Meaning of Residential Status under Income Tax - Income Tax Laws | Income Tax Laws - B Com PDF Download

Introduction

You are aware that Income Tax Act revolves around assessee and his income. In the previous units you have been familiarized with concepts such as assessee, previous year, assessment year etc., which are foundations of income tax. However, to determine tax liability of an assessee, it is essential to know his residential status. In this unit, we intend to explain the method of applying the rules regarding residential status and thereby determining the scope of total income of an assessee.

Importance of Residential Status

- According to Section 4 of the Income Tax Act, 1961, tax is applied to a person's income from the previous year at the rate set for the following assessment year. This rate is determined by the Annual Finance Act that the Parliament passes every February.

- A person's tax responsibility is based on their residence in India during the previous year.

- The residential status of a taxpayer can change from year to year; someone may be classified as a resident in one year and as a non-resident in another.

- Because of this, it is crucial to clearly identify the residential status of the taxpayer.

- It is important to know that the residential status applies uniformly to all sources of income for that taxpayer.

- The rules for determining residential status vary for different types of taxpayers, such as individuals, Hindu Undivided Families (HUF), firms, and companies.

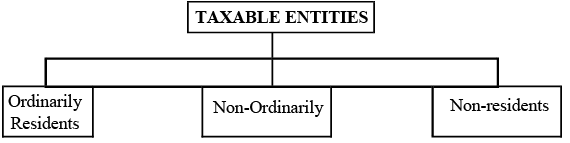

Categories of Residential Status

Section 5 of the Income tax Act deals with the scope of total income. It states that the scope of total income of a person is determined by reference to his residence in India in the previous year. Based on residence, the individuals and HUF entities are divided into three categories, viz. a) Persons who are ordinarily residents in India b) Persons who are not ordinarily residents in India c) Persons who are non-residents in India

For the purpose of determining the rules applicable in this regard, the assessees are divided into 4 groups, viz.

(i) Individuals

(ii) Non-company plural entities (H.U.F., firms or other association of persons)

(iii) Companies

(iv) Every other person

Rules for Determining the Residential Status

- The rules for figuring out the residential status vary based on the type of taxpayer.

- For individuals, the rules are found in Section 6(1).

- For Hindu Undivided Families, partnerships, or other groups of people, the guidelines are in Section 6(2).

- For companies, the criteria are described in Section 6(3).

- For all other types of individuals or entities, the relevant rules can be found in Section 6(4).

Individual

An Individual may have any of the following residential status depending upon applicability of rules of Income Tax Act:

(a) Resident and Ordinarily Resident

(b) Not Ordinarily Resident

(c) Non-Resident

(A) Resident and Ordinarily Resident

- Section 6(1) and Section 6(6)(a) of the Income Tax Act outline how to determine an individual's Residential status.

- Section 6(1) sets forth two main conditions, referred to as basic conditions.

- Section 6(6)(a) introduces two other conditions, called additional conditions.

- An individual is classified as a Resident in India if they meet at least one of the basic conditions and both of the additional conditions.

Conditions of Part I or Basic Conditions:

(i) He must be physically present in India for a period of 182 days or more during the relevant previous year, or

(ii) He must be in India for a period of 60 days (182 days in some special circumstance) or more during the relevant previous year and 365 days or more for 4 years immediately preceding the relevant previous year.

Exception to the ‘Basic Conditions’

- If an individual is a Citizen of India and leaves India during the previous year as part of the crew on an Indian ship or for a job outside India, he must meet the basic condition No (ii) only if he stays in India for at least 182 days instead of 60 days.

- For an individual who is a Citizen of India or a person of Indian Origin, if he is already outside India and visits India during the previous year, he must also meet the basic condition No (ii) only if he is in India for at least 182 days rather than 60 days.

Conditions of Part II or Additional Conditions [Section 6(6)(a)]

(a) If he has been resident in India for at least 2 out of the 10 years preceding the previous year, and

(b) He has been in India for a period or periods amounting in all to 730 days or more during 7 previous years preceding the previous year.

Stay in India

- To qualify, a person must have stayed in India for at least 182 days during the last year. This stay does not have to be continuous or at the same location.

- What matters is the total time spent in India. It doesn't matter if the person lived in a rented place, their own home, a hotel, or with friends.

