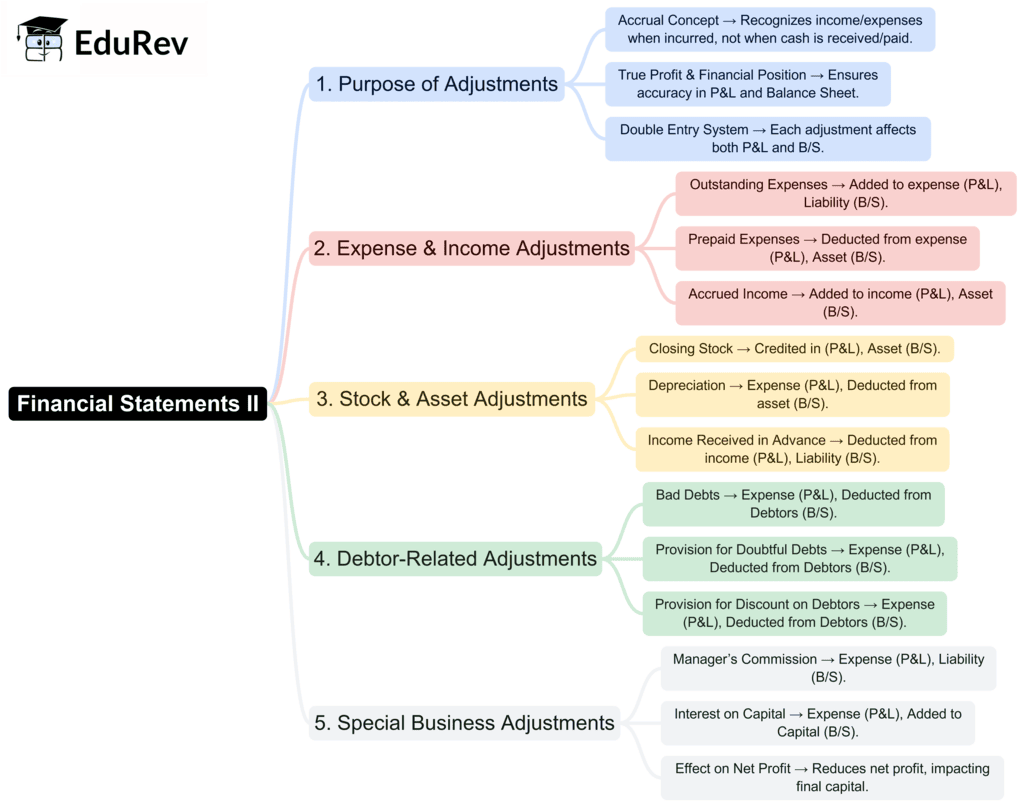

Commerce Exam > Commerce Notes > Accountancy Class 11 > Mind Map: Financial Statements II

Mind Map: Financial Statements II | Accountancy Class 11 - Commerce PDF Download

The document Mind Map: Financial Statements II | Accountancy Class 11 - Commerce is a part of the Commerce Course Accountancy Class 11.

All you need of Commerce at this link: Commerce

|

61 videos|154 docs|35 tests

|

FAQs on Mind Map: Financial Statements II - Accountancy Class 11 - Commerce

| 1. What are the main types of financial statements? |  |

Ans. The main types of financial statements are the income statement, balance sheet, cash flow statement, and statement of changes in equity. The income statement shows a company's revenues and expenses, the balance sheet provides a snapshot of assets, liabilities, and equity, the cash flow statement outlines cash inflows and outflows, and the statement of changes in equity explains changes in equity over a period.

| 2. Why are financial statements important for businesses? |  |

Ans. Financial statements are crucial for businesses as they provide essential information about financial performance and position. They help stakeholders make informed decisions regarding investments, credit, and management strategies. Additionally, they are used for regulatory compliance and financial analysis.

| 3. How often should financial statements be prepared? |  |

Ans. Financial statements are typically prepared on a quarterly and annual basis. Public companies are required to file quarterly reports (10-Q) and annual reports (10-K) with regulatory bodies, while private companies may prepare them annually or more frequently depending on the needs of management and stakeholders.

| 4. What is the difference between cash basis and accrual basis accounting? |  |

Ans. Cash basis accounting recognizes revenues and expenses only when cash is exchanged, while accrual basis accounting recognizes revenues when earned and expenses when incurred, regardless of when cash changes hands. Accrual basis is generally preferred for financial statements as it provides a more accurate picture of a company's financial health.

| 5. How can financial statements be analyzed for decision-making? |  |

Ans. Financial statements can be analyzed using various techniques such as ratio analysis, trend analysis, and vertical/horizontal analysis. Ratios like profitability, liquidity, and solvency ratios help assess a company's performance. Trend analysis examines financial data over time, while vertical and horizontal analysis compare line items within the statements to identify patterns and make informed decisions.

Related Searches