The Limited Liability Partnership Act(2008) - Partnership Laws, Business Law | Business Law - B Com PDF Download

Introduction

A partnership is often seen as an agreement between two people to run a business with the aim of making a profit. In this arrangement, the partners are fully responsible for the actions and mistakes of the business and each other. This model was common in the medieval times. However, when the idea of limited liability came into play, partnerships were viewed as risky and uncertain. This led to the need for limited liability partnerships (LLPs).

An LLP offers partners limited liability while also giving them the flexibility typical of partnership-based businesses. This adaptable nature of LLPs has made them a popular choice for businesses today.

Limited Liability Partnership

- The Limited Liability Partnership Act, 2008 (referred to as "the Act") governs the regulation of limited liability partnerships in India. This article discusses the key features and amendments of the Act while providing a critical assessment of its effectiveness.

- In India, Section 25 of the Indian Partnership Act, 1932 holds that all partners are jointly and severally liable for the actions of their fellow partners in their capacity as partners. Conversely, under Section 9 of the British Partnership Act, 1890, partners are jointly liable for the firm's contracts and jointly and severally liable for the firm's wrongdoings. This highlights the differing liability standards for partners in India and England.

- Partnerships with unlimited and personal liability are often seen as risky, necessitating the need for an alternative that offers limited liability. A limited liability partnership (LLP) allows partners to organize their business in the traditional partnership manner while enjoying the benefits of limited liability. An LLP is essentially a blend of a partnership firm and a company.

- According to Section 2(m) of the LLP Act, a foreign limited liability company is one that is found, incorporated, or registered in a foreign country and sets up business in India. Section 59 of the Act grants the Central Government the authority to establish rules governing the conduct of business by foreign limited liability companies in India.

Advantages of a Limited Liability Partnership (LLP)

- Flexibility in Internal Management: The internal management of an LLP is governed by the Limited Liability Partnership Agreement (LLP Agreement), allowing the firm to adopt any internal organization structure it prefers.

- Reduced Statutory Compliance: LLPs face less statutory compliance compared to companies registered under the Companies Act, 2013, making them easier to manage.

- No Ownership-Management Divide: There is no divide between ownership and management in an LLP, as every partner is an agent of the firm. However, partners are not liable for the wrongful acts of others.

- Distinct Legal Identity: An LLP has a legal identity separate from its members, meaning it is considered a separate person in the eyes of the law.

Disadvantages of a Limited Liability Partnership (LLP)

- Public Access to Documents: Documents filed by an LLP with the Ministry of Corporate Affairs are public records and can be obtained by anyone for a nominal fee. In contrast, the documents of a general partnership are not public and are not accessible to the public.

- Penalties for Non-Compliance: The Act imposes heavy penalties for non-compliance, and the operation of an LLP involves complex compliance requirements, which can hinder its growth.

- Limited Financing Options: LLPs have a restricted range of financing options. Venture capitalists and angel investors typically do not invest in LLPs. The primary financing options for LLPs are borrowing from financial institutions or obtaining loans from partners.

- Challenges for Venture Capitalists: Venture capitalists are reluctant to invest in LLPs because the LLP Act stipulates that every shareholder of an LLP is a partner, which comes with specific responsibilities that VCs prefer to avoid.

Historical Development

- The idea of a Limited Liability Partnership (LLP) was introduced by the Naresh Chandra Committee. This committee studied the rules regarding private companies and partnerships.

- The committee discovered that the unlimited liability faced by partners made partnerships less appealing. This risk of unlimited liability was a barrier to the growth of businesses that relied on professional partnerships.

- The concept of an LLP was viewed as a solution to make professional partnerships and small to medium enterprises more competitive.

- The committee pointed out that because of certain rules, professional firms could not participate in many types of business structures. In contrast, trading and manufacturing companies had the option to register as private or public companies under the Companies Act.

- The Companies Act, 2013, which was designed to regulate companies, was considered unsuitable for LLPs. There was a need for specific laws to manage the creation and regulation of LLPs, as strict rules from the Companies Act would limit their flexible nature.

- The need for specific laws for LLPs was further emphasized by the Committee on New Company Law in 2005, led by Dr. J.J. Irani.

- While the Naresh Chandra Committee aimed to introduce LLPs mainly for the service sector, the Irani Committee wanted to expand this idea to include small businesses.

- The Irani Committee argued that LLPs would allow small businesses to create agreements, form joint ventures, and access new technologies, helping them to compete on a global scale.

