Profit And Loss Accounts - Principles of Accounting, Accountancy and Financial Management | Accountancy and Financial Management - B Com PDF Download

Definition and Explanation:

The account through which annual net profit or loss of a business is ascertained, is called profit and loss account. Gross profit or loss of a business is ascertained through trading account and net profit is determined by deducting all indirect expenses (business operating expenses) from the gross profit through profit and loss account. Thus profit and loss account starts with the result provided by trading account.

The particulars required for the preparation of profit and loss account are available from the trial balance. Only indirect expenses and indirect revenues are considered in it. This account starts from the result of trading account (gross profit or gross loss). Gross profit is shown on the credit side of the profit and loss account and gross loss is shown on the debit side of this account. All indirect expenses are transferred on the debit side of this account and all indirect revenues on credit side. If the total of the credit side exceeds the debit side, the result is "net profit" and if the total of the debit side exceeds the total of the credit side, the result is net loss. As the net profit or net loss of a certain accounting period is determined through profit and loss account, so its heading is:

Sequence of Expenses in Profit and Loss Account:

There is no hard and fast rule as to the order in which the items of expenses are shown in profit and loss account. Generally, the items of expenses are shown in the following sequence:

Office and Administration Expenses:

These are the expenses with the management of the business e.g. salaries of manager, accountant and office clerks, office rent, office stationary, office electric charges, office telephone etc.

Selling and Distribution Expenses:

These are the expenses which are directly or indirectly connected with the sale of goods. These expenses vary with the sales i.e. they increase or decrease with the increase or decrease of sale of goods. Examples are advertisements, carriage outward, salesmen's salaries and commission, discount allowed, traveling expenses, bad debts, packaging expenses, warehouse rent etc.

Financial and Other Expenses:

All other expenses excepting those mentioned above are considered under this class.

Features of Profit and Loss Account:

- This account is prepared on the last day of an account year in order to determine the net result of the business.

- It is second stage of the final accounts.

- Only indirect expenses and indirect revenues are shown in this account.

- It starts with the closing balance of the trading account i.e. gross profit or gross loss.

- All items of revenue concerning current year - whether received in cash or not - and all items of expenses - whether paid in cash or not - are considered in this account. But no item relating to past or next year is included in it.

The following is a specimen of profit and loss account

Name of Business

Profit and Loss Account for the year ended

| $ |

| $ |

Trading A/C |

| Trading A/C |

|

Gross profit (transferred) | ----- | Gross profit (transferred) | ----- |

Office and Administration Expenses: | ----- | Interest received | ----- |

Salaries | ----- | Rent received | ----- |

Rent, rates, taxes | ----- | Discount received | ----- |

Postage & telegrams | ----- | Dividend received | ----- |

Office electric charges | ----- | Bad debts recovered | ----- |

Telephone charges | ----- | Provision for discount on creditors | ----- |

Printing and stationary | ----- | Miscellaneous revenue | ----- |

Selling and Distribution Expenses: |

| Net loss - transferred to capital A/C | ----- |

Carriage outward | ----- |

|

|

Advertisement | ----- |

|

|

Salesmen's salaries | ----- |

|

|

Commission | ----- |

|

|

Insurance | ----- |

|

|

Traveling expenses | ----- |

|

|

Bad debts | ----- |

|

|

Packing expenses | ----- |

|

|

Financial and Other Expenses: |

|

|

|

Depreciation | ----- |

|

|

Repair | ----- |

|

|

Audit fee | ----- |

|

|

Interest paid | ----- |

|

|

Commission paid | ----- |

|

|

Bank charges | ----- |

|

|

Legal charges | ----- |

|

|

Net profit - transferred to capital A/C | ----- |

|

|

If credit side exceeds the debit side = Net profit

If debit side exceeds the credit side = Net loss

Example:

The following is the trial balance of XYZ company on 31st December 2005

|

| Dr. | Cr. |

|

| Rs. | Rs. |

1 | Opening stock | 64,000 |

|

2 | Purchases | 460,000 |

|

3 | Returns inwards | 50,000 |

|

4 | Carriage inwards | 16,000 |

|

5 | Salaries | 96,000 |

|

6 | Carriage outwards | 10,000 |

|

7 | Rent | 72,000 |

|

8 | Discount allowed | 8,000 |

|

9 | Sundry debtors | 240,000 |

|

10 | Plant and Machinery | 360,000 |

|

11 | Furniture | 60,000 |

|

12 | Drawings | 18,000 |

|

13 | Sundry creditors |

| 350,000 |

14 | Returns outwards |

| 36,000 |

15 | Sales |

| 740,000 |

16 | Capital |

| 328,000 |

|

| 1,454,000 | 1,454,000 |

The closing stock is valued at Rs.126,000.

Required:

Prepare a profit and loss account for the year ended 31st December 2005.

Solution:

As we have already discussed that profit and loss account starts with the gross profit or gross loss figure produced by trading account, we have to determine the gross profit or gross loss by preparing trading account of XYZ company first.

XYZ co.

Trading Account for the year ended 31.12.2005

|

| Rs. |

|

| Rs. |

Stock 1.1.2005 |

| 64,000 | Sales | 740,000 |

|

Purchases | 4,60,000 |

| Less returns | 50,000 | 470000 |

Less returns | 36,000 | 424,000 |

|

| |

|

| Stock (closing) |

| 126,000 | |

Carriage inward |

| 16,000 |

|

|

|

Gross profit (transf. to P&L A/C) |

| 312,000 |

|

|

|

|

| 816,000 |

|

| 816,000 |

XYZ co.

Profit and Loss Account for the year ended 31.12.2005

| Rs. |

| Rs. |

Office and Administration Expenses: |

| Gross profit (transferred from) | 312,000 |

Salaries | 96,000 |

|

|

Rent, rates, taxes | 72,000 |

|

|

Selling and Distribution Expenses: |

|

|

|

Carriage outwards | 10,000 |

|

|

Discount allowed | 8,000 |

|

|

Net profit - transferred to capital A/C | 126,000 |

|

|

| 312,000 |

| 312,000 |

Profit and Loss Account/Statement

Types of Profit and Loss

- Gross profit/ Gross loss

- Net profit/ Net loss

We prepare Trading account to ascertain the Gross profit/ Gross loss. While we prepare Profit and loss account to ascertain the Net profit/ Net loss.

