Rectfication of Errors ( Part - 2) - Commerce PDF Download

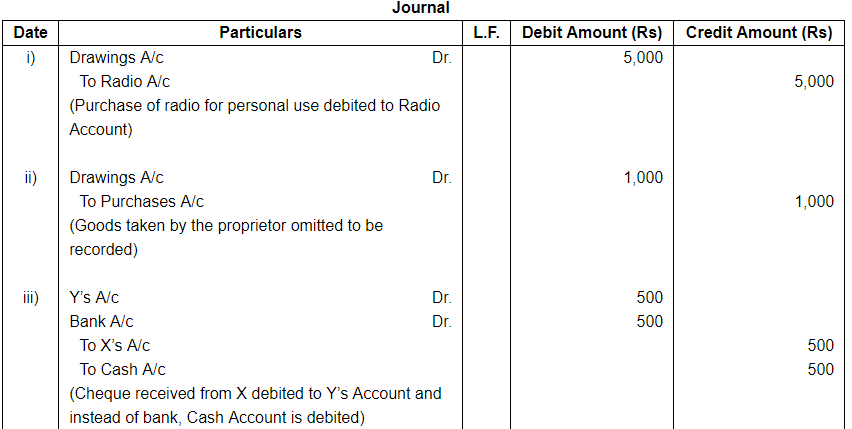

Question 12:

Pass rectifying entries:-

(i) ₹ 5,000 being the cost of a Radio purchased for the personal use of the proprietor has been debited to Radio account in the ledger.

(ii) Goods taken by the proprietor for ₹ 1,000, has not been entered in the books at all.

(iii) A cheque of ₹ 500 received from X was credited to the account of Y and debited to Cash instead of Bank A/c.

(iv) A cheque of ₹ 1,300 received from Ram Lal was dishonoured and debited to 'General Expenses' A/c.

(v) A sum of ₹ 3,000 drawn by the proprietor for his private travel was debited to 'Travelling Expenses A/c'.

(vi) Credit purchase of ₹ 500 from Ajay were posted to the credit of Vijay A/c.

(vii) An amount of ₹ 1,600 due from Chandan Lal was written off as 'Bad-debt' in previous year, was unexpectedly received this year, and has been credited to the account of Chandan Lal.

ANSWER:

Two Sided Errors

Page No 19.42:

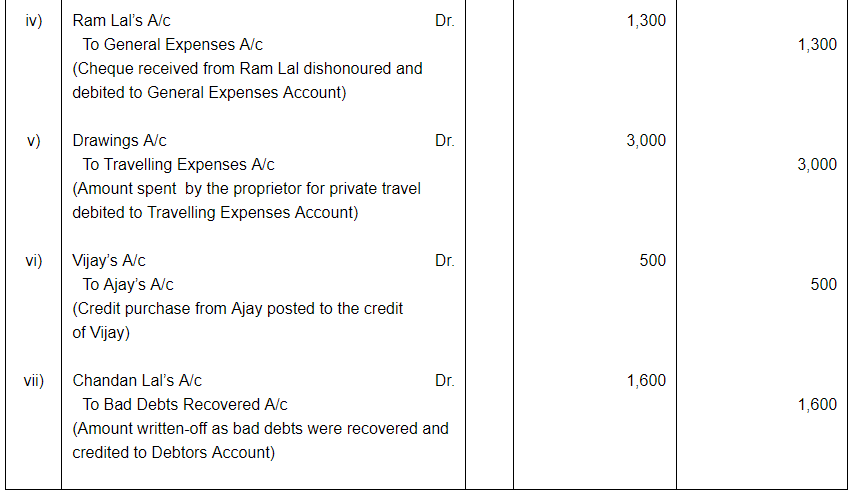

Question 13:

Rectify the following errors which were detected before preparing the Trial Balance:

(i) Purchase book has been overcast by ₹ 1,000.

(ii) Purchase from Ram ₹ 20,000 has been omitted to be posted to his account.

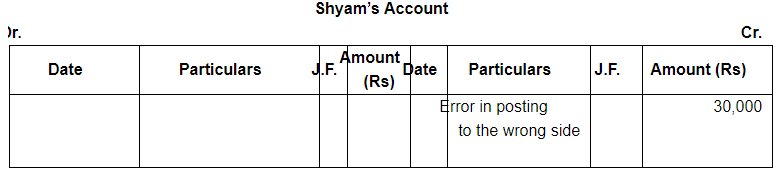

(iii) Purchase from Shyam ₹ 15,000 has been posted to the debit side of his account.

