Accounting for Share Capital NCERT Solutions | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

Q1. What is a public company?

Ans: A public company is a type of company that sells shares to the general public through the stock market. Here are the key characteristics:

- It must have at least seven members.

- According to the Companies Act 1956, a public company means a company which:

a) is not a private company,

b) has a minimum paid up capital of Rs 5,00,000 or such higher paid up capital, as may be prescribed,

c) is a private company, being a subsidiary of a company which is not a private company. - A public company should not be confused with a publicly owned company, which is owned and controlled by the government.

- It can issue shares to the public without restrictions on the number of shareholders.

Public companies can be classified into two types:

- Listed Company: Shares are traded on stock exchanges (e.g., Tata Motors, Reliance).

- Unlisted Company: Shares are not traded on stock exchanges.

Q2. What is a private limited company?

Ans: A private limited company is a type of business entity that limits the liability of its members. Here are its key features:

- Share Capital: It requires a minimum paid-up share capital of Rs 1,00,000.

- Share Transfer Restrictions: The transfer of shares is restricted, meaning members cannot freely sell their shares.

- Membership: A private limited company must have at least two and no more than 50 members, excluding current and former employees.

- Public Offerings: It cannot invite the general public to buy shares or debentures.

- Deposits: It cannot accept deposits from anyone other than its members, directors, and their relatives.

Unlike a public company, a private limited company cannot issue shares to the public or have its shares traded on the stock exchange. An example of a private limited company is Coca-Cola India Private Limited.

Q3. When can shares be Forfeited?

Ans: Shares can be forfeited when a shareholder does not pay the required money for their shares. The process involves the following steps:

- If a shareholder fails to pay the allotment money or any subsequent calls, the company sends a formal notice.

- If the shareholder still does not pay after receiving the notice, the company has the right to forfeit the shares.

- The shares are then cancelled, and the money already paid is retained by the company.

This procedure is typically outlined in the company's articles of association, which follow the guidelines set out in Table F.

Q4. What is meant by Calls-in-Arrears?

Ans: Calls-in-Arrears refers to the situation when a shareholder does not pay all the instalments on their shares by the due date. The company expects these shareholders to pay the outstanding amounts later. The unpaid amounts are collectively known as Calls-in-Arrears.

- When shares are issued, shareholders are required to pay in instalments.

- If a shareholder fails to pay by the due date, the amount owed is termed Calls-in-Arrears.

- Companies may charge interest on these arrears.

- It is not mandatory for a company to maintain a separate account for Calls-in-Arrears.

- Shareholders can also pay amounts in advance, known as Calls in Advance.

Q5. What do you mean by a listed company?

Ans: A listed company is a public company whose shares are available for trading on a recognised stock exchange. Examples include companies like Tata Motors and Reliance. Here are some key points about listed companies:

- Shares can be bought and sold by the public.

- They provide transparency in the trading of shares.

- Investors can easily track the value of their investments.

- Being listed enhances the company's credibility and goodwill.

- It helps potential investors make informed decisions about their investments.

Q6. What are the uses of securities premium?

Ans: As per Section 78 of the Companies Act of 1956, the amount of securities premium can be used by the company for the following activities:

1. For paying up unissued shares of the company to be issued to members (shareholders) of the company as fully paid bonus shares,

2. For writing off the preliminary expenses of the company,

3. For writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company,

4. For paying up the premium that is to be payable on redemption of preference shares or debentures of the company.

5. Further, as per Section 77A, the securities premium amount can also be utilised by the company to buy back its own shares.

Q7. What is meant by Calls-in-Advance?

Ans: Calls-in-Advance refers to when a shareholder pays some or all of the amount for shares before it is officially requested by the company. This early payment is recorded as a liability for the company.

- The amount received is known as Calls-in-Advance.

- This amount is credited to the Calls in Advance Account.

- It will be adjusted against future calls when they become due.

- Interest may be paid on this amount, typically at a rate not exceeding 12% per annum, if specified in the company's Articles of Association.

Q8. Write a brief note on 'Minimum Subscription'.

Ans: Minimum Subscription refers to the minimum amount that must be raised from the public when shares are issued. This amount is crucial for the company to proceed with the allotment of shares. Key points include:

- The minimum subscription cannot be less than 90% of the total issued amount, as per the Company Act of 1956.

- If the minimum subscription is not achieved, the company must refund all application amounts to the public.

- The company has 130 days from the issue date of the prospectus to return the application money if the minimum subscription is not met.

- Once the minimum subscription is received, the company can proceed with share allotment after fulfilling legal requirements.

- Letters of allotment are sent to successful applicants, while those who do not receive shares get letters of regret.

Long Answer Questions

Q1: What is meant by the word 'Company'? Describe its characteristics.

Ans: Section 3 (1) (i) of the Company Act of 1956 defines an organisation as a company that is formed and registered under the Act or any existing company that is formed and registered under any earlier company laws. In general, a company is an artificial person, created by law, that has a separate legal entity, perpetual succession, common seal and limited liability. It is a voluntary association of a person who together contribute to the capital of the company to do business. Generally, the capital of a company is divided into small parts known as shares, the ownership of which is transferable subject to certain terms and conditions. There are two types of companies: public companies and private companies.

Characteristics of Company

1. Association of Person: A company is formed voluntarily by a group of persons to perform a common business. The minimum number of people should be two for the formation of a private company and seven for a public company.

2. Artificial Person: A company is an artificial and juristic person that is created by law.

3. Separate Legal Entity: A company has a separate legal entity from its members (shareholders) and Directors. It can open a bank account, sign a contract and own property in its name.

4. Limited Liability: The liability of the members of a company is limited up to the nominal value or the face value of the shares. Unlike a partnership firm, on insolvency of a company, the members and the shareholders are not liable to pay the amount due to the creditors of the company. In fact, the members and the shareholders are only liable to pay the unpaid amount of the shares held by them. For example, if the value of a share is Rs 10 and Rs 6 is paid up, then the member is liable to pay only Rs 4.

5. Perpetual Existence: The existence of the company is not affected by the death, retirement, and insolvency of its members. That is, the life of a company remains unaffected by the life and the tenure of its members in the company. The life of a company is infinite until it is properly wound up as per the Company Act.

6. Common Seal: The Company is an artificial person and has no physical existence; hence, it cannot put its signature. Thus, the Common Seal acts as an official signature of a company that validates the official documents.

7. Transferability of Shares: The shares of a public limited company are easily and freely transferable without any consent from other members. But the share of ownership of a private limited company is not transferable without the consent of the other members.

Q2: Explain in brief the main categories in which the share capital of a company is divided.

Ans: The division of the share capital of a company into main categories is diagrammatically explained below.

1. Authorised Capital: It is an amount that is stated in the Memorandum of Association. It is the maximum amount that the company can raise by issuing shares. This maximum amount can be increased as per the procedures laid down in the Company Act.

2. Issued Capital: It is a part of authorised capital which is offered by the company to the general public for subscription. For example, if the authorised capital of a company is Rs 1,00,000 divided into Rs 10 per share, then the issued capital cannot be more than Rs 1,00,000.

3. Unissued Capital: It is a part of authorised capital that is not offered till now but can be offered to the general public in future. In the above example, if the issued capital is Rs 80,000, then the unissued capital is Rs 20,000.

4. Subscribed Capital: It is a part of issued capital that is actually subscribed by the general public. For example, if the company has issued 8,000 shares of Rs 10 per share and the public has subscribed for 7,500 shares, then the subscribed share capital of the company amounts to Rs 75,000.

5. Unsubscribed Capital: It is that part of the issued capital that is not subscribed by the public. For example, in the above example, 500 shares were left unsubscribed, making an unsubscribed share capital of Rs 5,000.

6. Called up Capital: It is a part of subscribed capital that is called up by the Directors from the shareholders of a company to pay. For example, if the Directors call up Rs 6 out of Rs 10 (i.e. the face value of the share) from the shareholders of 10,000 to pay, then Rs 60,000 is regarded as called up share capital.

7. Uncalled up Capital: It is that part of subscribed capital which is not called up till now but can be called up in future as per the need of the company. For example, in the above example, Rs 4 were left uncalled from shareholders holding 10,000 shares, so Rs 40,000 is uncalled up share capital.

8. Paid-up capital: It is that part of called-up share capital which is actually received from the shareholders. If the entire called-up money of Rs 4 on 1,000 shares has been received except from a shareholder holding 300 shares, then the paid-up share capital is Rs 2,800 (Rs 4,000 - Rs 1,200). The amount of Rs 1,200 is called a Call in Arrears that has been called up but is unpaid.

9. Reserved Capital: As per Section 99 of the Company Act of 1956, a limited company may call up any portion of uncalled share capital in the event of winding up of the company to pay its creditors. This amount of uncalled share capital cannot be used for any other purpose and is reserved for paying back the creditors; that is why such a portion of share capital is called reserve capital.

Q3: What do you mean by the term ‘share’? Discuss the type of shares, which can be issued under the Companies Act, 2013, as amended to date.

Ans: A share represents a portion of a company's capital divided into units of fixed value. Individuals who own shares are known as shareholders. Under the Companies Act, 2013, companies can issue two main types of shares:

Preference Shares:

- These shares provide holders with the right to receive dividends at a fixed rate or amount.

- Preference shareholders have priority in receiving their invested capital back before equity shareholders during the company's winding up.

- They can be further classified into:

- Cumulative: Accumulate unpaid dividends.

- Non-cumulative: Do not accumulate unpaid dividends.

- Redeemable: Can be bought back by the company after a certain period.

- Irredeemable: Cannot be bought back by the company.

Equity Shares:

- Equity shareholders have voting rights and control over company decisions.

- These shares do not have fixed dividends, and their returns depend on the company's profits.

- Equity shares can be classified into:

- With voting rights: Shareholders can vote on company matters.

- With differential rights: Shareholders may have different rights regarding voting or dividends.

Q4: Discuss the process for the allotment of shares of a company in case of over subscription.

Ans: When the total number of applications received for shares exceeds the number of shares offered by the company to the public, the situation of oversubscription arises. A company can opt for any of the three alternatives to allot shares in case of oversubscription of shares.

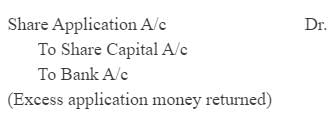

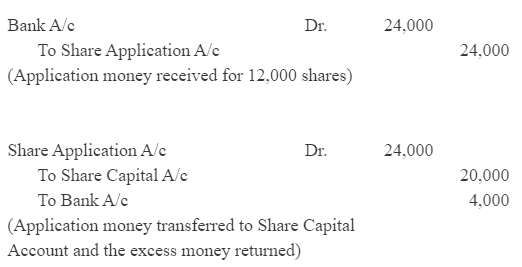

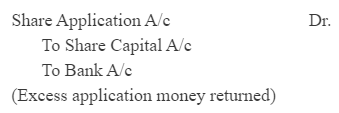

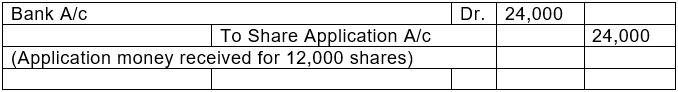

i) Excess applications are refused, and money received on excess applications is returned to the applicants.

The company can refuse excess applications, and the money received on these excess applications is returned to the applicants.

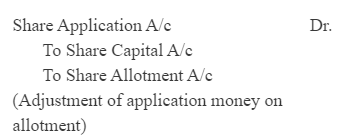

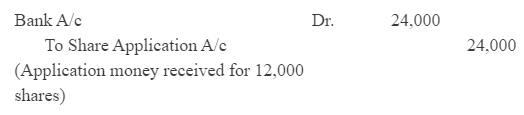

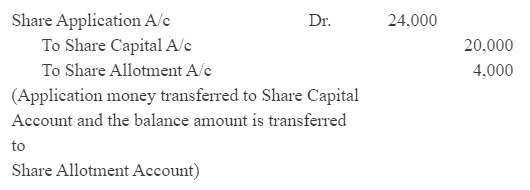

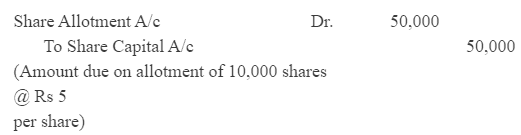

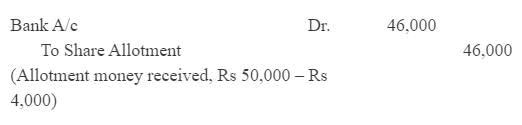

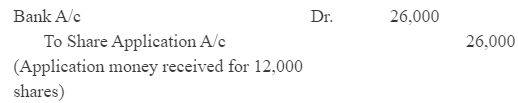

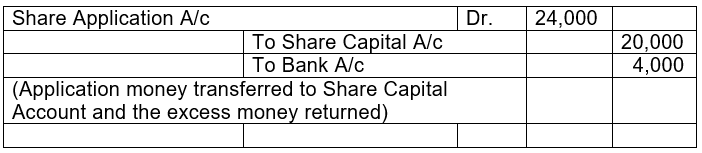

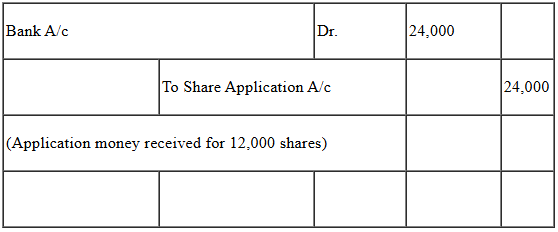

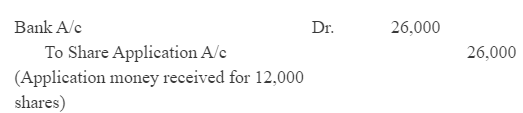

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. The amount payable is Rs 2 on application, Rs 5 on allotment, Rs 3 on the first and final call.

ii) Pro-rata Basis

ii) Pro-rata Basis

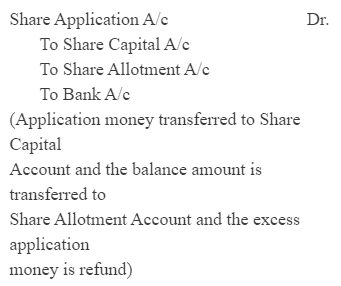

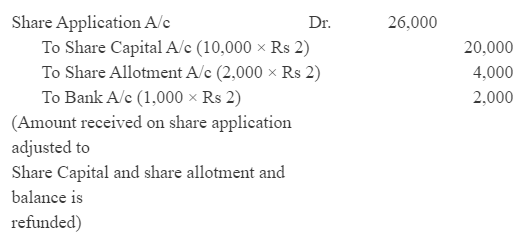

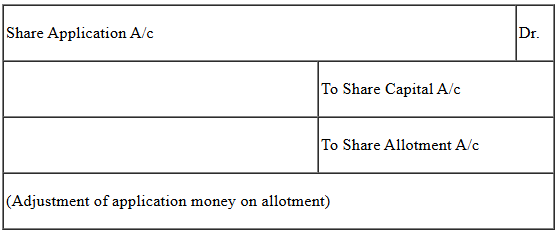

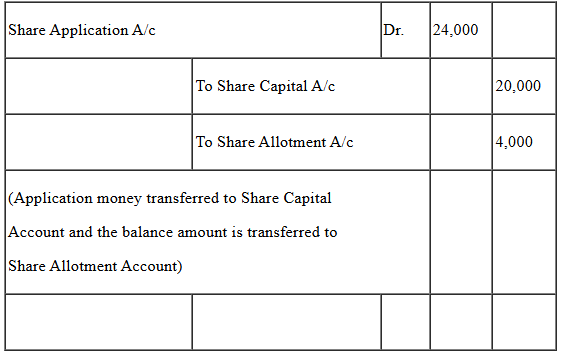

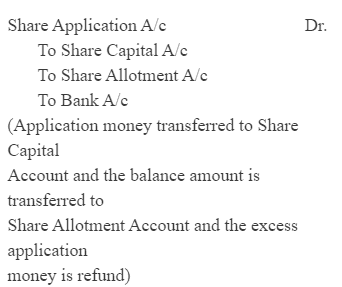

The company can allot shares on a pro-rata basis to all the share applicants. The excess amount received in the application is adjusted on the allotment.

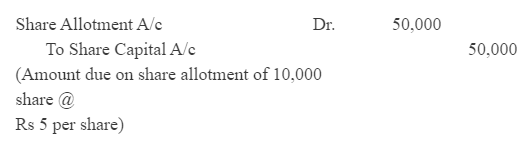

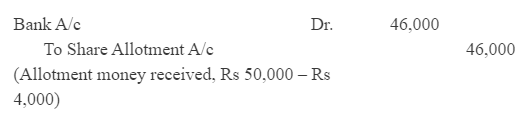

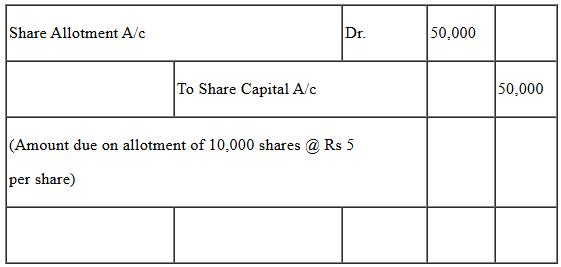

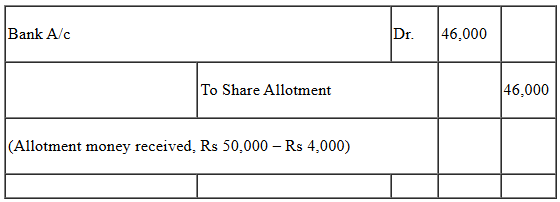

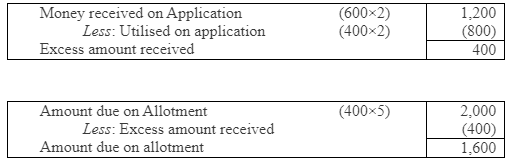

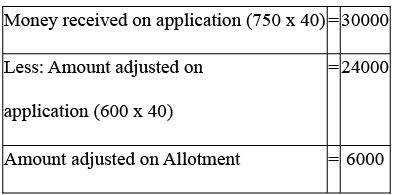

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. The amount payable is Rs 2 on application, Rs 5 on allotment, and Rs 3 on the first and final call.

