NCERT Solution (Part - 3) Recording of Transactions-I | Accountancy Class 11 - Commerce PDF Download

Page No 91:

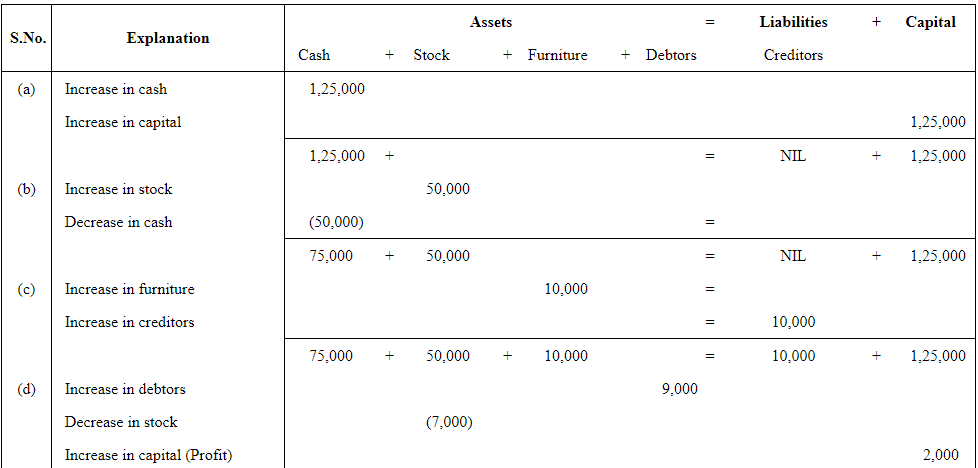

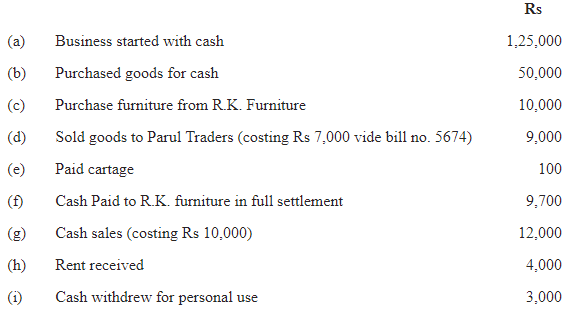

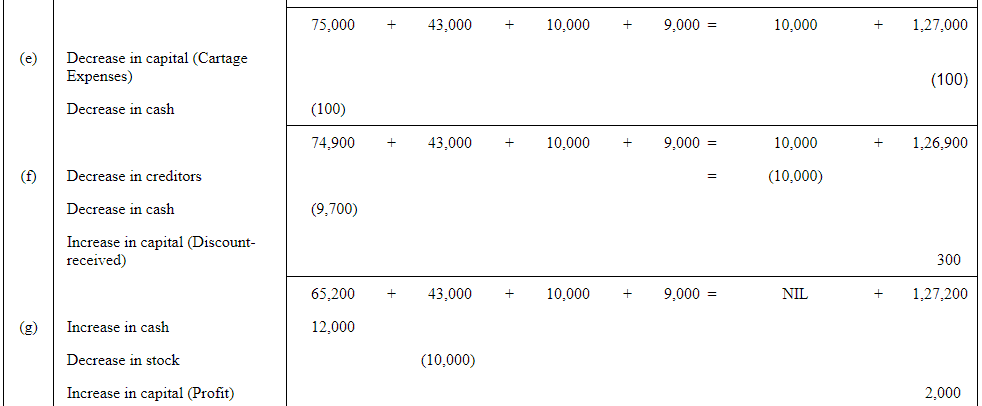

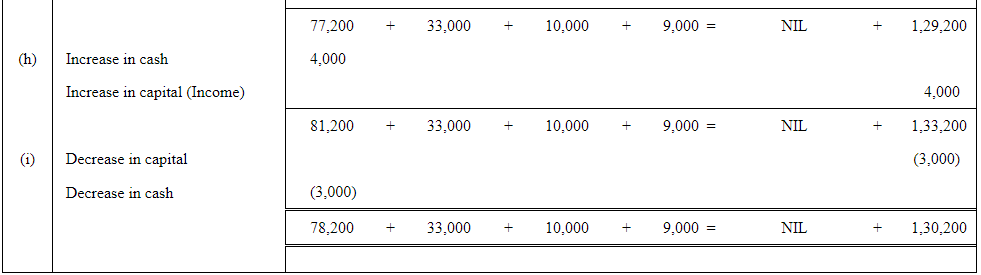

Question 9: Transactions of M/s. Vipin Traders are given below. Show the effects on Assets, Liabilities and Capital with the help of accounting Equation.

ANSWER:

Question 10: Bobby opened a consulting firm and completed these transactions during November, 2005:

(a) Invested Rs 4,00,000 cash and office equipment with Rs 1,50,000 in a business called Bobbie Consulting.

(b) Purchased land and a small office building. The land was worth Rs 1,50,000 and the building worth Rs 3,50,000. The purchase price was paid with Rs 2,00,000 cash and a long term note payable for Rs 8,00,000.

(c) Purchased office supplies on credit for Rs 12,000.

(d) Bobbie transferred title of motor car to the business. The motor car was worth Rs 90,000.

(e) Purchased for Rs 30,000 additional office equipment on credit.

(f) Paid Rs 75,00 salary to the office manager.

(g) Provided services to a client and collected Rs 30,000

(h) Paid Rs 4,000 for the month’s utilities.

(i) Paid supplier created in transaction (c).

(j) Purchase new office equipment by paying Rs 93,000 cash and trading in old equipment with a recorded cost of Rs 7,000.

