Rectification of Errors ( Part - 1) - Commerce PDF Download

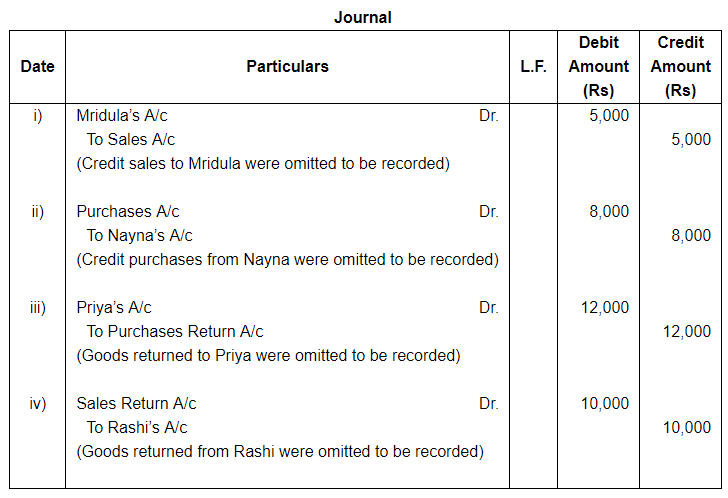

Page No 19.39:

Question 1:

Rectify the following errors:

(i) Credit sales to Mridula ₹ 5,000 were not recorded.

(ii) Credit purchases from Nayna ₹ 8,000 were not recorded.

(iii) Goods returned to Priya ₹ 12,000 were not recorded.

(iv) Goods returned from Rashi ₹ 10,000 were not recorded.

ANSWER:

Two-Sided Errors

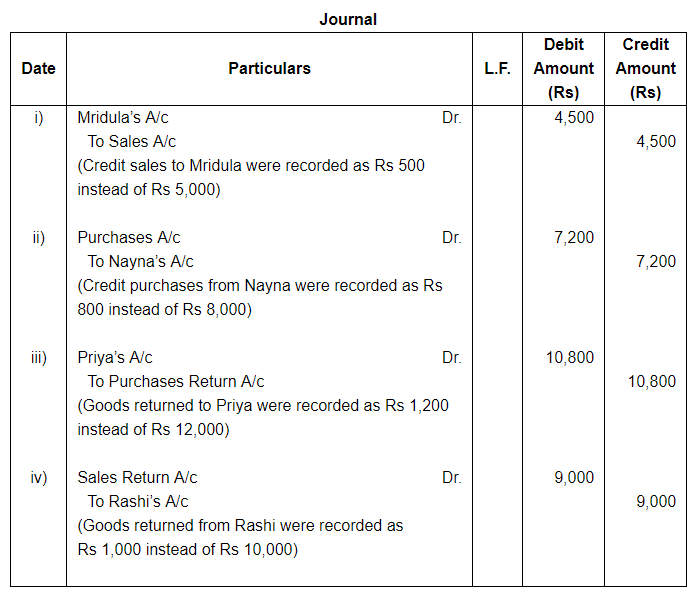

Question 2:

Rectify the following errors:

(i) Credit sales to Mridula ₹ 5,000 were recorded as ₹ 500.

(ii) Credit purchases from Nayna ₹ 8,000 were recorded as ₹ 800.

(iii) Goods returned to Priya ₹ 12,000 were recorded as ₹ 1,200.

(iv) Goods returned from Rashi ₹ 10,000 were recorded as ₹ 1,000.

ANSWER:

Two Sided Errors

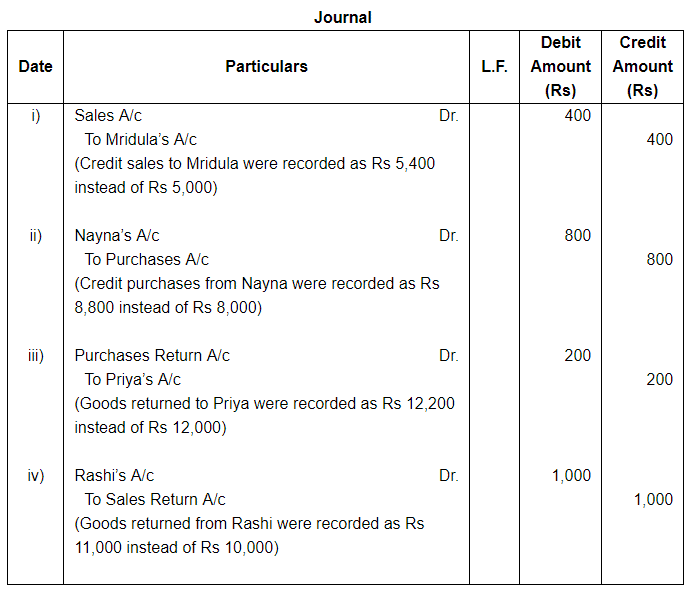

Question 3:

