NCERT Solution: Accounting for Not for Profit Organisation - 2 | Accountancy Class 12 - Commerce PDF Download

PAGE NO. 51

NUMERICAL QUESTIONS:

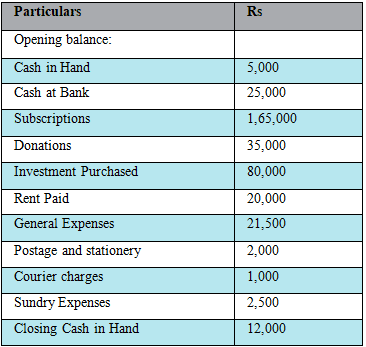

Q.1. From the following particulars taken from the Cash Book of a health club, prepare a Receipts and Payments Account.

Ans.

PAGE NO. 52

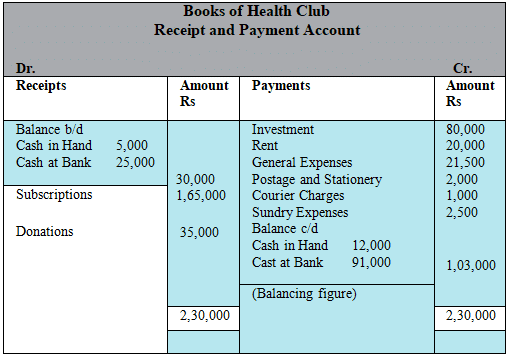

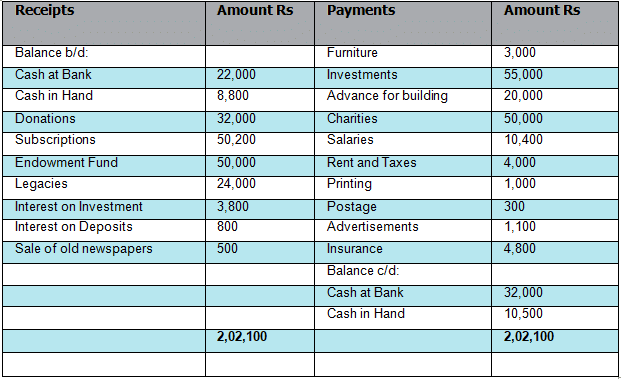

Q.2. The Receipt and Payment Account of Harimohan charitable institution is given:

Receipt and Payment Account for the year ending March 31, 2015

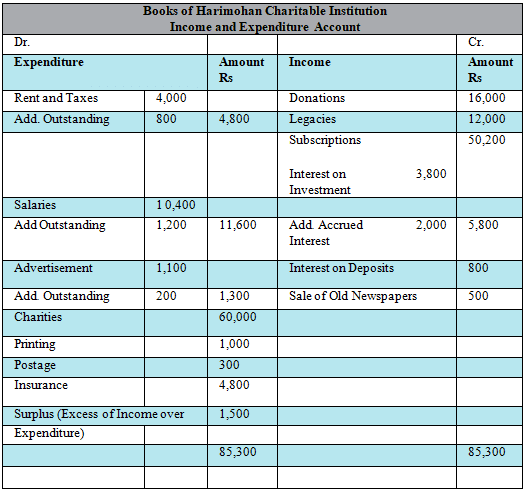

Prepare the Income and Expenditure Account for the Year ended on March 31, 2007 after considering the following:

(i) It was decided to treat Fifty per cent of the amount received on account of Legacies and Donations as income.

(ii) Liabilities to be provided for are:

Rent Rs 800; Salaries Rs 1,200; advertisement Rs 200.

(iii) Rs 2,000 due for interest on investment was not actually received.

Ans.

NOTE: As per the solution, Excess of Income over Expenditure is Rs 1,500; however, as per the book, it is Rs 2,500.

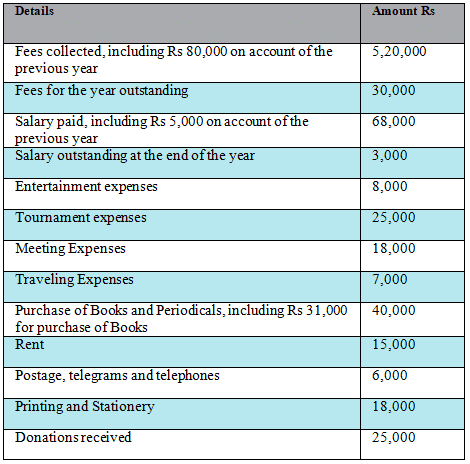

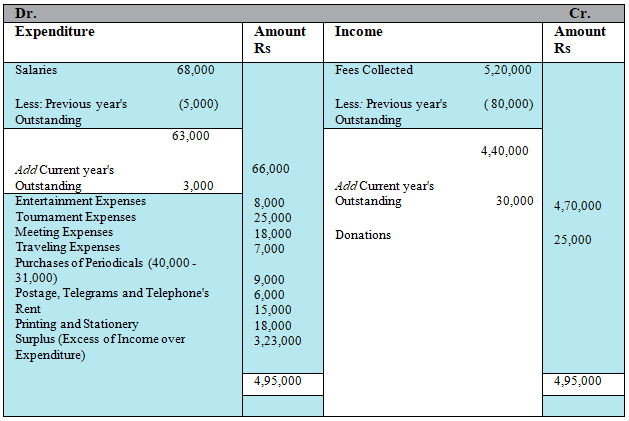

Q.3. From the following particulars, prepare Income and Expenditure account:

From the following particulars, prepare Income and Expenditure account:

Ans.

NOTE: As per the solution, Excess of Income over Expenditure is Rs 3,23,000; however, as per the book, it is Rs 3,07,000.

PAGE NO. 53

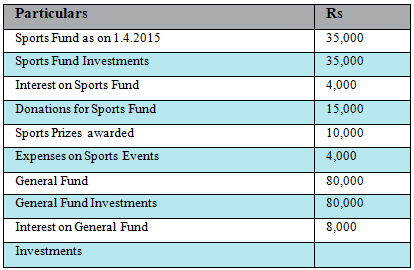

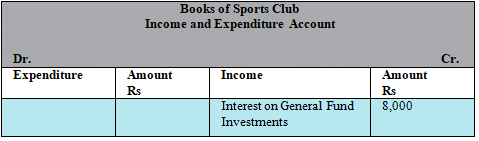

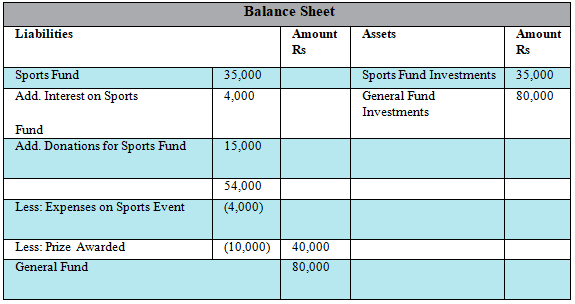

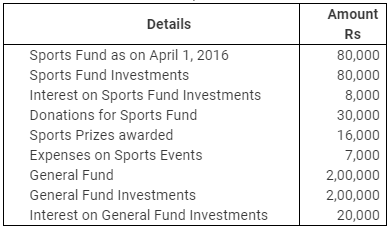

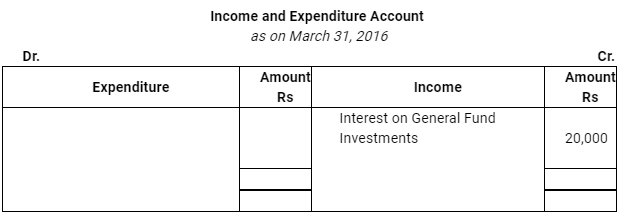

Q.4. Following is the information given in respect of certain items of a Sports Club. Show these items in the Income and Expenditure Account and the Balance Sheet of the Club:

Ans.