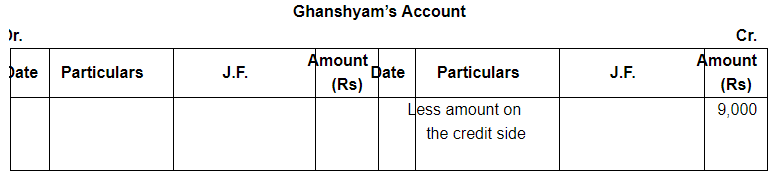

(iv) Purchase from Ghanshyam ₹ 10,000 has been posted to his account as ₹ 1,000.

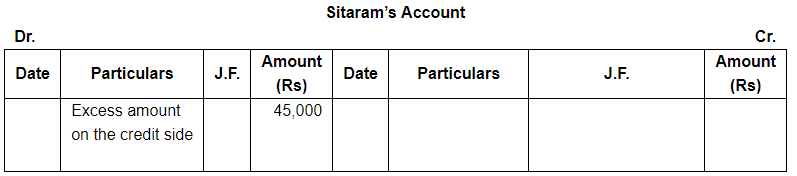

(v) Purchase from Sita Ram ₹ 5,000 has been posted to his account as ₹ 50,000.

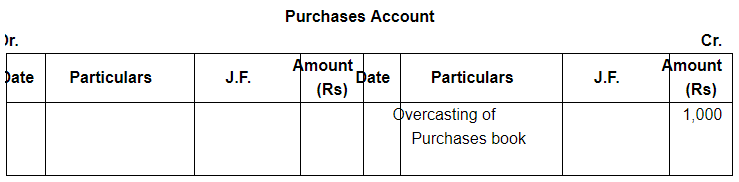

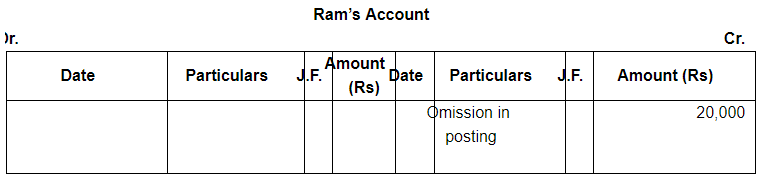

ANSWER:

One Sided Errors

1. Purchases Book has been overcasted by Rs 1,000. Since it is an error of casting that means individual creditors accounts have been posted correctly and only the total of purchases book has been posted incorrectly to the debit side of Purchases Account. Thus, Purchases Account will be rectified by recording Rs 1,000 on the credit side of Purchases Account.

2. Purchases from Ram Rs 20,000 has been omitted to be posted to his account. This mistake is happened only in Ram’s Account which means that the total of Purchases Book is correct. Thus, in order to rectify this error Rs 20,000 should be posted on the credit side of Ram’s Account.

3. Purchase from Shyam Rs 15,000 has been posted to the debit side of his account. It implies that there is no mistake in Purchases account, however, Shyam’s account has been wrongly debited with Rs 15,000 instead of crediting. Thus, rectification will be done by posting the double amount (Rs 30,000) on the credit side of Shyam’s Account.

4. Purchases made from Ghanshayam Rs 10,000 have been posted to his account as Rs 1,000. It is a mistake at the time of posting in the ledger account which implies that there is no mistake in the Purchases Account. In this case, Ghanshyam’s Account was credited with lesser amount. So, Rs 9,000 more will be credited to his account for rectification of this error.

5. Purchases made from Sitaram Rs 5,000 have been posted to his account as Rs 50,000. It implies that his account is credited with an excess amount of Rs 45,000 (50,000 – 5,000). Thus, in order to rectify this error Rs 45,000 is debited to Sitaram’s Account.