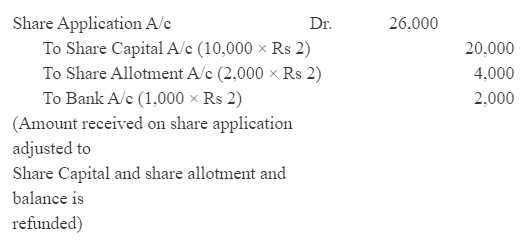

iii) Pro rata and refund of money

In this case, the company follows a combination of both methods. It may reject some share applications and may allot some applications on a pro-rata basis. Example: Shares issued 10,000 @ Rs 10 per share and money received for 13,000 shares. The amount payable is Rs 2 on application, Rs 5 on allotment, and Rs 3 on the first and final call. If the company rejects the applications for 1,000 shares and allots the remaining on a pro-rata basis.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 13,000 shares. The amount payable is Rs 2 on application, Rs 5 on allotment, and Rs 3 on the first and final call. If the company rejects the applications for 1,000 shares and allots the remaining on a pro-rata basis.

Q5: What is a 'Preference Share'? Describe the different types of preference shares.

Ans: Preference Shares: Section 85 of the Company Act,1956 defines Preference Shares to be featured by the following rights:

a. Preference Shares entitle its holder the right to receive dividends at a fixed rate or fixed amount.

b. Preference Shares entitle its holder the preferential right to receive repayment of capital invested by them before their equity counterparts at the time of winding up of the company.

Types of Preference Shares

The different types of Preference Shares are diagrammatically explained below.

1. On the basis of Dividend:

a) Cumulative Preference Shares

When a preference shareholder has a right to recover any arrears of dividend, before any dividend is paid to the equity shareholders, then the type of Preference Shares held by the shareholder is known as Cumulative Preference Shares. All Preference Shares are cumulative unless otherwise expressly stated to be non-cumulative.

b) Non Cumulative Preference Share

When a preference shareholder receives dividends only in case of profit and is not entitled to any right to recover the arrears of dividend, then the type of Preference Shares held by the shareholder is known as Non Cumulative Preference Shares.

2. On the basis of Participation:

a) Participating Preference Share

When a preference shareholder enjoys the right to participate in the surplus profit (in addition to the fixed rate of dividend) that is left after the payment of dividends to the equity shareholders, the type of shares held by the shareholder is known as Participating Preference Share.

b) Non participating Preference Share

When a preference shareholder receives only a fixed rate of dividend every year and does not enjoy the additional participation in the surplus profit, then the type of shares held by the shareholder is known as Non-Participating Preference Shares.

It must be noted that all Preference Shares are non-participating until and unless expressly stated.

3. On the basis of Redemption:

a) Redeemable preference share

When a preference shareholder is repaid by the company after a certain specified period in accordance with the terms specified in Section 80 of the Company Act of 1956, then the type of the shares held by him/her is known as Redeemable Preference Shares.

b) Non Redeemable Preference share

These shares are not repaid by the company during its lifetime. As per Section 80A of the Company Act of 1956, no company can issue Non Redeemable Preference Shares. It is merely a theoretical concept.

4. On the basis of Convertibility:

a) Convertible Preference Share

The shareholders holding Convertible Preference Shares have a right to convert his/her shares into equity shares.

b) Non Convertible Preference Share

Unlike Convertible Preference Shares, the shareholders holding Non-Convertible Preference Shares do not enjoy the right to convert their shares into equity shares.

Q6: Describe the provision of law relating to 'Calls-in-Arrears' and 'Calls-in-Advance'.

Ans: Calls-in-Arrears: This term refers to amounts that shareholders have not paid on allotment or subsequent calls. Key points include:

- The company's Articles of Association may allow it to charge interest on these unpaid amounts from the due date until payment is made.

- If the Articles do not specify, Table A applies, charging interest at a rate of 5% per annum.

- According to the Revised Schedule VI of the Companies Act, Calls-in-Arrears are deducted from the Called-up Share Capital in the Notes to Accounts.

- This deduction is reflected on the Equity and Liabilities side of the company's Balance Sheet.

- The company may also forfeit shares due to non-payment after notifying shareholders.

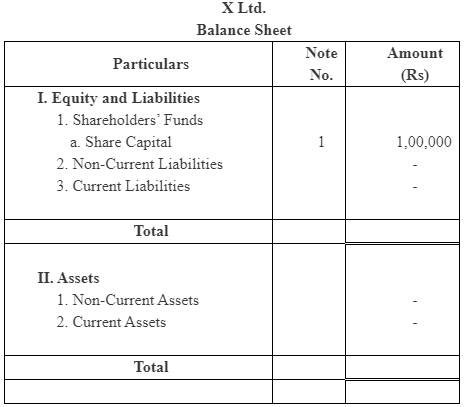

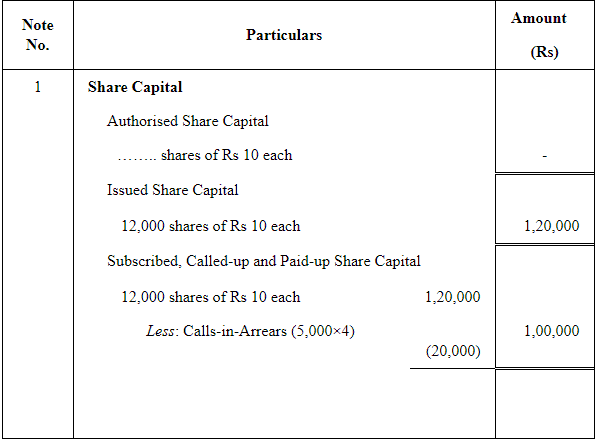

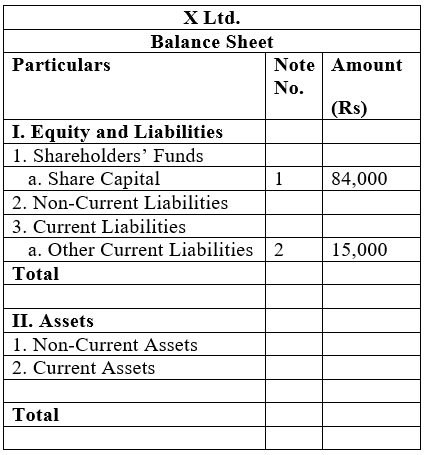

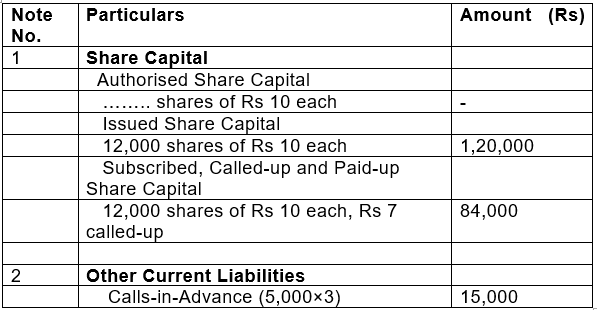

Example- X Ltd. issued 12,000 shares of Rs 10 each. All the shares were duly subscribed, however, the first and final call of Rs 4 on 5,000 shares remained unpaid.

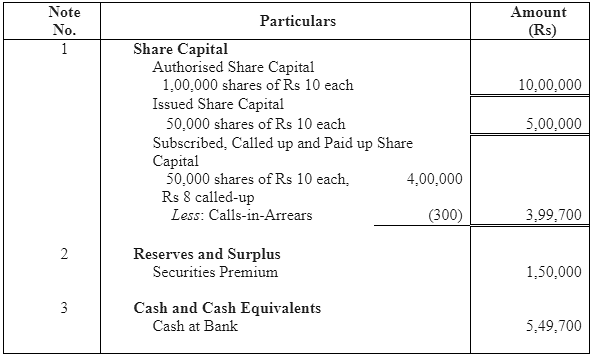

Notes to Accounts

Calls-in-Advance: When a shareholder pays the whole amount or a part of the amount in advance, i.e. before the company calls, then it is termed as Calls-in-Advance. The company is authorised by its Article of Association to pay interest at the specified rate on a call in advance from the date of payment till the date of the call made. If the Article of Association is silent in this regard, then Table A shall be applicable, that is, interest at 6% p.a. is provided to the shareholders. As per the Revised Schedule VI of the Companies Act, Calls-in-Advance (along with interest on it) is added to the 'Other Current Liabilities' in the Notes to Accounts. The final amount of Other Current Liabilities is shown under the main head of 'Current Liabilities' on the Equity and Liabilities side of the Company's Balance Sheet.

Example- X Ltd. issued 12,000 shares of Rs 10 each. All the shares were duly subscribed. The final call of Rs 3 was not yet made, however, a shareholder holding 5,000 shares paid the final call instalment in advance along with the allotment money.

Notes to Accounts

Q7: Explain the terms 'Over-subscription' and 'Under-subscription'. How are they dealt with in accounting records?

Ans: When the total number of applications received for shares exceeds the number of shares offered by the company to the public, the situation of Over-subscription arises. A company can opt for any of the three alternatives to allot shares in case of Over-subscription of shares.

i) Excess applications are refused and money received on excess applications is returned to the applicants.

The company can refuse excess applications and the money received on these excess applications is returned to the applicants.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call.

ii) Pro rata Basis

The company can allot shares on pro-rata basis to all the share applicants. The excess amount received in the application is adjusted on the allotment.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call.

iii) Pro rata and refund of money

In this case, the company follows a combination of both methods. It may reject some share applications and may allot some applications on the pro-rata basis.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 13,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call. If the company rejects the applications for 1,000 shares and allots the remaining on the pro rata basis.

Under-subscription- When the number of shares applied by the public is lesser than the number of shares issued by the company, then the situation of Under-subscription arises. As per the Company Act, the Minimum Subscription is 90% of the shares issued by the company. This implies that the company can allot shares to the applicants provided if applications for 90% of the issued shares are received. Otherwise, the company should refund the entire application amount received. In this regard, necessary Journal entry is passed only after receiving and refunding of the application money.

Q8: Describe the purposes for which a company can use 'Securities Premium Account'.

Ans: As per the Section 78 of the Companies Act of 1956, the amount of securities premium can be used by the company for the following activities:

1. For paying up unissued shares of the company to be issued to members (shareholders) of the company as fully paid bonus share,

2. For writing off the preliminary expenses of the company,

3. For writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company,

4. For paying up the premium that is to be payable on redemption of preference shares or debentures of the company.

5. Further, as per the Section 77A, the securities premium amount can also be utilised by the company to Buy-back its own shares.

Q9: State clearly the conditions under which a company can issue shares at a discount.

Ans: As per the Section 79 of the Company Act of 1956, following are the conditions under which a company can issue shares at a discount.

- A company can issue shares at discount provided it has previously issued such type of shares.

- The issue of shares at a discount is authorised by a resolution passed by the company in the General Meeting and sanction obtained from the Company Law Tribunal.

- The resolution specifies that the maximum rate of discount is 10% of the face value of the shares unless a higher percentage of discount is allowed by the Company Law Tribunal.

- A company can issue shares at a discount at least after one year from the date of commencing business.

- If a company wants to issue shares at a discount, then it must issue them within two months of obtaining sanction from the Company Law Tribunal.

- Every prospectus related to the issue of the shares should explicitly and clearly contain particulars of the discount allowed on the issue of shares.

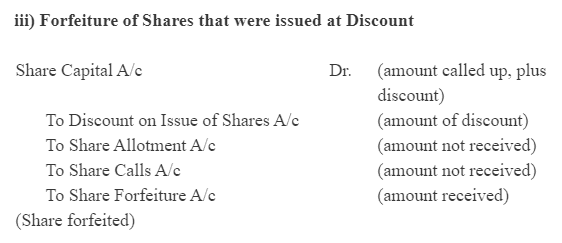

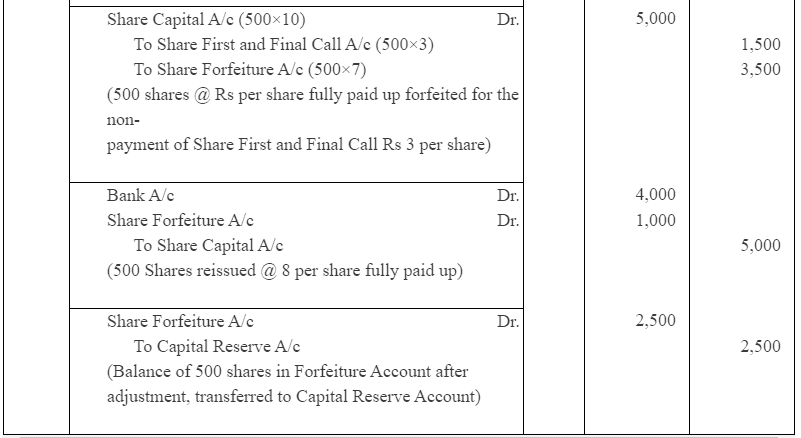

Q10: Explain the term 'Forfeiture of Shares' and give the accounting treatment on forfeiture.

Ans: Forfeiture of Shares occurs when a shareholder fails to pay the allotment money or any subsequent calls. In such cases, the company can cancel the shares after following the proper procedure. Here’s how it works:

- A notice is sent to the defaulting shareholder, requesting payment of Calls in Arrears along with any accrued interest within 14 days. Failure to pay will result in forfeiture.

- If the payment is not made, the company can forfeit the shares by passing a resolution.

- A notice of the resolution is sent to the shareholder, and a public announcement is made in a daily newspaper.

- The shareholder's name is removed from the register of members.

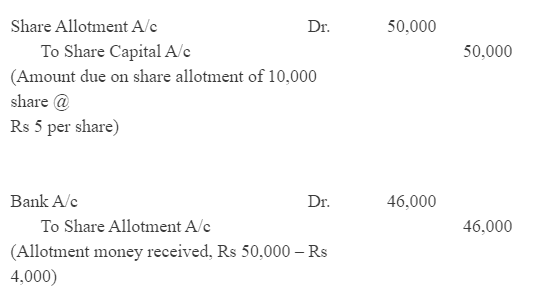

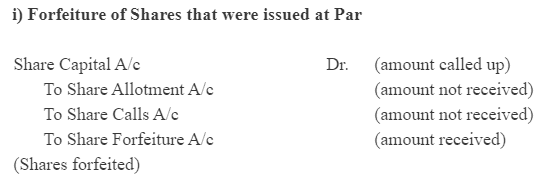

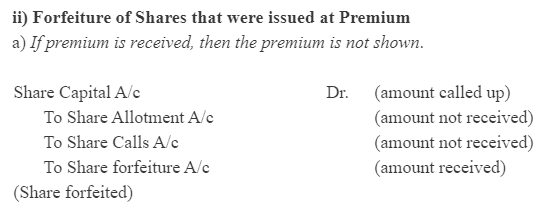

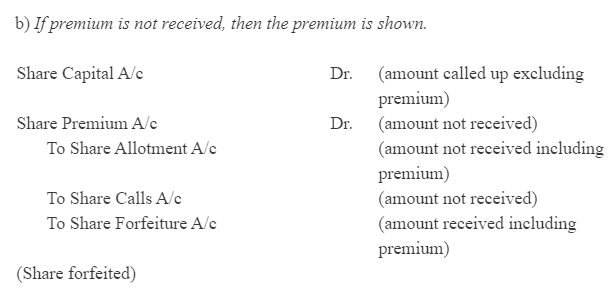

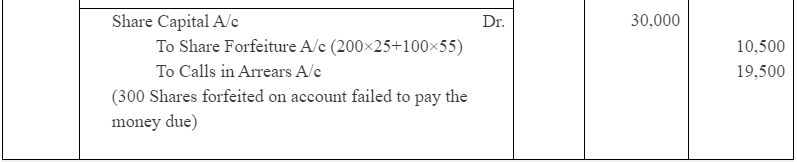

Accounting Treatment for Forfeiture of Shares:

- All accounting entries related to the forfeited shares, except for any share premium received, must be reversed.

- The Share Capital Account is debited with the amount called up for the forfeited shares.

- The amount already received is credited to the Forfeiture Shares Account.

- If shares were issued at a premium, the Securities Premium Reserve is also debited accordingly.

