NCERT Solution (Part - 4) - Issue and Redemption of Debentures | Additional Study Material for Commerce PDF Download

Page No 146:

Question 17:

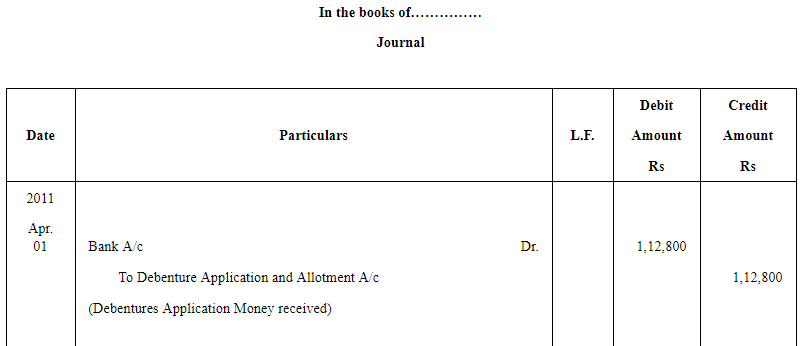

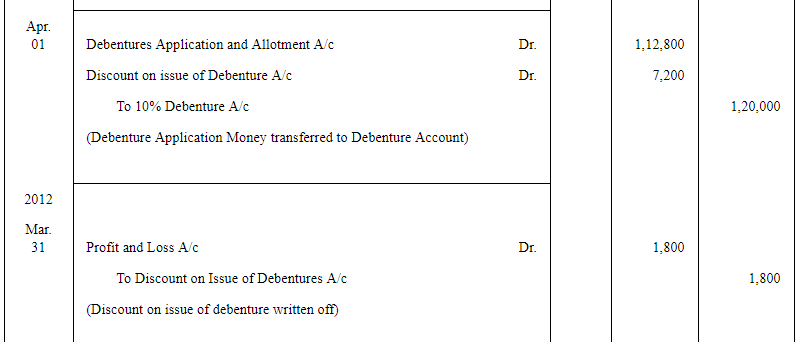

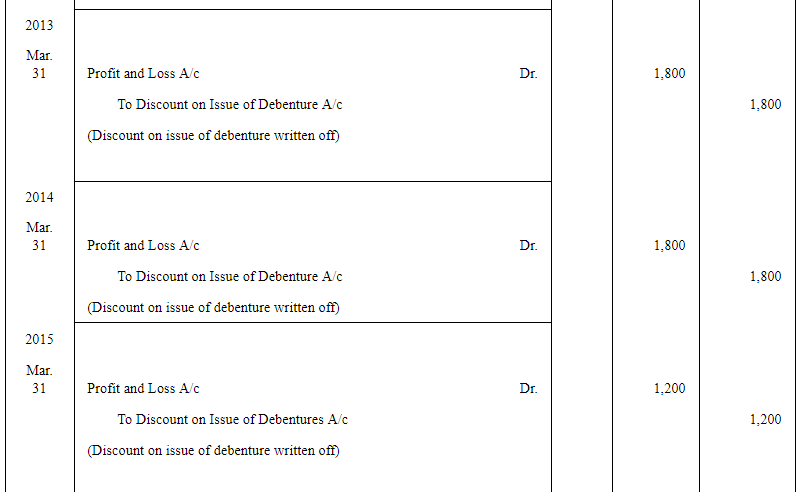

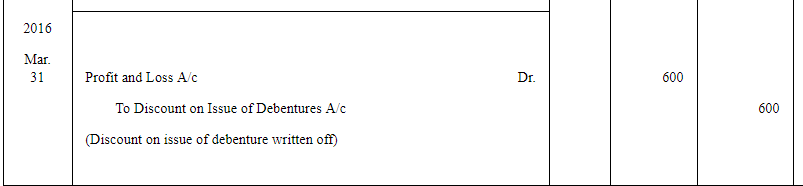

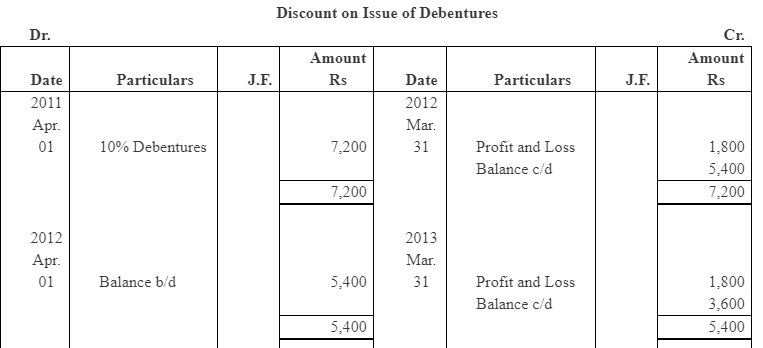

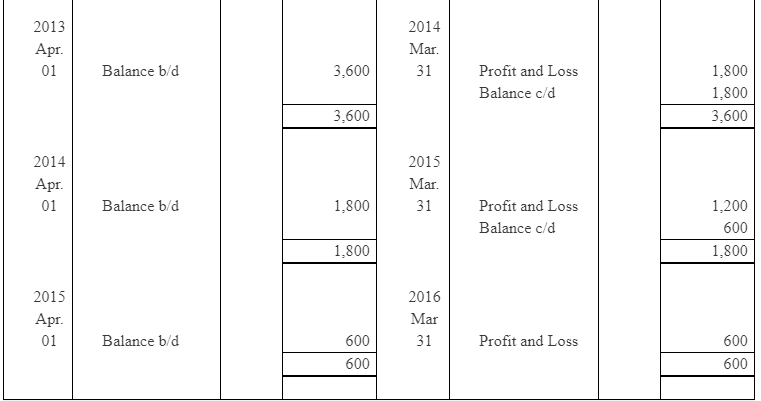

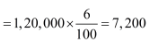

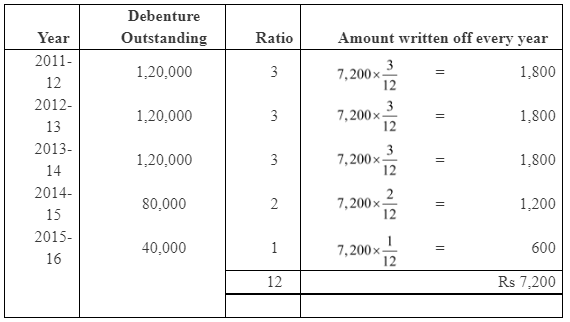

A company issued 10% Debentures of the face value of Rs,1,20,000 at a discount of 6% on April 01, 2011. The debentures are payable by annual drawings of Rs 40,000 commencing from the end of third year.

How will you deal with discount on debentures?

Show the discount on debentures account in the company ledger for the period of duration of debentures. Assume accounts are closed on March 31 every year.

ANSWER:

i) Working Note:

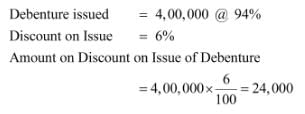

Amount of Discount on Issue of Debenture

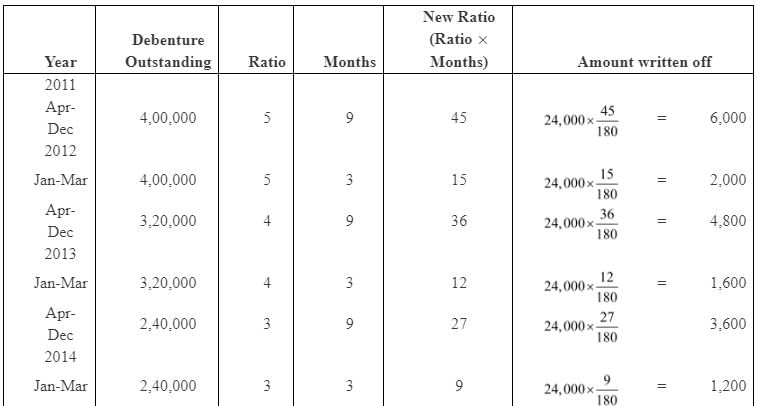

Question 18: B.Ltd. issued debentures at 94% for Rs 4,00,000 on April 01, 2011 repayable by five equal drawings of Rs 80,000 each. The company prepares its final accounts on March 31* every year.