Rectify the following errors:

(i) Credit sales to Mridula ₹ 5,000 were recorded as ₹ 5,400.

(ii) Credit purchases from Nayna ₹ 8,000 were recorded as ₹ 8,800.

(iii) Goods returned to Priya ₹ 12,000 were recorded as ₹ 12,200.

(iv) Goods returned from Rashi ₹ 10,000 were recorded as ₹ 11,000.

ANSWER:

Two Sided Errors

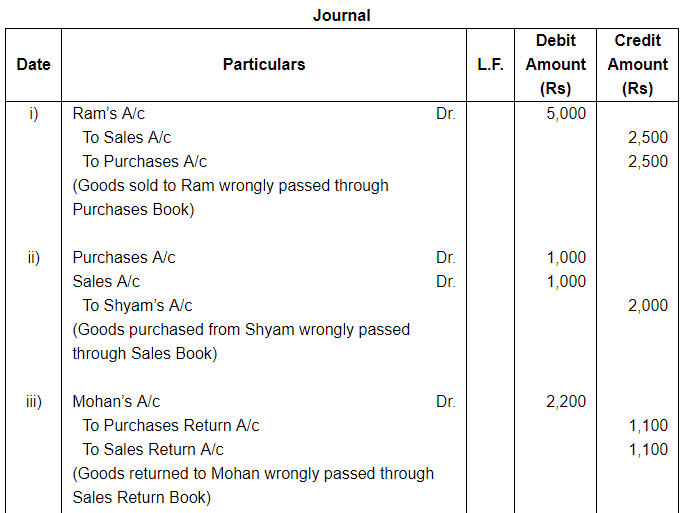

Question 4:

Give rectifying entries for the following:

(i) A credit sales of goods to Ram ₹ 2,500 has been wrongly passed through the 'Purchases Book'.

(ii) A credit purchase of goods from Shyam amounting to ₹ 1,000 has been wrongly passed through the 'Sales Book'.

(iii) A return of goods worth ₹ 1,100 to Mohan was passed through the 'Sales Return Book'.

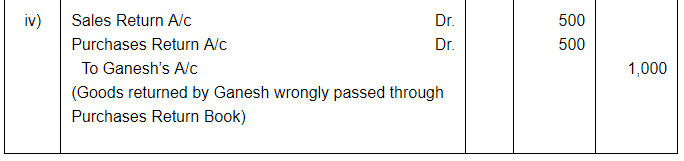

(iv) A return of goods worth ₹ 500 by Ganesh were entered in 'Purchases Return Book'.

ANSWER:

Two Sided Errors

Question 5:

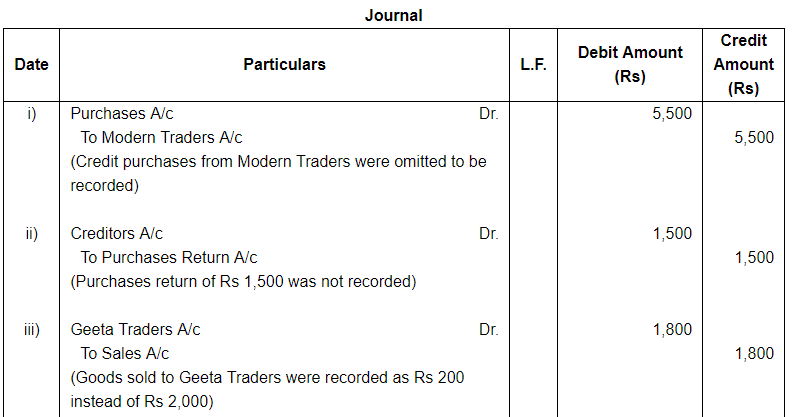

Rectify the following errors:-

(i) Goods for ₹ 5,500 were purchased from Modern Traders on credit, but no entry has yet been passed.

