Nature, Scope and Significance of Auditing - Auditing Concepts, Auditing & Secretarial Practice | Auditing and Secretarial Practice - B Com PDF Download

| Table of contents |

|

| Audit: Meaning, Objectives, and Scope |

|

| Types of Audit |

|

| Inherent Limitations of Audit |

|

| Relationship of Auditing with other Disciplines |

|

| Auditing |

|

Audit: Meaning, Objectives, and Scope

Meaning of Audit

- An audit refers to an independent examination of the financial information of any entity, regardless of whether it is profit-oriented or not, and irrespective of its size or legal form. The purpose of this examination is to express an opinion on the financial information.

- This definition implies several key points:

- Independence: An audit is conducted by an independent party to ensure objectivity.

- Financial Information: The examination focuses on financial information when the objective is to express an opinion.

- Applicability: The requirement for an audit applies to all entities, whether they are profit-oriented (such as commercial entities) or non-profit (like NGOs), regardless of their size (small or large) or legal form (such as proprietorships, partnerships, or companies).

- Clarity of Information: The information contained in the financial statements must be clear and unambiguous.

- Proper Classification and Disclosure: Amounts shown in financial statements should be properly classified, described, and disclosed in accordance with applicable accounting standards.

- True and Fair View: Financial statements should reflect a true and fair view of the financial results and position of the entity.

Points to Ensure in Financial Statements:

- Ledger balances must agree with the entries made in the books of account.

- There should be sufficient and appropriate evidence for the entries made in the books of account.

- All transactions must be recorded in the books of account, ensuring there are no omissions.

- The information in the financial statements should be clear and unambiguous.

- Amounts in the financial statements should be properly classified, described, and disclosed in accordance with applicable accounting standards.

- Financial statements should reflect a true and fair view of the financial results and position of the entity.

Objectives of Audit

- The primary objective of auditing financial statements is for the auditor to express an opinion on these statements.

- Financial statements are prepared based on recognized accounting policies, practices, and relevant statutory requirements.

- The auditor's opinion is crucial for determining the true and fair view of an enterprise's financial position and operating results.

- Users should not interpret the auditor's opinion as a guarantee of the enterprise's future viability or the management's efficiency.

- The auditor must review and assess the conclusions drawn from the audit evidence and their understanding of the business to form an opinion on the financial information.

Objectives of Auditor

- The objectives of the auditor are outlined in SA 200.

- The scope of an audit is determined by the auditor considering:

- Terms of the Audit Engagement: The specific agreements and expectations set out in the audit engagement.

- Requirements of Relevant Statute: Legal and regulatory requirements that govern the audit process.

- Pronouncements of the ICAI: Guidelines and standards set by the Institute of Chartered Accountants of India (ICAI).

- It is important to note that the terms of engagement cannot override statutory requirements or ICAI pronouncements.

Points to Consider in Determining Scope of Audit

- The audit should encompass the examination of all aspects of an entity relevant to its financial statements.

- The auditor must assess the sufficiency and appropriateness of the information in the accounting records and other source data, which involves evaluating accounting systems and internal controls, and performing necessary tests and verifications.

- To ensure proper disclosure in financial statements, the audit may require comparing the statements with underlying records and considering management's judgments in their preparation.

- The auditor should not undertake duties beyond their competence.

- Any limitations on the audit scope that hinder the auditor's ability to express an unmodified opinion should be clearly stated in the audit report.

Aspects to be Covered in Audit

1. Examination of Accounting System & Internal Control

- To ascertain whether it is appropriate for the business and helps in the proper recording of all transactions.

- To determine the Nature, Timing, and extent (NTE) of audit procedures to be performed.

- Reviewing the system and procedures to find out whether they are adequate and comprehensive.

2. Vouching of the transactions

- To ensure the authenticity and validity of transactions.

- To check the arithmetical accuracy of transactions.

- To ascertain a proper distinction between capital and revenue items.

3. Verification of Assets & Liabilities

- To ensure the existence and valuation of the assets and liabilities appearing in the balance sheet.

4. Statutory Compliances

- In cases of entities governed by specific laws, rules, or regulations, such as companies incorporated under the Companies Act, 2013.

5. Expression of Opinion

- On the true and fair view of the state of affairs as reflected by the balance sheet.

The audit report should express an opinion on the following:

- Whether the financial statements give a true and fair view of the state of affairs of the company as at the end of the financial year and of the profit or loss for the year.

