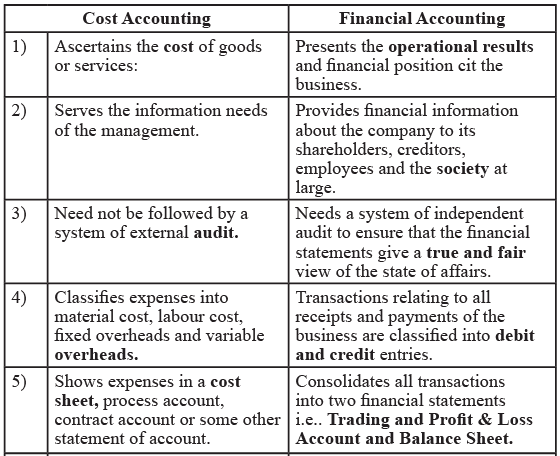

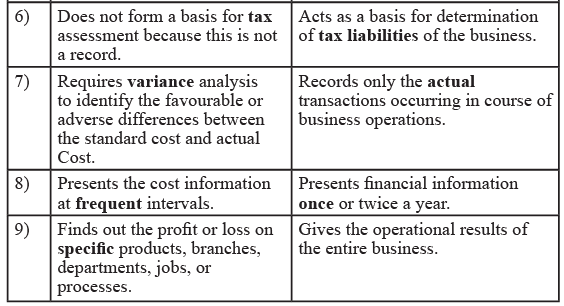

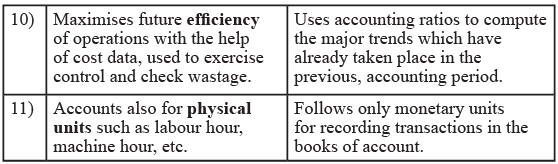

Difference Between Cost Accounting And Financial Accounting

The difference between Cost Accounting and Financial Accounting is as follows:

Common Goal: Despite the differences of purpose and approach between Cost Accounting and Financial Accounting, both the systems have a common goal of continuously assisting the organisation they serve. In fact, the two are complementary to each other. In a developing enterprise, therefore, both the systems operate to the advantage of the organisation and contribute to the smooth running of the business.

Advantages of Cost Accounting

- A well-organized costing system provides a steady flow of information about production, costs, materials, labor, inventory, and plant capacity. This aids in planning output effectively.

- It helps to spot unproductive activities, waste of resources, old machinery, and areas that are not working efficiently, which need quick solutions.

- Cost accounting ensures the collection of accurate and trustworthy cost data.

- It allows for the preparation of budgets and business forecasts.

- The system measures how well operations are performing by setting standards and analyzing variances.

- It aids in determining selling prices.

- Cost accounting allows for comparisons of costs across different time periods, products, departments, or companies.

- It enables advance estimates of costs and revenues.

- The system supports inventory control and regular stock-taking.

- It helps identify unused capacity and the costs associated with operating below the installed capacity.

- It allows for the frequent determination of cost and profit, along with a detailed examination of their causes.

- Decisions can be made based on facts and figures, which helps in creating effective policies for various issues such as:

- output levels

- make or buy decisions

- upgrading or replacing old equipment

- whether to shut down or continue operations during a downturn

- introducing new products or discontinuing old ones

- accepting special orders

- replacing labor with machinery

Because of the above advantages of cost accounting, its use is no more restricted to manufacturing establishments. Now-a-days, costing is used by various institutions-such as hospitals, transport undertakings, local authorities, offices, banks, educational institutions, etc. Besides, costing is of considerable advantage to the consumers. They get products at reasonable prices due to proper costing system. To the employees of the organization, costing is beneficial in granting incentives to good work, bonus and higher wages. Costing helps the investors, bankers, lenders and shareholders in evaluating the past profitability and future prospects of the company. It ultimately benefits the economic development of the country as a whole because of efficiency in industrial operations, effective mobilisation of resources, balanced utilisation of funds and timely achievement of targets.

Installation of a Costing System

- With the growth in the size and variety of businesses, a single costing system cannot meet the needs of every organization.

- The rules and methods of costing must be tailored to fit the unique features and environment of each organization.

- A well-designed costing system that matches the organization is essential for effective operations.

- Before setting up a costing system, it is wise to conduct a preliminary investigationto understand the specific needs of the business regarding:

- Product

- Organization

- Manufacturing process

- Selling and distribution methods

- Additionally, the implementation should ensure that:

- The current organization is minimally disrupted.

- The system is introduced gradually.

- The costing process is concise and focuses on relevant details.

- The procedure is simple and cost-effective to run.

- The system can produce regular reports for different levels of management.

- Two other important aspects to evaluate before starting a costing system are:

- What are the main objectives of costing in the business? For instance, is it being introduced to set prices, control costs, or both?

- What are the practical challenges in implementing the system?

Possible Difficulties

We must be conscious of the difficulties in introducing the system of costing and that they have to be overcome. These difficulties usually are:

- Inadequate support from top management and opposition to the system by some officers.

- Resistance from staff associated with the operation of the financial accounting system.

- Resentment at other levels in view of the additional work expected due to the costing system.

- Shortage of trained and qualified staff to handle the new system.

- Heavy costs involved in the process of installation.

Factors to be Considered

The following factors should be considered before the installation of a system of costing:

- Objective of the costing system.

- Nature of the business.

- Quality of the management.

- Size and type of organisation, scope of authority, sources of information and reports to be submitted.

- Technical aspect of the business.

- Attitude and behaviour of the staff in extending co-operation to the system and the organization.

- Impact of different operations on variable expenses.

- Manner of reconciliation between cost and financial accounts and the possibilities of developing them into an integrated system of accounting through control accounts.

- Quantum of information needs and the process of collecting the data without much labour.

- Nature of the product and the type of costing system which will suit the product.

- Extent to which the importance of the system can be appreciated by the supporting staff and an awareness created among them about the relevance of regular data collection.

Success of the Costing System

The requisites of an effective system of costing are as follows:

- It fits the needs and goals of the business.

- It is user-friendly and easy to manage. Standard forms should be used, and the purpose of each record and report should be clear to everyone involved.

- It gets full support from the staff.

- It guarantees quick and regular delivery of necessary information for preparing and presenting costing reports.

- It is well-connected to the financial accounting system, making it easier to match the results from cost accounts with financial accounts.

- It helps in effective cost control.

- It allows for comparison between estimates and actual outcomes.

- There is a lot of flexibility in the system, so it can easily adapt to changing business conditions or needs.

- The cost of setting up and running the costing system is worth it because of the benefits it brings.

Thus, the system of costing proposed to be installed in an organisation must be properly planned and introduced carefully so that it is competent enough to deliver the desired results. Much depends upon the manner in which the system operates so as to derive its best advantage.

|

117 videos|134 docs|14 tests

|

FAQs on Meaning, Scope & Objectives - Introduction to Cost Accounting, Cost Accounting - Cost Accounting - B Com

| 1. What is cost accounting? |  |

| 2. What is the scope of cost accounting? |  |

| 3. What are the objectives of cost accounting? |  |

| 4. How is cost accounting useful for businesses? |  |

| 5. What are the different methods of cost accounting? |  |