Sample Questions - Not For Profit Organisations | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Not-For Profit Organisations

Time – 50 mins

M.M. - 30

Q1. what is legacy? (1 mark)

Q2. Salary paid by Jaipur Sports Club for the year ended 31st March, 2008 amounted to Rs.2,00,000. How much amount will be recorded in Income and Expenditure Account in the following case

31-3-2007 31-3-2008

Rs. Rs.

Outstanding Salary 7,000 10,000

Prepaid Salary 5,000 4,000

(1 mark)

Q3. On the basis of the information given below calculate the amount of Stationery to be debited to the 'Income and Expenditure Account' of Good Health Sports Club for the year ended 31st March 2007:

April 1, 2006 March 31,2007

Rs. Rs.

Stock of Stationery 8,000 6,000

Creditors for Stationery 9,000 11,000

Stationery purchased during the year ended 31-3-2007 was Rs. 47,000. (4 marks)

Q4. Extracts of Receipts and Payments Account for the year ended March 31, 2006 are given below:

Subscriptions Outstanding as on March 31, 2005 5,000

Total Subscriptions Outstanding as on March 31, 2006 12,000

Subscriptions received in advance as on March 31, 2005 2,800

Calculate the amount of subscriptions to be shown on the income side of Income and Expenditure A/c and show the relevant data in the balance sheet as at 31st March 2005 and 2006. (4 marks)

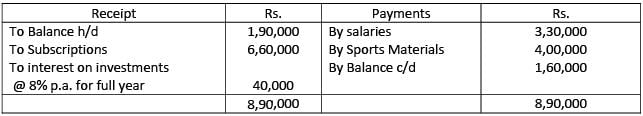

Q5. From the following Receipts and Payments Account of Sonic Club and from the given additional information; prepare Income and Expenditure Account for the year ending 31st March, 2015 and the Balance Sheet as at that date:

Receipts and Payments Account

for the year ending 31st March, 2015

Additional Information:

(i) The club had received Rs.20,000 for subscription in 2013-14 for 2014-15.

(ii) Salaries had been paid only for 11 months.

(iii) Stock of Sports Materials on 31st March, 2014 was Rs. 3,00,000 and on 31st March, 2015 Rs. 6,50,000. (6 marks)

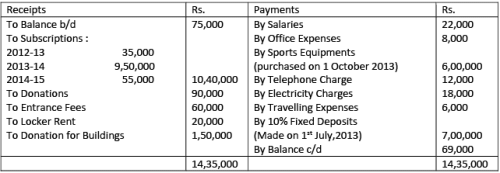

Q6. Following is the Receipts and Payments Account of a Club for the year ended 31st March, 2014:

Additional Information:

(i) Outstanding subscription for 2013-14 Rs.80,000.

(ii) Outstanding salaries as on 1st April, 2013 were Rs. 2,000 and as at 31st March, 2014 were Rs. 4,000.

(iii)Locker Rent rate is Rs. 2,000 per month.

(iv) Depreciation on sports equipment ®10% p.a.

Prepare Income and Expenditure Account of the Club for the year ended 31st h, 2014. (6 marks)

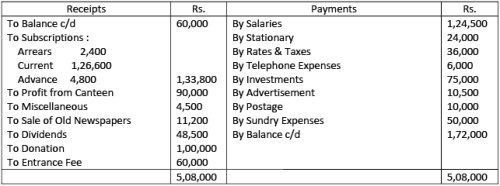

Q7. The following particulars relate to Madura Club for the year 31st March, 2015:

Receipts and Payments Account

You are required to prepare an Income and Expenditure Account and a Balance Sheet after making the following adjustments:

(i) There are 450 members each paying an annual subscription of Rs. 300, Rs. 2,700 being in arrears for 2013-14 at the beginning of this year.

(ii) A donation of Rs. 20,000 was wrongly included in subscriptions of the current year.

(iii) Entire donation and ¾ of entrance fees are to be capitalized.

(iv) Stock of Stationary on 31st March, 2014 was Rs. 3,000; and on 31st March, 2015 Rs. 5,400.

(v) Cost of Building is Rs. 6,00,000. Depreciate it at 5%. (8 marks)

|

79 docs|43 tests

|

FAQs on Sample Questions - Not For Profit Organisations - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is a not-for-profit organization? |  |

| 2. How do not-for-profit organizations differ from for-profit organizations? |  |

| 3. How do not-for-profit organizations fund their operations? |  |

| 4. What are the benefits of donating to a not-for-profit organization? |  |

| 5. How can I verify the legitimacy of a not-for-profit organization before making a donation? |  |