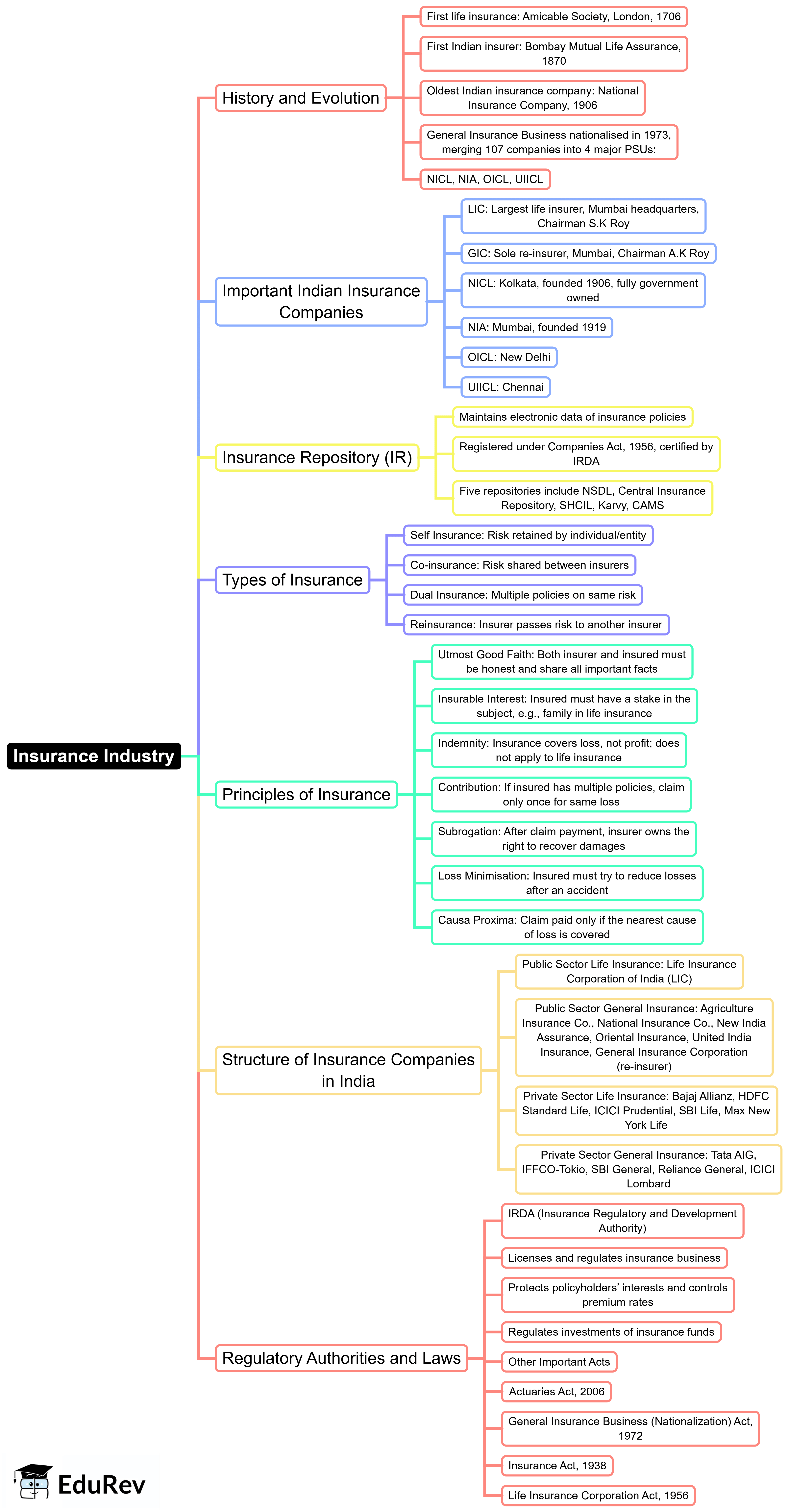

Bank Exams Exam > Bank Exams Notes > IBPS PO Prelims & Mains Preparation > Mind Map: Insurance industry

Mind Map: Insurance industry | IBPS PO Prelims & Mains Preparation - Bank Exams PDF Download

The document Mind Map: Insurance industry | IBPS PO Prelims & Mains Preparation - Bank Exams is a part of the Bank Exams Course IBPS PO Prelims & Mains Preparation.

All you need of Bank Exams at this link: Bank Exams

|

647 videos|1019 docs|305 tests

|

FAQs on Mind Map: Insurance industry - IBPS PO Prelims & Mains Preparation - Bank Exams

| 1. What are the main types of insurance products available in the insurance industry? |  |

Ans. The main types of insurance products include life insurance, health insurance, property insurance, auto insurance, and liability insurance. Life insurance provides financial support to beneficiaries upon the policyholder's death. Health insurance covers medical expenses, while property insurance protects against risks to property. Auto insurance covers vehicles against damages and liability, and liability insurance protects against claims resulting from injuries or damage to others.

| 2. How does the underwriting process work in the insurance industry? |  |

Ans. The underwriting process involves evaluating the risk of insuring a potential policyholder. Underwriters assess various factors such as the applicant's health, lifestyle, and financial history. Based on this analysis, they determine the appropriate premium rates and whether to accept or decline the application. This process helps ensure that the insurer can manage risk effectively while providing coverage.

| 3. What is the significance of regulatory frameworks in the insurance industry? |  |

Ans. Regulatory frameworks are crucial in the insurance industry as they ensure consumer protection, maintain market stability, and promote fair practices. They set standards for insurance providers regarding financial solvency, pricing, and claims handling. Regulatory bodies oversee compliance with laws and regulations, helping to build trust between consumers and insurers.

| 4. How do actuaries contribute to the insurance industry? |  |

Ans. Actuaries play a vital role in the insurance industry by analyzing statistical data to assess risk and determine premium pricing. They employ mathematical models to predict future claims and losses, enabling insurers to maintain profitability while providing adequate coverage. Their expertise is essential for developing new insurance products and ensuring the financial stability of insurance companies.

| 5. What factors influence the premium rates of insurance policies? |  |

Ans. Premium rates for insurance policies are influenced by several factors, including the type of coverage, the insured's age, health, and lifestyle, the value of the insured asset, and the overall risk profile. Additionally, market competition, claims history, and regulatory requirements can also affect pricing. Insurers assess these factors to establish fair and competitive premiums for policyholders.

Related Searches