Rectification of Errors - (Part - 7 ) | Accountancy Class 11 - Commerce PDF Download

Page No 17.41:

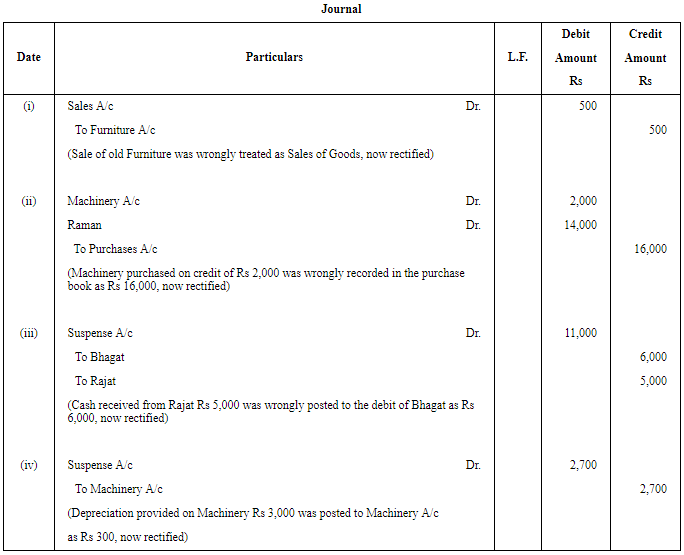

Question 36: Rectify the following errors by passing Journal entries:

(i) Old furniture sold for ₹ 500 has been credited to Sales Account.

(ii) Machinery purchased on credit from Raman for ₹ 2,000 recorded through

Purchases Book as ₹ 16,000.

(iii) Cash received from Rajat ₹ 5,000 was posted to the debit of Bhagat as ₹ 6,000.

(iv) Depreciation provided on machinery ₹ 3,000 was posted to Machinery Account as ₹ 300.

ANSWER:

Page No 17.42:

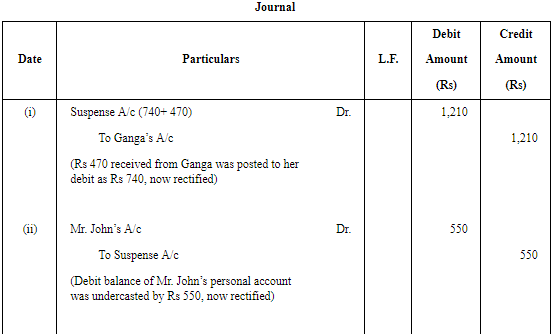

Question 37: Rectify the following errors by passing Journal entries:

(i) A sum of ₹ 470 received from Ganga was posted to her debit as ₹ 740.

(ii) A debit balance of ₹ 550 in the personal account of Mr. John was undercast.

(iii) Bills Receivable from Brown for ₹ 3,000 posted to the credit of Bills Payable Account and credited to Brown’s Account.

(iv) Goods returned by Mridul ₹ 225 have been entered in the Returns Outward Book.

ANSWER:

Page No 17.42:

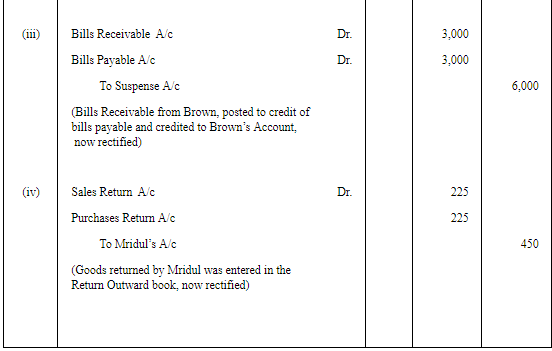

Question 38: While trying to close his books for the year ended 31st March, 2014, Mahesh found that the Trial Balance did not agree. He traced the following errors:

(i) In the Sales Book for the month of January total of Page No. 2 was carried forward to Page No. 3 as ₹ 1,000 instead of ₹ 1,200 and total of Page No. 6 was carried forward to Page No. 7 as ₹ 5,600 instead of ₹ 5,000.

(ii) Goods returned to Ram ₹ 1,000 were recorded in the Sales Book.

(iii) Bills Receivable for ₹ 1,600 from Noor was dishonoured and posted to debit of Allowances Account.