Accounting Treatment for Forfeiture of Shares:

Numerical Questions

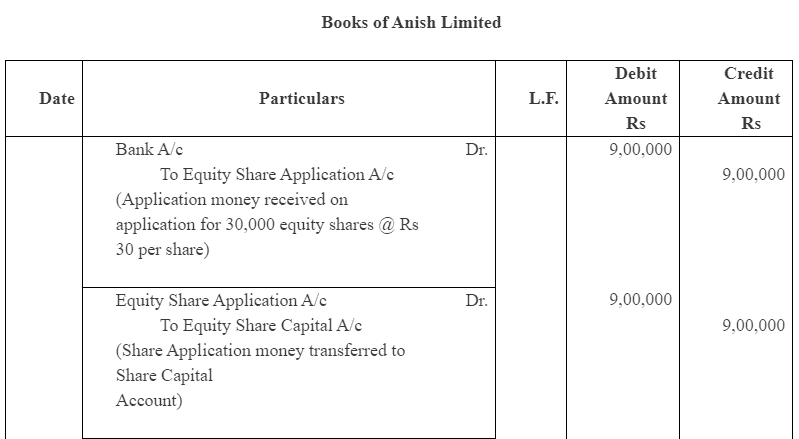

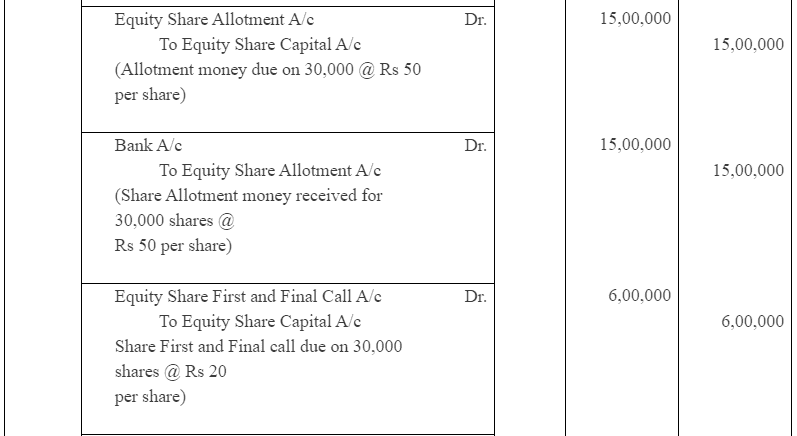

Q1: Anish Limited issued 30,000 equity shares of Rs 100 each payable at Rs 30 on application, Rs 50 on allotment and Rs 20 on Ist and final call. All money was duly received. Record these transactions in the journal of the company.

Ans:

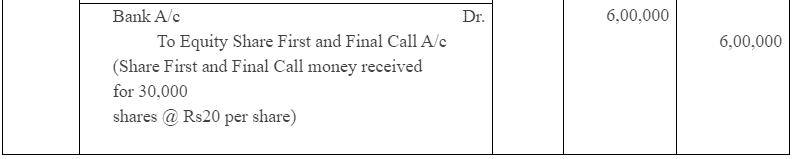

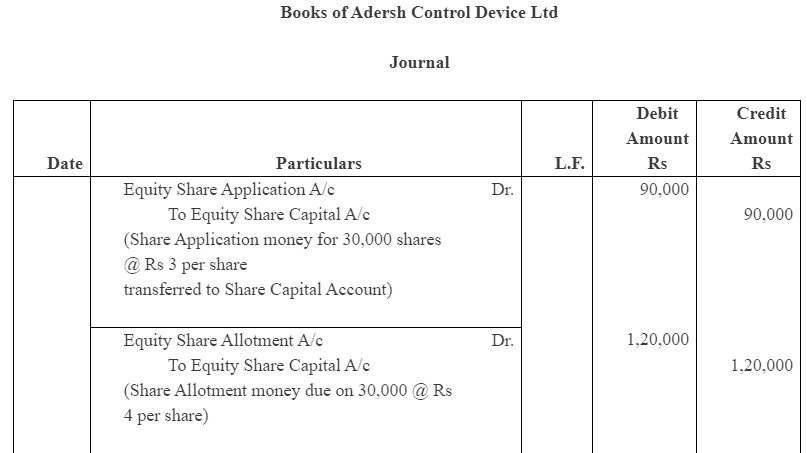

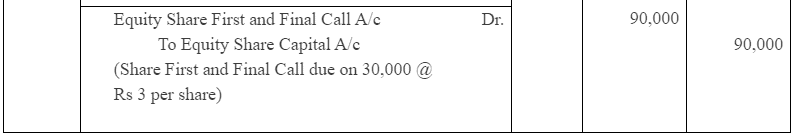

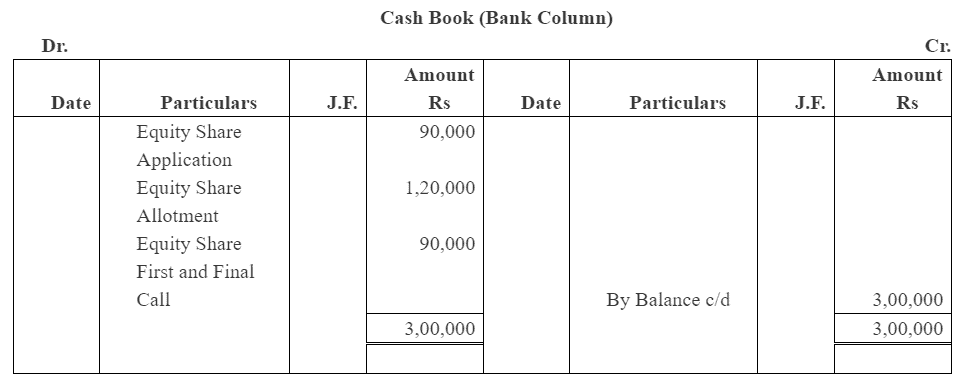

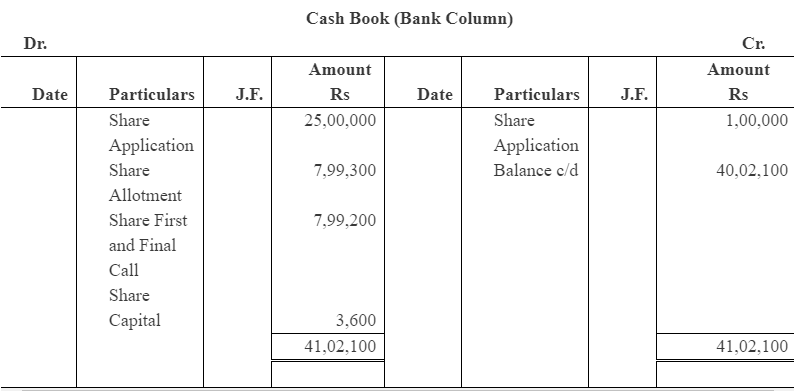

Q2: The Adersh Control Device Ltd was registered with the authorised capital of Rs 3,00,000 divided into 30,000 shares of Rs 10 each, which were offered to the public. Amount payable as Rs. 3 per share on application, Rs 4 per share on allotment and Rs 3 per share on first and final call. These share were fully subscribed and all money was dully received. Prepare journal and Cash Book.

Ans:

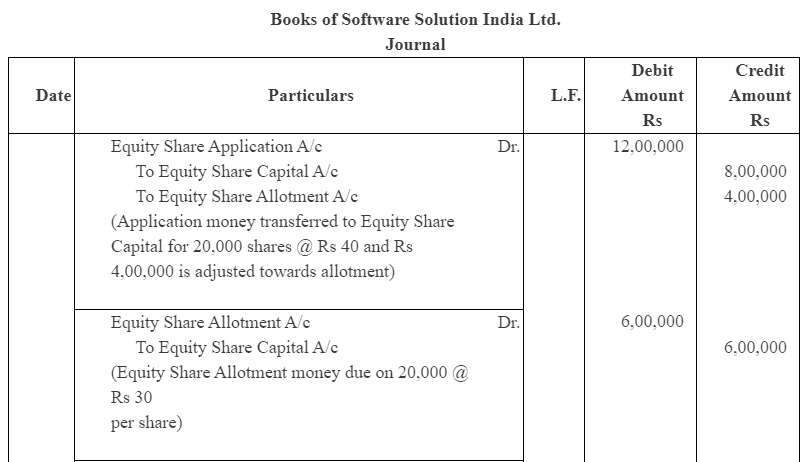

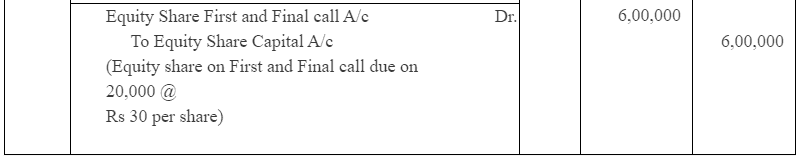

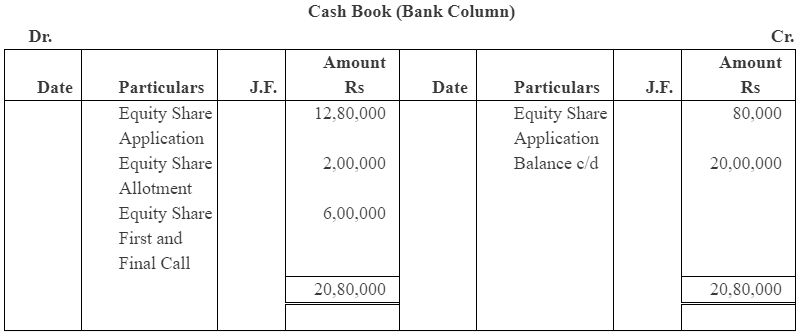

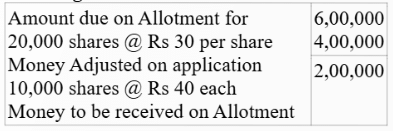

Q3: Software solution India Ltd inviting application for 20,000 equity share of Rs 100 each, payable Rs 40 on application, Rs 30 on allotment and Rs 30 on call. The company received applications for 32,000 shares. Application for 2,000 shares were rejected and money returned to Applicants. Applications for 10,000 shares were accepted in full and applicants for 20,000 share allotted half of the number of share applied and excess application money adjusted into allotment. All money received due on allotment and call. Prepare journal and cash book.

Ans:

Working Note:

Working Note:

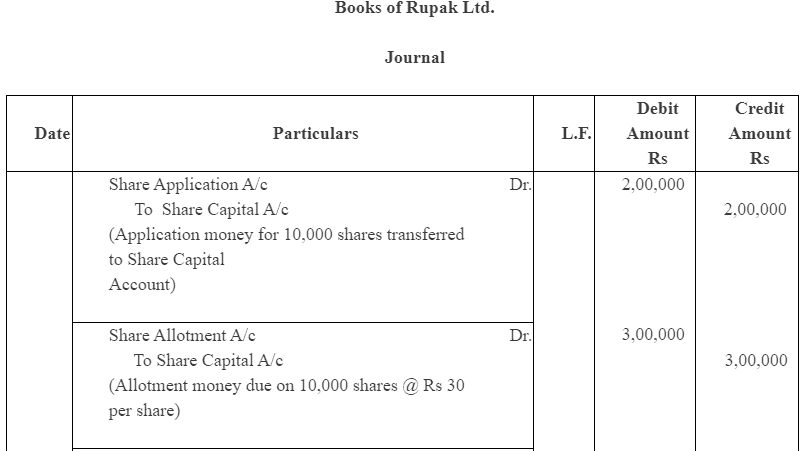

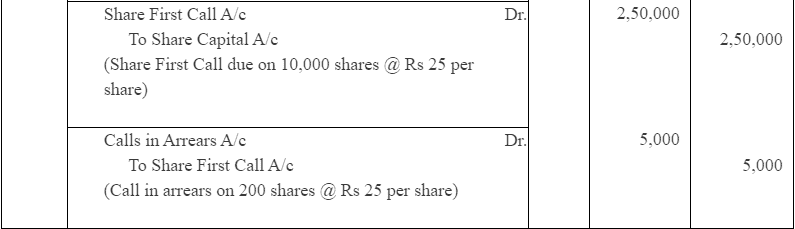

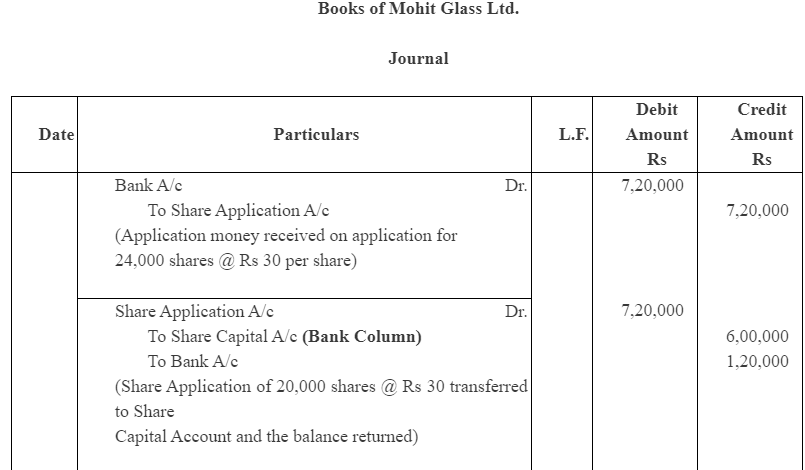

Q4: Rupak Ltd. issued 10,000 shares of Rs 100 each payable Rs 20 per share on application, Rs 30 per share on allotment and balance in two calls of Rs 25 per share. The application and allotment money were duly received. On first call all member pays their dues except one member holding 200 shares, while another member holding 500 shares paid for the balance due in full. Final call was not made. Give journal entries and prepare cash book.

Ans:

Working Note:

Working Note:

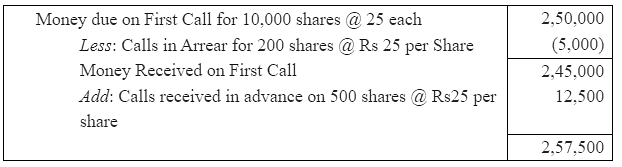

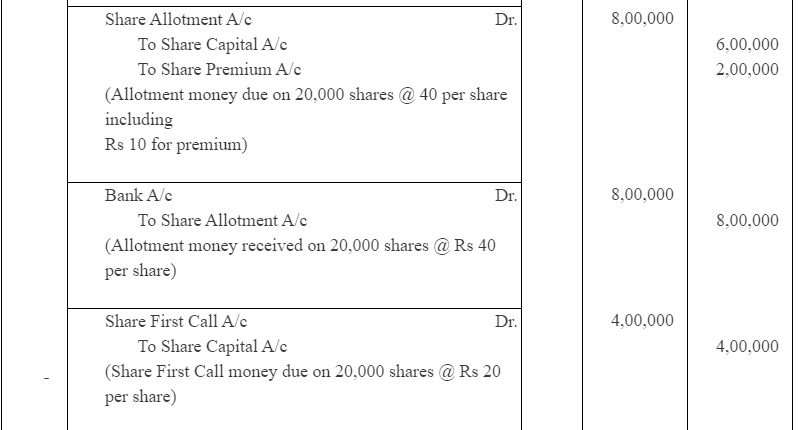

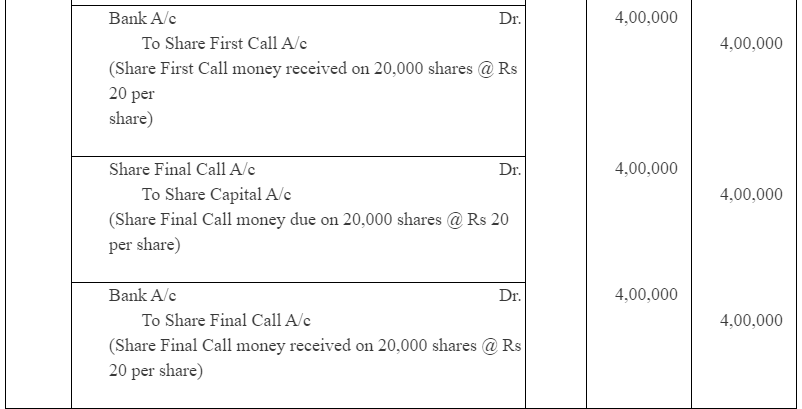

Q5: Mohit Glass Ltd. issued 20,000 shares of Rs 100 each at Rs 110 per share, payable Rs 30 on application, Rs 40 on allotment (including Premium), Rs 20 on first call and Rs 20 on final call. The applications were received for 24,000 shares and allotted 20,000 shares and reject 4,000 shares and amount returned thereon. The money was duly received. Give journal entries.