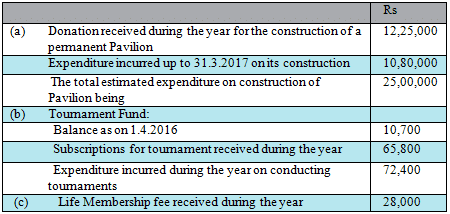

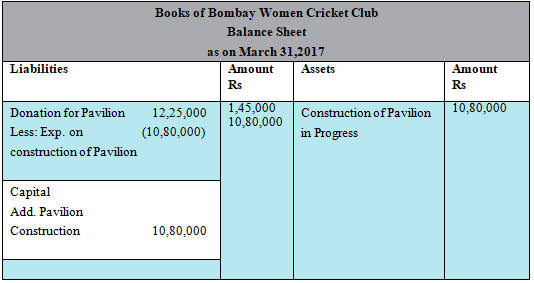

Q.5. How will you deal with the following items while preparing for the Bombay Women Cricket Club its income and expenditure account for the year ending 31.3.2017 and its Balance Sheet as on 31.3.2017:

Give reasons for your answers

Ans.

(a)

Reason

Donation for construction of Pavilion is a donation for specific purpose.

Expenses on construction on Pavilion is a capital expenditure.

(b)

Reason

All funds received are treated as capital receipts and expenses related to any fund are deduced from the concerned funds.

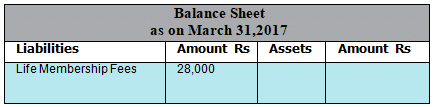

(c)

Reason

Life Membership Fees are considered as capital receipts and are shown on the Liabilities side of the Balance Sheet, if nothing is specified about its treatment. But if it is to be treated as revenue item, then it is shown on the credit side of the Income and Expenditure Account.

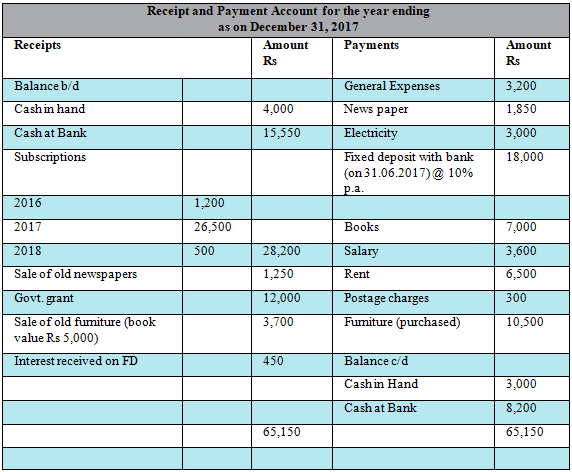

Q.6. From the following receipts and payments and information given below, Prepare Income and Expenditure Account and opening Balance Sheet of Adult Literacy Organisation as on December 31, 2013.

Information:

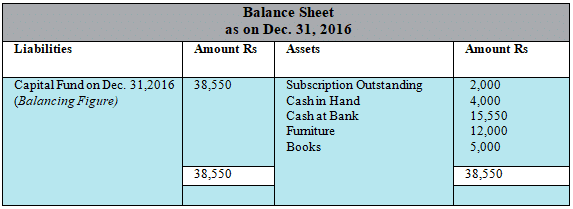

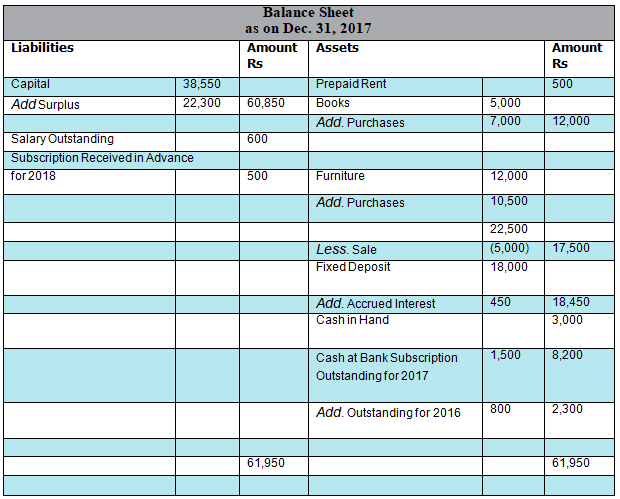

(i) Subscription outstanding as on 31.12.2016 Rs 2,000 and on December 31, 2017 Rs 1,500.

(ii) On December 31, 2017 Salary outstanding Rs 600, and one month Rent paid in advance.

(iii) On Jan. 01, 2016 organisation owned Furniture Rs 12,000, Books Rs 5,000.

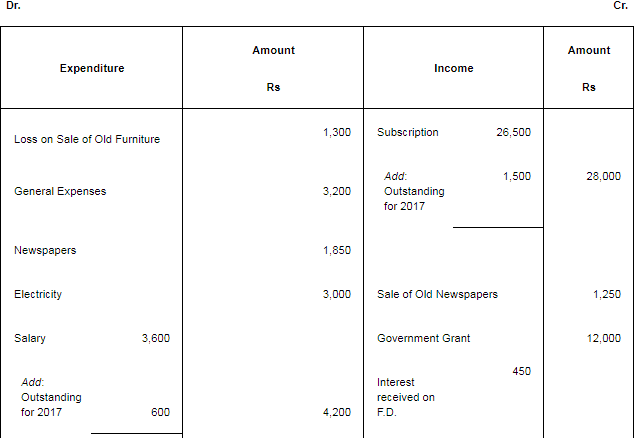

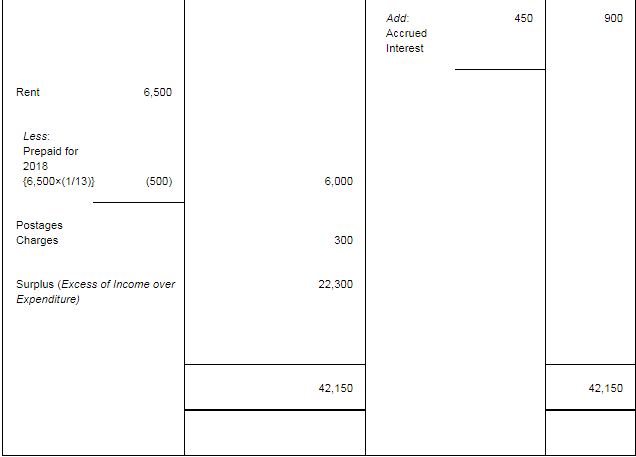

Ans.