(ii) Purchase Return for ₹ 1,500 not recorded in the books.

(iii) Goods for ₹ 2,000 sold to 'Geeta Traders' on Credit were entered in the sales book as ₹ 200 only.

(iv) Goods of the value of ₹ 1,800 returned by Sunil & Co. were included in stock, but no entry was passed in the books.

(v) Goods purchased for ₹ 900, entered in the purchases book as ₹ 9,000.

(vi) An invoice for goods sold to X was overcast by ₹ 100.

ANSWER:

Two Sided Errors

Page No 19.40:

Question 6:

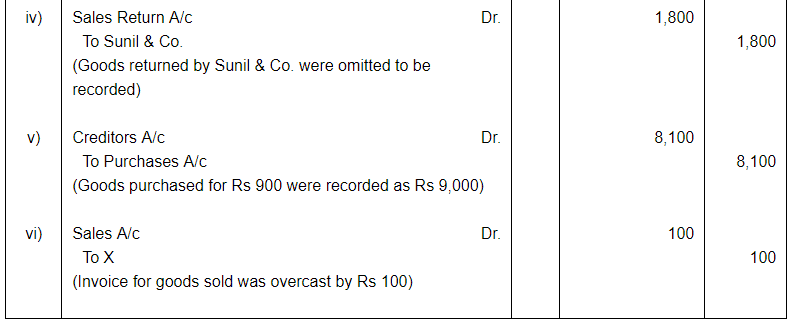

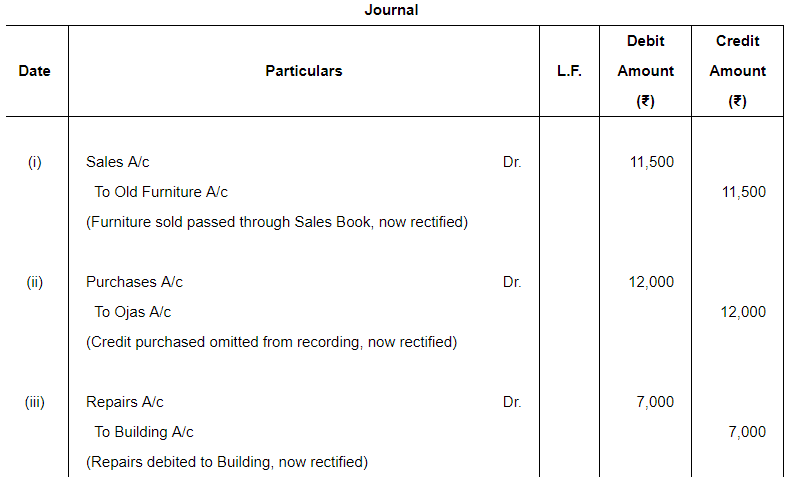

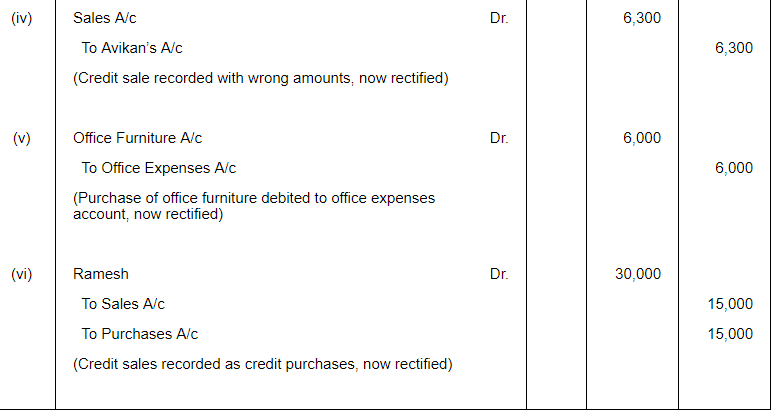

Rectify the following errors:

(i) Sold old furniture to A for ₹ 11,500 was passed through the Sales Book.

(ii) Credit purchases of ₹ 12,000 from Ojas omitted to be recorded in the books.

(iii) Repairs made were debited to Building Account ₹ 7,000.

(iv) Credit sale of ₹ 1,800 to Avikan was recorded as ₹ 8,100.

(v) ₹ 6,000 paid for office furniture was debited to office expenses account.

