Special Purpose Books II- Other Book(Part-1) | Accountancy Class 11 - Commerce PDF Download

Page No 11.42:

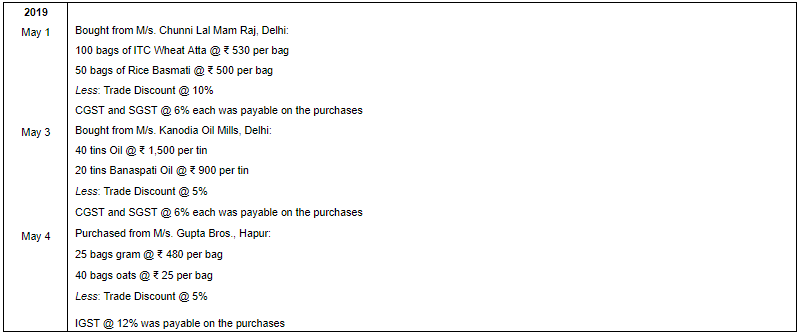

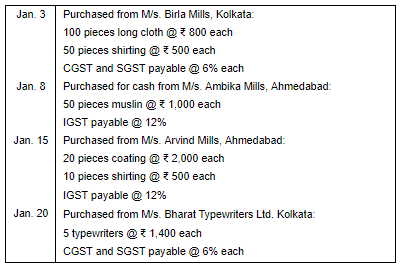

Question 1: Record the following transactions in the Purchases Book of Subhash General Stores, Delhi:

ANSWER:

Page No 11.42:

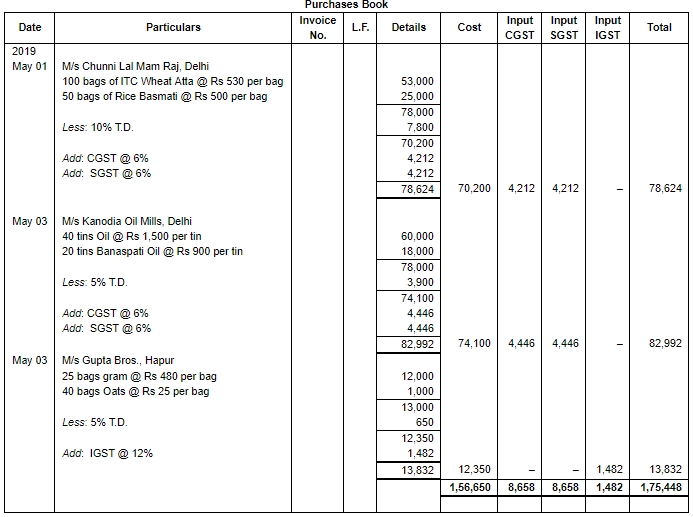

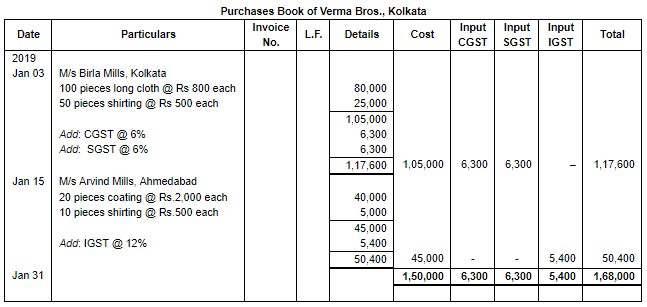

Question 2: Verma Bros. Kolkata carry on business as wholesale cloth dealer. From the following, write up their Purchases Book for January, 2019:

Show the posting from Purchases Book to Ledger accounts also.

ANSWER:

Page No 11.43:

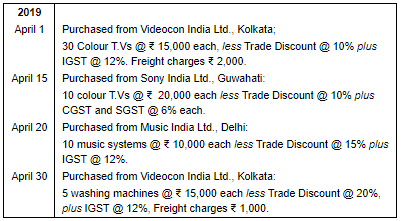

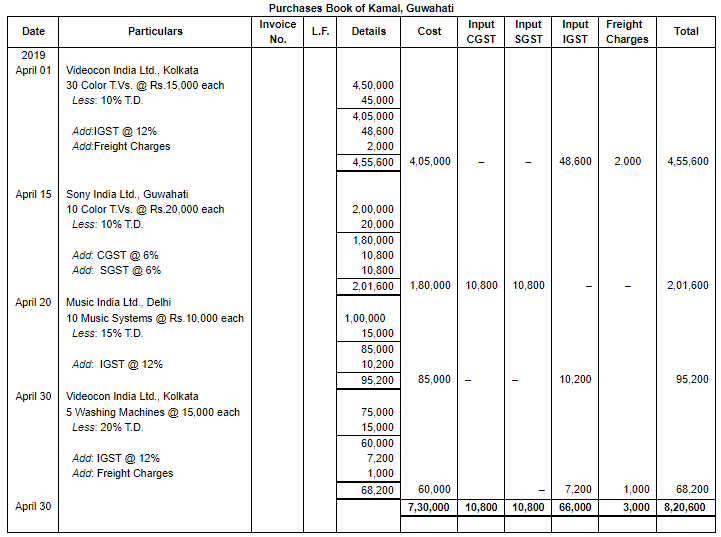

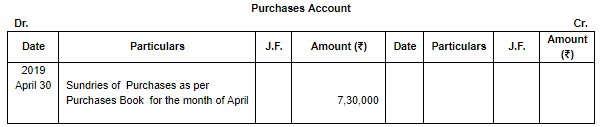

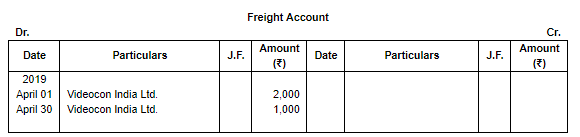

Question 3: From the following transactions of Kamal, Guwahati, prepare Purchases Book and post into Ledger:

ANSWER:

Page No 11.43:

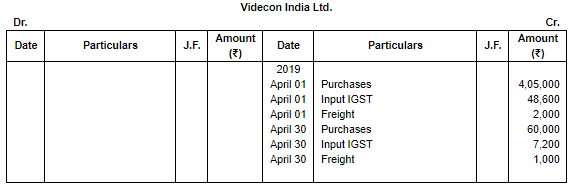

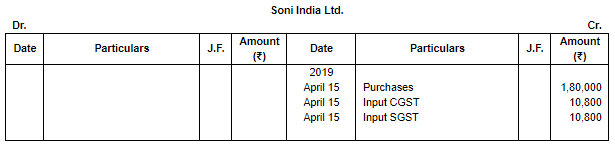

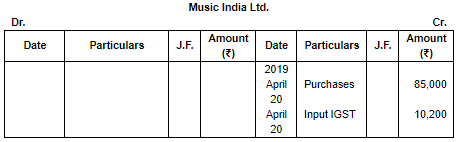

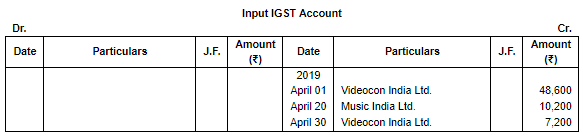

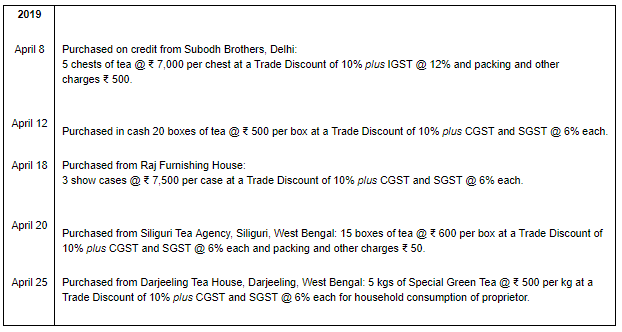

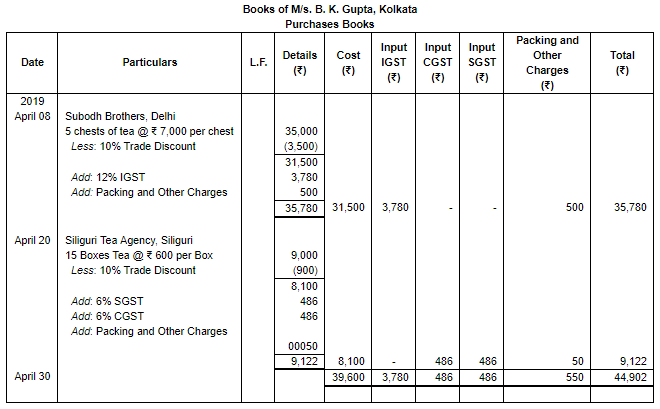

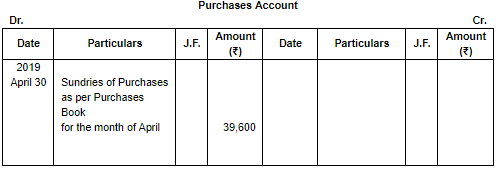

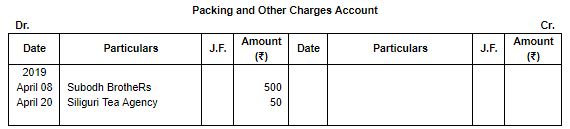

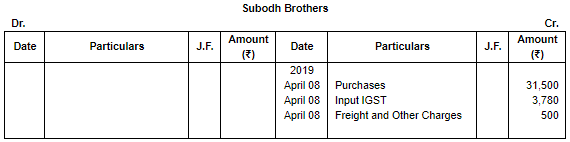

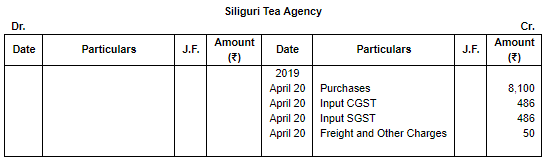

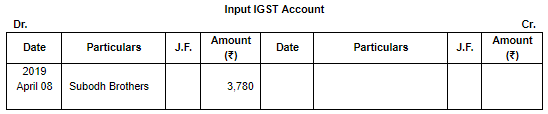

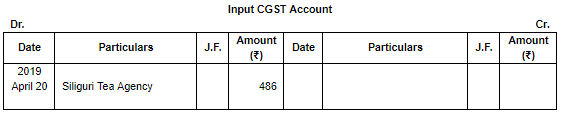

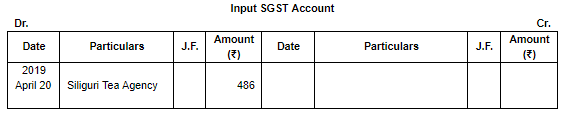

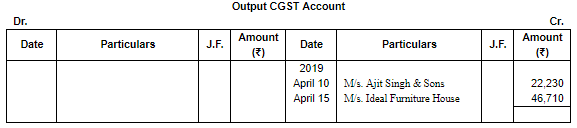

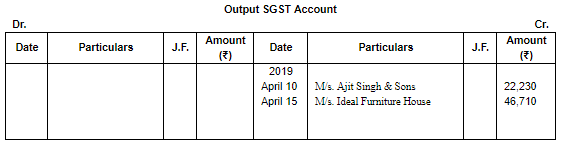

Question 4: The following purchases were made by Karam, Kolkata, during the month of April, 2019. Prepare Purchases Book and post into Ledger Accounts:

ANSWER:

Page No 11.43:

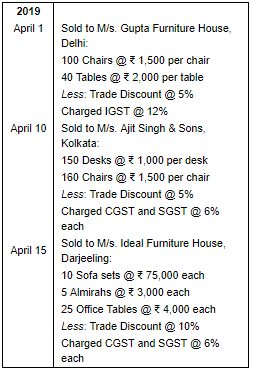

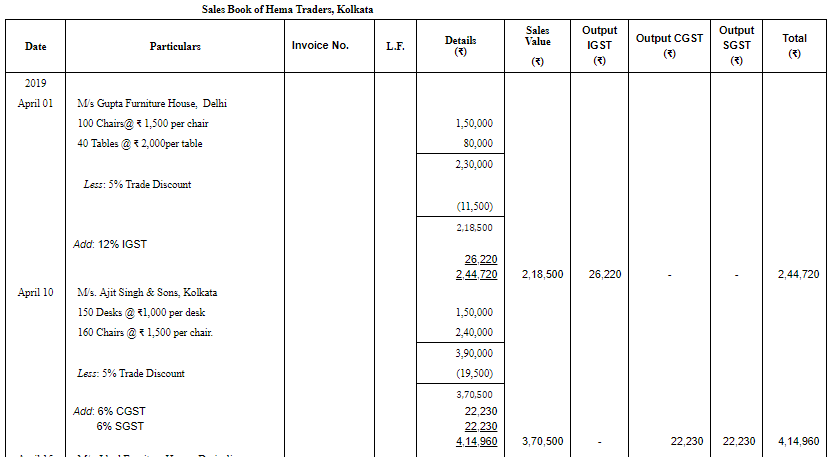

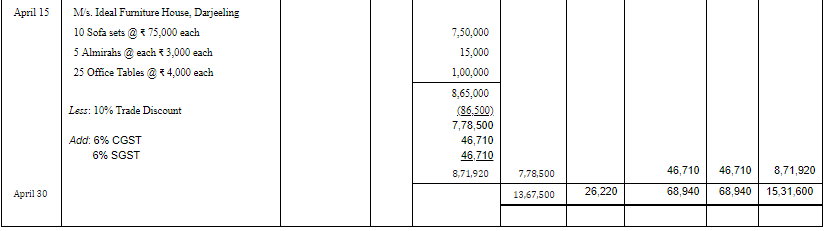

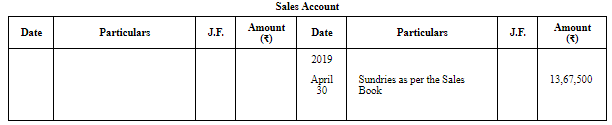

Question 5: Prepare Sales Book from the following transactions of Hema Traders, Kolkata dealing in furniture. Open the Ledger Accounts also:

ANSWER:

Page No 11.44:

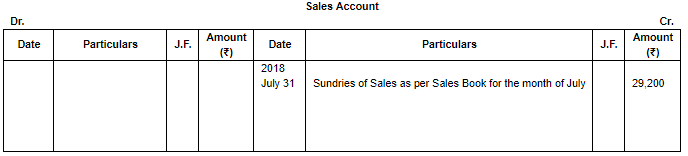

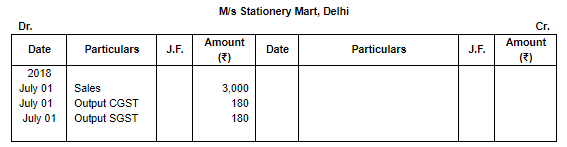

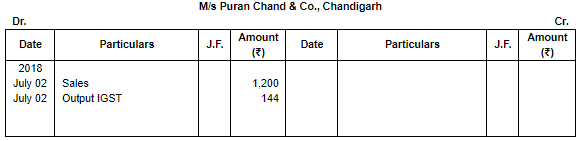

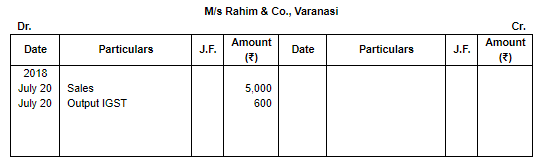

Question 6: From the following particulars, prepare a Sales Book of M/s. Gyan Prasad & Bros., Delhi, dealers of stationery and post into Ledger Accounts:

ANSWER:

Page No 11.44:

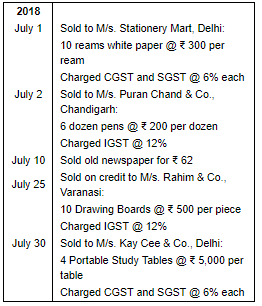

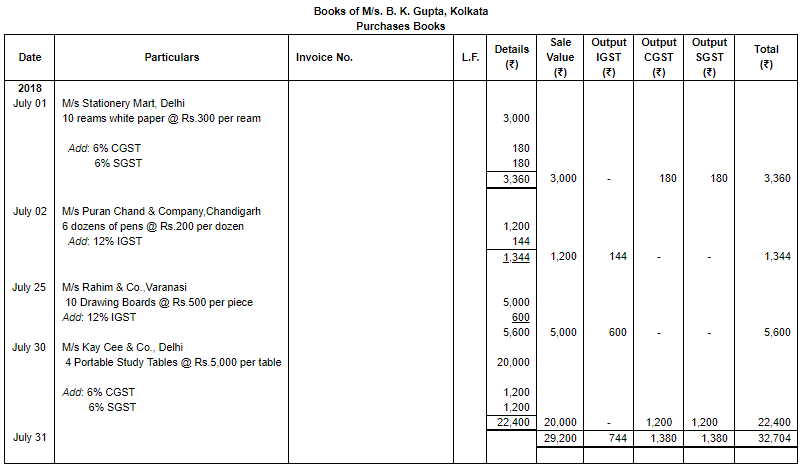

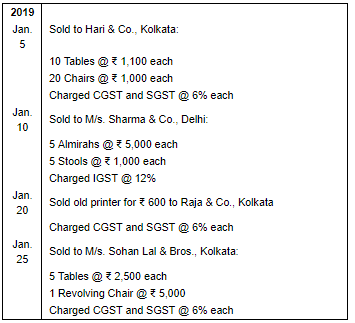

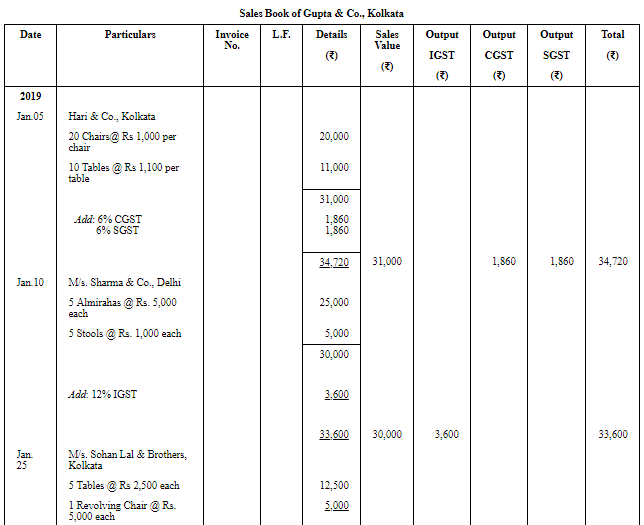

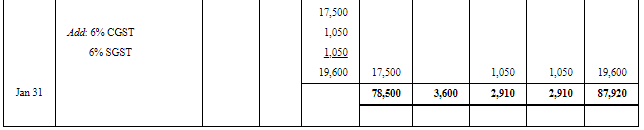

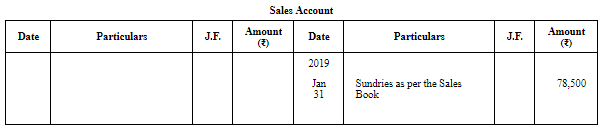

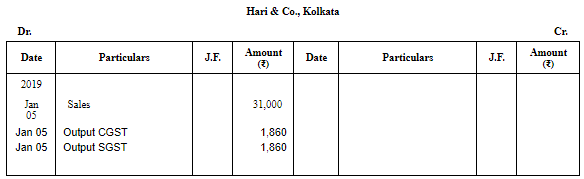

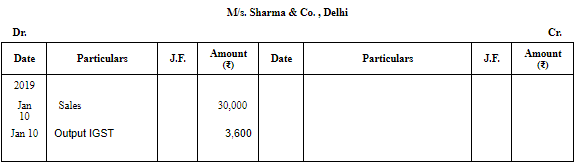

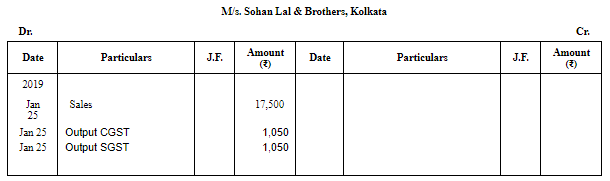

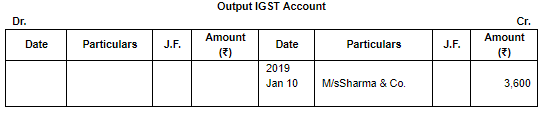

Question 7: From the following particulars, prepare Sales Book of Gupta & Co., Kolkata who deals in furniture:

Show the Posting from Sales Book to Ledger Accounts.

ANSWER:

Page No 11.45:

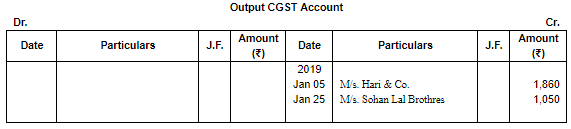

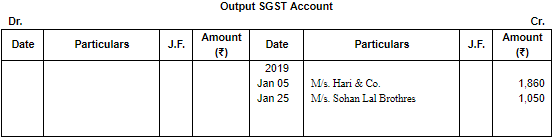

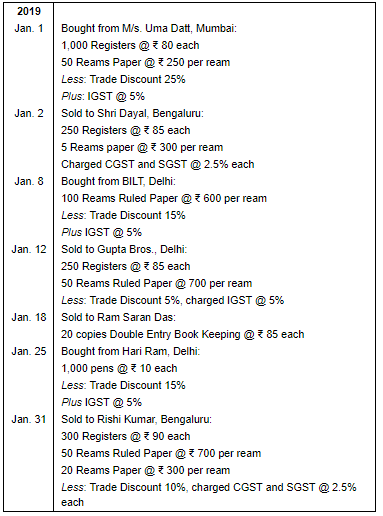

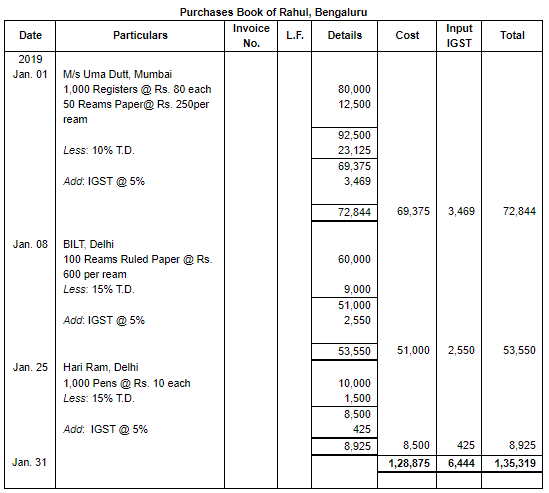

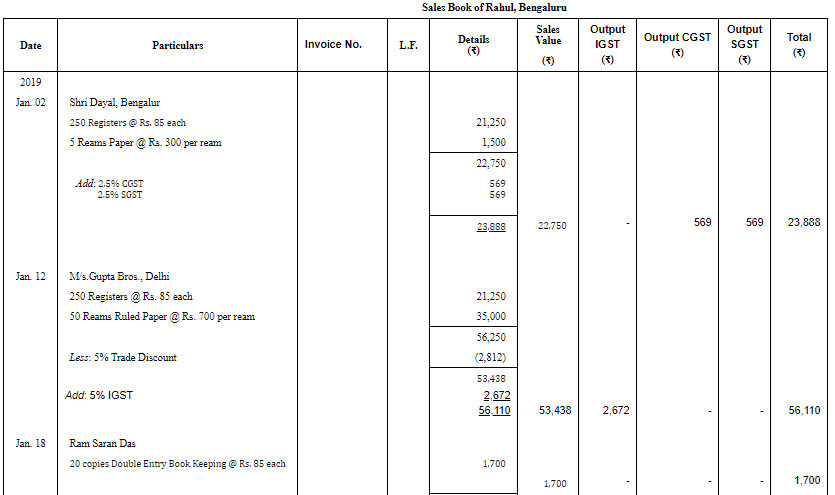

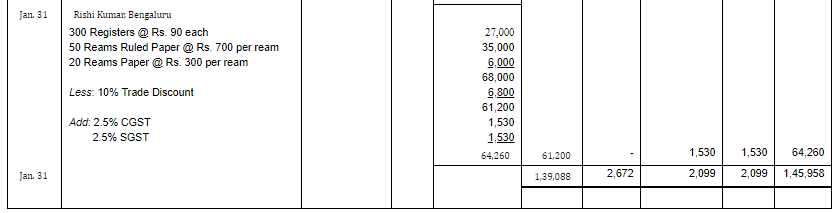

Question 8: Prepare Purchases and Sales Book from the following transactions of Rahul, Bengaluru:

ANSWER:

Page No 11.45:

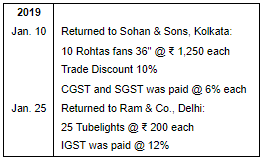

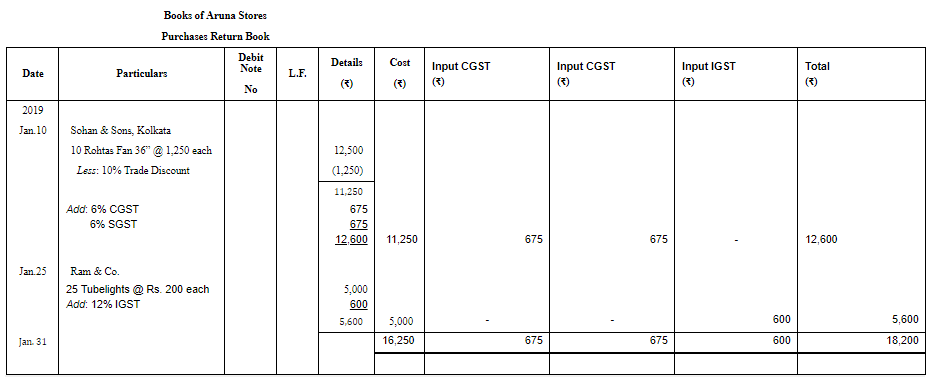

Question 9: Prepare Purchases Return Book of Aruna Stores, Kolkata from the following transactions and post them into Ledger:

ANSWER:

Page No 11.46:

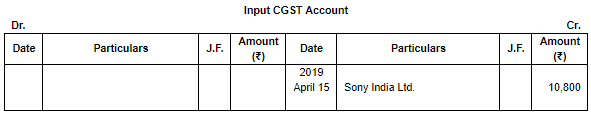

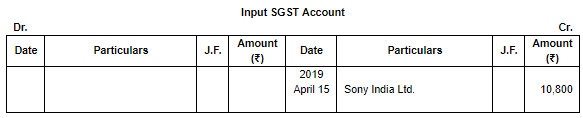

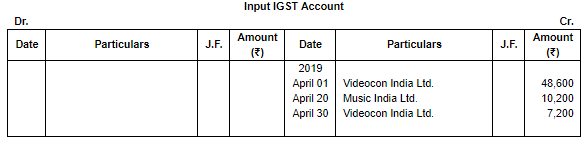

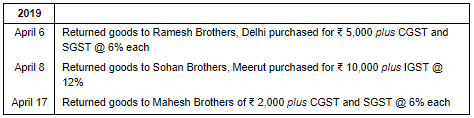

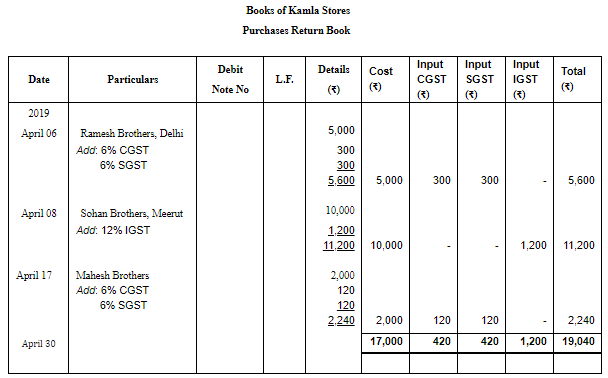

Question 10: Record the following transactions in the Purchases Return Book of Kamla Stores, Delhi for April, 2019:

ANSWER:

Page No 11.46:

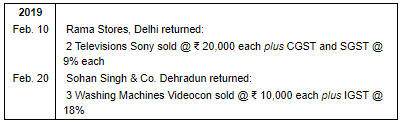

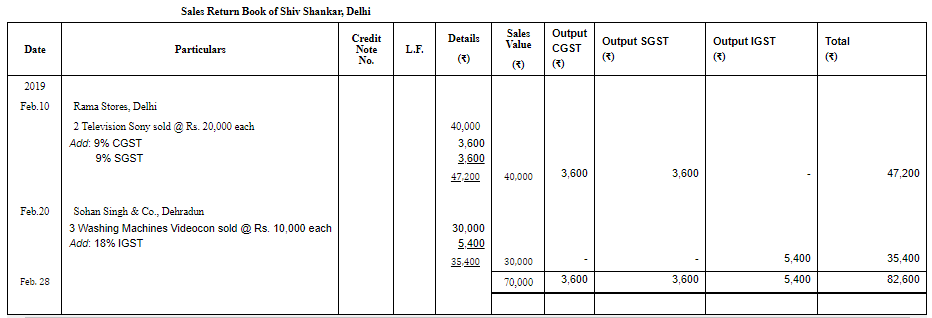

Question 11: Prepare Sales Return Book of Shiv Shankar, Delhi from the following transactions and post them into Ledger:

Answer:

Page No 11.46:

