Preparation of Financial Statements | Accounting for GCSE/IGCSE - Year 11 PDF Download

| Table of contents |

|

| Sole Traders |

|

| Partnerships |

|

| Limited Companies |

|

| Clubs and Societies |

|

| Manufacturing Accounts |

|

| Incomplete Records |

|

Sole Traders

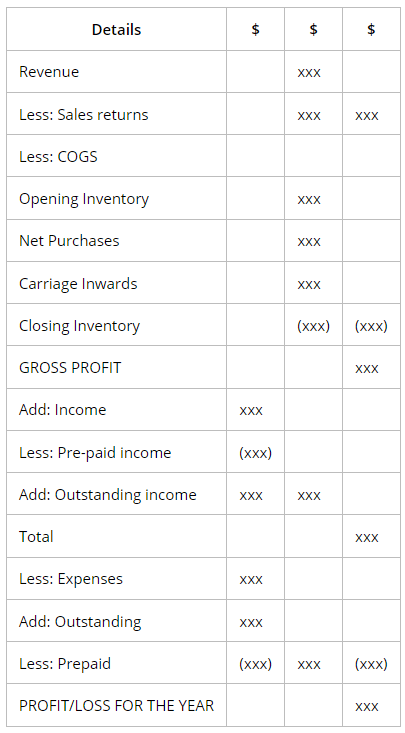

Income Statement

- Sole traders prepare financial statements like the income statement and statement of financial position at the end of the financial year to determine their profit or loss, as well as the value of their assets and liabilities at a specific date.

- The income statement includes:

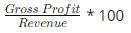

- Trading Section: This involves the buying and selling of goods and calculating the gross profit (Revenue - Cost of Sales).

- Profit/Loss Section: Calculated through a formula involving opening inventory, net purchases, returns, closing inventory, and other factors.

- Revenue is derived from net sales, which are sales minus returns, while the Cost of Sales represents the total cost of goods sold, not necessarily all goods purchased.

- Cash discounts, discounts allowed, and discounts received are excluded from the trading account as they result from early debt payments and are not sales-related.

- The income statement and trading account should specify the financial year/period covered and the business's trading name.