Question 14:

Rectify the following errors which were detected before preparing the Trial Balance:

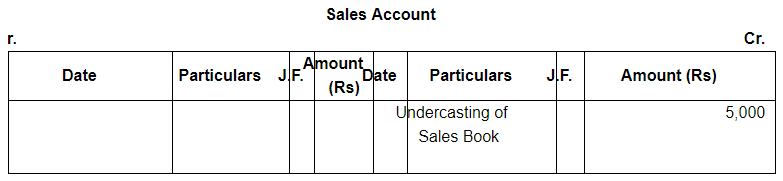

(i) The total of Sales Book carried forward ₹ 5,000 less.

(ii) A credit sale to Sita ₹ 6,300 posted as ₹ 3,600.

(iii) A credit sale to Radha ₹ 2,400 posted as ₹ 4,200.

(iv) A credit sale to Parbati ₹ 3,000 credited to her account.

(v) A credit sale to Laxmi ₹ 5,600 credited as ₹ 6,500.

ANSWER:

One Sided Errors

1. Sales book has been undercasted by Rs 5,000. Since it is an error of casting that means individual debtors accounts have been posted correctly and only the total of sales book has been posted incorrectly to the credit side of Sales Account. In this case it has been undercasted accordingly it would be rectified by crediting Sales Account with Rs 5,000.

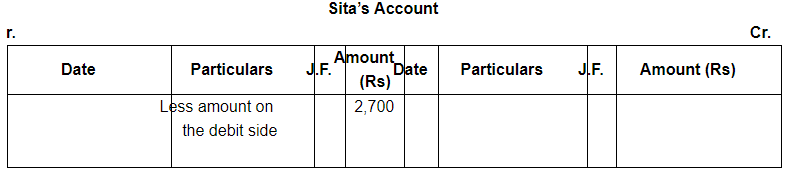

2. Credit sale to Sita Rs 6,300 has been posted to her account as Rs 3,600. It implies that Sita’s Account was debited with lesser amount. Thus, Rs 2,700 more will be debited to her account for rectification of this error.

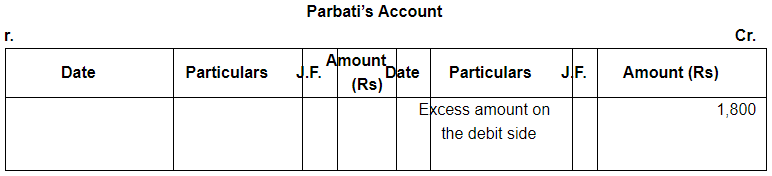

3. Credit sale to Radha Rs 2,400 has been posted to her account as Rs 4,200. In this case, Radha’s Account was debited with an excess amount of Rs 1,800 and accordingly Rs 1,800 should be credited to her account.

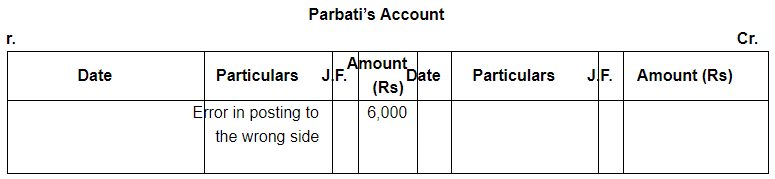

4. A credit sale to Parbati Rs 3,000 has been posted to the credit side of her account. This transaction must have been recorded on the debit side of Parbati’s Account, but, mistakenly it was recorded on the credit side. Thus, Rs 6,000 must be debited to her account.

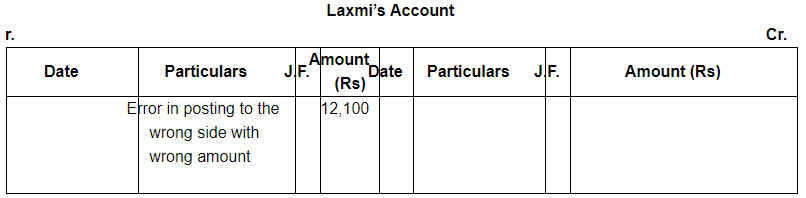

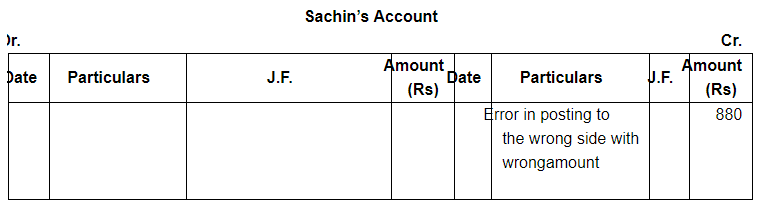

5. A credit sale to Laxmi Rs 5,600 has been posted to the credit side of her account as Rs 6,500. In this case, the transaction was recorded on the wrong side with wrong amount. Thus, Rs 12,100 (5,600 + 6,500) must be debited to her account.