Indicate the amount of discount to be written-off every accounting year assuming that the company decides to write off the debentures discount during the life of debentures. (Amount to be written-off: 2011 Rs 6,000; 2012 Rs 6,800; 2013 Rs 5,200; 2014 Rs 3,600; 2015 Rs 2,000; 2016 Rs 400).

*It should be December 31

ANSWER:

Amount of discount to written off every year

In 2011 = Rs 6,000

In 2012 = 2,000 + 4,800 = Rs 6,800

In 2013 = 1,600 + 3,600 = Rs 5,200

In 2014 = 1,200 + 2,400 = Rs 3,600

In 2015 = 800 + 1,200 = Rs 2,000

In 2016 = Rs 400

Working Notes

i) Amount of discount to be written off every year

Note: In the question, the closing date of the accounting year is March 31, however, it should be December 31.

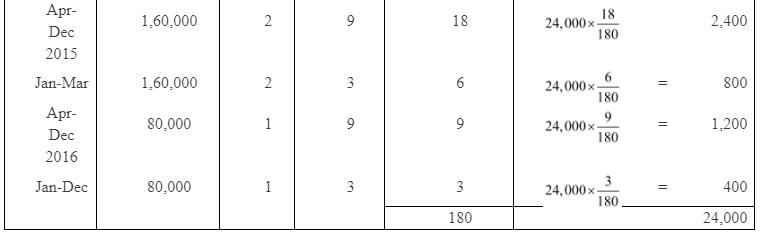

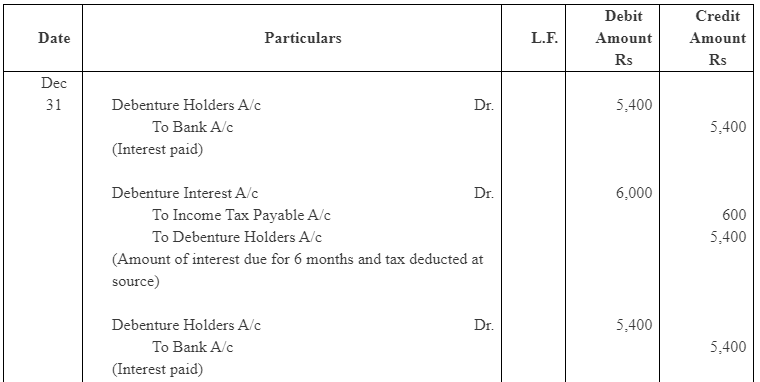

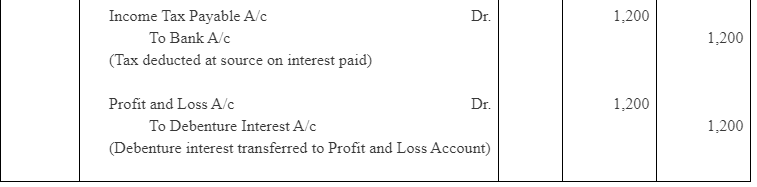

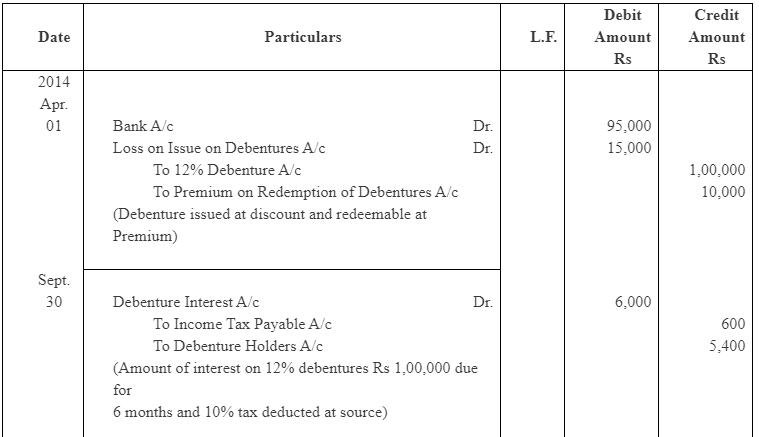

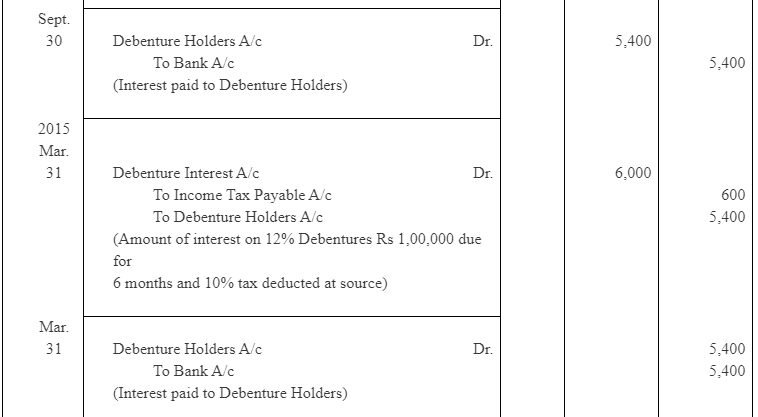

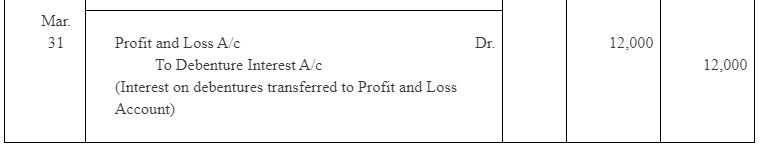

Question 19: B. Ltd. issued 1,000, 12% debentures of Rs 100 each on April 01, 2014 at a discount of 5% redeemable at a premium of 10%.

Give journal entries relating to the issue of debentures and debentures interest for the period ending March 31, 2015 assuming that interest is paid half yearly on September 30 and March 31 and tax deducted at source is 10%.

Answer :

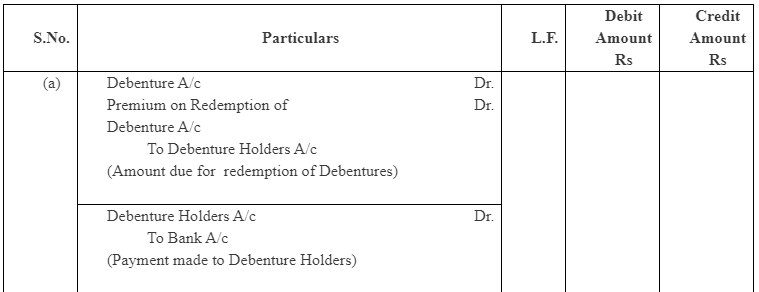

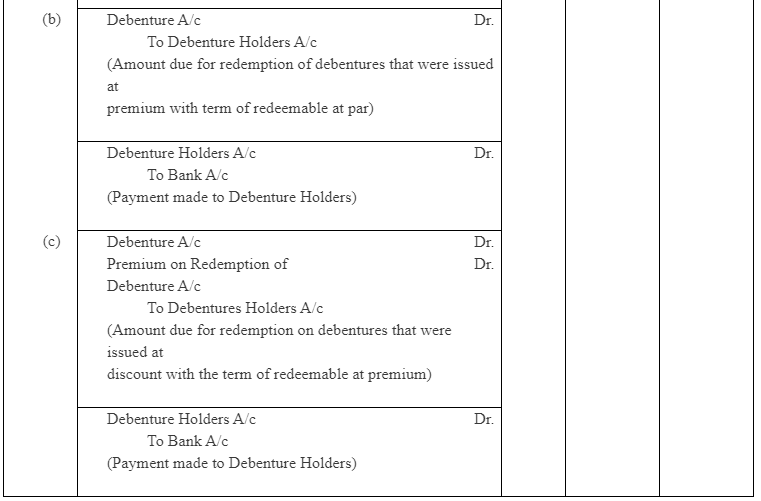

Question 20: What journal entries will be made in the following cases when company redeems debentures at the expiry of period by serving the notice: (a) when debentures were issued at par with a condition to redeem them at premium; (b) when debentures were issued at premium with a condition to redeem that at par; and (c) when debentures were issued at discount with a condition to redeem them at premium?

