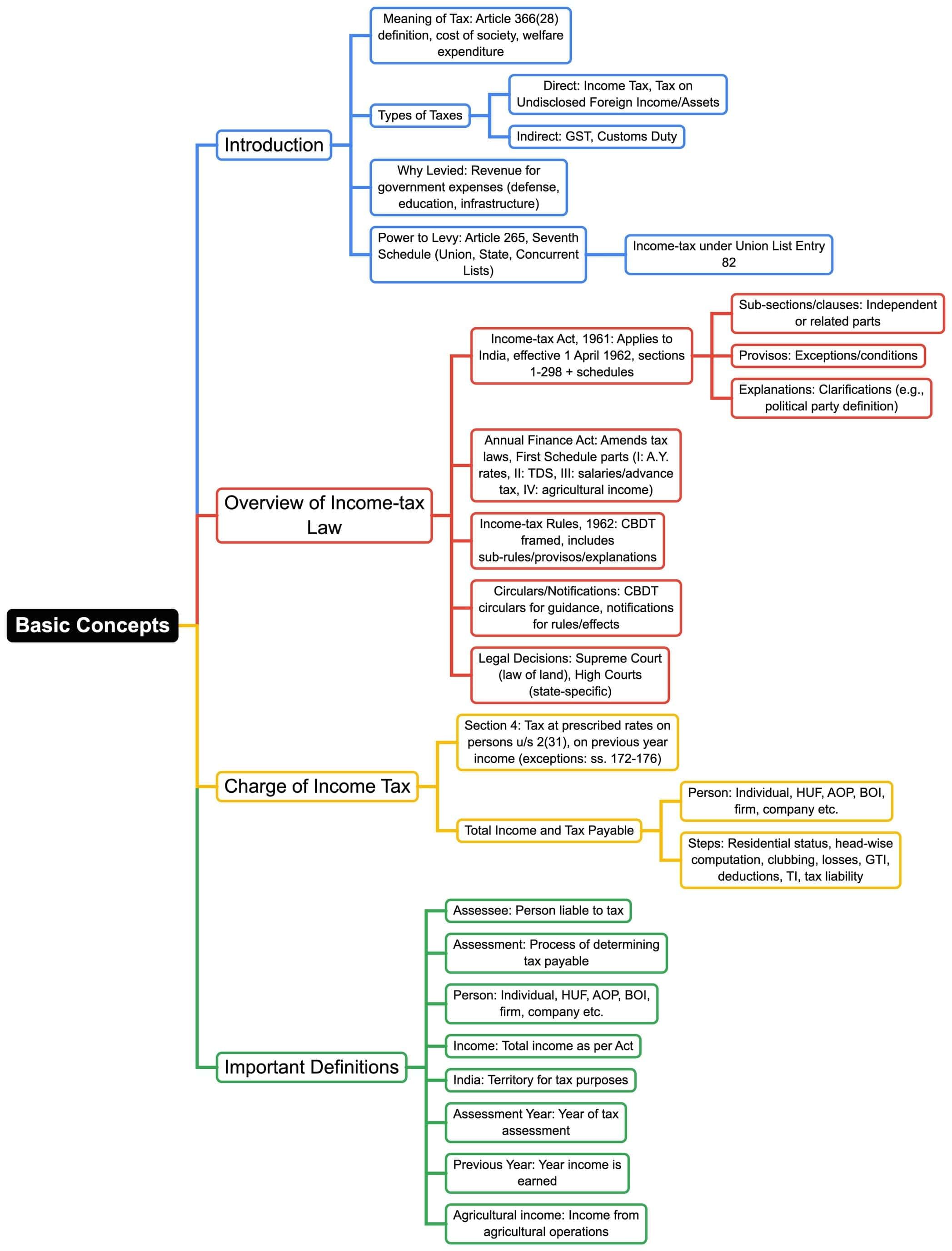

CA Intermediate Exam > CA Intermediate Notes > Taxation for CA Intermediate > Mind Map: Basic Concepts

Mind Map: Basic Concepts | Taxation for CA Intermediate PDF Download

The document Mind Map: Basic Concepts | Taxation for CA Intermediate is a part of the CA Intermediate Course Taxation for CA Intermediate.

All you need of CA Intermediate at this link: CA Intermediate

|

38 videos|118 docs|12 tests

|

FAQs on Mind Map: Basic Concepts - Taxation for CA Intermediate

| 1. What are the key subjects covered in the CA Intermediate syllabus? |  |

Ans. The CA Intermediate syllabus includes important subjects such as Accounting, Business Laws, Taxation, Cost and Management Accounting, Advanced Accounting, Auditing and Assurance, Information Technology, and Strategic Management. Each subject is designed to equip students with the necessary skills and knowledge required for a career in accounting and finance.

| 2. How can I effectively prepare for the CA Intermediate exam? |  |

Ans. Effective preparation for the CA Intermediate exam involves creating a structured study plan, understanding the syllabus thoroughly, and practicing regularly with previous years' question papers and mock tests. It's important to focus on conceptual understanding, time management, and revision strategies. Joining coaching classes or study groups can also enhance learning through collaboration.

| 3. What is the passing criteria for the CA Intermediate exam? |  |

Ans. To pass the CA Intermediate exam, candidates must secure a minimum of 40% marks in each paper and a total of 50% marks overall in all papers of that group. Students must also ensure that they meet the attendance requirements and complete the necessary practical training as prescribed by the regulatory body.

| 4. Are there any exemptions available for CA Intermediate candidates? |  |

Ans. Yes, candidates who have completed certain professional courses, such as the Foundation course of CA or equivalent qualifications, may be eligible for exemptions in specific subjects of the CA Intermediate exam. It is crucial to check the official guidelines provided by the regulatory authority to understand the eligibility criteria for exemptions.

| 5. What are the common challenges faced by students preparing for the CA Intermediate exam? |  |

Ans. Common challenges include managing time effectively, understanding complex concepts, maintaining motivation throughout the preparation period, and handling exam stress. Many students also struggle with the vast syllabus and the need for consistent practice. Developing a routine, seeking guidance from mentors, and focusing on wellness can help overcome these challenges.

Related Searches