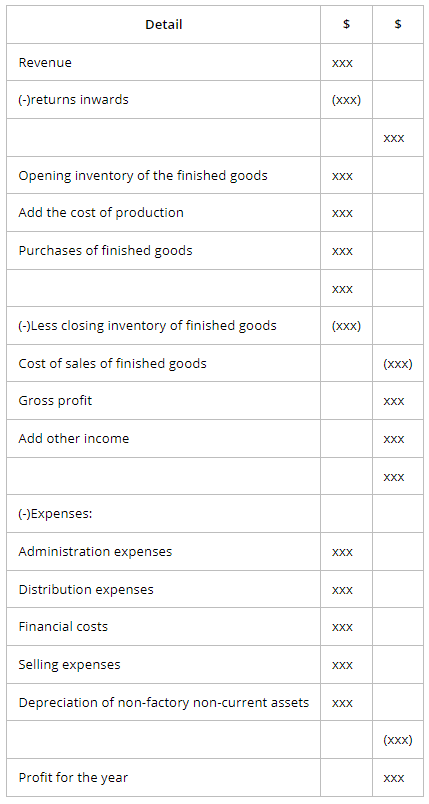

Income Statement Format

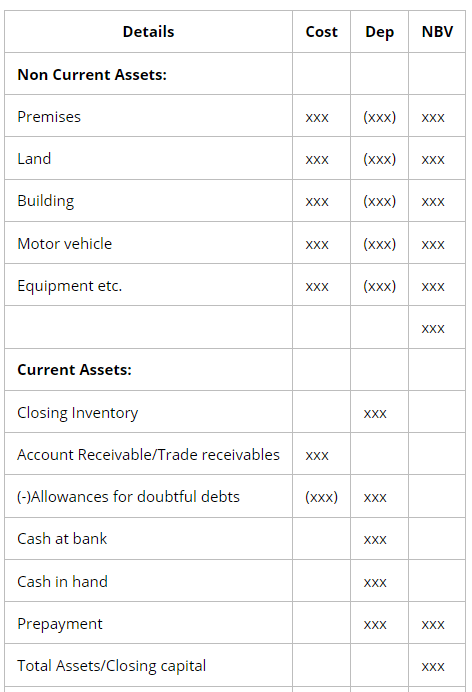

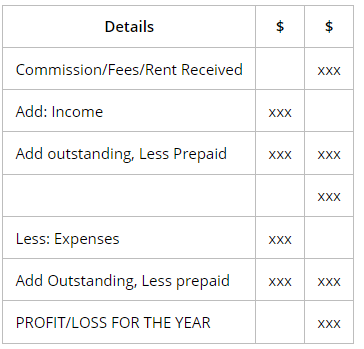

Statement of Financial Position

- The statement of financial position on a given date reflects a business's assets being equivalent to its capital plus any liabilities owed. This portrayal illustrates how resources are utilized (assets) and their sources (liabilities).

Balance sheet Format

Balance sheet as at….

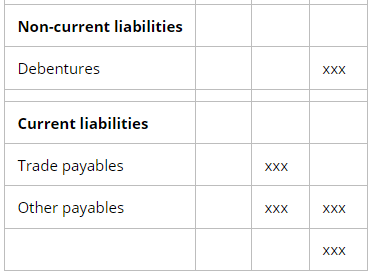

- Non-current liabilities are obligations that are not due within the next 12 months, such as long-term loans.

- Current liabilities represent short-term debts that are due within the next 12 months and stem from the day-to-day operations of a business. These values are subject to frequent changes, for example, trade payables.

- Assets and liabilities are categorized into distinct groups:

- Assets are segmented into current assets, which are short-term assets with fluctuating values and derive from regular business activities, like inventory.

- Non-current assets are long-term assets not meant for resale but aid the business in generating revenue. For instance, motor vehicles.

- Non-current assets are ranked by increasing liquidity, with less permanent assets listed first. This includes assets like land and buildings, machinery, fixtures, equipment, and motor vehicles.

- Current assets follow a similar liquidity order, with assets furthest from cash being listed first. These typically include inventory, trade receivables, other receivables, bank balances, and cash. Trade receivables are deemed more liquid than inventory since they can be sold to other businesses.

- Both current and non-current liabilities are arranged in ascending order, with liabilities to be settled first. Note that other payables will be listed after trade payables.

- A Statement of Financial Position (SOFP) should include a date reference and the business's trading name for clarity.

- Following the preparation of financial statements, each item on the trial balance impacts either the Income Statement (IS) or the Statement of Financial Position (SOFP). Additional notes may affect both statements.

- The balance of the capital account in the SOFP will increase if the business has made a profit or decrease if it has incurred a loss. A profit signifies an augmentation in net assets (capital) as the business's liabilities increase.

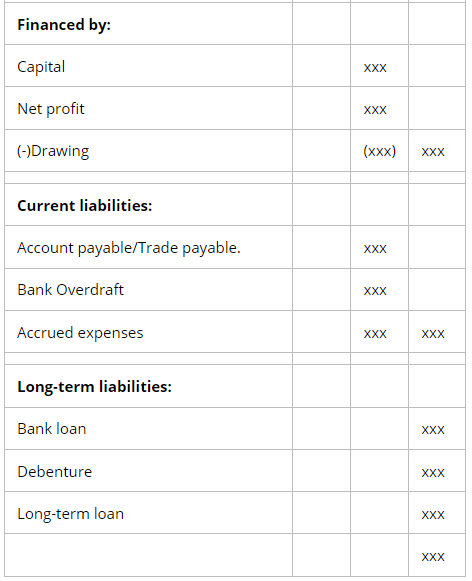

Service Business

- A service business differs from other types of businesses in that it does not involve the buying and selling of goods.

