Practice Question - 50 (Special Charts) | 100 DILR Questions for CAT Preparation PDF Download

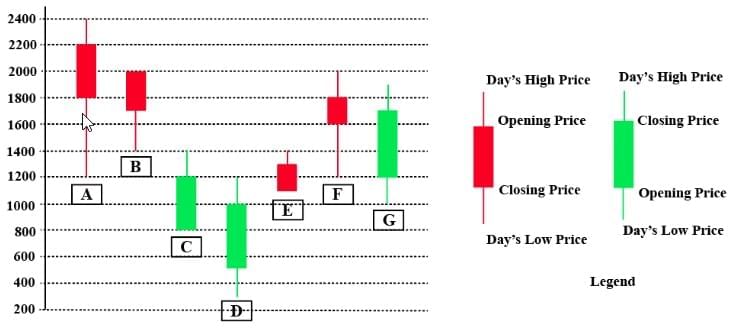

The chart below shows the price data for seven shares - A, B, C, D, E, F, and G as a candlestick plot for a particular day. The vertical axis shows the price of the share in rupees. A share whose closing price (price at the end of the day) is more than its opening price (price at the start of the day) is called a bullish share; otherwise, it is called a bearish share. All bullish and bearish shares are shown in green and red colour respectively.

Q1: Daily Share Price Variability (SPV) is defined as (Day’s high price - Day’s low price) / (Average of the opening and closing prices during the day). Which among the shares A, C, D and F had the highest SPV on that day?

(a) F

(b) A

(c) D

(d) C

View Answer

View Answer

Ans: (d)

Writing down the values given in the candlestick chart in the form of a table for ease of calculation,

We are given that, Daily Share Price Variability (SPV) is defined as (Day’s high price - Day’s low price) / (Average of the opening and closing prices during the day)

Calculating it for the four options,

Stock F: 800/1700=8/17

Stock A: 1200/2000=3/5

Stock D: 900/750=90/75=6/5

Stock C: 600/1000=3/5

Clearly Stock D has the highest SPV.

Q2: Daily Share Price Variability (SPV) is defined as (Day’s high price - Day’s low price) / (Average of the opening and closing prices during the day). How many shares had an SPV greater than 0.5 on that day?

View Answer

View Answer

Ans: 4

Writing down the values given in the candlestick chart in the form of a table for ease of calculation,

We are given that, Daily Share Price Variability (SPV) is defined as (Day’s high price - Day’s low price) / (Average of the opening and closing prices during the day)

Calculating it for the stocks

Stock A: 1200/2000=3/5

Stock B: 600/1850=60/185

Stock C: 600/1000=3/5

Stock D: 900/750=90/75=6/5

Stock E: 300/1200=1/4

Stock F: 800/1700=8/17

Stock G: 900/1450=90/145

We need to check for stocks greater than 0.5 on that day,

Stock A, Stock C, Stock D, Stock G have SPV greater than 0.5 that day.

Hence, the answer is 4.

Q3: Daily loss for a share is defined as (Opening price - Closing price) / (Opening price). Which among the shares A, B, F and G had the highest daily loss on that day?

(a) G

(b) B

(c) A

(d) F

View Answer

View Answer

Ans: (c)

Writing down the values given in the candlestick chart in the form of a table for ease of calculation,

Daily loss for a share is defined as (Opening price - Closing price) / (Opening price)

Daily loss for a share is defined as (Opening price - Closing price) / (Opening price)

Calculating this for the options:

Stock A: 400/2200=2/11

Stock B: 300/2000=3/20

Stock F: 200/1800=1/9

Stock G gained money that day

Hence Stock A has the highest Daily Loss.

Q4: What would have been the percentage wealth gain for a trader, who bought equal numbers of all bullish shares at opening price and sold them at their day’s high?

(a) 80%

(b) 50%

(c) 72%

(d) 100%

View Answer

View Answer

Ans: (a)

Writing down the values given in the candlestick chart in the form of a table for ease of calculation,

There are three bullish shares, C D and G

There are three bullish shares, C D and G

Lets say a trader buys one share of each of these stocks, and sells them at their day's high

One share of C at opening is 800, sells at 1400

One share of D at opening is 500, 1200

One share of G at opening is 1200, 1900

Total Investment is 2500, and total money after selling is 4500

That is an 80% return since,

|

102 videos|123 docs|121 tests

|

FAQs on Practice Question - 50 (Special Charts) - 100 DILR Questions for CAT Preparation

| 1. What are special charts and how are they used in data representation? |  |

| 2. What are the key differences between pie charts and bar charts? |  |

| 3. How should one choose the right type of chart for data presentation? |  |

| 4. What are common mistakes to avoid when creating special charts? |  |

| 5. How can special charts enhance data storytelling? |  |