UGC NET Paper 2: Commerce 13th June 2023 Shift 2 | UGC NET Past Year Papers PDF Download

Q1: Given below are two statements: one is labelled as Assertion A and the other is labelled as Reason R

Assertion A: "Promise is an agreement"

Reason R: "An agreement is the sum total of offer and 'acceptance"

In the light of the above statements, choose the most appropriate answer from the options given below:

(a) Both A and R are correct and R is the correct explanation of A

(b) Both A and R are correct but R is NOT the correct explanation of A

(c) A is correct but R is not correct

(d) A is not correct but R is correct

Ans: A

Sol: The correct answer is Both A and R are correct and R is the correct explanation of A.

Key Points

Promise:- A promise is a declaration or assurance that one will do something or that a particular thing will happen. It is often a unilateral declaration made by one party.

Agreement:- An agreement is a mutual understanding or arrangement between two or more parties. It often involves a 'meeting of the minds' where all involved parties agree to certain terms.

Assertion A: "Promise is an agreement"

- A promise to do something between two parties, or not, is said to form a sort of mutual understanding in pursuance of individual interests.

- For example If A promises to pay B a sum of Rs. 1000 to sell him 5 litres of oil and B accepts for the same, then Rs. 1000 is the consideration for a promise for B and vice versa.

Hence, Assertion A is correct.

Reason R: "An agreement is the sum total of offer and 'acceptance"

- The expression of the will of the person to another is called a proposal. This expression of interests with an intention to enter into a valid accord enforceable by law is termed is agreement.

- Every promise and every set of promises, forming the consideration for each other, is an agreement.

- A very essential element of proposal and subsequent agreement is the consideration for which the acceptor promises to do, or abstain from doing something, on the persuasion of the offerer.

- Without consideration, the promisor does not have any teeth to enter into a valid agreement.

- To sum up, we can represent the above information below: Agreement = Offer + Acceptance.

- Promises and commitments forming consideration for the parties to the same consent are known as an agreement. The agreement, which is legally enforceable, is known as a contract.

Hence, Reason R is correct.

Therefore we can say that Both A and R are correct and R is the correct explanation of A.

Q2: The potential benefit of FDI to host countries include which of the following:

A. Access to superior technology and increased competition

B. Employment generation

C. Increase in domestic investments

D. Bridging host countries foreign exchange gaps

E. Reduction in income inequality

Choose the correct answer from the options given below:

(a) B, D, E only

(b) A, B, E only

(c) C, E, D only

(d) A, C, D only

Ans: D

Sol: Foreign direct investment (FDI) is an ownership stake in a foreign company or project made by an investor, company, or government from another country.

Key Points

Benefits of FDI in host countries

Access to superior technology and increased competition

- Recipient businesses get access to latest financing tools, technologies and operational practices from across the world. Over time, the introduction of newer, enhanced technologies and processes results in their diffusion into the local economy, resulting in enhanced efficiency and effectiveness of the industry.

Increase in domestic investments

- FDI assures a large quantity of domestic capital, production level, and job prospects, which is a crucial step toward the country's economic progress.

Improved Capital Flow

- Inflow of capital is particularly beneficial for countries with limited domestic resources, as well as for nations with restricted opportunities to raise funds in global capital markets.

Bridging host countries foreign exchange gaps

- FDI improves a country's balance of Payment as it causes an influx in foreign curency and helps in bridging host country's foreign exchange gaps.

Therefore we can say that the correct answer is A, C, D only

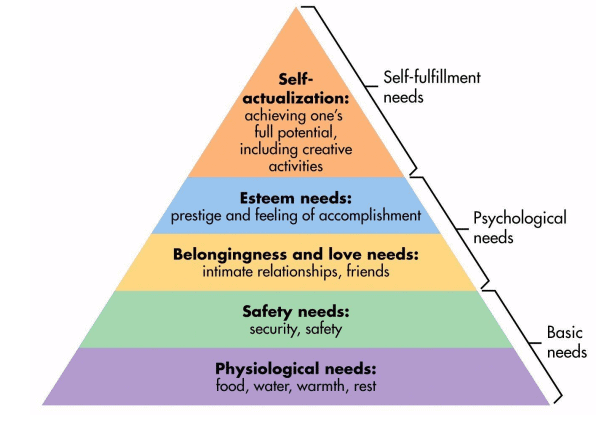

Q3: Maslow's Hierarchy of Needs depicts human needs in the form of hierarchy ascending from the lowest to highest need. The correct order is.

(a) Esteem needs, Acceptance needs. Safety needs, Physiological needs, Need for Self-Actualization

(b) Physiological Needs, Safety needs. Acceptance needs, Need for Self-Actualization

(c) Safety needs, Esteem needs, Need for Self-Actualization. Physiological Needs, Acceptance Needs

(d) Physiological needs, Acceptance needs. Safety needs, Need for Self-Actualization, Esteem Needs

Ans: B

Sol: Maslow's hierarchy of needs

- It is a motivational theory in psychology comprising a five-tier model of human needs

- Needs lower down in the hierarchy must be satisfied before individuals can attend to needs higher up.

- From the bottom of the hierarchy upwards, the needs are: physiological, safety, love and belonging, esteem and self-actualization.

- Physiological needs - These are biological requirements for Human survival, e.g. air, food, drink, shelter, clothing, warmth, sex, sleep. If these needs are not satisfied the human body cannot function optimally

- Safety needs - protection from elements, security, order, law, stability, freedom from fear.

- Love and belongingness needs - after physiological and safety needs have been fulfilled, the third level of human needs is social and involves feelings of belongingness. The need for interpersonal relationships motivates behavior

- Esteem needs - which Maslow classified into two categories: (i) esteem for oneself (dignity, achievement, mastery, independence) and (ii) the desire for reputation or respect from others (e.g., status, prestige).

- Self-actualization needs - realizing personal potential, selffulfillment, seeking personal growth and peak experiences. A desire “to become everything one is capable of becoming”

Therefore we can say that the correct answer is Physiological Needs, Safety needs. Acceptance Needs, Need for Self-Actualization.

Q4: Which one of the below mentioned transaction is not a non-cash transaction?

(a) The acquision of assets by assuming directly related liabilities

(b) Conversion of debt into equity

(c) Interest on dividend received from investing activities

(d) The acquisition of an enterprise by means of issue of share

Ans: C

Sol: The correct answer is Interest on dividends received from investing activities.

Non-cash expenses are those expenses that are recorded in the income statement but do not involve an actual cash transaction.

Some common noncash transactions include:

Depreciation:

- Depreciation means fall in the value of assets.

- The net result of an asset's depreciation is that sooner or later the asset will become useless. Depreciation does not result in outflow of cash and hence, it is a non-cash expenses.

Amortization:

- Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Concerning a loan, amortization focuses on spreading out loan payments over time.

Unrealized gain:

- The term unrealized gain refers to an increase in the value of an asset, such as a stock position or a commodity like gold, that has yet to be sold for cash. As such, an unrealized gain is one that takes place on paper, as it has yet to be realized

Unrealized loss

Impairment expenses

Stock-based compensation:

- Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business.

- Under US GAAP, stock based compensation (SBC) is recognized as a non-cash expense on the income statement.

- Provision for discount expenses

- Deferred income taxes

Q5: The adjusted present value model used by MNCs to evaluate capital budgeting decision is based on

(a) Gresham's principle

(b) Value additivity approach

(c) Law of one price

(d) Multilateral Netting approach

Ans: B

Sol: The correct answer is Value Additivity Principle

Important Points

Value Additivity Principle

- The Value Additivity Principle in NPV states that the value of the total NPV of a bigger project is equal to the summation of all smaller NPVs of projects. In other words, the summation of all smaller NPVs provides the bigger NPV of an investment project. The NPV of a group of the independent projects will be equivalent to the NPV of all the independent projects.

- If A and B are two smaller projects, then the total NPV of the bigger project (A+B) would be −

- NPV (A+B) = NPV (A) + NPV (B)

- The adjusted present value model used by MNCs to evaluate capital budgeting decision is based on this method

Other Related Points

law of one price (LOOP) :

- The law of one price (LOOP) states that in the absence of trade frictions (such as transport costs and tariffs), and under conditions of free competition and price flexibility (where no individual sellers or buyers have power to manipulate prices and prices can freely adjust), identical goods sold in different locations must sell for the same price when prices are expressed in a common currency

Gresham's law:

- In economics, Gresham's law is a monetary principle stating that "bad money drives out good".

- For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation

Multilateral netting:

- Netting is the process of consolidating payables against receivables between parties.