Books of Adult Literacy Organisation

Income and Expenditure Account

as on Dec. 31, 2017

PAGE NO. 54

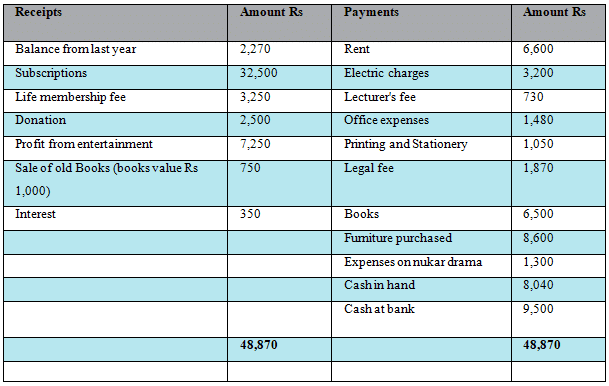

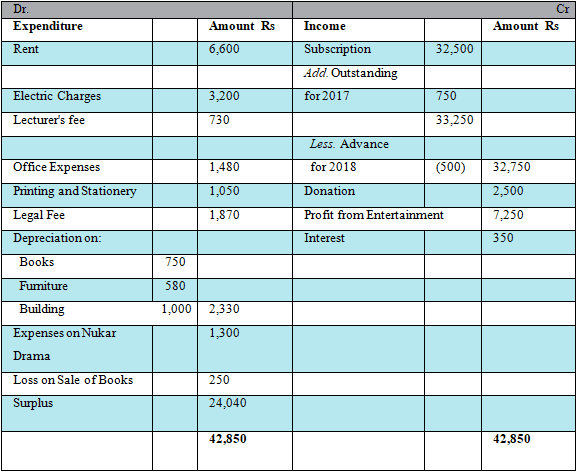

Q.7. The following is the account of cash transactions of the Nari Kalayan Samittee for the year ended December 31, 2017:

You are required to prepare an Income and Expenditure Account after the following adjustments:

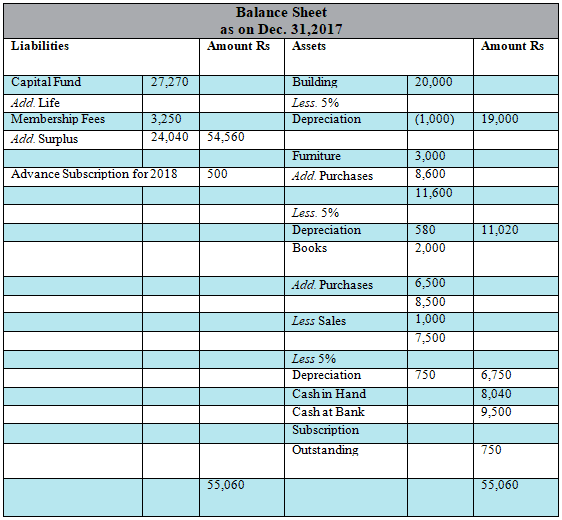

(a) Subscription still to be received are Rs 750, but subscription include Rs 500 for the year 2018.

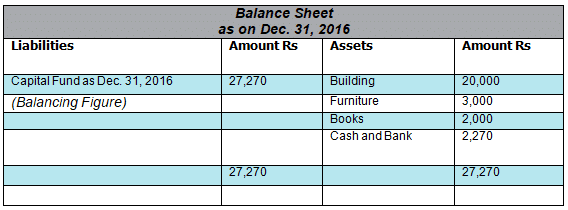

(b) In the beginning of the year the Sangh owned building Rs 20,000 and furniture Rs 3,000 and Books Rs 2,000.

(c) Provide depreciation on furniture @ 5% (including purchase), books @ 10% and building @ 5%.

Ans.

PAGE NO. 55

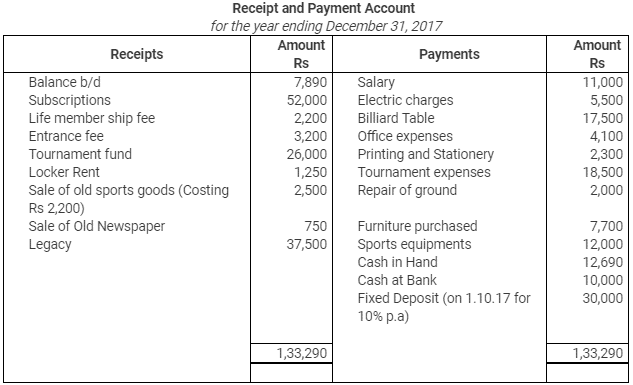

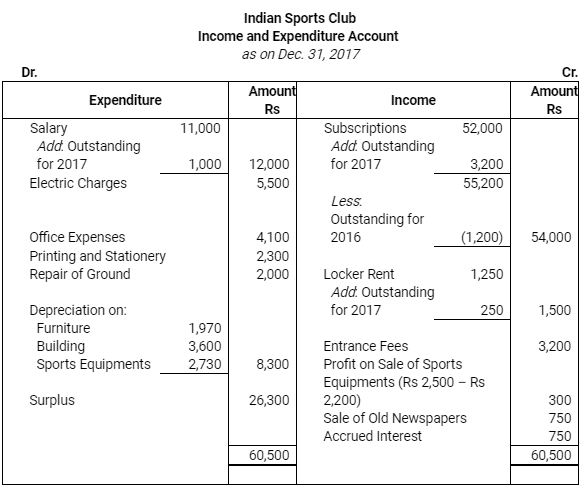

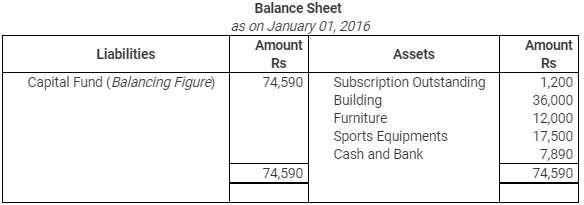

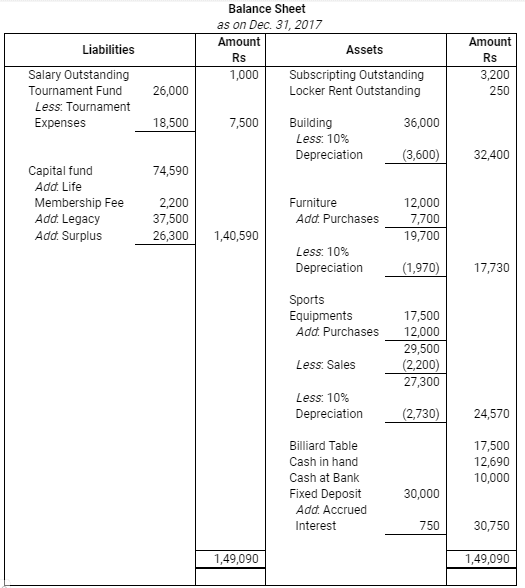

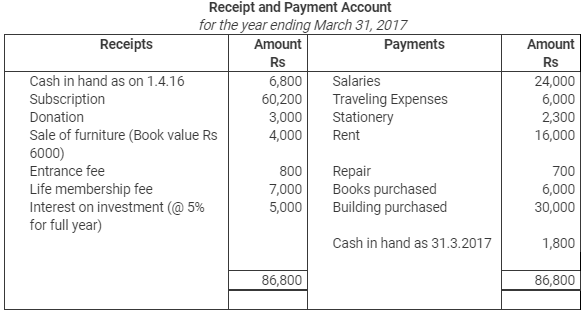

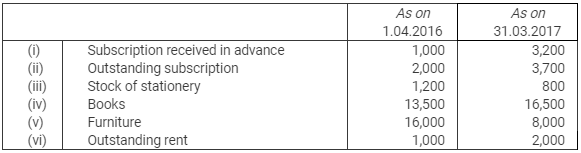

Q.8. Following is the Receipt and Payment Account of Indian Sports Club, prepared Income and Expenditure Account, Balance Sheet as on December 31, 2017:

Other Information:

Subscription outstanding was on December 31, 2016 Rs 1,200 and Rs 3,200 on December 31, 2017. Locker rent outstanding on December 31, 2013 Rs 250. Salary outstanding on December 31, 2013 Rs 1,000.

