NCERT Solution: Dissolution of Partnership Firm - 3 | Accountancy Class 12 - Commerce PDF Download

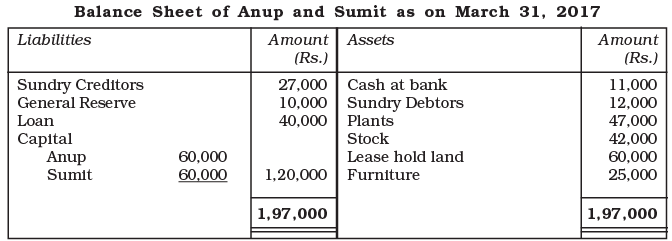

Q15: Anup and Sumit are equal partners in a firm. They decided to dissolve the parntership on March 31, 2017. When the balance sheet is as under:

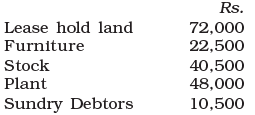

The Assets were realised as follows:

The Creditors were paid Rs 25,500 in full settlement. Expenses of Realisation amount to Rs 2,500.

Prepare Realisation Account, Bank Account, Partners Capital Accounts to close the books of the firm.

Ans:

Note: As per the solution, Profit on Realisation is Rs 6,500; however as per the answer given in the book is Rs 46,500. If Loan is not transferred to the Realisation Account and paid directly from Loan Account, then the answer would match with that of the book.