Objective of the Limited Liability Partnership Act, 2008

The Limited Liability Partnership Act, 2008 aims to establish guidelines for the formation and regulation of limited liability partnerships (LLPs). It also addresses matters related to the formation and regulation of LLPs. The LLP concept offers growth opportunities for small enterprises and encourages professionals with expertise in various fields to form partnerships.

When the LLP Act was enacted, the Companies Act, 1956 was in effect, which limited partnerships to a maximum of 20 partners. One of the main goals of the LLP Act was to increase this limit. Currently, the Companies Act, 2013 allows partnerships to have up to 100 partners.

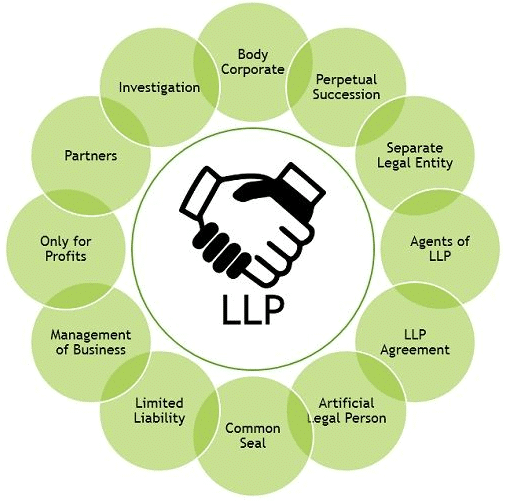

Nature and Salient Features of a Limited Liability Partnership

- Legal Identity: An LLP has a distinct legal identity separate from its partners. It can own, acquire, and hold property in its own name and has the ability to sue and be sued in its own name.

- Perpetual Succession: LLPs enjoy perpetual succession, meaning that a change in partners does not affect the rights and liabilities of the LLP. The entity continues to exist even if a partner dies, retires, becomes insolvent, or is declared insane.

- Exemption from Partnership Act: LLPs are exempt from the provisions of the Partnership Act, 1932, as stated in Section 4 of the Act.

- Partner Liability: Partners in an LLP are considered agents of the LLP but not of each other. This means that one partner is not liable for the wrongful acts or omissions of another partner. If the LLP fails to meet its obligations, its property will be used to settle the liabilities.

- Unauthorized Acts: An LLP cannot be held liable for unauthorized acts of its partners if the claiming party was aware that the partner was acting without authority.

- Limited Liability: The liability of a partner is limited to the obligations they owe as a partner of the LLP and does not extend to their personal or individual liabilities.

- Transfer of Rights: The rights of a partner, such as their share of profits or losses, can be partially or fully transferred. However, transferring rights does not grant the transferee the right to participate in the management of the LLP.

- Annual Compliance: LLPs are required to maintain annual accounts and file annual statements of solvency with the Registrar. The accounts are subject to scrutiny.

- Name Regulation: The government has the authority to direct an LLP to change its name if it closely resembles the name of another incorporated LLP, body corporate, or if the name is deemed undesirable. Additionally, LLPs must include "LLP" at the end of their name.

- Winding Up: LLPs can be wound up in two ways: voluntarily by the partners or by an order from the National Company Law Tribunal.

Partner of a Limited Liability Partnership

- According to Section 5 of the Limited Liability Partnership (LLP) Act, anyone, whether an individual or a corporate entity, can become a partner in an LLP. This means that both natural persons and legal entities are eligible to be partners. However, there are certain conditions under which a person may be disqualified from becoming a partner. If a person is declared insolvent or deemed to be of unsound mind by a competent court, they will be disqualified from being a partner in an LLP.

- Section 6 of the Act outlines the circumstances under which a partner can be held personally liable for the obligations of the LLP. An LLP must have a minimum of two partners. If the number of partners is reduced to two and the business continues for a period extending to six months with only one partner, that single partner can be held personally liable for the obligations of the LLP incurred during that period. However, the single partner must be aware that the partnership firm has only one partner during this time.

- As per Section 22 of the Act, the individuals who subscribe to the incorporation document at the time of registering the LLP are considered the partners of the LLP. The relationship between the partners and the LLP, as well as the relations among the partners themselves, are governed by the LLP agreement.

- Section 25 of the Act stipulates that a partner must inform the LLP about any change in their name or address within 15 days of the change. Additionally, a notice of such change must be sent to the Registrar.