Ans:

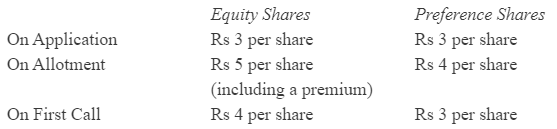

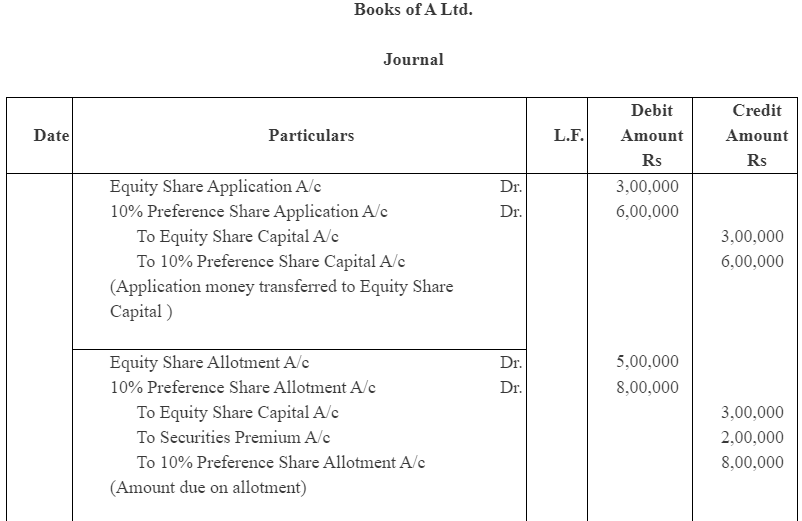

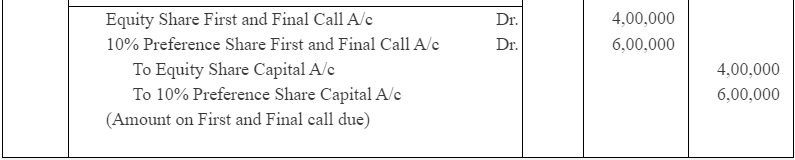

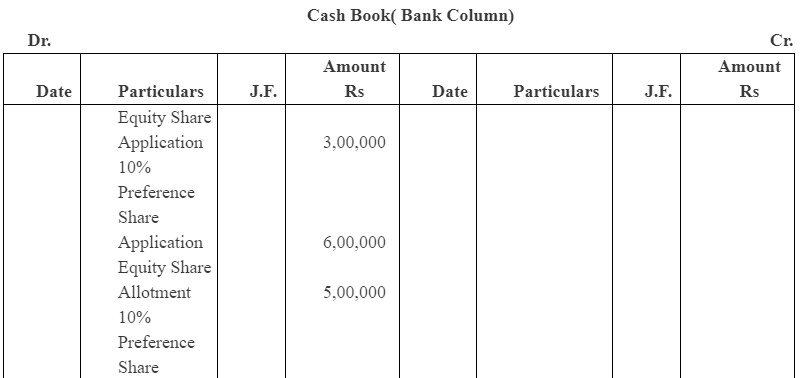

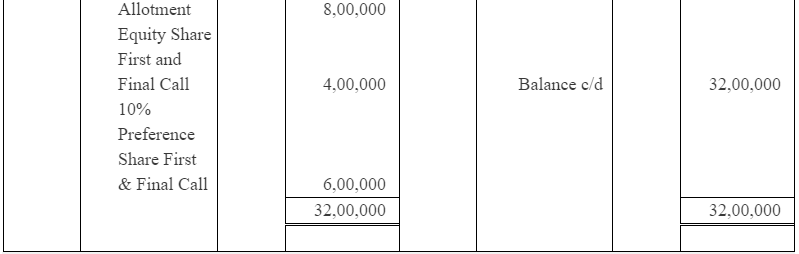

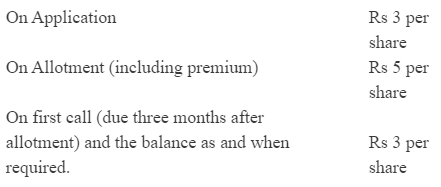

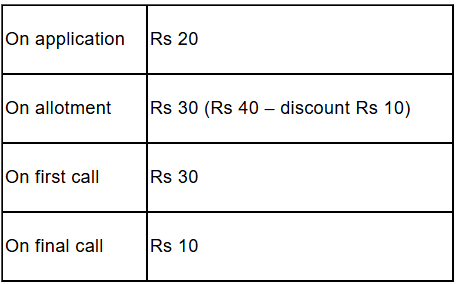

Q6: A limited company offered for subscription of 1,00,000 equity shares of Rs 10 each at a premium of Rs 2 per share. 2,00,000. 10% Preference shares of Rs 10 each at par.

The amount on share was payable as under :

All the shares were fully subscribed, called-up and paid.

Record these transactions in the journal and cash book of the company:

Ans:

Q7: Eastern Company Limited, having an authorised capital of Rs 10,00,000 in shares of Rs 10 each, issued 50,000 shares at a premium of Rs 3 per share payable as follows :

Applications were received for 60,000 shares and the directors allotted the shares as follows:

(a) Applicants for 40,000 shares received shares, in full.

(b) Applicants for 15,000 shares received an allotment of 8,000 shares.

(c) Applicants for 500 shares received 200 shares on the allotment, with excess money being returned.

All amounts due on allotment were received.

The first call was duly made and the money was received with the exception of the call due on 100 shares.

Give journal and cash book entries to record these transactions of the company. Also, prepare the Balance Sheet of the company.

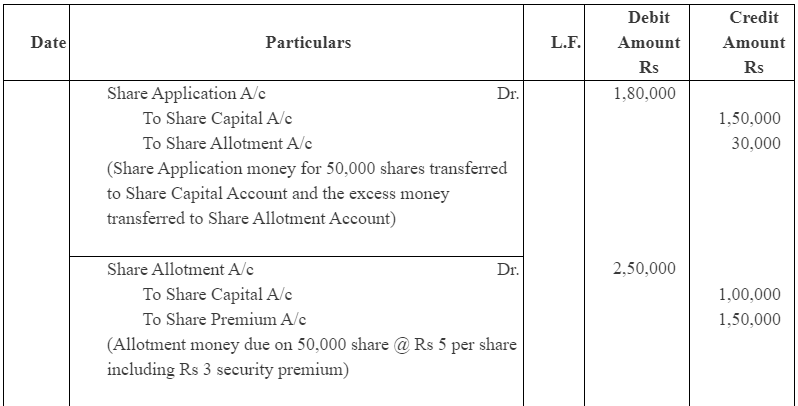

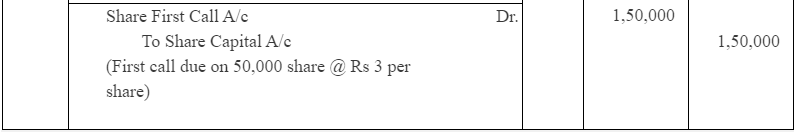

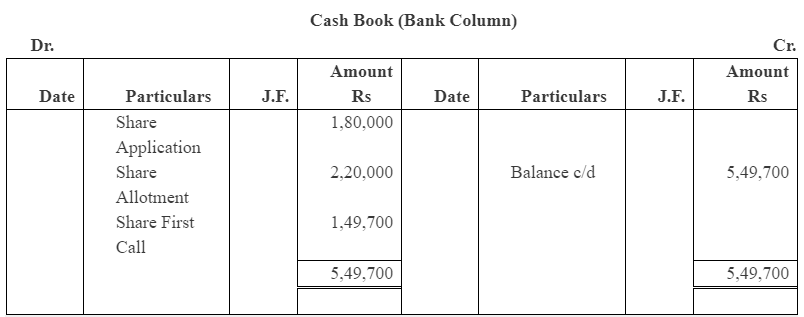

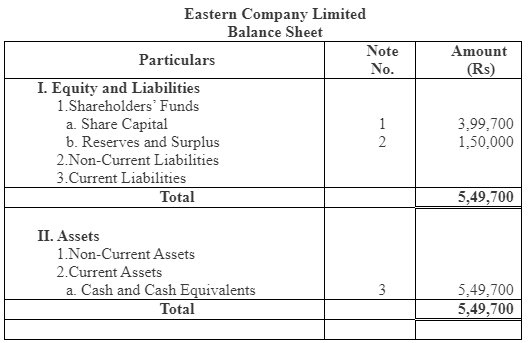

Ans:

To solve this question, applicants of category C have been assumed as 5000 instead of 500 and allotment to the applicants of this category has been taken as 2000 in place of 200.

Notes To Accounts

Notes To Accounts

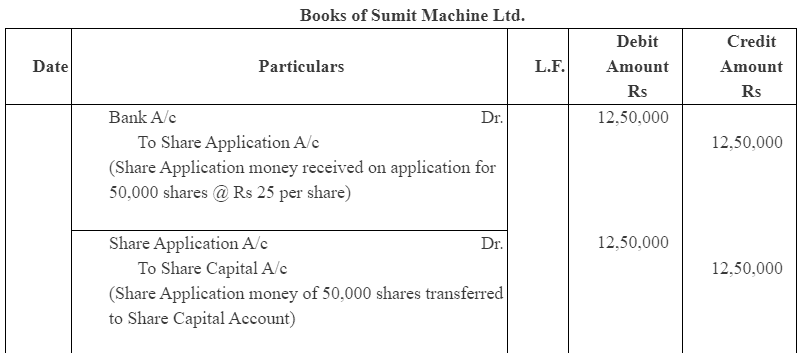

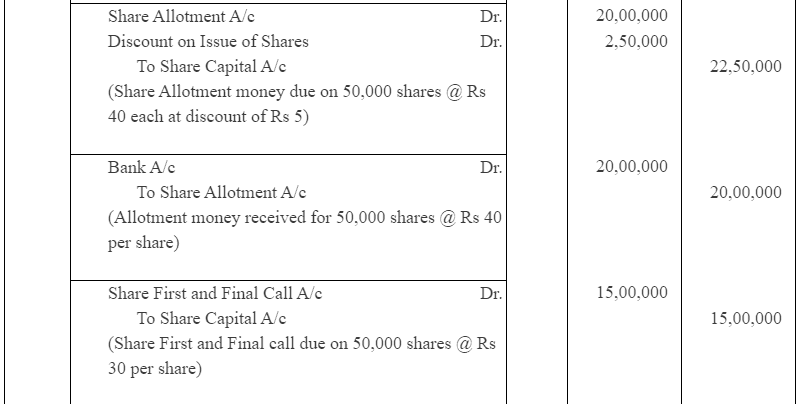

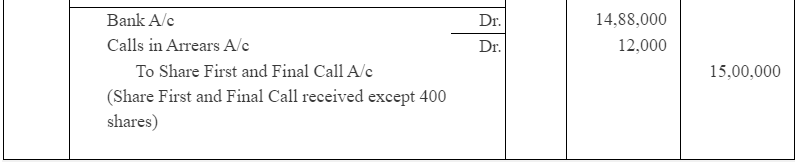

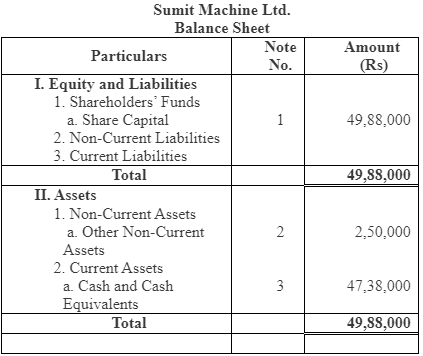

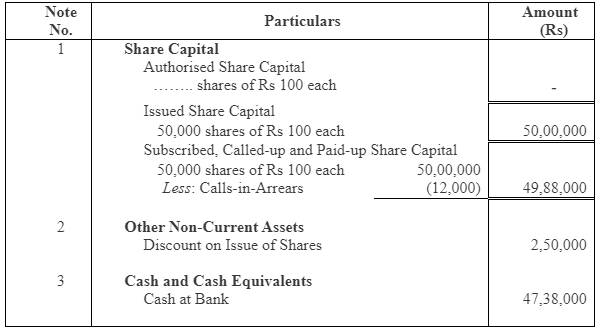

Q8: Sumit Machine Ltd issued 50,000 shares of Rs 100 each at discount of 5%. The shares were payable Rs 25 on application, Rs 40 on allotment and Rs 30 on first and final call. The issue were fully subscribed and money were duly received except the final call on 400 shares. The discount was adjusted on allotment. Give journal entries and prepare balance sheet.

Ans:

Notes to Accounts

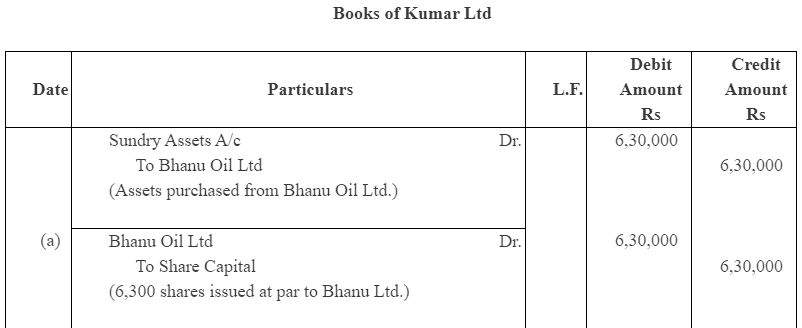

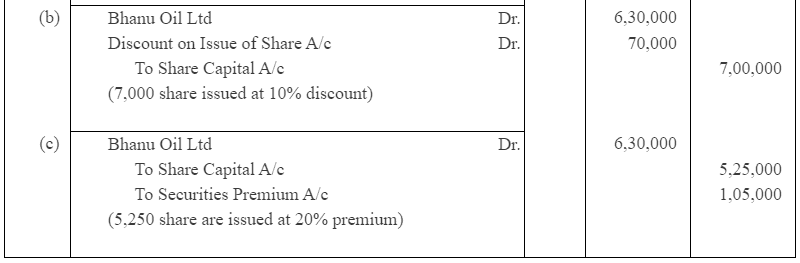

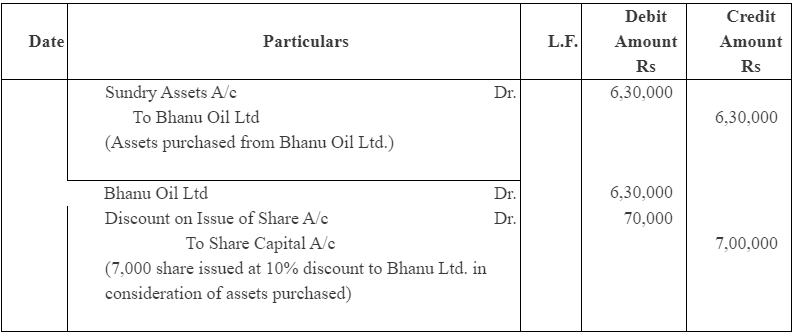

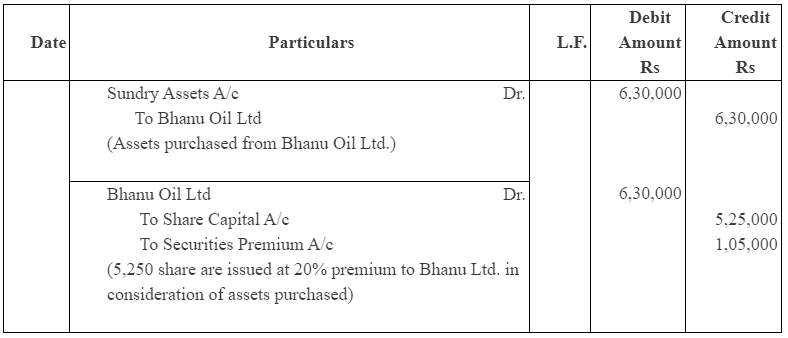

Q9: Kumar Ltd purchases assets of Rs 6,30,000 from Bhanu Oil Ltd. Kumar Ltd. issued equity share of Rs 100 each fully paid in consideration. What journal entries will be made, if the share are issued,

(a) at par,

(b) at discount of 10 % and

(c) at premium of 20%.

Ans:

Case (a)

No. of Shares issued of at par = (Amount payable over /Face Value)

6,300 Shares= {6,30,000/ 100})

Case (b)

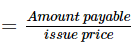

No. of Shares issued of at par =

7,000 Shares = ;

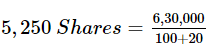

Case (c)

No. of Shares issued of at par =

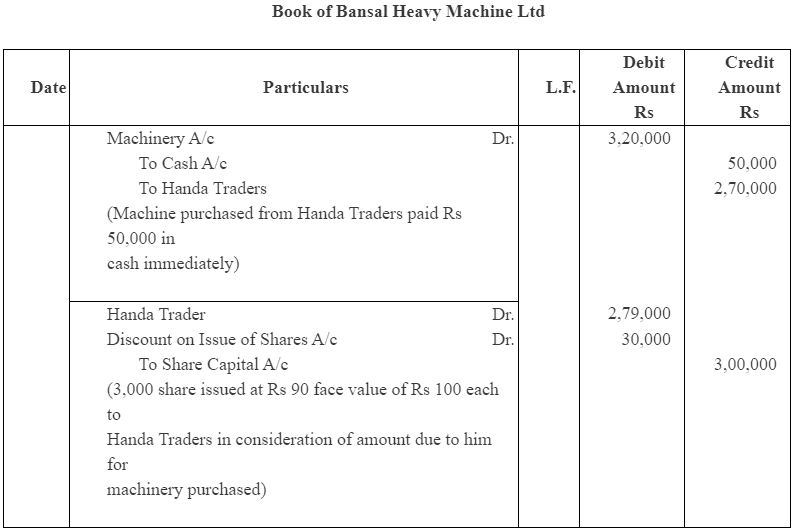

Q10: Bansal Heavy machine Ltd purchased machine worth Rs 3,20,000 from Handa Trader. Payment was made as Rs 50,000 cash and remaining amount by issue of equity share of the face value of Rs 100 each fully paid at an issue price of Rs 90 each. Give journal entries to record the above transaction.