- Instead, it focuses on providing services to customers. Even though a service business does not engage in traditional trading activities, its financial statements still need to be meticulously prepared to reflect its operations accurately.

- Format:

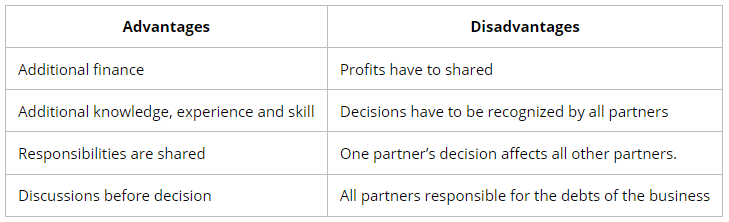

Partnerships

- A partnership is a type of business where two or more individuals come together to collaborate with the aim of generating profits.

- Various professionals such as accountants and solicitors join hands to establish a partnership, a practice commonly seen in family-run businesses. Sometimes, sole traders also join forces by merging their businesses.

- In a partnership, an additional account called the profit and loss appropriation account is created to illustrate how the annual profits or losses are distributed among the partners.

- Key points about partnership businesses:

- Most partnerships usually create a partnership agreement, which is not a legal requirement but significantly helps in preventing misunderstandings and disputes in the future. This agreement typically covers various aspects of the business, such as:

- Capital invested per partner

- Sharing of profits or losses

- Interest on capital invested

- Salaries of partners

- Possible upper limit on drawings

- Interest on drawings

- Interest on a partner's loan to the company

- When money is borrowed from a partner for a specific period, it is crucial to note that this amount is not considered part of the capital. Instead, it is treated similarly to a regular loan. The interest, if applicable, can be recorded in the current account of the partner instead of a separate liability account. In case the interest is paid, it is documented in a standard interest on loan account.

- In a partnership's accounting practices, the capital account can be structured in two ways: it may have two or more sections for the partners, or separate capital accounts can be prepared for each partner. These capital accounts specifically refer to fixed capital accounts. Additionally, for other financial transactions involving partners, a distinct current account and drawings account are established.

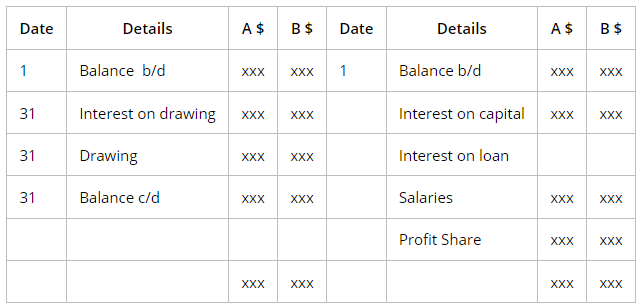

Capital and Current A/C

Current Account Format

Income Statement

- Similar to a sole trader's financial statement.

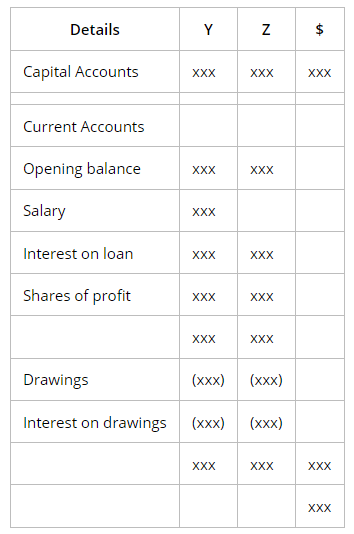

Statement of Financial Position

Format:

Statement of financial position at…..