Question 15(A):

Rectify the following errors assuming:-

That no suspense account has been opened with difference in the trial balance.

ANSWER:

One Sided Errors

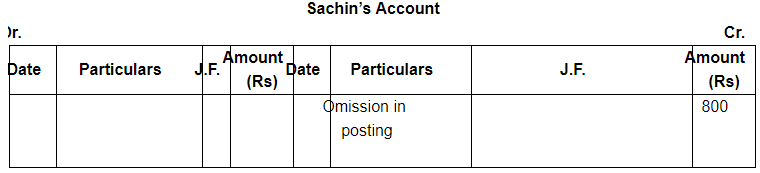

1. Purchases of Rs 800 from Sachin have been omitted to be posted to his account. It is a mistake at the time of posting in the ledger. Since the entry in the Purchases Book is correct, total of Purchases Book will also be correct. The mistake is only in Sachin’s account where Rs 800 has not been posted to the credit side of his account. So it would be rectified by crediting Sachin’s account with Rs 800.

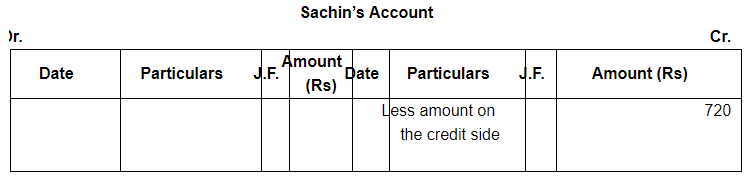

2. Purchases of Rs 800 from Sachin have been posted to his account as Rs 80. It is a mistake at the time of posting in the ledger. Because the entry in the Purchase Book is correct, so there is no mistake in Purchases account, the mistake will affect only Sachin’s Account where lesser amount has been credited to his account. So, Rs 720 more will be credited to his account for rectification of this error.

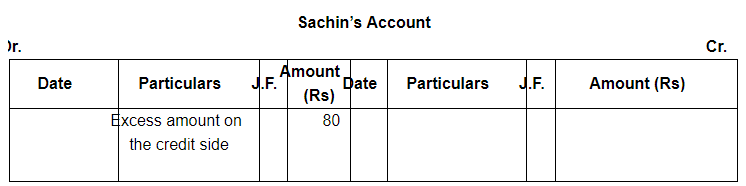

3. Purchases of Rs 800 from Sachin have been posted to his account as Rs 880. It is a mistake at the time of posting in the ledger. Because the entry in the Purchase Book is correct, so there is no mistake in Purchases account, the mistake will affect only Sachin’s account where an excess amount of Rs 80 is credited to his account. So Rs 80 will be debited to his account for rectification of this error.

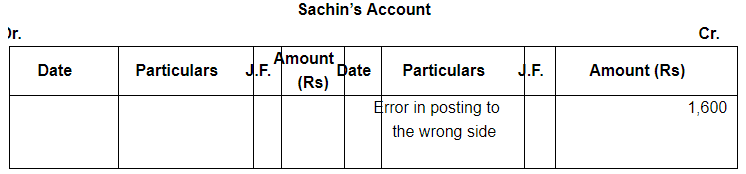

4. Purchase of Rs 800 from Sachin have been posted to the debit side of his account. It is a mistake at the time of posting in the ledger. There is no mistake in Purchases account the mistake will affect only Sachin’s account. Sachin’s account has been wrongly debited with Rs 800 instead of crediting his account. Hence rectification would be made by double the amount of entry.

5. Purchase of Rs 800 from Sachin have been posted to the debit side of his account as Rs 80. It is a mistake at the time of posting in the ledger. There is no mistake in Purchases account the mistake will affect only Sachin’s account. Sachin’s account has been wrongly debited with Rs 80 instead of crediting his account as Rs 800. Hence rectification would be made by adding these two amounts and Rs 880 will be credited to his account.