- Whether the financial statements comply with the accounting standards referred to in sub-section (3) of section 133 of the Companies Act, 2013.

- Whether the financial statements comply with the requirements of the Companies Act, 2013, and the rules made thereunder.

Types of Audit

- Audit required under law companies governed by the companies act, 2013; banking companies governed by the banking regulation act, 1949; electricity supply companies governed by the electricity Supply act, 1948; co-operative societies registered under the co-operative Societies act, 1912; public and charitable trusts registered under various religious and endowment acts; corporations set up under an act of parliament or State Legislature such as the Lic of India. (g) Specified entities under various sections of the income-tax act, 1961.

- Voluntary Audits audits of the accounts of proprietary entities, partnership firms, Huf, etc. in respect of such entities, there is no basic legal requirement of audit. Many of such enterprises as a matter of internal rules require audit. Some may be required to get their accounts audited on the directives of Government for various purposes like sanction of grants, loans, etc. But the important motive for getting accounts audited lies in the advantages that follow from an independent professional audit.

Advantages of Auditing Financial Statements

- Protecting the Interests of Fund Providers: Auditing safeguards the financial interests of individuals who are not involved in the management of the organization, such as partners or shareholders.

- Moral Check on Employees: Audits serve as a moral check on employees, deterring them from committing fraud or embezzlement.

- Settling Taxes and Negotiating Loans: Audited financial statements are useful for settling taxes, negotiating loans, and determining the purchase price for a business.

- Resolving Trade Disputes: Audited statements help resolve trade disputes, such as those related to higher wages or bonuses.

- Detecting Wastages and Losses: Audits assist in identifying wastages and losses, highlighting areas where internal checks or control measures may be lacking.

- Ensuring Proper Maintenance of Books: Independent audits verify whether necessary books of account and related records have been properly maintained, helping clients rectify deficiencies.

- Appraising Control Measures: Audits evaluate the existence and effectiveness of various control measures within organizations, reporting any weaknesses or inadequacies.

- Partner Admission or Retirement: Audited accounts facilitate the settlement of accounts during the admission or retirement of a partner.

- Granting Licenses: Governments may require audited and certified financial statements before granting licenses or providing assistance for specific trades.

Inherent Limitations of Audit

According to SA 200, which outlines the overall objectives of independent auditors and the conduct of audits in accordance with auditing standards, it is important to understand the inherent limitations of an audit. Auditors cannot eliminate audit risk entirely or provide absolute assurance that financial statements are free from material misstatements due to fraud or error. This is because most audit evidence is persuasive rather than conclusive.

Factors Contributing to Inherent Limitations

1. Nature of Financial Reporting:

- Financial statements are prepared by management using judgment to apply the relevant financial reporting framework (FRF) to the entity's facts and circumstances.

- This process introduces variability in some financial statement items that cannot be eliminated, even with additional auditing procedures.

2. Nature of Audit Procedures:

- There are practical and legal limitations on the auditor's ability to obtain audit evidence.

- Examples of these limitations include:

- Management and others may not provide complete information, either intentionally or unintentionally.

- Audit procedures may be ineffective in detecting fraud.

- An audit is not an official investigation into alleged wrongdoings.

3. Timeliness of Financial Reporting and Cost-Benefit Balance:

- Users expect auditors to form an opinion on financial statements within a reasonable time and at a reasonable cost.

- This expectation leads to the use of test checking and prioritizing areas with a higher risk of material misstatement while allocating fewer efforts to other areas.

4. Other Matters Affecting Audit Limitations:

- Certain assertions or subject matters significantly impact the auditor's ability to detect material misstatements.

- These include:

- Fraud, especially involving senior management or collusion.

- The existence and completeness of related party relationships and transactions.

- Non-compliance with laws and regulations.

- Future events or conditions that may affect the entity's ability to continue as a going concern.

Relationship of Auditing with other Disciplines

Auditing and Accounting:

- Auditing and accounting are closely linked because auditing involves reviewing financial statements, which are the outcome of the accounting process.

- Essentially, auditing starts where accounting ends.

- To effectively review financial statements, auditors must have a strong understanding of generally accepted accounting principles (GAAP).

Auditing and Law:

- Auditing requires examining transactions to ensure they are recorded in accordance with legal requirements, especially in regulated entities like companies.

- Auditors need a solid understanding of business and corporate laws, including contract law and laws governing negotiable instruments.