- Multilateral netting involves pooling the funds from two or more parties so that a more simplified invoicing and payment process can be achieved.

- It is a payment arrangement among multiple parties that transactions be summed, rather than settled individually. Multilateral netting can take place within a single organization or among two or more parties.

Q6: Which one of the following is an operational technique of hedging transaction exposure.

(a) Hedging through money market

(b) Hedging through forward

(c) Hedging through swap

(d) Hedging through leading & lagging

Ans: D

Sol: The correct answer is Hedging through leading & lagging.

Hedging in stock market is a strategy used by investors to reduce the risk of adverse price movements in an asset. It involves taking an offsetting position in a related security or financial instrument, with the goal of minimizing potential losses from market volatility.

Types of Hedging:

Hedging through money market :

- It is a technique used to lock in the value of a foreign currency transaction in a company’s domestic currency.

- Therefore, a money market hedge can help a domestic company reduce its exchange rate or currency risk when conducting business transactions with a foreign company.

- It is called a money market hedge because the process involves depositing funds into a money market, which is the financial market of highly liquid and short-term instruments like Treasury bills, bankers’ acceptances, and commercial paper.

Hedging through forward :

- Forward contract is used for hedging the foreign exchange risk for future settlement.

- For example, An importer or exporter having FX contract limit may lock in current exchange rate by entering into forward contract with the bank to avoid adverse rate movement.

Hedging through swap:

- Currency swaps are a way to help hedge against that type of currency risk by swapping cash flows in the foreign currency with domestic at a pre-determined rate.

Leading and lagging:

- In this timing payments in foreign currencies and take advantage of currency movements.

- Leading is paying in advance, and lagging is paying later, sometimes after the due date. Businesses that use these techniques try to anticipate which way a currency will move and make their transactions accordingly.

- It is a type of operational hedging that is the course of action that hedges the firm's risk exposure by means of non-financial instruments, particularly through operational activities.

Q7: Which of the following factors influence the selection and construction of the scale?

A. Multicollinearity

B. Data properties

C. Number of dimensions

D. Level of Significance

E. Research objectives

Choose the most appropriate answer from the options given below:

(a) A, B, C only

(b) D, E, B only

(c) C, E, B only

(d) A, E, D only

Ans: C

Sol: The correct answer is C, E, B only.

Explanation

- Multicollinearity: Multicollinearity refers to a high degree of correlation between independent variables in a multiple regression model. If such a correlation is found, it makes it difficult to understand the effect of each individual variable. However, multicollinearity is generally a consideration in the model-building step, not in scale selection and construction. Scales are employed to structure responses and don't deal directly with the relationship between multiple predictors.

- Data properties: The nature of the data you are working with can greatly influence the choice and construction of scale. Data properties may include characteristics such as distribution (normal or non-normal), type of data (nominal, ordinal, interval, or ratio), range of values, and the presence of outliers. For example, if you're working with ordinal data, certain scaling methods like Likert scales might be more appropriate.

- Number of dimensions: The number of dimensions in your data, or in other words, the number of variables or characteristics you are analyzing, can affect your scaling choice. In some instances, a unidimensional scaling is used when measurements reflect a single construct. However, when measurements reflect multiple characteristics, multidimensional scaling techniques are employed. These types of scales help to visualize patterns and relations in multi-attribute data sets.

- Level of Significance: The level of significance, often denoted by alpha (α), is a threshold set before the data collection for deciding whether to reject the null hypothesis. It determines the probability of rejecting the null hypothesis when it is true. Mostly used in hypothesis testing, it doesn't fundamentally impact the selection and construction of the scale. In scale selection and construction, the focus is on the properties of the data and research objectives, not testing hypotheses.

- Research objectives: The goals of your research or analysis also play a crucial role in the choice of your scaling method. If your objective is to establish a hierarchy or ranking of data points, an ordinal scale would be suitable. On the other hand, if your goal is to establish distances or intervals between data points, an interval or ratio scale might be more appropriate.

Q8: Arrange the key steps in developing a perceptual map to determine the position of a brand in the market place in sequence:

A. Identify set of competing brands

B. Conduct qualitative research where customers score each brand on all key attributes

C. Put brands on two dimensional maps

D. Aggregate all brands belonging to that category

E. Identify important attributes that consumers use when choosing brands using qualitative research

Choose the correct answer from the options given below:

(a) B, C, E, D, A

(b) D, A, E, B, C

(c) A, C, D, B, E

(d) E, B, C, A, D

Ans: B

Sol: A perceptual map is a chart used to illustrate where a product or brand and its competitors are positioned according to consumer perception.

Steps in developing a perceptual map to determine the position of a brand in the market place

Select attributes

- Attributes are the variables the customer factors into their decision to purchase a product or service.

- Consider the most important aspects of a product and which aspects you'd like to study.

- For example, key attributes for a food product can be its taste, texture, smell and quality, and attributes for a vehicle can be its price, performance and model year

Set Dimentions:

- After attributes, this is the most crucial step to perform.

- Setting dimensions for map allows the customer’s perceptions to reflect clearly.

- This process involves giving numerical values on each axis. More numerical values will cause better mapping

Identify competition

Identify the company's top competition, which can be several businesses or organizations that provide similar products and services.

This step can help in developing a perceptual map showing where the company and its competitors rank in the thoughts and perceptions of customers

Decide Products/Brands

To Map and build a perceptual map for shoes, different shoes from different brands or varying styles need to be selected.

These brands can be competitors or a part of the product umbrella.

This step is crucial to increase the efficiency of map, as when choose the right products, customer perceptions from the map can lead to needed changes

Conduct A Survey

Perceptual maps thrive on data, and conducting surveys are the best way to do that.

The survey building process is as simple as it can get with SurveySparrow, which allows you to get to the analysis and actual mapping stage faster.

Plot the Results and Create The Map

Analyzing Map

Gaps in the grid could indicate new market opportunities, while heavily clustered quadrants could indicate that you need to work on communicating your product's USP.

Therefore we can say that the correct answer is D, A, E, B, C.

Q9: For the interval-scale and ratio-scale data usually which of the following measure of association are used?

A. Kendall's tau b

B. Correlation ratio (eta)

C. Partial correlation

D. Spearman's rho

E. Product moment correlation

Choose the most appropriate answer from the options given below:

(a) A, D, E only

(b) B, A, E only

(c) C, B, E only

(d) D, B, E only

Ans: C

Sol: An interval scale is one where there is order and the difference between two values is meaningful. Examples of interval variables include: temperature (Farenheit), temperature (Celcius),

A ratio variable, has all the properties of an interval variable, and also has a clear definition of 0.0. When the variable equals 0.0, there is none of that variable. Examples of ratio variables include: enzyme activity, dose amount, reaction rate,

Important Points

Correlation ratio (eta)

- A correlation ratio in statistics is a measure of the curvilinear relationship between the statistical variances within individual categories and the variances of the entire population or sample. Scales are defined as the ratio of two standard deviations representing these types of variation.

Partial correlation

- Partial correlation measures the strength of a relationship between two variables, while controlling for the effect of one or more other variables.

Product moment correlation

- Pearson's product moment correlation coefficient (sometimes known as PPMCC or PCC,) is a measure of the linear relationship between two variables that have been measured on interval or ratio scales. It can only be used to measure the relationship between two variables which are both normally distributed.

Other Related Points

Kendall’s Tau-b

- It is a useful measure of correlation because it does not assume any particular distribution for the variables being analyzed.

- Unlike Pearson’s correlation coefficient, Kendall’s Tau-b can be used with both continuous and ordinal variables. This makes it an ideal tool for researchers who are working with non-parametric data or data that does not meet the assumptions of other statistical tests.

- Kendall’s Tau-b is also useful because it is less sensitive to outliers than other

Spearman's rho

- It is a non-parametric statistical test of correlation that allows a researcher to determine the significance of their investigation. It is used in studies that are looking for a relationship, where the data is at least ordinal

Therefore we can say that the correct answer is C, B, E only.

Q10: Tax planning involves which of the following features?

A. It is an inherent right of the taxpayer

B. It has originated from the very existence of certain exemptions, deductions etc

C. Transactions take the form of colorable devices

D. It is legal and accepted by the judiciary

E. It is based on the principle of disclosure

Choose the most appropriate answer from the options given below:

(a) A, B, D only

(b) B, D, E only

(c) B, C, D only

(d) A, D, C only

Ans: B

Sol: Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow us to pay the lowest taxes possible.

Features of Tax Planning

Object:

- The main object of tax planning is to reduce tax liability. This object is achieved by claiming deductions, reliefs and rebates allowed under the Act.