Answer 20:

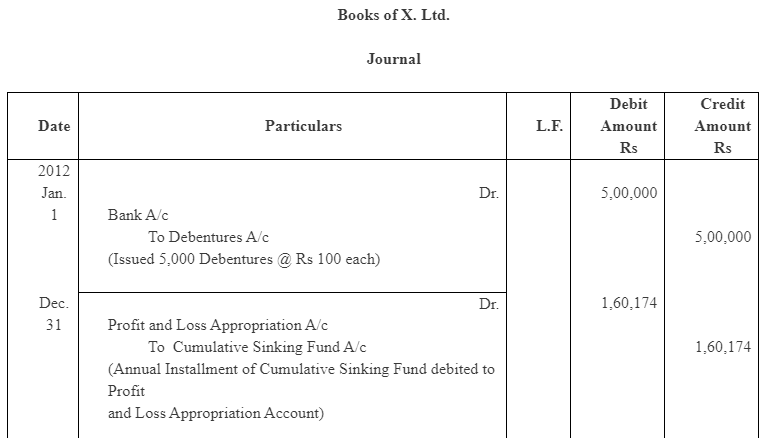

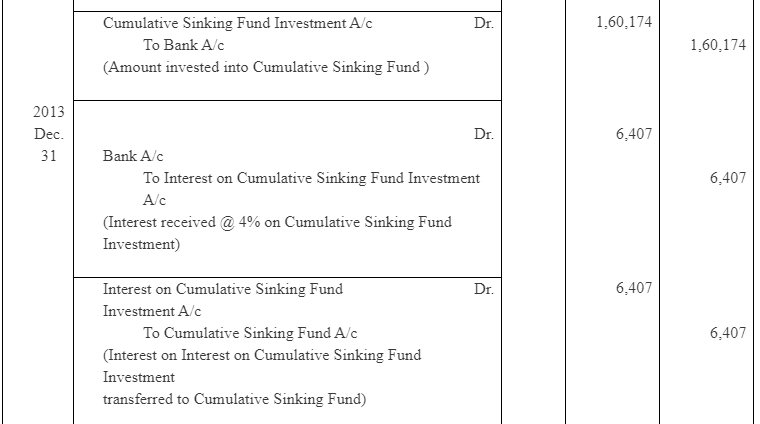

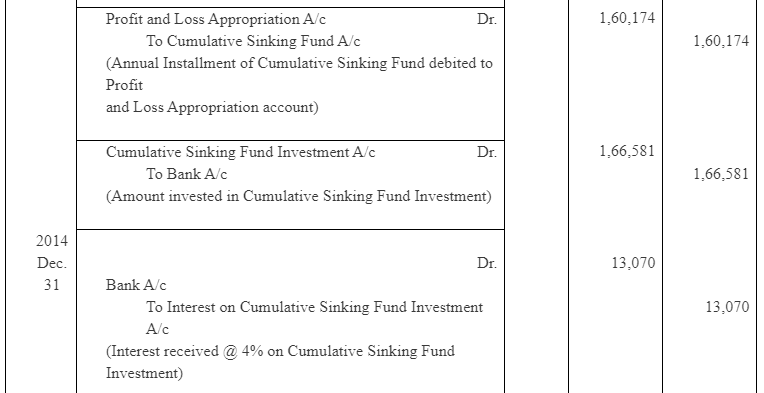

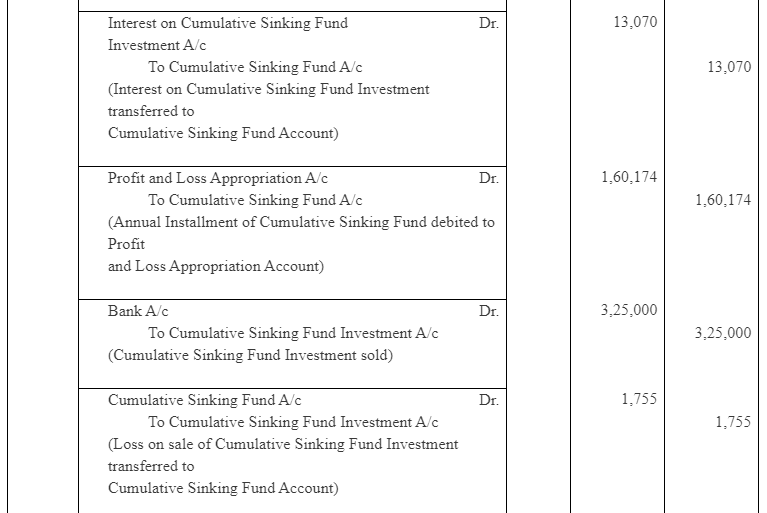

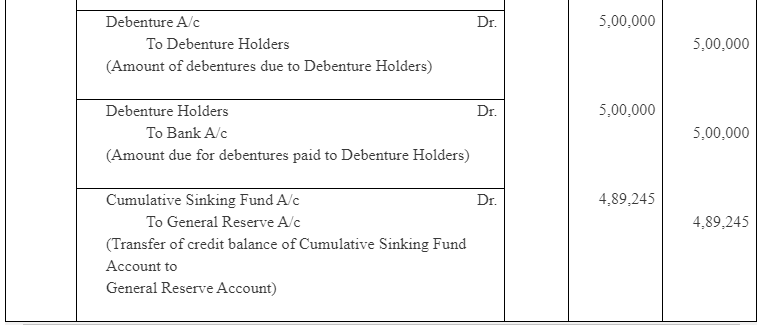

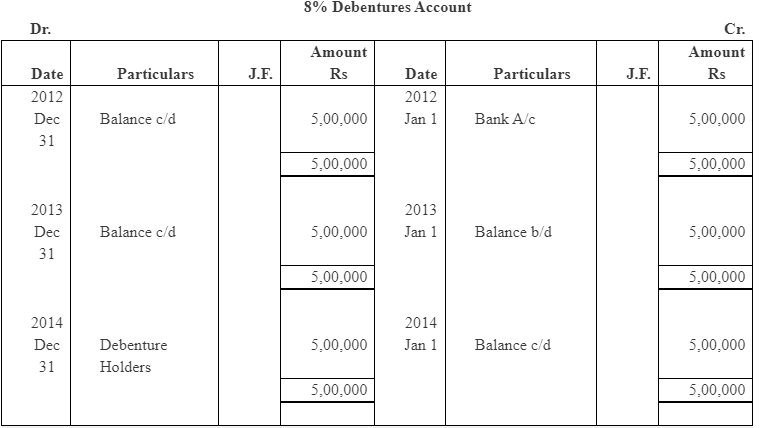

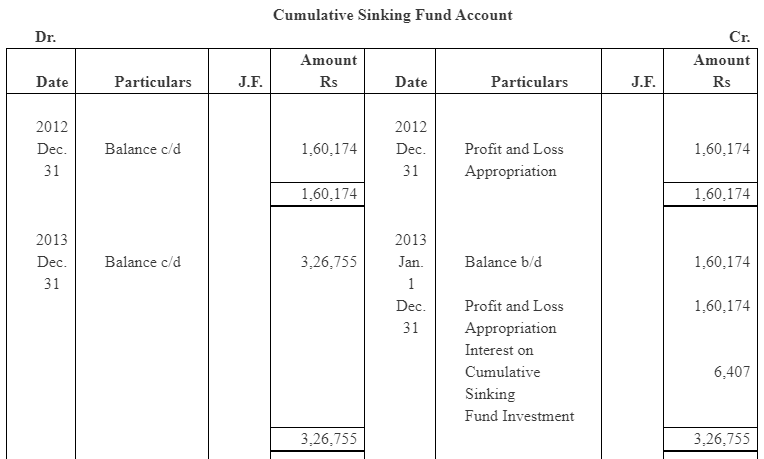

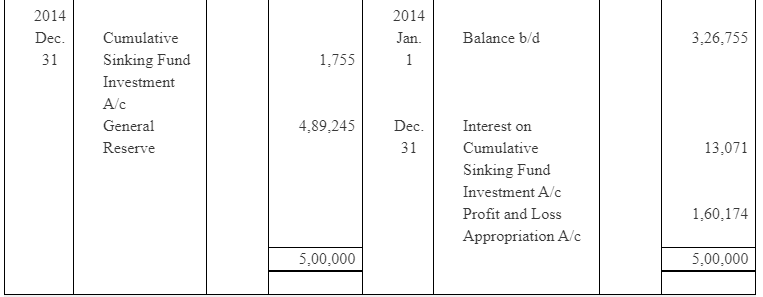

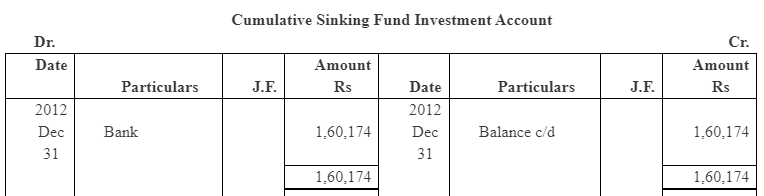

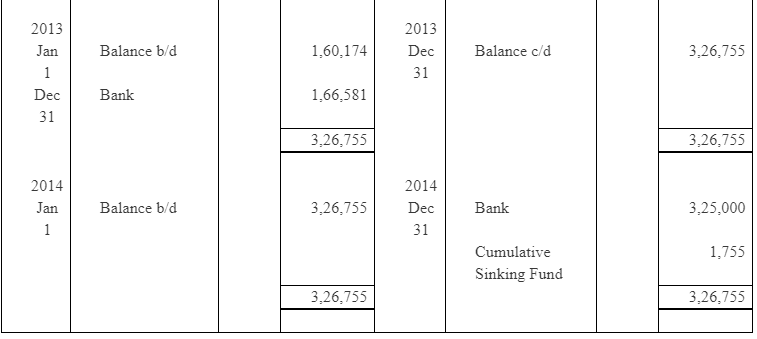

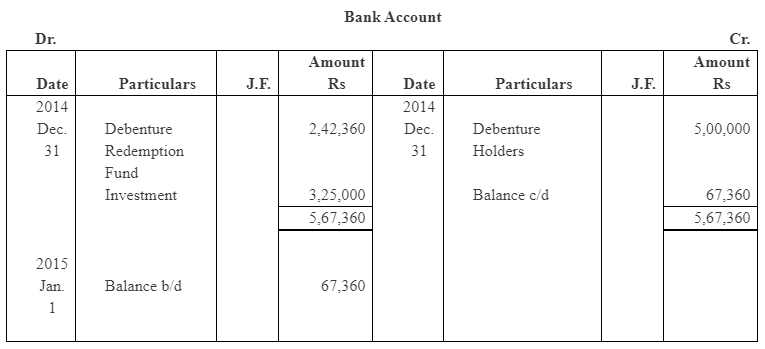

Question 21: On January 01, 2012, X. Ltd. issues 5,000, 8% Debentures of Rs 100 each repayable at par at the end of three years. It has been decided to set up a cumulative sinking fund for the purpose of their redemption. The investments are expected to realise 4% net. The Sinking Fund Table shows that Rs 0.320348 amounts to one rupee @4% per annum in three years. On December 31, 2015 the balance at bank was Rs 2,42,360 and the investments realised Rs 3,25,000. The debentures were paid off.

Give journal entries and show ledger account.

Answer 21:

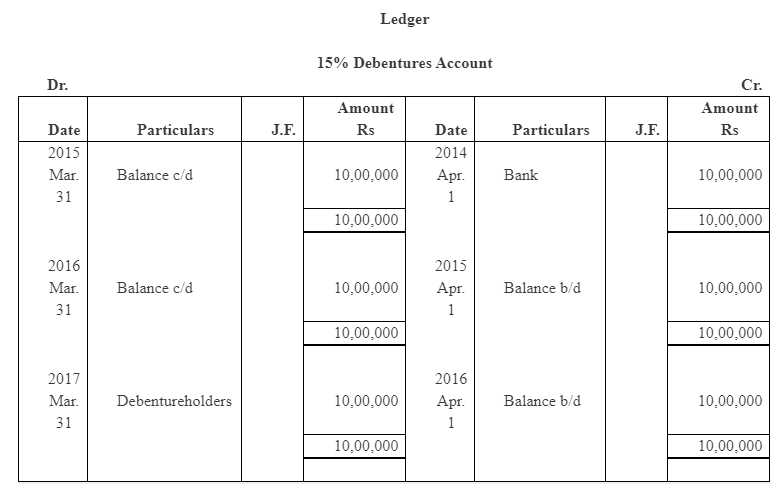

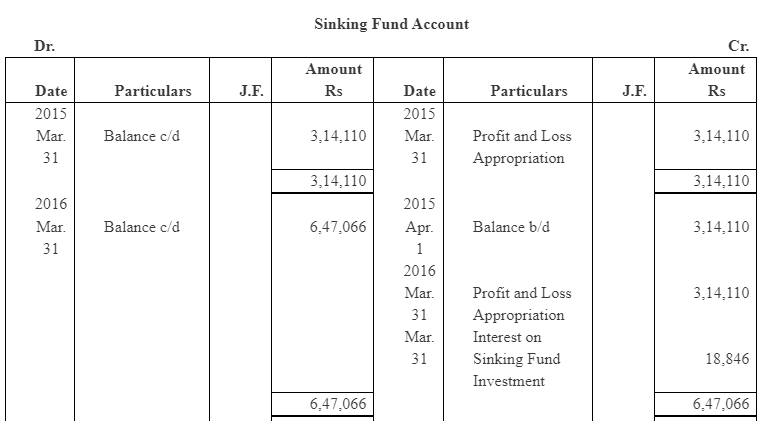

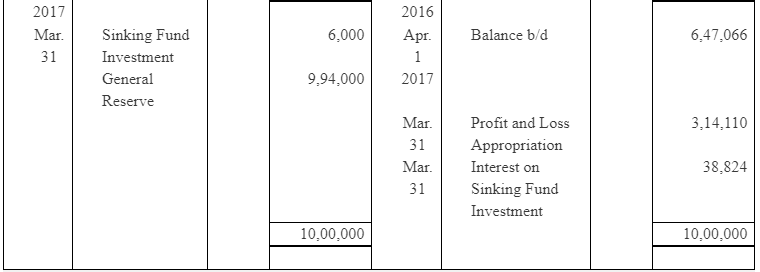

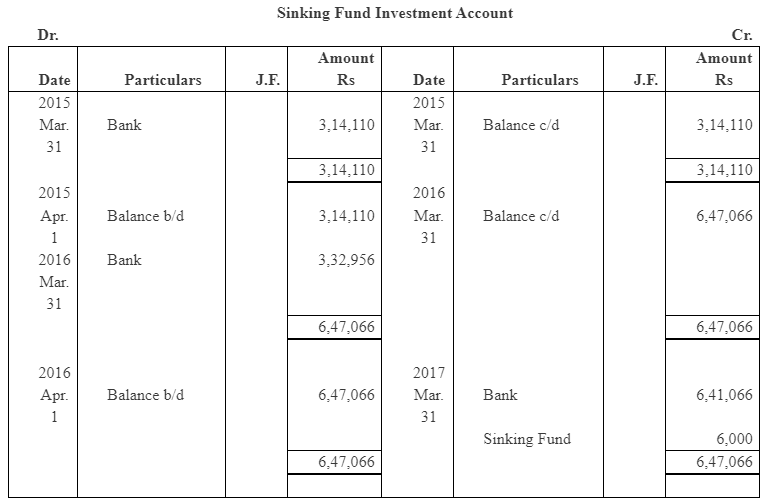

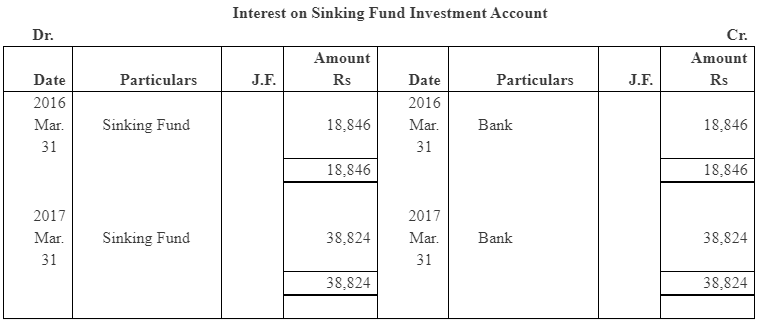

Question 22: On April 01, 2014 a company issued 15% debentures of Rs 10,00,000 at par. The debentures were redeemable at par after three years from the date of Issue. A sinking fund was set up to raise funds for redemption of debentures. The amount for the purpose was invested in 6% Government securities of Rs 100 each available at par. The sinking fund table shows that if investments earn 6% per annum, to get Re.1 at the end of 3 years, one has to invest Rs 0.31411 every year together with interest that will be earned. On March 31, 2017, all the Government securities were sold at a total loss of Rs 6,000 and the debentures were redeemed at par.

Prepare Debentures Account Sinking Fund Account, Sinking Fund Investment Account and Interest on Sinking Fund Investment Company closes its books of accounts every year on March 31.

Answer :

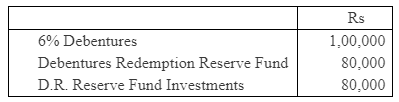

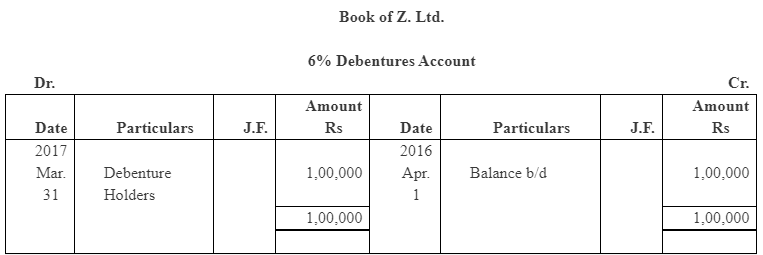

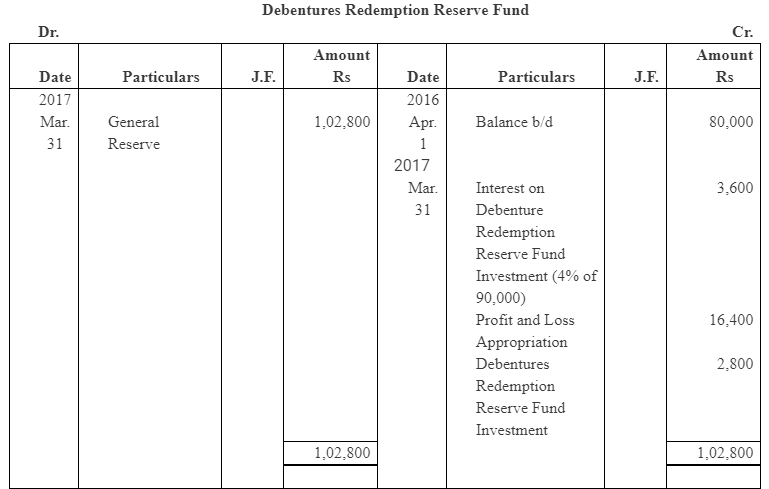

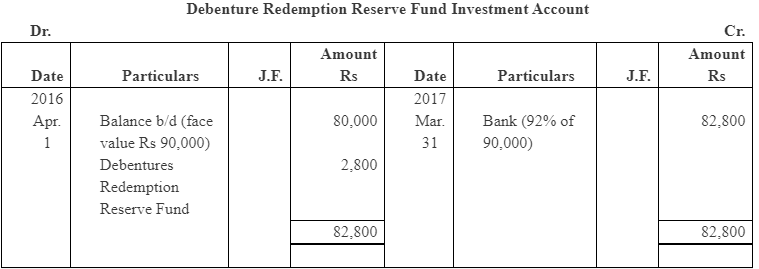

Question 23: On April 01, 2016 the following balances appeared in the books of Z. Ltd.:

The investments consisted of 4% Government securities of the face value of Rs 90,000.

The annual instalment was Rs 16,400. On March 31, 2017, the balance at Bank was Rs 26,000 (after receipt of interest on D.R.Reserve Fund Investment). Investments were realised at 92% and the Debentures were redeemed. The interest for the year had already been paid.

Show the ledger accounts affecting redemption.

Answer :