- Additionally, knowledge of direct and indirect tax laws is important for auditors when analyzing transactions from an accounting perspective.

Auditing and Behavioral Science:

- Behavioral science is relevant to auditing because understanding human behavior is crucial for auditors in performing their duties effectively.

- Auditors interact with various individuals within an organization, and management auditors focus on human behavior rather than just financial data.

- Designing an internal control system involves considering personnel, as the system relies on the competence and honesty of the people working in the organization.

Auditing and Statistics & Mathematics:

- Auditors use statistical sampling when selecting samples for testing transactions, making knowledge of statistics important for drawing meaningful conclusions.

- Additionally, a basic understanding of mathematics is necessary for tasks such as inventory verification.

Auditing and Data Processing:

- Many organizations now use computers for financial accounting, which involves documenting, recording, collating, allocating, and valuing large amounts of accounting data quickly.

- Auditors working in computerized environments need to understand the components and capabilities of the systems used, as well as related terminology.

- Electronic Data Processing (EDP) auditing is emerging as a specialized discipline within auditing.

Auditing and Financial Management:

- Auditing is closely related to various functional areas of business management, including finance, production, marketing, and personnel.

- Auditors should be familiar with financial techniques such as working capital management, funds flow analysis, ratio analysis, and capital budgeting.

- Understanding the role of financial institutions and government activities that impact financial markets is also important for auditors.

Auditing

Meaning and Concept: An audit refers to the independent examination of financial information pertaining to any entity, regardless of its profit orientation, size, or legal structure, with the intention of expressing an opinion on the information presented. This definition implies several key points:

- Applicability to All Entities: Audits are required for every entity, whether it is profit-oriented (such as commercial entities) or not (like non-governmental organizations or NGOs).

- Size Independence: The requirement for an audit applies regardless of the size of the entity, be it small or large.

- Legal Form Independence: Audits are necessary irrespective of the legal form of the entity.

Different authorities have defined the term auditing in various ways:

- Spicer and Pegler: They describe auditing as an examination of books of accounts and vouchers of a business to ensure that the balance sheet provides a true and fair view of the business's state of affairs, and that the profit and loss account accurately reflects the profit or loss for the financial period based on the information available.

- Prof. L.R. Dicksee: According to Prof. Dicksee, auditing involves examining accounting records to determine whether they accurately and completely reflect the transactions they relate to.

- Comptroller and Auditor General of India: The book "An Introduction to Indian Government Accounts and Audit" defines audit as an instrument of financial control, safeguarding the proprietor against extravagance, carelessness, or fraud by agents or servants in the realization and utilization of money or assets. It ensures that accounts accurately represent facts and that expenditure is incurred with due regularity and propriety. The agency responsible for this is called an auditor.

Objectives of Auditing

Auditing has two main objectives: the primary objective and the secondary (or incidental) objective.

Primary Objective: According to Section 227 of the Companies Act 1956, the primary duty of the auditor is to report to the owners whether the balance sheet presents a true and fair view of the company’s financial position and whether the profit and loss account accurately reflects the profit or loss for the financial year.

Secondary Objective: This objective is also known as the incidental objective because it is secondary to the main goal. The incidental objectives of auditing include:

- Detection and Prevention of Frauds: Fraud involves the intentional misrepresentation of financial information with the aim to deceive. This can occur through manipulation of accounts, misappropriation of cash, or misappropriation of goods. It is crucial for auditors to detect and prevent such frauds to ensure the integrity of financial statements.

- Detection and Prevention of Errors: Errors refer to unintentional mistakes in financial information due to ignorance of accounting principles (principle errors) or negligence of accounting staff (clerical errors). Auditors need to be vigilant about the possibility of errors as they can also lead to misstatements in financial position.

The detection of material frauds and errors is an incidental objective of independent financial auditing because it relates to the main goal of ensuring that financial statements provide a true and fair view. The Institute of Chartered Accountants of India emphasizes that auditors should consider the possibility of frauds or errors in the accounts being audited, as these could result in misstatements of the financial position.

Scope of Audit: The scope of an audit is determined by the auditor and should encompass the examination of all aspects of an entity relevant to its financial statements. Auditors must assess the sufficiency and appropriateness of information contained in accounting records and other source data, which involves:

- Evaluating accounting systems and internal controls.

- Performing necessary tests, inquiries, and verification procedures on accounting transactions and account balances.