Profit and loss account is made to ascertain annual profit or loss of business. Only indirect expenses are shown in this account. All the items of revenue and expenses whether cash or non-cash are considered in this account.

Only the revenue or expenses related to the current year are debited or credited to profit and loss account. The profit and loss account starts with gross profit at the credit side and if there is a gross loss, it is shown on the debit side.

Profit and Loss Account Format

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | To Gross profit b/d | ||

Management expenses: | Income: | ||

To salaries | By Discount received | ||

To office rent, rates, and taxes | By Commission received | ||

To printing and stationery | Non-trading income: | ||

To Telephone charges | By Bank interest | ||

To Insurance | By Rent received | ||

To Audit fees | By Dividend received | ||

To Legal charges | By Bad debts recovered | ||

To Electricity charges | Abnormal gains: | ||

To Maintenance expenses | By Profit on sale of machinery | ||

To Repairs and renewals | By Profit on sale of investments | ||

To Depreciation | By Net Loss | ||

(transferred to Capital A/c) | |||

Selling distribution expenses: | |||

To Salaries | |||

To Advertisement | |||

To Godown | |||

To Carriage outward | |||

To Bad debts | |||

To Provision for bad debts | |||

To Selling commission | |||

Financial expenses: | |||

Bank charges | |||

Interest on loan | |||

Discount allowed | |||

Abnormal losses: | |||

To Loss on sale of machinery | |||

To Loss on sale of investments | |||

To Loss by fire | |||

To Net Profit | |||

(transferred to capital a/c) | |||

TOTAL | TOTAL |

Items not shown in Profit and Loss Account Format

- Drawings: Drawings are not the expenses of the firm. Hence, debit it to the Capital a/c and not to the Profit and loss a/c.

- Income tax: In the case of companies income tax is an expense but in the case of a sole proprietor, it is his personal expense. Therefore, debit it to Capital A/c.

- Discount: As we know the discount is of two types – a trade discount and cash discount. We deduct Trade discount from the invoice amount and hence do not show it in the books of accounts. On the other hand, we allow a cash discount when the customer pays the amount on a certain date. We show the cash discount in the books of accounts. Thus, we debit it to profit and loss account.

- Bad debts: It is the amount which is due from a customer and he does not pay it. We debit this amount to Profit and Loss A/c. In case if the provision is already made for bad bets than it is first written off from it. In case if bad debts are recovered, so it is again. Now it is not credited to the party’s account but should be credited to bad debts recovered account. And it will be shown on the credit side of profit and loss account.

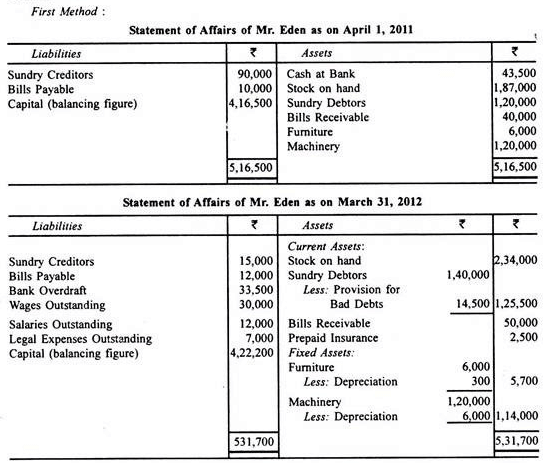

Trading and Profit and Loss Account: Problem with Solution # 1.

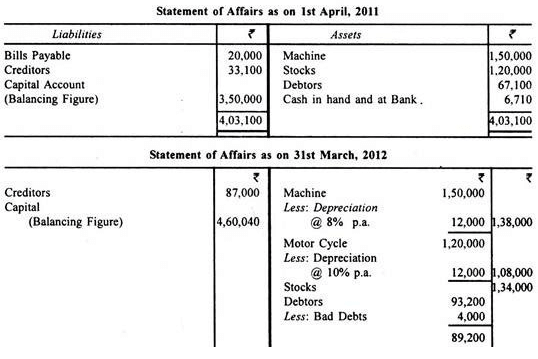

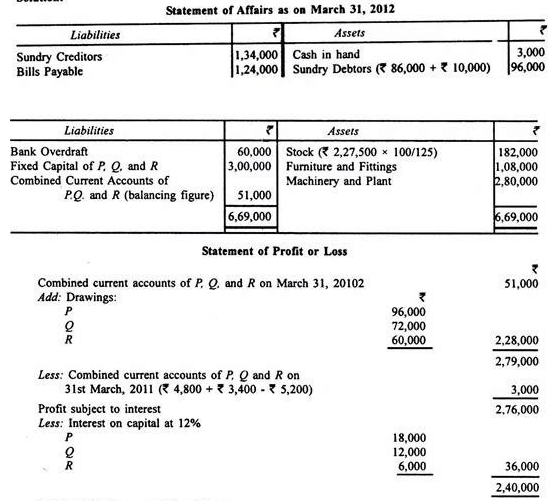

Mr. Z owns a general store in Delhi and does not maintain his accounts on double entry system.

His assets and liabilities on 1st April, 2011 were as follows:

Bills Payable Rs 20,000, Creditors Rs 33,100, Stock Rs 1,20,000, Debtors Rs 66,000, Cash in hand and at Bank Rs 67,100 and Machine Rs 1,50,000

His position on 31st March, 2012 was as follows:

Machine Rs 1,50,000, Debtors Rs 93,200, Motor Cycle Rs 1,20,000, Cash in hand Rs 30,000, Bank balance as per banks-statement Rs 59,300, Stock Rs 1,34,000 and Creditors t 87,000.

During the year, he withdrew Rs 45,000 for household requirements and a motor cycle was purchased for Rs 1,20,000 for business use. A cheque for Rs 7,000 issued in March, 2012 was not presented to bank upto 31st March, 2012.

Ascertain the amount of profit earned by the trader for the year ended 31st March, 2010 after making the following adjustments:

(a) Write off Rs 4,000 as bad debts and make a provision for doubtful debts @ 5% on the remaining debtors.

