NCERT Solution (Part - 2) - Reconstitution - Retirement/Death of a Partner | Additional Study Material for Commerce PDF Download

Page No 219:

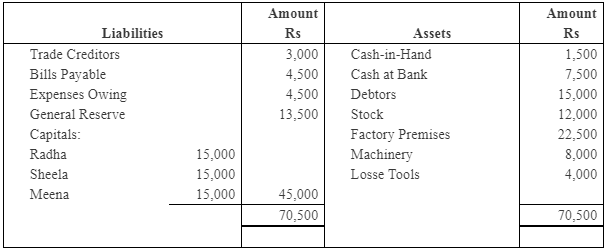

Question 6: Radha, Sheela and Meena were in partnership sharing profits and losses in the proportion of 3:2:1. On April 1, 2017, Sheela retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

a) Goodwill of the firm was valued at Rs 13,000.

b) Expenses owing to be brought down to Rs 3,750.

c) Machinery and Loose Tools are to be valued at 10% less than their book

value.

d) Factory premises are to be revalued at Rs 24,300.

Prepare:

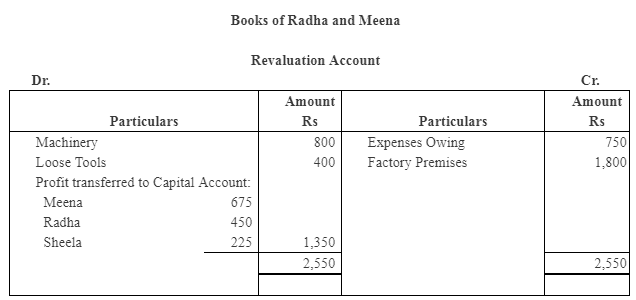

1. Revaluation account

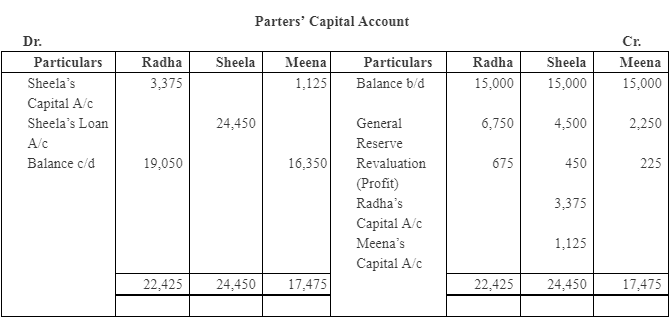

2. Partner’s capital accounts and

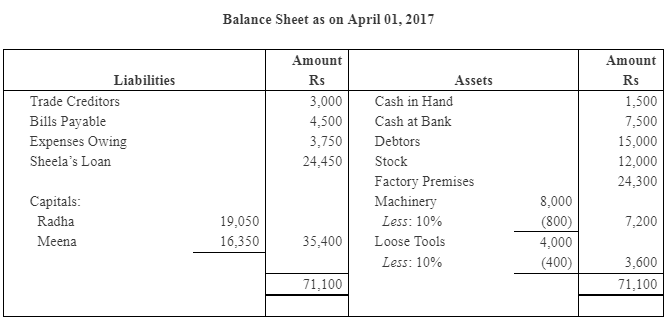

3. Balance sheet of the firm after retirement of Sheela.

Answer :

Working Notes:

1) Sheela’s share of goodwill

Total goodwill of the firm × Retiring Partner’s share

2) Gaining Ratio = New Ratio − Old Ratio

Page No. 220

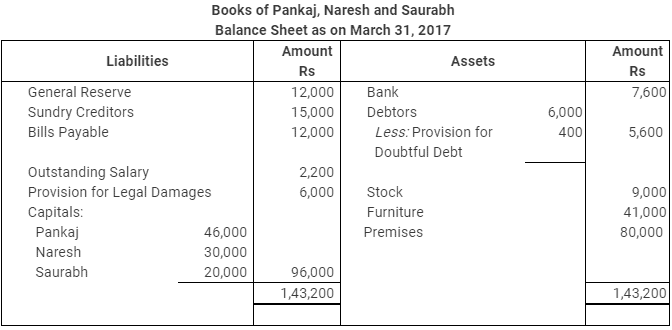

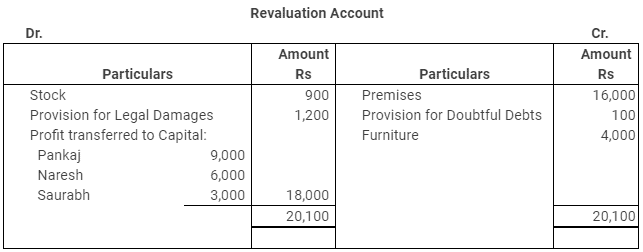

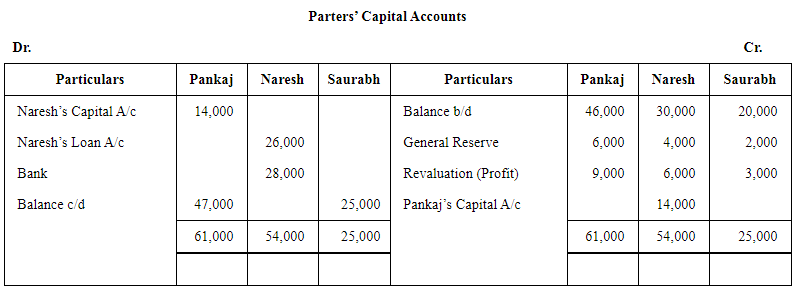

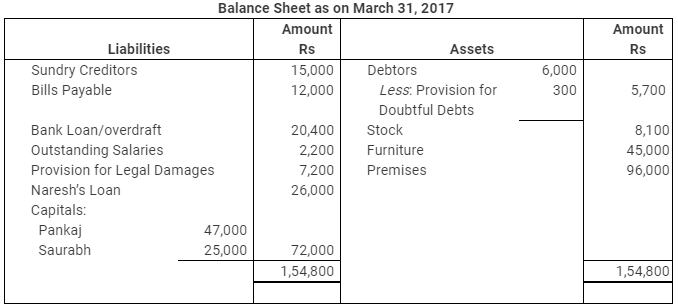

Question 7: Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3:2:1. Naresh retired from the firm due to his illness. On that date the Balance Sheet of the firm was as follows:

Additional Information

(i) Premises have appreciated by 20%, stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors. Further, provision for legal damages is to be made for Rs 1,200 and furniture to be brought up to Rs 45,000*.

(The amount of Rs 450 that is being given in the book for furniture is a mistake, as it should be Rs 45,000)

(ii) Goodwill of the firm be valued at Rs 42,000.

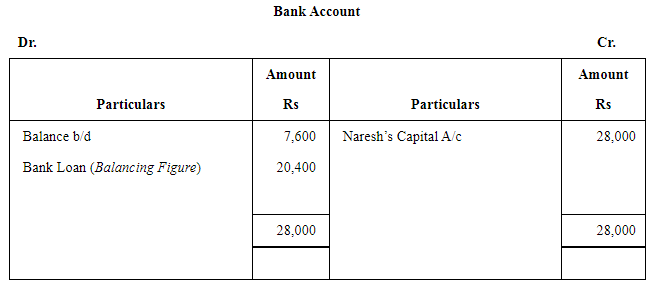

(iii) Rs 26,000 from Naresh’s Capital account be transferred to his loan account and balance be paid through bank; if required, necessary loan may be obtained from Bank.

(iv) New profit sharing ratio of Pankaj and Saurabh is decided to be 5:1.

Give the necessary ledger accounts and balance sheet of the firm after Naresh’s retirement.

Answer :

Page No. 221

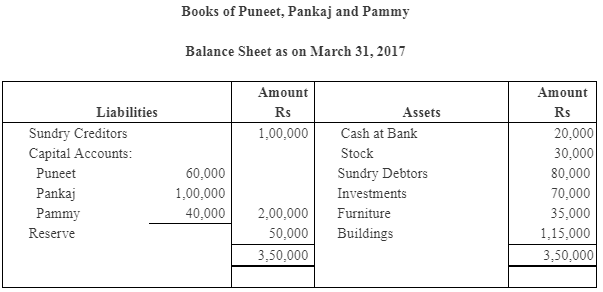

Question 8: Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2:2:1 respectively. Their balance sheet as on March 31, 2017 was as follows:

Mr. Pammy died on September 30, 2017. The partnership deed provided the following:

(i) The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

(ii) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below: for 2013–14; Rs 80,000; for 2014–15, Rs 50,000; for 2015–16, Rs 40,000; for 2016–17, Rs 30,000.

The drawings of the deceased partner up to the date of death amounted to Rs 10,000. Interest on capital is to be allowed at 12% per annum.