Ethical:

- Tax planning is ethical because it is an act within the four corners of the Act and it is not a colourable device to avoid the tax. It is based on the principle of disclosure

Basis:

- The basis of tax planning is claiming the deductions, rebates and reliefs which have been provided in the Act to achieve certain social and economic goals. It has originated from the very existence of certain exemptions, deductions etc

Study and analysis:

- Tax planning requires a thorough knowledge of the Act and analysis of its provisions so that tax liability may be reduced by fulfilling the conditions laid down in the Act.

Term:

- Tax planning can be short-term tax planning or long-term tax planning. When it is resorted to for the current year, it is called short-term tax planning but when it is resorted to availing tax benefits year after year, it is known as long-term tax planning.

It is legal and accepted by the judiciary:

- The Supreme Court of India delivered the first landmark judgement on the distinction between 'tax planning' and 'tax evasion' in the case of CTO Vs McDowell and Co Ltd in 1985, holding that "Tax planning may be acceptable provided it is done within the framework of law.

Therefore we can say that the correct answer is B, D, E only.

Q11: Which expenses are expressly disallowed under profits from Business or Profession?

A. Salary paid out of India or to a non-resident in India

B. Wealth tax

C. Payment to any Rural Development Programme

D. Expenditure incurred by companies on notified skill development project

E. Interest, royalty or fees payable outside India

Choose the correct answer from the options given below:

(a) A, D, E only

(b) A, B, C only

(c) C, D, E only

(d) A, B, E only

Ans: D

Sol: Disallowed Expenditure are those expenses which are not allowed/ cannot be deducted while computing the taxable income under the head “Profits and Gains from Business or Profession”. It means such expenses will be added to the income on which tax needs to be remitted.

Expenses expressly disallowed under profits from Business or Profession are

Payments/ Credits made to Non- Resident, not being a Company or to a foreign Company

- If there is default in the TDS deduction or payment by the payer in respect of the payment/ credit of interest, Royalty, Fee for technical Services or any other sum chargeable under this Act (Other than Salary) to non-Resident, not being a Company or to a foreign Company, then 100% of such expenditure is disallowed in the hands of the payer.

Payment of Salary

- Any Salary payable — Outside India or — To a Non- Resident in India shall be disallowed, if tax has not been deducted or paid on or before the due date prescribed for such deductions

Payment made to State Government

- It includes Royalty, license fee, service fee, privilege fee, service charge or any other fee or charge

Disallowance of Income Tax, Wealth Tax, etc

- Payment of Income tax like TDS, Self Assessment Tax and Wealth tax is not allowed as deduction while computing Profits and Gains from Business or Profession

- Payment to Provident Fund and other Funds

- Any payment to a provident or other fund established for the benefit of the employees shall be disallowed unless the employer has made effective arrangements to secure that tax shall be deducted at source from any payments made from the fund which are chargeable to tax under the head “Salaries

Therefore we conclude that the correct answer is A, B, E only.

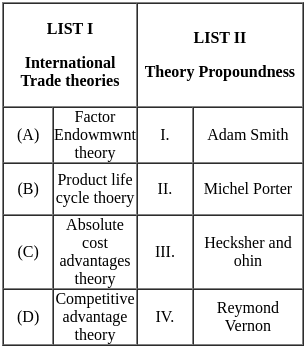

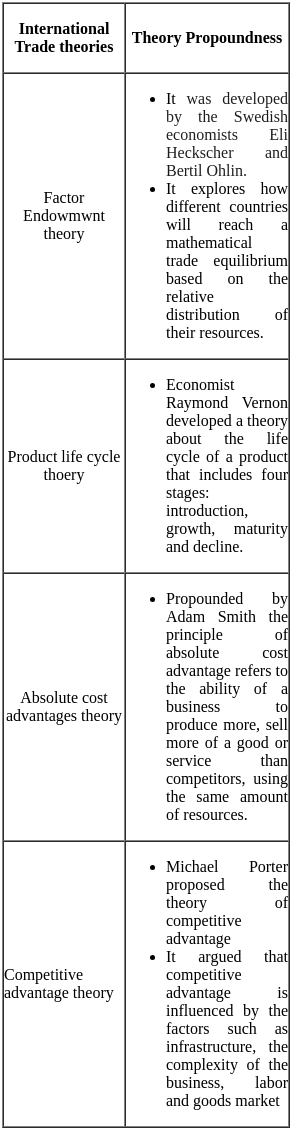

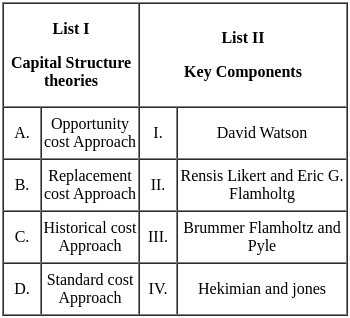

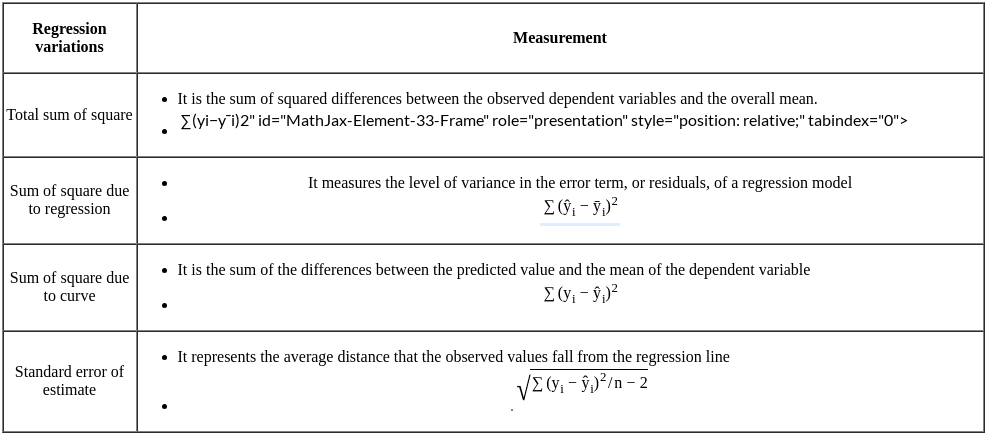

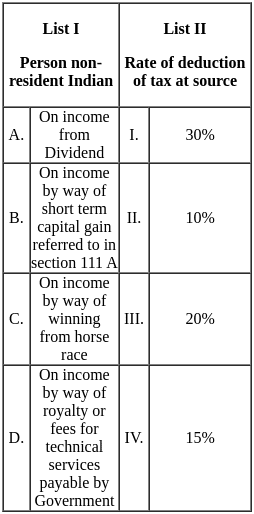

Q12: Match List I with List II.

Choose the correct answer from the options given below:

(a) A - I, B - III, C - II, D - IV

(b) A - III, B - IV, C - I, D - II

(c) A - II, B - IV, C - I, D - III

(d) A - IV, B - I, C - III, D - II

Ans: B

Sol: Explanation  Therefore we conclude that the correct answer is A - III, B - IV, C - I, D - II.

Therefore we conclude that the correct answer is A - III, B - IV, C - I, D - II.

Q13: _____ are the moral principles and values that guide behavior within the field of marketing and cover issues such as product safety. and truthfulness in marketing. communication. honesty in relationships with customers distributors, pricing issue,s and the impact of marketing decisions on the environment and society.

(a) Sustainable practices

(b) Marketing ethics

(c) Positioning principles

(d) Corporate social responsibility

Ans: B

Sol: The correct answer is Marketing ethics .

Important Points

Marketing ethics

- It refers to the principles and values that guide the behavior of marketers, emphasizing honesty, responsibility, fairness, and respect for consumers and society

- Marketing ethics are a set of moral principles that guide a company's promotional activities.

- Ethical marketing refers to a marketer’s obligation to ensure all marketing activities stick to core ethics principles, involving integrity, humility, and honesty — both internally and externally.

Other Related Points

Sustainability:

- As per UN World Commission on Environment and Development: “sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

Positioning:

- "Positioning" is the process that produces the product's image and places it in the consumer's mind. Positioning is the main process behind how consumers become aware of brands and their reputations

Corporate social responsibility:

- Corporate social responsibility or corporate social impact is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable institution.