To ensure proper disclosure of information in financial statements, audits may involve:

- Comparing financial statements with underlying records.

- Considering management’s judgments used in preparing financial statements.

Any limitations on the scope of the audit that affect the auditor’s ability to express an unmodified opinion should be clearly stated in the audit report.

Inherent Limitations of an Audit: According to SA 200, auditors cannot eliminate audit risk entirely or obtain absolute assurance that financial statements are free from material misstatements due to fraud or error. This is because audit evidence is often persuasive rather than conclusive, and inherent limitations exist due to:

i. Nature of Financial Reporting: Financial statements are prepared based on management’s judgment in applying the relevant financial reporting framework (FRF). This involves a degree of variability that cannot be completely eliminated through additional auditing procedures.

ii. Nature of Audit Procedures: There are practical and legal constraints on the auditor’s ability to gather audit evidence, such as:

- Management and others may not provide complete information, either intentionally or unintentionally.

- Audit procedures may not be effective in detecting fraud.

- Audits are not conducted as official investigations into suspected wrongdoings.

iii. Timeliness of Financial Reporting and Cost-Benefit Balance. Users expect auditors to form an opinion on financial statements within a reasonable timeframe and at a reasonable cost. This leads to a focus on test checking and prioritizing areas with a higher risk of material misstatement.

iv. Other Matters Affecting Audit Limitations. In certain cases, the limitations on the auditor’s ability to detect material misstatements are more pronounced. This includes specific assertions or subject matters that are particularly significant.

Relationship between Accounting and Auditing Principles

Accounting principles are broad decision-making rules that come from accounting concepts. These principles guide the creation of accounting techniques, which are specific rules for recording particular transactions and events within an organization. The outcome of any accounting system is the financial statements that reflect an entity's financial information. When preparing and presenting these financial statements, it is crucial to consider various accounting principles, including:

- Cost Principle

- Revenue Principle

- Matching Principle

- Objectivity Principle (Verifiability Principle)

- Consistency Principle

- Full Disclosure Principle

- Conservatism Principle

- Materiality Principle

- Uniformity and Comparability Principle

An audit involves the independent examination of an entity's financial statements, regardless of its profit orientation, size, or legal form, to express an opinion on the accuracy and fairness of the financial information presented. During this examination, auditors ensure that all fundamental accounting principles have been followed in the preparation and presentation of the financial statements. Therefore, auditors must have a solid understanding of these accounting principles, as they form the foundation for reliable, high-quality, and acceptable financial statements.

There is a strong interrelationship between accounting and auditing principles. According to AAS 1 issued by the ICAI on "Basic Principles Governing an Audit," the following principles govern an auditor's professional responsibility and must be adhered to during an audit:

- Integrity

- Objectivity and Independence

- Confidentiality

- Skills and Competence

- Planning

- Documentation

- Audit Evidence

- Accounting System and Internal Control

- Work Performed by Others

- Audit Conclusion and Reporting

Integrity: Auditors must be straightforward, honest, and sincere in their professional duties. Integrity is subjective and cannot be standardized by law or set standards. Auditors should maintain an impartial attitude during audits to avoid any appearance of bias.

Objectivity and Independence: Auditors must remain objective and independent in their professional work. Objectivity means not being influenced by personal biases or external pressures. Independence ensures that an auditor's judgment is not swayed by the wishes of others or personal interests.

Confidentiality: Auditors must keep confidential information obtained during their work private. They should not disclose such information to third parties without the client's permission or unless required by law.

Skills and Competence: Audits should be conducted by individuals with adequate training, experience, and technical competence. The Institute of Chartered Accountants of India offers continuing professional education to its members to maintain high auditing standards.

Planning: Auditors should plan their work effectively, which includes understanding the client's business, accounting system, and internal controls, as well as formulating an audit program.

Documentation: Auditors should systematically maintain documents created or collected during the audit process. This documentation serves as evidence that the audit was conducted following established principles.

Audit Evidence: Auditors must gather sufficient and appropriate audit evidence through compliance and substantive procedures. Compliance procedures ensure that the internal control system is functioning as intended, while substantive procedures involve detailed tests of transactions and balances to verify the completeness, accuracy, and validity of the data produced by the accounting system.

