NCERT Solution: Cash Flow Statement -2 | Accountancy Class 12 - Commerce PDF Download

Numerical Questions

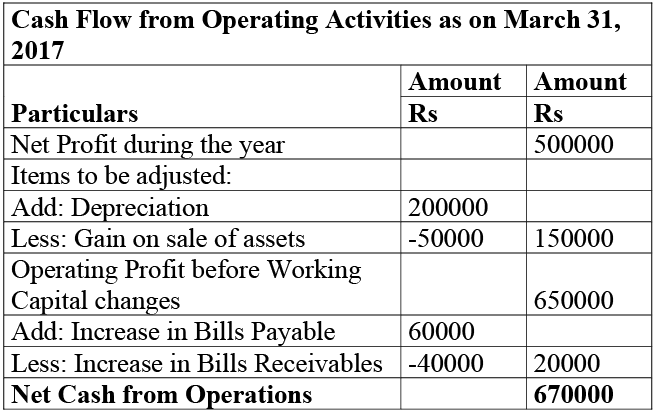

Q1: Anand Ltd., arrived at a net income of Rs. 5,00,000 for the year ended March 31, 2017. Depreciation for the year was Rs. 2,00,000. There was a profit of Rs. 50,000 on assets sold which was transferred to Statement of Profit and Loss account. Trade Receivables increased during the year Rs. 40,000 and Trade Payables also increased by Rs. 60,000. Compute the cash flow from operating activities by the indirect approach.

Ans:

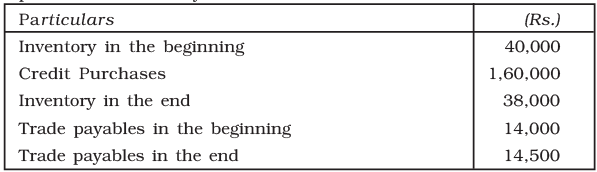

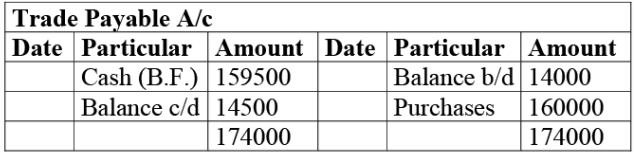

Q2: From the information given below you are required to calculate the cash paid for the inventory:

Ans: Cash paid for Inventory amounts to Rs 1,59,500

Cash paid for Inventory amounts to Rs 1,59,500

Q3: For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow viz., operating, investing and financing.

(a) Acquired machinery for Rs 2,50,000 paying 20% drawn and executing a bond for the balance payable.

(b) Paid Rs. 2,50,000 to acquire shares in Infor ma Tech. and received a dividend of Rs. 50,000 after acquisition.

(c) Sold machinery of original cost Rs. 2,00,000 with an accumulated depreciation of Rs. 1,60,000 for Rs. 60,000.

Ans:

(a) Amount paid for Machinery = 250000 x 20/100 = 50000

Part payment Rs.50000 for acquiring machinery Rs.250000 is related with Investing Activities.

(b) Amount paid for acquiring shares (250000)

Dividend received 50000

Net Cash used in Investing Activities (200000)

Amount paid to acquire assets and dividend received is a part of Investing Activities.

(c) Inflow of cash of Rs.60000 on sale of machinery is a part of Investing Activities.

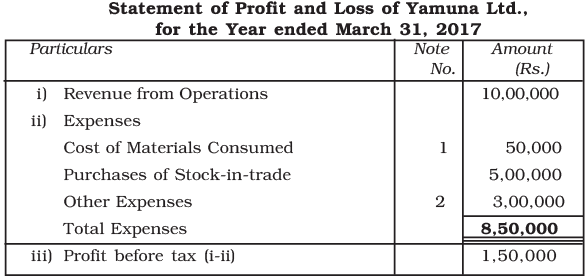

Q4: The following is the Profit and Loss Account of Yamuna Limited:

Additional information:

(i) Trade receivables decrease by Rs. 30,000 during the year.

(ii) Prepaid expenses increase by Rs. 5,000 during the year.

(iii) Trade payables increase by Rs. 15,000 during the year.

(iv) Outstanding expenses payable increased by Rs. 3,000 during the year.

(v) Other expenses included depreciation of Rs. 25,000.

Compute net cash from operations for the year ended March 31, 2017 by the indirect method.

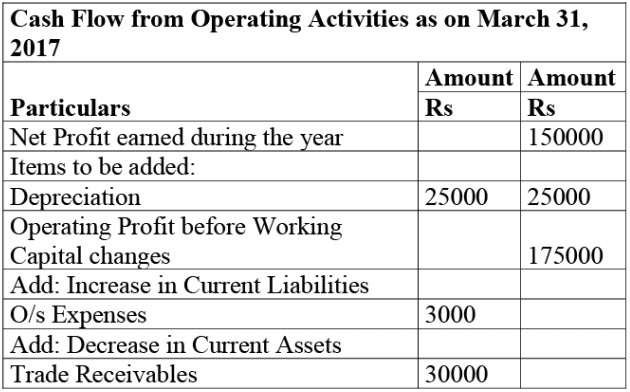

Answer: Cash Flow from Operating Activities of Yamuna Limited as on March 31, 2017