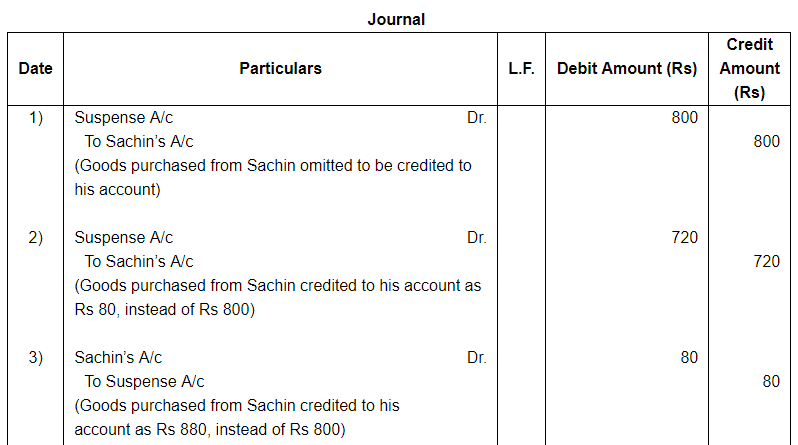

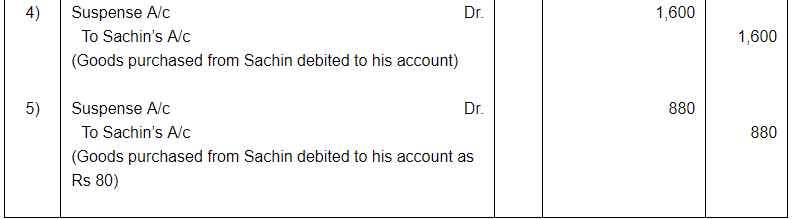

Question 15(B):

Rectify the following errors assuming:-

that such a suspense account has been opened.

1. Goods costing ₹ 800 purchased from Sachin on credit were omitted to be credited to his account.

2. Goods costing ₹ 800 purchased from Sachin on credit were credited to his account as ₹ 80.

3. Goods costing ₹ 800 purchased from Sachin on credit were credited to his account as ₹ 880.

4. Goods costing ₹ 800 purchased from Sachin on credit were posted to the debit of his account.

5. Goods costing ₹ 800 purchased from Sachin on credit were posted to the debit of his account as ₹ 80.

ANSWER:

One Sided Errors

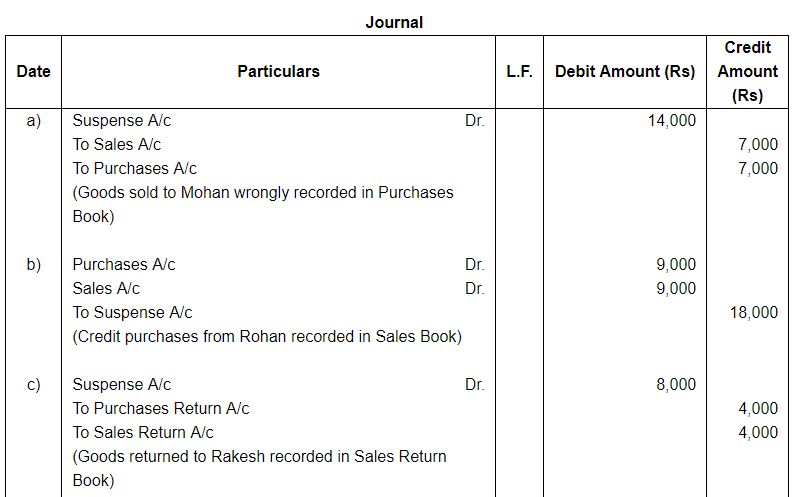

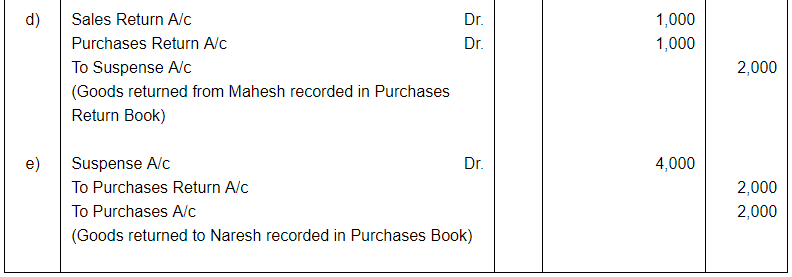

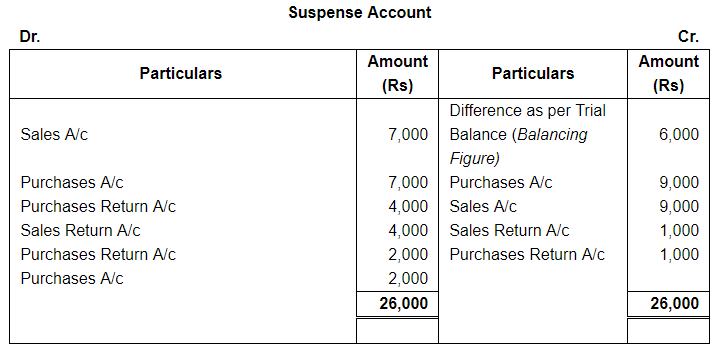

Question 16:

Rectify the following errors assuming that Suspense Account was opened. Ascertain the difference in Trial Balance.

(a) Credit sales to Mohan ₹ 7,000 were recorded in Purchase Book. However, Mohan's Account was correctly debited.

(b) Credit purchases from Rohan ₹ 9,000 were recorded in Sales Book. However, Rohan's Account was correctly credited.

(c) Goods returned to Rakesh ₹ 4,000 were recorded in Sale Returns Book. However, Rakesh's Account was correctly debited.

(d) Goods returned from Mahesh ₹ 1,000 were recorded through Purchase Returns Book. However, Mahesh's Account was correctly credited.

(e) Goods returned to Naresh ₹ 2,000 were recorded through Purchases Book. However, Naresh's Account was correctly debited.

ANSWER:

One Sided Errors

Page No 19.43:

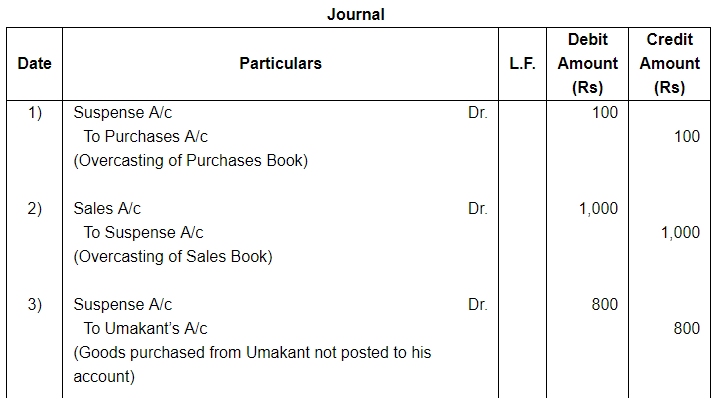

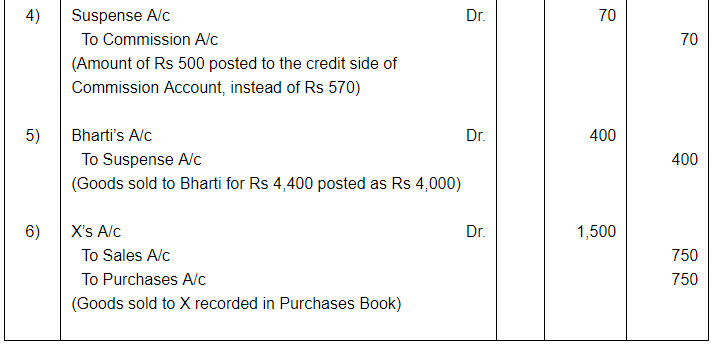

Question 17:

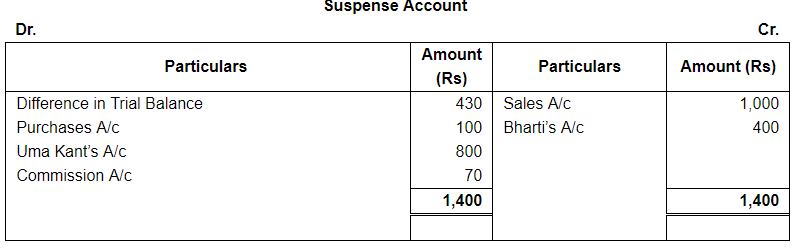

There was a difference of ₹ 430 in a Trial Balance. It was placed on the Debit side of a Suspense A/c. Later on the following errors were discovered. Pass rectifying entries and prepare Suspense A/c.