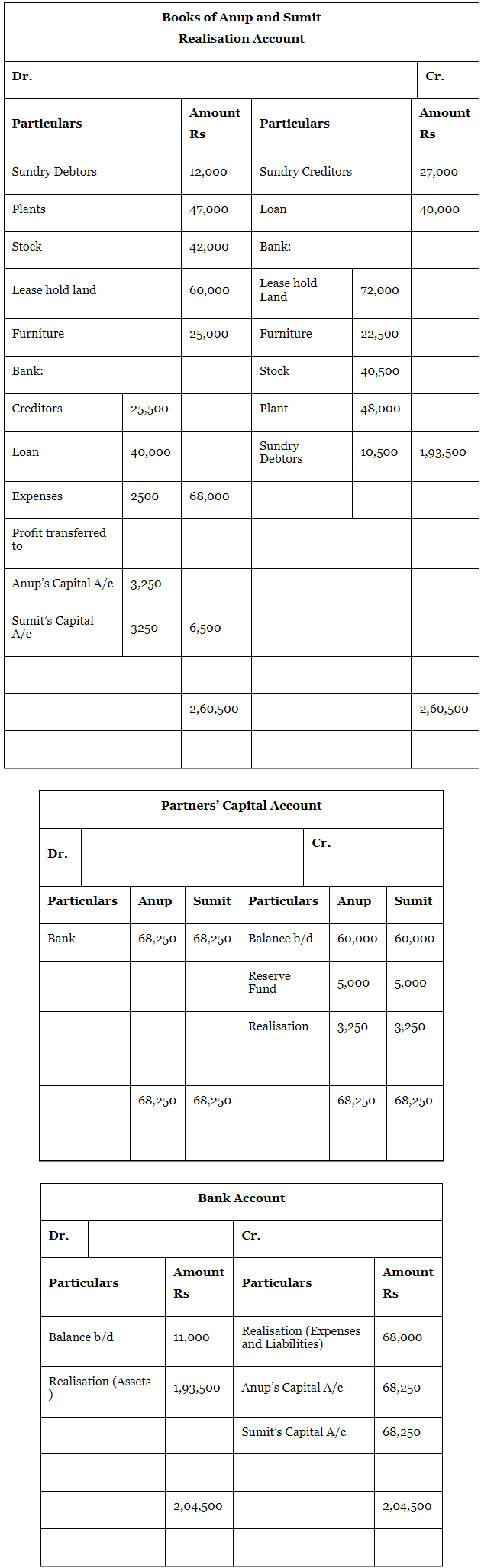

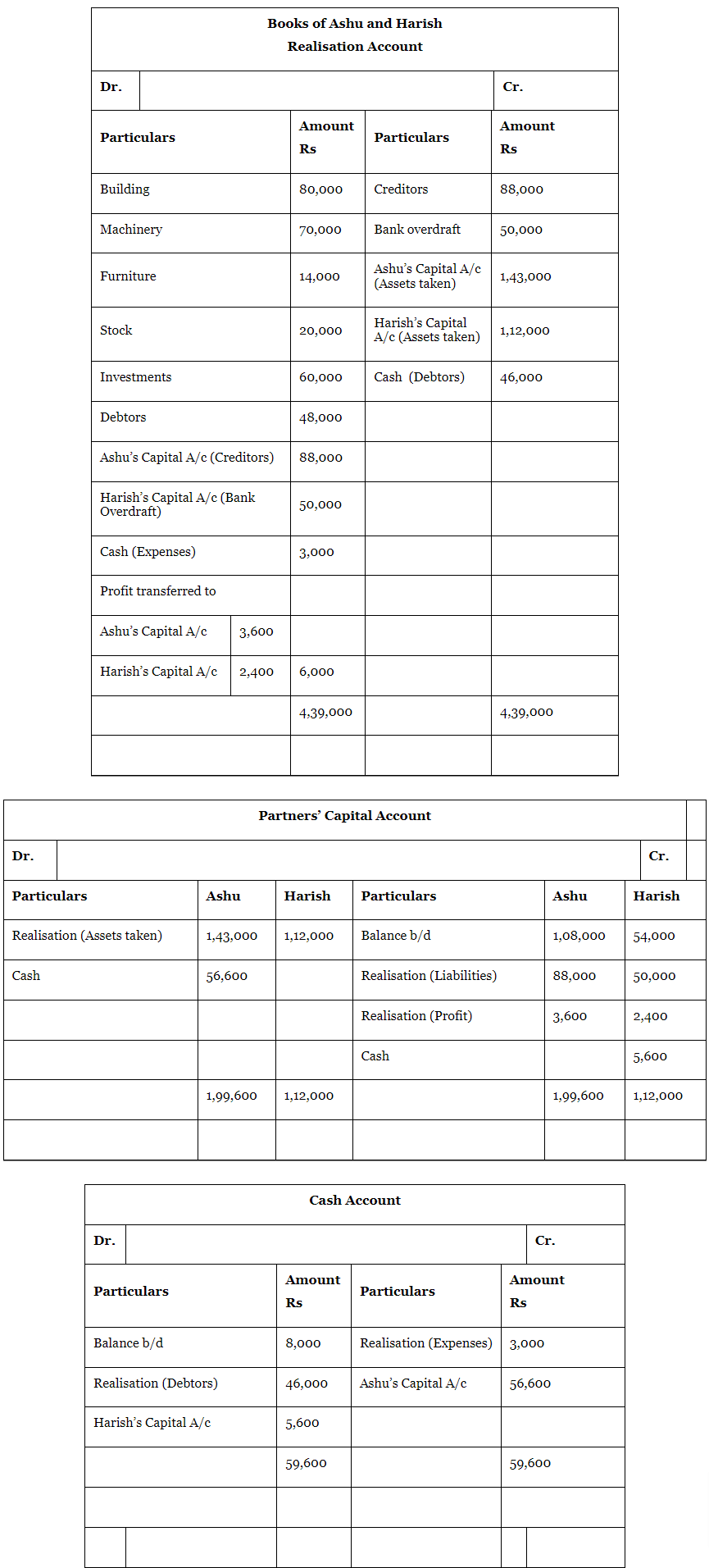

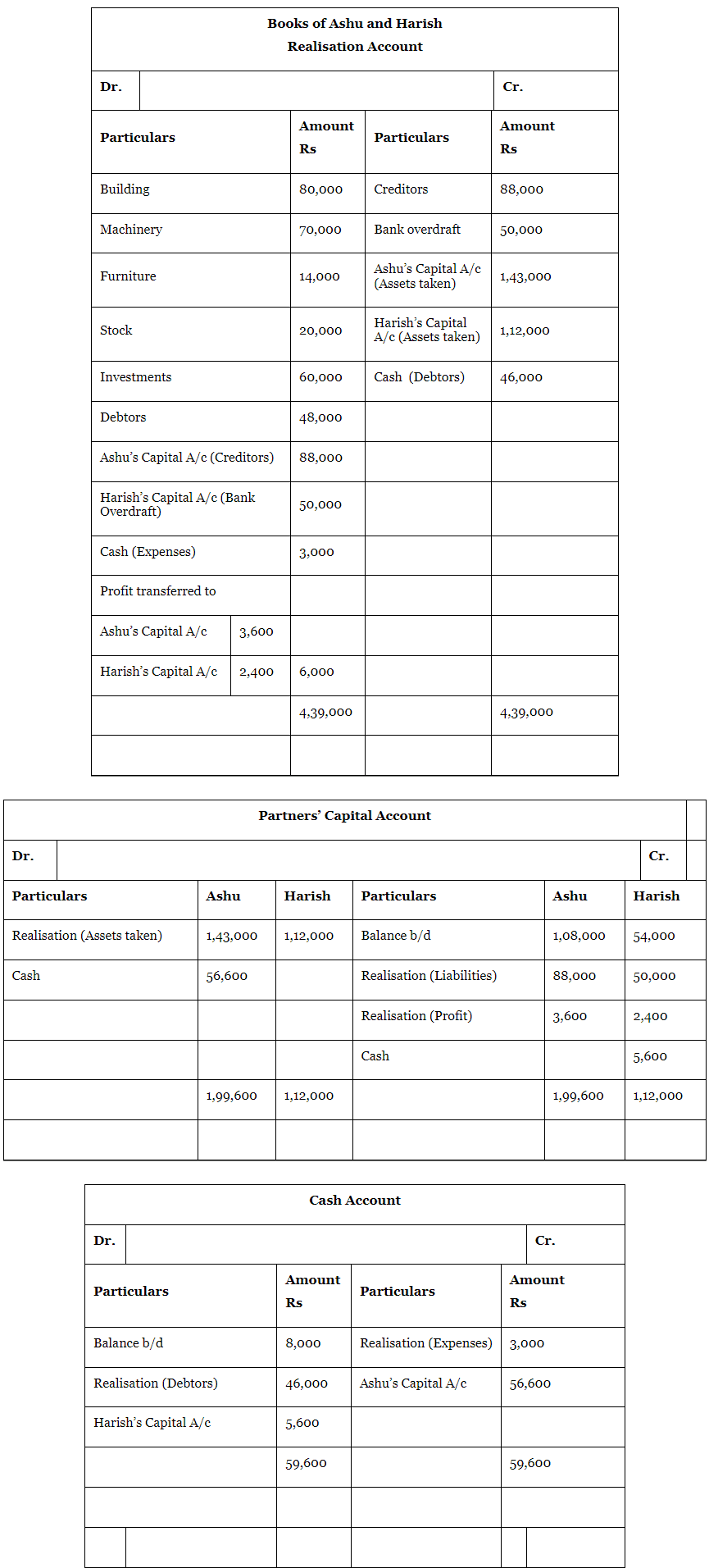

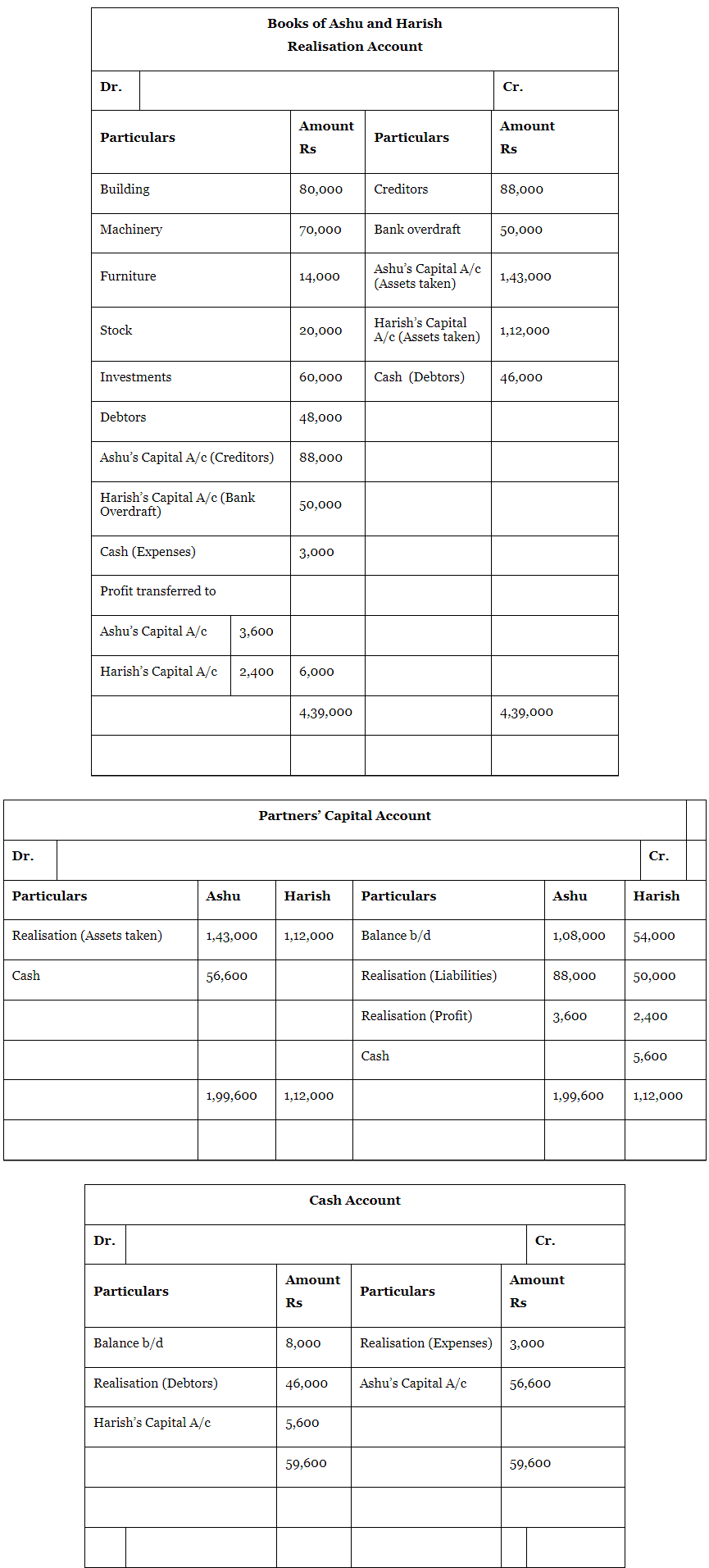

Q16: Ashu and Harish are partners sharing profit and losses as 3:2. They decided to dissolve the firm on March 31, 2017. Their balance sheet on the above date was:

Ashu is to take over the building at Rs 95,000 and Machinery and Furniture is take over by Harish at value of Rs 80,000. Ashu agreed to pay Creditor and Harish agreed to meet Bank overdraft. Stock and Investments are taken by both partner in profit sharing ratio. Debtors realised for Rs 46,000, expenses of Realisation amounted to Rs 3,000. Prepare necessary ledger account.