(b) Provide for full year depreciation on Machine @ 8% per annum and on Motor Cycle @ 10% per annum on diminishing balance method.

Solution:

Trading and Profit and Loss Account: Problem with Solution # 2.

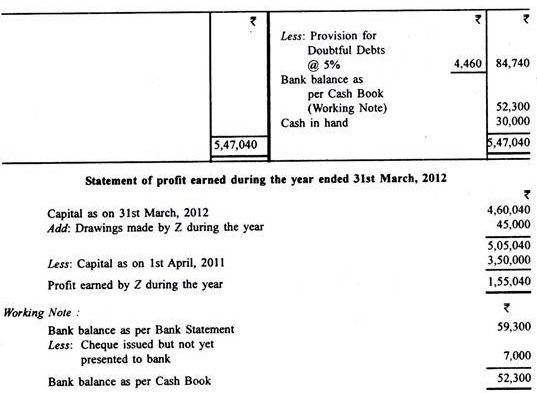

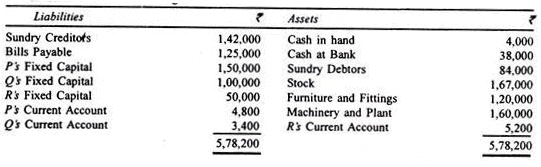

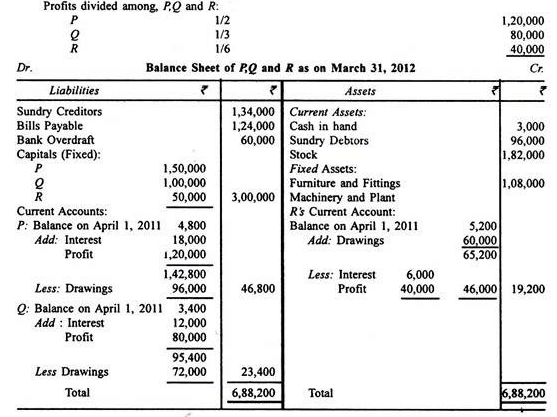

The following is the balance sheet of M/s. P.Q. and R as on March 31.2011:

P, Q, and R share profits in the ratio of 3:2:1 respectively after charging 12% interest on capitals. During 2011-2012, the drawings were: P at Rs 8,000 per month; and Q at Rs 6,000 per month and R at Rs 5,000 per month.

On 31st March 2012, the various assets were: Cash in hand, Rs 3,000; Sundry Debtors, Rs 86,000; Stock, Rs 2,27,500 at selling price which was fixed at cost plus 25% Furniture and Fittings, Rs 1,08,000; and Machinery and Plant, Rs 2,80,000. Liabilities were; Sundry Creditors, Rs 1,34,000; Bills Payable Rs 1,24,000 and Bank Overdraft, Rs 60,000 as per Pass Book which showed that a cheque of Rs 10,000 deposited had been returned dishonoured. Ascertain the profit or loss made by the firm in 2011-2012 and show the Balance Sheet as on 31st March, 2012.

Solution:

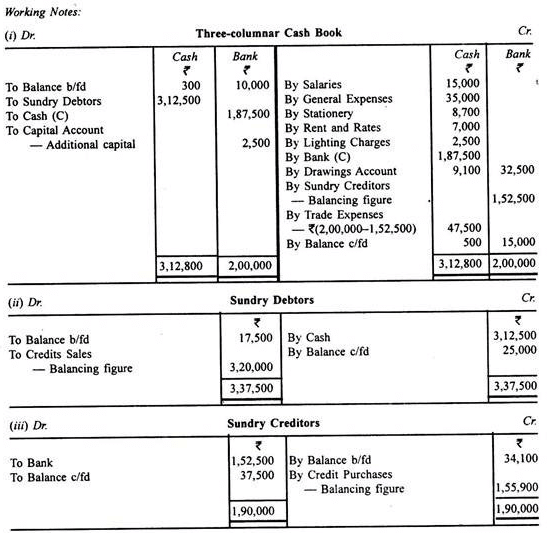

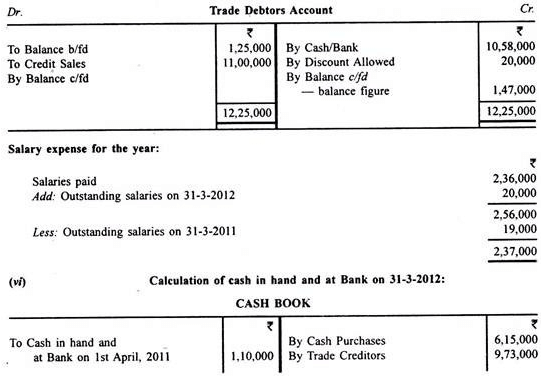

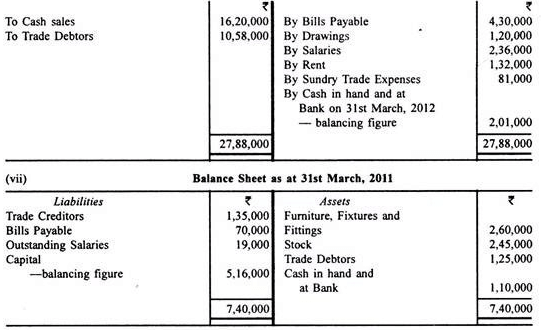

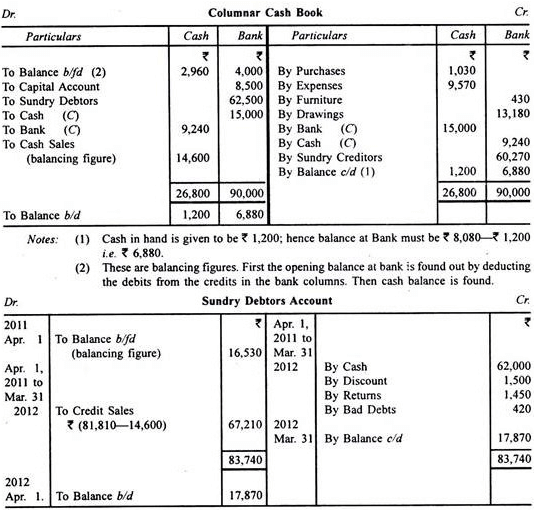

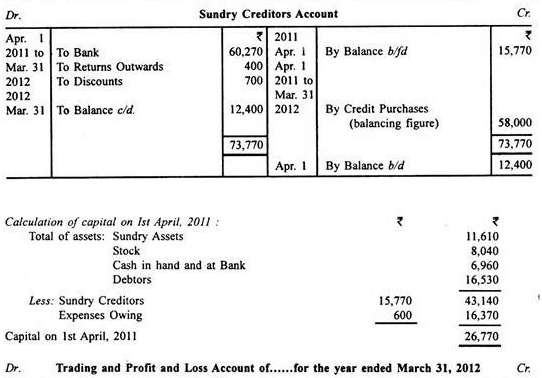

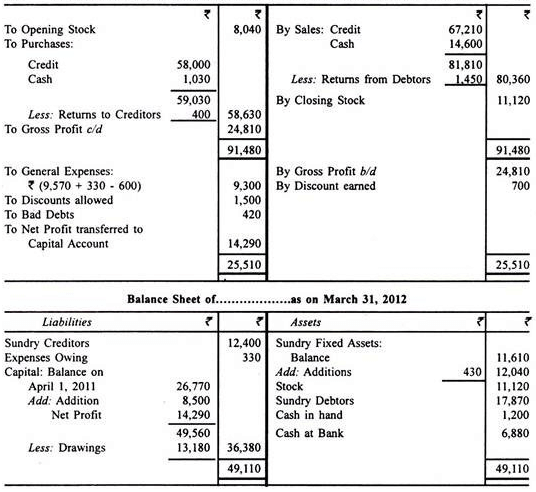

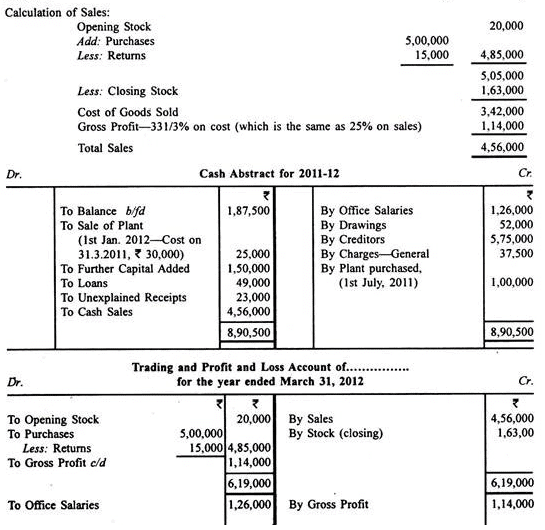

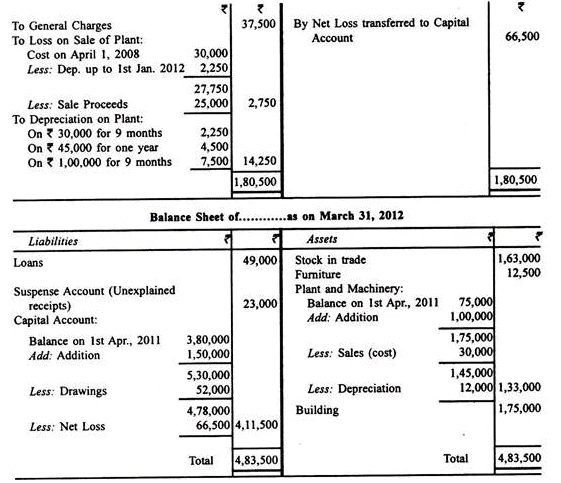

Trading and Profit and Loss Account: Problem with Solution # 3.

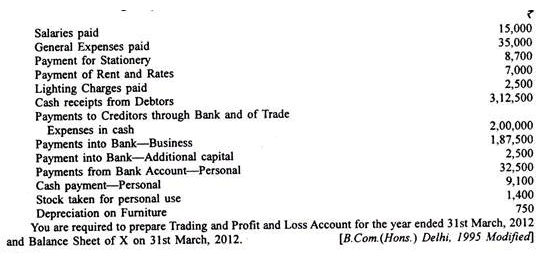

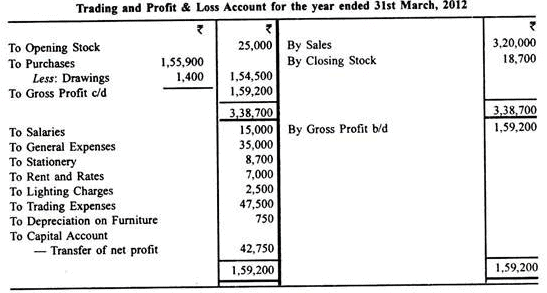

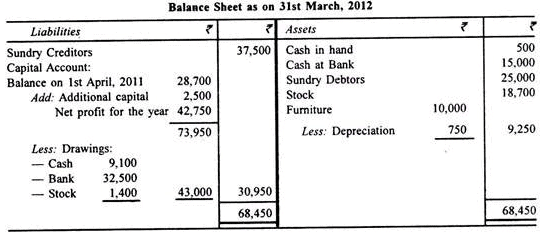

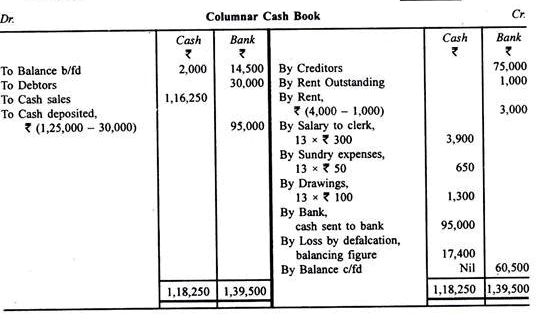

X is a tobacco merchant. He follows the practice of paying creditors for goods purchased through his Bank Account and making payments in cash on all nominal accounts.

X had not kept his books on the double-entry principles nor had he balanced his three-columnar Cash Book.

