Scope of Finance | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Meaning of Finance |

|

| Key Aspects of Finance |

|

| Scope of Finance |

|

| Scope of Finance Function |

|

| Scope of Public Finance |

|

| Scope of Business Finance |

|

Meaning of Finance

Finance involves the efficient management of money and assets, along with the analysis of markets and institutions engaged in resource acquisition and distribution. It encompasses various activities and fields related to fund planning, sourcing, investment, and control. Finance is critical in both personal and organizational contexts, impacting choices regarding expenditure, savings, investments, and risk management.

Key Aspects of Finance

The essential aspects of finance are outlined below:

Financial Planning:

- Financial planning involves setting goals, assessing resources, and creating strategies to achieve financial objectives effectively. It includes budgeting, forecasting, and developing a roadmap for financial success.

Capital Budgeting:

- Capital budgeting is the process of evaluating and selecting long-term investment projects. It helps in determining which projects are worth investing in and which should be avoided based on their potential returns and risks.

Risk Management:

- Risk management in finance involves identifying, assessing, and mitigating risks that may affect financial outcomes. It aims to minimize potential losses and safeguard assets through various strategies such as insurance, diversification, and hedging.

Investment Analysis:

- Investment analysis focuses on evaluating investment opportunities to determine their potential for providing returns. It involves assessing factors like risk, return, liquidity, and market conditions to make informed investment decisions.

Financial Markets:

- Financial markets are platforms where individuals and entities trade financial securities, commodities, and other fungible items at prices determined by supply and demand. They play a crucial role in allocating capital efficiently and facilitating economic growth.

Scope of Finance

The scope of finance encompasses various areas that include:

- Personal Finance: Involves managing individual finances to build wealth and achieve financial objectives. This includes budgeting, saving, investing, tax planning, insurance, retirement planning, and estate planning.

- Corporate Finance: Focuses on how companies raise, invest, and manage capital to enhance shareholder value. It includes activities such as capital budgeting, working capital management, capital structure decisions, dividend policies, and mergers and acquisitions.

- Public Finance: Deals with the revenue and expenditure of nations along with tax policies. This area covers government budgets, management of public debt, provision of public goods, transfer payments, and subsidies.

- Investment Finance: Involves the management of assets and the utilization of financial tools to meet the return objectives of investors. It includes tasks like asset valuation, portfolio management, and the development of investment strategies for individuals, companies, and institutions.

- Financial Systems: Encompasses the institutions, markets, instruments, and regulations that facilitate the allocation of funds within an economy. This includes entities like banks, insurance companies, capital markets, stock exchanges, payment systems, and central banks.

- Global Finance: Focuses on the macroeconomic aspects of international trade, capital flows, and foreign trade relations between countries. It includes areas such as foreign exchange markets, balance of payments, exchange rate mechanisms, and financing of global trade.

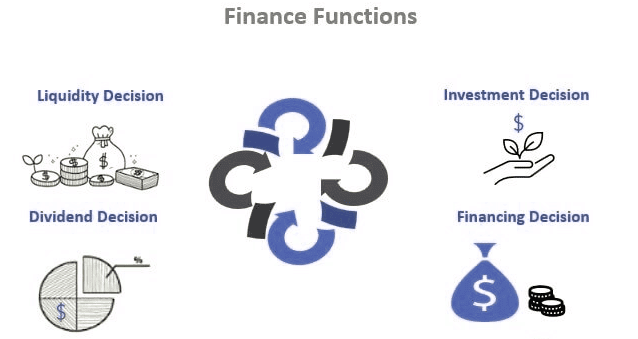

Scope of Finance Function

The finance function encompasses the following key areas:

- Financial Planning and Analysis: Developing budgets and forecasts, analyzing financial performance, and setting corporate goals while allocating resources. Monitoring performance against these plans.

- Treasury Management: Managing cash inflows and outflows to ensure obligations are met and liquidity is optimized. Implementing cash management strategies.

- Financial Reporting: Preparing accurate and timely financial statements and reports for both internal and external stakeholders, ensuring compliance with regulatory requirements.

- Tax Management: Adhering to relevant tax regulations, filing returns, and making tax payments. Strategizing to minimize the company’s tax liabilities.

- Investment Management: Evaluating investment opportunities and managing the allocation of surplus cash and assets to maximize returns.