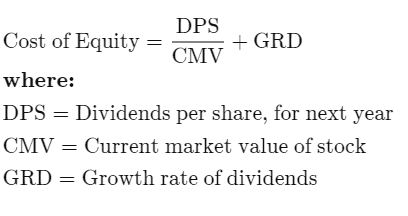

Q14: A company's stock sells for Rs. 63. The company pays an annual dividend of Rs. 3 per share and has long established record of increasing its dividend by a constant 5% annually. For this company, the cost of equity (Ke) is ______.

(a) 13%

(b) 14%

(c) 10%

(d) 8%

Ans: C

Sol: The correct answer is 10%

Cost of equity

- It is the return that a company requires for an investment or project, or the return that an individual requires for an equity investment.

- The formula used to calculate the cost of equity is either the dividend capitalization model or the CAPM.

Here DPS=3 Rs

CMV=63 Rs

GRD=0.05

Putting values in above formula

=(3/63)=0.05

0.0976 ~ 10%

Q15: Which are the conditions in which unilateral relief is granted in cases where section 90 is not applicable in income tax?

A. a resident of India in the previous year", "accrues".

B. The income should have accrued out side India

C. The assessee should not have paid the tax in such foreign country by deduction

D. The income should not accrued outside India

E. The income should be taxed both in India and a foreign country with which India has no agreement for relief

Choose the correct answer from the options given below:

(a) A, B, E only

(b) B, C, E only

(c) A, D, E only

(d) A, C, E only

Ans: A

Sol: When there is no agreement between the home and resident countries, the home country is responsible for offering tax relief and preventing double taxation. Section 91 discusses the unilateral relief segment in detail.

Tax relief under Section 90

- Tax relief under Section 90 is for those who accrue income from global sources.

- This section also has provisions per which the Central government can enter into DTAA agreements with the government outside India.

- For tax relief under this a resident of India in the previous year", "accrues".

- Tax relief under Section 90A If India has entered into DTAA with the specified association, tax relief will be calculated as per the norms of Section 90 If the resident does not belong to India, they have to obtain a tax residence certificate (TRC) from the country to which they belong

- If India and a foreign country have a DTAA (Double Taxation Avoidance Agreement), relief is available under Section 90. If a DTAA exists with a particular association, there is tax relief under Section 90A. If India and a foreign country do not have a DTAA, relief is available under Section 91

Here are the basic rules for computing tax relief under Section 90

- Add both the income from India and foreign countries which is the global income Compute tax on the global income

- Calculate the average tax rate by dividing the computed tax by global income

- Calculate the amount of tax to be paid in a foreign country by diving the income accrued from the foreign country with the average tax rate computed above

- The tax relief that a taxpayer is subjected to get will be lower out of the amount computed above or the fixed value of tax to be paid.

Therefore we can say that the correct answer is A, B, E only.

Q16: When technology allows many firms to operate efficiently in the markets, which market structure represents a better use of society's resources?

(a) Perfect competition

(b) Monopoly

(c) Monopolistic Competition

(d) Oligopoly

Ans: A

Sol: The correct answer is Perfect competition .

There are four types of competition in a free market system: perfect competition, monopolistic competition, oligopoly, and monopoly.

Important Points

Perfect competition

- It occurs when all companies sell identical products, market share does not influence price, companies are able to enter or exit without barriers, buyers have perfect or full information, and companies cannot determine prices.

Following are the characteristics of perfect competition:

- Large numbers of buyers and sellers in the market.

- Free entry and exit of firms in the market.

- Each firm should be selling a homogeneous product. Buyers and sellers should possess complete knowledge of the market.

- No price control.

- When technology allows many firms to operate efficiently in the markets, this market structure represents a better use of society's resources

Other Related Points

- Under monopolistic competition, many sellers offer differentiated products—products that differ slightly but serve similar purposes. By making consumers aware of product differences, sellers exert some control over price.

- In an oligopoly, a few sellers supply a sizable portion of products in the market. They exert some control over price, but because their products are similar, when one company lowers prices, the others follow.

- In a monopoly, there is only one seller in the market. The market could be a geographical area, such as a city or a regional area, and does not necessarily have to be an entire country. The single seller is able to control prices.

Q17: Arrange the steps for verification and value of furniture and fixtures by an auditor.

Ensure that the amount and rate of

A. Depreciation charged on different items is based on fair estimate of their working life

B. Check that repair to furniture if any, during the current year is debited to Profit and loss Account

C. Verify with reference to the purchase invoice in case of the assets have been acquired during the current accounting period

D. See that payment made on account of purchases of any item of furniture and fixture through the invoices of the suppliers

E. Check that a stock register is maintained containing the details of the various items purchased

Choose the correct answer from the options given below:

(a) C, E, A, B, D

(b) A, B, C, D, E

(c) B, C, D, A, E

(d) A, E, C, D, B

Ans: A

Sol: Steps for verification and value of furniture and fixtures by an auditor.:

- 1. The auditor has to see that a proper record showing quantitative details of furniture and fixtures owned by the client is maintained.It is to be Verified with reference to the purchase invoice in case of the assets have been acquired during the current accounting period

- 2. The auditor has to see that all expenses incidental to the purchase of furniture and fixtures is capitalised along with the purchase price paid for it.He must Check that a stock register is maintained containing the details of the various items purchased

- 3. The auditor has to inquire whether the furniture and fixtures have been properly insured or not.

- 4. The auditor has to see that adequate provision for depreciation on furniture and fixtures is made. Depreciation charged on different items is based on fair estimate of their working life

- 5. The auditor if possible can go for physical verification of furniture on test check basis or he can rely on the management certificate to that effect.Check that repair to furniture if any, during the current year is debited to Profit and loss Account.

- 6.See that payment made on account of purchases of any item of furniture and fixture through the invoices of the suppliers

- 7. He has to further see that any damaged or unusable furniture, if existing, is fully written off in the books.

Therefore we can say that the correct sequence is C, E, A, B, D.

Q18: Which of the following are necessary characteristics of modern selling?

A. Database and knowledge management

B. Brand extension

C. Customer relationship management

D. Segmentation, targeting and positioning

E. Satisfying needs and adding value

Choose the most appropriate from the options given below:

(a) A, C, E only

(b) B, C, D only

(c) C, D, E only

(d) A, D, E only

Ans: A

Sol: Modern selling combines new tools and modern sales techniques, such as digital selling and social selling, to find, engage, and connect with potential customers.

Characteristics of modern selling

Customer maintenance and deletion:

- Many companies have discovered that 80 per cent of their sales come from 20 per cent of their customers. This means that it is very important to devote substantial resources to retaining existing high volume, high potential and highly profitable customers.

- Key account management has turn out to be an important form of sales organization because a salesperson or sales team can focus their efforts on one or a few chief customers.

Database and knowledge management:

- The modern sales force needs to be qualified in the Use and creation of customer databases, and how to use the internet to assist the sales task (e.g. finding customer and competitor information). In the past, sales people recorded customerinformation on cards and sent in the information through the post to head office.

Customer relationship management:

- Customer relationship management requires that the sales force focuses on the long term and not just on closing the next sale. The emphasis should be on creating win–win situations with customers so that both parties to the dealings gain and want to carry on the relationship.

Satisfying needs and adding value:

- Delivering added value for customers is all about understanding their circumstances, needs and preferences – at a specific moment in time. What customers perceive as a value add depends on who they are, what makes them tick and exactly what they need at a given moment.

Problem solving and system selling:

- Much of modern selling, mainly in business to business situations, is based upon the salesperson performing as a consultant working with the customer to spot problems, find out needs and propose and implement effective solutions.

Therefore we can say that the correct answer is A, C, E only.

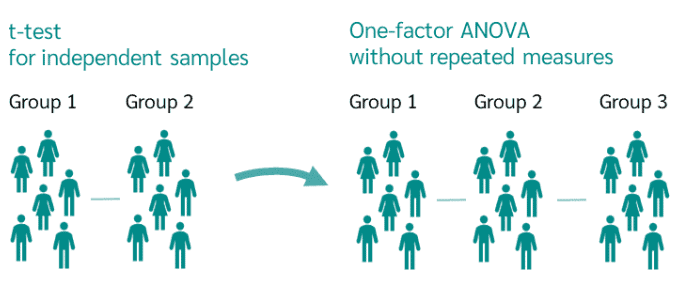

Q19: One factor Analysis of Variance (ANOVA) ______.

(a) is a perfect generalization of the t-test for paired observations.

(b) requires that the number of observations in each group be identical

(c) has less power when the number observations in each group is not identical

(d) is extremally sensitive to slight departure from normality

Ans: C

Sol: The correct answer is has less power when the number observations in each group is not identical

ANOVA:

- The one factorial analysis of variance tests whether there is a difference between the means of more than 2 groups. Thus, one-way ANOVA is the extension of the independent t-test to more than two groups or sample.

