NCERT Solution: Dissolution of Partnership Firm - 2 | Accountancy Class 12 - Commerce PDF Download

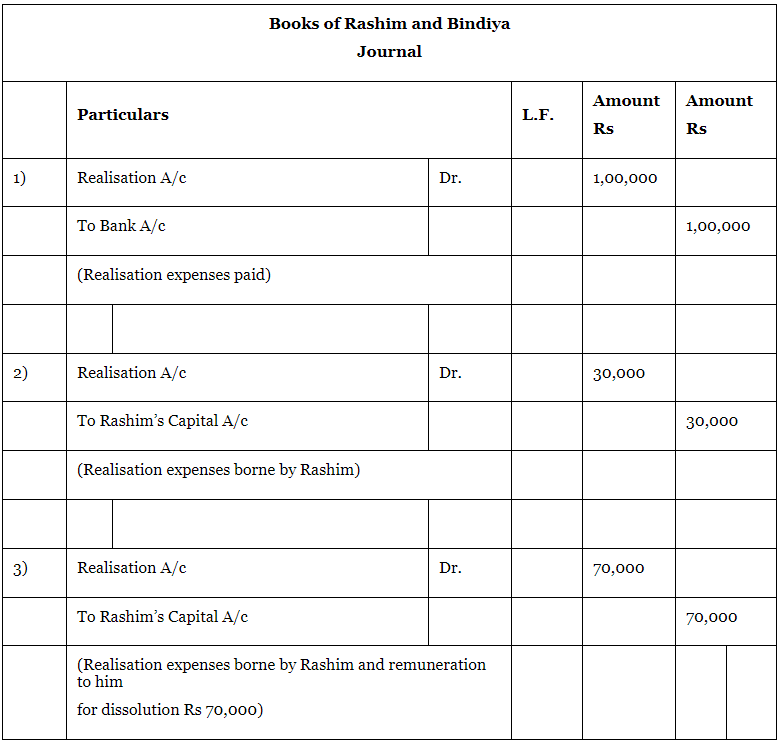

Q6: How will you deal with the realisation expenses of the firm of Rashim and Bindiya in the following cases:

1. Realisation expenses amount to Rs. 1,00,000,

2. Realisation expenses amounting to Rs. 30,000 are paid by Rashim, a partner.

3. Realisation expenses are to be borne by Rashim and he will be paid Rs. 70,000 as remuneration for completing the dissolution process. The actual expenses incurred by Rashim were Rs. 1,20,000.

Ans:

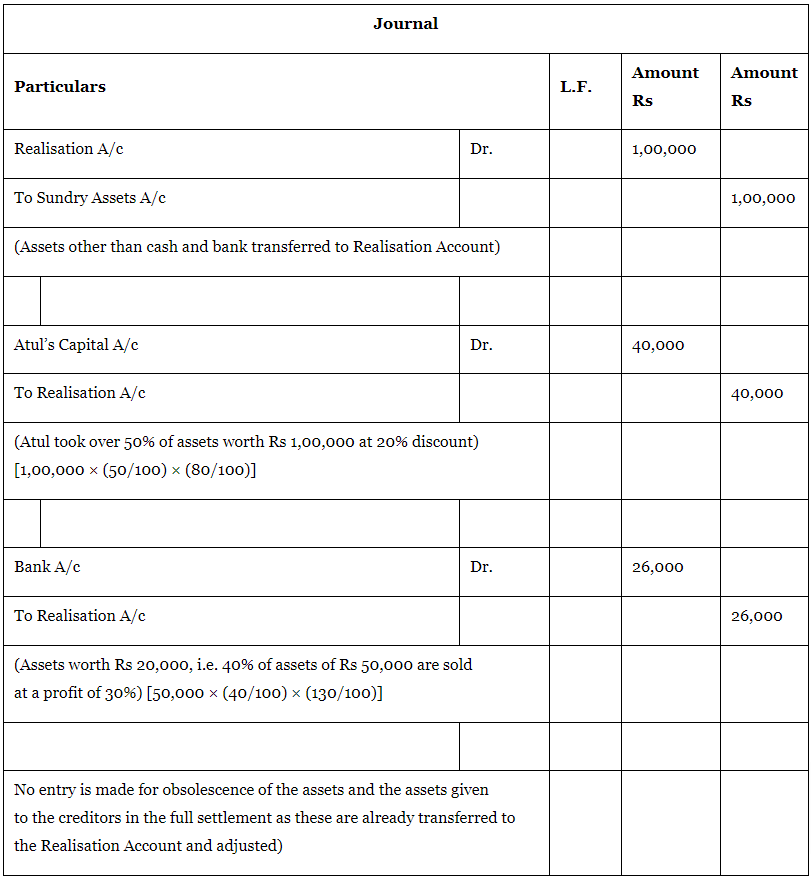

Q7: The book value of assets (other than cash and bank) transferred to Realisation Account is Rs. 1,00,000. 50% of the assets are taken over by a partner Atul, at a discount of 20%; 40% of the remaining assets are sold at a profit of 30% on cost; 5% of the balance being obsolete, realised nothing and remaining assets are handed over to a Creditor, in full settlement of his claim.

You are required to record the journal entries for realisation of assets.

Ans:

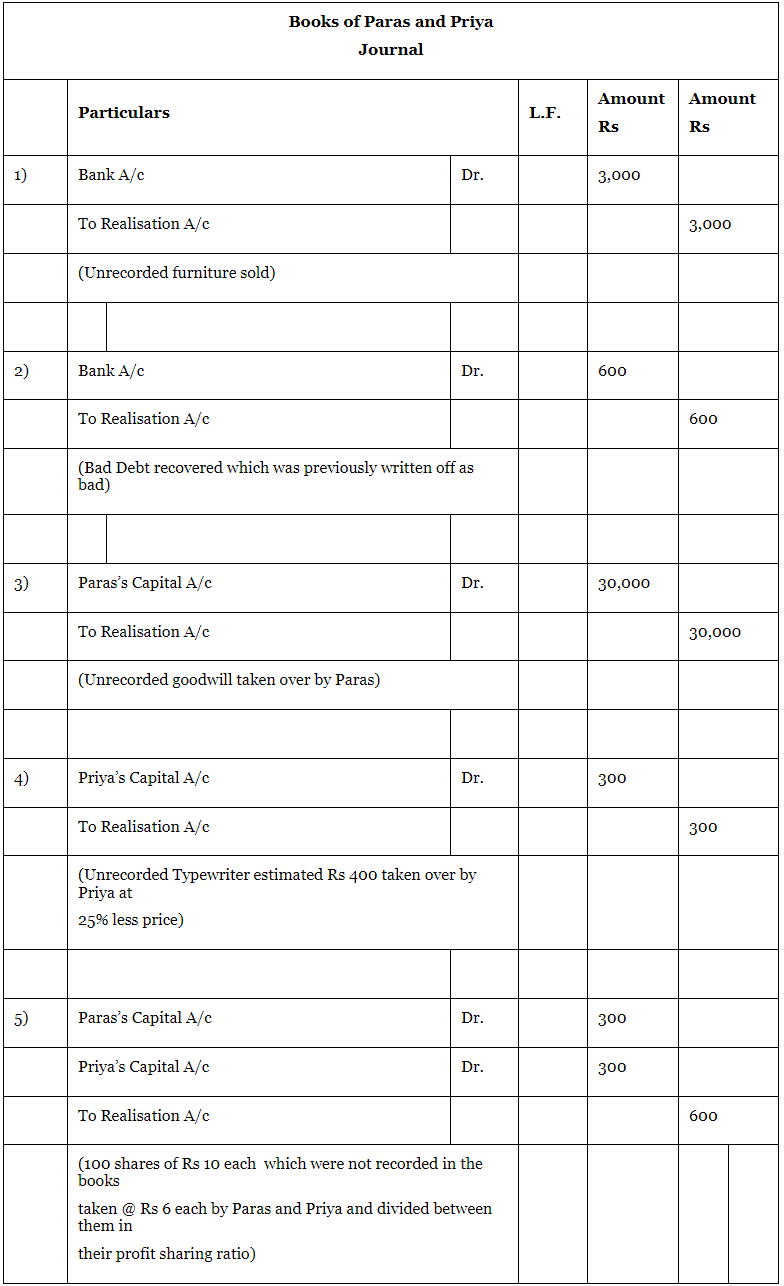

Q8: Record necessary journal entries to record the following unrecorded assets and liabilities in the books of Paras and Priya:

1. There was an old furniture in the firm which had been written-off completely in the books. This was sold for Rs 3,000,

2. Ashish, an old customer whose Account for Rs 1,000 was written-off as bad in the previous year, paid 60%, of the amount,

3. Paras agreed to take over the firm’s goodwill (not recorded in the books of the firm), at a valuation of Rs 30,000,

4. There was an old typewriter which had been written-off completely from the books. It was estimated to realize Rs 400. It was taken away by Priya at an estimated price less 25%,

5. There were 100 shares of Rs 10 each in Star Limited acquired at a cost of Rs 2,000 which had been written-off completely from the books. These shares are valued @ Rs 6 each and divided among the partners in their profit sharing ratio.

Ans:

Q9: All partners wish to dissolve the firm. Yastin, a partner wants that her loan of Rs. 2,00,000 must be paid off before the payment of capitals to the partners. But, Amart, another partner wants that the capitals must be paid before the payment of Yastin’s loan. You are required to settle the conflict giving reasons.

Ans: As per section 48 of Partnership Act 1932, at the time of dissolution, loans and advances from the partners must be paid off before the settlement of their capital accounts. Hence, Yastin’s argument is correct that her loan of Rs 2,00,000 must be paid off before the payment of partners' capital.

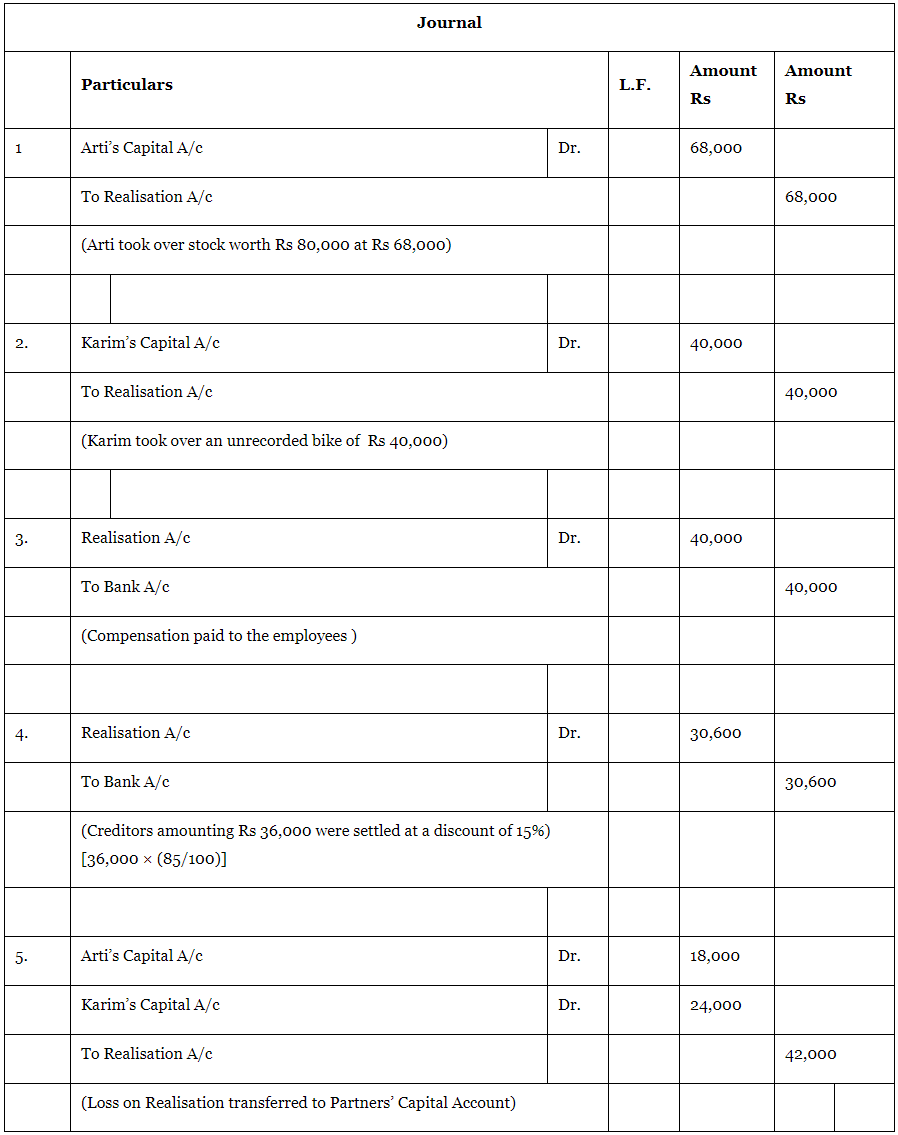

Q10: What journal entries would be recorded for the following transactions on the dissolution of a firm after various assets (other than cash) on the third party liabilities have been transferred to Reliasation Account.