Rectify the above errors.

ANSWER:

Page No 17.42:

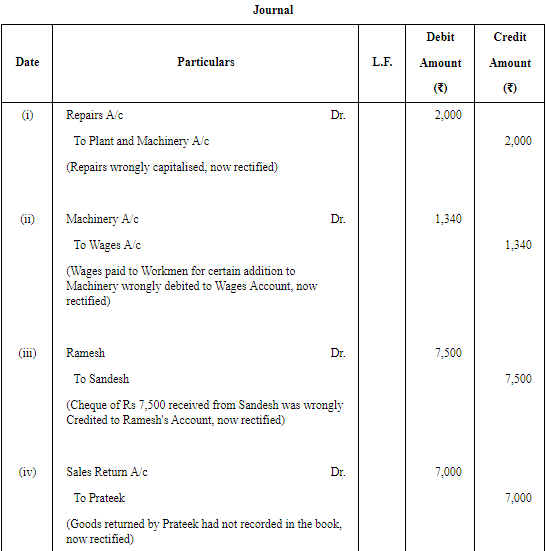

Question 39: Pass the rectification entries for the following transactions:

(i) Repairs to plant amounting to ₹ 2,000 had been charged to Plant and Machinery Account.

(ii) Wages paid to the firm's workmen for making certain additions to machinery amounting to ₹ 1,340 were debited to Wages Account.

(iii) A cheque for ₹ 7,500 received from Sandesh was credited to the account of Ramesh.

(iv) Goods to the value of ₹ 7,000 returned by Prateek were included in closing stock, but no entry was made in the books.

(v) Goods costing ₹ 5,000 were purchased for various members of the staff and the cost was included in 'Purchases'. A similar amount was deducted from the salaries of the staff members concerned and the net payments to them debited to Salaries Account.

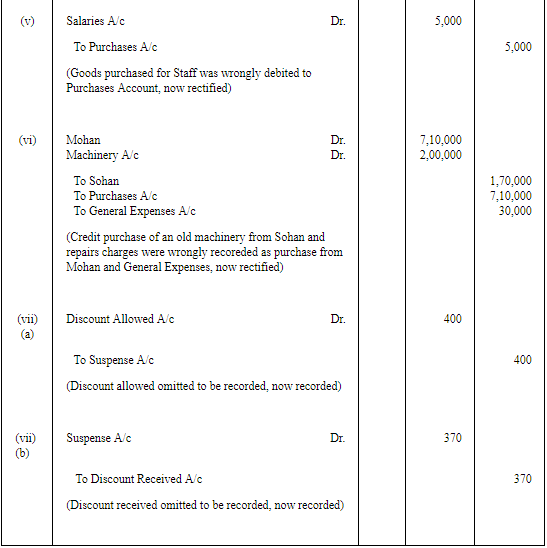

(vi) Credit purchase of old machinery from Sohan for ₹ 1,70,000 was entered in the Purchase Book as purchase from Mohan for ₹ 7,10,000. ₹ 30,000 paid as repairing charges on the reconditioning of a newly purchased second hand machinery were debited to General Expenses Account.

(vii) Debit and Credit totals of discount columns in the Cash Book which come to ₹ 400 and ₹ 370 respectively have not been posted to Discount Accounts.

ANSWER:

Page No 17.43:

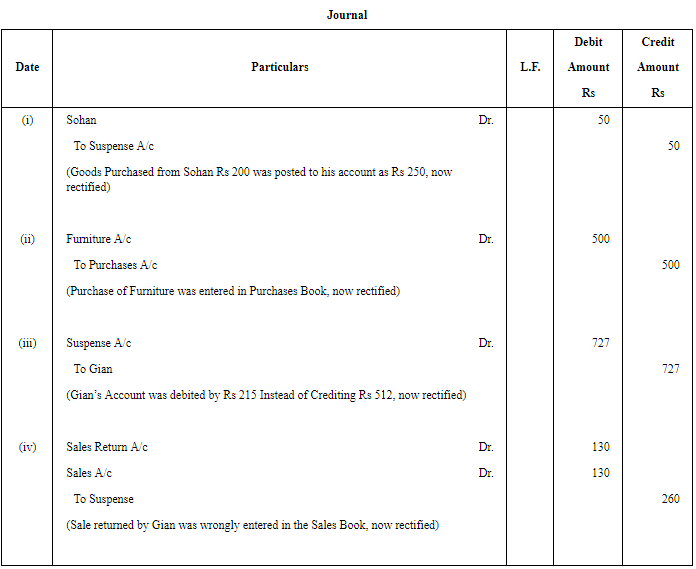

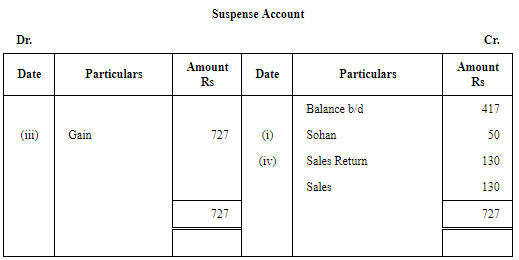

Question 40: A Trial Balance disclosed a difference of ₹ 417 placed on the credit side of the Suspense Account. Later on the following errors were located:

(i) Goods worth ₹ 200 purchased from Sohan had been posted to his account as ₹ 250.

(ii) A purchase of furniture for ₹ 500 was recorded in the Purchases Book.

(iii) Instead of crediting Gian’s Account with ₹ 512, it was debited with ₹ 215.

(iv) Goods worth ₹ 130 returned by Gian were entered in the Sales Book and posted therefrom to the credit of Gian’s Personal Account.

Pass the rectifying entries and prepare a Suspense Account.

ANSWER:

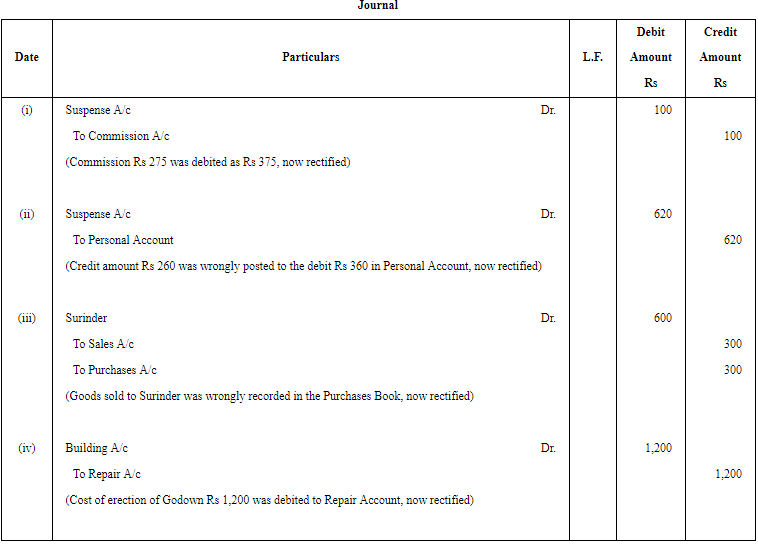

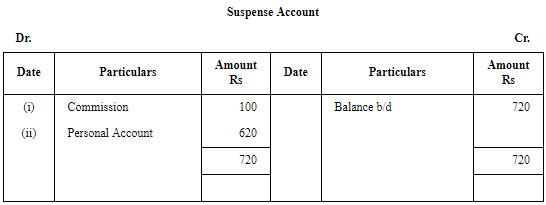

Page No 17.43:

Question 41: There was a difference of ₹ 720 in the Trial Balance which has been transferred to the credit side of the Suspense Account. Pass the rectifying entries and prepare a Suspense Account to rectify the following errors:

(i) An amount of ₹ 375 now posted on the debit side of the Commission Account instead of ₹ 275.

(ii) Credit amount of ₹ 260 posted to the debit of the Personal Account as ₹ 360.

(iii) Goods sold to Surinder recorded in Purchases Book ₹ 300.

(iv) D’s bill for erection of godown at a cost of ₹ 1,200 has been charged to the Repairs Account.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Rectification of Errors - (Part - 7 ) - Accountancy Class 11 - Commerce

| 1. What is the importance of rectification of errors in commerce? |  |

| 2. How can errors be rectified in commerce? |  |

| 3. What are the common types of errors in commerce? |  |

| 4. How do errors impact the financial statements in commerce? |  |

| 5. Are there any preventive measures to avoid errors in commerce? |  |