(k) Completed services of a client for Rs 26,000. This amount is to be paid within 30 days

(l) Received Rs 19,000 payment from the client created in transaction (k).

(m) Bobby withdrew Rs 20,000 from the business. Analyse the above stated transactions and open the following T-accounts:

Cash, client, office supplies, motor car, building, land, long term payables, capital, withdrawals, salary, expense and utilities expense.

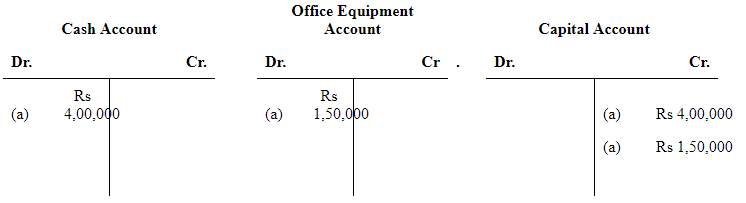

ANSWER:

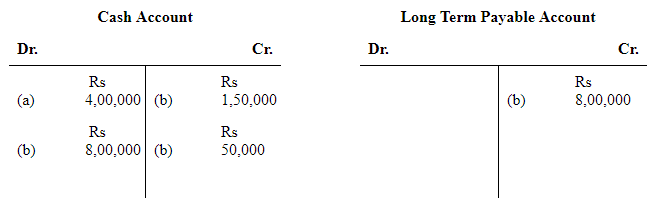

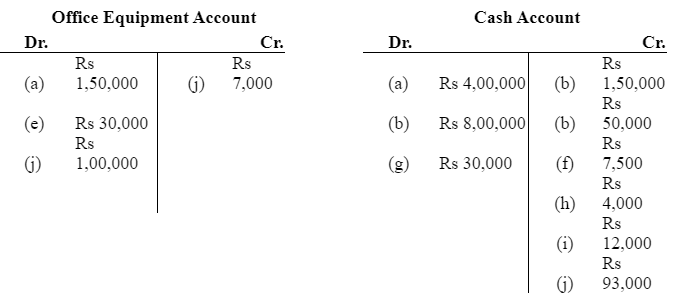

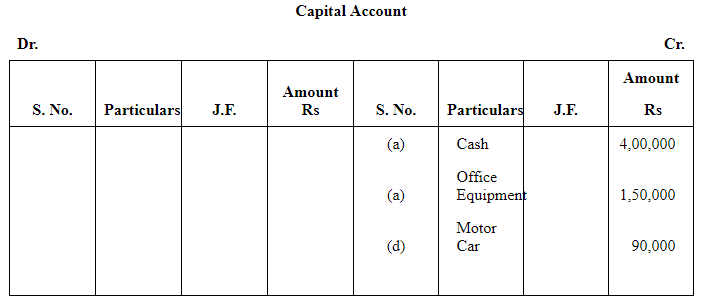

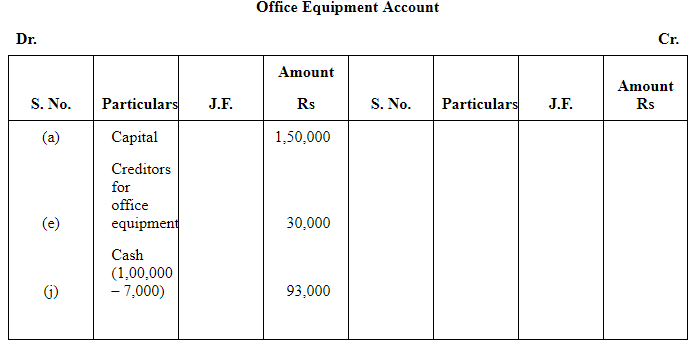

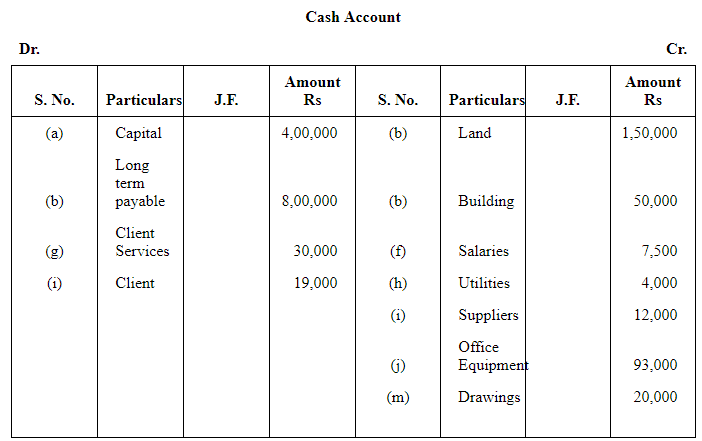

a) The transaction (a) increases assets by Rs 5,50,000 (cash Rs 4,00,000 and office equipment Rs 1,5,000) it will be debited and on the other hand it will increase the capital by Rs 5,50,000, so it will be credited in capital account.

