Rectification of Errors - (Part - 6) | Accountancy Class 11 - Commerce PDF Download

Page No 17.40:

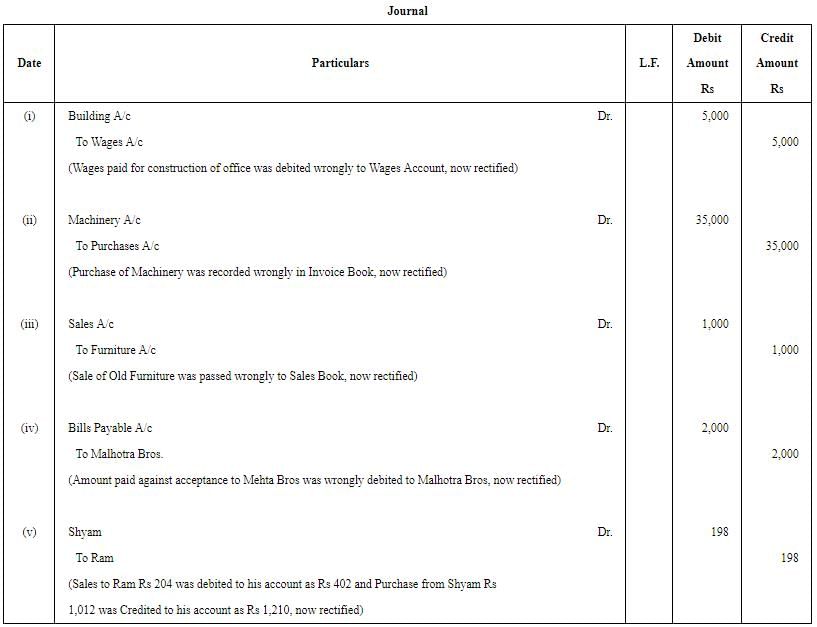

Question 30: Rectify the following errors:

(i) Wages paid for the construction of office debited to the Wages Account, ₹ 5,000.

(ii) Machinery purchased for ₹ 35,000 was passed through the Purchases Book.

(iii) Old furniture sold for ₹ 1,000, passed through the Sales Book.

(iv) ₹ 2,000 paid to Mehta Bros. against acceptance were debited to Malhotra Bros. Account.

(v) Sales of ₹ 204 to Ram debited to his account as ₹ 402 and purchases of ₹ 1,012 from Shyam credited to his account as ₹ 1,210.

ANSWER:

Page No 17.40:

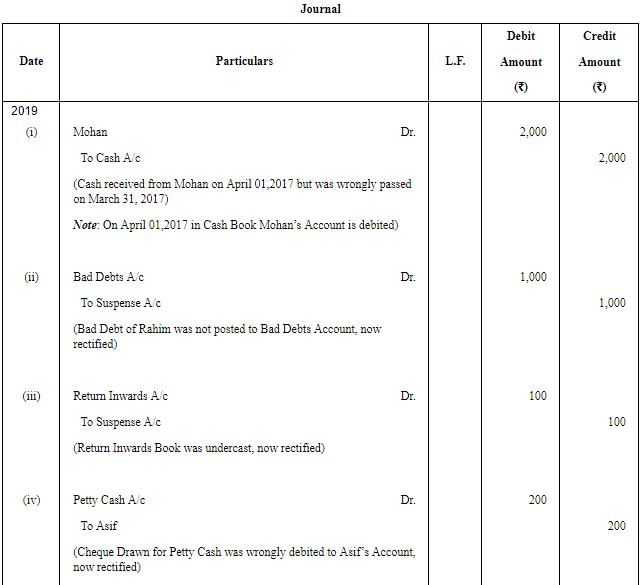

Question 31: Pass the rectification entries for the following transactions:

(i) An amount of ₹ 2,000 received from Mohan on 1st April, 2019 had been entered in the Cash Book as having been received on 31st March, 2019.

(ii) The balance in the account of Rahim ₹ 1,000 had been written off as bad but no other account has been debited.

(iii) An addition in the Returns Inward Book had been cast ₹ 100 short.

(iv) A cheque for ₹ 200 drawn for the Petty Cash Account has been posted in the account of Asif.

(v) A discounted Bill of Exchange for ₹ 20,000 returned by the firm's bank had been credited to the Bank Account and debited to Bills Receivable Account. A cheque was received later from the customer for ₹ 20,000 and duly paid.

(vi) Ramesh's Account was credited with ₹ 840 twice instead of once.

ANSWER:

Page No 17.41:

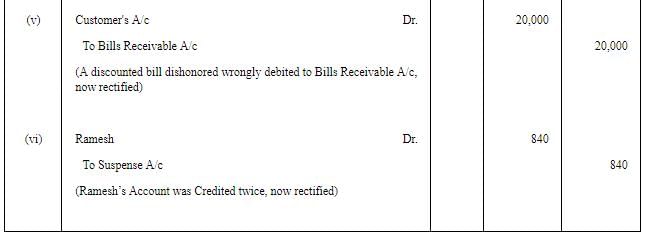

Question 32: Rectify the following errors:

(i) Sale of old furniture worth ₹ 3,000 treated as sales of goods.

(ii) Sales Book added ₹ 5,000 short.