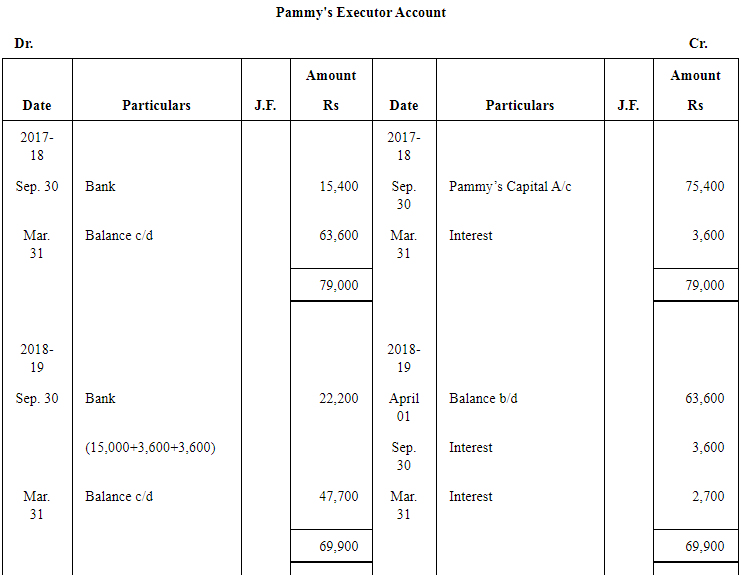

Surviving partners agreed that Rs 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance.

Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due.

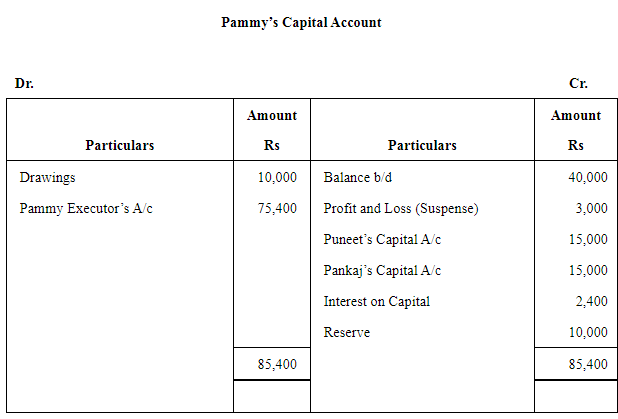

Answer :

Working Notes:

Working Notes:

1) Pammy’s Share of Profit

Previous Year’s Profit x Proportionate Period x Share of Deceased Partner

2) Pammy’s Share of Goodwill

Goodwill of the firm = Average Profit x Numbers of Year’s Purchase

Average Profit

Goodwill of the firm = 50,000 x 3 = Rs 1,50,000

3) Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Puneet and Pankaj = 2 : 2 or 1 : 1

4) Interest on Capital for 6 months, i.e. from April 1, 2007 to September 30, 2007

Amount of Capital x Rate of Interest x Period

5) Interest Amount

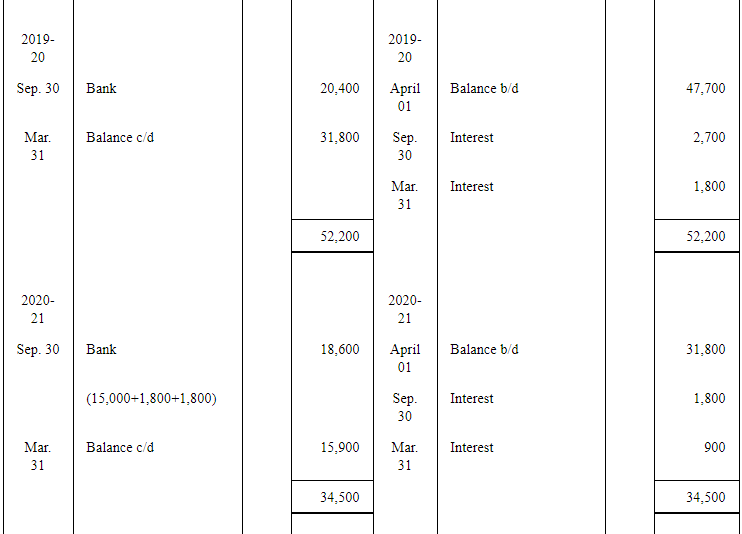

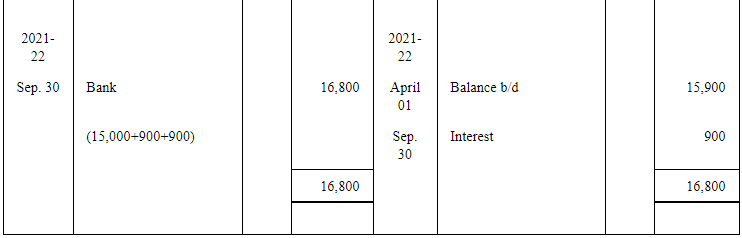

The firm closes its books every year on March 31, while installments to Pammy's Executor are paid on September 30 every year.

