Commerce Exam > Commerce Notes > Accountancy Class 12 > Mind Map: Issue and Redemption of Debentures

Mind Map: Issue and Redemption of Debentures | Accountancy Class 12 - Commerce PDF Download

The document Mind Map: Issue and Redemption of Debentures | Accountancy Class 12 - Commerce is a part of the Commerce Course Accountancy Class 12.

All you need of Commerce at this link: Commerce

|

42 videos|199 docs|43 tests

|

FAQs on Mind Map: Issue and Redemption of Debentures - Accountancy Class 12 - Commerce

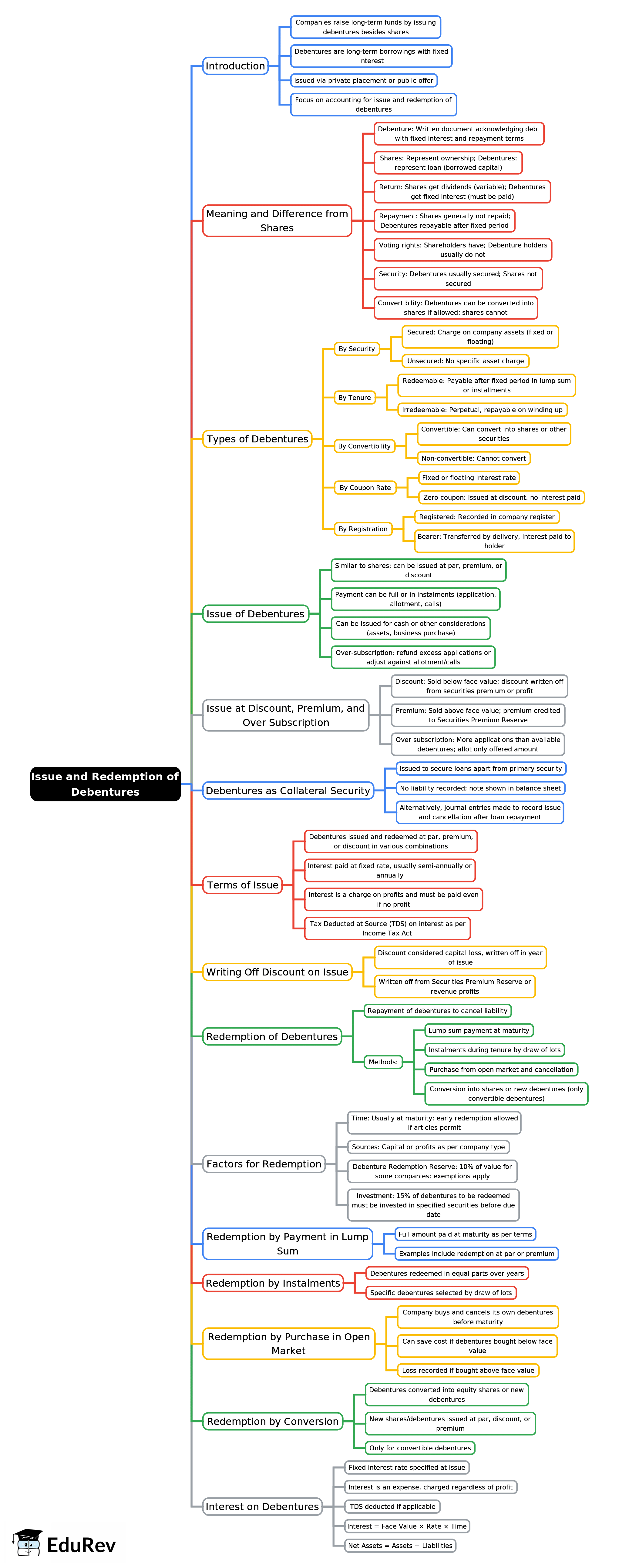

| 1. What are debentures and how do they function in financing for companies? |  |

Ans.Debentures are long-term financial instruments issued by companies to raise capital. They are essentially loans made by investors to the company, which promises to pay back the principal amount along with interest at specified intervals. Debentures may be secured or unsecured; secured debentures are backed by the company's assets, while unsecured debentures are not. They function as a means for companies to finance projects, expansion, or operational costs without giving up equity.

| 2. What is the process of issuing debentures? |  |

Ans.The process of issuing debentures involves several key steps. First, the company must pass a resolution in a board meeting to issue debentures. Next, the company prepares a prospectus that outlines the terms and conditions of the debentures, including interest rate, maturity date, and repayment terms. The company then approaches potential investors, and upon receiving subscriptions, it issues the debentures. Finally, the company must ensure compliance with regulatory requirements and register the debentures with relevant authorities.

| 3. What are the key features and benefits of investing in debentures? |  |

Ans.Key features of debentures include fixed interest payments, a predetermined maturity date, and a promise of capital repayment. Benefits of investing in debentures include steady income through interest payments, lower risk compared to stocks, especially if they are secured, and the ability to diversify an investment portfolio. Additionally, debentures often have a higher yield compared to traditional savings accounts or government bonds.

| 4. How does the redemption of debentures work? |  |

Ans.Redeeming debentures involves repaying the principal amount to the debenture holders at the end of the maturity period or earlier if the debentures are callable. The company plans for redemption by setting aside funds during the term of the debenture for this purpose. The redemption process may include the payment of interest up to the redemption date, and if applicable, the company must also communicate with debenture holders regarding the redemption process and any pertinent details.

| 5. What are the tax implications of investing in debentures? |  |

Ans.The tax implications of investing in debentures vary based on jurisdiction. Generally, the interest income from debentures is subject to income tax at the investor's applicable tax rate. In some cases, certain types of debentures may offer tax benefits or exemptions. It's important for investors to keep track of the interest earned and consult tax regulations or a tax advisor to understand their specific tax obligations regarding debenture investments.

Related Searches