1. Arti took over the Stock worth Rs 80,000 at Rs 68,000.

2. There was unrecorded Bike of Rs 40,000 which was taken over By Mr. Karim.

3. The firm paid Rs 40,000 as compensation to employees.

4. Sundry creditors amounting to Rs 36,000 were settled at a discount of 15%.

5. Loss on Realisation Rs 42,000 was to be distributed between Arti and Karim in the ratio of 3:4.

Ans:

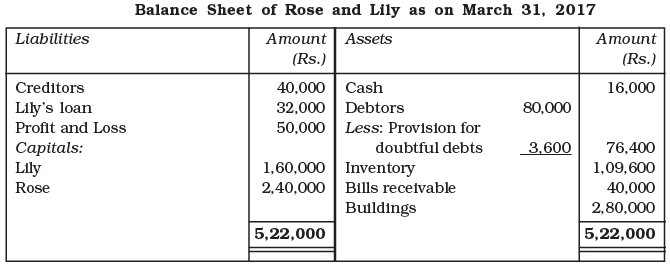

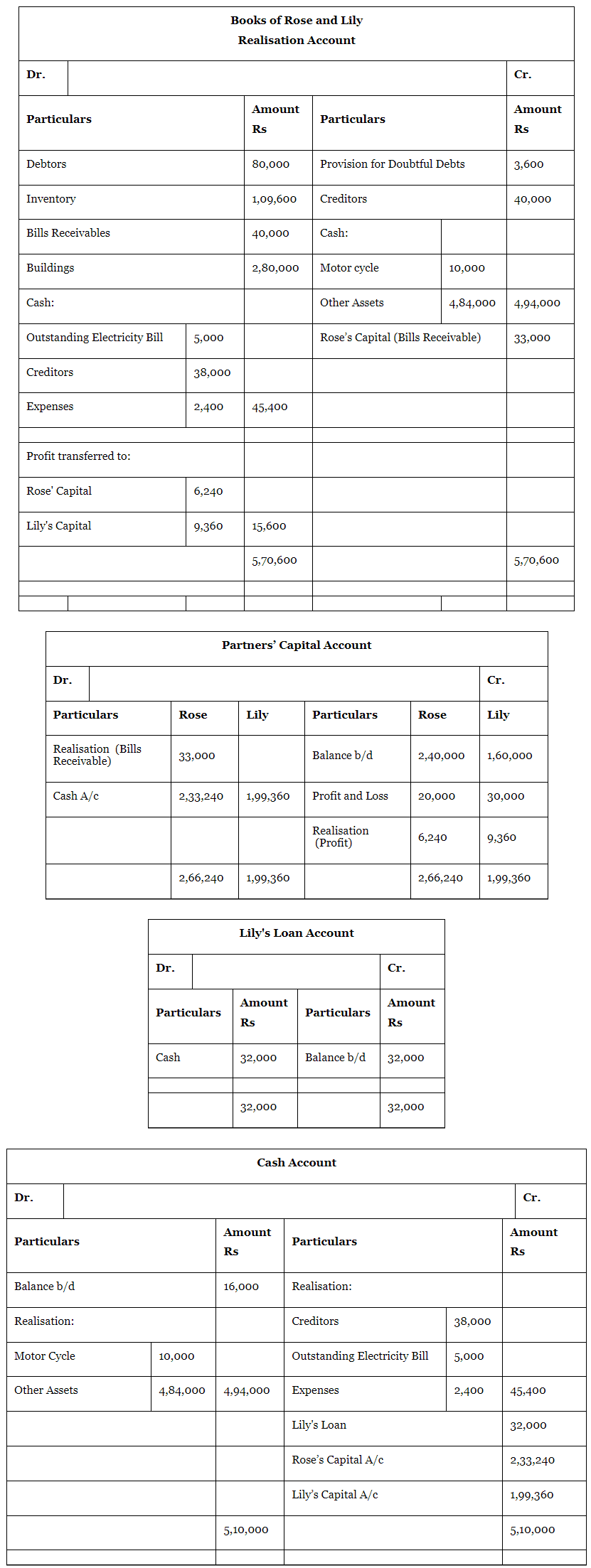

Q11: Rose and Lily shared profits in the ratio of 2:3. Their Balance Sheet on March 31, 2017 was as follows:

Rose and Lily decided to dissolve the firm on the above date. Assets (except bills receivables) realised Rs. 4,84,000. Creditors agreed to take Rs. 38,000. Cost of realisation was Rs. 2,400. There was a Motor Cycle in the firm which was bought out of the firm’s money, was not shown in the books of the firm. It was now sold for Rs. 10,000. There was a contingent liability in respect of outstanding electric bill of Rs. 5,000 which was paid Bill Receivable taken over by Rose at Rs. 33,000.

Show Realisation Account, Partners Capital Acount, Loan Account and Cash Account.

Ans:

Note: In the solution Contingent Liability of Electricity Bill has been treated as Electricity Bill Payable. Further, it is also been assumed that Rosy has taken over Bills Receivable at Rs 33,000.

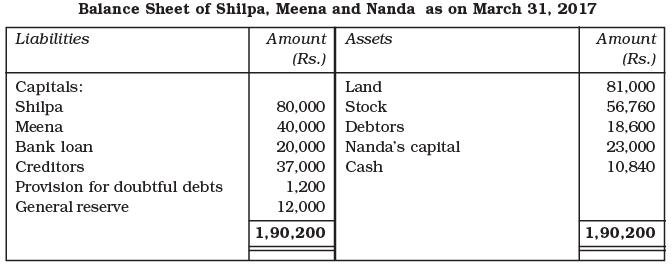

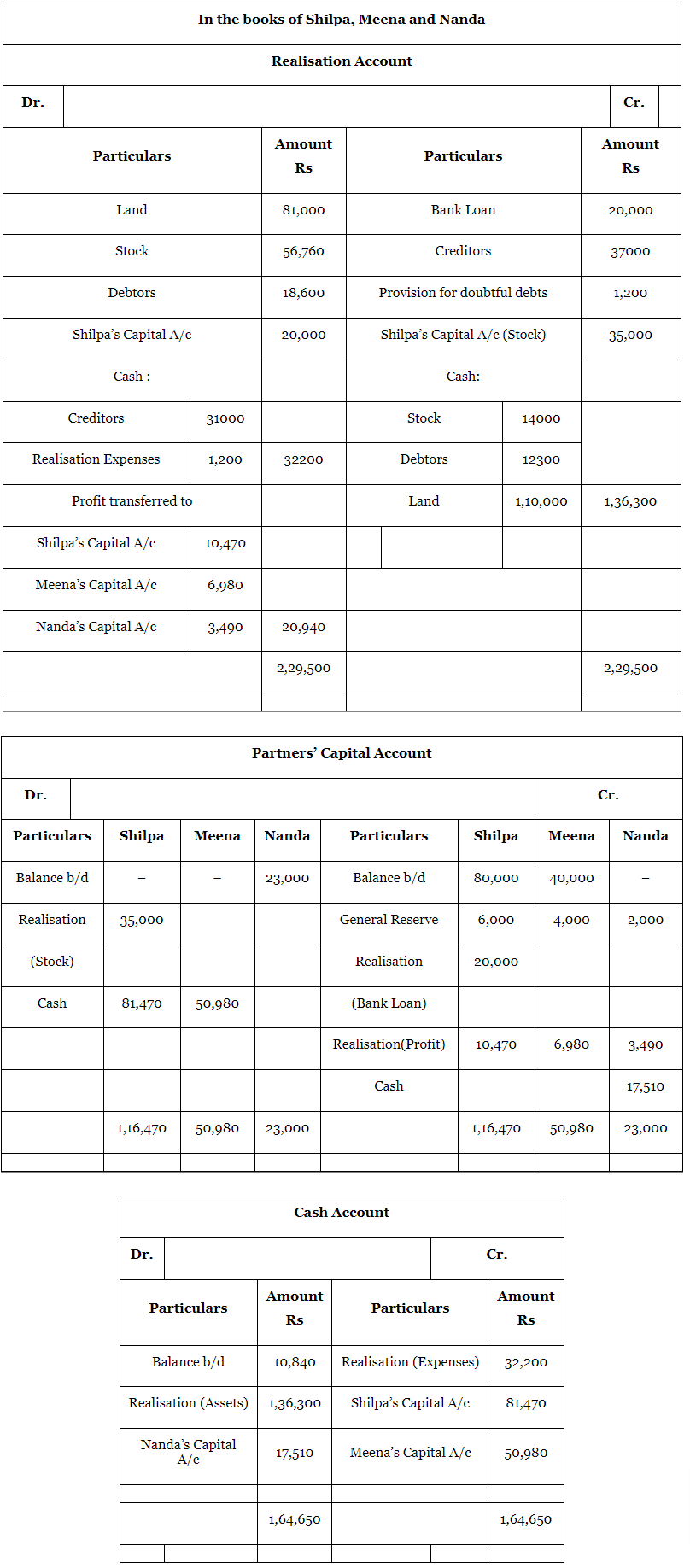

Q12: Shilpa, Meena and Nanda decided to dissolve their partnership on March 31, 2017. Their profit sharing ratio was 3:2:1 and their Balance Sheet was as