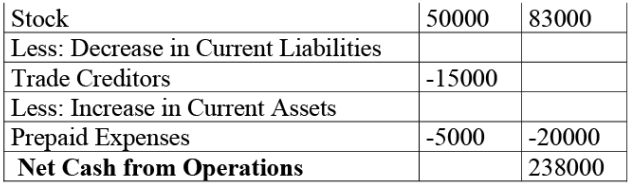

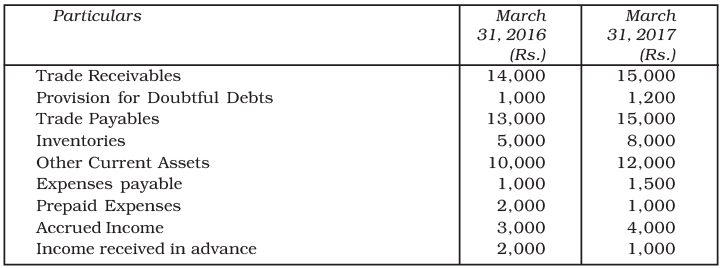

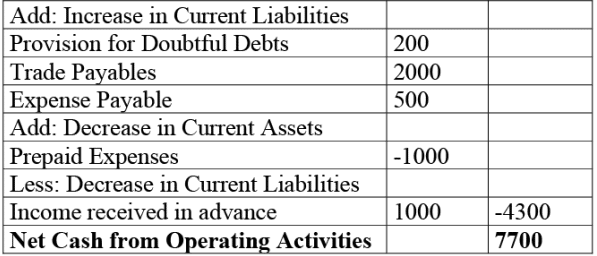

Q5: Compute cash from operations from the following figures:

(i) Profit for the year 2016-17 is a sum of Rs. 10,000 after providing for depreciation of Rs. 2,000.

(ii) The current assets and current liabilities of the business for the year ended March 31, 2016 and 2015 are as follows: Ans:

Ans:

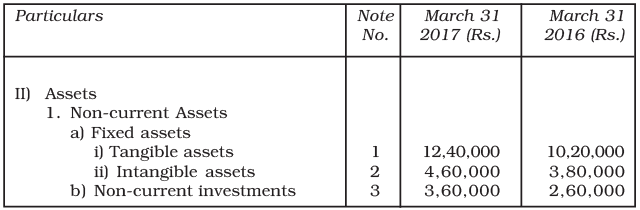

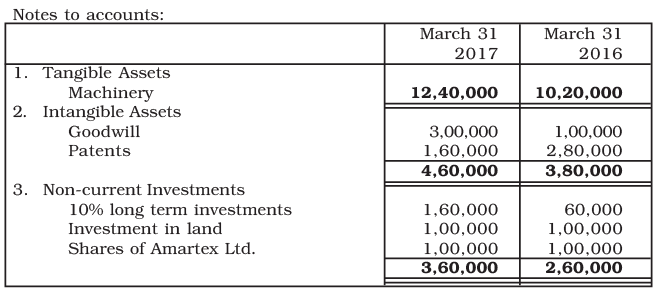

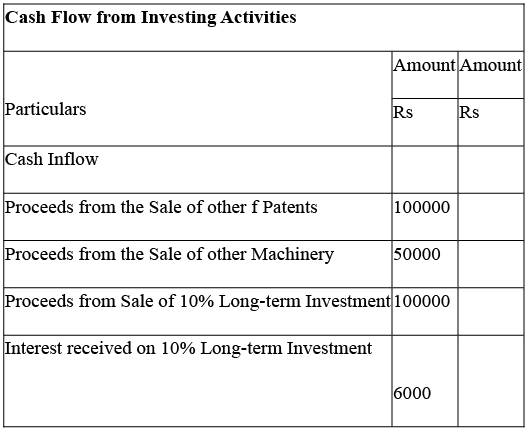

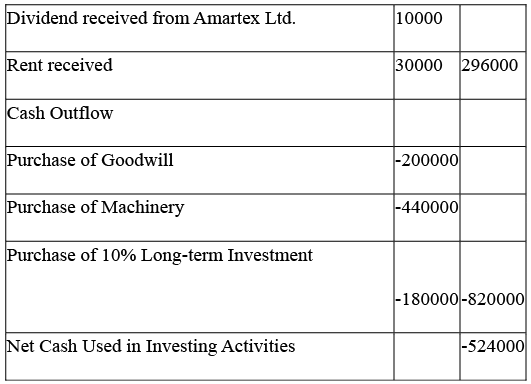

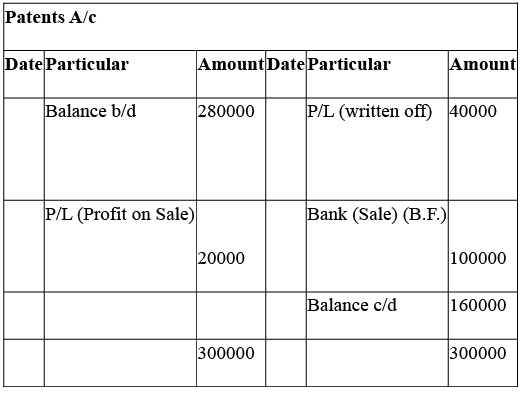

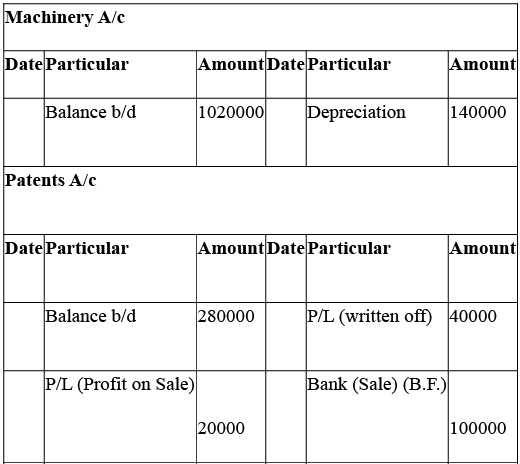

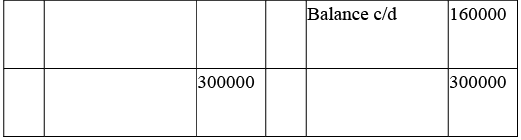

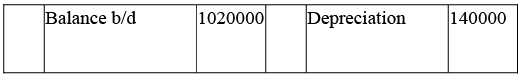

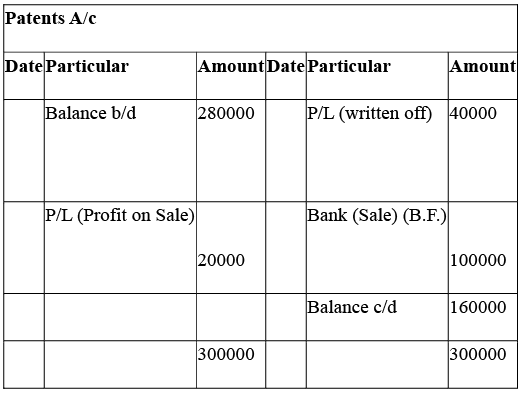

Q6: From the following particulars of Bharat Gas Limited, calculate Cash Flows from Investing Activities. Also show the workings clearly preparing the ledger accounts.

Balance Sheet of Bharat Gas Ltd., as on 31 March, 2016 and 31 March 2017

Notes:

1 Tangible assets = Machinery

2 Intangible assets = Patents

Additional Information:

(a) Patents were written-off to the extent of Rs. 40,000 and some Patents were sold at a profit of Rs. 20,000.

(b) A Machine costing Rs. 1,40,000 (Depreciation provided thereon Rs. 60,000) was sold for Rs. 50,000. Depreciation charged during the year was Rs. 1,40,000.

(c) On March 31, 2016, 10% Investments were purchased for Rs. 1,80,000 and some Investments were sold at a profit of Rs. 20,000. Interest on Investment was received on March 31, 2017.

(d) Amartax Ltd., paid Dividend @ 10% on its shares.

(e) A plot of Land had been purchased for investment purposes and let out for commercial use and rent received Rs. 30,000.

Ans:

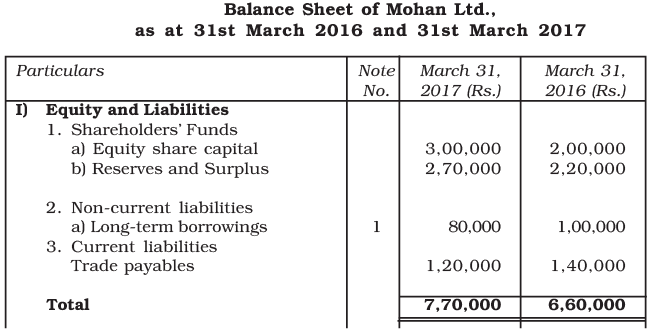

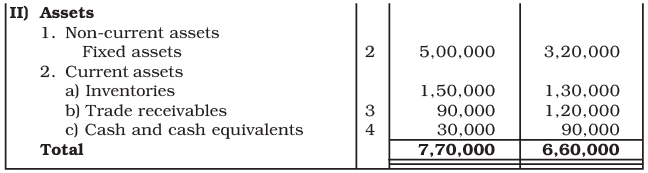

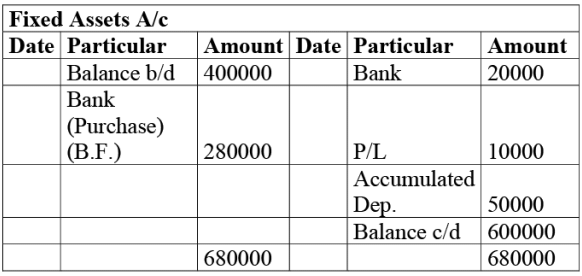

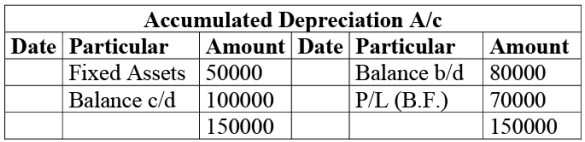

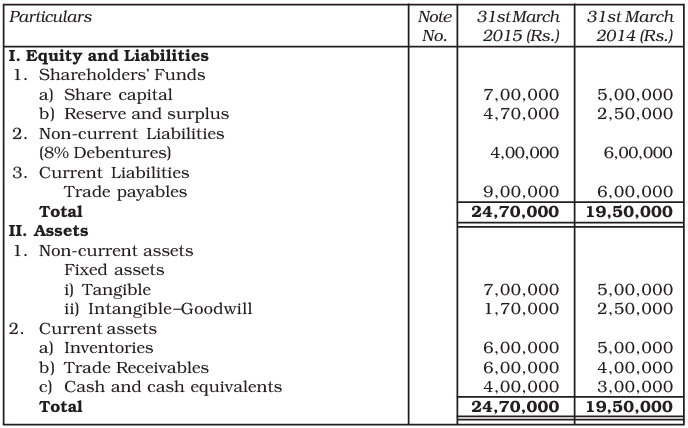

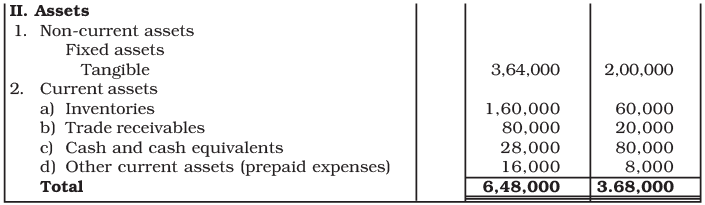

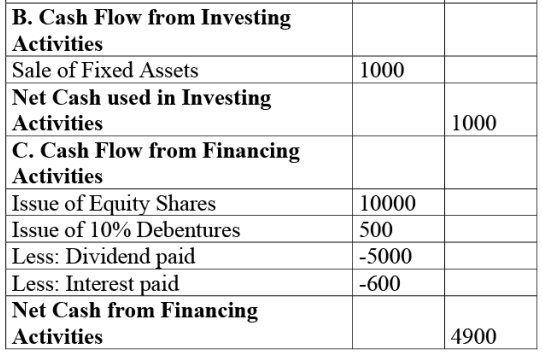

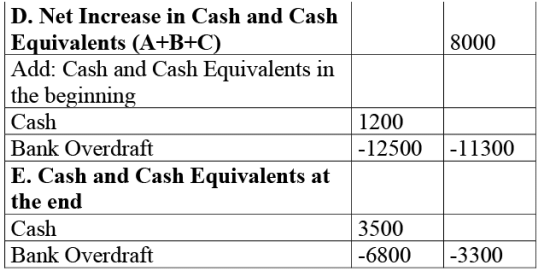

Q7: From the following Balance Sheet of Mohan Ltd., prepare cash flow Statement:

Notes to accounts: Additional Information:

Additional Information:

Machine Costing Rs. 80,000 on which accumulated depreciation was Rs. 50,000 was sold for Rs. 20,000. 9% bank loan Rs. 20,000 was repaid on March 31, 2017. Proposed dividend for the year 2015-16 was Rs. 60,000.

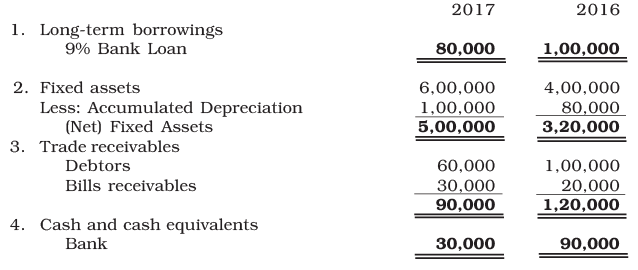

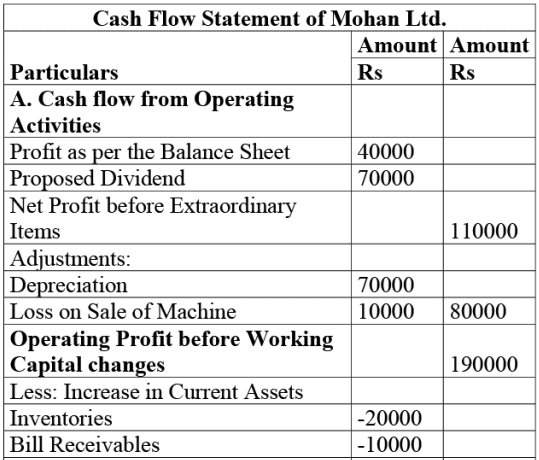

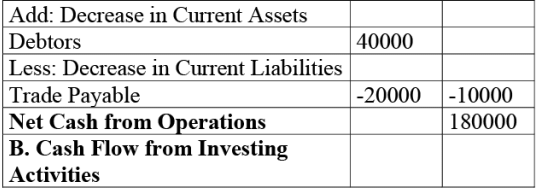

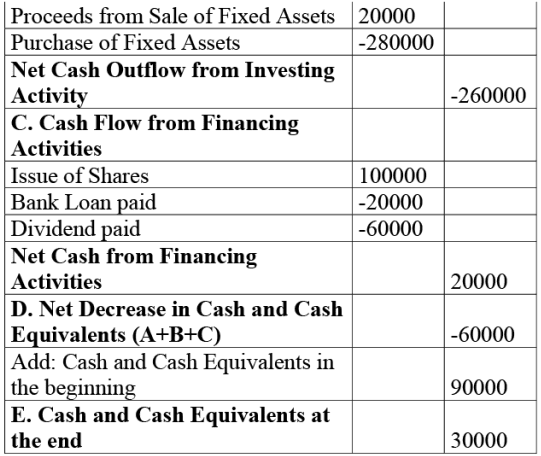

Ans:

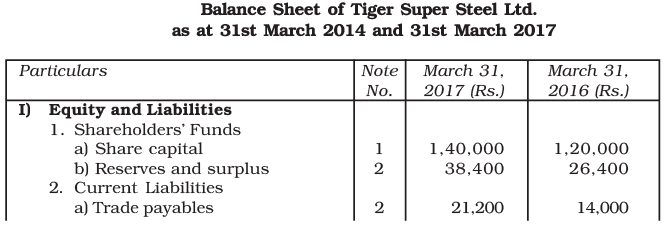

Q8: From the following Balance Sheets of Tiger Super Steel Ltd., prepare Cash Flow Statement:

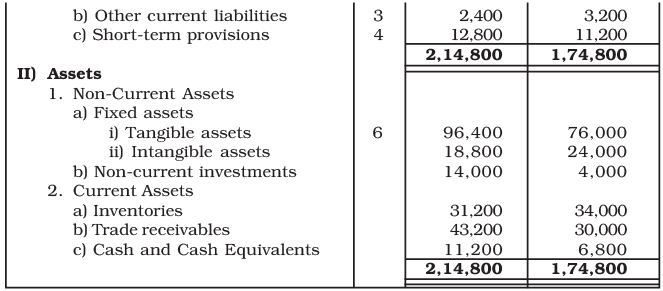

Notes to accounts:

Notes to accounts: Additional Information:

Additional Information:

*Proposed dividend for 2016-17 is Rs. 15,600 and for 2015-16 is Rs. 11,200.

Depreciation Charged on Land & Building Rs. 20,000, and Plant Rs. 10,000 during the year. Proposed dividend for 2016-17 Rs. 15,600 and 2015-16 Rs. 11,200

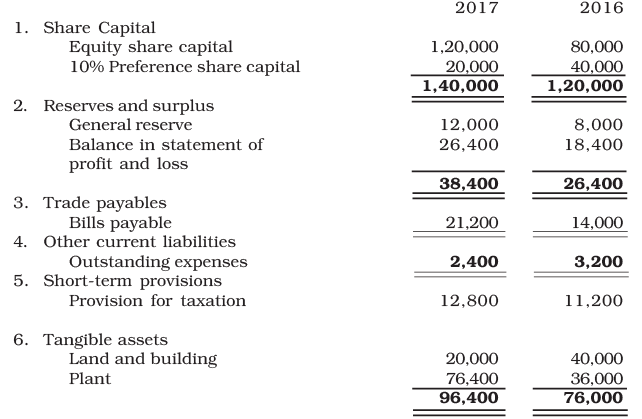

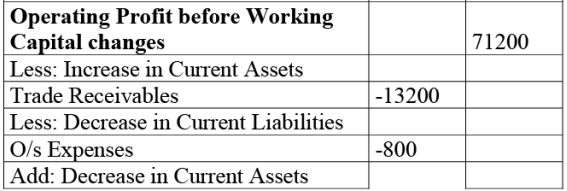

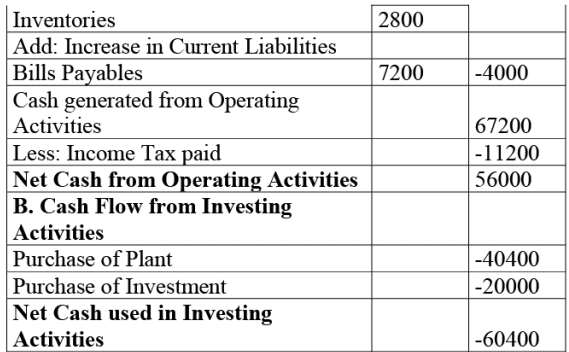

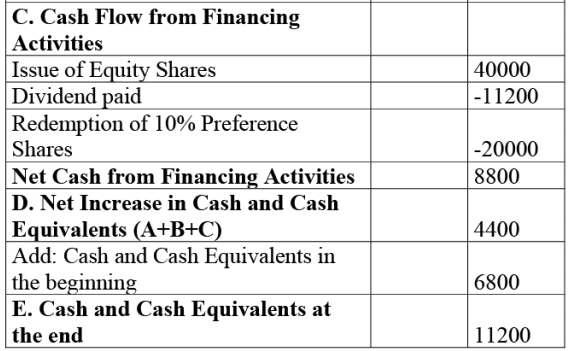

Ans:

Working Note: 1.

Working Note: 1. 2.

2.