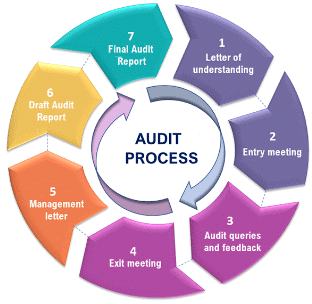

Audit Process

A. Accounting System and Internal Control

- Management is responsible for preparing the financial statements of an entity, which requires maintaining an adequate accounting system with various internal controls appropriate to the size and nature of the business.

- The auditor must ensure that the internal control system is sufficient to guarantee that all necessary accounting information is recorded.

- The extent of substantive procedures depends on the accounting system and internal controls in place.

- If there is a strong accounting system and internal control, the procedures can be less extensive; otherwise, they will need to be more thorough.

B. Work Performed by Others

- During an audit, auditors may delegate work to assistants and consider work done by other auditors.

- However, auditors remain responsible for the opinion expressed on the financial statements and cannot escape liability by claiming they delegated work or used others' work.

- Therefore, auditors must carefully direct, supervise, and review the work delegated to others and ensure that the work performed by other auditors and experts is adequate for their purposes.

C. Audit Conclusion and Reporting

- The final outcome of the audit process is the audit report, in which the auditor expresses their opinion on the financial statements of an entity.

- The auditor's conclusion and reporting should be based on the audit evidence obtained and typically include the following:

- Whether the financial statements are prepared in accordance with generally accepted accounting principles (GAAP) and applied consistently.

- Whether the financial information complies with relevant laws and regulations.

- Whether there is adequate disclosure of all material facts.

- The audit report should clearly express the auditor's opinion on the financial information and comply with the requirements of the relevant statute, agreement, or regulation.

- Different types of opinions that may be included in the audit report are:

(i) Unqualified or clean opinion

(ii) Qualified opinion

(iii) Adverse opinion

(iv) Disclaimer of opinion

In cases of qualified, adverse, or disclaimer opinions, the audit report should explain the reasons for such opinions.

Errors and Frauds

Errors: An error in the context of financial statements refers to an unintended mistake that occurs in the accounting records and related data. This can include mathematical or accounting errors, oversight or misinterpretation of facts, or misapplication of accounting policies.

Errors can be broadly categorized into two types: (a) Principal Errors and (b) Clerical Errors

Principal Errors: These errors occur when the fundamental principles of accountancy are not followed while recording a transaction. For example, recording a capital expenditure as a revenue expenditure or vice versa. Such errors are often difficult to detect because the Trial Balance may still tally despite them. They typically arise from a lack of understanding of accounting principles.

Examples of Principal Errors:

- Recording wages paid for the installation of plant and machinery as wages paid to workers.

- Incorrectly recording a revenue receipt as a capital receipt.

- Making incorrect provisions for doubtful debts.

- Setting incorrect provisions for discounts on debtors.

- Debiting rent paid to a landlord to the landlord account instead of the rent account.

- Overvaluing or undervaluing stock due to ignorance.

Clerical Errors: These errors occur due to the negligence of accounting staff. Clerical errors can be further divided into:

- Errors of Omission: Failing to record a transaction.

- Errors of Commission: Recording a transaction incorrectly.

- Duplicating Errors: Recording a transaction multiple times.

- Compensating Errors: Errors that offset each other.

Reasons and Circumstances of Error and Fraud

R.K. Mautz has classified the reasons and circumstances of errors and included fraud in the broad category of errors. The classifications are the following:

- Ignorance: This involves a lack of knowledge by employees regarding accounting developments, generally accepted accounting principles (GAAP), appropriate account classifications, necessary reconciliations between subsidiary ledgers and controlling accounts, and good accounting practices in general.

- Carelessness: This refers to negligence on the part of individuals performing accounting tasks, leading to mistakes or oversights.

- Concealment: This involves a deliberate attempt to hide the impact of defalcations or shortages of various kinds.

- Bias: This refers to a tendency within management to allow prejudice or bias to influence the interpretation of transactions or events, or their presentation in financial statements.

- Tax Minimization: This reflects an ongoing desire to minimize income tax liabilities.

Sixth Cause

- A sixth cause, considered more serious in nature, involves intentional efforts by individuals in positions of authority to manipulate the financial statements by:

- Enhancing the representation of the financial picture: This means making the financial situation appear better than it is.

- Deteriorating the representation of the financial picture: This involves making the financial situation look worse than it is.

- Converting errors for personal benefit: This refers to exploiting errors in a way that benefits the individual personally.