(vi) A credit sale of goods of ₹ 15,000 to Ramesh has been wrongly passed through the purchases Book.

ANSWER:

Question 7:

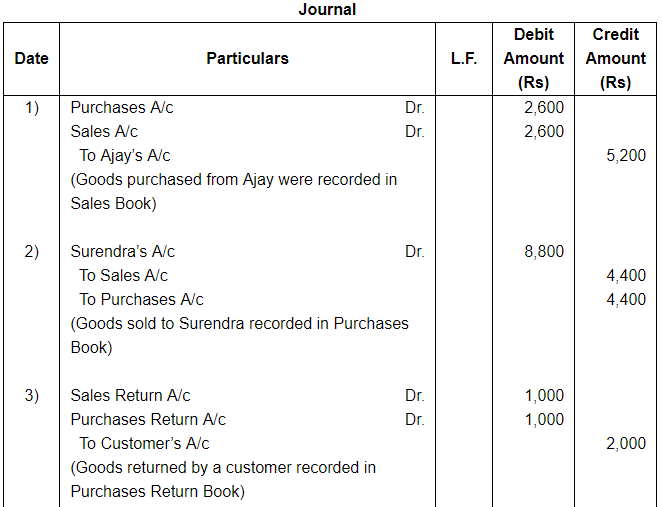

Give Journal Entries to rectify the following errors:-

1. Goods purchased from Ajay for ₹ 2,600 were recorded in Sales Book by mistake.

2. Goods for ₹ 4,400 sold to Surendra was passed through Purchase Book.

3. A customer returned goods worth ₹ 1,000. It was recorded in 'Purchase Return Book'.

4. A credit sale of ₹ 126 to Rajesh was entered in the books as ₹ 162.

5. Sale of old chairs and Table for ₹ 700 was treated as sale of goods.

6. Rent of proprietor's residence, ₹ 800, debited to Rent A/c.

ANSWER:

Two Sided Errors

Question 8:

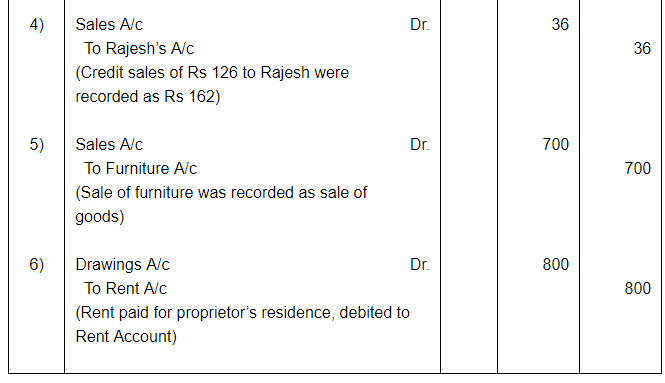

Rectify the following errors:-

1. A sale of goods to Raja Ram for ₹ 2,500 was passed through the Purchases Book.

2. Salary of ₹ 800 paid to Hari Babu was wrongly debited to his personal account.

3. Furniture purchased on credit from Mohan Singh for ₹ 1,000 was entered in the Purchases Book.

4. ₹ 5,000 spent on the extension of buildings was debited to Buildings Repairs Account.

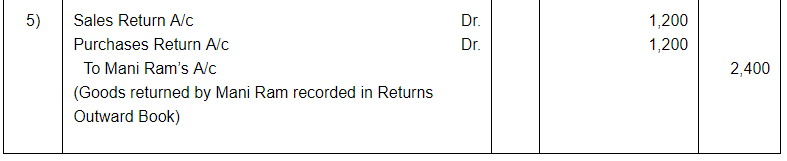

5. Goods returned by Mani Ram ₹ 1,200 were entered in the Returns Outwards Book.

ANSWER:

Two Sided Errors

Question 9:

Rectify the following errors:

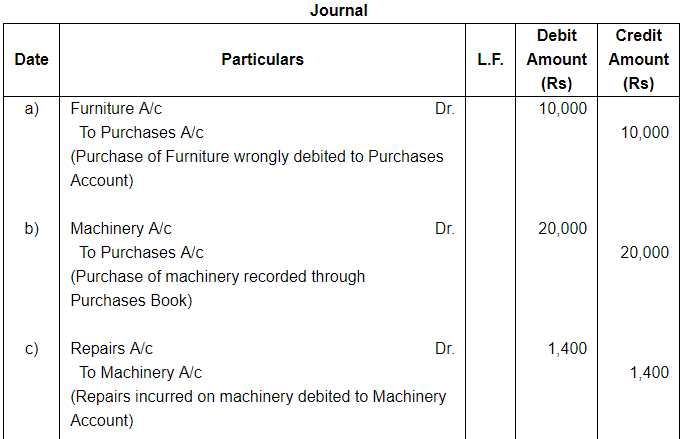

(a) Furniture purchased for ₹ 10,000 wrongly debited to Purchases Account.