- It is most often employed when there are at least three groups of data, otherwise a t-test would be a sufficient statistical analysis.

- It has less power when the number observations in each group is not identical

For a one-factor ANOVA to be calculated, the following conditions must be met:

1. Level of scale

- The scale level of the dependent variable should be metric, that of the independent variable nominally scaled.

2. Independence

- The measurements should be independent, i.e. the measured value of one group should not be influenced by the measured value of another group.

3. Homogeneity

- The variances in each group should be approximately equal. This can be checked with the Levene test.

4. Normal distribution

- The data within the groups should be normally distributed.

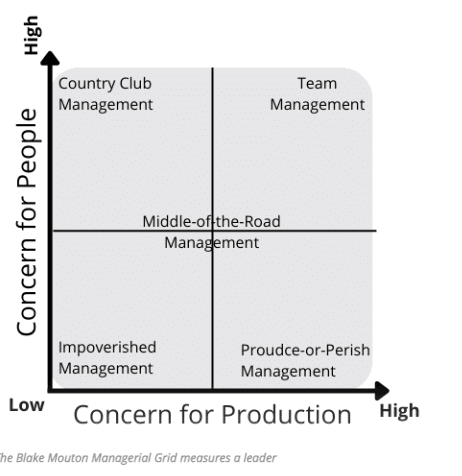

Q20: Blake and Mouton recognise four leadership styles. One of them is the autocratic task management style. The autocratic task manager 1s one who

(a) Concern themselves very little with either people or production and have minimum involvement in their jobs.

(b) Display in their actions, the highest possible dedication both to people and to production.

(c) are concerned only with developing an efficient operation who have little or no concern for people

(d) have little or no concern for production but are concerned only for people

Ans: C

Sol: The Blake and Mouton Managerial Grid

- It is a mental framework and graphic created by Robert Blake and Jane Mouton that can be used to help leaders identify their own leadership style and the style of their subordinates. The x-axis of the grid measures a leader's concern for production. The y-axis of the grid measures a leader's concern for people.

- The five leadership styles identified in the Blake Mouton Managerial resulting from a specific combination of a leader's concern for production and a leader's concern for people.

- These styles are known as country club management, impoverished management, middle-of-the-road management, produce or perish management, and team management.

Impoverished Management – Low Results/Low People

The Impoverished or "indifferent" manager is mostly ineffective. With a low regard for creating systems that get the job done, and with little interest in creating a satisfying or motivating team environment

- Produce-or-Perish Management – High Results/Low People Also known as "authoritarian" or "authority-compliance" managers, people in this category believe that their team members are simply a means to an end. The team's needs are always secondary to its productivity. This type of manager is autocratic, has strict work rules, policies and procedures, and can view punishment as an effective way of motivating team members.

Middle-of-the-Road Management – Medium Results/Medium People

- A Middle-of-the-Road or "status quo" manager tries to balance results and people, but this strategy is not as effective as it may sound. Through continual compromise, they fail to inspire high performance and also fail to meet people's needs fully.

- Country Club Management – High People/Low Results The Country Club or "accommodating" style of manager is most concerned about their team members' needs and feelings.

- Team Management – High Production/High People According to the Blake Mouton model, Team Management is the most effective leadership style. It reflects a leader who is passionate about their work and who does the best they can for the people they work with.

Therefore we can say that the correct answer is are concerned only with developing an efficient operation who have little or no concern for people .

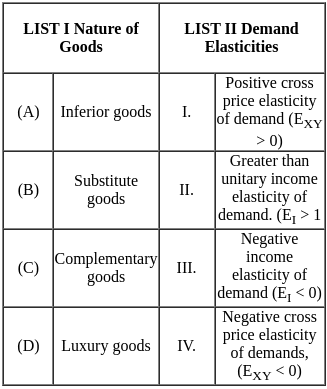

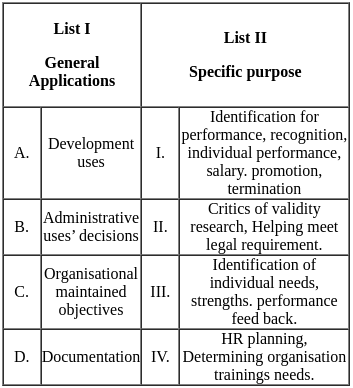

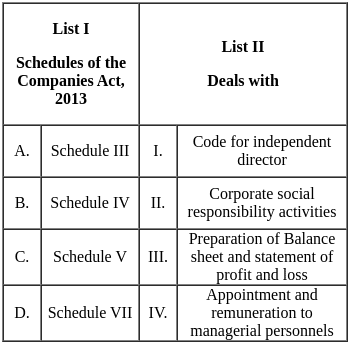

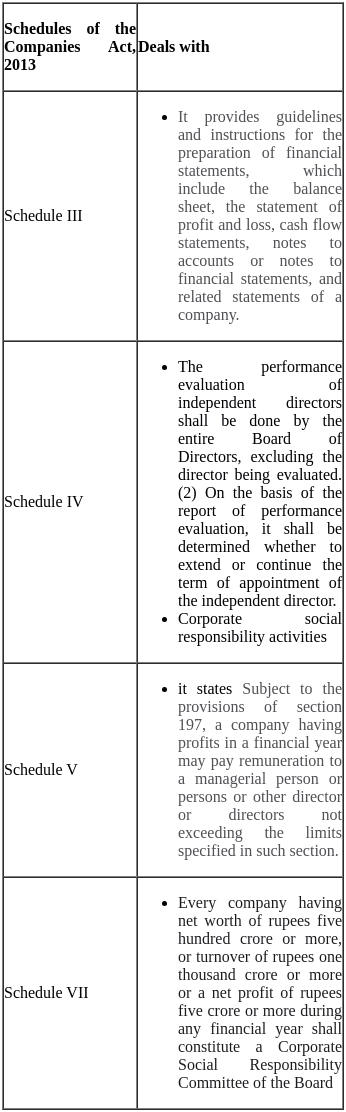

Q21: Match List I with List II.

Choose the correct answer from the options given below:

(a) A - III, B - IV, C - II, D - I

(b) A - III, B - I, C - IV, D - II

(c) A - II, B - I, C - III, D - IV

(d) A - IV, B - III, C - I, D - II

Ans: B

Sol: The correct answer is A - III, B - I, C - IV, D - II.

Important Points Inferior goods -

- Inferior goods are a type of good for which demand tends to decrease as consumer incomes rise and increase as consumer incomes fall.

- This is reflected in the concept of negative income elasticity of demand (Elasticity of Income, EI < 0).

- The negative income elasticity indicates that as consumers' incomes increase, which are likely to shift their consumption towards higher-quality or more desirable goods, leading to a decrease in demand for the inferior good.

Substitute goods -

- Substitute goods are products that can be used in place of each other, meaning that satisfy similar needs or desires.

- When the price of one substitute good increases, the demand for the other substitute tends to increase.

- This relationship is reflected in the concept of positive cross-price elasticity of demand (EXY > 0).

- Positive cross-price elasticity means that an increase in the price of one good leads to an increase in the quantity demanded of the other good.

Complementary goods -

- Complementary goods are products that are typically used together, so an increase in the price of one complementary good tends to lead to a decrease in the demand for the other, and vice versa.

- This is reflected in the concept of negative cross-price elasticity of demand (EXY < 0).

Luxury goods -

- Luxury goods typically have an income elasticity of demand (EI) greater than 1.

- This means that as consumer incomes rise, the demand for luxury goods increases at a proportionally higher rate.

- When people's incomes go up, they tend to spend a larger percentage of their income on luxury items.

- Conversely, if incomes fall, the demand for luxury goods tends to decrease at a higher rate.

- For luxury goods, this sensitivity is high, hence the value of EI > 1.

Q22: While using a recruiting yield pyramid, the managers are aware of which of the following while recruiting new hires?

A. The ratio of official needs to actual hires is 2 to 1

B. The ratio of places to the people called for an interview is 12 to 1

C. The ratio of offers male to new hires is 20 to 1

D. The ratio of candidates invited for interviews to candidates interviewed is about 4 to 3

E. The ratio of candidates interviewed to offers made is 3 to 2

Choose the most appropriate from the options given below:

(a) A, D, E only

(b) B, C, D only

(c) A, C, E only

(d) B, D, E only

Ans: A

Sol: The correct answer is A, D, E only.

- The recruiting yield pyramid is a visual representation used by human resource professionals and recruiters to illustrate the various stages of the hiring process and the conversion rates at each stage.