On January 1, 2017, club has Building Rs 36,000, furniture Rs 12,000, Sports equipments Rs 17,500. Depreciation charged on these items @ 10% (including Purchase).

Ans.

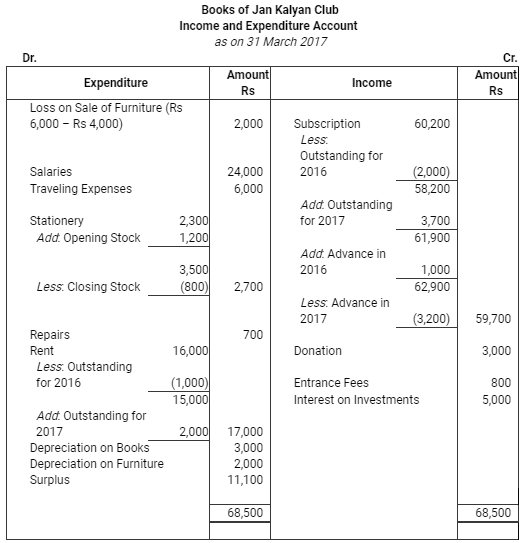

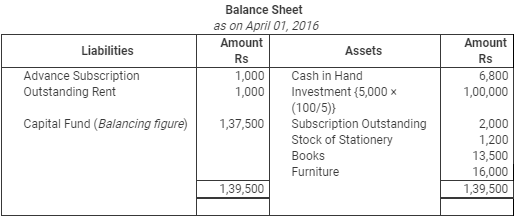

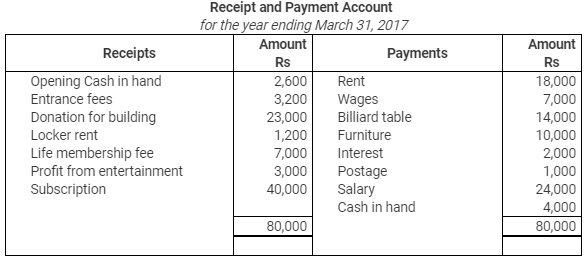

Q.9. From the following Receipt and Payment Account of Jan Kalyan Club, prepare Income and Expenditure Account and Balance Sheet for the year ending March 31, 2017.

Q.9. From the following Receipt and Payment Account of Jan Kalyan Club, prepare Income and Expenditure Account and Balance Sheet for the year ending March 31, 2017.

Additional Information:

Ans.

PAGE NO. 56

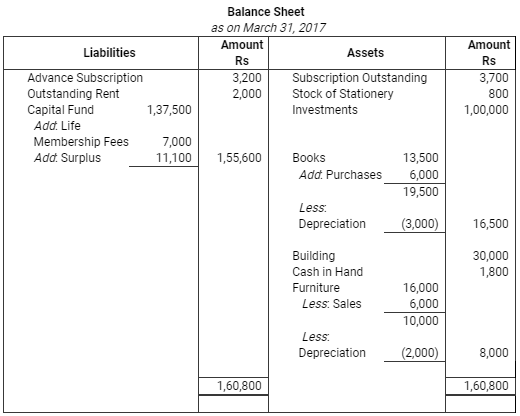

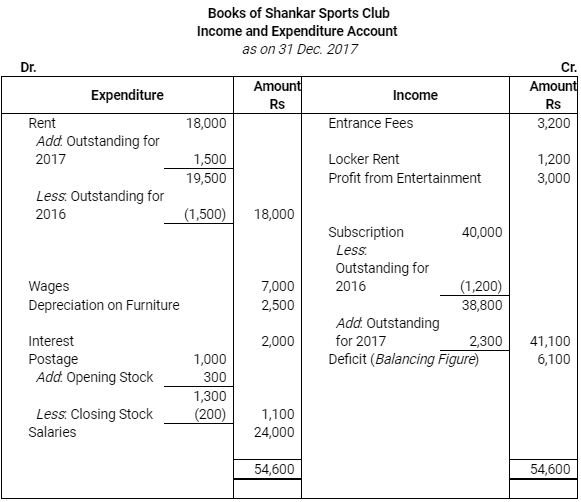

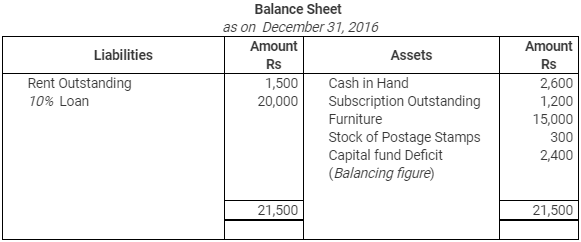

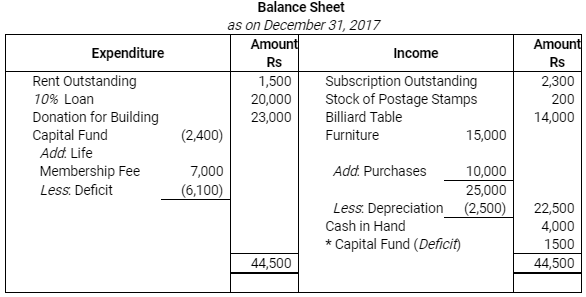

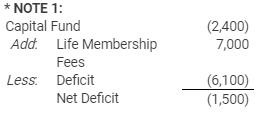

Q.10. Receipt and Payment Account of Shankar Sports club is given below, for the year ended March 31, 2017

Prepare Income and Expenditure Account and Balance Sheet with help of following Information:Subscription outstanding on March 31, 2016 is Rs 1, 200 and Rs 2,300 on March 31, 2017, opening stock of postage stamps is Rs 300 and closing stock is Rs 200, Rent Rs 1,500 related to 2015 and Rs 1,500 is still unpaid.On April 01, 2016 the club owned furniture Rs 15,000, Furniture valued at Rs 22,500

Prepare Income and Expenditure Account and Balance Sheet with help of following Information:Subscription outstanding on March 31, 2016 is Rs 1, 200 and Rs 2,300 on March 31, 2017, opening stock of postage stamps is Rs 300 and closing stock is Rs 200, Rent Rs 1,500 related to 2015 and Rs 1,500 is still unpaid.On April 01, 2016 the club owned furniture Rs 15,000, Furniture valued at Rs 22,500

On March 31, 2017. The club took a loan of Rs 20,000 (@ 10% p.a.) in 2017*.

Ans.