Designated Partner

According to Section 7 of the LLP Act, it is mandatory for an LLP to have a minimum of two designated partners, one of whom must be a resident of India. Both designated partners must be natural persons; body corporates cannot serve as designated partners. If all the members of the LLP are body corporates, their nominees will act as designated partners.

A resident of India, as defined in the explanation of Section 7, is an individual who has lived in India for at least 182 days in the preceding year.

Certain individuals are ineligible to be appointed as designated partners:

- Minors

- Individuals declared bankrupt within the last five years

- Individuals imprisoned for over six months

- Individuals with a history of fraudulent credit in the past five years

Any vacancy in the position of a designated partner must be filled within 30 days of its occurrence. If vacancies are not filled or if there is only one designated partner in the LLP, all partners will be deemed designated partners. Failure to comply with the requirements of Section 7 may result in fines of up to 5 lakh rupees for the LLP and its partners.

Role and Duties of a Designated Partner

- The LLP agreement outlines the specific duties of a designated partner, who is responsible for ensuring compliance with all provisions of the LLP Act. Designated partners are required to obtain a Designated Partner’s Identification Number (DPIN).

- Section 35 of the Act mandates that designated partners ensure the LLP files its annual return within 60 days of the financial year’s end. Failure to do so may result in fines of up to 1 lakh rupees for the designated partner.

- Under Section 47, designated partners are required to assist inspectors appointed under Chapter IX in investigating the affairs of the LLP.

Resignation or Cessation of Partnership

Section 24 of the LLP Act outlines the procedure for a partner wishing to resign. A partner intending to resign must provide a 30-day notice to the other partners, expressing their intention to leave the partnership.

A person ceases to be a partner in an LLP upon their death, insolvency, or if a court declares them of unsound mind. When an individual ceases to be a partner, the former partner or any entitled individual will receive the share of accumulated profit and capital contributed by the former partner. However, they will not have the right to participate in the management of the LLP.

Incorporation of a Limited Liability Partnership (LLP)

To establish an LLP, it is necessary to register it under the Limited Liability Partnership Act, 2008. The process involves several steps:

- Filing the Incorporation Document: An LLP is incorporated by submitting the incorporation document to the Registrar in the state where the LLP intends to set up its registered office. This document must be signed by at least two individuals who plan to carry out a lawful business with the aim of making a profit.

- Compliance Statement: Along with the incorporation document, a statement confirming compliance with all provisions of the Act is required. This statement can be prepared by a chartered accountant, cost accountant, company secretary, advocate, or any person involved in the LLP’s formation, along with someone who has signed the incorporation document.

- Penalties for False Statements: If the person making the compliance statement knows it is false or is unsure of its accuracy, they may face up to 2 years of imprisonment and a fine of up to 5 lakh rupees.

- Contents of the Incorporation Document: The document must include the name and registered office of the LLP, the names and addresses of all partners, including designated partners, and the proposed business activities of the LLP.

- Registration and Certificate: Once all conditions are met within the stipulated time, the Registrar will register the incorporation document and issue a certificate of incorporation to the LLP.

Conversion to a Limited Liability Partnership (LLP)

Chapter X of the Act outlines three types of conversion to a Limited Liability Partnership (LLP). Conversion involves transferring the assets, liabilities, privileges, interests, and obligations of a firm or company to the LLP.

Conversion of a Partnership Firm to an LLP

- Section 55 and Schedule 2 of the Act detail the procedure for converting a partnership firm into an LLP.

- This conversion will not affect existing agreements made by the partnership firm; instead, the LLP will be considered a party to these contracts.

Conversion of a Private Company to an LLP

- A private company can be converted into an LLP if there is no security interest in its assets and if the partners of the proposed LLP are solely the shareholders of the private company.

- The private company must provide a statement to the registrar, signed by all shareholders, indicating the company's name, registration number, and incorporation date.

- Additionally, the statement and incorporation document as per Section 11 need to be submitted to the Registrar.

- The Registrar may issue a certificate of registration or refuse to register the LLP, and this refusal can be challenged before the Tribunal.

Conversion of a Public Listed Company to an LLP

- Section 57 and the 4th Schedule of the Act outline the procedure for converting an unlisted public company into an LLP.

- At the time of application, there should be no security interest in the company’s assets for eligibility.

- After registration, the LLP must inform the Registrar of Firms (for conversions from partnership firms) or the Registrar of Companies (for conversions from private or unlisted public companies) within 15 days.

- Upon registration, the holders of the private or public company become partners of the LLP and are bound by the provisions of the Act.