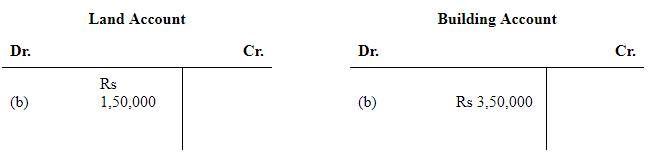

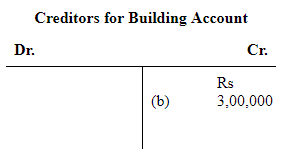

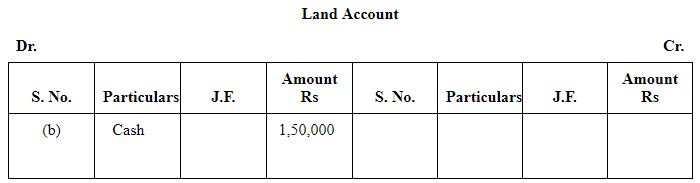

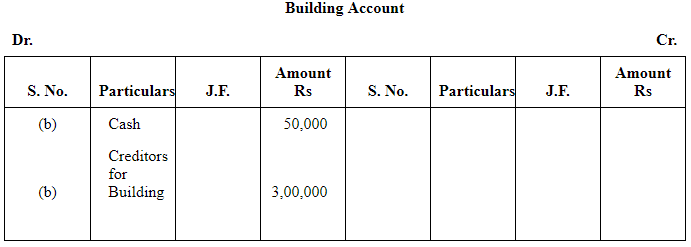

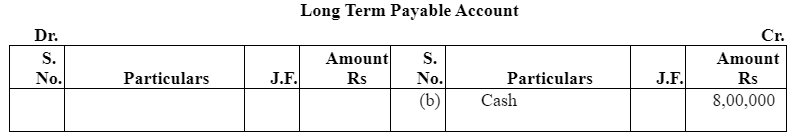

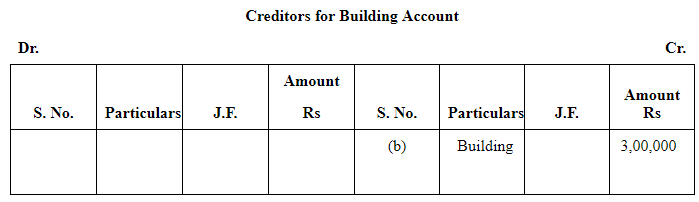

b) Purchase of land and small office building are assets. On one hand, the purchase of these items will increase their individual accounts and this will increase the total amount of the assets in the business; so, both the accounts will be debited. On the other hand, payment in cash on the purchase of these assets will decrease the cash balance, so cash account will be credited to the extent of amount paid. After payment for building in cash, the balance of building account will be transferred to creditors for building account. This will increase the amount of the creditors, which in turn will increase the total liabilities of the business. Long term payables are regarded as loan to the business that will increase both cash balance (due to intake of loan) as well as liabilities of the business.

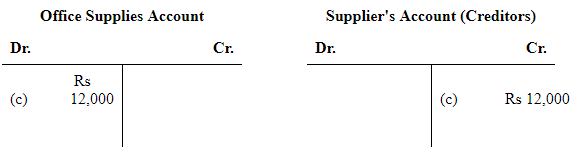

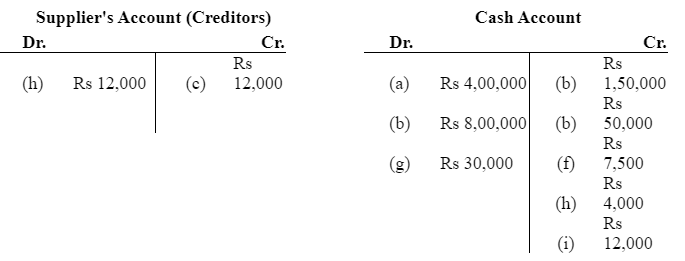

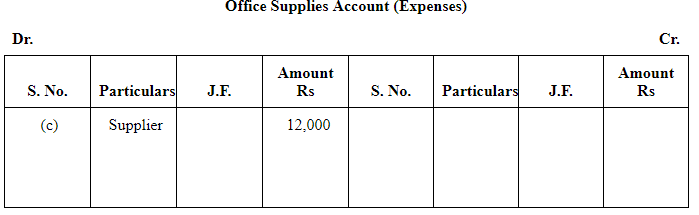

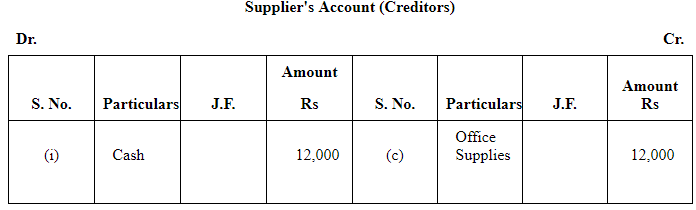

c) Here ‘office supplies’ is an expense. So, according to the golden rule, ‘All expenses are debited’, it will be debited on one hand while on the other hand, office supplies has been purchased on credit, so it will increase the liability, on account of which, supplier’s account will be credited.

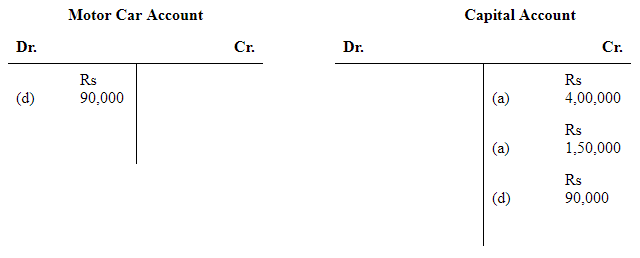

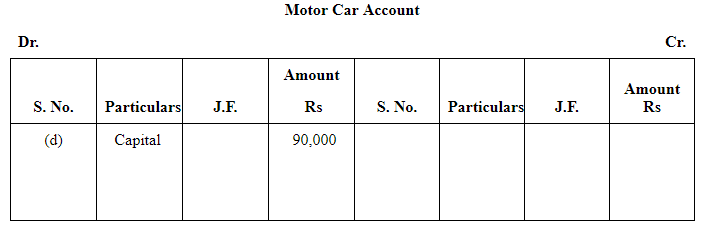

d) Amount invested (motor car) by the proprietor in the business would increase both the capital and assets.