PAGE NO. 57

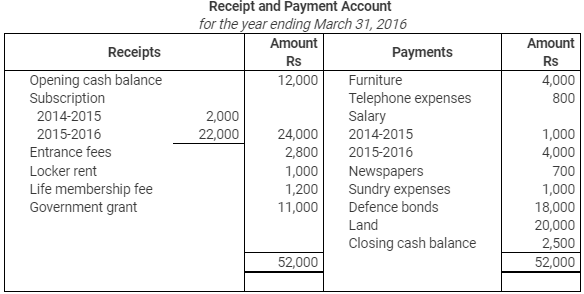

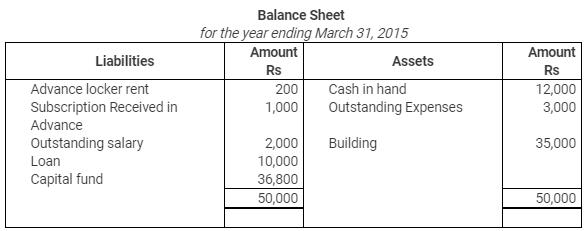

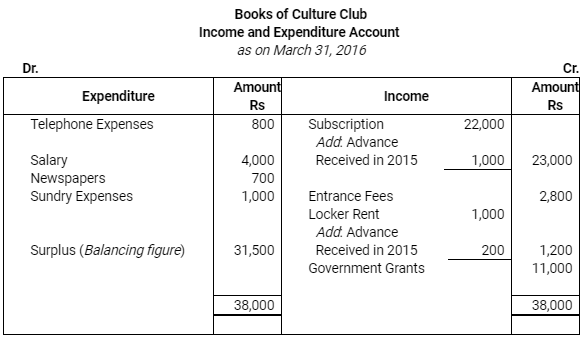

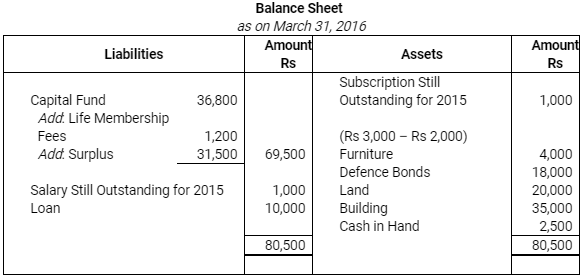

Q.11. Prepare Income and Expenditure Account and Balance Sheet for the year ended December 31, 2006 from the following Receipt and Payment Account and Balance Sheet of culture club:

Ans.

Ans.

PAGE NO. 58

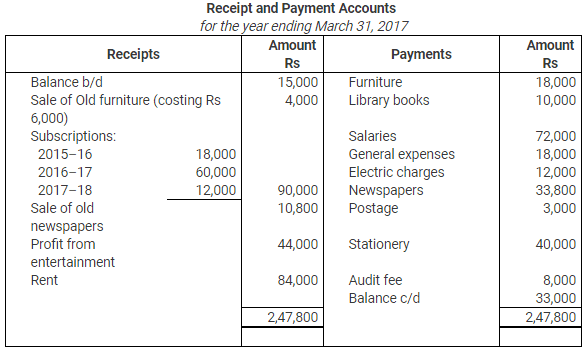

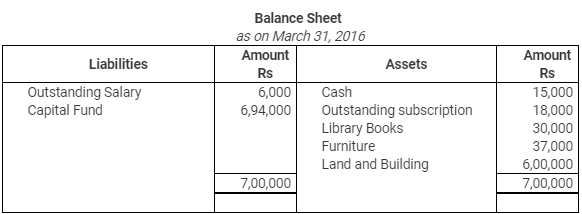

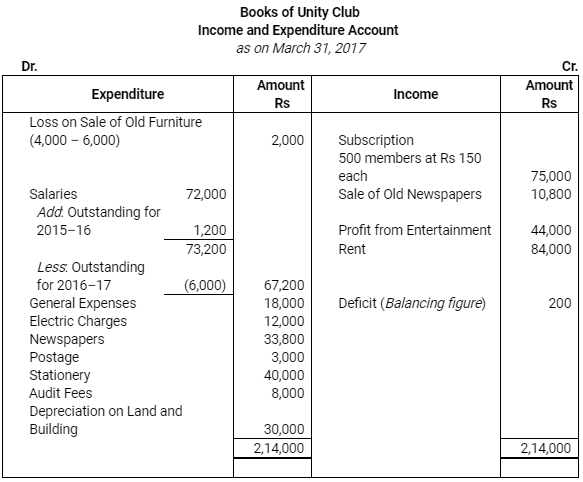

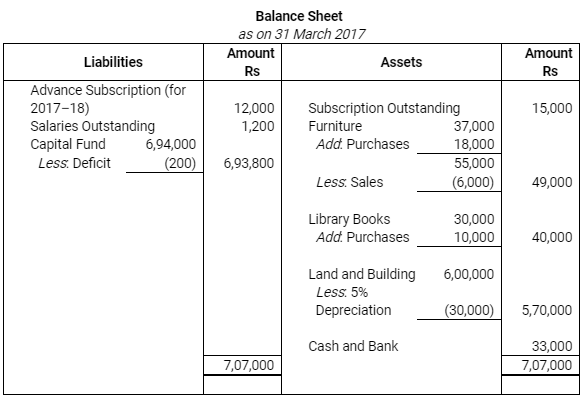

Q.12. From the following Receipt and Payment Account prepare final accounts of a Unity Club for the year ended March 31, 2017.

Additional Information:

1. The Club had 500 members each paying an annual subscription of Rs 150.

2. On 31.3.2016 salaries outstanding amounted to Rs 1,200 and salaries paid included Rs 6,000 for the year 2015–16.

3. Provide 5% depreciation on Land and Building.

Ans.

PAGE NO. 58

Q.13. Following is the information in respect of certain items of a Sports Club. You are required to show them in the Income and Expenditure Account and the Balance Sheet. Ans.

Ans.

PAGE NO. 59

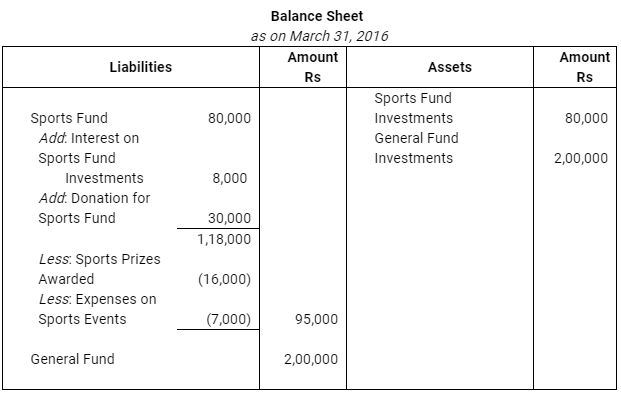

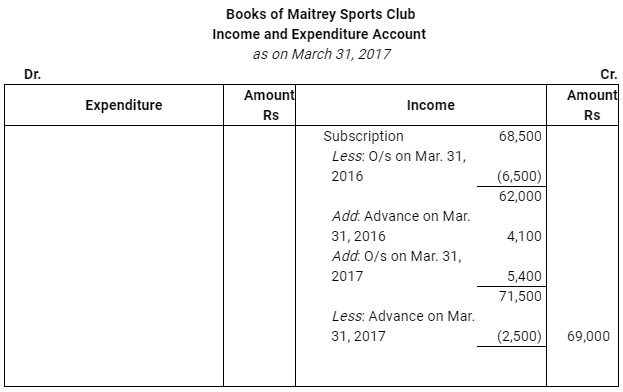

Q.14. Receipt and Payment Account of Maitrey Sports Club showed that Rs 68,500 were received by way of subscriptions for the year ended on March 31, 2017.