- The key requirement is that the individual must have been in India for a total of 182 days or more in the previous year.

- Additionally, for the 365-day requirement, the stay can be regular or irregular and might occur just once in the four years before the last year.

- This means the person must have spent a total of 365 days in India over the four years leading up to the previous year.

- The four-year period refers to the twelve calendar months immediately before the start of the previous year.

- Again, for the second condition regarding the 365 days, the stay does not need to be regular; it could happen just once in those four years.

- The important factor is the overall stay, which must total 365 days or more during the four years leading up to the previous year.

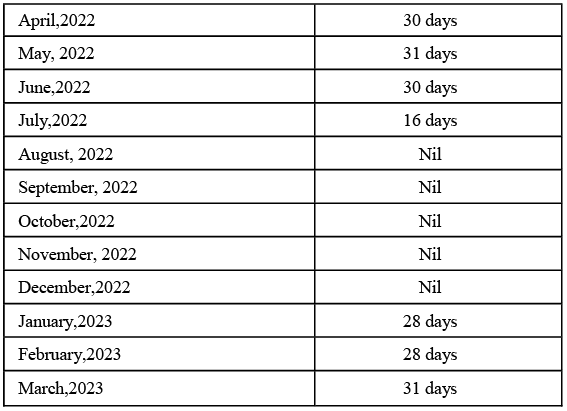

Illustration: Mr. Anil citizen of Spain has been staying in India since 1985. He leaves India on 16.7.2022 on a visit to U.S.A. and returns on 4.1.2023. Determine his residential status for the previous year 2022-23.

Sol: If Mr. Anil satisfies first condition (stay in India for at least 182 days) his stay in India during the previous year 1.4.2022 to 31.3.2023 is as under:

Thus, his total stay in India during the previous year is 194 days. As, he is in India for more than 182 days during the relevant previous year, he satisfies the first condition and is, therefore, a resident.

(B) Not Ordinarily Resident

If an individual satisfies anyone of the two conditions of Part I, or basic condition but does not satisfy both the conditions or fulfils only one of the two additional conditions of Part II, he is said to be resident but not ordinarily resident or simply stated, he will be a “not ordinarily resident”.

Illustration: Mr. Mayank came to India for the first time in July 2022 and stayed in Delhi up to 31st March 2023. Determine his residential status for the assessment year 2023-24.

Sol: For the assessment year 2023-24, Mr. Mayank is resident but not ordinarily resident. During the previous year 2022-23, Mr. Mayank was in India for a period of more than 182 days, and he thereby fulfils one of the basic conditions or condition (1) of Part I. But he does not satisfy both the additional conditions of Part II. Therefore, he is resident but not ordinarily resident for the assessment year 2023-24.

C) Non-Resident

If an individual does not satisfy anyone of the basic conditions or conditions of Part I, he is said to be non-resident in that previous year whether he satisfies one or both conditions of Part II or additional conditions.

Illustration: Mr. Anup left India for Canada on August 15, 2014. During 2022-23, he came to India on July 12, 2022, and stayed in Delhi for a period of one month and again left for Canada, on August 10, 2022. Determine his residential status for the assessment year 2023-24.

Sol: Mr. Anup is a non-resident for the assessment year 2023-24, as he stayed in India for only 30 days during the previous year 2022-23. As such, he does not satisfy any of the basic conditions of Part I. Therefore, he is a non-resident.

Exceptions (section 6(1A)) applicable from AY 2021-22

- An individual is considered a resident but not ordinarily resident if they meet these 3 conditions:

- The individual is an Indian citizen and not a foreign citizen, even if they may have Indian roots.

- Their total taxable income during the previous year, excluding income from foreign sources, is more than Rs. 15,00,000.

- They are not required to pay taxes in any other country.

- Additionally, an individual can be deemed a resident but not ordinarily resident if they satisfy these 4 conditions:

- The individual is either an Indian citizen or a person of Indian origin.

- Their total taxable income for the previous year, excluding foreign income, is over Rs. 15,00,000.

- They visit India during the relevant previous year.

- They stay in India for at least 120 days (but less than 182 days) during the relevant previous year and have spent a total of at least 365 days in India during the 4 years before the previous year.

Non-Company Plural Entities

Under this section, we will examine the rules regarding residential status of plural entities such as Hindu Undivided Family (HUF), firms and association of persons.