- It helps in analyzing the effectiveness and efficiency of the recruitment process.

Important PointsThe typical stages represented in a recruiting yield pyramid, along with their conversion rates -

- Total Applicants - This is the starting point of the recruitment process, where all potential candidates who apply for a job are considered.

- Screened Applicants - After initial application screening, some candidates may not meet the minimum qualifications and are screened out.

- Candidates Invited for Interview - From the screened applicants, a portion will be invited for an interview. This could be a phone interview, a video interview, or an in-person interview.

- Candidates Interviewed - This represents the number of candidates who actually go through the interview process.

- Offers Extended - After the interview process, some candidates will receive job offers.

- Offers Accepted - Out of the candidates who receive offers, some will accept and join the organization.

As per question,

- The ratio of official needs to actual hires is 2 to 1 - This means for every two positions that are officially needed, only one person is actually hired.

- The ratio of candidates invited for interviews to candidates interviewed is about 4 to 3 - This means for every four candidates invited for an interview, three are actually interviewed.

- The ratio of candidates interviewed to offers made is 3 to 2 - This means for every three candidates interviewed, two receive offers.

Thus, correct option 1 is A, D, and E only.

Q23: Sequence the following steps in the process of securitisation.

A. Special purpose vehicle (SPV) issue tradeable securities to find the purchase of pool of assets

B. SPV subcontracts (outsource) the originator for collection of interest and principle payments on the pool of assets

C. SPV repay the funds to the investor or cashflow arise on the pool of assets

D. Originator maker a pool of assets and sold it to the SPV

E. SPV pays the funds the orgination for the pool of assets

Choose the correct answer from the options given below:

(a) B, D, A, C, E

(b) D, E, B, A, C

(c) D, B, A, E, C

(d) E, A, B, D, C

Ans: B

Sol: The correct answer is - D, E, B, A, C

D: Originator creates a pool of assets and sells it to the SPV – First step, pooling and transferring assets.

E: SPV pays the funds to the originator for the pool of assets – SPV raises funds and pays the originator.

A: SPV issues tradeable securities to fund the purchase of assets – SPV issues securities to investors.

B: SPV subcontracts the originator for collection of interest and principal payments – SPV delegates collection to the originator.

C: SPV repays the funds to the investor as cash flow arises – Investors receive returns from asset cash flows.

Additional Information

Securitisation Process

- Securitisation is a financial process where assets are pooled together and then converted into tradeable securities.

- The SPV plays a critical role in isolating the pool of assets from the originator’s balance sheet, thus reducing risk and enabling easier access to capital.

Role of SPV

- The SPV is a legal entity created solely for the purpose of holding the asset pool and issuing the securities.

- It helps protect investors by ensuring that the underlying assets are legally separated from the originator.

Investors in Securitisation

- Investors in securitisation typically include institutions like banks, pension funds, and mutual funds that seek to invest in asset-backed securities.

- These investors receive periodic payments based on the cash flows generated by the underlying assets in the pool.

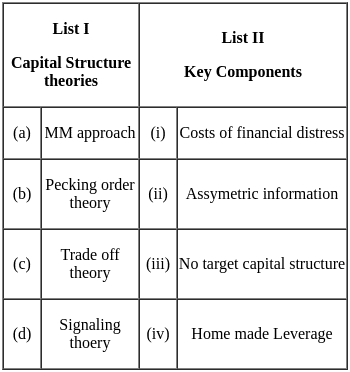

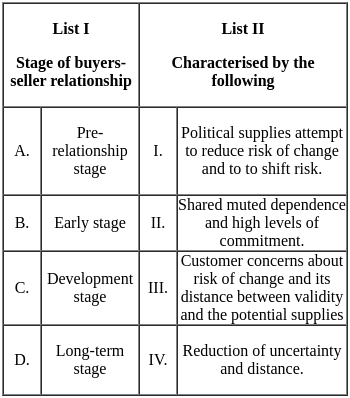

Q24: Match List I with List II.

Choose the correct answer answer from the options given below:

(a) A - III, B - II, C - IV, D - I

(b) A - IV, B - III, C - I, D - II

(c) A - IV, B - I, C - III, D - II

(d) A - IV, B - III, C - II, D - I

Ans: B

Sol: The correct answer is A - IV, B - III, C - I, D - II.

Important PointsMM approach - Home made Leverage

- Modigliani-Miller theorem - Investors can create their own leverage by borrowing and investing in risk-free assets.

- Homemade leverage- Investors can replicate the effects of corporate leverage by borrowing and investing in a firm's debt and equity.

Implications -

- Firms' capital structure is irrelevant to investors.

- Firms should focus on maximizing expected future cash flows and reducing risk, regardless of how they finance their operations.

In other words, investors can achieve the same level of risk and return regardless of the firm's capital structure. This is because they can always borrow or lend money to adjust their own leverage.

Pecking order theory - No target capital structure

- The Pecking Order Theory suggests that firms prioritize financing methods in a specific order.

- This begin with internal funds, followed by debt issuance, and finally, equity issuance.

- Unlike the traditional notion of a target capital structure, this theory contends that firms do not have a predetermined mix of debt and equity in mind.

- Instead, they rely on available funds and prefer internal financing due to the asymmetry of information between management and external investors.

- This theory emphasizes the pragmatic approach firms take in their financing decisions.

Trade off theory - Costs of financial distress

- Trade-off theory in finance suggests that companies must strike a balance between the tax benefits of debt financing and the costs associated with financial distress.

- The costs of financial distress include legal and administrative expenses related to bankruptcy proceedings, the loss of customer and supplier relationships, and the decline in the firm's value due to the uncertainty surrounding its financial health.

- Additionally, financial distress can lead to a reduced ability to invest in profitable projects, ultimately impacting the company's long-term viability.

Signaling theory - Asymmetric information

- Signaling theory addresses situations where one party possesses more or better information than another.

- In financial contexts, it often refers to a firm's ability to convey its quality or prospects to investors.

- For example, a company may issue a dividend to signal confidence in its future earnings or undertake a stock buyback to indicate undervaluation.

- These actions are intended to bridge the information gap and convey positive signals to investors, potentially affecting the firm's stock price.

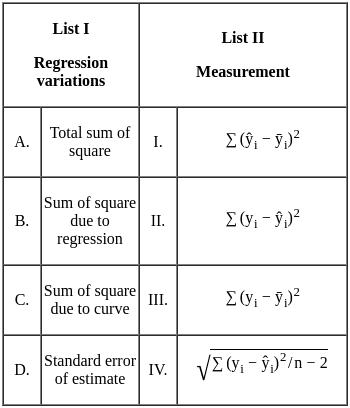

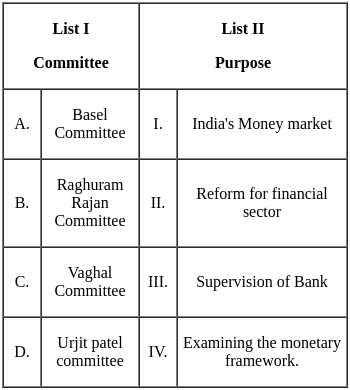

Q25: Match List I with List II.

Choose the correct answer answer from the options given below:

(a) A - I, B - II, C - III, D - IV

(b) A - II, B - III, C - I, D - IV

(c) A - I, B - IV, C - III, D - II

(d) A - IV, B - II, C - III, D - I

Ans: D

Sol: The correct answer is A - IV, B - II, C - III, D - I.

Important PointsOpportunity cost Approach - Hekimian and jones

- Hekimian and Jones' Opportunity Cost Approach is a method for evaluating the cost of equity capital.

- It posits that the cost of equity is equivalent to the return that could be earned on an investment of similar risk elsewhere in the market.

- This approach considers the foregone returns an investor could have earned in alternative investments of comparable risk.

- By comparing the expected returns from different investment opportunities, it helps determine the appropriate cost of equity for a company.

Replacement cost Approach - Rensis Likert and Eric G. Flamholtz

- The Replacement Cost Approach was introduced by Rensis Likert and Eric G. Flamholtz.

- It is a method used in financial accounting that values assets based on the cost to replace them at current market prices.

- This approach provides a more accurate reflection of a company's true economic worth, especially in times of inflation or changing market conditions.

- By considering the cost of acquiring or replicating assets, it offers a more realistic assessment of a company's value compared to historical cost accounting methods.

- The Historical Cost Approach, associated with Brummer, Flamholtz, and Pyle, is an accounting method that values assets at their original purchase cost.

- This approach does not consider changes in market value or inflation over time.

