Types of Banks | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Types of Banks in India |

|

| Central Bank |

|

| Commercial Banks |

|

| Cooperative Banks |

|

| Specialized Banks |

|

| Major Functions of Banks in India |

|

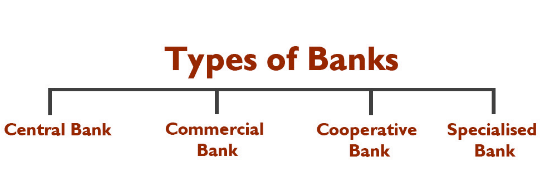

Types of Banks in India

Banks in India can be broadly classified into Commercial Banks, Cooperative Banks, and Regional Rural Banks (RRBs). Within commercial banks, there are Public Sector Banks, Private Sector Banks, and Foreign Banks. Cooperative banks are divided into Urban Cooperative Banks and Rural Cooperative Banks. RRBs are specialized banks that cater to the financial needs of rural areas.

Central Bank

India’s central bank is the Reserve Bank of India (RBI), which regulates the Indian banking system, oversees monetary policy, and manages the country’s foreign exchange reserves.

Commercial Banks

Commercial banks are the most common banks in India, offering a range of services such as savings accounts, loans, and investment products.

Public Sector Banks

These are government-owned banks that dominate India’s banking landscape. Major public sector banks include:

- State Bank of India

- Punjab National Bank

- Bank of Baroda

- Canara Bank

- Union Bank of India

- Indian Bank

- Central Bank of India

- Indian Overseas Bank, and others.

Several public sector banks have undergone mergers, such as Andhra Bank and Corporation Bank merging with Union Bank of India, and Vijaya Bank and Dena Bank merging with Bank of Baroda.

Private Sector Banks

Private banks are owned by private entities or individuals and have become increasingly prominent. Leading private sector banks include:

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- Yes Bank

- IndusInd Bank, among others.

Foreign Banks

These are branches of international banks operating in India, offering services in corporate banking, investment banking, and retail banking. Prominent foreign banks include:

- HSBC

- Citibank

- Deutsche Bank

- Standard Chartered Bank

- Barclays Bank, among others.

Regional Rural Banks (RRBs)

Established in 1975, RRBs aim to provide financial services to rural areas. They are jointly sponsored by commercial banks and the government. Some of the prominent RRBs include:

- Assam Gramin Vikash Bank

- Karnataka Gramin Bank

- Punjab Gramin Bank, among others.

Cooperative Banks

Cooperative banks are owned by their members and primarily serve rural communities. They provide savings accounts, loans, and credit, playing a crucial role in supporting agriculture and rural economies.

Scheduled and Non-Scheduled Banks

- Scheduled Banks: These banks are listed under the Second Schedule of the RBI Act, 1934, and include public sector banks, private sector banks, and foreign banks.

- Non-Scheduled Banks: These are smaller banks not included in the RBI’s Second Schedule and often serve specific markets. Examples include The Andaman and Nicobar State Cooperative Bank and The Sikkim State Cooperative Bank.

Local Area Banks (LABs)

LABs were introduced in 2013 to provide financial services to underserved areas. They help promote financial inclusion in their respective regions.

Payments Banks

Launched in 2015, payments banks offer limited banking services like savings accounts, money transfers, and bill payments but do not provide loans or credit cards. Key payments banks include:

- Airtel Payments Bank

- India Post Payments Bank

- Paytm Payments Bank

- Jio Payments Bank, and others.

Small Finance Banks (SFBs)

Introduced in 2015, SFBs cater to the financial needs of underserved segments, such as small businesses and farmers. Major SFBs include:

- AU Small Finance Bank

- Equitas Small Finance Bank

- Ujjivan Small Finance Bank

- Jana Small Finance Bank, among others.

Specialized Banks

These banks serve specific sectors of the economy, such as agriculture or industry. Examples include the National Bank for Agriculture and Rural Development (NABARD) and the Industrial Development Bank of India (IDBI).

Major Functions of Banks in India

- Safeguarding Deposits: Banks offer secure locations to store money while paying interest on these deposits.

- Lending: Banks provide loans to individuals and businesses using deposits, earning profits through interest.

- Money Supply Regulation: Banks regulate the money supply through credit creation.

- Foreign Exchange Management: Banks deal with foreign exchange transactions.

- Miscellaneous Services: Banks offer services such as overdraft protection, locker facilities, and ATM access.

|

237 videos|236 docs|166 tests

|

FAQs on Types of Banks - Crash Course for UGC NET Commerce

| 1. What are the different types of banks in the Indian banking system? |  |

| 2. Can you provide examples of specialized banks in India? |  |

| 3. What is the role of Agriculture Banks in the Indian banking system? |  |

| 4. How do Industrial Banks contribute to the Indian economy? |  |

| 5. What services do Trade Banks offer in India? |  |