Hindu Undivided Family [Section 6(2)]

The residential status of an HUF depends on two factors, the location of control and management of its affairs and the residential status of its Karta.

(A) Ordinarily Resident [Section 6(2)]

HUF is said to be ordinarily resident in India in any previous year:

(a) If the control and management of its affairs is wholly or-partly situated in India during the previous year.

The expression ‘Control and Management’ signifies controlling and directive power. In other words, it means the ‘head and brain’. Moreover, the control and management should be de facto (in effect) and not merely the right or power to control and manage.

(b) If its manager (Karta) satisfies the following conditions of Section 6(6)(a):

(i) Its manager has been resident in India in 2 out of 10 previous years preceding that year; and

(ii) Its manager has, during the 7 years preceding that year, been in India for a period amounting in all to 730 days or more.

For the purposes of calculating the period of the manager’s stay in India, we shall add up the stay in India of all the successive managers of the family, in case of the death of the first manager.

Illustration: A Hindu Undivided Family carries Import-Export business in India, Nepal, Sri Lanka, and Pakistan. The Karta stays in India and manages the affairs of HUF through employees and agents. What will be the status of the family for income-tax purpose?

Sol: The control and management of the affairs of the family is situated wholly in India and the manager stays in India and fulfils the conditions of Part II or additional conditions of Section 6(6)(a). Hence, the Hindu Undivided Family is resident in India.

B) Not Ordinarily Resident

A Hindu Undivided family is said to be “not ordinarily resident in India, if control and management of its affairs is situated wholly or partly in India during the previous year, but its manager does not satisfy the additional condition conditions of Section 6(6)(a).

C) Non-resident

- A Hindu Undivided Family is considered a non-resident only when its control and management are completely located outside of India during the previous year.

- If the control and management are partially in India and the Karta meets the requirements of Part II Section 6(6), then the family is regarded as a resident in India.

Illustration: Head Office of AB, a Hindu Undivided Family is situated in Dubai. The family is managed by Mr. A, who is a resident in India in only 2 years out of 10 years preceding the previous year 2022-23. Determine the residential status of the HUF for the assessment year 2023-24, if the affairs of the family business are (i) wholly controlled from Dubai (ii) partly controlled from India.

Sol: i) Here the affairs of HUF are controlled and managed from outside India. Therefore AB, a Hindu Undivided Family is non-resident for the assessment year 2023-24.

ii) Under this situation, the affairs of HUF are controlled and managed partly from India. Therefore, the HUF is resident of India. However, it would be ordinarily resident in India if Karta/Manager satisfies the conditions laid down in Part II Section 6(6)(a) below:

a) He has been resident in India at least 2 out of 10 years preceding the previous year.

b) He has been in India for a period or periods amounting in all to 730 days or more during the 7 years preceding the previous year.

As the manager, Mr. ‘A’ is resident in India in only 2 out of 10 years preceding the previous year, the HUF would be ‘non-ordinarily resident’ in India for the assessment year 2023-24.

Firms and other Association of Persons [Section 6(2)]

Firms and other association of persons can fall under two categories only. They may either be residents or non-residents. The category of non-ordinarily residents does not apply to such assessee.

(A) Resident

According to section 6(2), a firm or other association of persons is said to be resident in India in any previous year where during that year the control and management of its affairs is partially or wholly situated in India. The residential status of its partners in India is immaterial.

(B) Non-Resident

A firm or an association of persons is said to be non-resident in such cases only where the control and management of its affairs is situated wholly outside India during the previous year.

Illustration: A firm has five partners who are permanent residents in India. The firm owns a rubber estate in Malaysia. The estate is managed and controlled by the partners in India, through an agent in Malaysia. Determine the residential status of the firm.

Sol: Even if the control and management of the firm is partly situated in India, the firm becomes resident. Here, all the partners reside in India and manage at least a part of the affairs of the estate. As such, the firm is resident in India.

Residential status of a company [Section 6(3)]

- A company is considered a residentin India during a previous year if:

- It is an Indian company, or

- It is a foreign company and its place of effective management (POEM) is in India during that year.

- A company is regarded as non-residentin any previous year if:

- It is not an Indian company, and

- Its place of effective management is not in India during that year.

- The place of effective management refers to the location where important management and business decisions necessary for running the company are effectively made.

