Risk Management & NPA Management in Indian Banking Sector | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Risk Management |

|

| Types of Risks in Banking |

|

| Role of RBI in Risk Management |

|

| NPA Management |

|

| NPA Management in Banks |

|

| NPA Management Tools |

|

Risk Management

Risk in banking refers to the potential for undesirable outcomes that have financial consequences, such as loss or reduced earnings, due to uncertain or unpredictable events. In essence, it represents the uncertainty of outcomes, with greater risk often correlating with higher potential returns.

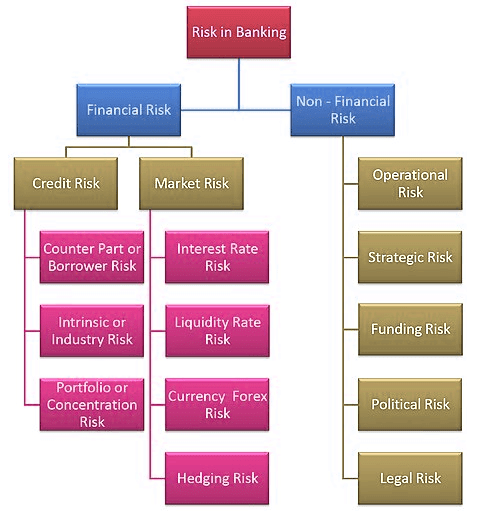

Types of Risks in Banking

Liquidity Risk: This arises from the mismatch between the funding of long-term assets with short-term liabilities, leading to potential issues with refinancing or rollover.

- Funding Risk: This is the risk of not being able to obtain necessary funds to meet cash flow obligations, such as unanticipated withdrawals or non-renewal of deposits.

- Time Risk: This arises when expected funds do not materialize, leading to issues like assets turning non-performing.

- Call Risk: This occurs when contingent liabilities become due or when a bank cannot seize profitable opportunities due to liquidity constraints.

Interest Rate Risk: This risk affects the bank's earnings or the market value of its assets due to changes in interest rates. It influences both the net interest margin and the economic value of the bank's assets and liabilities.

Market Risk: This is the risk of adverse changes in the market value of trading portfolios due to fluctuations in market prices, including interest rates, equities, commodities, and currencies. Market risk includes:

- Forex Risk: The risk of losses due to adverse currency exchange rate movements.

- Market Liquidity Risk: The risk that a bank cannot execute a large transaction at the current market price.

Credit Risk: This is the risk that a borrower or counterparty will fail to meet their obligations. Major variants include:

- Counterparty Risk: The risk of loss due to a trading partner's failure to perform.

- Country Risk: The risk that external factors in a country will lead to non-performance by a borrower or counterparty.

To mitigate credit risk, banks assess the creditworthiness of borrowers, use credit ratings, set prudential limits, and maintain flexibility for special circumstances.

Operational Risk: Defined by the Basel Committee as the risk of loss from inadequate or failed internal processes, people, systems, or external events. It includes:

- Transaction Risk: Risks from fraud, failed business processes, and issues with business continuity.

- Compliance Risk: The risk of legal or regulatory penalties or reputational damage from failing to comply with laws and regulations.

Other Risks:

- Strategic Risk: Arising from poor business decisions or failure to adapt to industry changes.

- Reputation Risk: The risk of damage to a bank's reputation, potentially leading to financial loss or a reduced customer base.

- Systematic Risk: Inherent to the entire market or economy, also known as undiversifiable risk.

- Unsystematic Risk: Specific to an industry or company, also known as diversifiable risk.

Effective risk management combines handling uncertainty, risk, equivocality, and error. Initially, Indian banks followed risk control systems aligned with legal and accounting standards, but with deregulation and evolving customer behaviors, banks face challenges in adapting to mark-to-market accounting and maintaining a risk management framework aligned with corporate goals and market developments.

Role of RBI in Risk Management

The Reserve Bank of India (RBI) plays a critical role in risk management by evaluating banks' financial soundness using the CAMELS framework, which includes:

- Capital Adequacy

- Asset Quality

- Management

- Earnings Quality

- Liquidity

- Sensitivity to Market Risk

This framework, established in 1988 and expanded in 1997 to include market risk sensitivity, assesses both domestic and foreign banks. Since the early 1990s, RBI has shifted its focus from basic regulatory requirements to comprehensive risk management guidelines, with a revised supervisory mechanism in place since 1994. This includes evaluating banks through CAMELS and CACS (for foreign banks), aiming to ensure a robust and stable financial system.