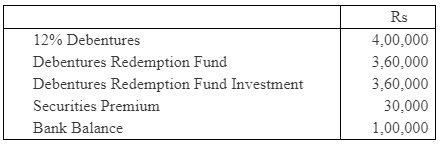

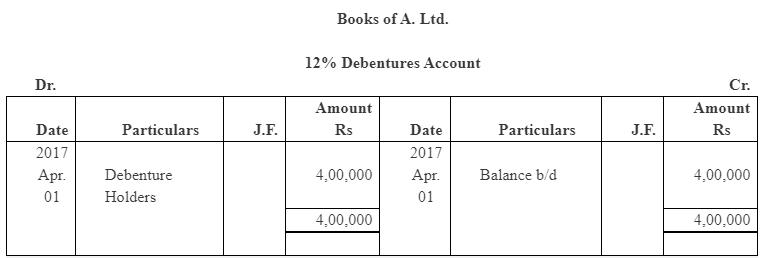

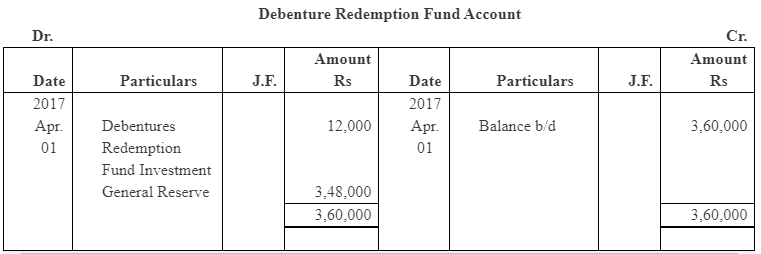

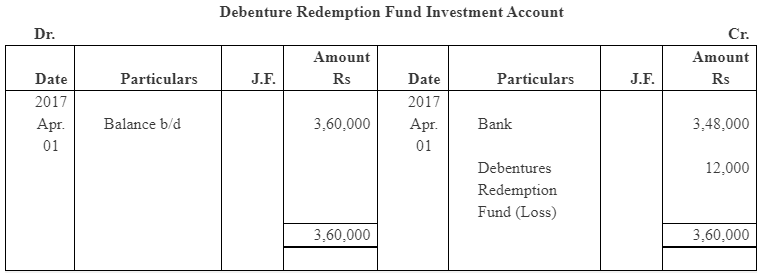

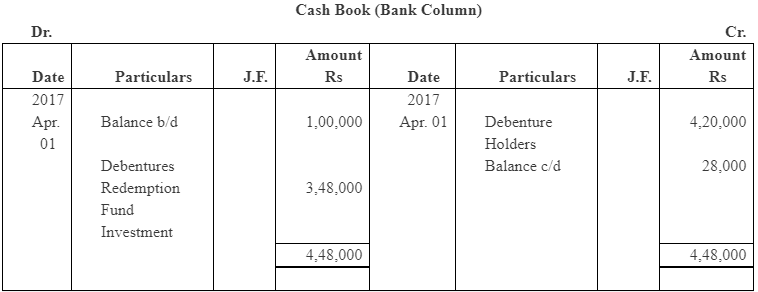

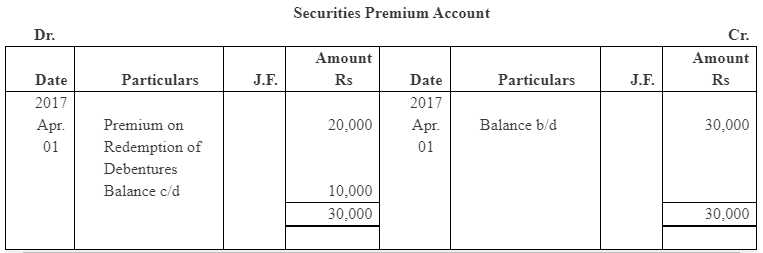

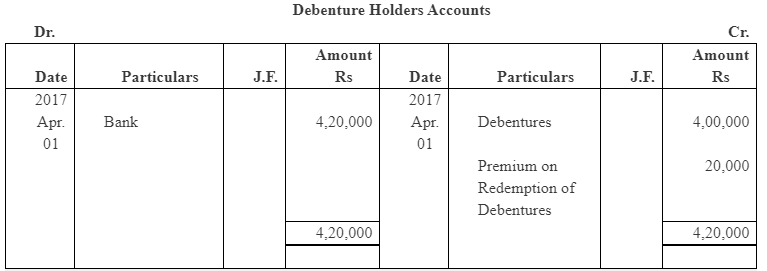

Question 24: The following balances appeared in the books of A.Ltd. on April 01, 2017

On April 01, 2017, the company redeemed all the debentures at 105 per cent out of funds raised by selling all the investments at Rs 3,48,000. Prepare the necessary ledger accounts.

Answer:

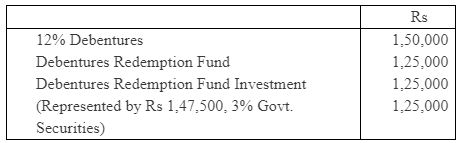

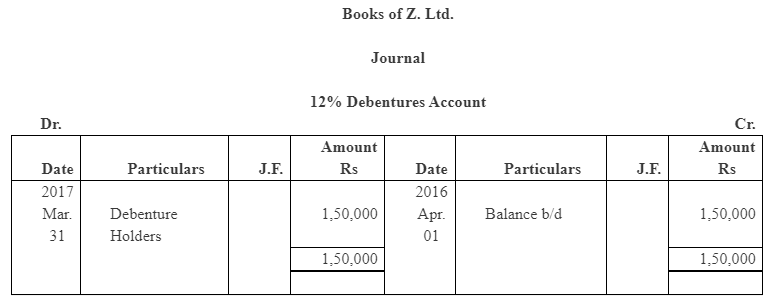

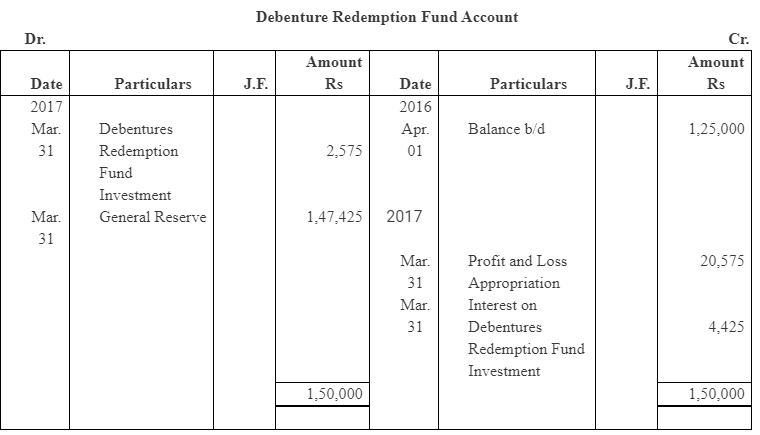

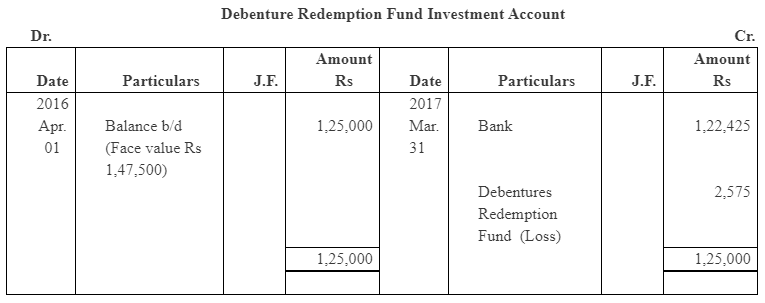

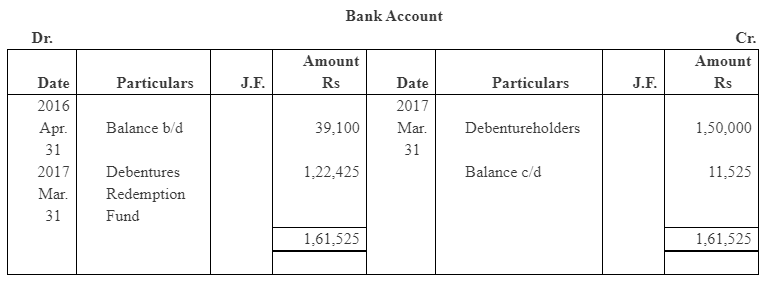

Question 25: The following balances appeared in the books of Z.Ltd. on April 01, 2016