Ans:

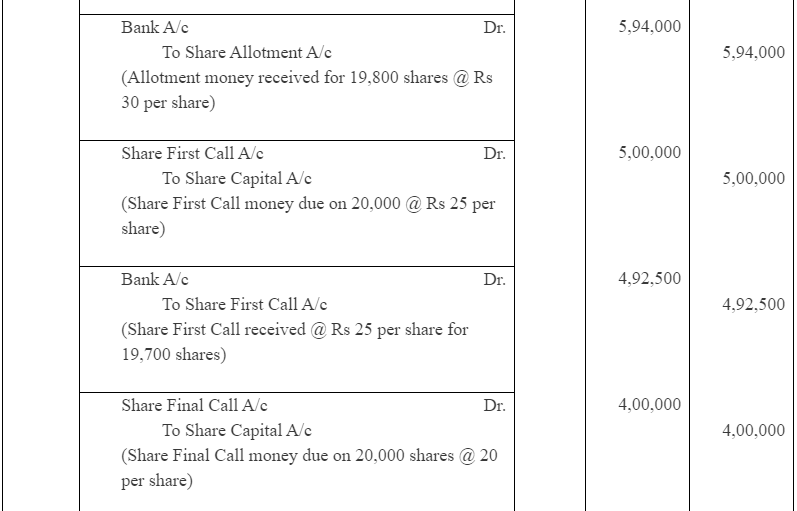

Working Notes:-

1. Number of shares issued

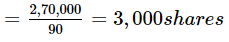

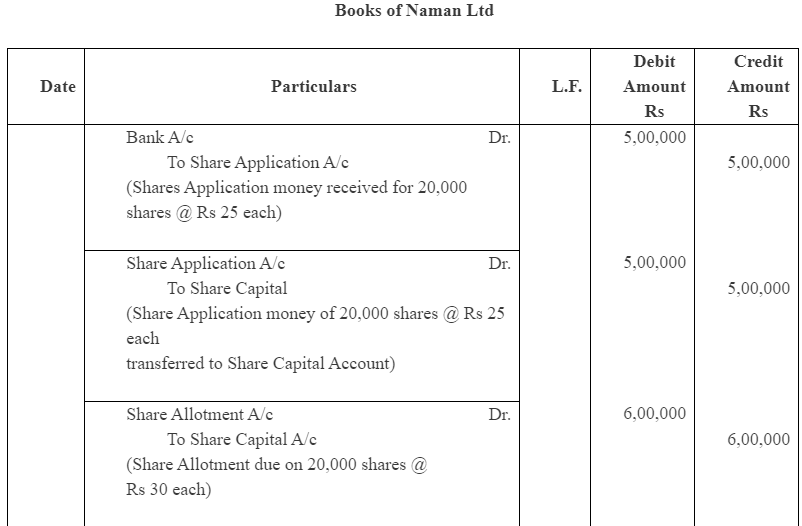

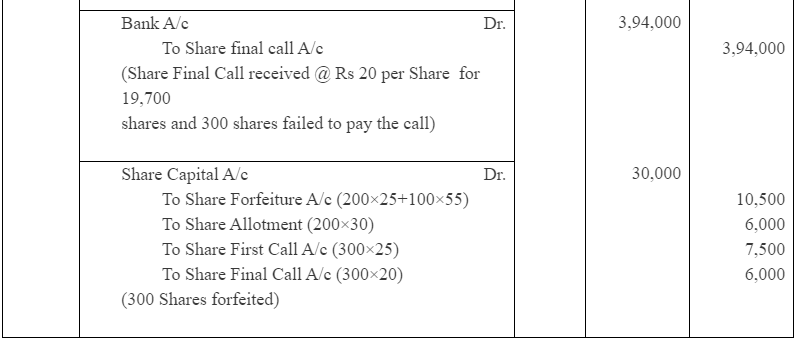

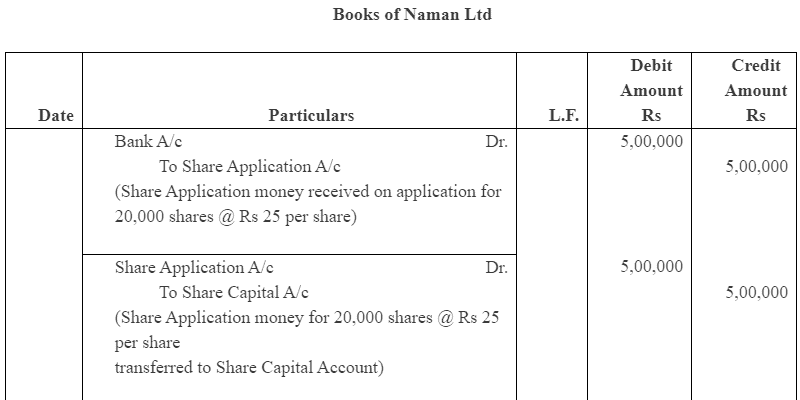

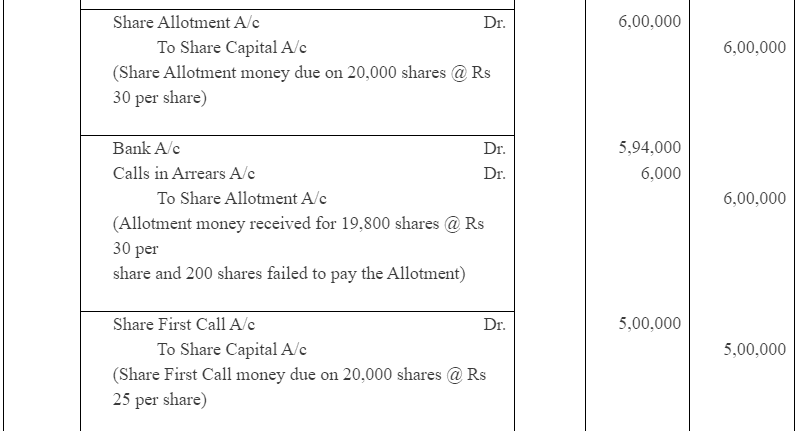

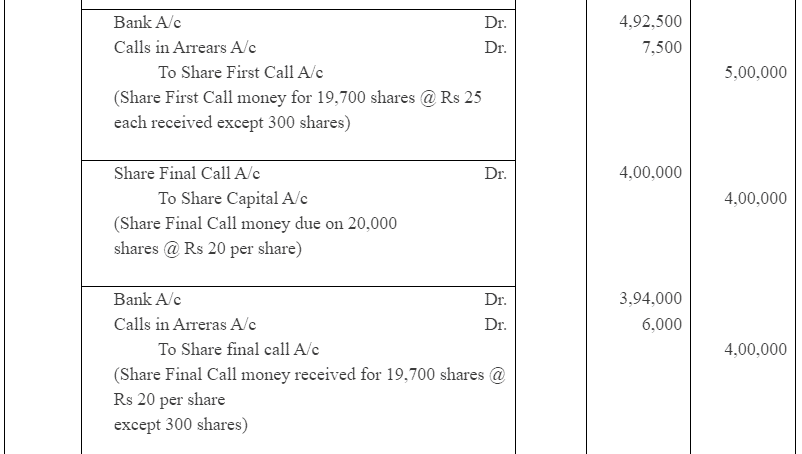

Q11: Naman Ltd issued 20,000 shares of Rs 100 each, payable Rs 25 on application, Rs 30 on allotment , Rs 25 on first call and The balance on final call. All money duly received except Anubha, who holding 200 shares did not pay allotment and calls money and Kumkum, who holding 100 shares did not pay both the calls. The directors forfeited shares of Anubha and kumkum.

Give journal entries.

Ans:

Alternatively, this question can be solved by debiting Calls in Arrears Account.

Working Note:

1. Forfeited Amount

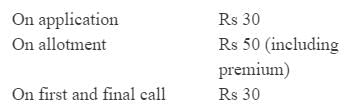

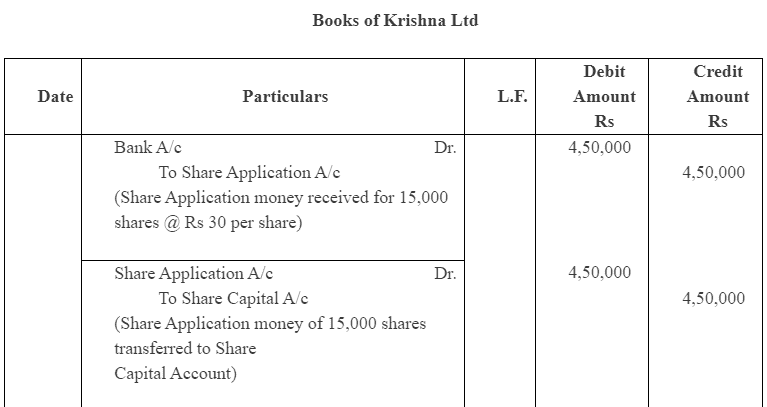

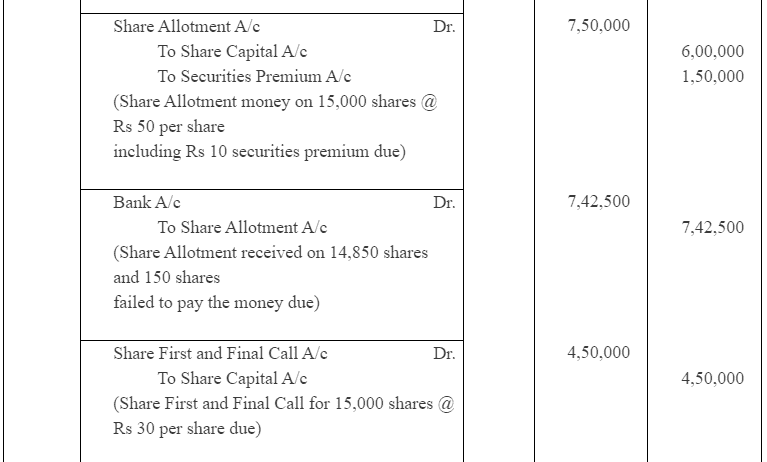

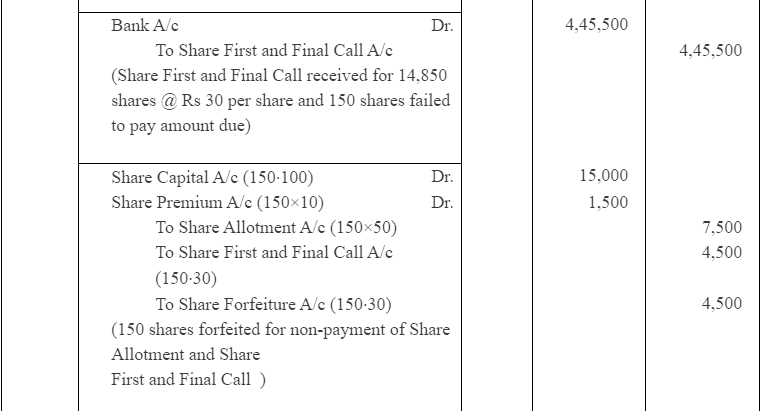

Q 12: Kishna Ltd issued 15,000 shares of Rs 100 each at a premium of Rs 10 per share, payable as follows:

All the shares subscribed and the company received all the money due, With the exception of the allotment and call money on 150 shares. These shares were forfeited and reissued to Neha as fully paid share of Rs 12 each.

Give journal entries in the books of the company.

Ans:

Note: In the solution, the reissued price of Rs 12 has been assumed as Rs 120 per share.

Note: In the solution, the reissued price of Rs 12 has been assumed as Rs 120 per share.

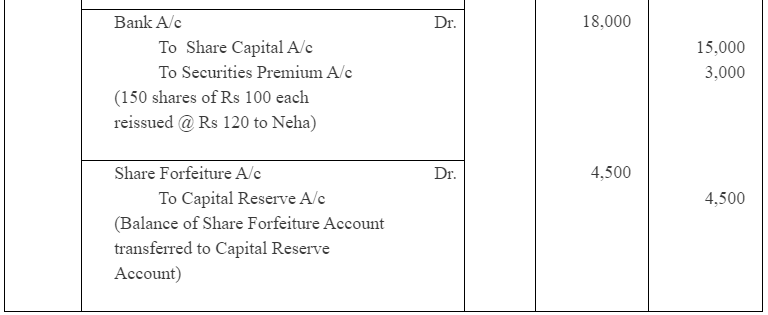

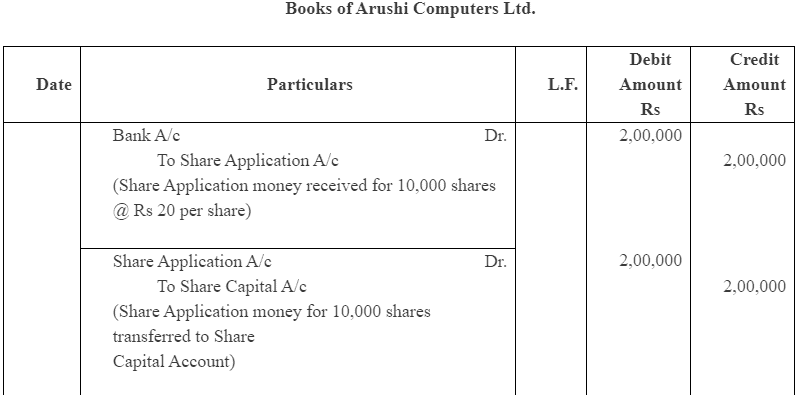

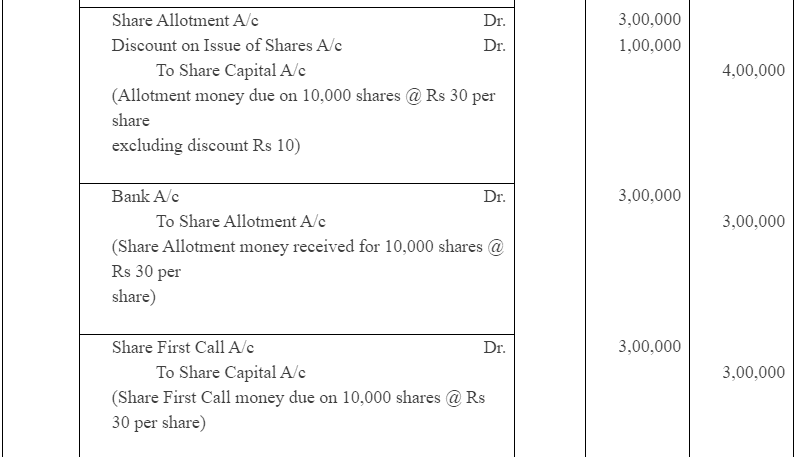

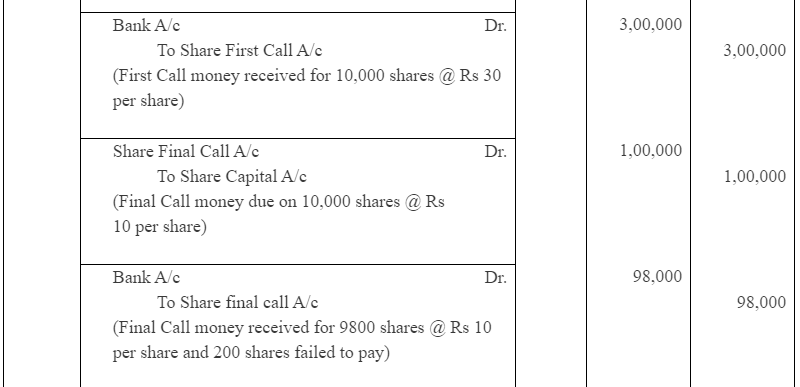

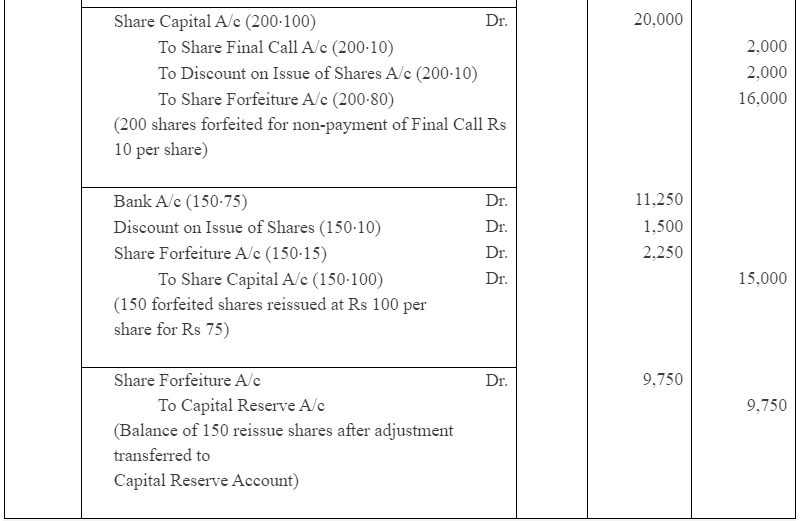

Q13: Arushi Computers Ltd issued 10,000 equity shares of Rs 100 each at 10% discount. The net amount payable as follows:

A shareholder holding 200 shares did not pay final call. His shares were forfeited. Out of these 150 shares were reissued to Ms. Sonia at Rs 75 per shares. Give Journal entries in the books of the company.

Ans:

Working Notes:

Working Notes:

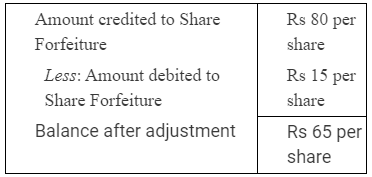

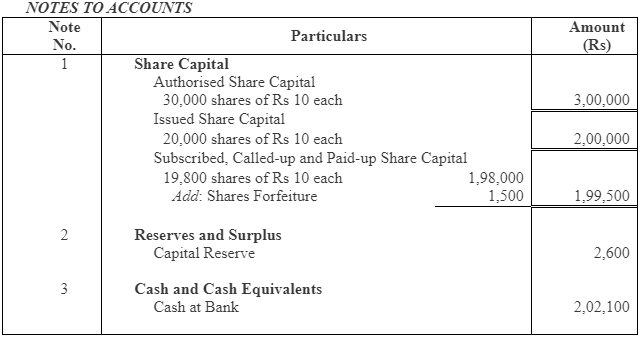

Amount Transferred to Capital Reserve A/c

Amount transferred to Capital Reserve Account = Balance per share after adjustment × Number of shares reissued Rs 9,750 = Rs 65 × Rs 150 per share

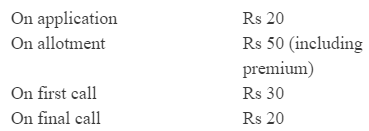

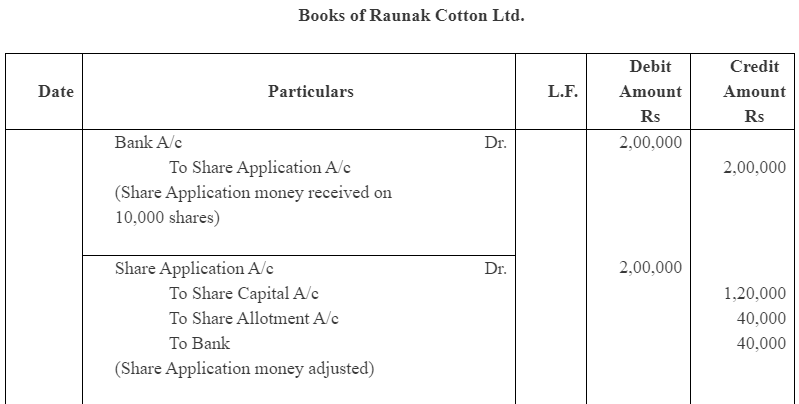

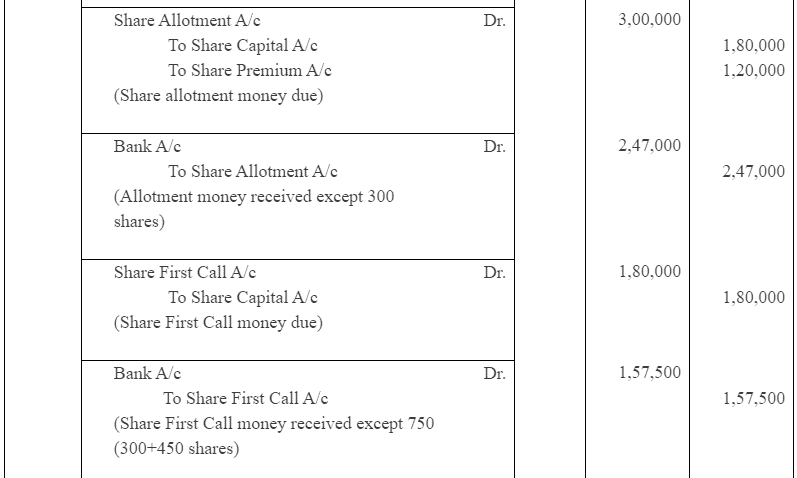

Q14: Raunak Cotton Ltd. issued a prospectus inviting applications for 6,000 equity shares of Rs 100 each at a premium of Rs 20 per shares, payable as follows:

Applications were received for 10,000 shares and allotment was made Pro-rata to the applicants of 8,000 shares, the remaining applications Being refused. Money received in excess on the application was adjusted toward the amount due on allotment.