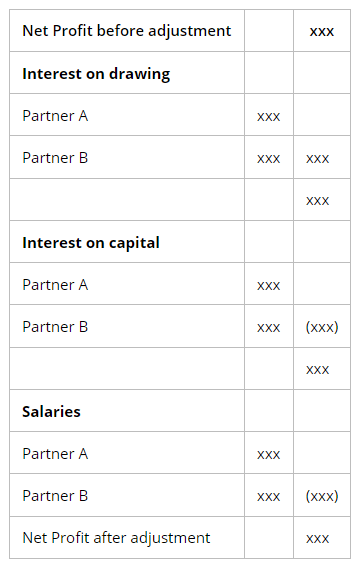

Profit and Loss Appropriation Account

- The profit for the year is calculated, including interest on drawings and deducting interest on capital, partner salaries, and other relevant items. The remaining profit is distributed among partners.

- The format includes:

Limited Companies

- A limited company is a type of business that exists as a distinct legal entity from its owners (shareholders). The shareholders' liability is limited to the value of the shares they own.

- A limited company can be established as a new business entity, or an existing sole trader or partnership can undergo conversion to a limited company for purposes of expansion.

- The capital structure of a limited company is organized into units known as shares. Shareholders' liability for the company's debts is typically limited to the face value of their shares.

- By issuing shares, a substantial amount of capital can be raised to support the company's operations and growth.

- Profits generated by a limited company are distributed among shareholders in the form of dividends, which are usually expressed as a percentage of the face value of the shares they own.

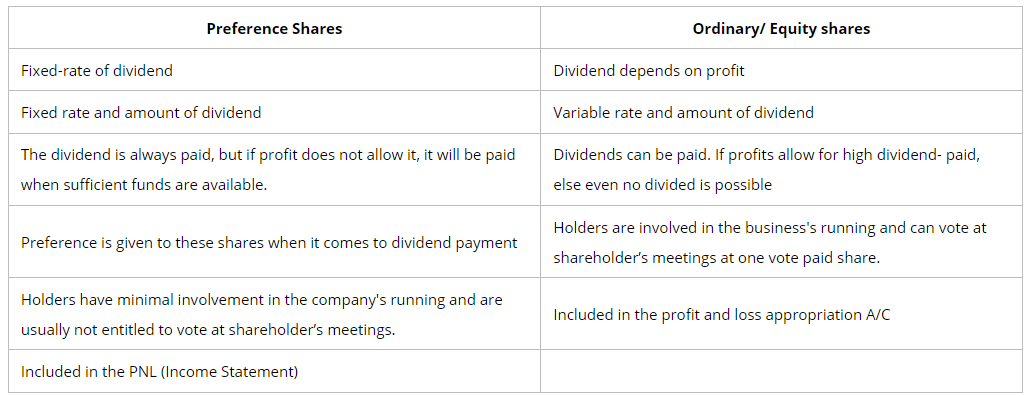

- There are two main types of shares: Preference Shares and Ordinary/Equity Shares:

Company Capital and Equity

- Role of Shareholders and Company Decision-Making: Shareholders cannot engage in daily decision-making of a company, leading to the appointment of a board of directors, CEO, etc. Legal actions target the company rather than its members.

- Authorized Share Capital: In the past, businesses had to specify a maximum limit of issued capital known as authorized share capital.

- Issued Share Capital: This represents the value of shares actually issued by the company, with the flexibility to release more shares when needed.

- Called-up and Paid-up Capital: Companies may not utilize the entire called-up capital immediately, only collecting a portion. Paid-up capital refers to the actual amount received.

- Debentures and Loan Capital: Firms can raise funds through debentures or loan notes, prioritized over dividend payments. Debenture holders lack ownership rights or voting privileges in the company.