Hurdles in Conversion

- Conversion to an LLP involves certain costs and risks and is a complex process requiring the consent of all partners or members, including minority shareholders.

- The converting company will be deemed dissolved and removed from the registrar’s records.

- A key condition for conversion is that no security interest should exist on any asset of the company at the time of application, which is rare in practice.

- Conversion to an LLP is a one-way process; companies cannot revert to a partnership firm or public/private company.

Investigation of a Limited Liability Partnership

Chapter IX of the Act addresses the investigation of Limited Liability Partnerships (LLPs).

Appointment of Inspectors

- Under Section 43, the Central Government has the authority to appoint inspectors to investigate the affairs of an LLP. This can occur if the government believes that the LLP is not complying with the Act.

- Section 45 specifies that a body corporate or firm cannot be appointed as inspectors.

Role of Courts and Tribunals

- The Central Government can initiate an investigation if a court or tribunal orders it. A tribunal can make this order either on its own or upon request from at least 20% of the LLP's partners.

Application by Partners

- When partners request an investigation, they must provide supporting evidence and make a security deposit with the Central Government.

Inspector's Report

- According to Section 49, inspectors must submit their findings to the Central Government, which will then share the report with the LLP.

- The report is considered evidence in legal proceedings.

Legal Actions

- If the Central Government believes, based on the inspector's report, that an offence has occurred, it can initiate legal proceedings.

- Partners, designated partners, employees, and agents of the LLP are required to assist the government in such cases.

Powers of Inspectors

- Inspectors can investigate entities currently or previously associated with the LLP, as well as former or current partners, with prior approval from the Central Government.

- Inspectors can apply to the Judicial Magistrate or Metropolitan Magistrate for permission to seize documents if they believe such documents are at risk of being destroyed, altered, or concealed.

- The seized documents can be kept for up to six months and must be returned to the original custodian after the investigation.

Limited Liability Partnership (Amendment) Act, 2021

Start-up LLP and Small LLP

- The Limited Liability Partnership (Amendment) Act, 2021, introduced the concept of small limited liability partnerships (LLPs).

- A small LLP is defined as one with a contribution of less than 25 lakhs or a higher prescribed amount less than 5 crores, and a turnover of less than 40 lakhs or a higher prescribed amount less than 50 crores.

- Small LLPs must also meet any other prescribed criteria.

- The Amendment also introduced the concept of start-up LLPs, which are LLPs recognized as start-ups by the Central Government.

- The aim is to provide small and start-up LLPs with advantages over other LLPs, such as reduced penalties in cases of default.

- In case of a default, small or start-up LLPs would be liable to only half the penalty prescribed for general LLPs.

- A maximum penalty of Rupees 1 lakh can be imposed on such an LLP, and a maximum penalty of Rupees 5 lakh on partners or members.

Resident of India

- The Amendment modifies the definition of 'resident of India' in Section 7 of the principal Act.

- A resident of India, for the purpose of the Act, is now defined as a person who has lived in India for a minimum of 120 days in the preceding financial year.

Punishment

- Section 30 of the LLP Act, 2008, stated that in cases of fraud committed by an LLP or its partners, both the LLP and the fraudulent partners would face unlimited liability.

- Those involved in the fraud would be liable for imprisonment up to 2 years and a fine up to Rupees 5 lakh.

- The Amendment Act increases the imprisonment term from 2 to 5 years.

- As per Section 21 of the Act, an LLP failing to include its name, registration number, and registered office address in official correspondence and invoices would face a fine up to Rupees 25,000.

- The Amendment raises this fine limit to Rupees 10,000.

Change in the name of LLP

- The Amendment empowers the Central Government to direct an LLP to change its name if it is identical to an existing LLP or trademark.

- The LLP must change its name within 3 months, or the Central Government can allot a new name to the LLP.

Appeal from the order of the National Company Law Tribunal

- The Amendment Act allows a person aggrieved by the order of the National Company Law Tribunal (NCLT) to appeal to the National Company Law Appellate Tribunal (NCLAT) within 60 days of the NCLT order.

- If the NCLT order was based on party consent, no appeal can be made against it.

- The NCLAT will hear the parties and pass an order modifying, upholding, or setting aside the NCLT order.

Special Courts

- The Amendment Act modifies Section 77 of the principal Act, which originally granted jurisdiction to Judicial Magistrates of the first class or Metropolitan Magistrates to try offences under the LLP Act 2008.

- The Amendment provides for the setting up of special courts to exclusively try offences under the Act.