The additional information was as under:

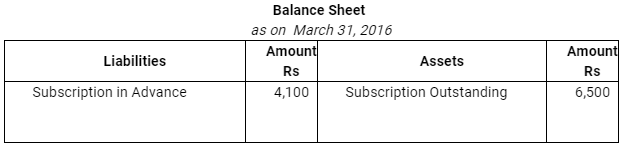

1. Subscription Outstanding as on March 31, 2016 were Rs 6,500,

2. Subscription received in advance as on March 31, 2016 were Rs 4,100,

3. Subscription Outstanding as on March 31, 2017 were Rs 5,400,

4. Subscription received in advance as on March 31, 2017 were Rs 2,500.

Show how that above information would appear in the final accounts for the year ended on March 31, 2017 of Maitrey Sports Club.

Ans.

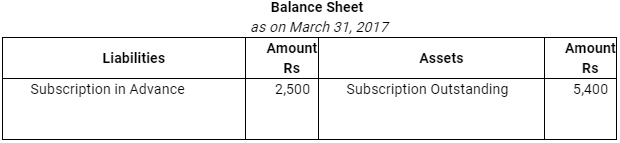

Q.15. Following is the Receipt and Payment account of Rohatgi Trust :

Q.15. Following is the Receipt and Payment account of Rohatgi Trust :

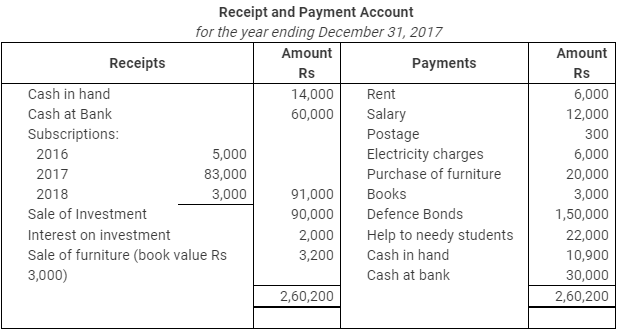

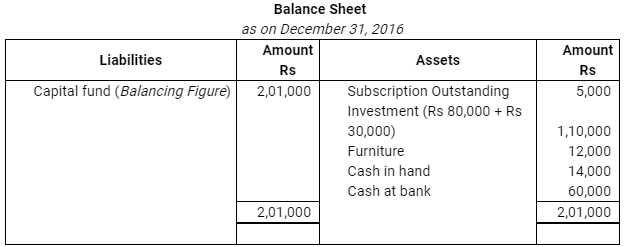

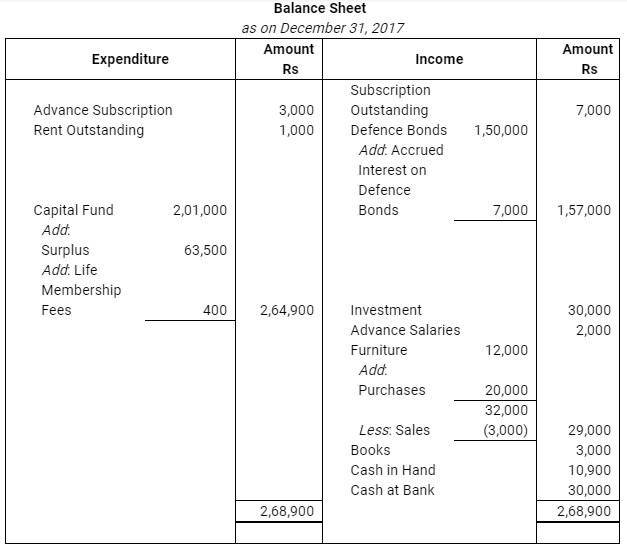

Prepare Income and expenditure account for the year ended December 31, 2017, and a balance sheet as on that date after the following adjustments: Subscription for 2017, still owing were Rs 7,000. Interest due on defence bonds was Rs7,000, Rent still owing was Rs 1,000. The Book value of investment sold was Rs 80,000, Rs 30,000 of the investment were still in hand. Subscription received in 2017 included Rs 400 from a life member. The total furniture on January 1, 2017 was worth Rs 12,000. Salary paid for the year 2018 is Rs 2,000.

Ans.

PAGE NO. 60

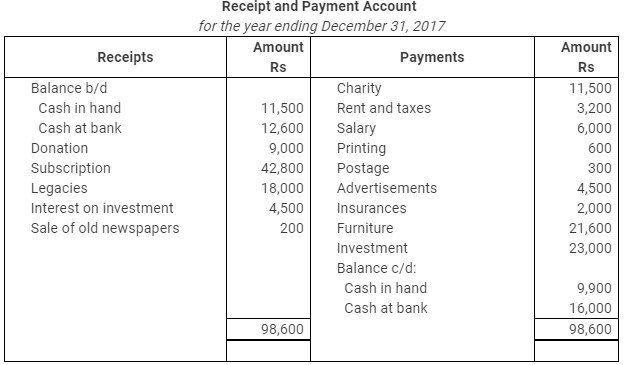

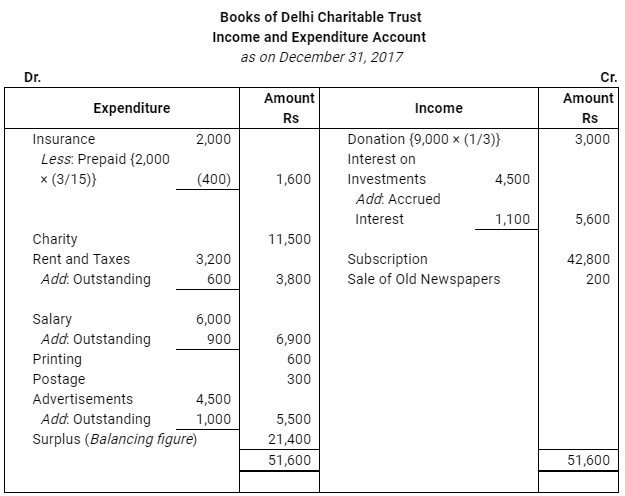

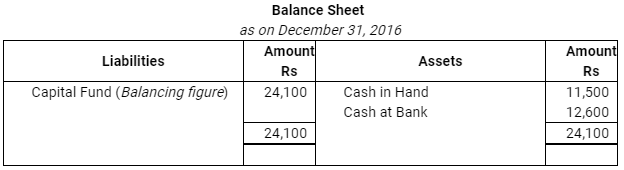

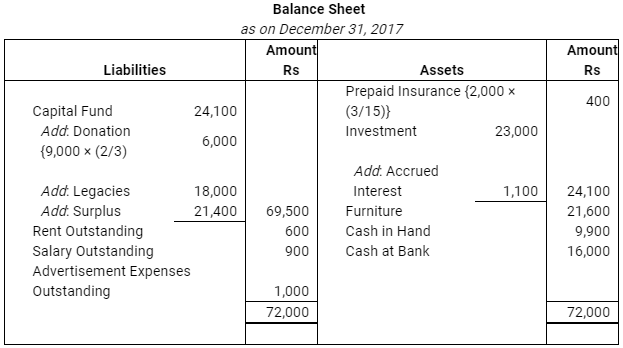

Q.16. Following Receipt and Payment Account was prepared from the cash book of Delhi Charitable Trust for the year ending December 31, 2017 Prepare Income and expenditure account for the year ended December 31, 2017, and a balance sheet as on that date after the following adjustments:

Prepare Income and expenditure account for the year ended December 31, 2017, and a balance sheet as on that date after the following adjustments:

(a) It was decided to treat one-third of the amount received on account of donation as income.