Equity and Financial Statements

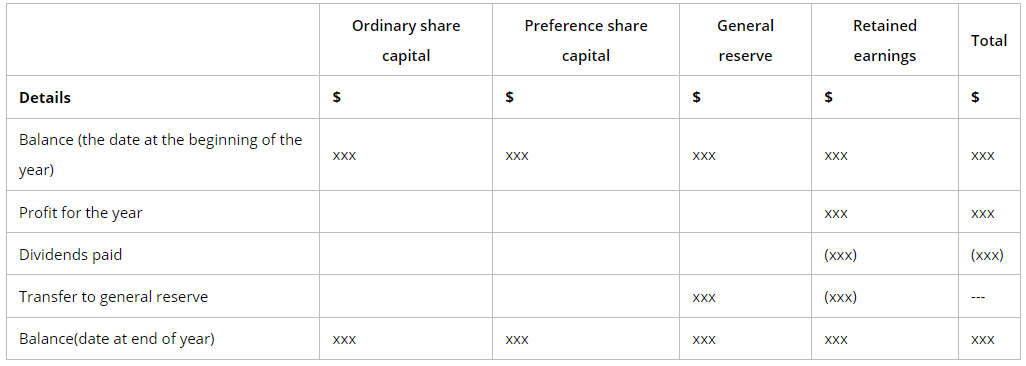

- Statement of Changes in Equity: Companies must disclose these changes, sometimes preparing a profit and loss appropriation account.

- Proposed Dividends and Interim Payments: Proposed dividends are not immediately recorded. Interim dividends are reflected in the statement of financial position at the fiscal year-end.

- Retention of Profits: Not all profits are distributed as dividends due to various reasons such as cash constraints. Unpaid dividends and debenture interests are classified as current liabilities.

- Capital Section of Financial Position: Includes share capital reserves like general reserve and retained profits under 'Capital and Reserves.'

The total of these values = Shareholder’s fund.

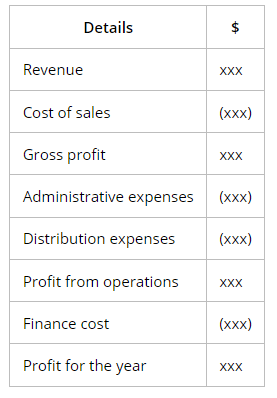

Income Statement

Limited company income statement format:

Statement of Changes in Equity

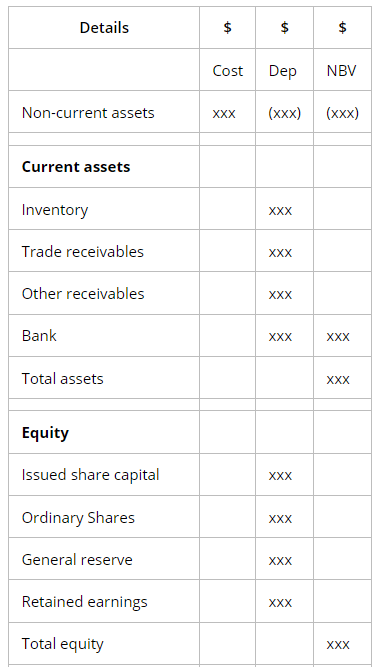

Format: Statement of Financial Position

Statement of Financial Position

Format:

Statement of financial position at……

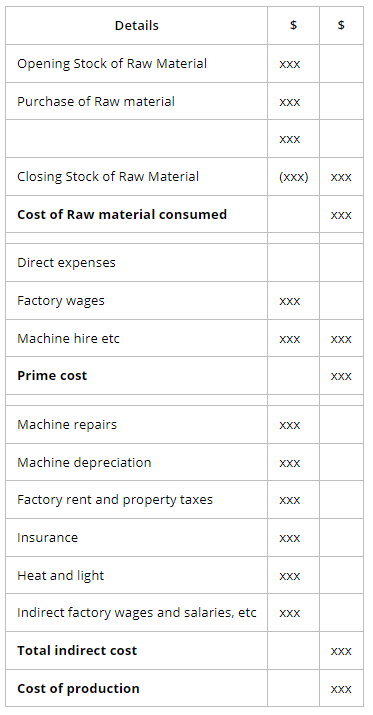

Clubs and Societies

- Clubs and societies are examples of non-trading organizations. Their primary aim is not profit-making but providing services to their members.

- The main source of revenue for these entities comes from member subscriptions, which are usually paid annually for the use of provided facilities. A treasurer oversees the financial management, paying external debts, and collecting dues.