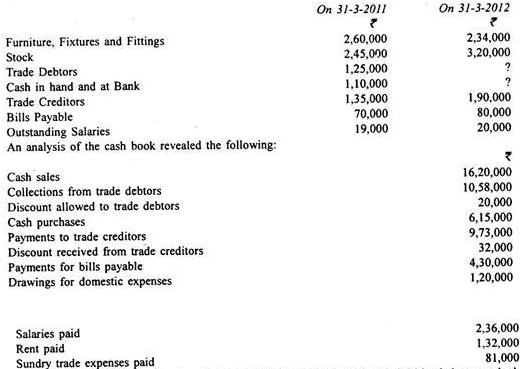

However, the following information has been extracted from A”s accounting records:

Transactions during the year ended 31st March, 2012 were as follows:

Solution:

Trading and Profit and Loss Account: Problem with Solution # 4.

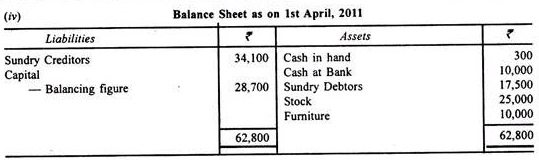

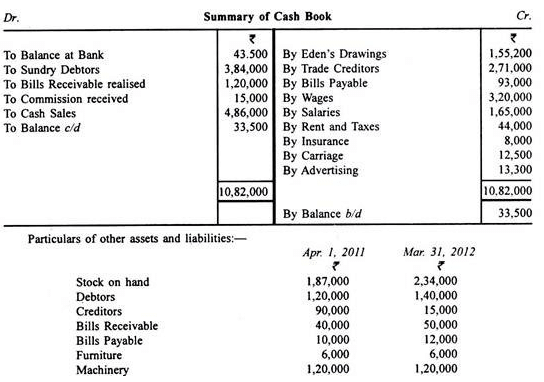

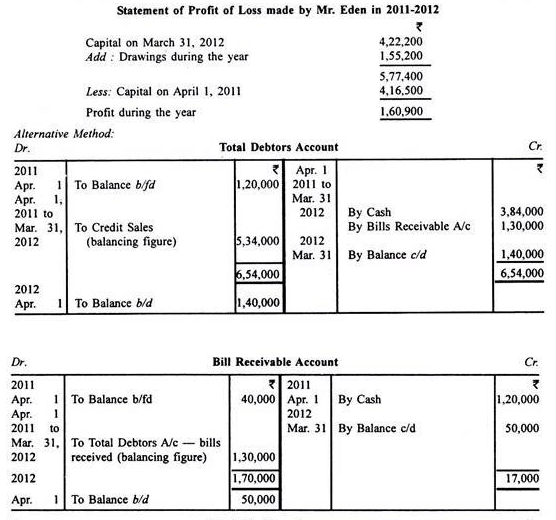

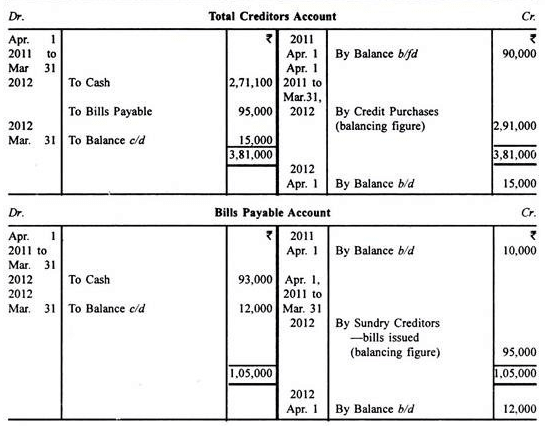

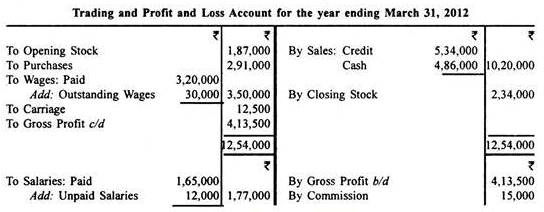

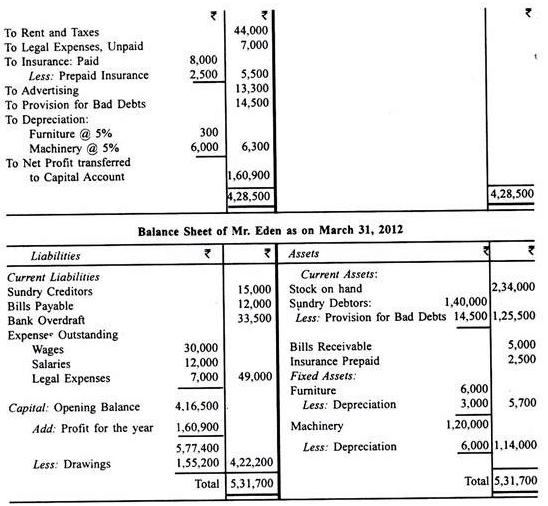

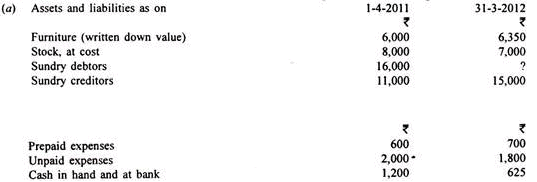

Mr. Eden who keeps his books by single entry system gives you the following information for the year ended 31st March, 2012:

A provision of Rs 14,500 is required for doubtful debts and depreciation at 5% is to be written off on Machinery and Furniture. Rs 30,000 is outstanding for wages and Rs 12,000 for salaries. Insurance has been prepaid to the extent of Rs 2,500. Legal Expenses are outstanding to the extent of Rs 7,000.

Find out in two different ways the profit or loss made by Mr. Eden during 2011-2012. Also prepare his balance sheet at the end of the year.

Solution:

Trading and Profit and Loss Account: Problem with Solution # 5.