- The newly inserted Section 77A specifies that these special courts will have exclusive jurisdiction, except in cases where the Registrar or a higher-ranking official makes a complaint in writing.

Can an LLP Be a Partner in a Partnership Firm?

The question of whether a Limited Liability Partnership (LLP) can be a partner in a partnership firm has seen differing opinions among various High Courts in India. Let's look at two significant cases that highlight this issue:

1. M/S Diamond Nation v. Deputy State Tax Commissioner (2019)

- Facts: In this case, the Registrar of Firms denied the registration of Go Green Diamonds LLP as a partner in the petitioners' firm. The Registrar argued that an LLP could not be a partner in a partnership firm.

- Petitioners' Argument: The petitioners argued that Section 4 of the Indian Partnership Act allows a legal person to be a partner in a partnership firm. They cited Section 2(d) of the LLP Act, which states that an LLP is a body corporate with a distinct identity from its members, supporting their claim that an LLP can be a partner.

- Respondents' Argument: The respondents contended that Sections 25 and 49 of the Indian Partnership Act indicate that all partners are jointly and severally liable. They pointed out that LLP partners have limited liability, which is inconsistent with partnership principles. Additionally, they noted that a partnership firm does not have a separate identity from its members, while an LLP does, leading to potential legal ambiguities.

- Court's Consideration: The court referenced a previous ruling in Dulichand Laxminaraya v. Commissioner of Income Tax (1956), where it was established that a firm cannot enter into a partnership because it is not a legal person.

- Judgment: The court ruled that allowing an LLP to be a partner in a partnership firm would contradict Sections 25 and 49 of the Partnership Act. It emphasized that the limited liability of LLP partners goes against the principles of the Partnership Act. The court concluded that a body of persons cannot be a partner, and there is harmony between the LLP Act and the Partnership Act. Therefore, the Registrar's refusal to register the LLP as a partner was upheld.

2. Jayamma Xavier v. Registrar of Firms (2021)

- Case Overview: In this case, an LLP had formed a partnership with an individual. However, the registrar of firms declined to register this partnership, citing the reason that an LLP is not permitted to be a partner in such an arrangement.

- Petitioners' Argument: The petitioners argued that the Partnership Act does not explicitly forbid an LLP from entering into a partnership. They emphasized that an LLP possesses perpetual succession and is recognized as a separate legal entity, capable of initiating or facing legal actions in its own name.

- Respondents' Argument: The respondents contended that specific sections of the Indian Partnership Act, namely Sections 25, 26, and 49, are at odds with the provisions outlined in the LLP Act of 2008. Consequently, they argued, an LLP should not be allowed to partake in a partnership.

- Legal Question: The central legal question was whether an LLP can be considered a legal person and, consequently, whether it can enter into a partnership with an individual.

- Court's Judgment: The court determined that a partnership can be established between two individual persons. It referred to the definition of a person in Section 3(42) of the General Clauses Act, 1897, which recognizes a body corporate as a legal person. Since an LLP is classified as a body corporate under the LLP Act of 2008, the court found no legal inconsistency in allowing an LLP to be a partner in a partnership firm.

- Legal Implications: The court clarified that when an LLP enters into a partnership, it is governed by the provisions of the Partnership Act. This means that the liabilities of the LLP partners under the LLP Act would not be applicable in this context. The liability of the LLP would be separate from that of its individual partners.

Conclusion

- The LLP Act is applicable beyond just professional enterprises, indicating its broader scope. This suggests that the Act prioritizes the recommendations of the Irani Committee over those of the Naresh Chandra Committee.

- The 2021 Amendment modernizes the Act to align with current economic conditions. It introduces concepts like start-up LLPs and small LLPs, reflecting the government’s policy to promote and incentivize small enterprises and startups. The establishment of special courts is expected to expedite case disposal and enhance the ease of doing business in India.

- There is a pressing need for the Supreme Court to clarify its position on whether an LLP can enter into a partnership.

|

30 videos|99 docs|17 tests

|

FAQs on The Limited Liability Partnership Act(2008) - Partnership Laws, Business Law - Business Law - B Com

| 1. What is the Limited Liability Partnership Act of 2008? |  |

| 2. What are the key provisions of the Limited Liability Partnership Act of 2008? |  |

| 3. How is a limited liability partnership different from a general partnership? |  |

| 4. What are the advantages of forming a limited liability partnership? |  |

| 5. How can a limited liability partnership be dissolved or closed? |  |