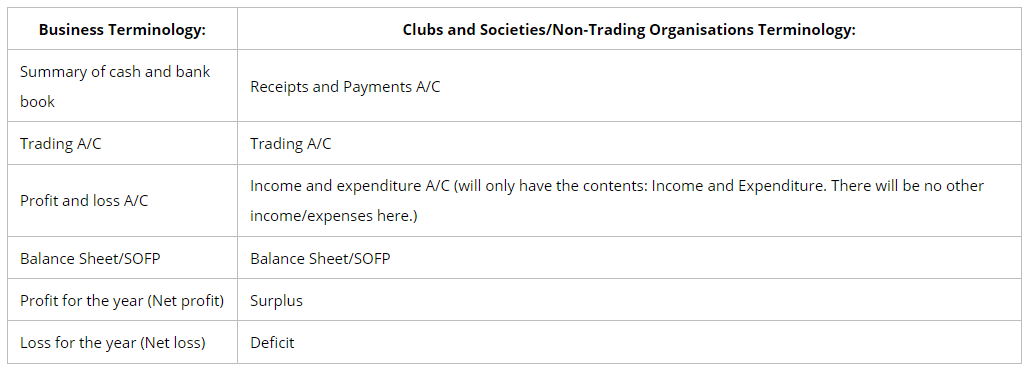

Terminology in Financial Statements and Accounting Records

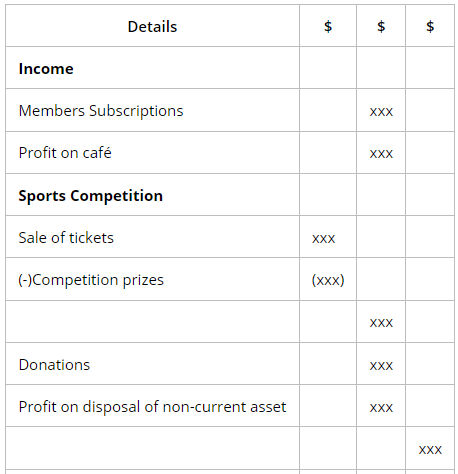

- A surplus represents the surplus of income over expenses, while a deficit indicates expenses exceeding income. The principles governing the preparation of profit and loss accounts are similar to those for income and expenditure accounts.

- When conducting fundraising activities like competitions, it's crucial to offset the income against the related expenses in the income and expenditure account.

- Amounts owed for subscriptions or prepaid subscriptions can be categorized under other receivables or payables, respectively, with appropriate disclosures.

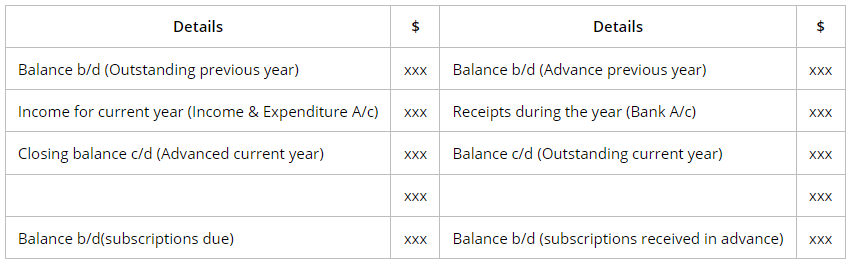

- To align expenses with income, subscription fees for a specific period must be reflected in the income and expenditure account. A separate subscription account is prepared for this purpose, with distinctions made for members who have paid in advance and those who haven't.

