SSC CGL Exam > SSC CGL Notes > Quantitative Aptitude for SSC CGL > Mind Map: Banker's Discount

Mind Map: Banker's Discount | Quantitative Aptitude for SSC CGL PDF Download

The document Mind Map: Banker's Discount | Quantitative Aptitude for SSC CGL is a part of the SSC CGL Course Quantitative Aptitude for SSC CGL.

All you need of SSC CGL at this link: SSC CGL

|

317 videos|290 docs|185 tests

|

FAQs on Mind Map: Banker's Discount - Quantitative Aptitude for SSC CGL

| 1. What is the concept of Banker's Discount in financial transactions? |  |

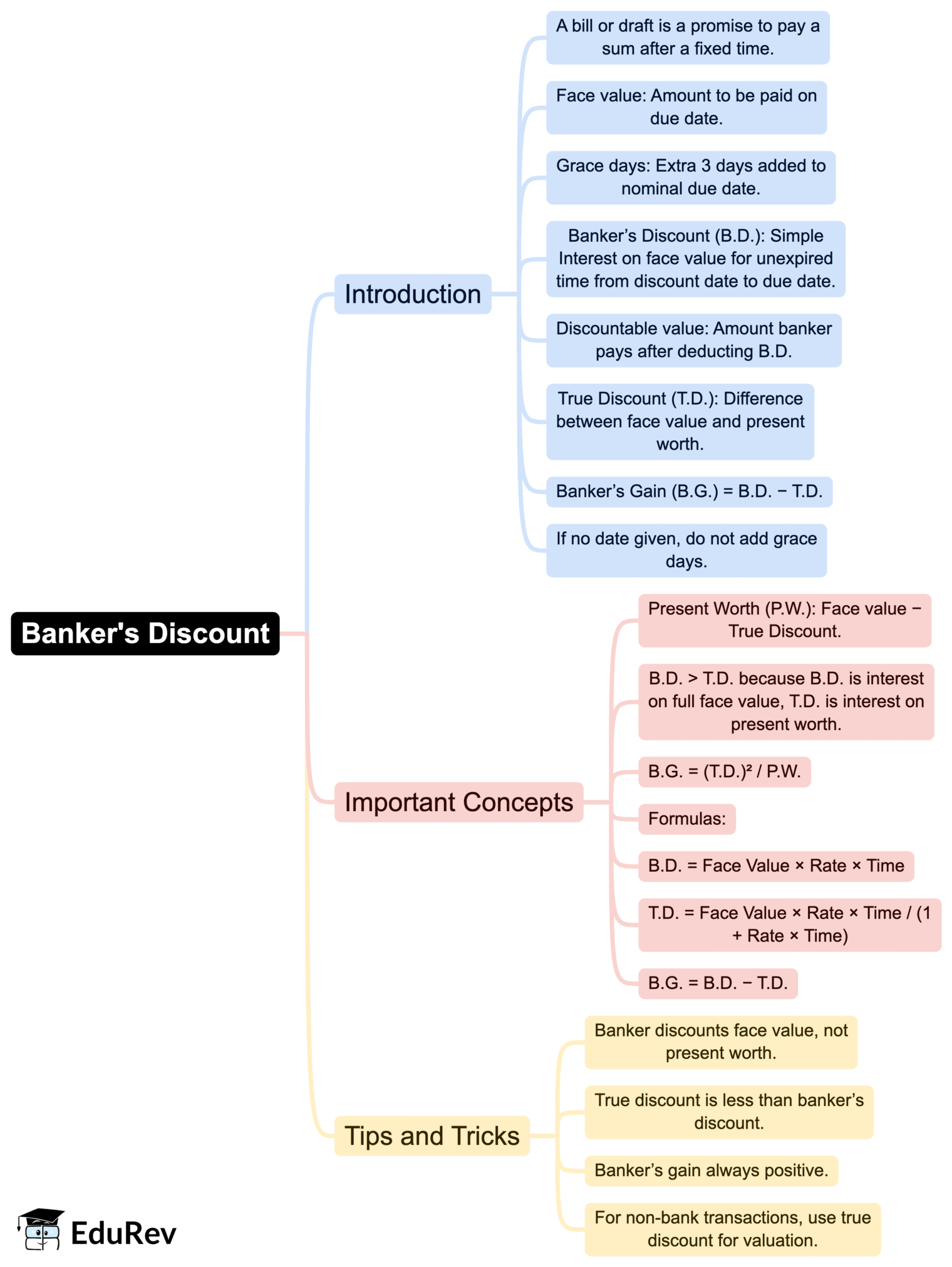

Ans. Banker's Discount refers to the amount deducted from the face value of a bill or note by a bank when it is discounted. It is the interest charged for the time period between the discounting of the bill and its maturity date. The formula used to calculate Banker's Discount is: BD = (Face Value x Rate x Time) / 100, where Face Value is the total amount on the bill, Rate is the interest rate, and Time is the duration until maturity.

| 2. How is Banker's Discount different from True Discount? |  |

Ans. Banker's Discount is calculated on the face value of the bill, while True Discount is calculated on the present value of the bill. True Discount represents the actual interest that would be paid on the present value until maturity. The relationship between True Discount and Banker's Discount is that True Discount is always less than Banker's Discount since it accounts for the time value of money.

| 3. In what scenarios is Banker's Discount typically applied? |  |

Ans. Banker's Discount is typically applied in scenarios involving promissory notes, bills of exchange, and other short-term financial instruments. Businesses often use this method when they need immediate cash flow and wish to discount their receivables with banks before the due date.

| 4. How do banks determine the rate used for calculating Banker's Discount? |  |

Ans. Banks determine the rate for calculating Banker's Discount based on several factors, including the prevailing market interest rates, the creditworthiness of the borrower, the time period until the bill matures, and the bank's own policies. The rate can vary from one financial institution to another, and it may also depend on economic conditions.

| 5. What are the advantages of using Banker's Discount for businesses? |  |

Ans. The advantages of using Banker's Discount for businesses include improved cash flow, the ability to access funds quickly without waiting for the maturity of bills, and the flexibility to manage short-term financial needs. It allows businesses to meet their immediate expenses, invest in opportunities, and maintain smooth operations without delays.

Related Searches