1. Purchases book was overcast by ₹ 100.

2. Sales book was overcast by ₹ 1,000.

3. Goods for ₹ 800 purchased from Umakant, though entered in the purchase book, has not been posted to his account.

4. An amount of ₹ 500 has been posted to the credit side of commission account instead of ₹ 570.

5. Goods sold to Bharti for ₹ 4,400 has been posted to her account as ₹ 4,000.

6. Goods sold to X for ₹ 750 were recorded in purchase book.

ANSWER:

One Sided Errors

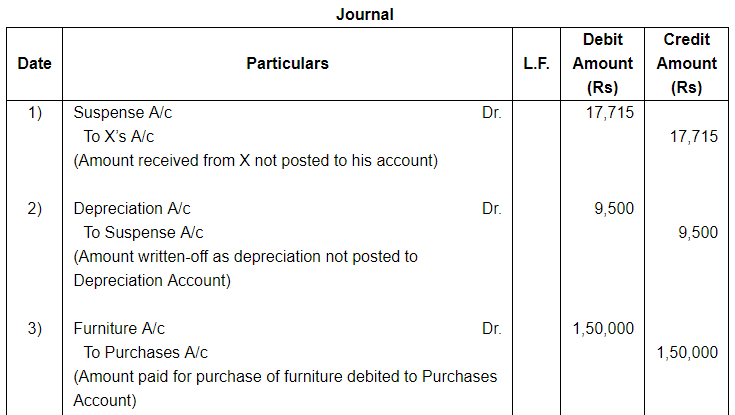

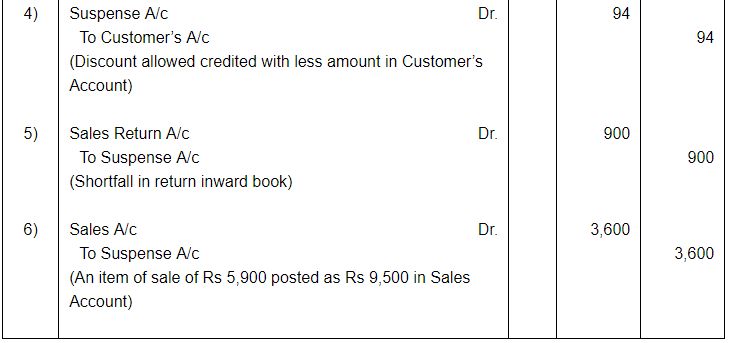

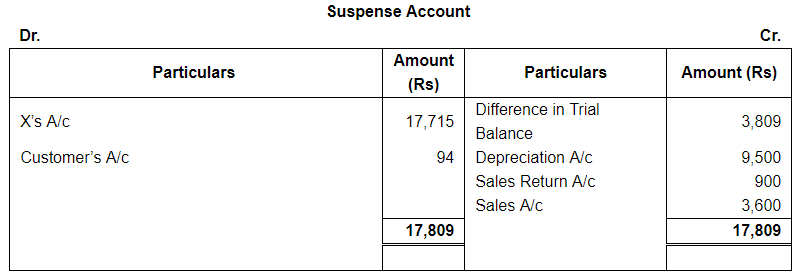

Question 18:

In taking out the Trial Balance, book-keeper finds that he is out ₹ 3,809 excess debit. Being desirous of closing his books he places the difference to a newly opened Suspense A/c which is carried forward. In the next period he discovered that :-

1. ₹ 17,715 received from X has not been posted to his account.

2. A sum of ₹ 9,500 written off as depreciation on fixtures has not been posted to the Depreciation A/c.

3. ₹ 1,50,000 paid for furniture purchased has been charged to Ordinary Purchases A/c.

4. A discount of ₹ 3,742 allowed to a customer has been credited to him as ₹ 3,648.

5. The total of the Inwards return has been added ₹ 900 short.

6. An item of Sale for ₹ 5,900 was posted as ₹ 9,500 in the Sales Account.

Give the rectifying entries and prepare the Suspense Account.