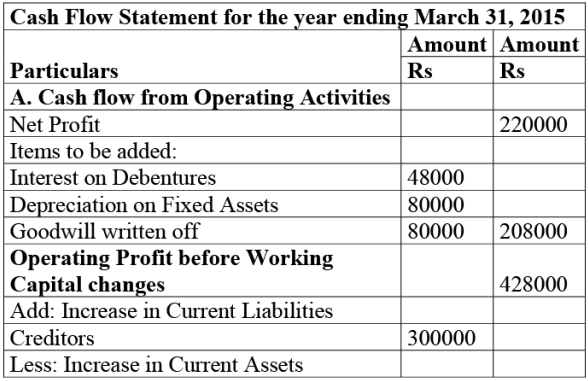

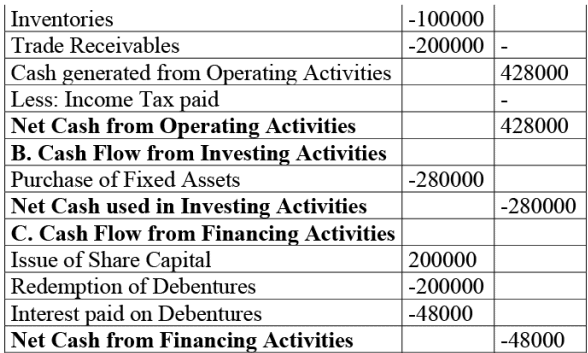

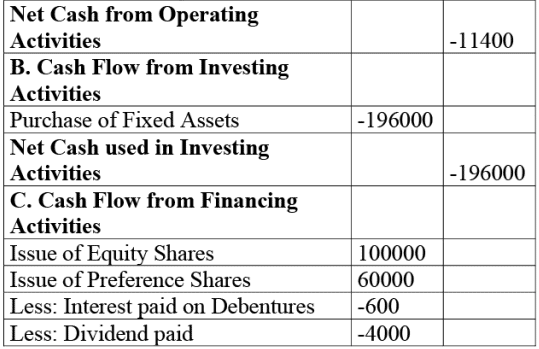

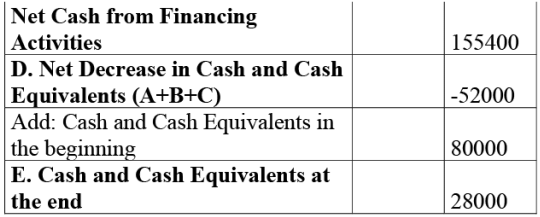

Q9: From the following information, prepare cash flow statement: Additional Information:

Additional Information:

Depreciation Charged on Plant amounted to Rs. 80,000.

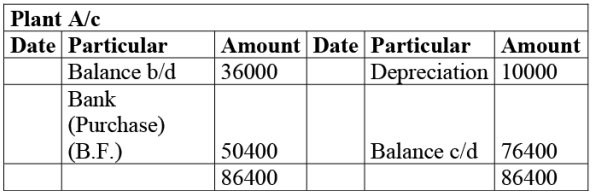

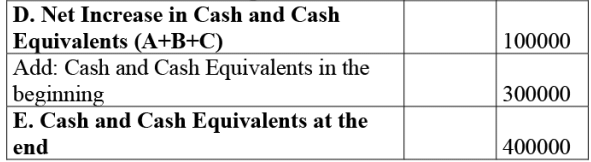

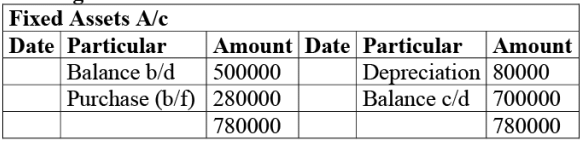

Ans:

Working Note:

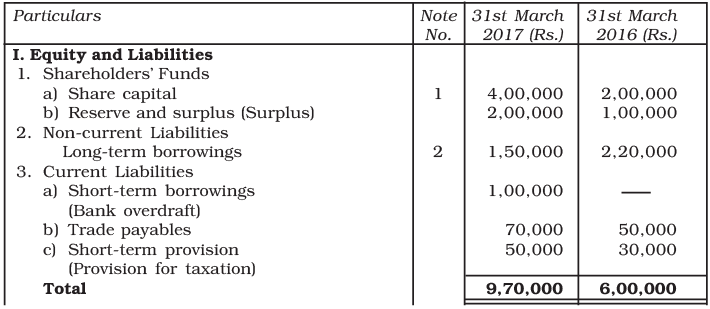

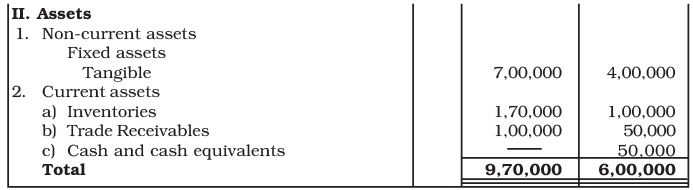

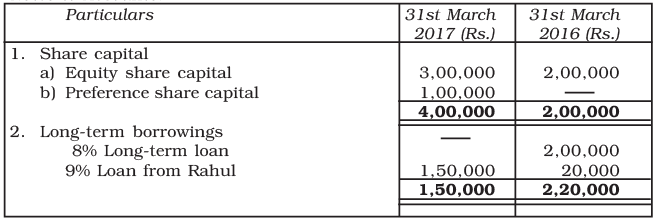

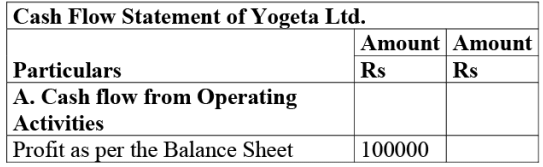

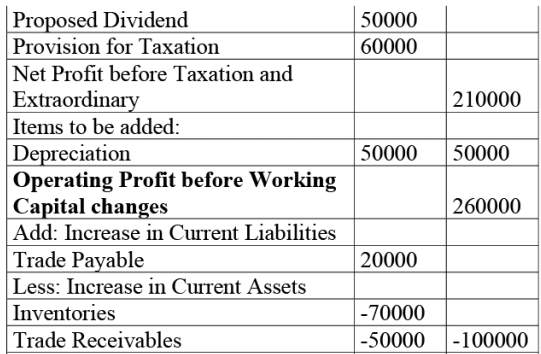

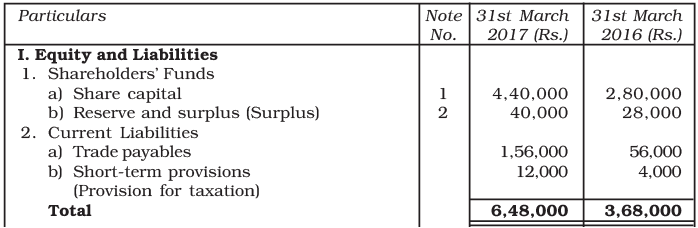

Q10. From the following Balance Sheet of Yogeta Ltd., prepare cash flow statement:

Notes to Accounts:

Notes to Accounts:

Additional Information:

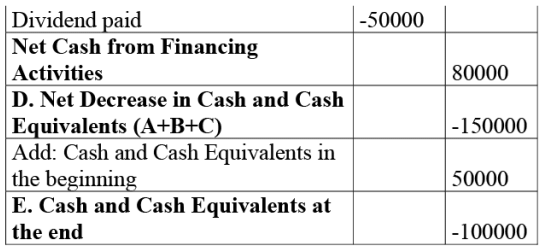

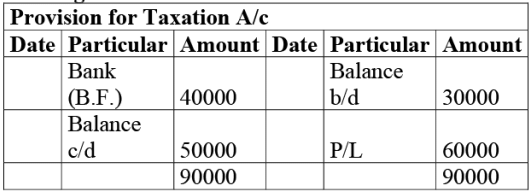

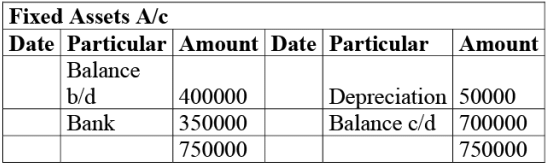

Net Profit for the year after charging Rs. 50,000 as Depreciation was Rs. 1,50,000. Dividend paid on Share was Rs. 50,000, Tax Provision created during the year amounted to Rs. 60,000. 8% loan was repaid on March 31, 2017 and an additional 9% loan of Rs. 1,30,000 was obtained from Rahul on April 01, 2016.

Ans:

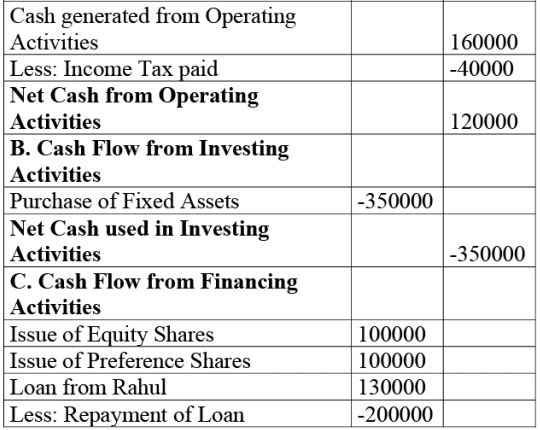

Working Note: 1

Working Note: 1 Working Note: 2

Working Note: 2

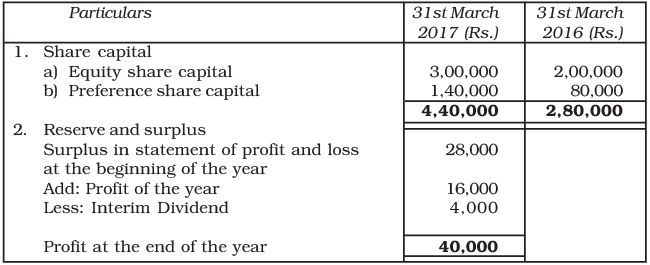

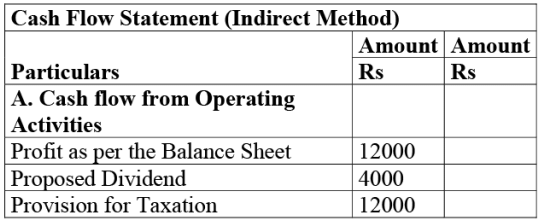

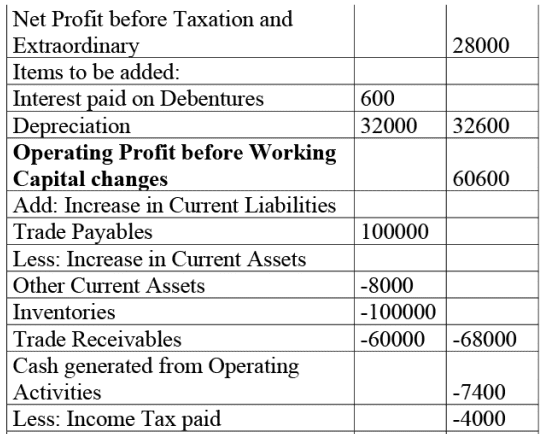

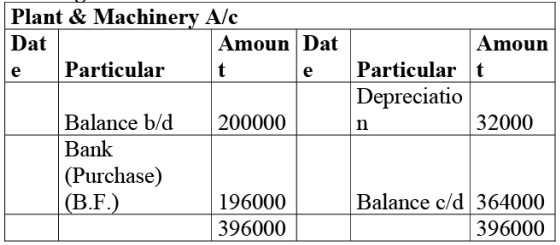

Q11: Following is the Balance sheet of Garima Ltd., prepare cash flow statement.

Notes to Accounts: Additional Information:

Additional Information:

1. Depreciation charged during the year Rs. 32,000

Ans:

Working Note:

Working Note:

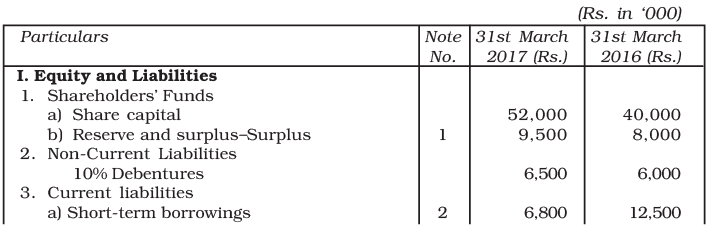

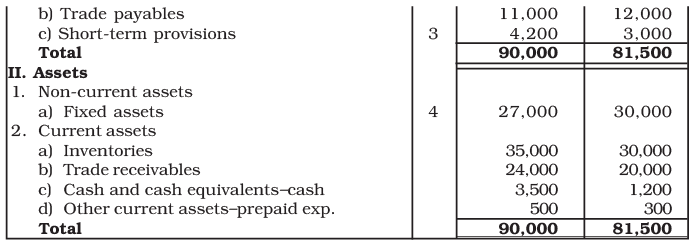

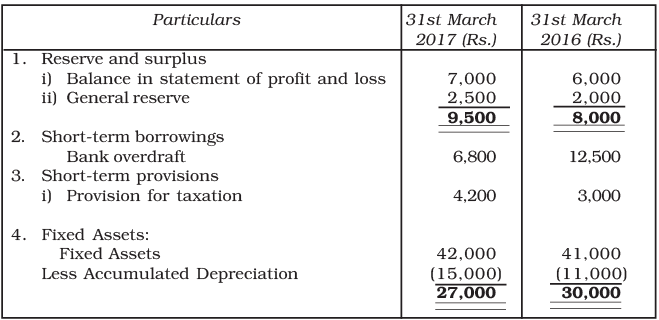

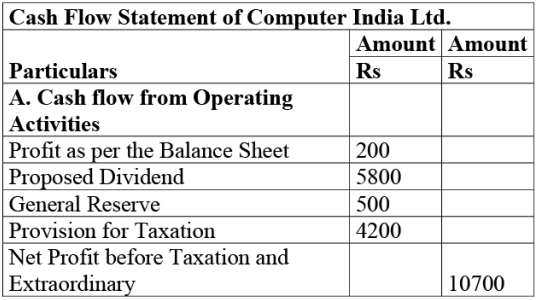

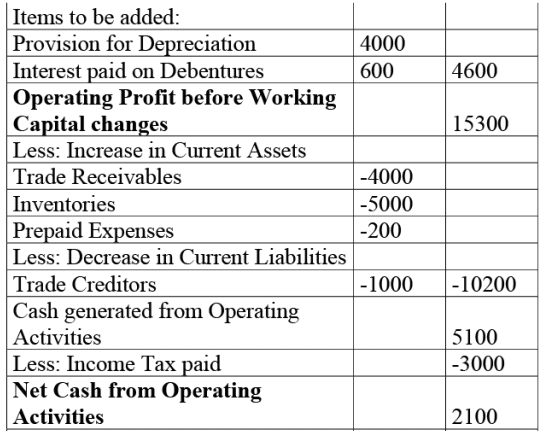

Q12: From the following Balance Sheet of Computer India Ltd., prepare cash flow statement.

Notes to Accounts:

Notes to Accounts: Additional Information:

Additional Information:

Proposed dividend for the year 2015-16 is Rs. 2,50,00,000

Ans:

|

42 videos|255 docs|51 tests

|

FAQs on NCERT Solution: Cash Flow Statement -2 - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement and why is it important? |  |

| 2. What are the main components of a cash flow statement? |  |

| 3. How do you calculate cash flow from operating activities? |  |

| 4. What is the difference between cash flow and profit? |  |

| 5. How can a cash flow statement help in financial analysis? |  |