The books of account of a trader showed the following figures:

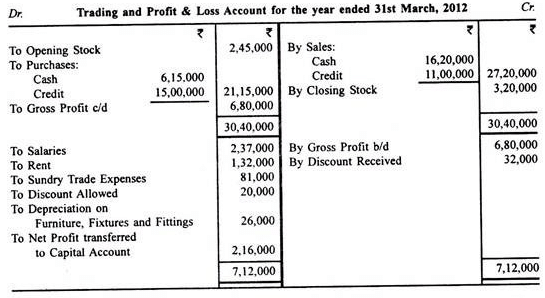

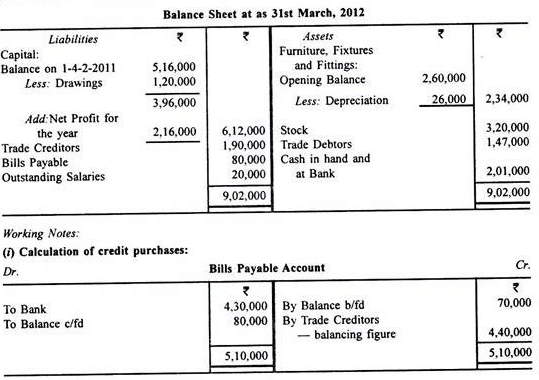

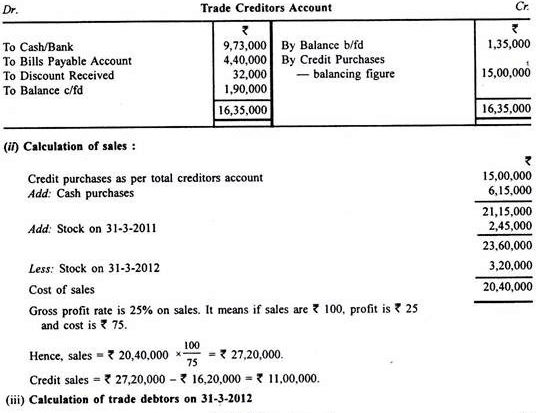

Depreciation is provided on furniture. fixtures and fittings @ 10% p.a. on diminishing balance method. The trader maintains a steady gross profit rate of 25% on sales.

You arc required to prepare trading and profit & loss account for the year ended 31st March, 2012 and balance sheet as at that date.

Solution:

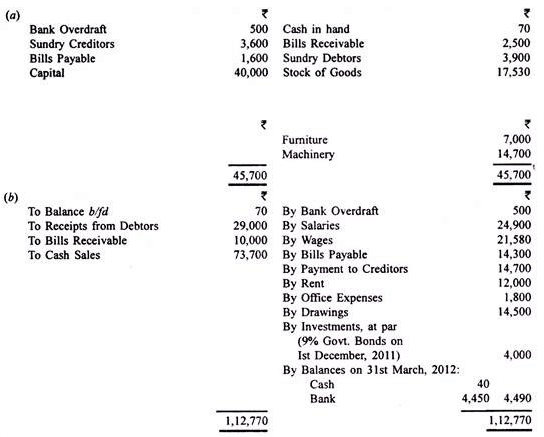

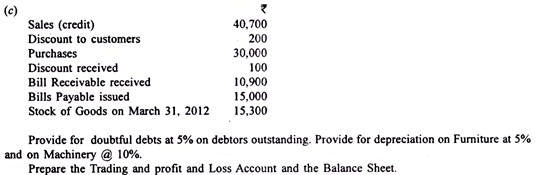

Trading and Profit and Loss Account: Problem with Solution # 6.

You are given:

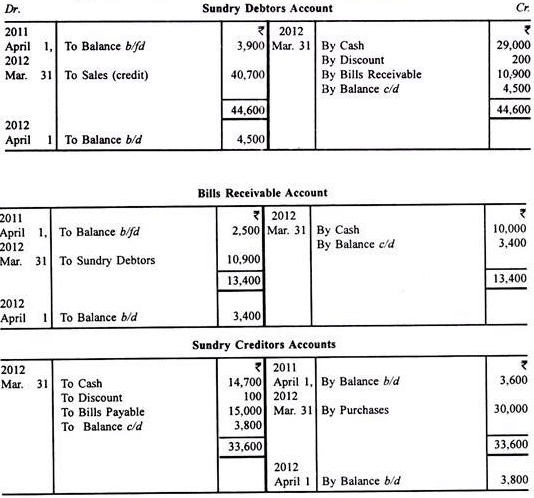

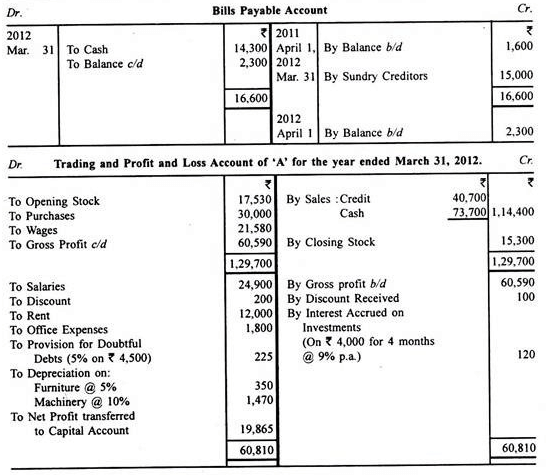

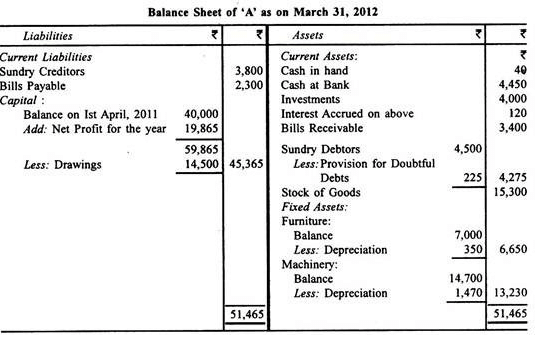

(a) The Balance Sheet of A on 1st April, 2011 (b) The cash transactions for the year up to March 31, 2012 (c) A summary of the remaining trading transactions.