ANSWER:

One Sided Errors

Question 19:

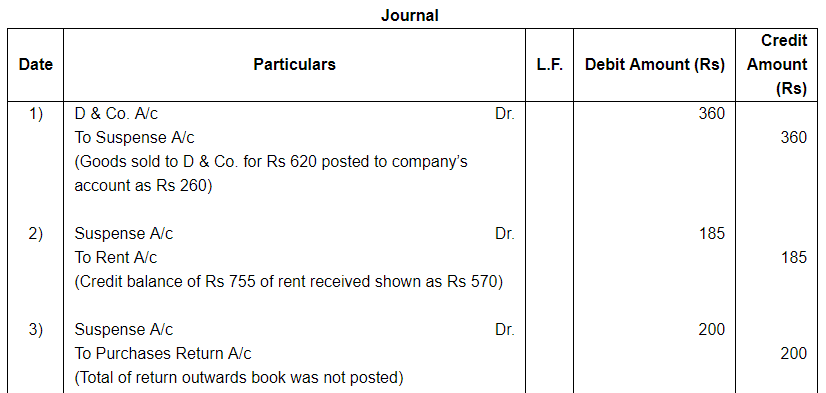

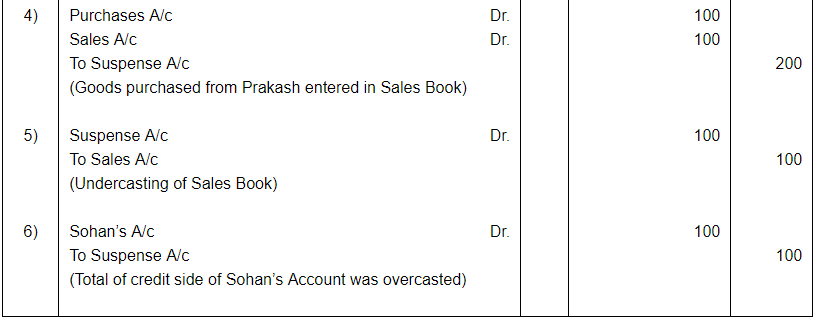

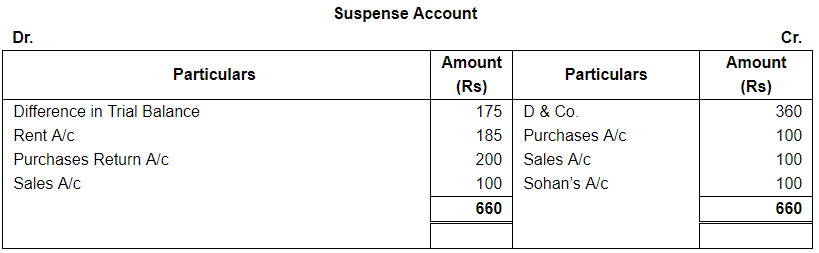

A Book-keeper failed to balance his trial balance, the credit side exceeding the debit side by ₹ 175. This amount was entered in a Suspense Account. Later on the under mentioned errors were discovered:-

1. Goods amounting to ₹ 620 sold to D & Co. were correctly entered in the Sales book, but posted to the Company's A/c as ₹ 260.

2. A credit balance of ₹ 755 of Rent Received account was shown as ₹ 570.

3. The total of Returns Outwards Book amounting to ₹ 200 was not posted to the Ledger.

4. Goods worth ₹ 100 were purchased from Prakash but the amount was entered in the Sales Book. The account of Prakash was correctly credited.

5. Sales Book was undercast by ₹ 100.

6. The total of the credit side of Sohan's account was overcast by ₹ 100.

Give journal entries to rectify these errors and prepare the Suspense Account.

ANSWER:

One Sided Errors

FAQs on Rectfication of Errors ( Part - 2) - Commerce

| 1. What is the importance of rectification of errors in commerce? |  |

| 2. How can errors be rectified in commerce? |  |

| 3. What are the common types of errors in commerce? |  |

| 4. What are the potential consequences of not rectifying errors in commerce? |  |

| 5. How can businesses prevent errors in commerce? |  |