Subscription Account Format

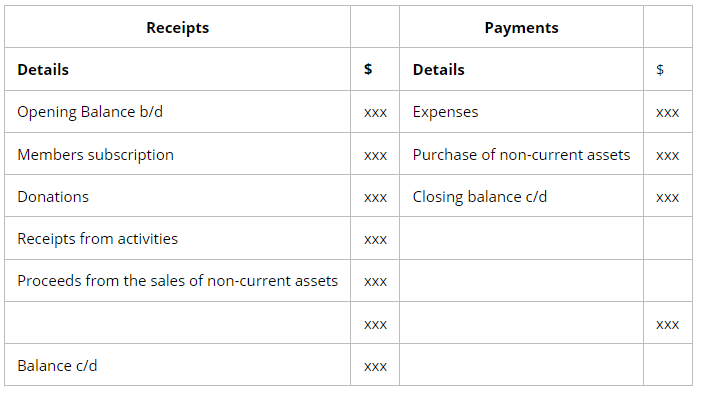

Receipts and Payments Account

- The Receipts and Payments Account usually does not distinguish between cash and bank transactions. It closely resembles a cash book in its structure. Note: Balances on the Account may represent cash, bank, or a combination of both. An opening credit balance could indicate an overdraft.

The Receipts and Payments Account Format

- The receipts and payments account offers a snapshot of funds received and paid out, excluding detailed income and expenses. To determine the actual financial status, additional calculations are necessary with relevant data.

- Clubs and societies engage in trading activities, even if it's not their primary revenue source. They manage a distinct income statement solely for the trading account of each venture. This includes expenses like shop attendant salaries and equipment depreciation. Profits or losses from such ventures are then transferred to the income and expenditure account under other income or expenses.

Income and Expenditure A/C

Income and expenditure account format:

Income and expenditure acc for the year ended…….

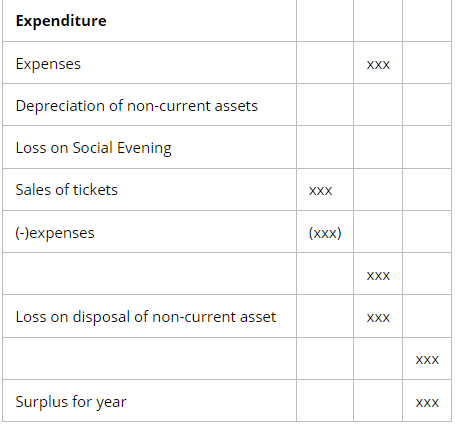

Statement of Affairs

- The financial overview of a club or society resembles that of a business, although without the concept of capital. This absence of capital is due to club or society members not contributing money in the same way as a business owner. Any surplus funds are retained to establish the capital fund, referred to as the accumulated fund. Conversely, a deficit diminishes this fund.

- Just as in a business, Assets = capital + liabilities; in a club of society, Assets = Accumulated funds + Liabilities.

Manufacturing Accounts

- Certain businesses involve manufacturing in addition to buying and selling goods, such as a textile manufacturer producing clothes.

- The accounting records for these businesses resemble those of trading businesses. Moreover, a manufacturing account is maintained to compute the costs incurred in manufacturing goods during a specific financial period.

- Types of inventory include:

- Raw Materials

- Work in Progress

- Finished Goods

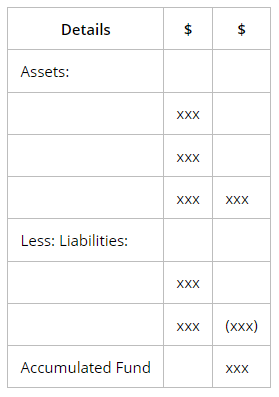

Manufacturing Account Overview

- Manufacturing A/c is prepared to know the cost of production of finished goods using the formula:

- Prime Cost + Factory Overheads

- Prime Cost = Direct Material + Direct Labour + Direct Expenses

- Calculation of unit cost: if a manufacturer makes one identical product, its unit cost can be calculated by the formula:

Manufacturing A/C Format

Income Statement and SOFP

Income statement format:

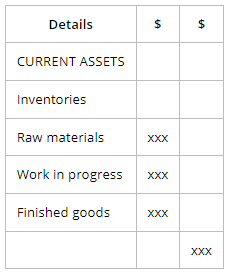

Statement of financial position format:

Incomplete Records

- Certain businesses do not maintain a complete set of double-entry bookkeeping records (e.g., small businesses). No trial balance can be drawn up for them, and some preparatory calculations are required before they can start preparing their financial statements.