- It is straightforward and easy to implement, providing a reliable record of transactions.

- However, critics argue that it may not reflect the true economic value of assets, especially in times of inflation or rapidly changing market conditions.

Standard cost Approach - David Watson

- The Standard Cost Approach, associated with David Watson, is a method used in managerial accounting to establish predetermined, standard costs for producing goods or services.

- These standard costs are based on a detailed analysis of past performance, industry benchmarks, and other relevant factors.

- Deviations from the standard costs can indicate areas where operations may need improvement or where there may be unexpected efficiencies.

- This approach helps in cost control and performance evaluation within an organization.

Q26: The utilitarian view of ethics is one of the few perspectives on business ethics and it includes:

A. Respecting and protecting individual liberties and privileges

B. Imposing and enforcing rules fairly and impartially

C. Ethical decisions made solely on the basis of their outcomes or consequences

D. Encourages efficiency and productivity and is consistent with goal of profit maximisation

E. Ethical decisions be learned on existing ethical norms in industries and communities

Choose the most appropriate from the options given below:

(a) A, E only

(b) C, D only

(c) B, C only

(d) D, E only

Ans: B

Sol: The correct answer is C, D only.

- Business ethics refers to the principles, values, and moral guidelines that guide the behavior and decision-making processes within a business or organizational context.

- It encompasses the standards of conduct and integrity that individuals and organizations should uphold while conducting their operations.

Important Points

- The utilitarian view of ethics in business holds that decisions should be based on maximizing overall happiness or utility.

- It prioritizes actions that lead to the greatest benefit for the greatest number of people involved, considering stakeholders' well-being.

- This perspective assesses ethical choices based on their outcomes and consequences rather than strict adherence to rules or norms.

- It encourages efficiency and productivity, aligning with the goal of profit maximization for the overall benefit of society.

- However, critics argue that it can sometimes overlook the rights and interests of minority stakeholders in pursuit of the greatest overall good.

- As per questions, point C and D,

- The utilitarian view of ethics emphasizes making ethical decisions solely based on their outcomes or consequences. This means that an action is considered ethical if it leads to the greatest overall happiness or utility for the greatest number of people.

- The utilitarian view encourages efficiency and productivity and is consistent with the goal of profit maximization. This is because, under utilitarianism, actions that lead to greater overall utility, which can include financial well-being, are considered ethically favorable.

Q27: The coexistence and cooperation between the formal and informed financial sector is commonly referred to as:

(a) Flexibility of operation

(b) Financial dualism

(c) Well regulated financial system

(d) Catering the financial needs of modern economy

Ans: B

Sol: The correct answer is financial dualism.

- The formal financial sector refers to regulated and organized institutions like banks, credit unions, and financial markets that operate under government supervision.

- On the other hand, the informal financial sector consists of unregulated and often community-based systems, like moneylenders, rotating savings and credit associations (ROSCAs), and microfinance groups.

Important Points

- Financial dualism refers to the coexistence of a formal and informal financial sector in an economy.

- The formal financial sector is regulated by the government and includes banks, microfinance institutions, and other financial institutions that offer a variety of financial services, such as savings accounts, loans, and insurance.

- The informal financial sector is unregulated and includes a variety of traditional financial institutions, such as money lenders, rotating savings and credit associations (ROSCAs), and pawnbrokers.

- Financial dualism may exist because of cultural factors. Some people may prefer to use the informal financial sector because it is more familiar to them or because they do not trust the formal financial sector.

- There are a number of benefits to financial dualism.

- The informal financial sector can provide financial services to people who would not otherwise have access to them.

- This can help to promote economic growth and development. The informal financial sector can also help to reduce poverty by providing people with the financial resources they need to start or grow a business.

some examples of cooperation between the formal and informal financial sectors -

- Banks may offer mobile banking services to reach customers in rural areas.

- Insurance companies may offer micro-insurance products to low-income people.

- Governments may provide training and financial support to informal financial institutions.

Q28: Identify the correct sequence of the leadership development process as adopted by Anderson Consulting.

A. Coach executive terms on individual leadership and effective teamwork

B. Assess organisation's direction and current strategies speed at which successful results he achieved

C. Create effective communication strategies for key influences directors shareholder employees etc

D. coach individual executives performed behavior along communications

E. Assessing the organization's culture, defining expected shifts, and developing an action plan for change in the work culture by the person leading the charge.

Choose the correct answer from the options given below:

(a) C, D, B, A, E

(b) E, B, A, C, D

(c) D, A, B, E, C

(d) B, E, D, A, C

Ans: D

Sol: The correct answer is B, E, D, A, C.

- Leadership development process refers to a structured and intentional approach to nurturing and enhancing leadership skills and qualities in individuals.

- It involves activities, training, and experiences aimed at cultivating traits like communication, decision-making, and team building.

Important Points

- Anderson Consulting's leadership development process is based on the belief that leadership is a skill that can be learned and developed.

- The process is designed to help employees to develop the skills and knowledge they need to be effective leaders.

- Anderson Consulting uses a variety of methods to identify the employees who have the potential to become leaders in the future.

The correct sequence of the leadership development process as adopted by Anderson Consulting is as follows -

- Identify the leadership talent pipeline - This involves identifying the employees who have the potential to become leaders in the future. Anderson Consulting uses a variety of methods to do this, including performance reviews, assessments, and feedback from managers.

- Develop a leadership development plan for each employee - This plan should be tailored to the individual's needs and goals, and it should identify the specific training and development activities that the employee needs to undertake.

- Provide leadership training and development opportunities - Anderson Consulting offers a variety of leadership training programs, including in-class training, online courses, and coaching.

- Provide mentorship and support - Anderson Consulting encourages its leaders to mentor and support their employees. This can help employees to develop their leadership skills and to prepare for more senior roles.

- Evaluate the effectiveness of the leadership development process - Anderson Consulting regularly evaluates the effectiveness of its leadership development process to ensure that it is meeting the needs of the organization and its employees.

Q29: Which of the following enumerates the distinctive features of Management Audit?

A. It is an appraisal of both policies and actions

B. It is preventive as well as creative check of cost accounting data

C. It is organisation oriented

D. It is dynamic and result oriented rather than simply procedure bound

E. It ensures the sound and healthy growth of business organisation

Choose the correct answer from the options given below:

(a) A, B, D only

(b) A, C, E only

(c) B, D, E only

(d) A, D, E only

Ans: D

Sol: The correct answer is A, D, E only. Explanation

- A management audit is an independent and systematic evaluation of an organization's management system and processes.

- It is conducted to assess the effectiveness and efficiency of management in carrying out its responsibilities, and to identify areas for improvement.

- Management audits can be conducted by internal auditors, external auditors, or a combination of both.

- Internal auditors are employees of the organization, while external auditors are independent contractors.

Important Points

The distinctive features of management audit -

Comprehensive -

- Management audits involve a thorough assessment of various aspects of management practices, processes, and performance within an organization.

- It aims to provide a holistic view of how the organization is managed.

Objective -

- The audit is conducted with objectively and impartiality.

- The auditors or consultants conducting the management audit should not have any bias that could influence their findings and recommendations.

Systematic -

- Management audits follow a structured and systematic approach to gather relevant data, analyze information, and identify areas of improvement.

- It ensures that the audit is conducted in a methodical manner.

Appraisal of both policies and actions -

- Management audit is not just a review of the organization's policies and procedures.

- It also assesses how effectively these policies and procedures are being implemented.

Dynamic and result oriented -

- Management audit is not a static process.

- It must be flexible enough to adapt to changes in the organization's environment and to new challenges that the organization faces. Management audit is also focused on achieving results.

- It is not simply a compliance exercise.

Sound and healthy growth of the organization -

- The ultimate goal of management audit is to help the organization to grow and succeed.

- Management auditors identify areas where the organization can improve its performance and efficiency.

Thus, correct answer is A, D, E only.

Q30: Matrix structure is the realisation of two dimensional structure which emanates directly from two dimensions of authority. From which of the two, a is matrix structure is created?

(a) Functional and divisional

(b) Functional and project

(c) Functional and line

(d) Divisional and line

Ans: B

Sol: The correct answer is Functional and project.Important Points

- A matrix structure is a combination of two or more organizational structures, such as functional and project management.

- In a matrix structure, employees report to both a functional manager and a project manager.

- The functional manager is responsible for the employee's day-to-day work, while the project manager is responsible for the employee's work on a specific project.

The two dimensions of authority in a matrix structure are -

- Functional authority - Functional authority is the authority to make decisions about the work of a department or function. Functional managers have functional authority over their employees.