Solution:

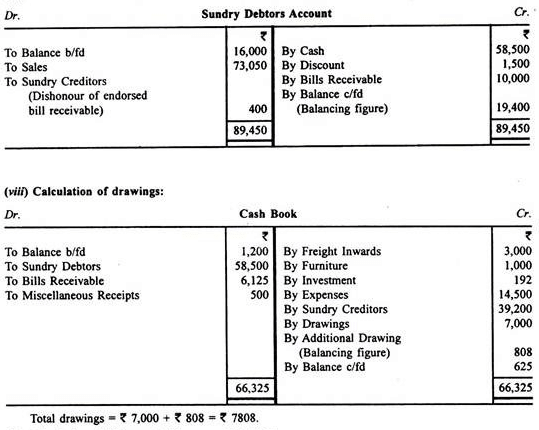

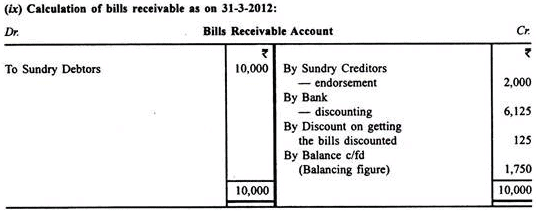

Nose. The student is given here all the transactions but not the closing balances of debtors, bills receivable, creditors and bills payable. Without these balances, the balance sheet cannot be prepared on March 31, 2012. Hence the following four accounts.

Trading and Profit and Loss Account: Problem with Solution # 7.

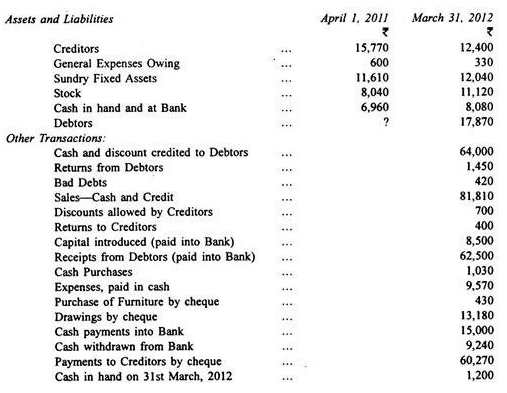

The following information is supplied, from which you are required to prepare Trading and Profit and Loss Account for the year ended and Balance Sheet as on 31st March, 2012:

Solution:

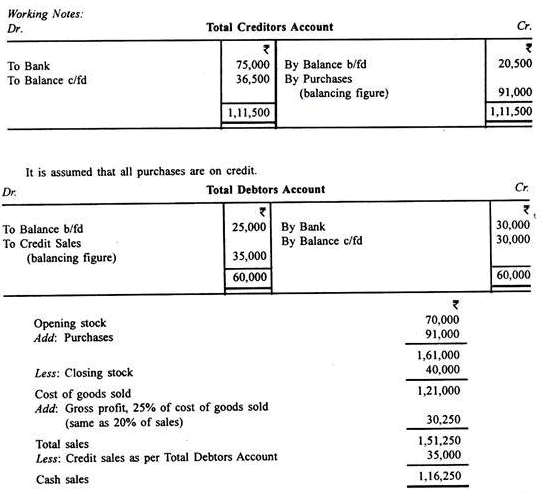

It will be noted that since the capital in the beginning is not given, the opening balance sheet will be necessary, For this, the figure for debtors in the beginning will have to be found out. This requires information regarding credit sales. But the question gives information regarding cash and credit sales combined. Hence, it is necessary to prepare the Cash Book, besides Total Debtors and Total Creditors accounts.

Trading and Profit and Loss Account: Problem with Solution # 8.

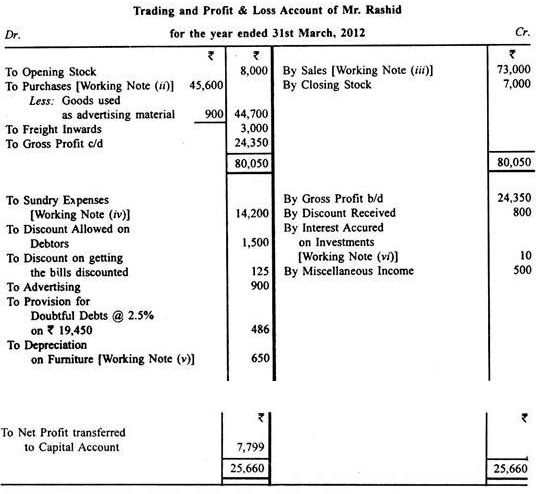

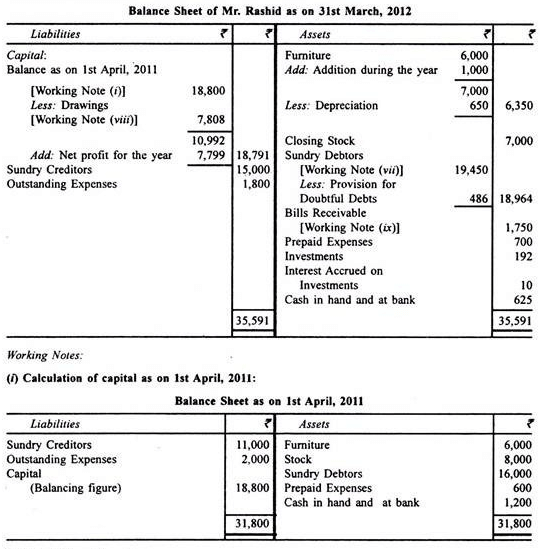

Mr. Rashid furnishes you with the following information relating to his business:

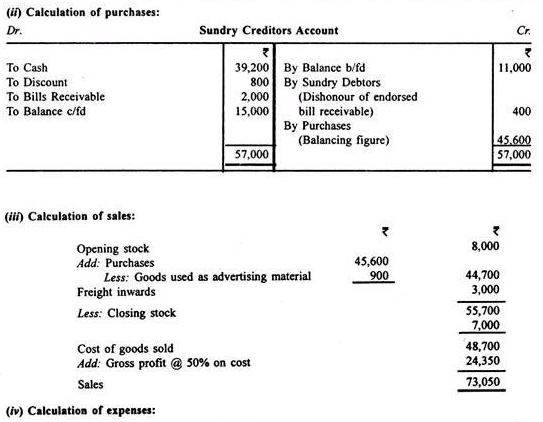

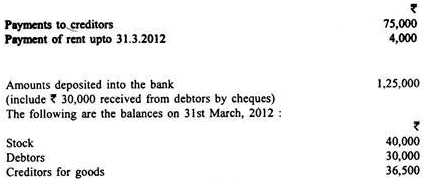

(b) Receipts and payments during the year ended 31-3-2012:

(i) Collections from debtors, after allowing discount of Rs 1,500 amounted to Rs 58,500.