(b) Machinery purchased on credit from Raman for ₹ 20,000 was recorded through Purchases Book.

(c) Repairs on machinery ₹ 1,400 debited to Machinery Account.

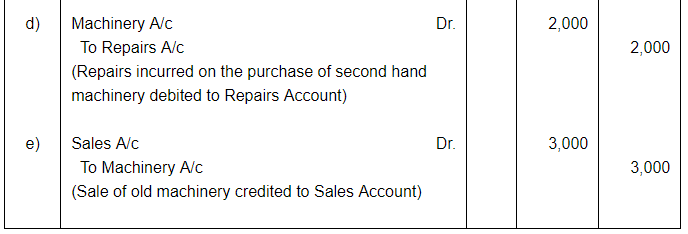

(d) Repairs on overhauling of second hand machinery purchased ₹ 2,000 was debited to Repairs Account.

(e) Sale of old machinery at book value of ₹ 3,000 was credited to Sales Account.

ANSWER:

Two Sided Errors

Page No 19.41:

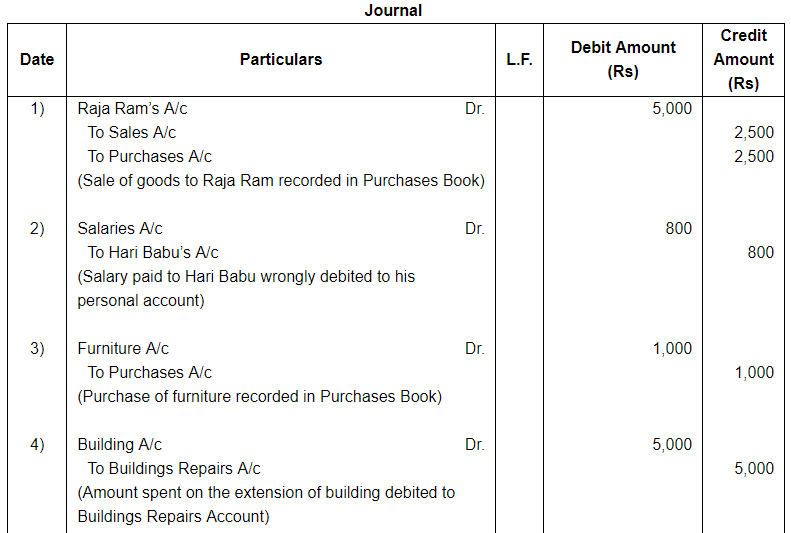

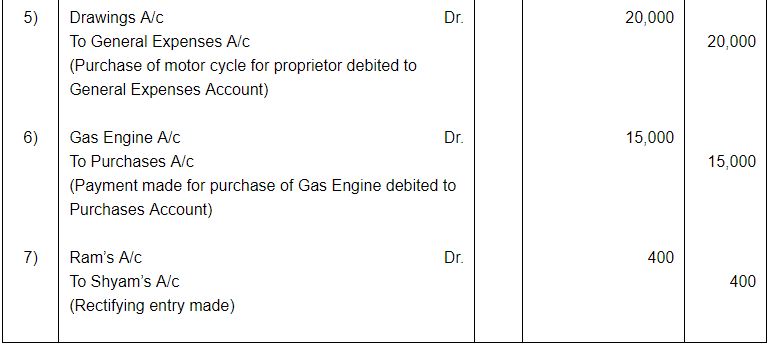

Question 10:

Pass Journal Entries to rectify the following errors:-

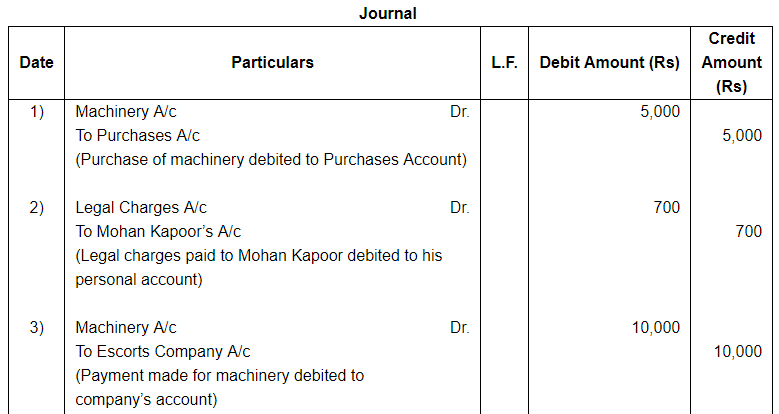

(1) Machinery purchased for ₹ 5,000 has been debited to Purchases A/c.

(2) ₹ 700 paid to Sh. Mohan Kapoor as Legal Charges were debited to his personal account.

(3) ₹ 10,000 paid to Escorts Company for Machinery purchased stand debited to Escorts Company account.

(4) Typewriter purchased for ₹ 6,000 was wrongly passed through purchase book.

(5) ₹ 20,000 paid for the purchase of a Motor Cycle for proprietor has been charged to 'General Expenses' A/c.

(6) ₹ 15,000 paid for the purchase of 'Gas Engine' were debited to 'Purchases' A/c.

(7) Cash paid to Ram ₹ 400 was debited to the account of Shyam.

ANSWER:

Two Sided Errors

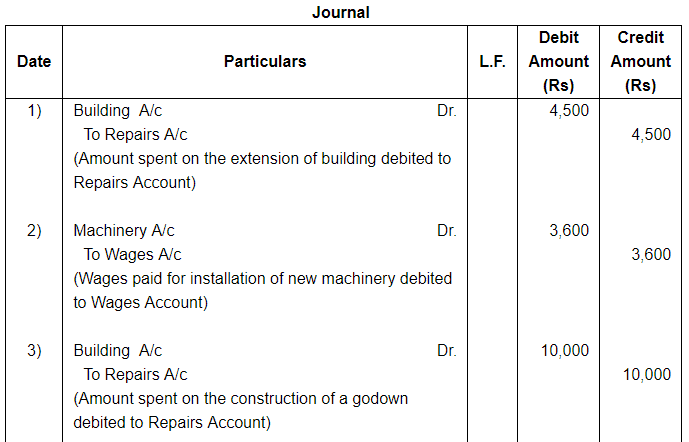

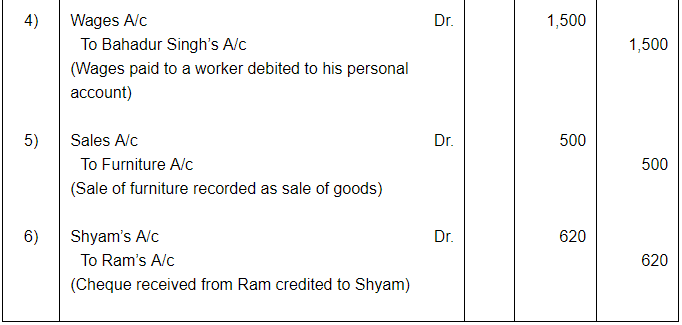

Question 11:

Rectify the following errors:-

1. ₹ 4,500 spent on the extension of Buildings were debited to Repairs A/c.

2. Wages paid to the firm's own workmen ₹ 3,600 for the installation of a new machinery were posted to Wages Account.

3. Contractor's bill for the construction of a godown at a cost of ₹ 10,000 has been charged to 'Repairs' A/c.

4. ₹ 1,500 paid as Wages to a worker 'Bahadur Singh', has been debited to his personal account.

5. Old furniture sold for ₹ 500 has been credited to Sales Account.

6. A cheque of ₹ 620 received from Ram, has been wrongly credited to Shyam.

ANSWER:

Two Sided Errors

FAQs on Rectification of Errors ( Part - 1) - Commerce

| 1. What is rectification of errors in commerce? |  |

| 2. Why is rectification of errors important in commerce? |  |

| 3. What are some common types of errors in commerce that require rectification? |  |

| 4. What are the steps involved in the rectification of errors in commerce? |  |

| 5. How does rectification of errors affect the financial statements in commerce? |  |