Ans:

Note: As per the solution, the Profit on Realisation is Rs 6,000; however, the answer mentioned in the book is Rs 14,000.

Working Notes:

| Ashu | Harish |

Building | 95,000 |

|

Machinery and Furniture |

| 80,000 |

Stock (3:2) | 12,000 | 8,000 |

Investment (3:2) | 36,000 | 24,000 |

| Rs 1,43,000 | Rs 1,12,000 |

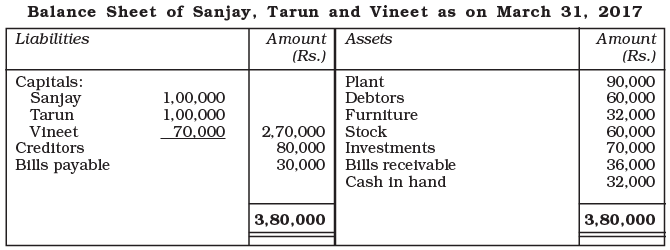

Q17: Sanjay, Tarun and Vineet shared profit in the ratio of 3:2:1. On March 31, 2017 their balance sheet was as follows:

On this date the firm was dissolved. Sanjay was appointed to realise the assets.

Sanjay was to receive 6% commission on the sale of assets (except cash) and was to bear all expenses of realisation.

Sanjay realised the assets as follows : Plant Rs. 72,000, Debtors Rs. 54,000, Furniture Rs. 18,000, Stock 90% of the book value, Investments Rs. 76,000 and Bills receivable Rs.31,000. Expenses of realisation amounted to Rs.4,500.

Prepare Realisation Account, Capital Accounts and Cash Account

Ans:

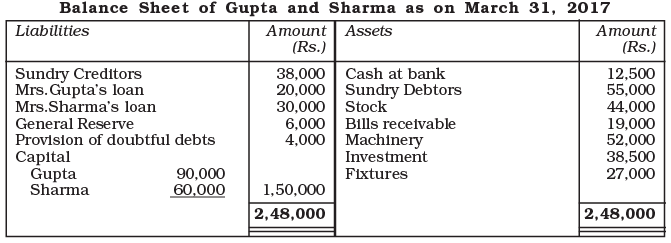

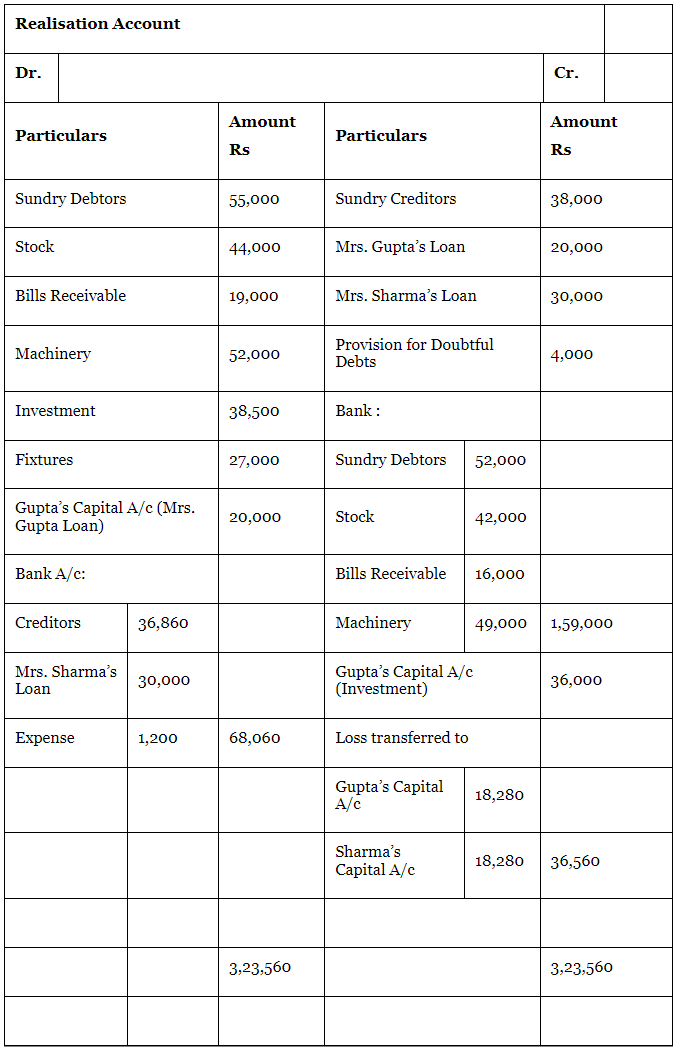

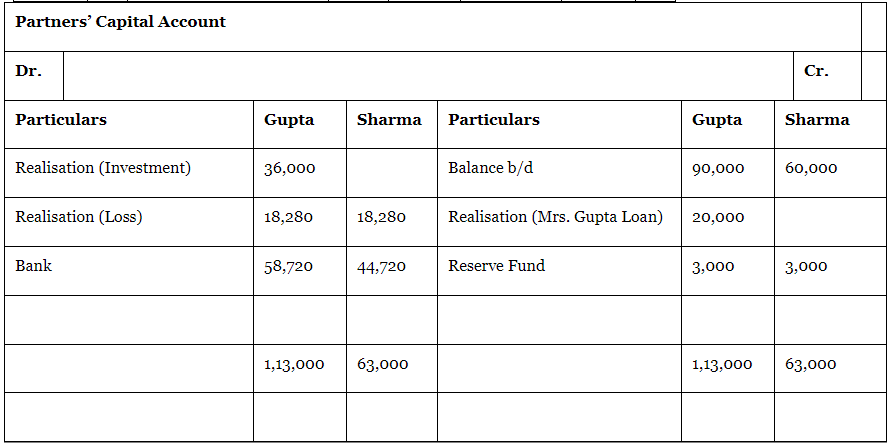

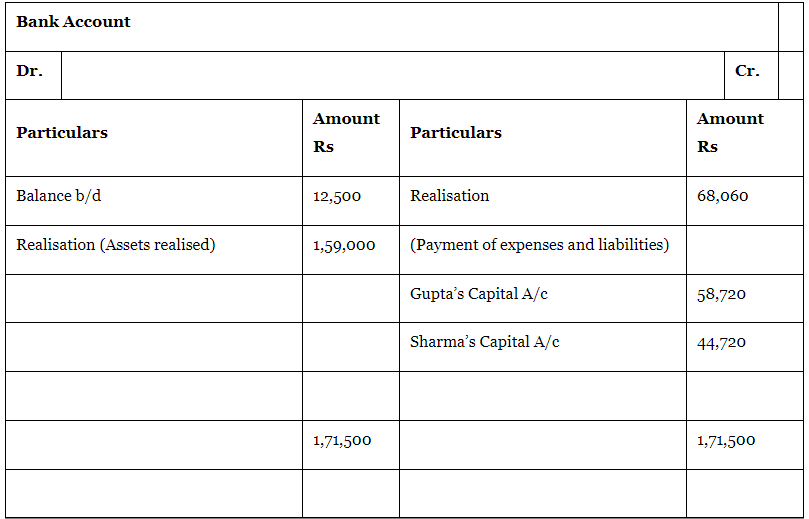

Q18: The following is the Balance Sheet of Gupta and Sharma as on March 31,2017:

The firm was dissolved on December 31, 2017 and asset realised and settlements of liabilities as follows:

(a) The Realisation of the assets were as follows:

| Rs |

Sundry Debtors | 52,000 |

Stock | 42,000 |

Bills receivable | 16,000 |

Machinery | 49,000 |

(b) Investment was taken over by Gupta at agreed value of Rs 36,000 and agreed to pay of Mrs. Gupta’s loan.

(c) The Sundry Creditors were paid off less 3% discount.

(d) The Realisation expenses incurred amounted to Rs 1,200.

Journalise the entries to be made on the dissolution and prepare Realisation Account, Bank Account and Partners Capital Accounts.

Ans:

Note: As per the solution, Loss on Realisation is Rs 36,560 and the total of Bank Account is Rs 1,71,500. However, the answers mentioned in the book are Rs 19,660 and Rs 1,88,500 respectively.