Types of Errors in Accounting

1. Commission Errors: These occur when a transaction is recorded incorrectly but within the same class of accounts. Examples include:

- Posting Error: Recording a transaction in the wrong account. For instance, if a transaction meant for A is recorded in B's account.

- Casting Error: Miscalculating the total of a column. For example, carrying forward a balance of Rs.510 as Rs.501.

- Totalling Error: Incorrectly adding up a column of figures. This type of error affects the trial balance.

2. Omission Errors: These occur when a transaction is not recorded at all or only partially recorded.

- Full Omission: Both the debit and credit aspects of a transaction are missing, making it difficult to trace. The trial balance will still tally in this case.

- Partial Omission: Only one aspect of the transaction is recorded, making it easier to identify the error.

Steps to Identify Errors in Accounts

To identify errors in accounts, auditors can follow these steps:

- Check Opening Balances: Verify the opening balances against the balance sheet of the previous year.

- Verify Ledger Posting: Ensure that entries are posted correctly into the respective ledger accounts.

- Total of Subsidiary Books: Check the accuracy of the totals in the subsidiary books.

- Castings and Carry Forwards: Verify all castings and carry forwards for accuracy.

- List of Debtors and Creditors: Ensure that the list of debtors and creditors matches the ledger accounts.

- Inclusion of All Accounts: Make sure that all accounts from the ledger are included.

- Trial Balance Total: Verify the total of the trial balance.

- Comparison with Previous Year: Compare items in the trial balance with those of the previous year.

- Identify Differences: Look for significant differences and check for possible errors in amounts.

- Round Figure Differences: Check for differences involving round figures such as Rs. 1,000 or Rs. 100.

- Misplacement or Transposition of Figures: Look for errors in the placement or transposition of figures, like 45 for 54 or 81 for 18.

- Careful Scrutiny: Ultimately, careful scrutiny is essential for detecting errors.

- Unposted Entries: Ensure that no entry from the original books has been left unposted.

Understanding Frauds in Accounting

Fraud in accounting refers to intentional misrepresentation aimed at deceiving others for personal gain. It involves deliberate mistakes in financial records with the intention of benefiting oneself. There are two main aspects of fraud in accounting:

- Defalcation: This involves the misappropriation of cash or goods. It is a form of fraud where someone illegally takes or uses funds or assets for personal use.

- Fraudulent Manipulation of Accounts: This type of fraud does not involve defalcation but involves altering accounts dishonestly. It could include falsifying records, inflating expenses, or other deceptive practices to misrepresent the financial position.

Types of Frauds

As per the standard auditing practices by the Institute of Chartered Accountants of India, fraud involves the intentional misrepresentation of financial information by individuals in management or third parties. It is the deliberate concealment or misrepresentation of a material fact with the intent to deceive, cheat, or mislead another party. There are various types of frauds, including:

- Manipulation of Accounts

- Misappropriation of Cash

- Misappropriation of Goods

Manipulation of Accounts

Manipulation of accounts occurs when an individual makes a false entry in the books of accounts, alters or destroys a true entry, or prevents the making of a true entry in the business records. This is typically carried out by top management to overstate or understate profits and the financial condition of the business for their own benefit. Common methods of manipulation include:

- Non-provision of depreciation on fixed assets

- Overvaluation or undervaluation of assets

- Recording revenue expenditure as capital expenditure

- Showing expenses of the next year in the current year’s profit and loss account

- Not recording current year’s accrued expenses

A common form of account manipulation is known as “ window dressing .”

Misappropriation of Cash

Misappropriation of cash, also referred to as embezzlement, involves the fraudulent appropriation of cash belonging to another party by someone entrusted with it. This can occur through various means, such as:

- Not recording full cash sales and pocketing a portion of the proceeds

Teeming and lading

- Misappropriating money received from the sale of goods sent on a sale or return basis

- Making fictitious entries in customer accounts for bad debts, discounts, etc.

- Misappropriating the amount received from the sale of defective goods by not recording such sales

- Recording fictitious cash purchases

- Recording payments to fictitious creditors

- Not recording discounts received from creditors

- Recording payments to dummy or ghost workers and pocketing the money

Misappropriation of Goods

Misappropriation of goods involves the fraudulent application of goods by those who handle them. This can be done by:

- Recording sales of larger quantities and misappropriating the balance

- Recording purchases of large quantities, receiving less quantity, and then receiving the balance amount privately

Situations That May Raise Fraud Suspicions for Auditors

- Missing Documentation: When essential documents like vouchers, invoices, cheques, or contracts are absent.