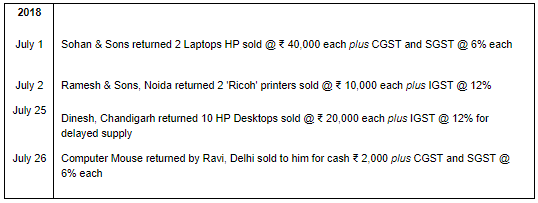

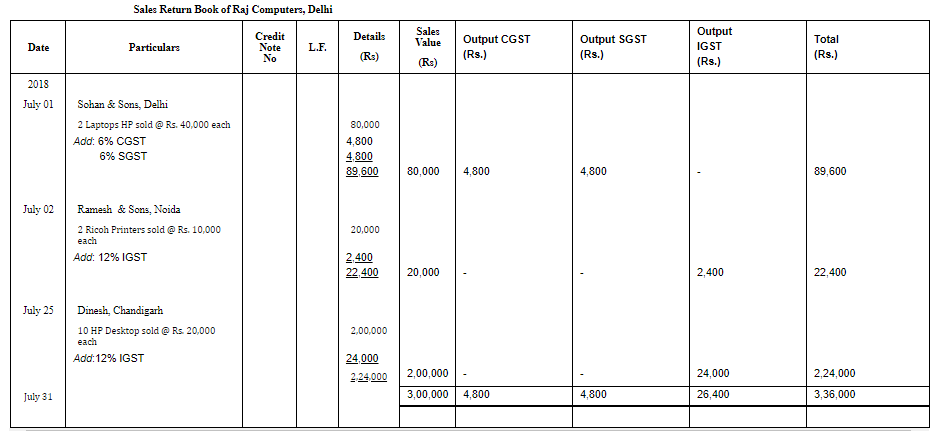

Question 12: Enter the following transactions in the Sales Return Book of Raj Computers, Delhi:

Write up the Ledger Accounts.

ANSWER:

Page No 11.46:

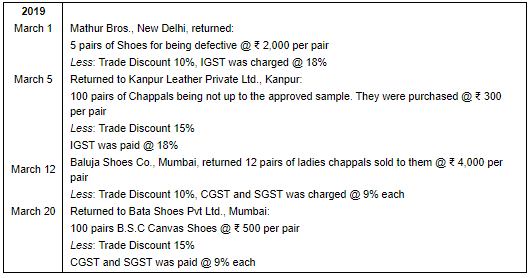

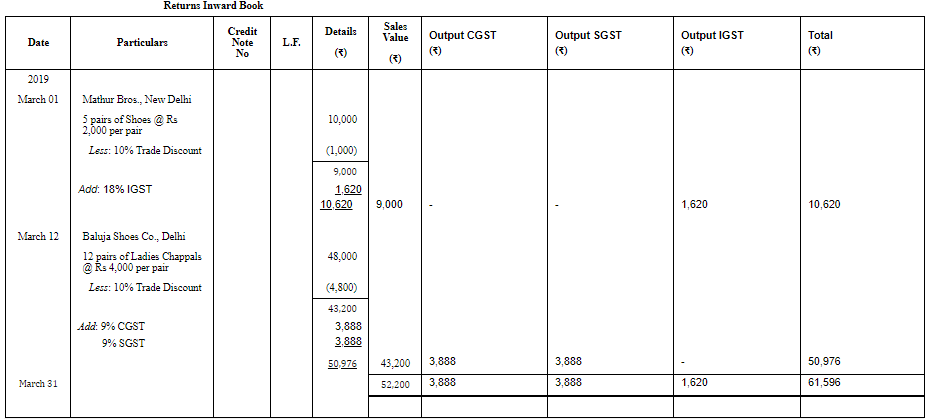

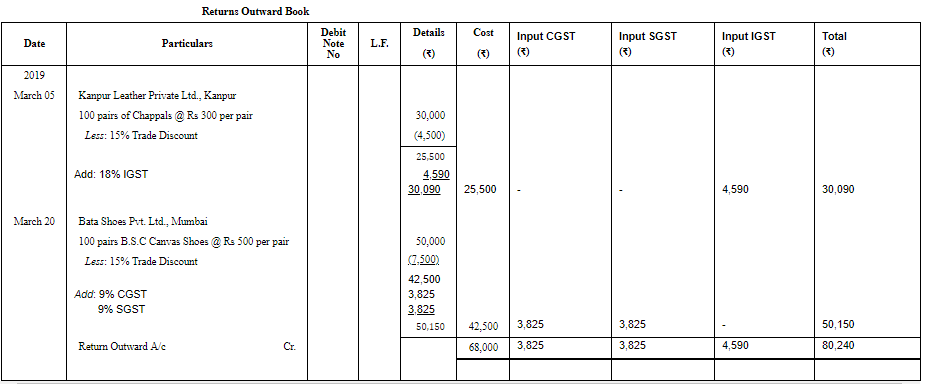

Question 13: Prepare Returns Inward and Return Outward Books of Manoj, Mumbai from the following transactions and post them into Ledger Accounts:

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Special Purpose Books II- Other Book(Part-1) - Accountancy Class 11 - Commerce

| 1. What is a special purpose book in commerce? |  |

| 2. What are some examples of special purpose books in commerce? |  |

| 3. Why are special purpose books important in commerce? |  |

| 4. How are special purpose books different from general purpose books in commerce? |  |

| 5. How can businesses ensure the accuracy of their special purpose books in commerce? |  |