(b) Insurance premium was paid in advance for three months.

(c) Interest on investment Rs1,100 accrued was not received.

(d) Rent Rs600: salary Rs900 and advertisement expenses Rs1,000 outstanding as on December 31, 2017.

Ans.

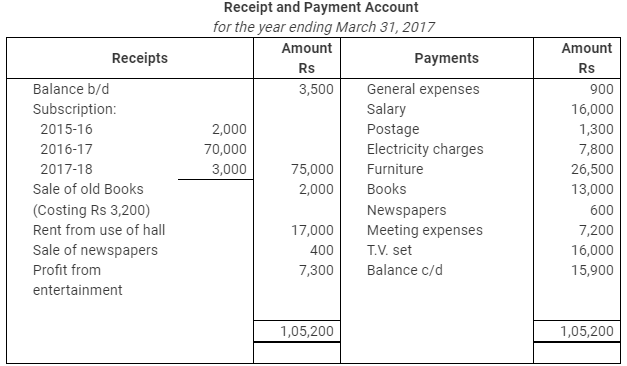

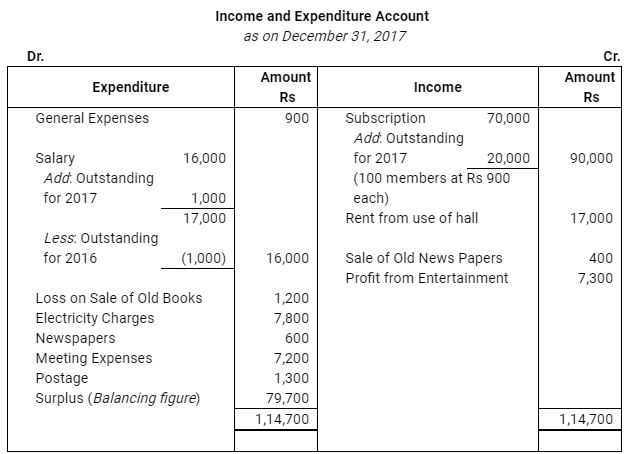

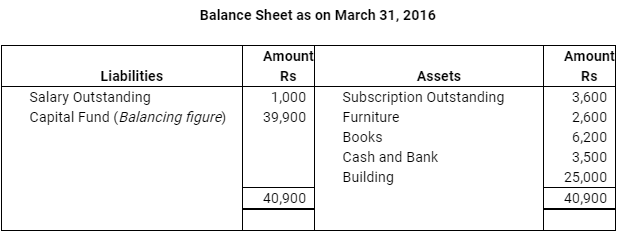

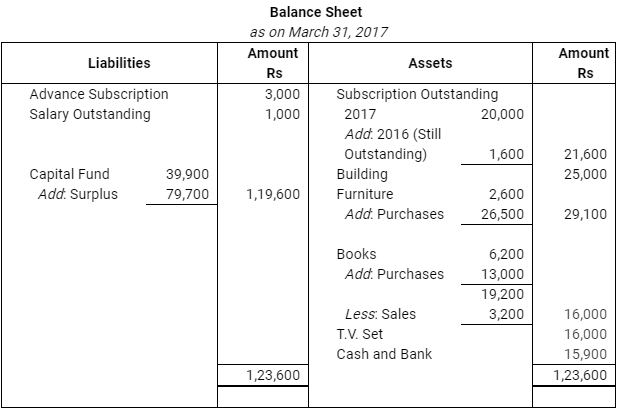

Q.17. From the following Receipt and Payment Account of a club, prepare Income and Expenditure Account for the year ended December 31, 2017 and the Balance Sheet as on that date. Additional Information:

Additional Information:

(a) The club has 100 members each paying an annual subscription of Rs 900. Subscriptions outstanding on March 31, 2016 were Rs 3,600.

(b) On March 31, 2017, salary outstanding amounted to Rs 1,000, Salary paid included Rs 1,000 for the year 2012.

(c) On April 1, 2017 the club owned land and building Rs 25,000, furniture Rs 2,600 and books Rs 6,200.

Ans.