(iii) Rent of proprietor’s residence, ₹ 6,500 debited to Rent Account.

(iv) Goods worth ₹ 11,970 returned by Manav posted to his debit as ₹ 11,790.

ANSWER:

Page No 17.41:

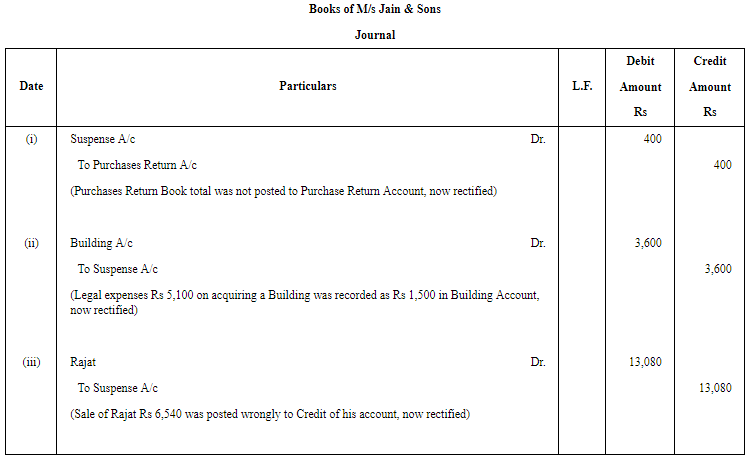

Question 33: There was a difference in the Trial Balance of M/s. Jain & Sons, prepared for the year ended 31st March, 2009. The accountant put the difference in Suspense Account.

The following errors were found:

(i) Purchases Return Book total ₹ 400 has not been posted to Ledger Account.

(ii) ₹ 5,100 spent on legal expense for the newly acquired Building was debited to the Building Account as ₹ 1,500.

(iii) A sale of ₹ 6,540 to Rajat has been credited to his account.

Rectify the errors and show the Suspense Account with Nil closing balance.

ANSWER:

Page No 17.41:

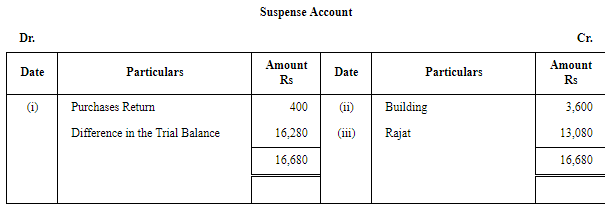

Question 34: Give the Journal entries to rectify the following errors:

(i) Purchases Book was overcast by ₹ 1,000.

(ii) Installation charges on new machinery purchased ₹ 500 were debited to Sundry Expenses Account as ₹ 50.

(iii) Radhey Shyam returned goods worth ₹ 500 which was entered in the Purchases Return Book.

(iv) Goods taken by the proprietor for ₹ 5,000 have not been entered in the books at all.

ANSWER:

Page No 17.41:

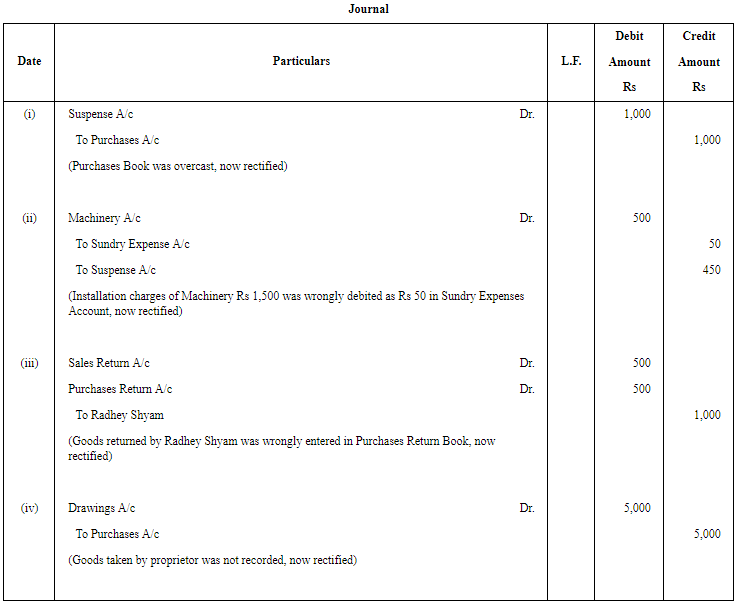

Question 35: Rectify the following errors:

(i) The total of one page of Sales Book was carried forward as ₹ 371 instead of ₹ 317.

(ii) ₹ 540 received from Yatin was posted to the debit of his Account.

(iii) Purchases Returns Book was overcast by ₹ 300.

(iv) An item of ₹ 1,062 entered in Sales Return Book had been posted to the debit of customer who returned the goods.

(v) ₹ 1,500 paid for furniture purchased had been charged to ordinary Purchase Account.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Rectification of Errors - (Part - 6) - Accountancy Class 11 - Commerce

| 1. What is rectification of errors in commerce? |  |

| 2. What are some common types of errors in commerce? |  |

| 3. How can errors in commerce be rectified? |  |

| 4. What are the consequences of not rectifying errors in commerce? |  |

| 5. How can businesses prevent errors in commerce? |  |