Amount outstanding on 30 September = 75,400 – 15,400 = Rs 60,000

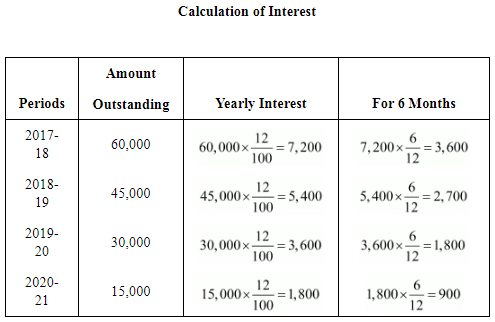

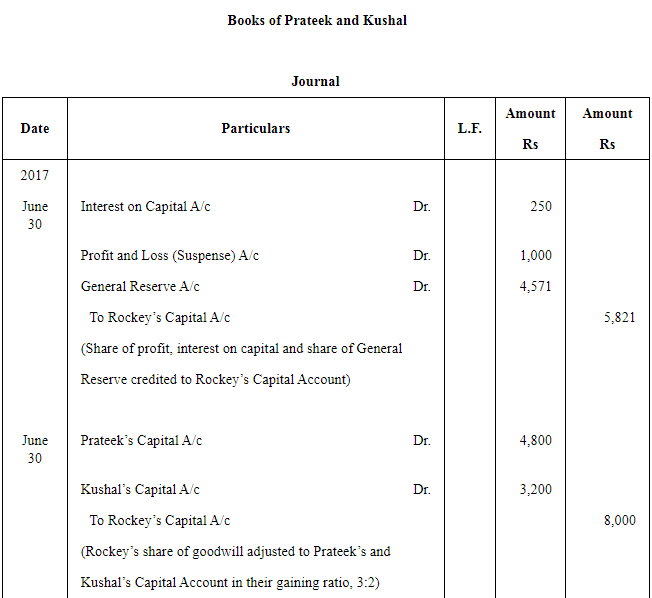

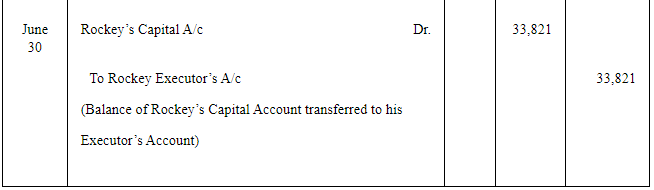

Question 9 : Following is the Balance Sheet of Prateek, Rockey and Kushal as on March 31, 2007.

Answer :

Rockey died on June 30, 2017. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

a) Amount standing to the credit of the Partner’s Capital account.

b) Interest on capital at 5% per annum.

c) Share of goodwill on the basis of twice the average of the past three years’ profit and

d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2015, March 31, 2016 and March 31, 2017 were Rs 12,000, Rs 16,000 and Rs 14,000 respectively. Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up Rockey’s capital account to be rendered to his executor.

Answer :

Working Notes:

1. Rockey’s Share of Profit = Previous year’s profit × Proportionate Period × Share of Deceased Partner

2. Rockey’s Share of Goodwill

Goodwill of a firm = Average profit × Numbers of year’s Purchase

Goodwill of a firm = 14,000 × 2 = Rs 28,000

3. Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio between Prateek and Kushal = 9:4 or 3:2