Illustration: The Indian chemical limited is a registered Indian company carrying business in India and in Gulf countries. The control and management of its affair was partially situated in Riyadh (Saudi Arabia) during the year ending March 31, 2023. What will be the residential status of the company for the assessment year 2023-24?

Sol: The Indian chemical limited is an Indian company, therefore, it should be treated as resident in India and the facts regarding control and management outside the country are immaterial.

Any other Person [Section 6(4)]

(A) Resident: Every other person (local authority, artificial juridical person e.g.: Statutory Corporations) is said to be resident in India in any previous year, if the control and management of its affairs is partly or wholly situated in India.

(B) Non-Resident: Every other person is said to be non-resident if control and management of its affairs is situated wholly outside India. Note: Firm and other Association of persons, companies and every other person can never be a ‘Not Ordinarily Resident.’

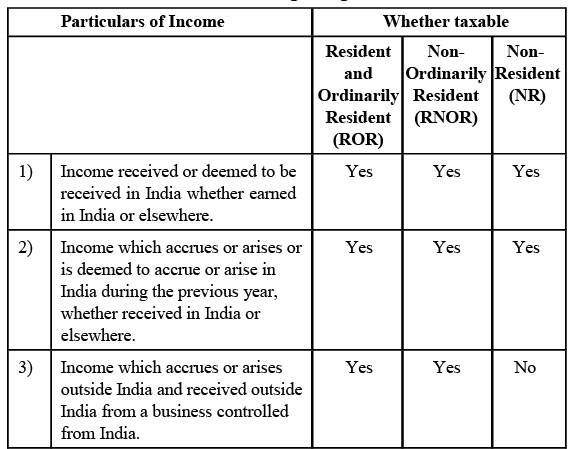

Scope of Total Income on the Basis of Residence

We have examined the rules determining the residential status of assessee as given in section 5 of Income Tax Act. As stated earlier, the scope of total income of an assessee depends on his residential status in the previous year. In the following sections, we will explain the scope of total income for the different categories of assessee viz.

(i) Residents and ordinarily resident [Section 5(1)]

(ii) Not-ordinarily residents [Section 5(1)]

(iii) Non-residents [Section 5 (2)]

Resident an d Ordinarily Resident

The total income of any person, who is resident in the relevant previous year, includes all income from whatever sources derived which:

(a) Is received, or deemed to be received in India in such year by him or on his behalf during the previous year; or

(b) Accrues or arises or is deemed to accrue or arise to him in India during the previous year; or

(c) Accrues or arises to him outside India during such year.

Not Ordinarily Resident

- If a person is not ordinarily resident, their total income for the previous year includes all income from any sources, which:

- Is received or is considered to be received in India during that year by or on behalf of that person.

- Accrues or arises or is thought to accrue or arise to them in India during the previous year.

- Accrues or arises to them outside India during that year but comes from a business that is controlled (either fully or partially) in India or a profession established in India.

- The main difference between the total income of an ordinarily resident and a not ordinarily resident is related to income that accrues or arises outside India.

- For a resident, all income, no matter the source, is included in their total income.

- However, for a not ordinarily resident, only income that comes from a business controlled (either fully or partially) in India or a profession set up in India will be included in their total income.

Non-Resident

- If a person is a non-resident in India, their total income for the relevant year includes all earnings from any source which:

- a) Is received or is considered received in India during that year by or for that person.

- b) Accrues, arises, or is considered to accrue or arise to them in India during that year.

- Therefore, non-residents are not responsible for income that comes from outside India, even if that income is sent back to India.

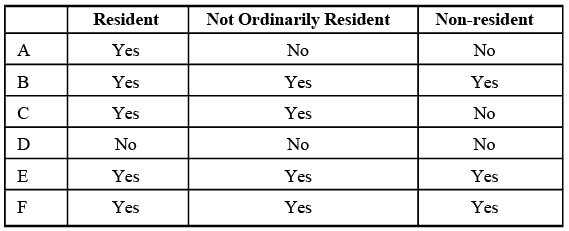

Illustration: Sri P.C. Reddy, an Indian citizen has different sources of income in India and U.K.

a) Income from property in U.K.

b) Salary earned and received in India

c) Profits from a business situated in U.K. but controlled from India.

d) Past untaxed foreign income brought to India during the previous year.

e) Dividend paid by an Indian company and received in U.K.

f) Profit earned from a business in Hyderabad.