(ii) Collections on discounting of bills of exchange, after deduction of discount of Rs 125 by the bank totalled Rs 6,125.

(iii) Creditors of Rs 40,000 were paid Rs 39,200 in full settlement of their dues.

(iv) Payment of freight inwards, Rs 3,000.

(v) Amounts withdrawn for personal use, Rs 7,000.

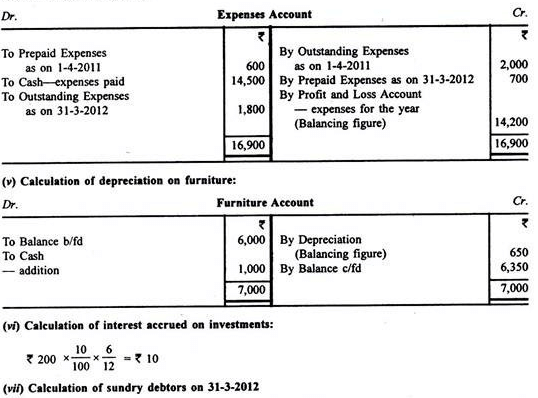

(vi) Payment for office furniture, Rs 1,000.

(vii) Investment of the face value of Rs 200 and carrying annual interest of 10% were purchased at 96% on 1st July, 2008 and payment made therefor.

(viii) Expenses including salaries paid, Rs 14,500.

(ix) Miscellaneous receipts, Rs 500.

(c) Bills of exchange drawn on and accepted by customers during the year amounted to Rs 10,000. Of these, bills of exchange of Rs 2,000 were endorsed in favour of creditors. An endorsed bill of exchange of Rs 400 was dishonoured.

(d) Goods costing Rs 900 were used as advertising materials.

(e) Goods are invariably sold to show a gross profit of 33 1/3% on sales.

(f) Difference in cash books, if any, is to be treated as further drawing or introduction by Mr. Rash id.

(g) Provide at 2.5% for doubtful debts on closing debtors.

Rashid asks you to prepare trading and profit and loss account for the year ended 31st March, 2012 and the balance sheet as on that date.

Solution:

Trading and Profit and Loss Account: Problem with Solution # 9.

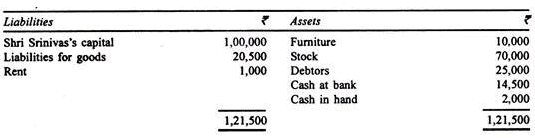

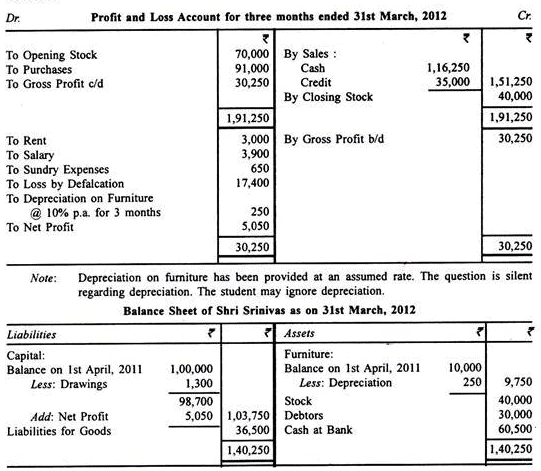

The following is the Balance Sheet of the retail business of Shri Srinivas as at 31st March, 2011:

You are furnished with the following information:

(1) Shri Srinivas sells his goods at a profit of 20% on sales.

(2) Goods are sold for cash and credit. Credit customers pay by cheques only.

(3) Payments for purchases are always made by cheques.

(4) It is the practice of Shri Srinivas to send to the bank every weekend the collections of the week after paying every week, salary of Rs 300 to the clerk, sundry expenses of Rs 50 and personal expenses Rs 100.

Analysis of the Bank Pass-book for the 13 week period ending 31st March, 2012 disclosed the following:

On the evening of 31st March, 2012 the Cashier absconded with the available cash in the cash box. There was no cash deposit in the week ended on that date.

You are required to prepare a statement showing the account of cash defalcated by the Cashier and also a Profit and Loss Account for the period ended 31st March, 2012 and a Balance Sheet as on that date.

Solution:

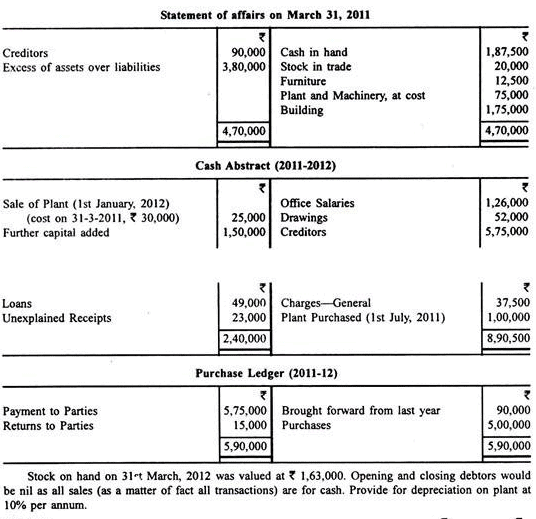

Trading and Profit and Loss Account: Problem with Solution # 10.

While you are dealing with a case of preparation of accounts from incomplete records, you find that the Cash Account (Abstract) is out of balance to such an extent that it is obvious that the record of cash takings is wholly unreliable. Accordingly, you decide to ignore the takings figure as recorded and arrive at your sales figure on the basis of purchases as shown and the gross profit percentage ratio applicable to the trade concerned which is in the neighbourhood of 25 per cent on sales.

From the information below, you are required to prepare a Trading and Profit and Loss Account for the year ended 31st March, 2012 and the statement of affairs on that date:

Solution:

|

44 videos|75 docs|18 tests

|

FAQs on Profit And Loss Accounts - Principles of Accounting, Accountancy and Financial Management - Accountancy and Financial Management - B Com

| 1. What is a profit and loss account? |  |

| 2. What is the purpose of a profit and loss account? |  |

| 3. How is a profit and loss account prepared? |  |

| 4. What is the difference between gross profit and net profit? |  |

| 5. How can a profit and loss account be used for financial analysis? |  |