4. Interest on Capital for 3 months i.e. from April 1, 2007 to June 30, 2007

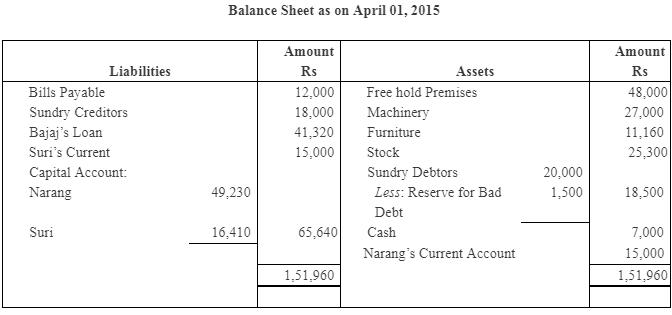

Amount of × Rate of Interest × Period

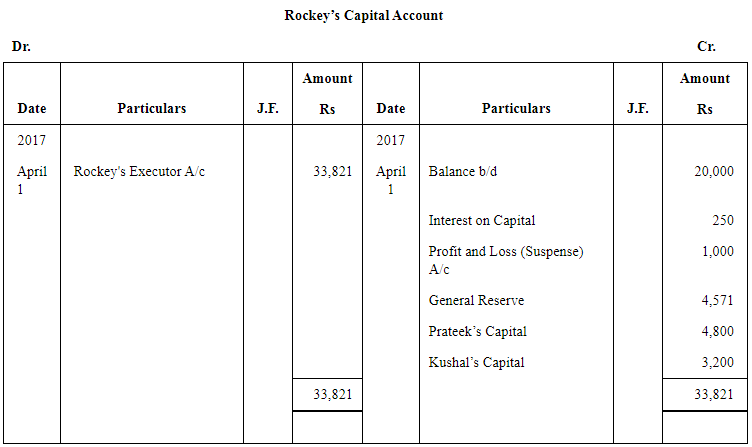

Question 10: Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of 1/2 , 1/6 and 1/3 respectively. The Balance Sheet on April 1, 2015 was as follows:

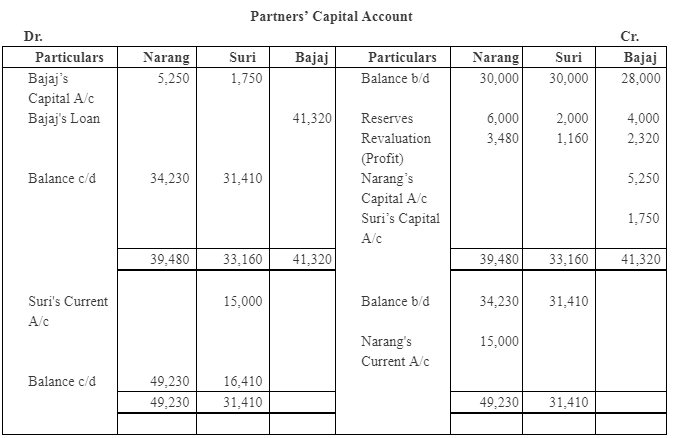

Bajaj retires from the business and the partners agree to the following:

a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

c) Bad Debts reserve is to be increased to Rs 1,500.

d) Goodwill is valued at Rs 21,000 on Bajaj’s retirement.

e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Bajaj. Surplus/deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

Answer:

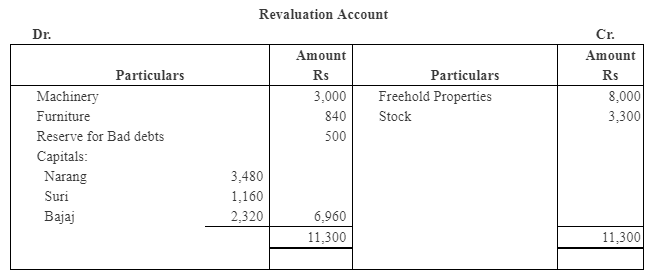

Working Notes:

Working Notes:

1. Bajaj Share in Goodwill = Total Goodwill of the firm ´ Retiring Partner’s Share =

2. Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Narang and Suri = 3:1

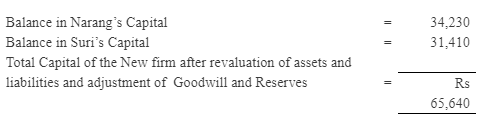

3. Calculation of New Capitals of the existing partners.

Based on new profit sharing ratio of 3:1

NOTE:

i. In the given Question Suri’s Capital is Rs 30,000 instead of Rs 20,000.

ii. Due to insufficient balance in Bajaj’s Capital Account, the amount due to Bajaj is transferred to his Loan Account.

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 2) - Reconstitution - Retirement/Death of a Partner - Additional Study Material for Commerce

| 1. What is reconstitution in the context of partnership accounting? |  |

| 2. How is the retirement of a partner handled in reconstitution? |  |

| 3. What happens to the deceased partner's share in reconstitution? |  |

| 4. How is the value of a partner's share determined in reconstitution? |  |

| 5. What are the different methods of settling a partner's share in reconstitution? |  |