PAGE NO. 61

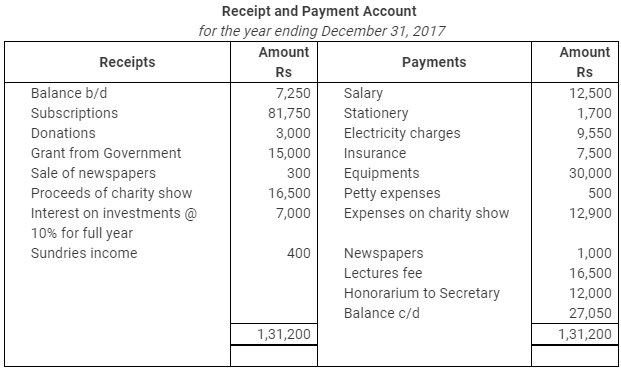

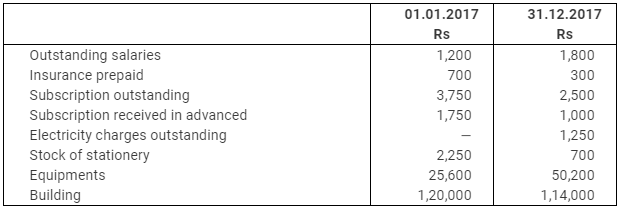

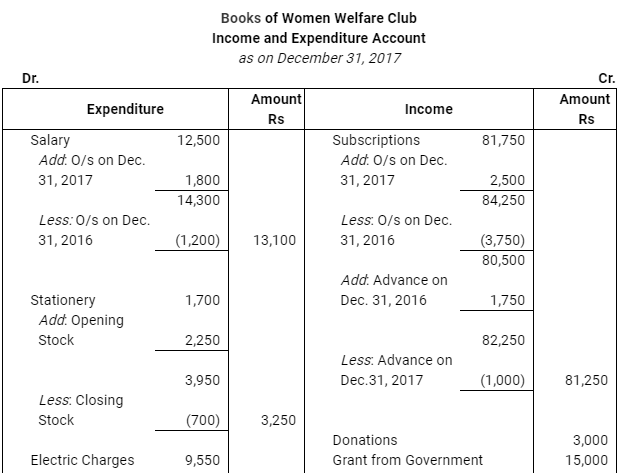

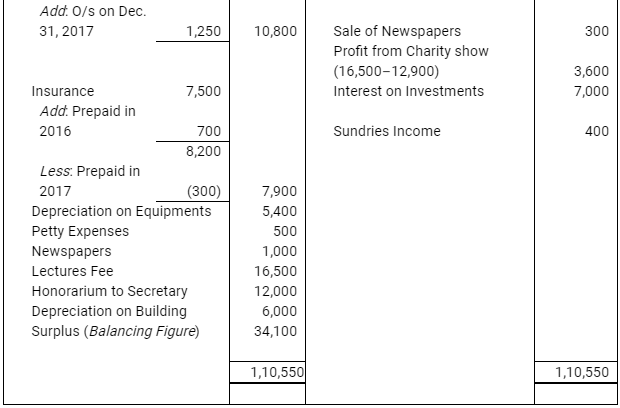

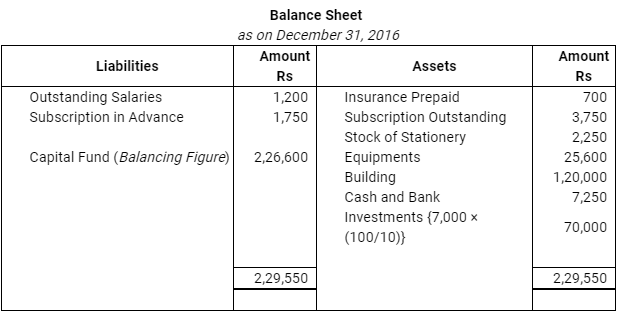

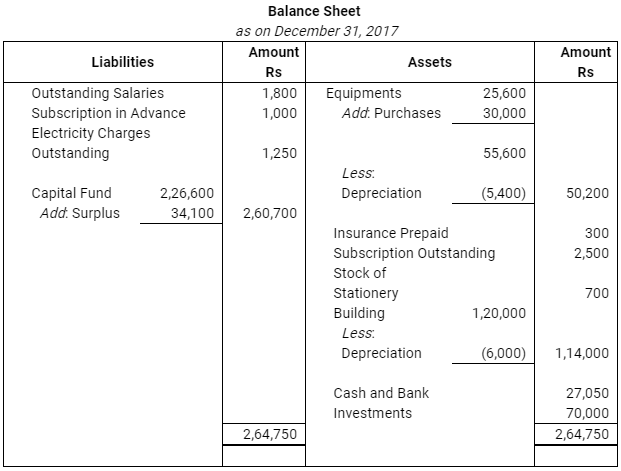

Q.18. Following is the Receipt and Payment Account of Women’s Welfare Club for the year ended December 31, 2017: Additional Information:

Additional Information:

Prepare Income and Expenditure Account for the year ended December 31, 2017 and Balance Sheet as on that date.

Ans.

PAGE NO. 62

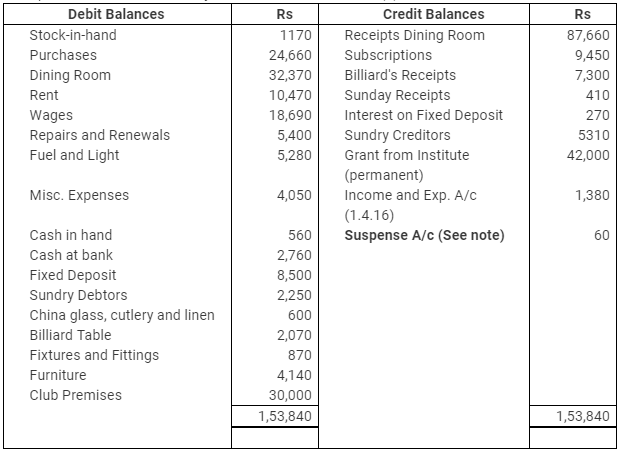

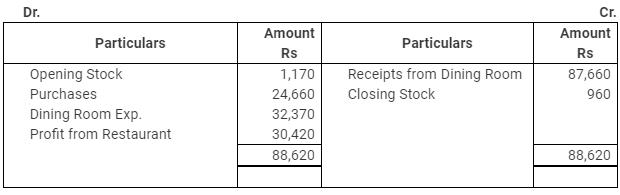

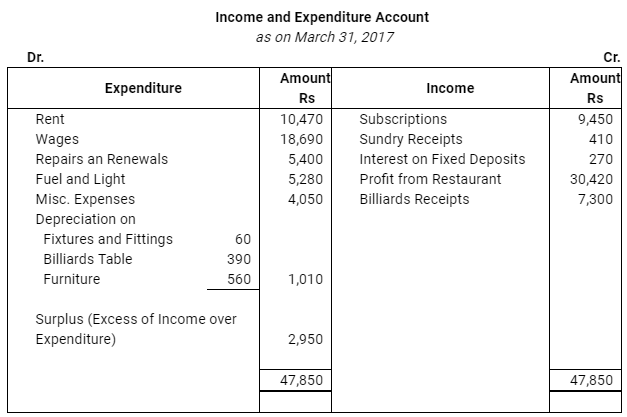

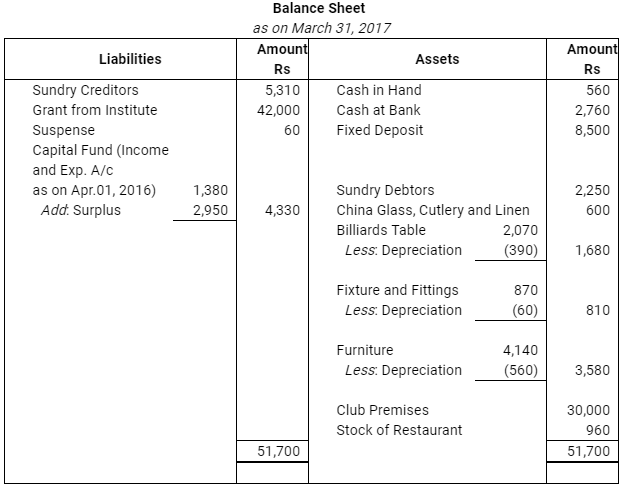

Q.19. As at March 31,2017 the following balances have been extracted from the books of the Indian Chartered Accountants Recreation Club and you are asked to prepare (1) Trading Account for ascertaining gross profit derived from running restaurant and dining room and (2) Income and Expenditure Account for the year ended March 31, 2017 (3) and a Balance Sheet as at that date.

On March 31,2016 stock of restaurant consisted of Rs 900 and Rs 60 respectively. Provide depreciations Rs 60 on fixtures and fittings, Rs 390 on billiard table and Rs 560 on furniture.

Ans.

Important Note:

1. Credit side of the Trial Balance of the question is short by Rs 60. Thus, in order to tally both sides of the Trial Balance, Suspense Account will be opened with the difference amount of Rs 60.

2. In the adjustment, Closing Stock should be Rs 960 instead of Rs 900.

Books of Indian Chartered Accountants Recreation Club

Restaurant Trading Account

|

51 videos|270 docs|51 tests

|

FAQs on NCERT Solution: Accounting for Not for Profit Organisation - 2 - Accountancy Class 12 - Commerce

| 1. What is meant by not for profit organization? |  |

| 2. What are the sources of income for not for profit organizations? |  |

| 3. What is the accounting treatment for donations received by a not for profit organization? |  |

| 4. What is the difference between a not for profit organization and a for-profit organization? |  |

| 5. What is the importance of maintaining proper accounting records for not for profit organizations? |  |