The annual instalment added to the fund is Rs 20,575. On March 31, 2017, the bank balance after the receipt of interest on the investment was Rs 39,100. On that date, all the investments were sold at 83 per cent and the debentures were duly redeemed.

Show the necessary ledger accounts for the year 2016-17.

Answer :

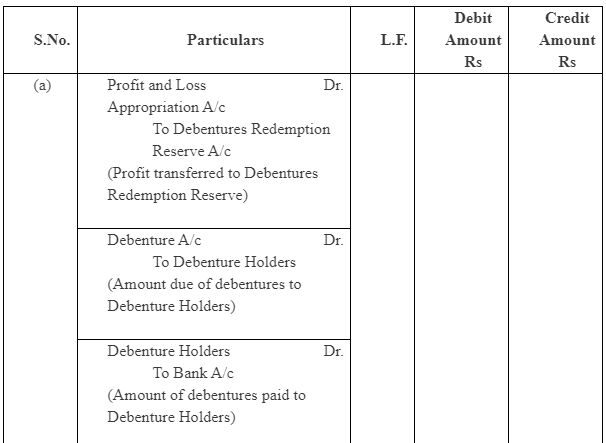

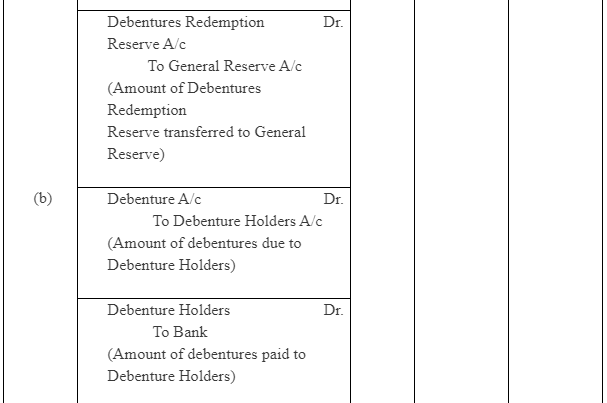

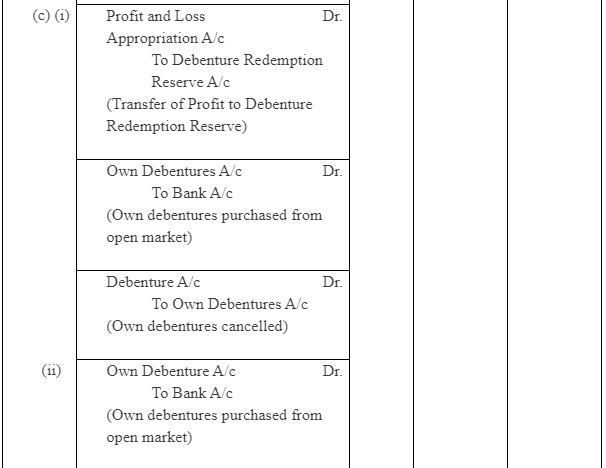

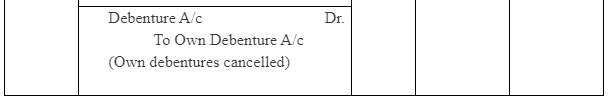

Question 26: What entries for the redemption of debentures will be done when : (a) debentures are redeemed by annual drawings out of profits; (b) debentures are redeemed by drawing a lot out of capital; and (c) debentures are redeemed by purchasing them in the open market when sinking fund for the redemption of debentures is not maintained − (i) when out of profit, and (ii) when out of capital?