- Discrepancies in Accounts: If the control account does not match with the subsidiary books.

- Trial Balance Issues: When the difference in the trial balance is hard to pinpoint.

- Fluctuations in Ratios: Notable fluctuations in Gross Profit (G.P.) and Net Profit (N.P.) ratios.

- Balance Confirmation Discrepancies: When there is a difference between the balance and the confirmation of that balance by involved parties.

- Stock Discrepancies: When the stock recorded in the books differs from the stock physically counted.

- Unsatisfactory Explanations: If the explanations provided by the client are not satisfactory.

- Overwriting of Figures: Instances of overwriting on certain figures.

- Contradictory Explanations: When there are contradictions in the explanations given by different parties.

Duties of an Auditor in Detecting Fraud

Auditors play a crucial role in ensuring the integrity of financial statements and detecting fraudulent activities. Here are the key duties an auditor should perform in respect of fraud:

- Examine all aspects of finance: The auditor should thoroughly review all financial aspects of the organization to identify any irregularities.

- Vouch receipts: Verify all receipts by cross-referencing them with counterfoils, carbon copies, cash memos, sales reports, and other relevant documents.

- Check salary and wages register: Conduct a detailed examination of the salary and wages register to ensure accuracy and legitimacy.

- Verify stock valuation methods: Ensure that the methods used for valuing stocks are appropriate and consistent.

- Review stock registers and related documents: Check stock registers, goods inward notes, goods outward books, and delivery challans for discrepancies.

- Calculate ratios: Analyze various financial ratios to detect any fraudulent manipulation of accounts.

- Investigate unusual items: Scrutinize the details of any unusual items that may indicate fraudulent activity.

- Probe into suspicious issues: Investigate any problems or issues that raise suspicion during the audit process.

- Exercise skill and care: Perform duties with reasonable skill and care to ensure thoroughness and accuracy.

- Make surprise visits: Conduct unannounced visits to check accounts and verify information.

Classification of Audits

Audits can be classified based on various criteria, leading to different types of audits. Here are the classifications:

- Objective-wise: Internal Audit and Independent Financial Audit.

- Periodicity-wise: Periodical, Continuous, Interim, Final, Limited Review.

- Organisation Structure-wise: Statutory and Non-Statutory Audits.

- Specific Matter-wise: Cost, Management, Tax, Social Propriety, Performance Audits, etc.

Periodical Audit:

A periodical audit is conducted at the end of a specific period, ensuring that the audit is completed in a single, uninterrupted session. This type of audit minimizes the risk of collusion between the audit staff and the client’s staff and avoids any disruption to the client’s work. Final audits are also known as periodical audits, as they begin only after the period to be audited has expired. Periodical audits are cost-effective and convenient, making them suitable for small businesses that may require quarterly, half-yearly, or yearly audits, but only after the periodic finalization of accounts.

Interim Audit

An interim audit is conducted for a portion of the accounting year with specific interim purposes in mind. It involves auditing financial statements or other data for only part of the accounting year and is typically performed between two regular audits. The purposes for conducting an interim audit may include:

- Declaring an interim dividend.

- Submitting accounts for a specific purpose as required by an authority.

- Disclosing periodic financial information to comply with statutory requirements.

- Assessing the adequacy of the internal control system before the final audit.

Continuous Audit

A continuous audit involves the auditor or their staff being engaged in checking the accounts throughout the entire period or attending the client’s office at regular or irregular intervals during the period. This type of audit is suitable in the following cases:

- When final accounts are needed immediately after the close of the financial year, such as in banks.

- When there are numerous transactions requiring regular auditing.

- When the internal check system is inadequate.

- When monthly or quarterly statements of accounts are prepared and need to be presented to management.

- When there are high sales volumes.

|

54 videos|65 docs|22 tests

|

FAQs on Nature, Scope and Significance of Auditing - Auditing Concepts, Auditing & Secretarial Practice - Auditing and Secretarial Practice - B Com

| 1. What is the nature of auditing? |  |

| 2. What is the scope of auditing? |  |

| 3. What is the significance of auditing? |  |

| 4. What are the auditing concepts? |  |

| 5. What is the role of auditing in secretarial practice? |  |