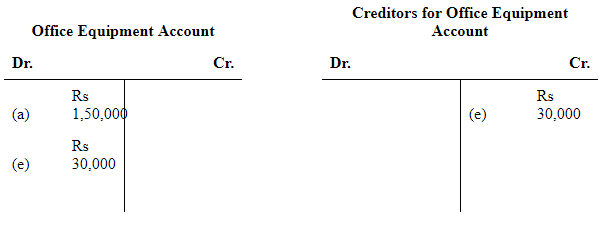

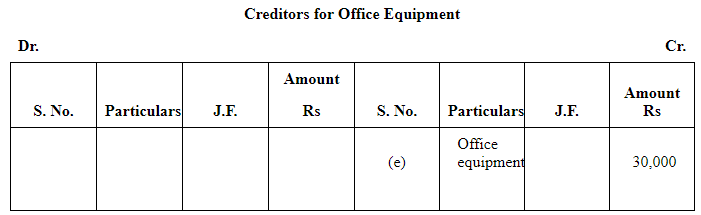

e) Purchase of additional equipment increases the assets; hence, offices equipment account will be debited. Further as the office equipment was purchased on credit, it increases the amount of the creditors for office equipment and the creditors account will be credited.

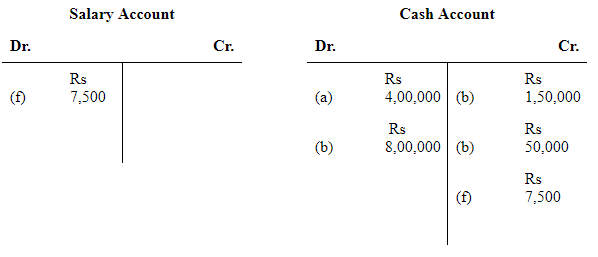

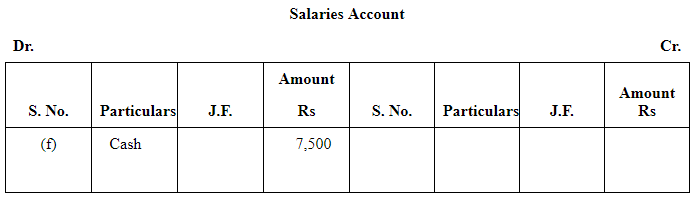

f) Salary is an expense and as all the expenses are debited, so the payment of salary to the manager will be debited to the salary account. And on the other hand the payment of the salary in cash decreases the cash balance (Assets) so the cash account would be credited (as decrease in assets is credited).

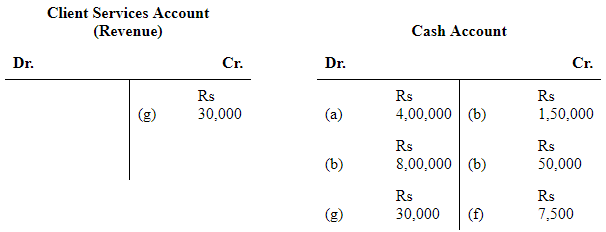

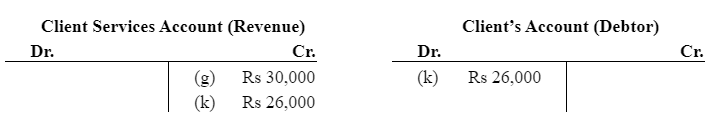

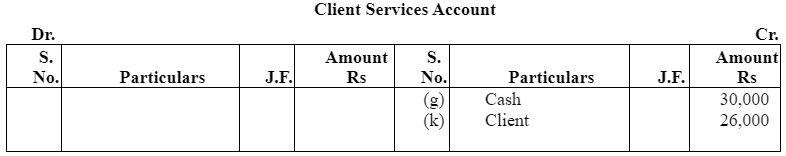

g) Amount received or receivable from services rendered to the client is revenue for the business. All revenues are to be credited so client service account will be credited.

On the other hand, cash received in exchange of services would increase the cash balance. It would be debited to the cash account.

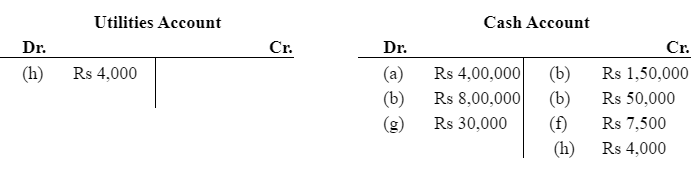

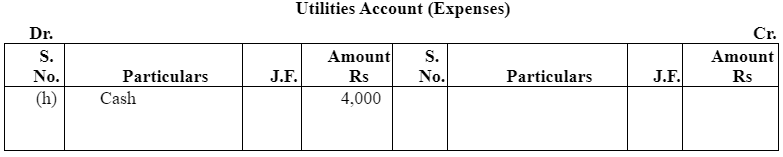

h) The ‘utilities’ has been treated as a revenue expense. All expenses are to be debited. Amount paid for utilities would be debited to Utilities account. Utilities have been paid in cash so the cash account will be credited (as this decreases assets).

i) Payment to the supplier (creditors) will be debited. It results in the decrease in liabilities. Further as the payment has been made in cash, so it results in decrease in the cash balance (assets) and hence the cash account will be credited.

j) Purchase of the equipments will be debited in the Equipment Account (as there is increase in the assets). Also as the equipments of worth Rs 1,00,000 and Rs 93,000 have been purchased for cash and old equipments of worth Rs 7,000 have been exchanged so the purchase of the equipments will be debited in the Office Equipment account and equipment of Rs 7,000 will be credited in the same account.