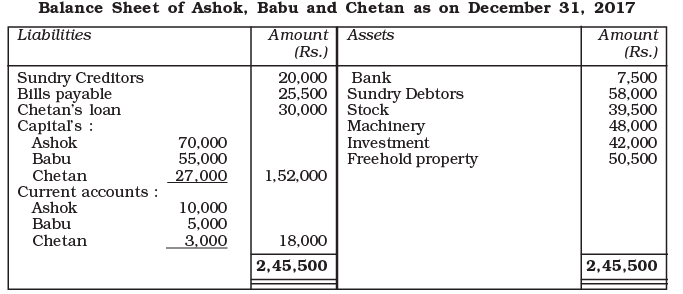

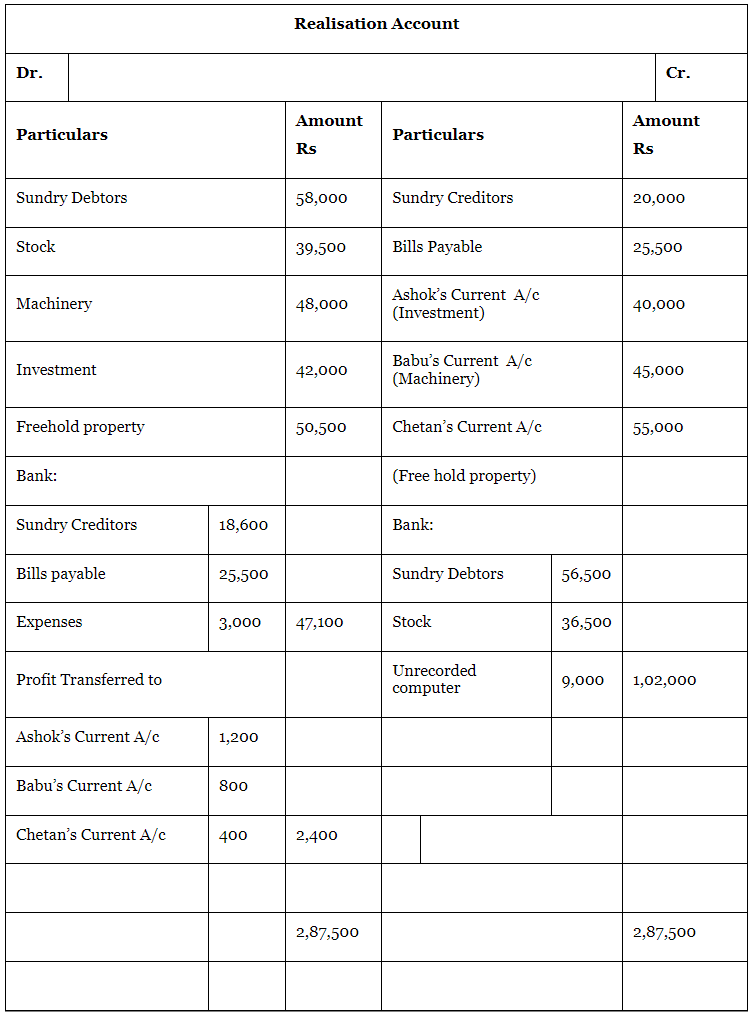

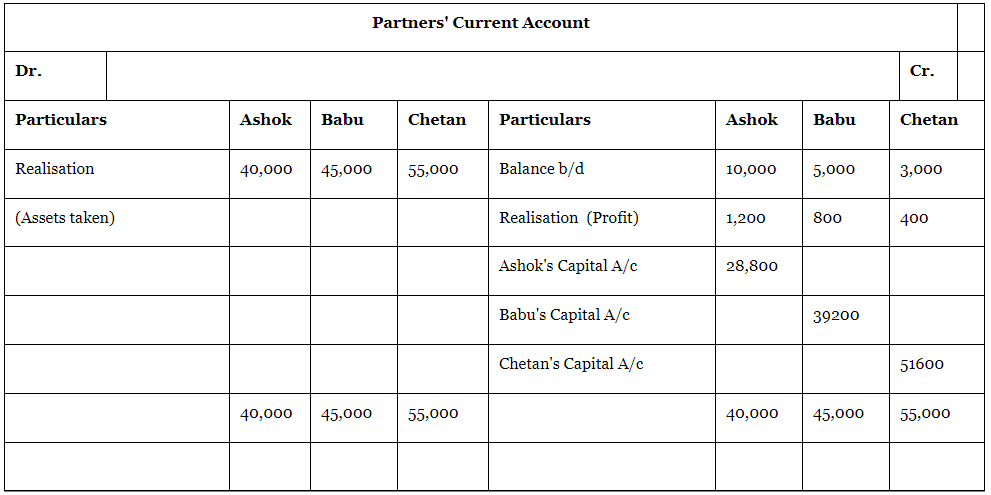

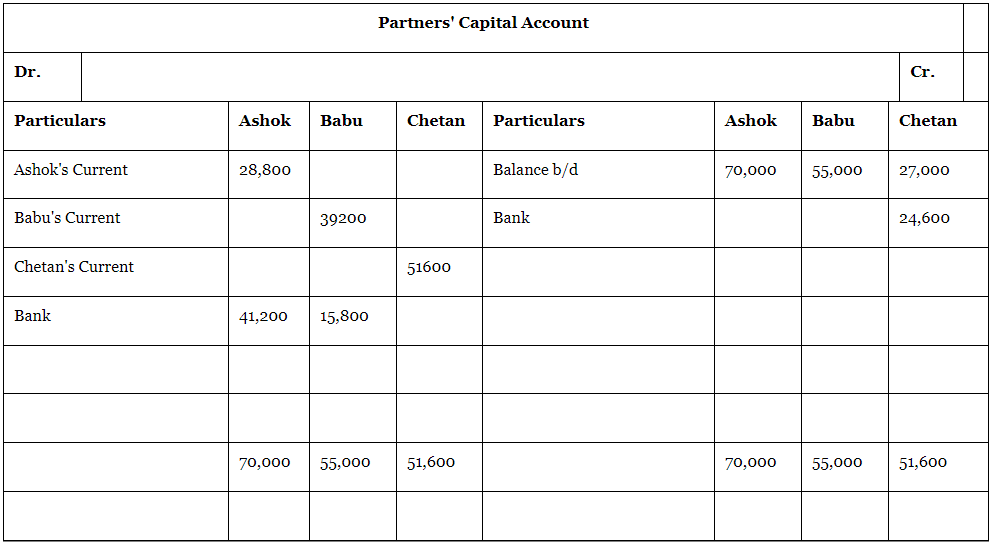

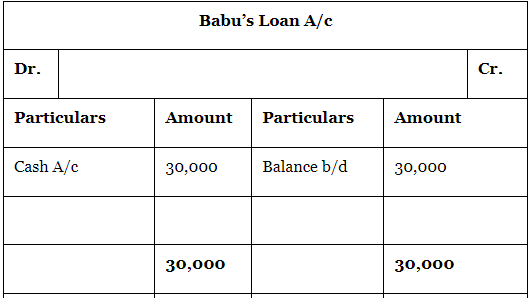

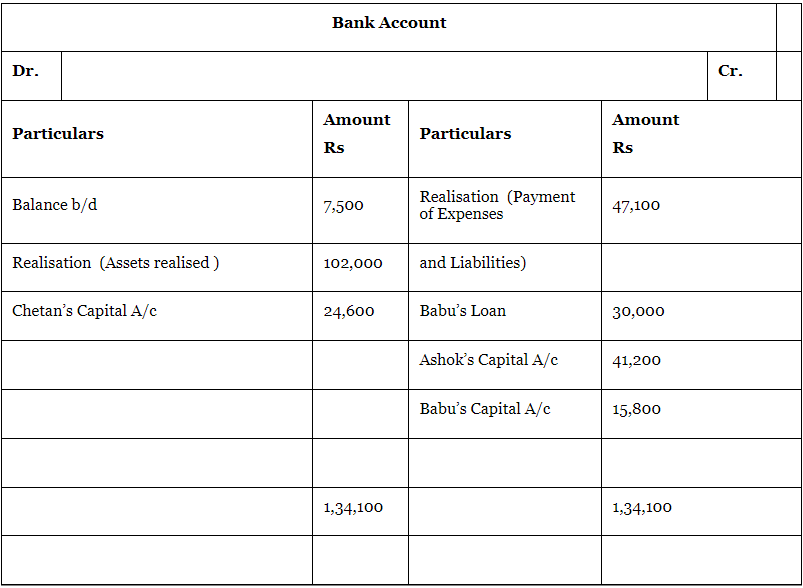

Q19: Ashok, Babu and Chetan are in partnership sharing profit in the proportion of 1/2, 1/3, 1/6 respectively. They dissolve the partnership of the December 31, 2017, when the balance sheet of the firm as under:

The Machinery was taken over by Babu for Rs 45,000, Ashok took over the Investment for Rs 40,000 and Freehold property took over by Chetan at Rs 55,000. The remaining Assets realised as follows: Sundry Debtors Rs 56,500 and Stock Rs 36,500. Sundry Creditors were settled at discount of 7%. A Office computer, not shown in the books of Accounts realised Rs 9,000. Realisation expenses amounted to Rs 3,000.

Prepare Realisation Account, Partners Capital Account, Bank Account.

Ans:

Note: As per the solution, profit on realisation is Rs 2,400. However, the answer provided in the book is Rs 1,200.