NPA Management

Non-performing assets (NPAs) are a significant challenge for Indian banks, affecting their profitability and lending capacity. Effective NPA management is essential for reducing losses and maintaining financial health. Both the government and the Reserve Bank of India (RBI) have implemented reforms to improve NPA resolution, including stricter norms for early recognition, setting reduction targets, and enhancing recovery tools such as the Insolvency and Bankruptcy Code (IBC). Despite some progress, more efforts are needed, including faster legal processes, better governance, stricter penalties for defaulters, and improved skills among bank staff to manage NPAs effectively.

NPA Management in Banks

NPAs are loans and advances where borrowers have not made interest or principal payments for at least 90 days. Rising NPAs threaten banks' profitability, asset quality, and ability to issue new loans. Effective NPA management involves several steps:

- Early Detection and Classification: Banks need robust systems to identify NPAs early. Defaults beyond 90 days should be classified correctly according to RBI guidelines, such as sub-standard, doubtful, or loss assets.

- Regular Follow-Up: Persistent follow-up with borrowers through calls, letters, emails, and personal visits helps remind them of repayment obligations and negotiate repayment plans. Banks may offer solutions like extended tenures or waived penalties.

- Loan Restructuring: When feasible, banks can restructure NPAs by adjusting repayment schedules, offering moratoriums, or reducing interest rates. However, frequent restructuring should be avoided.

- Collateral Invocation: Banks can recover funds by invoking and selling collateral against NPAs. Challenges include poor valuation of collateral and slow legal processes for asset sale.

- Legal Action: If recovery efforts fail, banks should promptly initiate legal proceedings against defaulters. They can use Debt Recovery Tribunals and the National Company Law Tribunal under the IBC for corporate loans.

- Provisioning for Losses: Banks must set aside provisions for potential loan losses to mitigate the impact of NPAs on profitability. The RBI sets these provisioning requirements.

- Internal Improvements: Enhancing internal processes, systems, staff skills, and governance structures helps better detect, manage, and resolve NPAs. Technology plays a crucial role in monitoring loans and streamlining processes.

NPA Management Tools

Banks use several tools to manage NPAs effectively:

- Early Warning Systems: These systems monitor indicators such as declining cash flows, overdue payments, and negative reports to detect potential NPAs early.

- Loan Rating Models: These assess the risk associated with each loan and help prioritize monitoring based on risk levels.

- Specialized Asset Management Cells: These cells focus on developing recovery plans, initiating legal actions, and overseeing resolution efforts.

- Restructuring Schemes: RBI’s restructuring schemes for MSMEs and other small loans help address temporary issues, though excessive restructuring should be avoided.

- Asset Reconstruction Companies: Banks may sell large NPAs to these companies, which use aggressive recovery techniques.

- Improved Governance: Better oversight and governance of high-value NPAs help prevent delays and evergreening. Outsourcing recovery functions to specialized agencies can also be effective.

- Technology and Analytics: Automated systems and analytics are crucial for tracking loans, identifying issues early, and evaluating resolution options.

NPA Resolution Strategies

- Restructuring and Rescheduling: Work with borrowers to make repayments more manageable by extending loan terms, reducing interest rates, or allowing interest-only payments temporarily.

- Legal Recovery: Resort to legal measures, such as filing cases or enforcing security interests, if negotiations fail.

- Loan Recovery Agencies: Engage third-party agencies specializing in debt recovery to handle collection processes and negotiate with borrowers.

Prevention of NPAs

- Credit Risk Assessment: Implement robust assessment processes to approve loans for creditworthy borrowers and minimize default risks.

- Diversification: Spread the loan portfolio across various sectors and types to reduce risks associated with concentration in specific industries.

- Early Warning Systems: Use systems to identify signs of financial distress early, allowing for timely corrective actions to prevent loans from becoming NPAs.

Conclusion

Rising NPAs are a major issue for Indian banks, affecting their profitability and lending capabilities. While various tools and strategies are available to manage and resolve NPAs, more comprehensive efforts are required. Policy reforms, technology adoption, enhanced governance, and internal capacity building are essential to effectively manage NPAs. Banks need to adopt a proactive, integrated approach to leverage all available options for better NPA management.

|

157 videos|236 docs|166 tests

|

FAQs on Risk Management & NPA Management in Indian Banking Sector - Crash Course for UGC NET Commerce

| 1. What is the significance of Net Interest Margin (NIM) in the risk management of banks? |  |

| 2. How does the RBI play a role in managing credit risk in banks? |  |

| 3. What are the key components of operational risk in the banking sector? |  |

| 4. How does market liquidity risk impact banks' risk management strategies? |  |

| 5. How does the SEBI Grade A exam prepare candidates for risk management and NPA management in the Indian banking sector? |  |