He would like to know his tax liability if he is:

1) Ordinarily resident 2) Not ordinarily resident 3) Non-resident in India in respect of the above incomes

Sol:

Kinds of Income

It appears from the scope of total income that four types of incomes form part of the tax liability. They are:

(1) Income received in India. (Section 7)

(2) Income deemed to be received in India. (Section 7)

(3) Income accruing or arising in India. (Section 9)

(4) Income deemed to accrue or arise in India. (Section 9)

Let us now discuss them in detail.

Income Received in India

- Any income earned in India during the previous year is taxable, regardless of the taxpayer's residential status or where the income was generated.

- The term receipt of income refers to the income that the taxpayer receives for the first time and has control over.

- Once income is received, moving that income to another location does not count as a new receipt.

- Income does not always need to be in cash; it can also be in the form of benefits. For example, providing rent-free accommodation or other perks to an employee is considered salary, even if no cash is involved.

- However, any income received in kind must have a value equivalent to cash or be in the form of something that has monetary worth.

- For non-residents, income earned abroad is not taxed unless it is brought into India.

- When money is received in India, it is considered income from an external source, but that receipt does not count as income.

- If a non-resident has already received money outside India as income or exempt income and then transfers it to India, this transfer is not considered as new income.

Income Deemed to be Received in India

- The contribution made by the central government in the previous year to an employee's account under a pension scheme as per section 80CCD is considered income received in India.

- Any amount contributed by the employer to a recognized provident fund that exceeds 12% of the employee's salary is treated as income received.

- The interest credited to the employee's recognized provident fund that goes beyond 9.5% per annum is also deemed as income received.

- When an employee who is part of an unrecognized provident fund joins a recognized provident fund, the total amount transferred from the unrecognized fund is called the transferred balance. The employer's contribution and any interest on this transferred balance are also considered income received.

Incomes Accruing or Arising in India

Income is said to be received, when it reaches the assessee, but where the right to receive the income becomes vested in the assessee, it is said to accrue or arise. Accrual of income means a stage, where the assessee has acquired a right to receive such income, when the same income is received in the accounting year, it is said to arise. Income accrues when the right to receive it comes into existence; but it arises when the method of accounting shows it in the shape of profits or gains.

The income must accrue or arise in India. If it accrues or arises outside India; it cannot be taxed in the hands of person who is non-resident in India.

Income Deemed to Accrue or Arise in India

- Income from a business connection in India: Any income that comes, either directly or indirectly, from a business connection in India is considered to be earned in India. Business connections can take different forms, such as:

- Establishing a subsidiary company in India that operates for a non-resident parent company.

- Having a branch office in India.

- Engaging an agent in India for a non-resident organization.

- Income from property or assets located in India: Any income that comes from property, whether movable or immovable, and regardless of whether it is tangible or intangible, is considered to arise in India if the property is situated in India.

- Income from interest, royalties, or technical fees:This type of income is deemed to arise in India if it is paid by:

- The Government.

- A person who is a resident in India and uses the funds for business or professional purposes in India.

- A person who is a non-resident in India, provided that the interest is for money borrowed and used for business or professional activities conducted in India.

Incidence of Tax

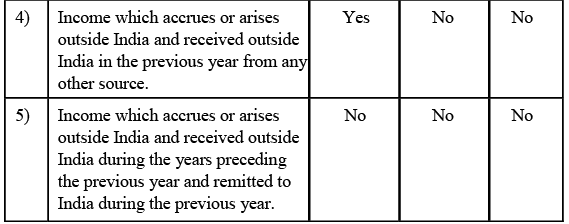

The below table 3.1 summarizes the provisions regarding incidence of tax.

Provisions regarding incidence of tax

|

27 videos|41 docs|11 tests

|

FAQs on Meaning of Residential Status under Income Tax - Income Tax Laws - Income Tax Laws - B Com

| 1. What is the meaning of residential status under income tax? |  |

| 2. What is an Ordinary Resident? |  |

| 3. What is the significance of residential status under income tax? |  |

| 4. What is the difference between Resident and Non-Resident under income tax? |  |

| 5. What are the tax implications for Resident but Not Ordinarily Resident under income tax? |  |