- Risk Management: Identifying and analyzing financial risks related to market conditions, credit, liquidity, and operational factors. Developing and implementing strategies to mitigate these risks.

- Capital Raising: Securing debt and equity financing to fulfill the company’s capital requirements. Managing the organization’s capital structure.

- Cost Control: Implementing cost control measures and monitoring expenses to improve operational efficiency and reduce costs.

- Relationship Management: Engaging with banks, creditors, rating agencies, investors, and other external financial stakeholders to safeguard and advance the company’s financial interests.

- Compliance: Ensuring all financial operations, policies, and transactions adhere to regulatory and legal standards.

Scope of Public Finance

- Government Revenue: Encompasses taxes, duties, fees, and fines collected by the government. Public finance examines various tax policies and mechanisms to generate revenue.

- Government Expenditure: Involves spending on public services such as defense, infrastructure, healthcare, education, and social welfare. Public finance evaluates how resources are allocated across these programs.

- Public Debt: Includes government-issued bonds and loans. Public finance focuses on managing public debt to minimize costs and risks.

- Fiscal Policy: The use of taxation, expenditure, and borrowing to influence macroeconomic factors like economic growth, employment, and inflation. Public finance assesses the effectiveness of these fiscal tools.

- Provision of Public Goods: Covers goods and services provided by the government that are non-excludable and non-rivalrous, such as national defense and law enforcement. Public finance seeks to optimize the allocation of resources for these public goods.

- Redistribution of Income: Involves using taxes and transfer payments to redistribute income from wealthier individuals to those in need. Public finance analyzes the impact of these redistributive policies.

- Budget: The annual financial statement detailing state revenue and expenditures. Public finance studies the budgeting process and evaluates the impact of budgetary grants.

- Economic Stabilization: Utilizes fiscal policy tools to stabilize the economy during periods of economic fluctuation. Public finance assesses the effectiveness of these interventions.

- Evaluation of Public Projects: Involves cost-benefit analysis and social return on investment to assess the desirability of public sector projects. This is a key aspect of public finance.

Scope of Business Finance

- Capital Budgeting: Involves evaluating and selecting investment projects to maximize a firm's value using techniques like NPV, IRR, and payback period.

- Working Capital Management: Ensures adequate cash flow and liquidity for day-to-day operations by managing cash, inventory, and accounts receivable and payable.

- Capital Structure: Focuses on finding the optimal mix of debt and equity to finance a firm's operations and growth, impacting financial risk and return.

- Dividend Policy: Determines the proportion of profits to distribute as dividends to shareholders versus retaining for reinvestment, balancing shareholder needs with the firm’s growth.

- Mergers and Acquisitions: Evaluates the strategic fit, synergies, costs, and risks of acquiring or merging with another firm, including the financing of such transactions.

- Cost of Capital: Determines the rate of return needed on existing assets and new investments to create value, guiding capital budgeting decisions.

- Treasury Management: Manages cash inflows and outflows to meet short-term obligations and optimize liquidity, including cash forecasting and managing banking relationships.

- Risk Management: Identifies and analyzes financial risks related to currency, interest rates, liquidity, credit, and operations, and develops strategies to mitigate these risks.

- Financial Reporting: Involves preparing internal and external reports on financial performance and position to ensure transparency, compliance, and good governance.

- Budgeting: Develops short-term and long-term financial plans that align with the firm’s strategies and goals, providing a framework for resource allocation and target setting.

Conclusion

The scope of finance is extensive, encompassing the generation, management, and investment of funds across various economic sectors. Key areas include personal finance, corporate finance, public finance, investment finance, financial systems, and global finance. While each area has distinct concepts, tools, and practices, they all depend on an integrated financial system. The goal is to optimize the allocation of scarce resources, manage associated risks, and promote sustainable economic growth.

|

157 videos|236 docs|166 tests

|

FAQs on Scope of Finance - Crash Course for UGC NET Commerce

| 1. What is the scope of finance in public finance? |  |

| 2. What are some key areas covered under the scope of finance in public finance? |  |

| 3. How does the scope of finance in public finance impact the overall economy? |  |

| 4. What are the career opportunities in the field of public finance with a focus on finance scope? |  |

| 5. How can an understanding of the scope of finance in public finance benefit individuals and organizations? |  |