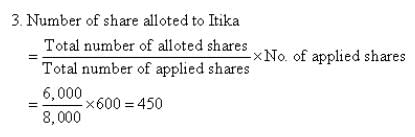

Rohit, to whom 300 shares were allotted failed to pay allotment and calls money, his shares were forfeited. Itika, who applied for 600 shares, failed to pay the two calls and her share were also forfeited. All these shares were sold to Kartika as fully paid for Rs 80 per shares.

Give journal entries in the books of the company.

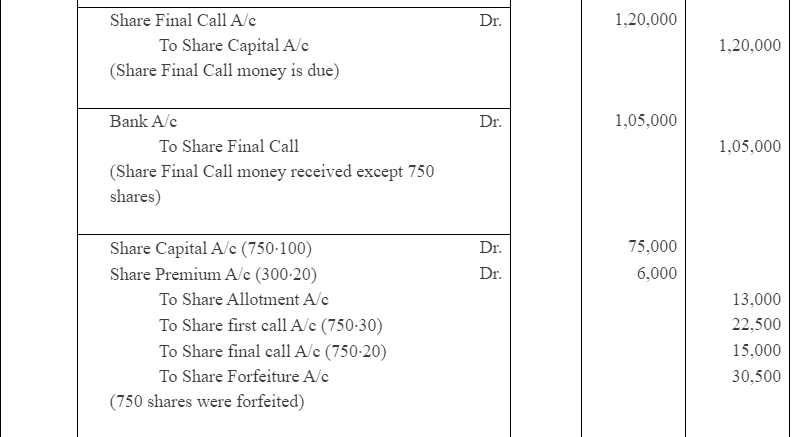

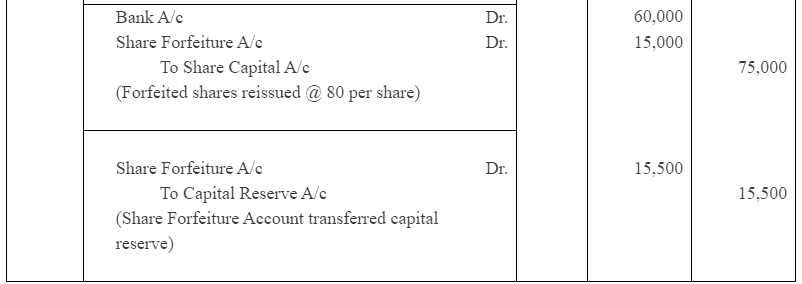

Ans:

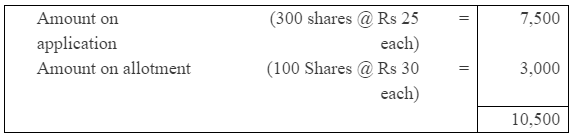

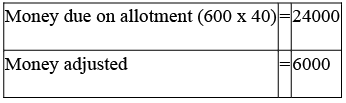

2. Call in arrears by Rohit on allotment

4. Share Forfeiture amount

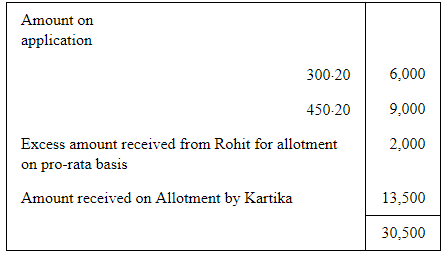

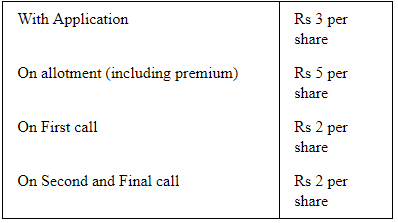

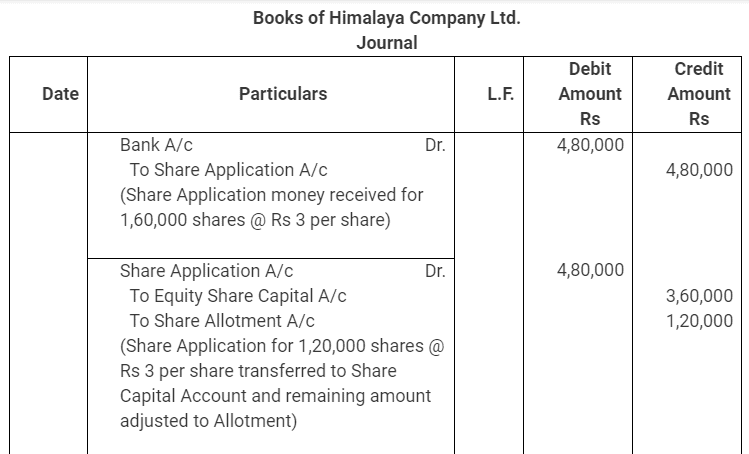

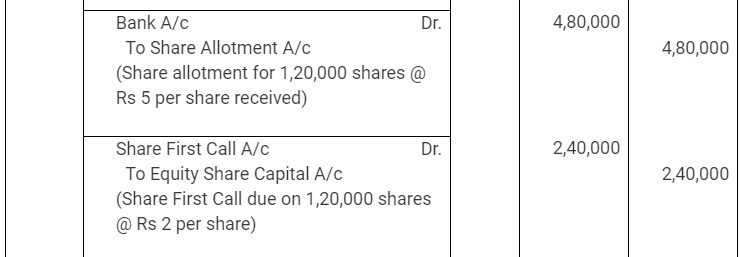

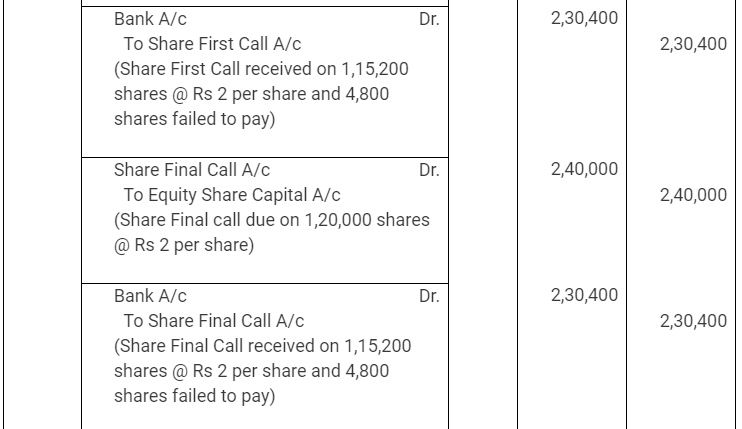

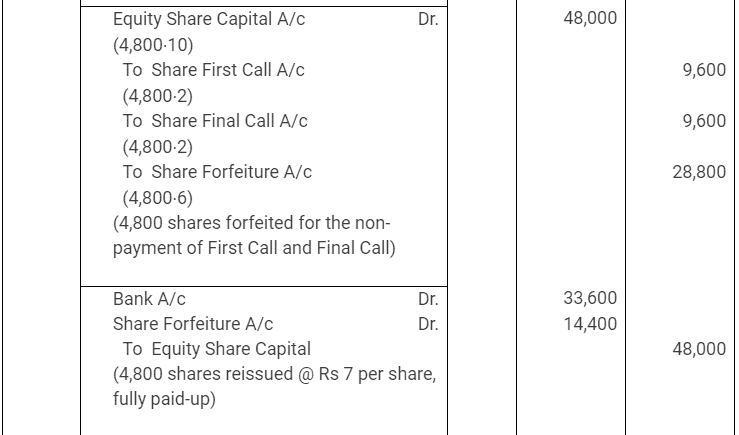

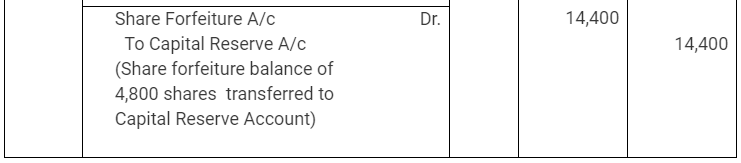

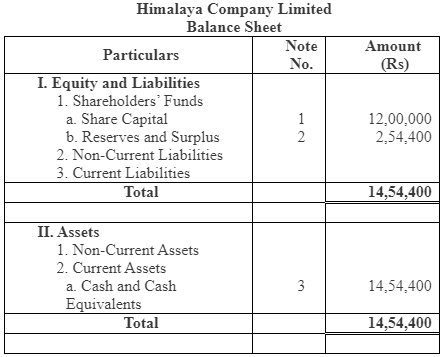

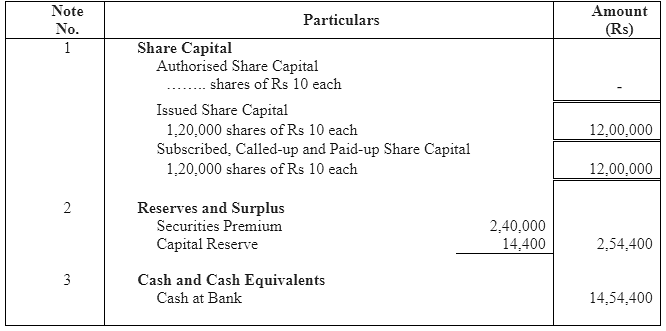

Q15: Himalaya Company Limited issued for public subscription of 1,20,000 equity shares of Rs 10 each at a premium of Rs 2 per share payable as under :

Applications were received for 1,60,000 shares. Allotment was made on pro-rata basis. Excess money on application was adjusted against the amount due on allotment.

Rohan, whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at Rs 7 per share.

Record journal entries in the books of the company to record these transactions relating to share capital. Also show the company’s balance sheet.

Ans:

Notes to Account

Notes to Account

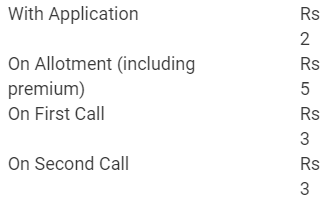

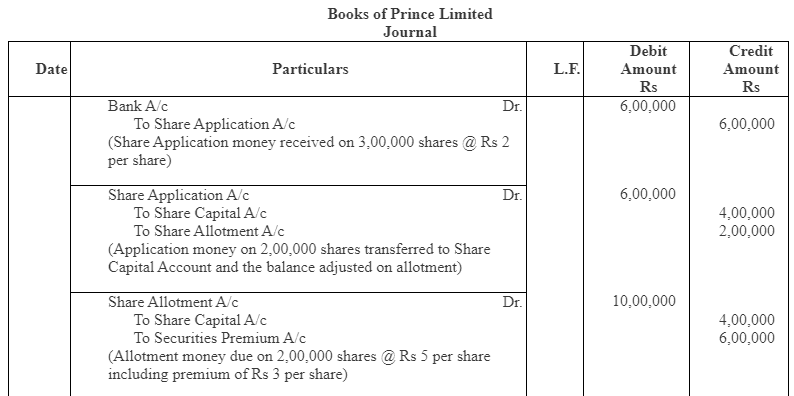

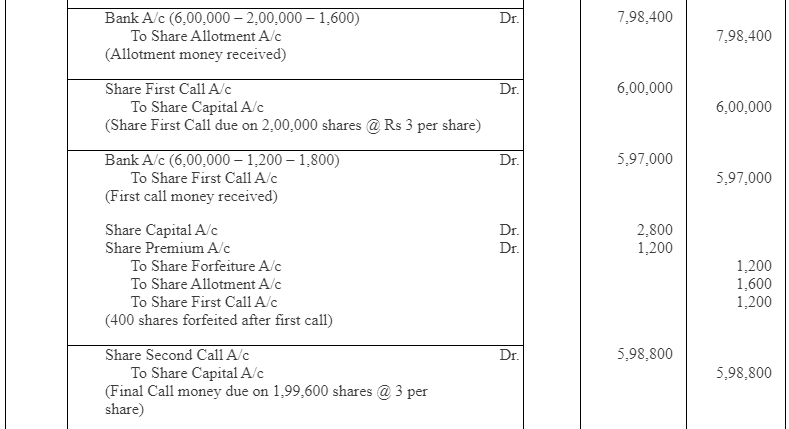

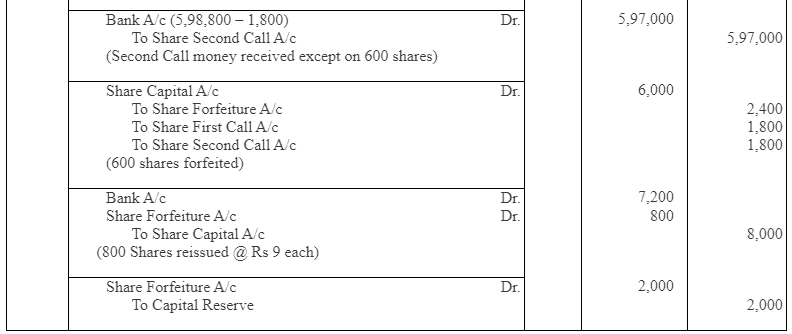

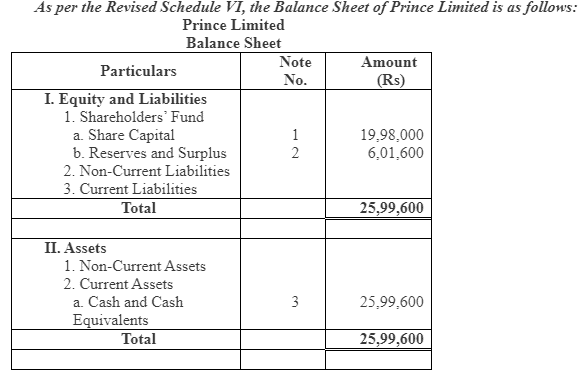

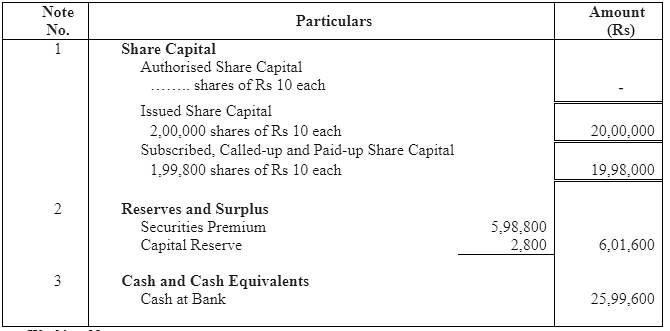

Q16: Prince Limited issued a prospectus inviting applications for 2,00,000 equity shares of Rs 10 each at a premium of Rs 3 per share payable as follows : Applications were received for 30,000 shares and allotment was made on pro-rata basis. Money overpaid on applications was adjusted to the amount due on allotment.

Applications were received for 30,000 shares and allotment was made on pro-rata basis. Money overpaid on applications was adjusted to the amount due on allotment.

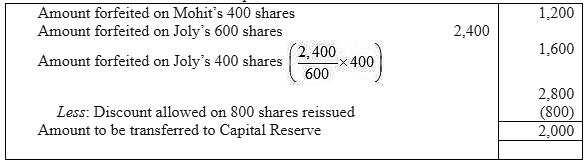

Mr. ‘Mohit’ whom 400 shares were allotted, failed to pay the allotment money and the first call, and her shares were forfeited after the first call. Mr. ‘Joly’, whom 600 shares were allotted, failed to pay for the two calls and hence, his shares were forfeited.

Of the shares forfeited, 800 shares were reissued to Supriya as fully paid for Rs 9 per share, the whole of Mr. Mohit’s shares being included.

Record journal entries in the books of the Company and prepare the Balance Sheet.