Answer :

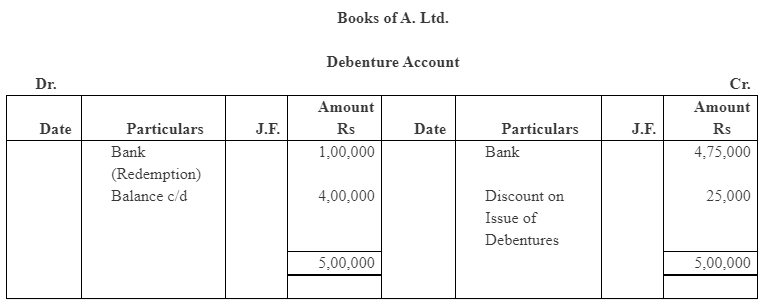

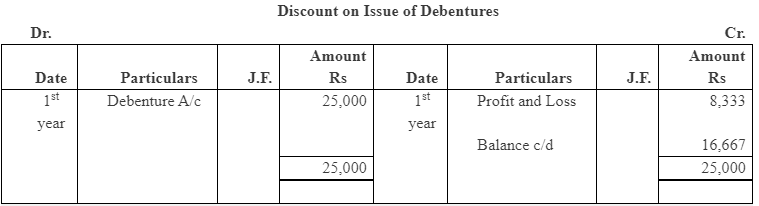

Question 27: A. Ltd. Company issued Rs,5,00,000 Debentures at a discount of 5% repayable at par by annual drawings of Rs.1,00,000.

Make the necessary ledger accounts in the books of the company for the first year.

Answer:

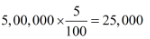

Discount on issue of Debenture =

Writing of Discount on Issue of Debenture

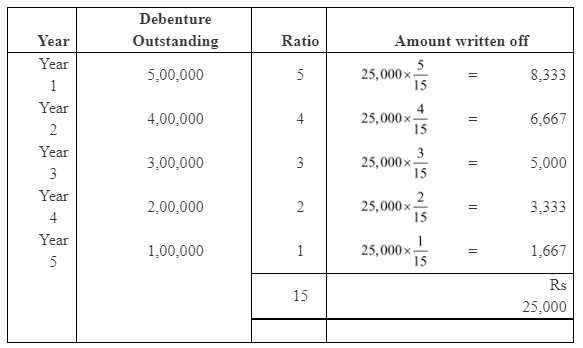

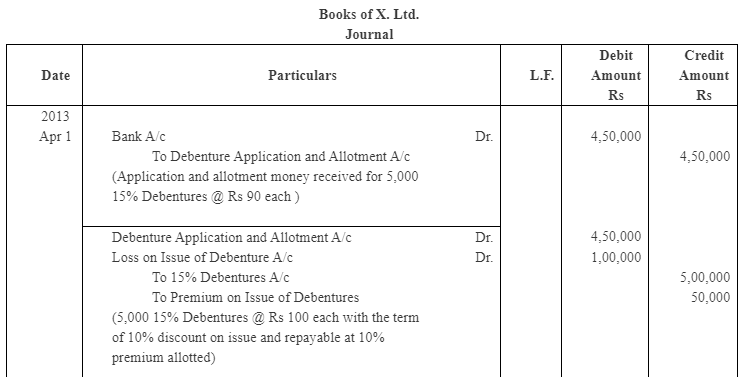

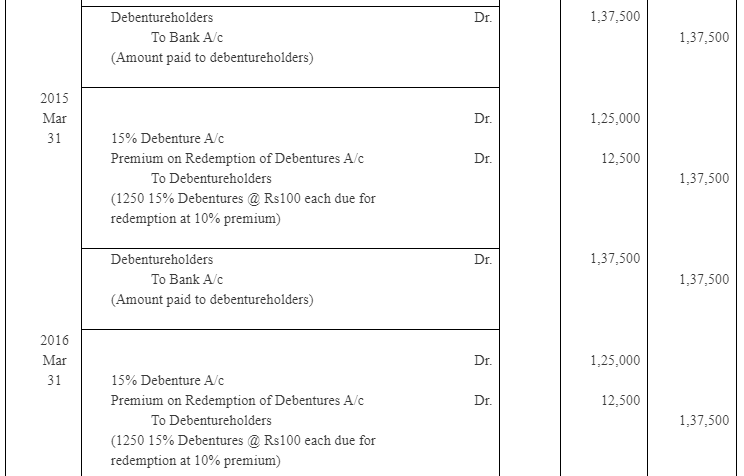

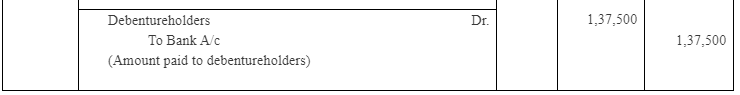

Question 28: X.Ltd. issued 5,000, 15% debentures of Rs.100 each on April 01, 2013 at a discount of 10%, redeemable at a premium of 10% in equal annual drawings in 4 years out of capital.

Give journal entries both at the time of issue and redemption of debentures. (Ignore the treatment of loss on issue of debentures and interest.)

Answer 28:

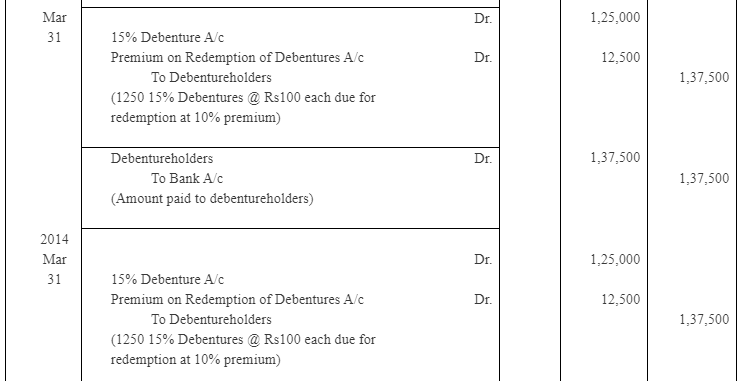

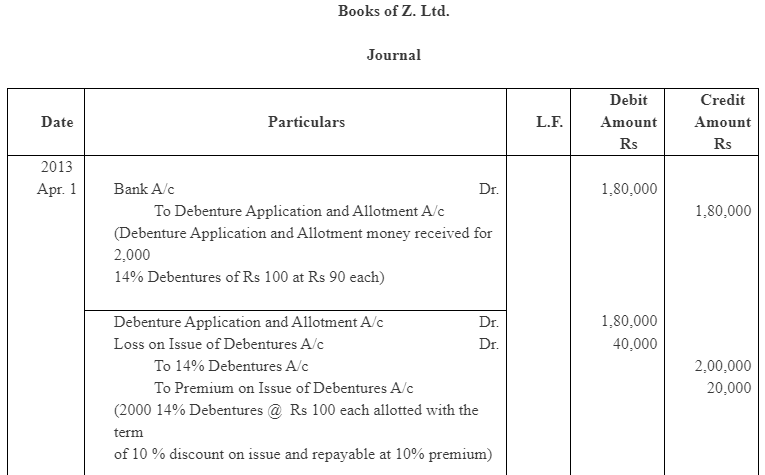

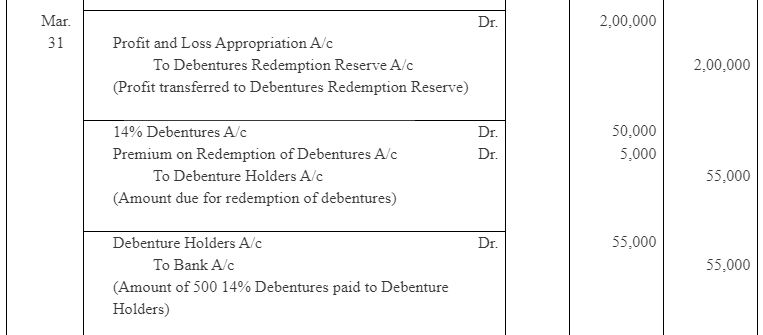

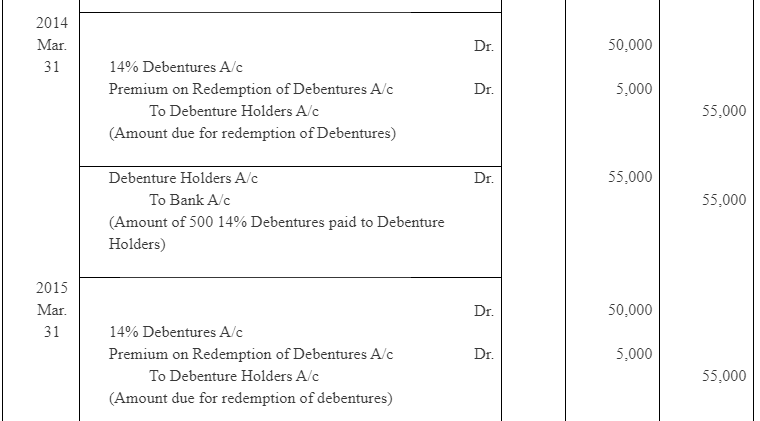

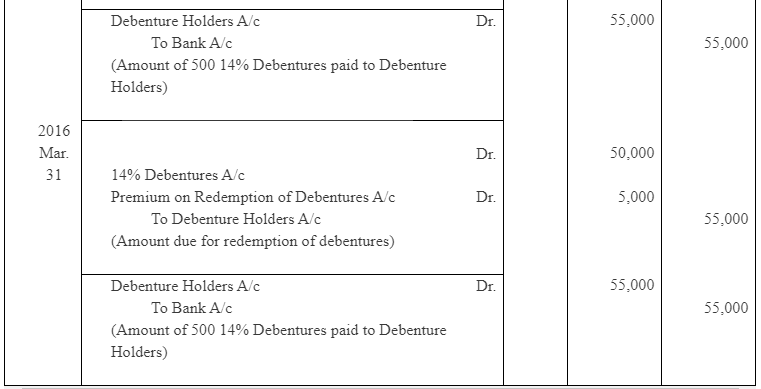

Question 29: Z.Ltd. issued 2,000, 14% debentures of Rs.100 each on April 01, 2013 at a discount of 10%, redeemable at a premium of 10% in equal annual drawings in 4 years out of profits.

Give journal entries both at the time of issue and redemption of debentures. (Ignore the treatment of loss on issue of debentures and interest.)

Answer :

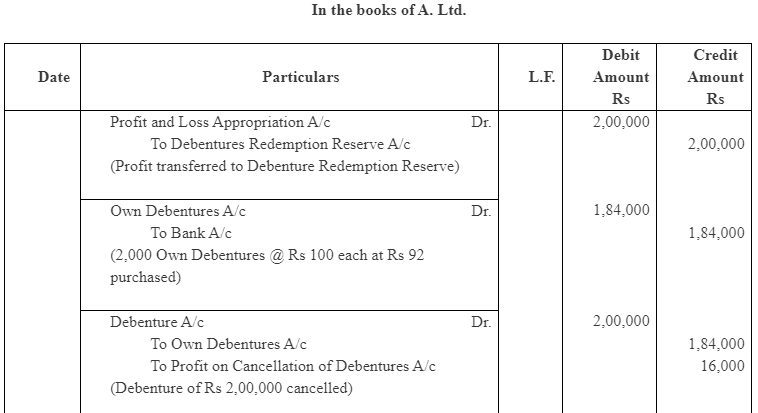

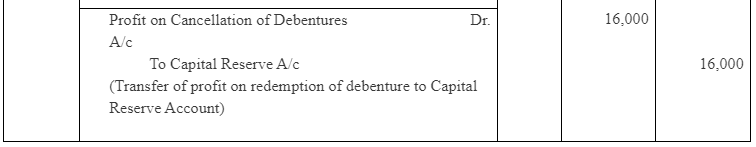

Question 30: A.Ltd. purchased its own debentures of the face value of Rs.2,00,000 from the open market for immediate cancellation at Rs.92. Record the journal entries.

Answer:

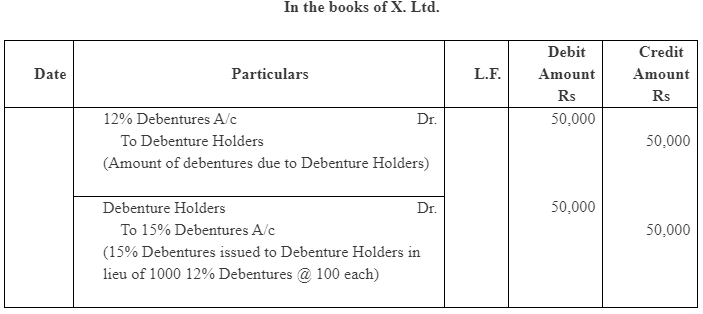

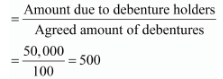

Question 31: X.Ltd. redeemed 1,000, 12% debentures of Rs.50 each by converting them into 15% New Debentures of Rs.100 each. Journalise.

Answer :

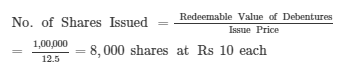

Working Notes:-

Number of Debentures to be issued

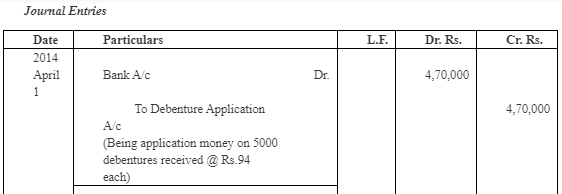

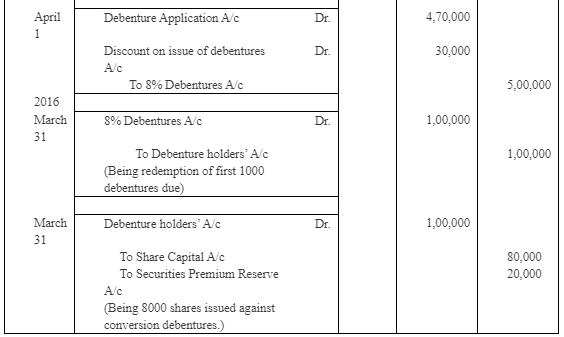

Question 32: On April 01, 2014, a company made an issue of 5,000, 8% debentures of Rs 100 each at Rs 94 per debentures. The terms of issue provided for the redemption of 1,000 debenture every year starting from March 31, 2016 either by purchase from open market or by converting them into Equity shares of Rs 10 each at a premium of Rs 2.50 per share. On March 31, 2016, the company redeemed 1,000 debentures by converting them into equity shares. Give the necessary journal entries.

Answer :

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 4) - Issue and Redemption of Debentures - Additional Study Material for Commerce

| 1. What is the meaning of issue of debentures? |  |

| 2. What is the difference between secured and unsecured debentures? |  |

| 3. How are debentures redeemed? |  |

| 4. What is the difference between convertible and non-convertible debentures? |  |

| 5. What are the advantages of issuing debentures for a company? |  |