- Under a single entry system, not all aspects (Dr. or Cr.) of the financial transaction are recorded; one or both aspects may be recorded.

- When a list of assets and liabilities is prepared without double-entry bookkeeping, it is known as a statement of affairs, similar to a balance sheet.

Why is the Single-Entry System Used?

- The single-entry system is utilized by certain businesses, such as small enterprises, that do not maintain a complete set of double-entry bookkeeping records. In such cases, a trial balance cannot be prepared directly, necessitating preliminary calculations for financial statement preparation.

- In the single-entry system, only one aspect (either Debit or Credit) of a financial transaction is recorded, or in some instances, both aspects might be recorded partially.

- When a statement of affairs is created without double-entry bookkeeping, it serves a similar purpose to a balance sheet, outlining assets and liabilities without the complexities of a double-entry system.

- Small businesses often do not maintain complete accounting book records like traders' partnerships.

- Businesses are generally not required by law to maintain financial statements and usually opt for an entry system.

- Due to the complexity and manual labor involved in maintaining books of accounts, businesses tend to avoid keeping complete records.

- It is cost-effective as fewer books need to be maintained, and there is no need to hire an accountant, clerk, or cashier.

Capital A/C

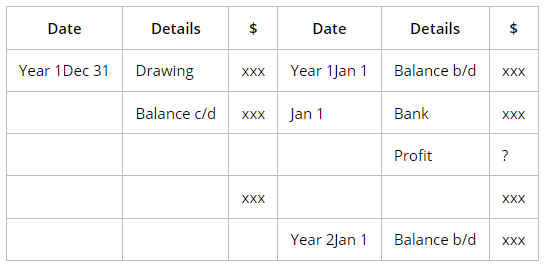

Capital Account Format

- Profit Calculation Process: To determine profit, a Capital Account is utilized to track changes in capital, such as drawings. The variance in capital is then considered either as profit or loss. One limitation of this method is the lack of detailed insights into gross profit and sales, hindering comprehensive analysis for informed decision-making.

- Formula for Profit Calculation: The formula for profit is: Profit = Closing Capital - Drawings - Additional Capital - Opening Capital.

- Comprehensive Financial Statements: Businesses can provide detailed financial information regarding money transactions, assets, and liabilities. This data allows for the computation of sales, purchases, and expenses, leading to the creation of comprehensive financial statements.

- Discrepancies in Creditor and Debtor Transactions: The amounts paid to creditors may not always align precisely with the purchase figures. Similarly, sales figures might differ from the amounts received from debtors due to various factors like pending payments from the previous year.

- Calculating Credit Sales and Purchases: Credit Sales can be determined by subtracting Cash Sales from Total Sales or by preparing a Sales Ledger Control Account. Similarly, Credit Purchases are calculated by deducting Cash Purchases from Total Purchases or by preparing a Purchases Ledger Control Account.

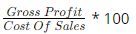

- Markup Calculation:

- Margin Calculation

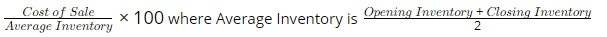

- Understanding Inventory Turnover: The rate of inventory turnover signifies how often a business replaces its inventory within a specific time frame. It is calculated by

- Stolen Cash = Prepare a cash book

- Depreciation = Apply revaluation method

|

22 videos|29 docs|12 tests

|

FAQs on Preparation of Financial Statements - Accounting for GCSE/IGCSE - Year 11

| 1. What are the key differences between Sole Traders, Partnerships, and Limited Companies? |  |

| 2. How do Manufacturing Accounts differ from regular financial statements? |  |

| 3. How can clubs and societies prepare financial statements if they have incomplete records? |  |

| 4. What are some common challenges faced when preparing financial statements for partnerships? |  |

| 5. Why is it important for businesses to accurately prepare financial statements? |  |