Ans:

Notes to Account

Notes to Account Working Note:

Working Note:

1. Number of shares applied by Mohit = (Total number of applied shares/Total number of allotted shares) x Number of shares allotted = (300000/200000) x 400 = 600 shares

2. Amount to be transferred to capital Reserve

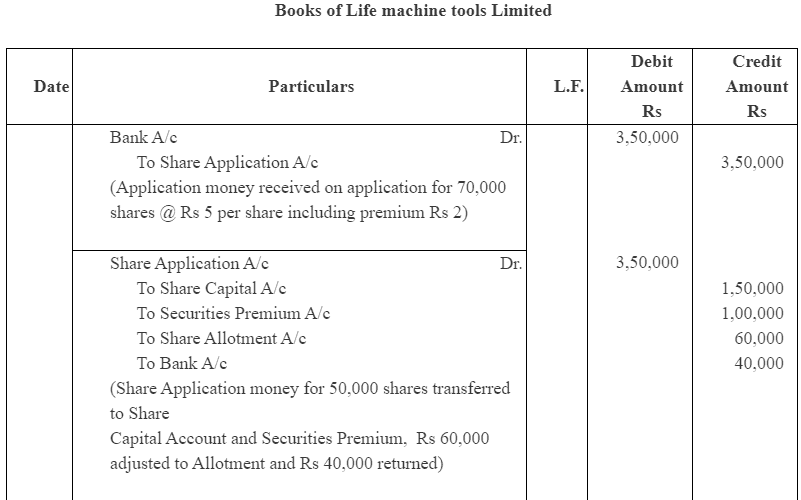

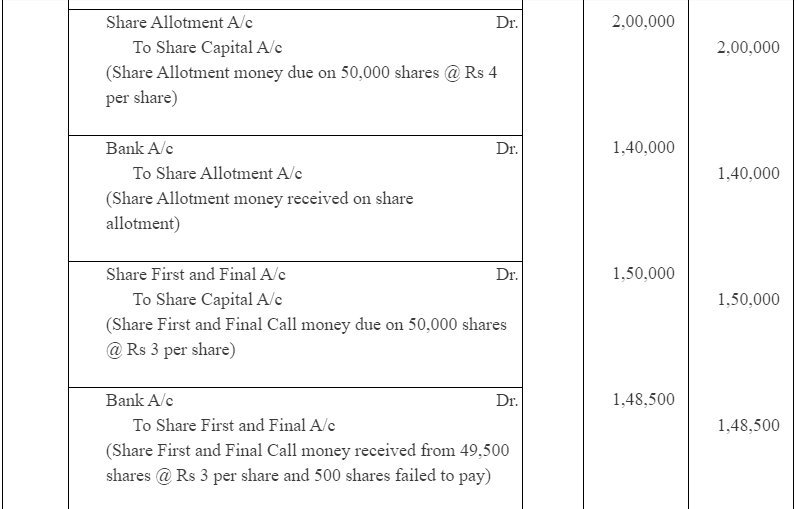

Q17: Life Machine Tools Limited, issued 50,000 equity shares of Rs. 10 each at Rs. 12 per share, payable at to Rs. 5 on application (including premium), Rs. 4 on allotment and the balance on the first and final call.

Applications for 70,000 shares had been received. Of the cash received, Rs 40,000 was returned and Rs 60,000 was applied to the amount due on allotment, the balance of which was paid. All shareholders paid the call due, with the exception of one shareholder of 500 shares. These shares were forfeited and reissued as fully paid at Rs 8 per share. Journalise the transactions.

Ans:

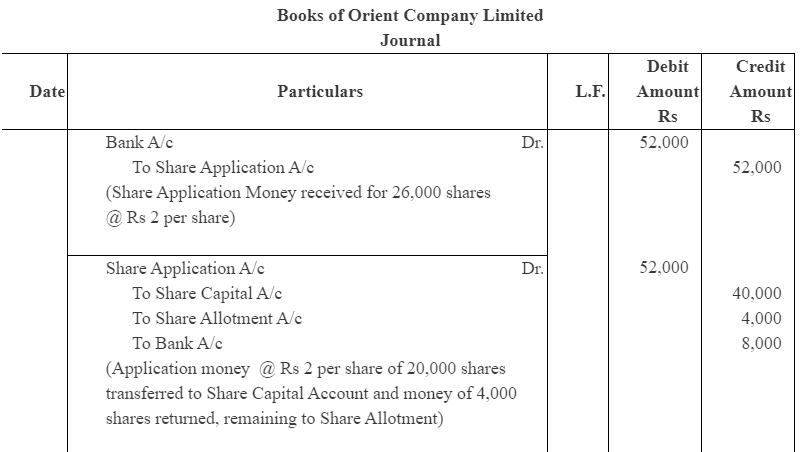

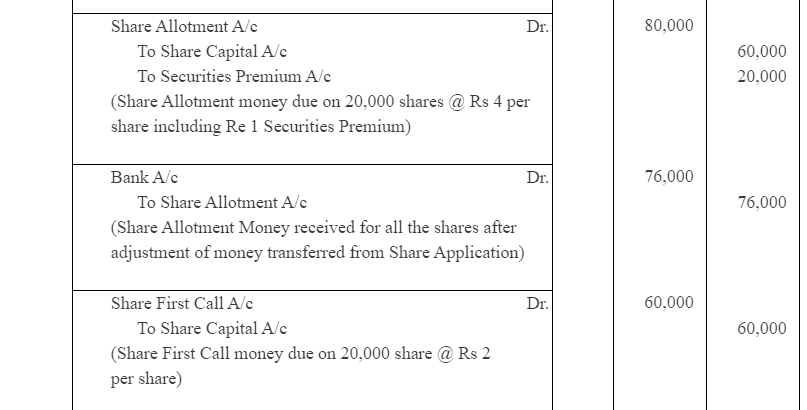

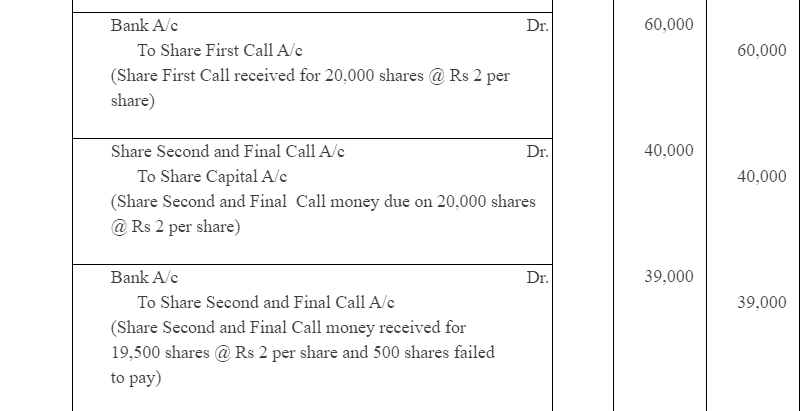

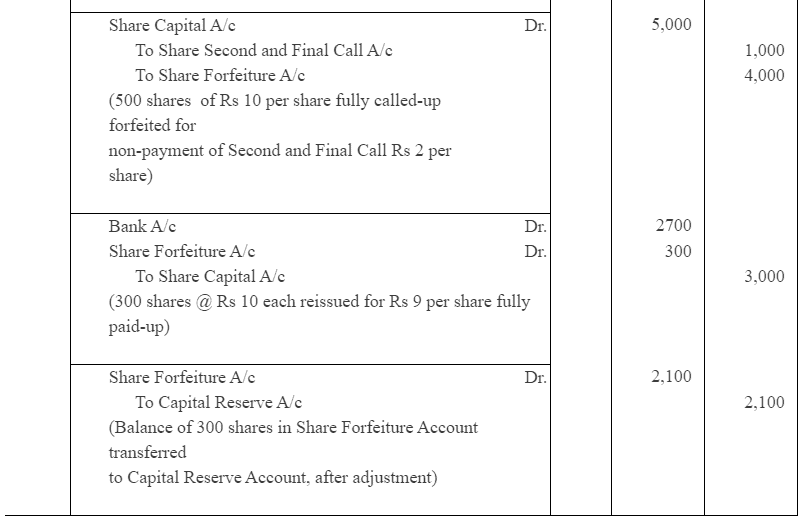

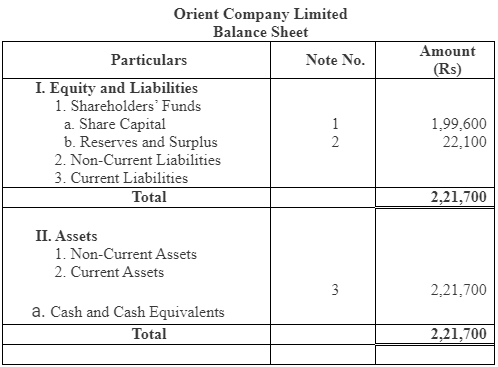

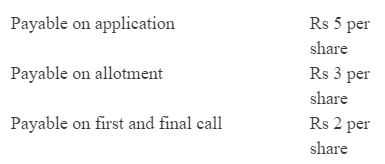

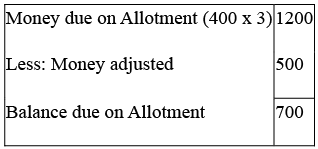

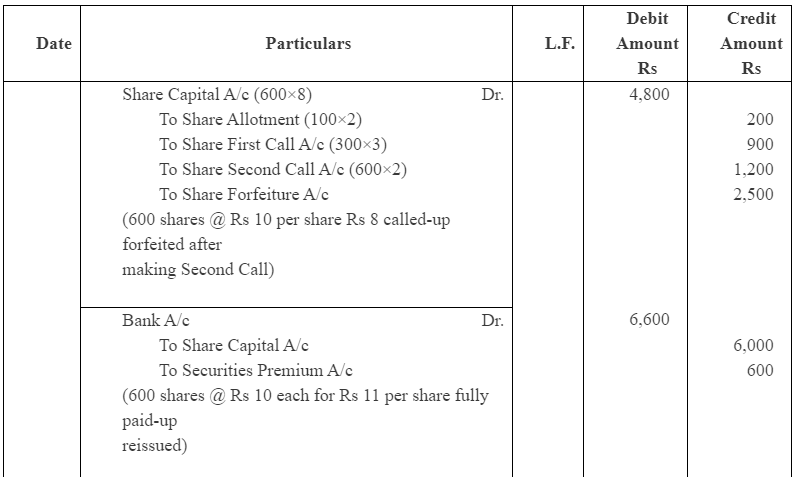

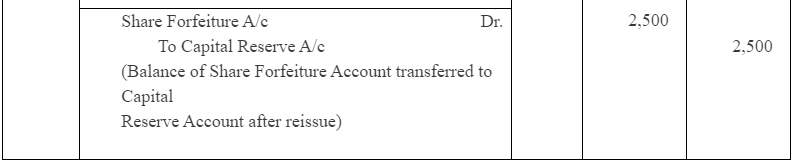

Q18: The Orient Company Limited offered for public subscription 20,000 equity shares of Rs 10 each at a premium of 10% payable at Rs 2 on application; Rs 4 on allotment including premium; Rs 3 on First Call and Rs 2 on Second and Final call. Applications for 26,000 shares were received. Applications for 4,000 shares were rejected. Pro-rata allotment was made to the remaining applicants. Both the calls were made and all the money were received except the final call on 500 shares which were forfeited. 300 of the forfeited shares were later on issued as fully paid at Rs 9 per share. Give journal entries and prepare the balance sheet.

Ans:

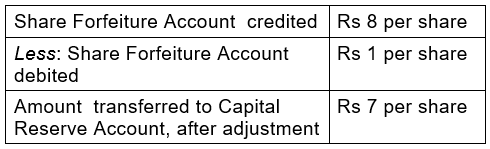

Working Notes:

The amount transferred to Capital Reserve Account, after adjustment for 300 shares = 300 Shares @ Rs 7 per share = Rs 2,100

Q19: Alfa Limited invited applications for 4,00,000 of its equity shares of Rs 10 each on the following terms :

Applications for 5,00,000 shares were received. It was decided :

(a) to refuse allotment to the applicants for 20,000 shares;

(b) to allot in full to applicants for 80,000 shares;

(c) to allot the balance of the available shares' pro-rata among the other applicants; and

(d) to utilise excess application money in part as payment of allotment money.

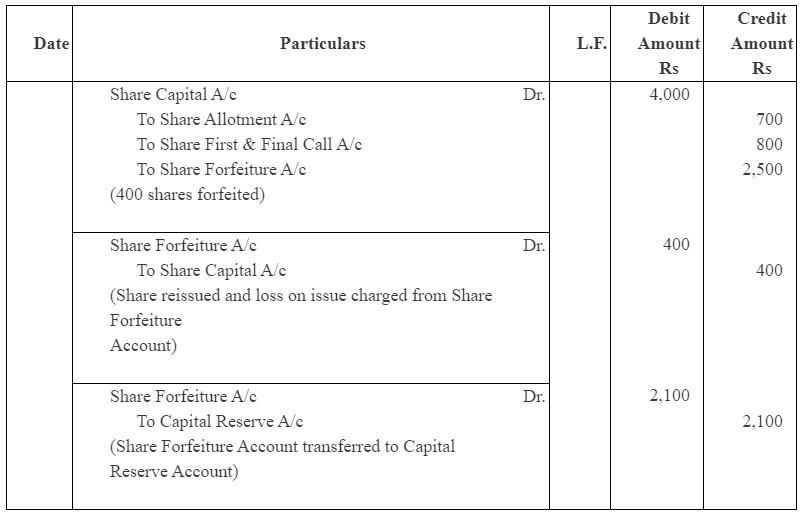

One applicant, whom shares had been allotted on pro-rata basis, did not pay the amount due on allotment and on the call, and his 400 shares were forfeited. The shares were reissued @ Rs 9 per share. Show the journal and prepare Cash book to record the above.

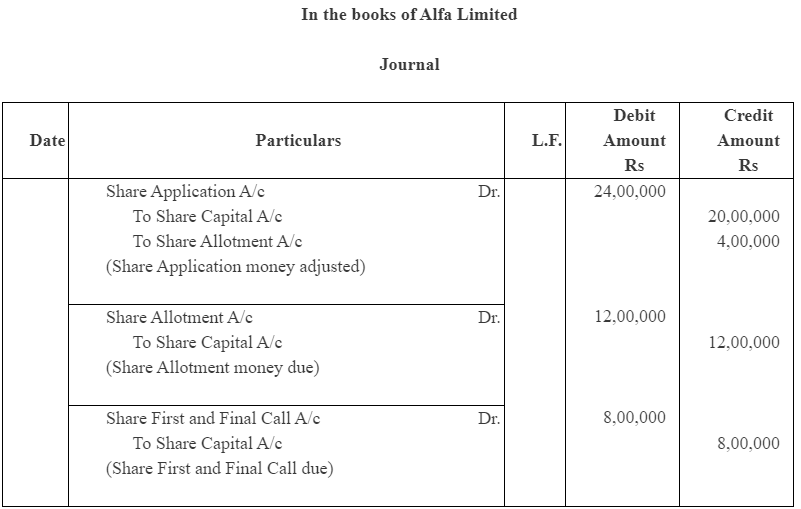

Ans:

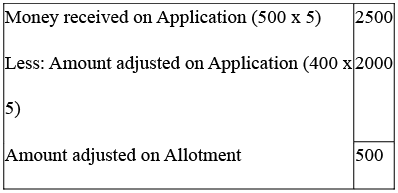

Working Note:

1. Number of Share Applied by Applicant = (Total number of Applied Shares/Total number of Allotted Shares) x Number of Shares Allotted = (400000/320000) x 400 = 500 shares

2. Call in arrears by applicant on allotment

3.

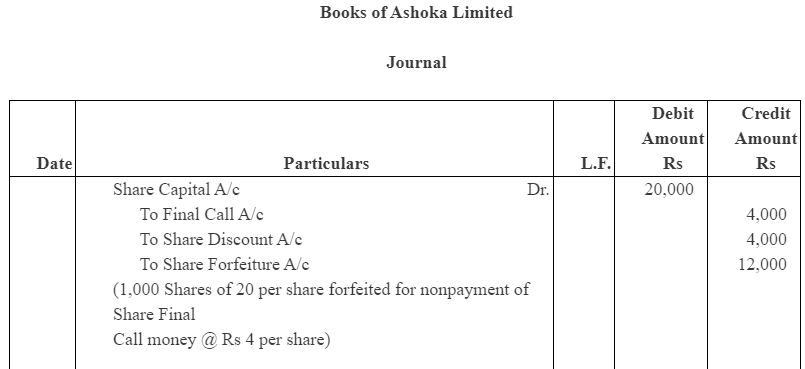

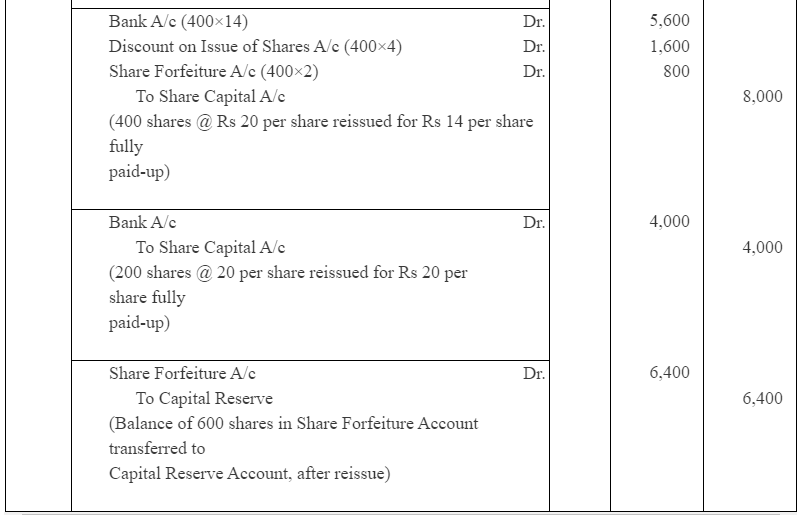

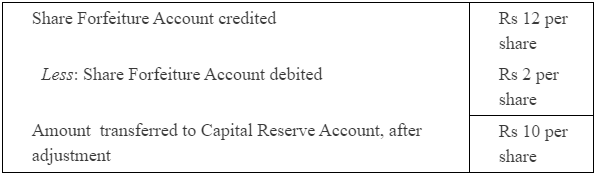

Q20: Ashoka Limited Company which had issued equity shares of Rs 20 each at a discount of Rs 4 per share, forfeited 1,000 shares for non-payment of final call of Rs 4 per share. 400 of the forfeited shares are reissued at Rs 14 per share out of the remaining shares of 200 shares reissued at Rs 20 per share. Give journal entries for the forfeiture and reissue of shares and show the amount transferred to capital reserve and the balance in Share Forfeiture Account.