under:  The stock of value of Rs. 41,660 are taken over by Shilpa for Rs. 35,000 and she agreed to discharge bank loan. The remaining stock was sold at Rs. 14,000 and debtors amounting to Rs. 10,000 realised Rs. 8,000. land is sold for Rs. 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to Rs. 1,200. There was a typewriter not recorded in the books worth Rs. 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account.

The stock of value of Rs. 41,660 are taken over by Shilpa for Rs. 35,000 and she agreed to discharge bank loan. The remaining stock was sold at Rs. 14,000 and debtors amounting to Rs. 10,000 realised Rs. 8,000. land is sold for Rs. 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to Rs. 1,200. There was a typewriter not recorded in the books worth Rs. 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account.

Ans:

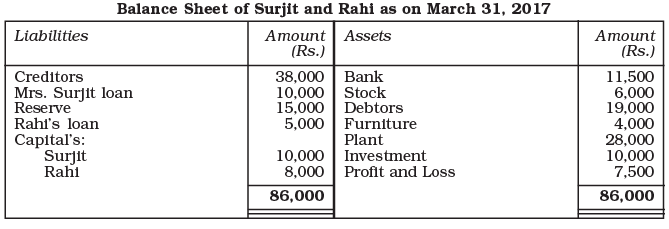

Q13: Surjit and Rahi were sharing profits (losses) in the ratio of 3:2, their Balance Sheet as on March 31, 2017 is as follows:

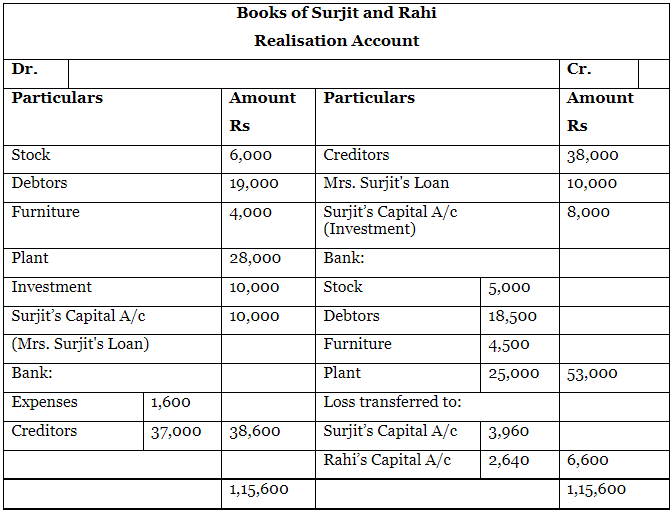

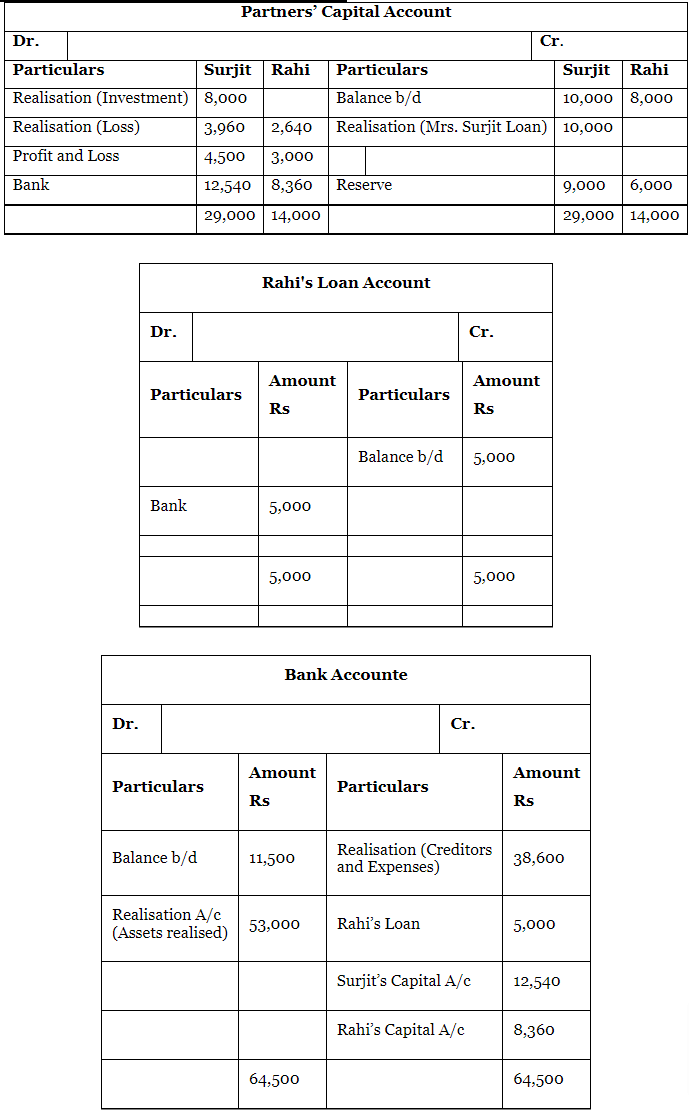

The firm was dissolved on March 31, 2017 on the following terms:

1. Surjit agreed to take the investments at Rs. 8,000 and to pay Mrs. Surojit’s loan.

2. Other assets were realised as follows:

Stock Rs. 5,000

Debtors Rs. 18,500

Furniture Rs. 4,500

Plant Rs. 25,000

3. Expenses on realisation amounted to Rs. 1,600. 4. Creditors agreed to accept Rs. 37,000 as a final settlement.

You are required to prepare a Realisation account, Partner’s Capital account and Bank account.

Ans:

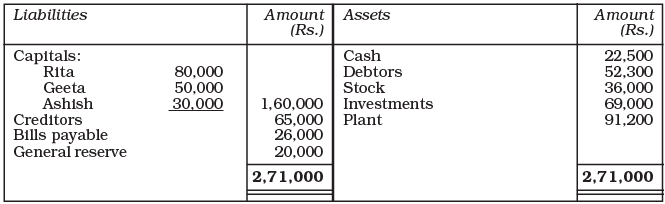

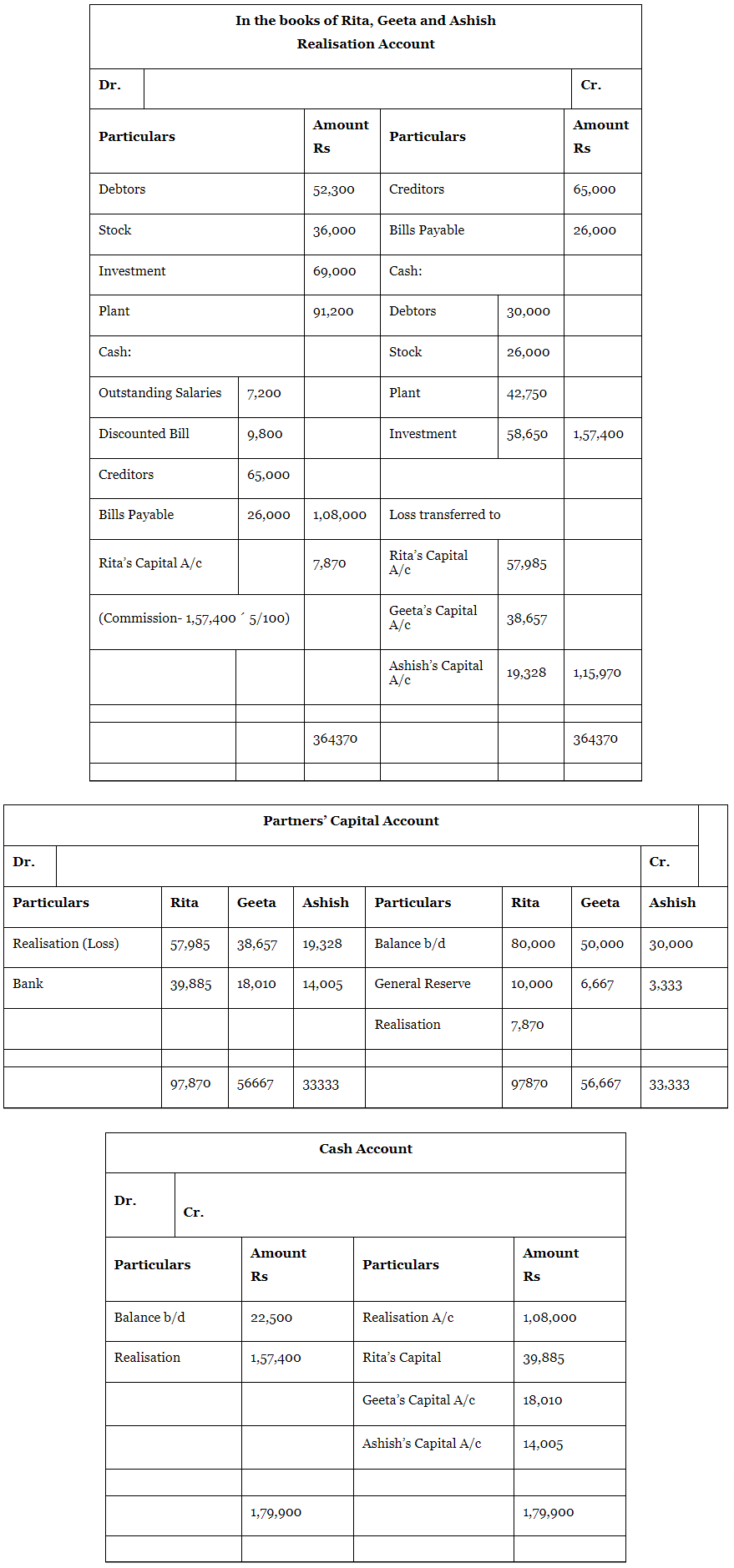

Q14: Rita, Geeta and Ashish were partners in a firm sharing profits/losses in the ratio of 3:2:1. On March 31, 2017 their balance sheet was as follows:

On the date of above mentioned date the firm was dissolved:

1. Rita was appointed to realise the assets. Rita was to receive 5% commission on the sale of assets (except cash) and was to bear all expenses of realisation,

2. Assets were realised as follows:

Debtors Rs.30,000

Stock Rs.26,000

Plant Rs.42,750

3. Investments were realised at 85% of the book value,

4. Expenses of realisation amounted to Rs. 4,100,

5. Firm had to pay Rs. 7,200 for outstanding salary not provided for earlier,

6. Contingent liability in respect of bills discounted with the bank was also materialised and paid off Rs. 9,800,

Prepare Realisation account, Capital Accounts of Partner’s and Cash Account.

Ans:

Note: As per the solution, the Loss on Realisation should be Rs 1,15,970 and the total of Cash Account should be Rs 1,79,900; however, the answer given in the book shows Rs 1,29,455 and Rs 1,65,705 respectively.

Note: Click here for Part III.

|

51 videos|270 docs|51 tests

|

FAQs on NCERT Solution: Dissolution of Partnership Firm - 2 - Accountancy Class 12 - Commerce

| 1. What are the key steps involved in the dissolution of a partnership? |  |

| 2. How are assets distributed among partners during dissolution? |  |

| 3. What is the difference between dissolution of partnership and dissolution of partnership firm? |  |

| 4. What are the rights of partners upon dissolution of a partnership? |  |

| 5. How is goodwill treated during the dissolution of a partnership? |  |