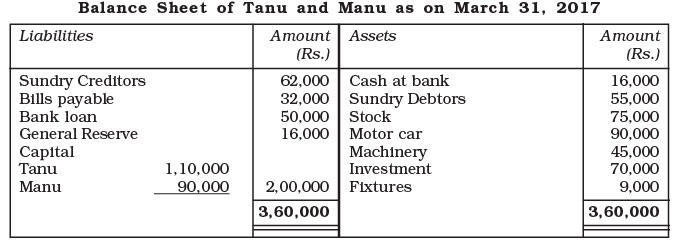

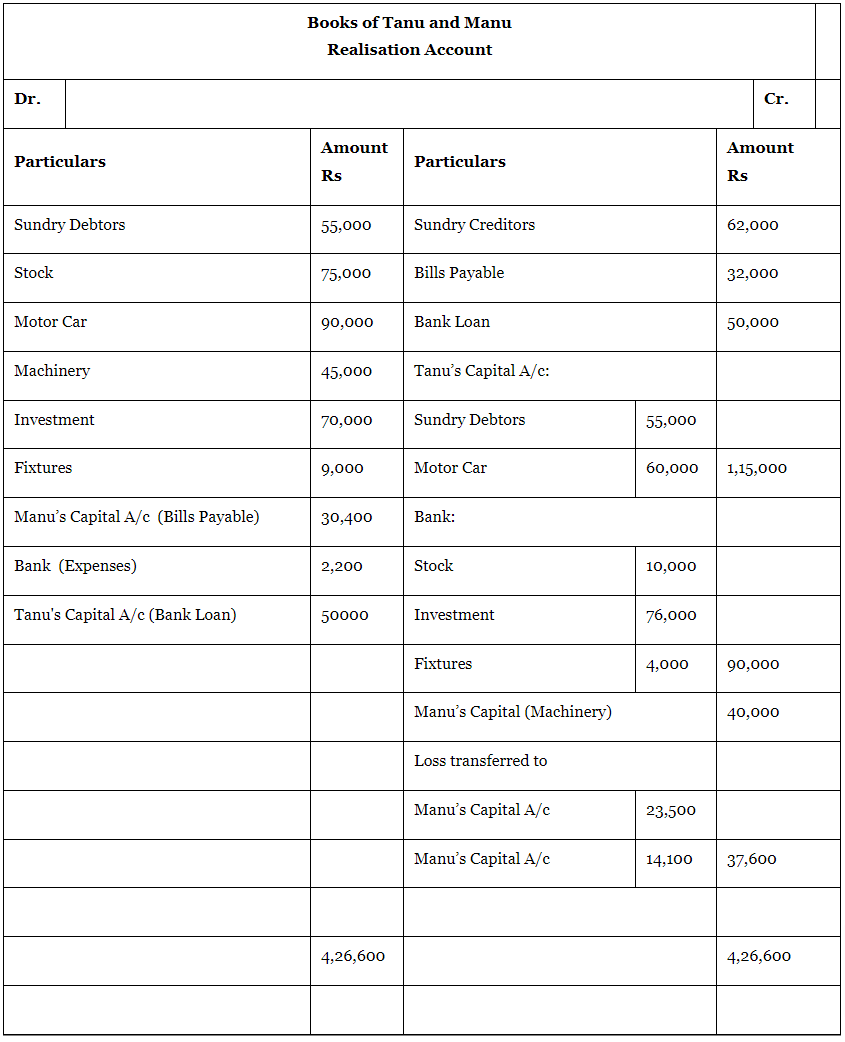

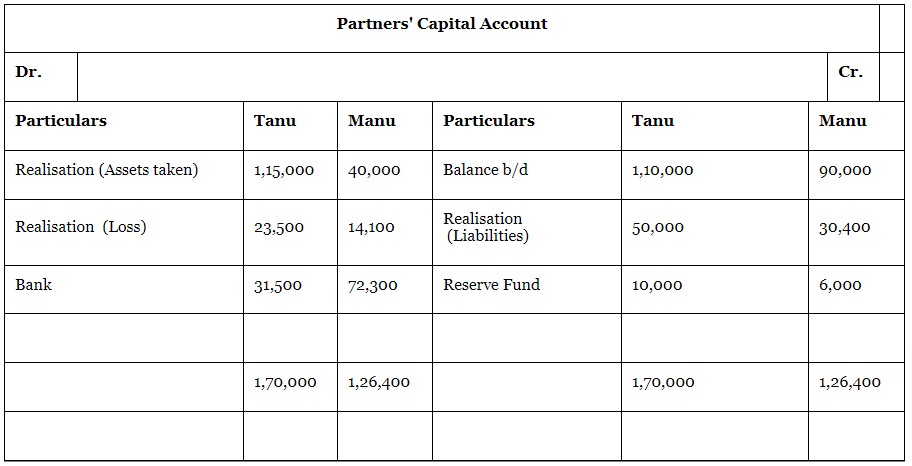

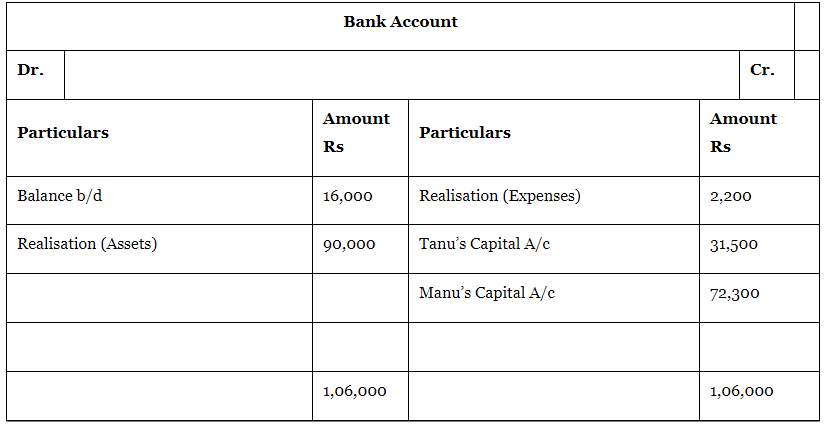

Q20: The following is the Balance sheet of Tanu and Manu, who shares profit and losses in the ratio of 5:3, On March 31, 2017:

On the above date the firm is dissolved and the following agreement was made: Tanu agree to pay the bank loan and took away the sundry debtors. Sundry creditors accepts stock and paid Rs 10,000 to the firm. Machinery is taken over by Manu for Rs 40,000 and agreed to pay of bills payable at a discount of 5%.. Motor car was taken over by Tanu for Rs 60,000. Investment realised Rs 76,000 and fixtures Rs 4,000. The expenses of dissolution amounted to Rs 2,200.

On the above date the firm is dissolved and the following agreement was made: Tanu agree to pay the bank loan and took away the sundry debtors. Sundry creditors accepts stock and paid Rs 10,000 to the firm. Machinery is taken over by Manu for Rs 40,000 and agreed to pay of bills payable at a discount of 5%.. Motor car was taken over by Tanu for Rs 60,000. Investment realised Rs 76,000 and fixtures Rs 4,000. The expenses of dissolution amounted to Rs 2,200.

Prepare Realisation Account, Bank Account and Partners Capital Accounts.

Ans:

|

42 videos|199 docs|43 tests

|

FAQs on NCERT Solution: Dissolution of Partnership Firm - 3 - Accountancy Class 12 - Commerce

| 1. What are the key steps involved in the dissolution of a partnership? |  |

| 2. What are the reasons for the dissolution of a partnership? |  |

| 3. How is the profit distribution handled during the dissolution of a partnership? |  |

| 4. What legal formalities must be completed after the dissolution of a partnership? |  |

| 5. What is the significance of preparing final accounts during the dissolution process? |  |