Ans:

Balance in Share Forfeiture Account (12,000 – 800 – 6,400) = Rs 4,800

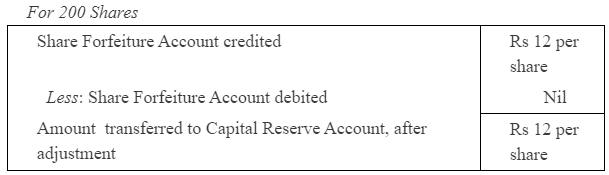

Working Notes:

For 400 Shares

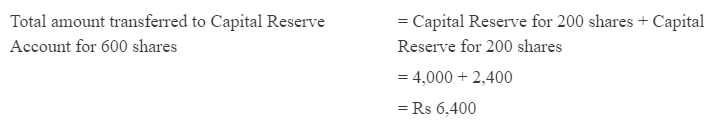

Amount of 400 shares transferred to Capital Reserve Account, after reissue = 400 Shares @ Rs 10 per share = Rs 4,000

Amount of 200 shares transferred to Capital Reserve Account, after reissue = 200 Shares @ Rs 12 per share = Rs 2,400

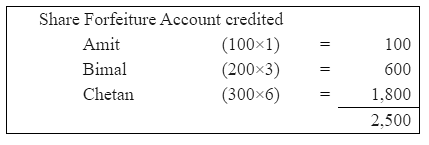

Q21: Amit holds 100 shares of Rs 10 each on which he has paid Re.1 per share as application money. Bimal holds 200 shares of Rs 10 each on which he has paid Re.1 and Rs 2 per share as application and allotment money, respectively. Chetan holds 300 shares of Rs 10 each and has paid Re.1 on application, Rs 2 on allotment and Rs 3 for the first call. They all fail to pay their arrears and the second call of Rs 2 per share and the directors, therefore, forfeited their shares. The shares are reissued subsequently for Rs 11 per share as fully paid. Journalise the transactions.

Ans:

Working Notes:

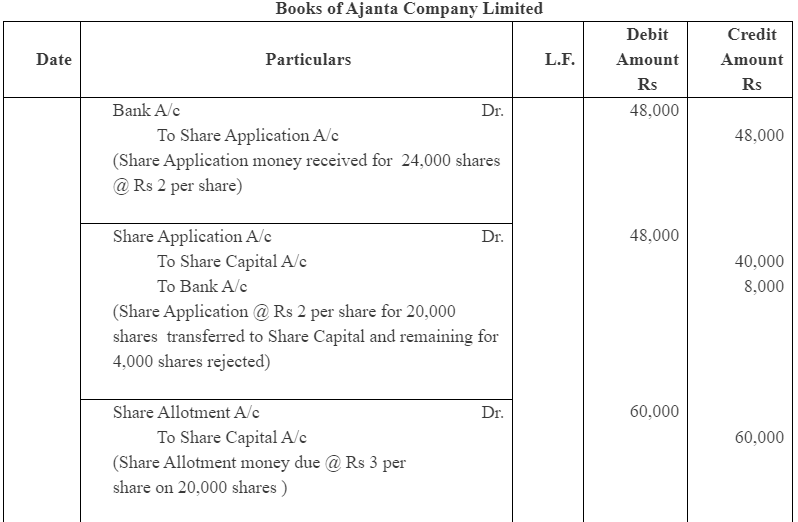

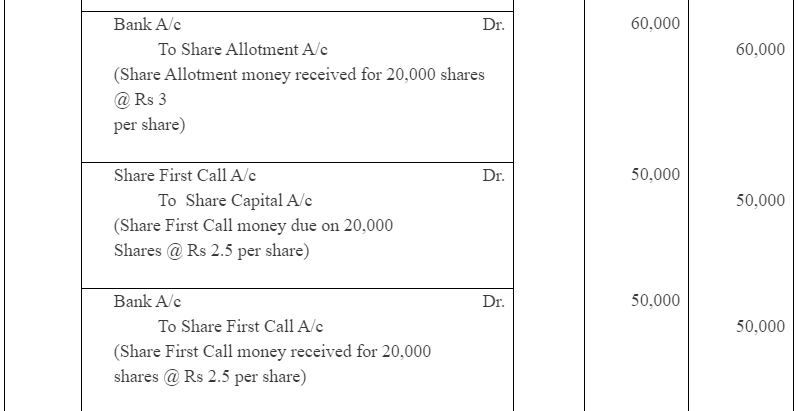

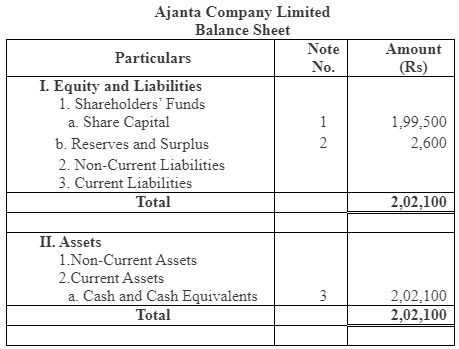

Q22: Ajanta Company Limited having a normal capital of Rs. 3,00,000, divided into shares of Rs. 10 each offered for public subscription of 20,000 shares payable at Rs. 2 on application; Rs. 3 on allotment and the balance in two calls of Rs. 2.50 each. Applications were received by the company for 24,000 shares. Applications for 20,000 shares were accepted in full and the shares allotted. Applications for the remaining shares were rejected and the application money was refunded.

All moneys due were received with the exception of the final call on 600 shares which were forfeited after legal formalities were fulfilled. 400 shares of the forfeited shares were reissued at Rs. 9 per share.

Record necessary journal entries and prepare the balance Sheet showing the amount transferred to capital reserve and the balance in Share forfeiture account.

Ans:

Working Note:

Working Note:

Amount of 400 shares transferred to Capital Reserve Account, after reissue = 400 Shares @ Rs 6.5 per share = Rs 2,600

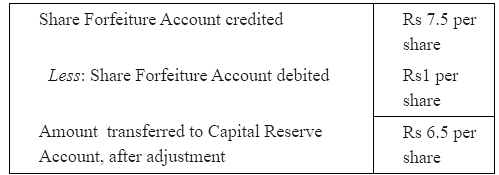

Q23: Journalise the following transaction in the books Bhushan Oil Ltd:

(a) 200 shares of Rs 100 each issued at a discount of Rs 10 were forfeited for the non payment of allotment money of Rs 50 per share. The first and final call of Rs 20 per share on these share were not made. The forfeited share were reissued at Rs 70 per share as fully paid-up.

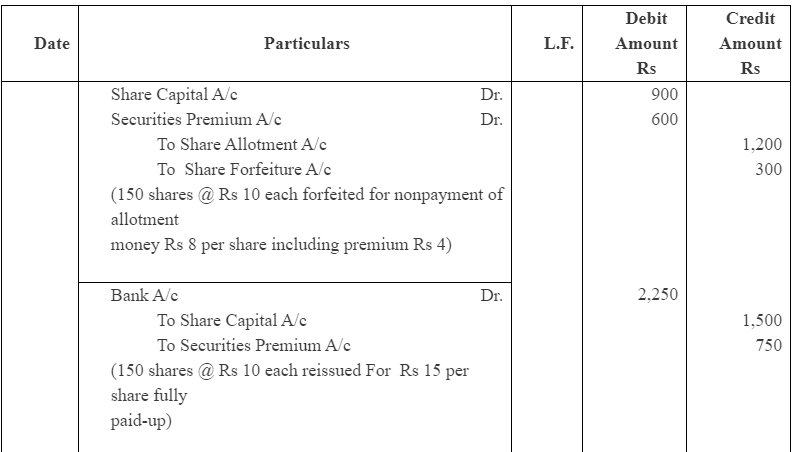

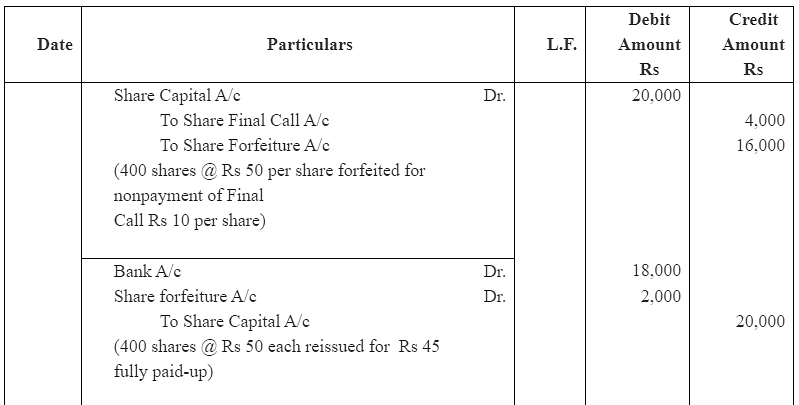

(b) 150 shares of Rs 10 each issued at a premium of Rs 4 per share payable with allotment were forfeited for non-payment of allotment money of Rs 8 per share including premium. The first and final call of Rs 4 per share were not made. The forfeited share were reissued at Rs 15 per share fully paid-up.

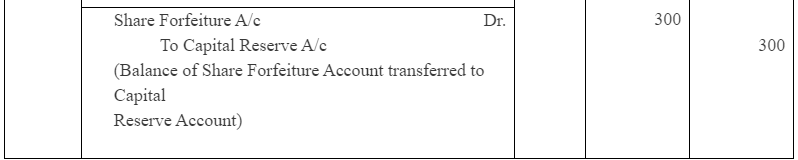

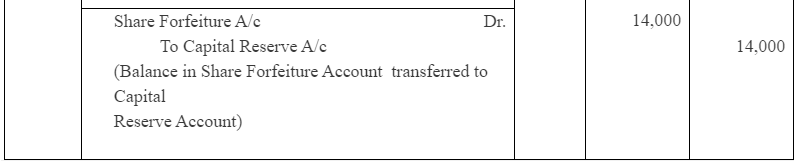

(c) 400 share of Rs 50 each issued at par were forfeited for non-payment of final call of Rs 10 per share. These share were reissued at Rs 45 per share fully paid-up.

Ans:

Case (b)

Case(c)

Case(c)

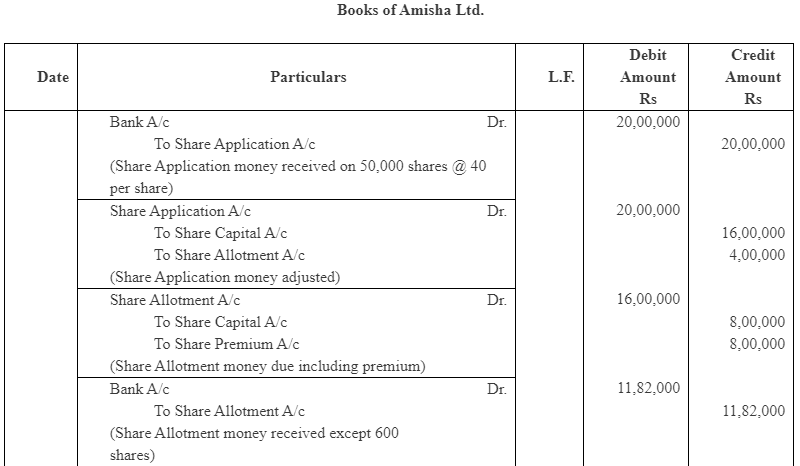

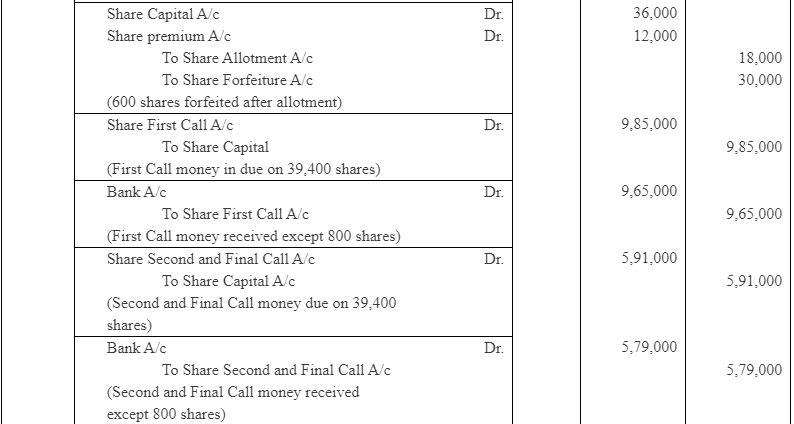

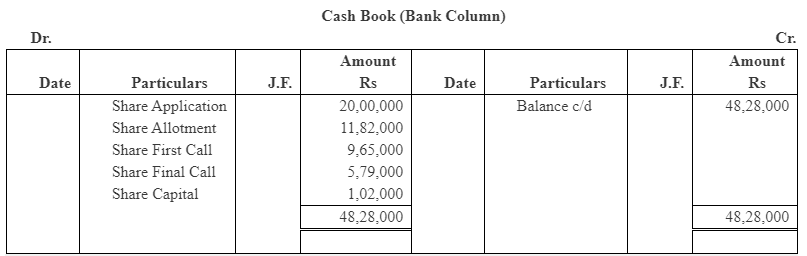

Q24 : Amisha Ltd inviting application for 40,000 shares of Rs 100 each at a premium of Rs 20 per share payable; on application Rs 40; on allotment Rs 40 (Including premium): on first call Rs 25 and Second and final call Rs 15.

Application were received for 50,000 shares and allotment was made on pro-rata basis. Excess money on application was adjusted on sums due on allotment.

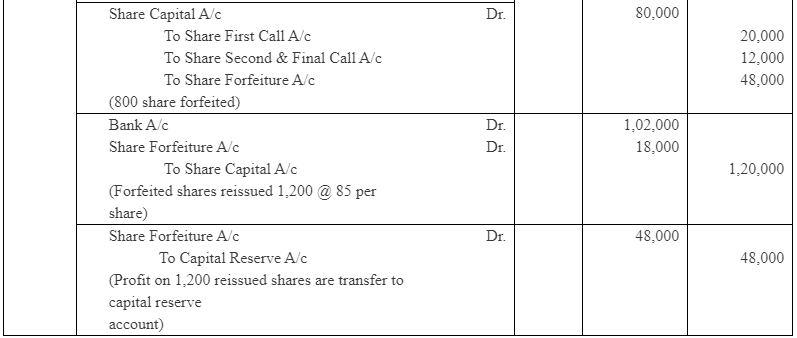

Rohit to whom 600 shares were allotted failed to pay the allotment money and his shares were forfeited after allotment. Ashmita, who applied for 1,000 shares failed to pay the Two calls and his shares were forfeited after the second call. Of the shares forfeited, 1,200 shares were sold to Kapil for Rs 85 per share as fully paid, the whole of Rohit's shares being included.

Record necessary journal entries.

Ans:

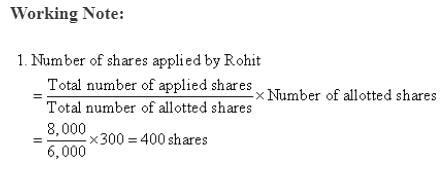

Working Notes:

Working Notes:

1. Number of Share Applied by Rohit = (Total number of Applied Shares/Total number of Allotted Shares) x Number of Allotted Shares = (50000/40000) x 600 = 750 shares

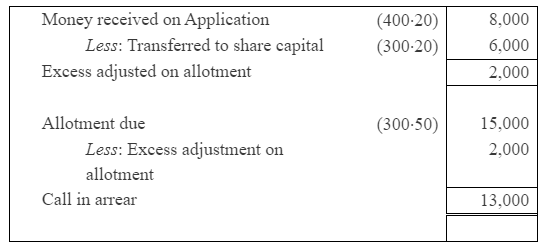

2. Call in arrears by Rohit on allotment 3.

3.

4. Number of shares allotted to Ashmita = (Total number of Allotted Shares/Total number of Applied Shares) x Number of Applied Shares = (40000/50000) x 1000 = 800 shares

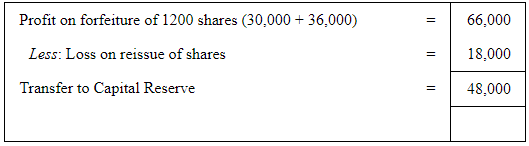

5. Profit on the forfeiture of 600 shares of Rohit = Rs.30000 Profit on the forfeiture of 600 shares of Ashmita = 48000 x (600/800) = Rs.36000

6. Balance in Share Forfeiture Account (48,000 – 36,000) = Rs. 12,000

|

42 videos|199 docs|43 tests

|

FAQs on Accounting for Share Capital NCERT Solutions - Accountancy Class 12 - Commerce

| 1. What is share capital in accounting? |  |

| 2. How is share capital recorded in the financial statements? |  |

| 3. What are the different types of shares that a company can issue? |  |

| 4. What is the difference between authorized capital and paid-up capital? |  |

| 5. What is the significance of share capital in a company's financial health? |  |