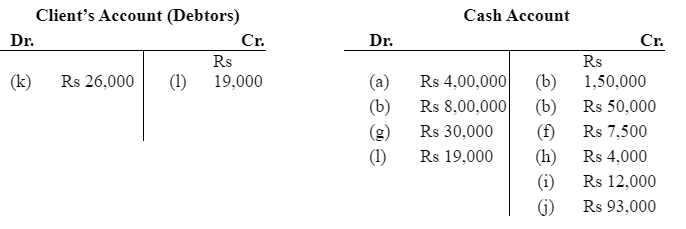

k) Receipt from ‘Client services’ is revenue. All revenues are credited. The client services account will be credited and client is considered as debtors, so the client account will be debited.

l) The client has been considered as Debtors. The amount received from the client will lead to the decrease in the debtors balance and the client account will be credited. Receipts from the client will increase the cash balance (asset), and hence the cash account will be debited.

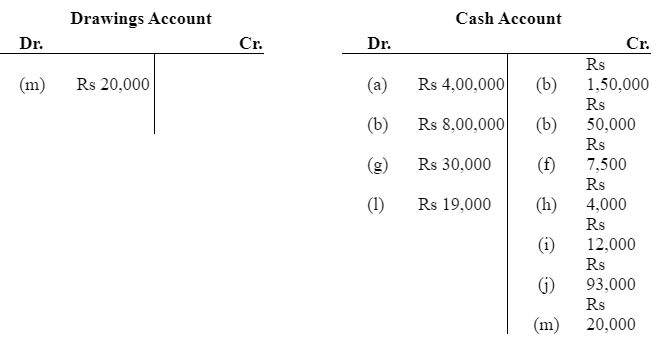

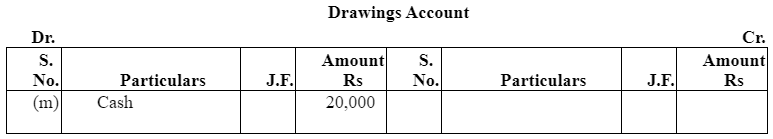

m) The amount withdrawn by the proprietor is considered as ‘drawings’. According to the Business Entity Concept, drawings decrease the owner’s capital,) Thus the drawings account will be debited (as decrease in capital is debited). On the other hand as drawings have been made in cash, decrease in cash means cash account will be credited with the amount of drawings.

T – Accounts

Page No 92:

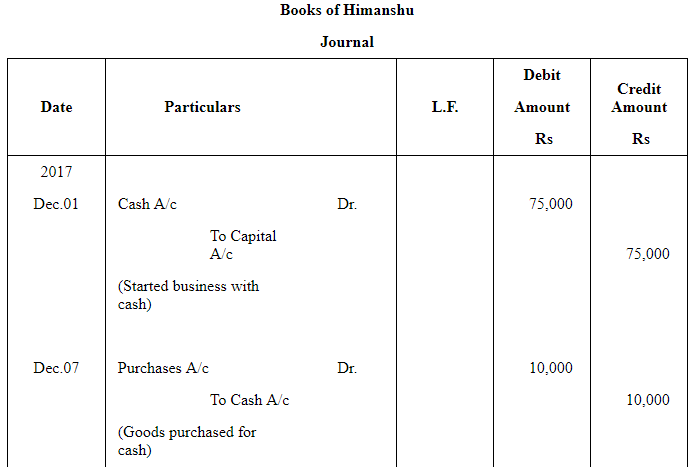

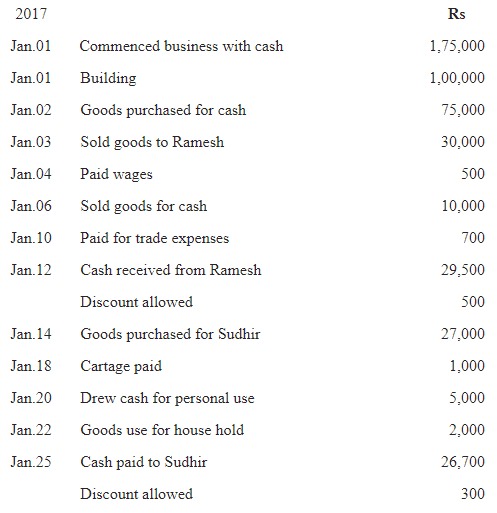

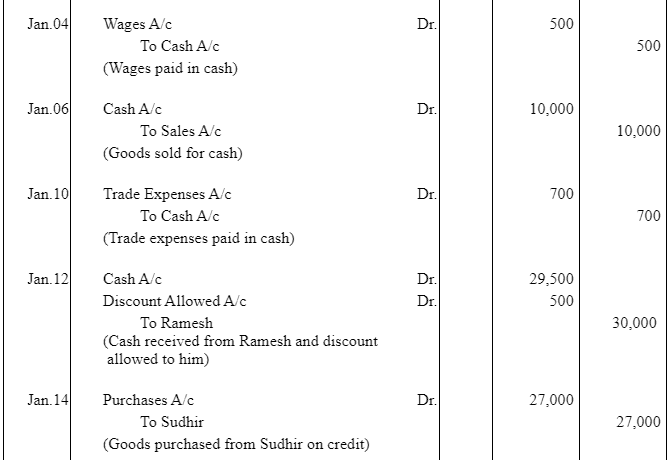

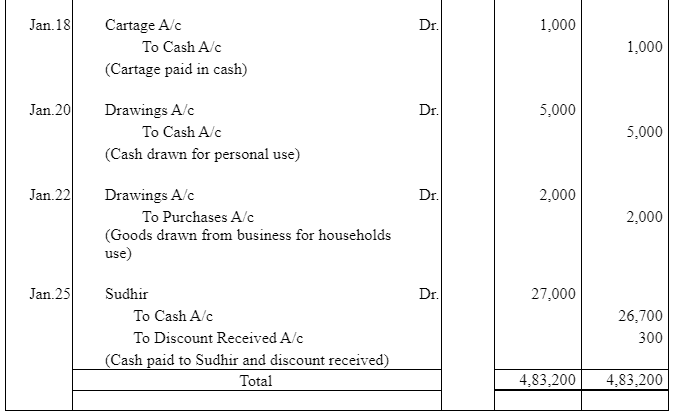

Question 11: Journalise the following transactions in the books of Himanshu:

ANSWER:

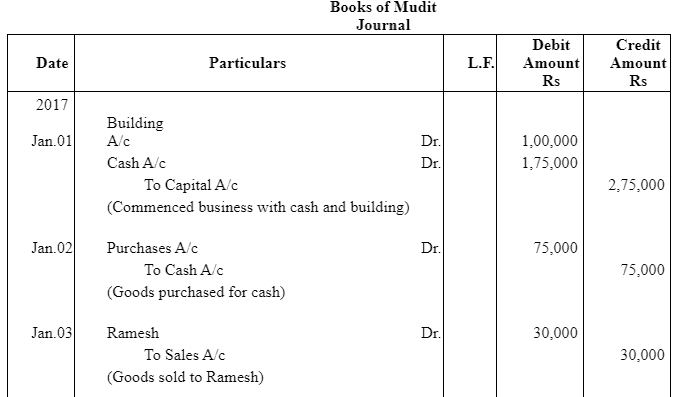

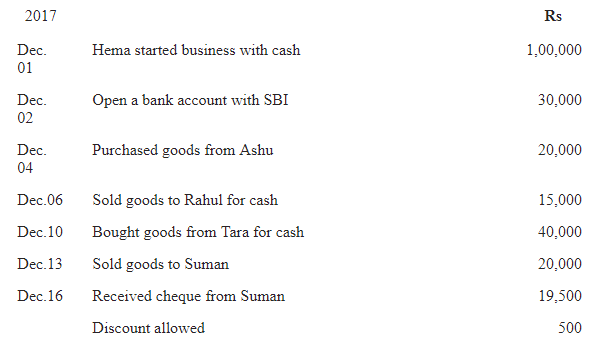

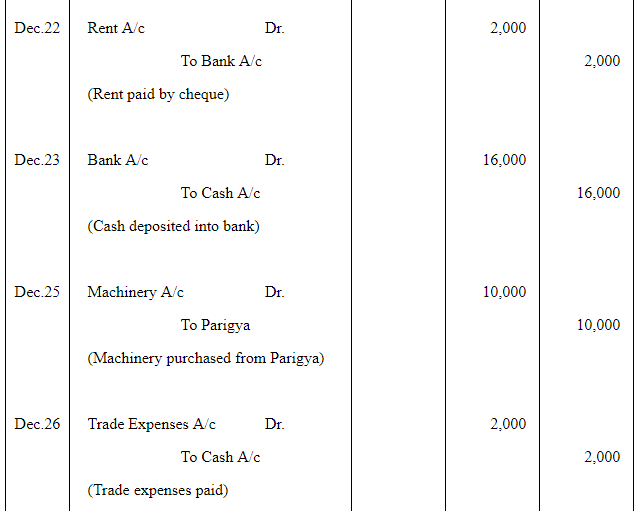

Question 12: Enter the following Transactions in the Journal of Mudit :

ANSWER:

Page No 93:

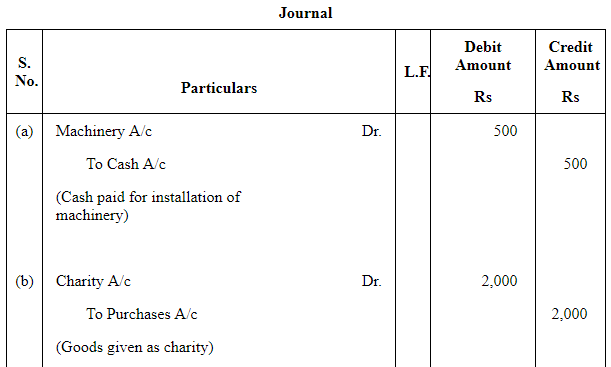

Question 13:

Journalise the following transactions:

ANSWER:

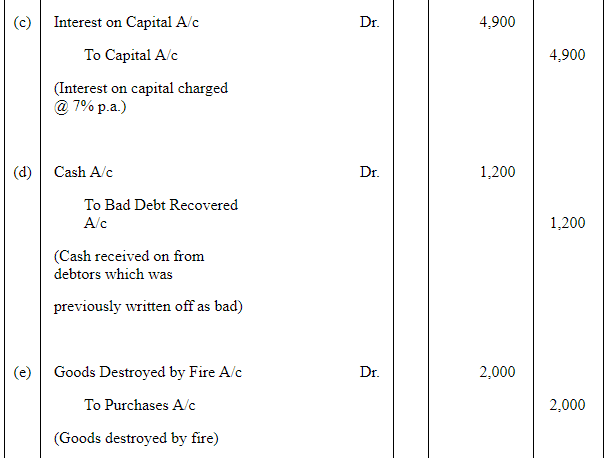

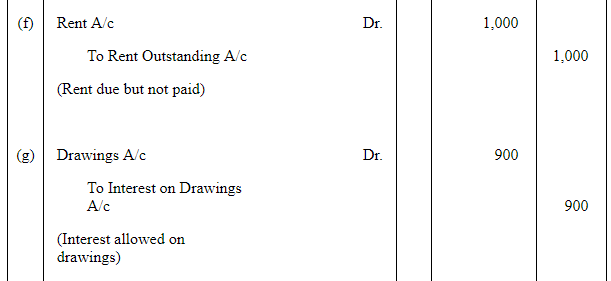

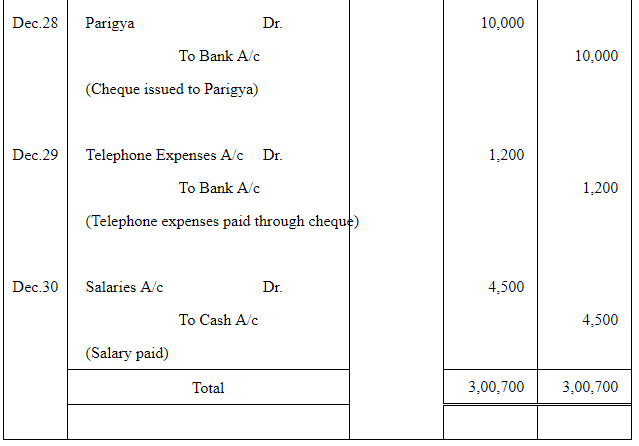

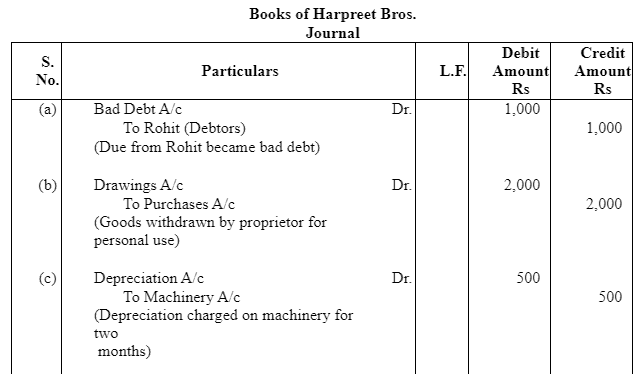

Question 14: Jouranlise the following transactions in the books of Harpreet Bros.:

(a) Rs 1,000 due from Rohit are now bad debts.

(b) Goods worth Rs 2,000 were used by the proprietor.

(c) Charge depreciation @ 10% p.a for two month on machine costing Rs 30,000.

(d) Provide interest on capital of Rs 1,50,000 at 6% p.a. for 9 months.

(e) Rahul become insolvent, who owed is Rs 2,000 a final dividend of 60 paise in a rupee is received from his estate.

ANSWER:

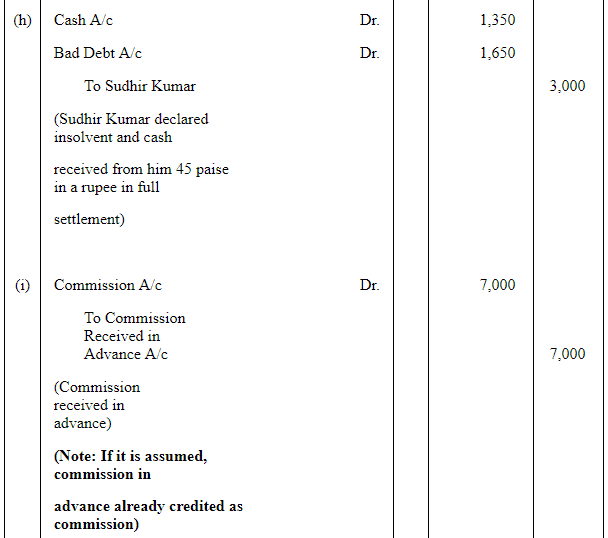

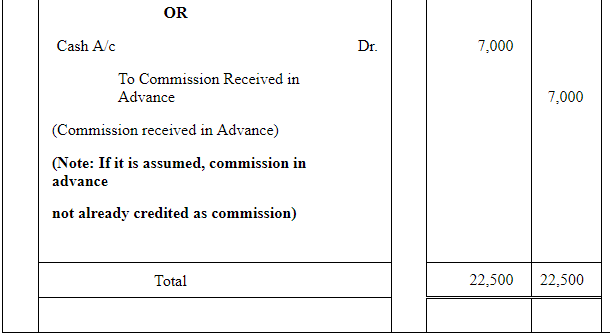

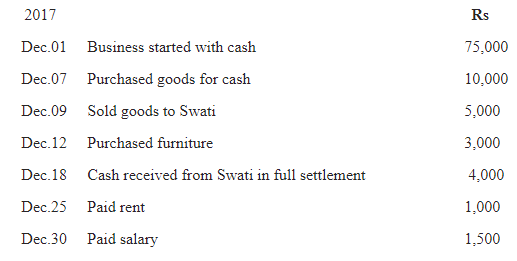

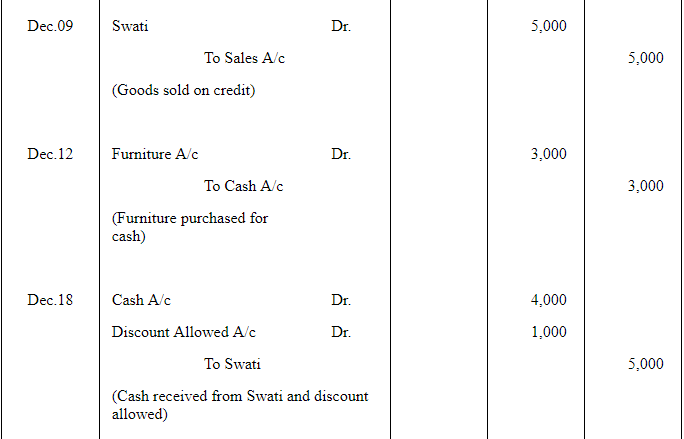

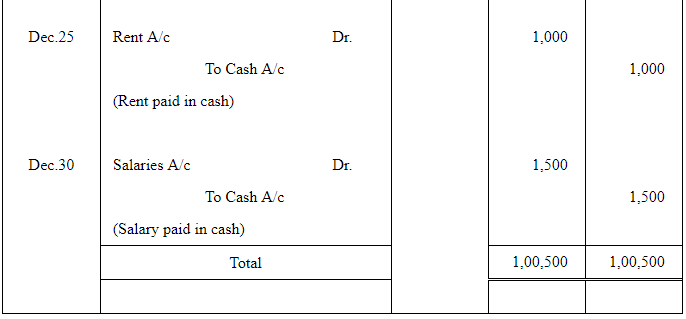

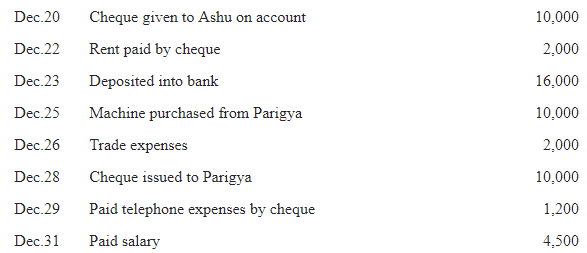

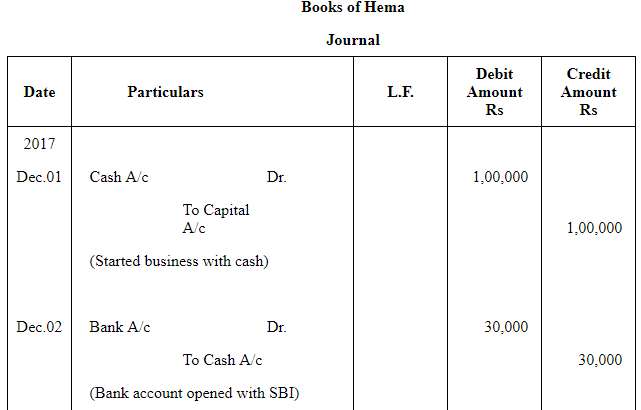

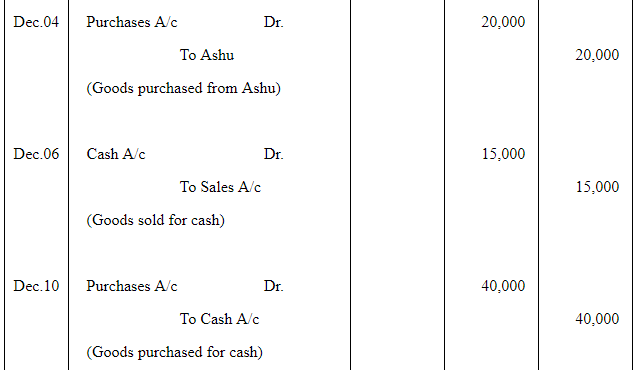

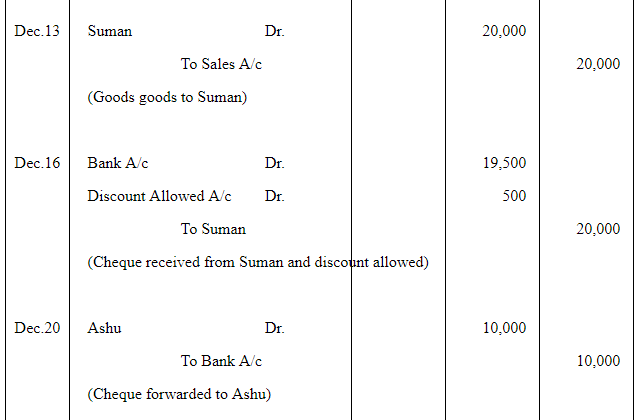

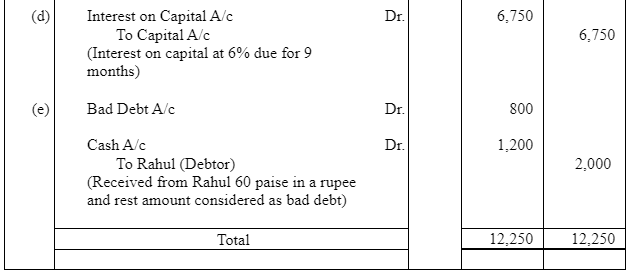

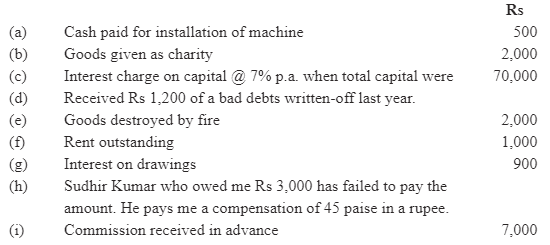

Question 15: Prepare Journal from the transactions given below:

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on NCERT Solution (Part - 3) Recording of Transactions-I - Accountancy Class 11 - Commerce

| 1. What is the purpose of recording transactions in accounting? |  |

| 2. What are the different methods of recording transactions? |  |

| 3. How does the recording of transactions help in financial analysis? |  |

| 4. What are the essential elements of a transaction that need to be recorded? |  |

| 5. What are the consequences of not recording transactions accurately? |  |