- Project authority - Project authority is the authority to make decisions about the work of a specific project. Project managers have project authority over the employees assigned to their projects.

- The two-dimensional structure of a matrix structure is created by the intersection of functional authority and project authority.

- This can be visualized as a grid, with functional departments on one axis and projects on the other axis.

- Employees in a matrix structure are located at the intersection of their functional department and the project(s) they are assigned to.

Q31: The problem of persistent current account deficit can be avoided by pursuing which of the following polices?

A. Encouraging Savings

B. Controlling fiscal deficit

C. Devaluation of the domestic currency

D. Curtailing productivity

E. Reduced dependence in costly external commercial borrowings

Choose the correct answer from the options given below:

(a) A, B, D only

(b) B, C, E only

(c) C, D, E only

(d) D, E, A only

Ans: B

Sol: The correct answer is B, C, E only.

Explanation

- A current account deficit indicates that a nation is importing more goods, services, and capital than it is exporting.

- This deficit must be financed through borrowing or by using reserves.

- A sustained current account deficit can lead to a nation's increased indebtedness or a decrease in its foreign exchange reserves, which can have implications for its overall economic stability and long-term growth.

Important Points The problem of persistent current account deficit can be avoided by pursuing the following policies -

Controlling fiscal deficit -

- A fiscal deficit is when a government spends more money than it collects in taxes.

- This can lead to a current account deficit because the government needs to borrow money to finance its spending.

- By controlling the fiscal deficit, the government can reduce its need to borrow money and improve the current account balance.

Devaluation of the domestic currency -

- Devaluation of the domestic currency makes exports cheaper and imports more expensive.

- This can lead to an increase in exports and a decrease in imports, which can help to improve the current account balance.

Reduced dependence in costly external commercial borrowings -

- External commercial borrowings are loans that a country takes from foreign banks and other financial institutions.

- These loans can be expensive, and they can increase a country's debt burden.

- By reducing its dependence on external commercial borrowings, a country can improve its current account balance.

The other options are not effective ways to reduce a persistent current account deficit -

- Encouraging Savings - Encouraging savings can help to reduce the demand for imports, but it will not necessarily lead to an increase in exports.

- Curtailing productivity - Curtailing productivity will lead to a decrease in both exports and imports. However, it will also lead to a decline in economic growth.

Q32: One of the key assumptions of the Boston Consulting Group Growth Share matrix is

(a) Cash flow can be equated with profitability.

(b) Market share has a positive effect on cash flow as profits are related to market share.

(c) Market share acts as a proxy to competitive strength.

(d) Market growth rate cannot be used as a proxy to market attractiveness.

Ans: B

Sol: The correct answer is Market share has a positive effect on cash flow as profits are related to market share.

- The Boston Consulting Group (BCG) Growth-Share Matrix is a portfolio planning tool that helps businesses make strategic decisions about their product portfolio.

- It plots businesses into four quadrants based on market growth and relative market share: stars, cash cows, question marks, and dogs.

- The BCG Growth-Share Matrix can be used to make a variety of strategic decisions, such as which businesses to invest in, divest, or price differently.

Important PointsThe correct answer is Market share has a positive effect on cash flow as profits are related to market share.

- The BCG Growth-Share Matrix is based on the assumption that market share has a positive effect on cash flow.

- This is because businesses with a higher market share are more likely to have economies of scale, which can lead to lower costs and higher profits.

- Additionally, businesses with a higher market share are more likely to be able to charge higher prices for their products or services.

The other options are not assumptions of the BCG Growth-Share Matrix -

- Cash flow can be equated with profitability - Cash flow and profitability are not the same thing. Cash flow is the movement of money in and out of a business, while profitability is the amount of money that a business makes after all expenses have been paid.

- Market share acts as a proxy to competitive strength - Market share is not a perfect proxy for competitive strength. There are other factors that can contribute to competitive strength, such as customer loyalty, brand recognition, and product differentiation.

- Market growth rate cannot be used as a proxy to market attractiveness - Market growth rate can be used as a proxy for market attractiveness. A market with a high growth rate is likely to be more attractive to businesses than a market with a low growth rate.

Q33: Which one of the following is concerned with Endowment Policy?

(a) The issuer has advantage of receiving money at regular intervals of the policy with a specific sum of money at the expiry of the policy

(b) At the expiry of the policy. the insured receives the sum of insurance policy

(c) It covers the insured for the whole life. His nominee receives the assured sum with bonus after the death of insured

(d) The premium cost is high. If the insurer dies, the nominee receives the insurance amount

Ans: B

Sol: The correct answer is At the expiry of the policy. the insured receives the sum of insurance policy.

- An endowment policy is a type of life insurance contract that provides both a death benefit and a savings or investment component.

- It combines insurance coverage with a savings plan, allowing the policyholder to accumulate a lump sum amount over a specified period.

- If the policyholder survives the policy term, they receive the accumulated amount as a maturity benefit; in case of demise during the term, the beneficiary receives the death benefit.

- Additionally, endowment policies often offer bonuses or returns on investments, making them a popular choice for individuals seeking a combination of protection and savings.

- They are typically used for long-term financial goals like funding education or providing for retirement.

Important Points

Advantages for the Issuer in Receiving Regular Payments and a Specific Amount at Policy Expiry: This describes a scenario where the insurance company (issuer) benefits from receiving the regular premium payments from the policyholder and a certain sum of money at the end of the policy term. While the issuer does indeed receive regular payments in the form of premiums with most insurance policies, the end of the policy term usually involves a payout to the policyholder or their beneficiaries, not the issuer.

Sum of Insurance Paid to the Insured at Policy Expiry: This is a key characteristic of endowment policies. The policyholder, or "the insured," receives a lump sum payment at the end of the policy term if they are still alive. If the policyholder dies during the term, the death benefit is paid to the nominee.

Whole Life Coverage with Sum Assured Plus Bonus to the Nominee after the Policyholder’s Death: This statement is more characteristic of a whole life insurance policy as they are designed to provide lifelong coverage. The policyholder's beneficiaries (or "nominee") receive an assured sum along with any bonuses or dividends upon the policyholder's death.

High-Premium Cost, with the Insurance Amount Going to the Nominee upon the Insurer’s death: While it's true that insurance policies can have high premiums (such as whole life insurance), the receiving of the insurance amount by the nominee upon death of the insurer can be a characteristic of many life insurance policies, not just endowment policies. This statement describes life insurance in a broader sense, so it doesn't specifically pertain to endowment policies.

So, option 2 correctly pertains to the features and benefits of an Endowment Policy.

Q34: Which of the following elements cause problem in application of internal rate of return method while evaluating mutually exclusive projects?

A. Discount rate

B. Timing

C. Scale

D. Reversing flow

E. Leverage

Choose the correct answer from the options given below:

(a) A, B only

(b) D, E only

(c) B, C only

(d) A, D only

Ans: C

Sol: The correct answer is B, C only.

Let's analyze each statement:

Discount Rate

- This option is incorrect because:

- The internal rate of return (IRR) method itself doesn't directly focus on the discount rate; it determines the discount rate that makes the net present value (NPV) zero.

- When comparing mutually exclusive projects, IRR doesn't directly address differences caused by varying discount rates.

Timing

- This option is correct because:

- IRR may not accurately handle projects with different cash flow timings.

- Projects with early returns versus those with later returns can yield misleading IRR results, leading to potentially poor decision-making.

Scale

- This option is correct because:

- The IRR method doesn't consider the scale or size of projects.

- Comparing projects of different scales using IRR can be misleading, as a higher IRR on a small project might be less desirable than a lower IRR on a larger project.

Reversing Flow

- This option is incorrect because:

- Reversing flow (changes in the direction of cash flows) can complicate IRR calculations but isn't a fundamental problem in comparing mutually exclusive projects.

- Multiple IRRs can exist if cash flows change direction, but this issue isn't specific to project scale or timing differences.

Leverage

- This option is incorrect because:

- Leverage refers to the use of borrowed capital to finance a project, which isn't a direct concern when comparing the IRR of mutually exclusive projects.

- IRR analysis typically assumes project financing is separate from evaluation.

Based on the evaluation above, the correct answer is option 3: B and C, as these statements correctly describe aspects of the limitations of the IRR method when evaluating mutually exclusive projects.

Q35: Which of the following shapes are used to describe the long-run average cost curve?

A. S-shape

B. L-shape

C. V-shape

D. U-shape

E. W-shape

Choose the correct answer from the options given below:

(a) A and B only

(b) B and D only

(c) C and E only

(d) C and D only

Ans: B

Sol: The correct answer is B and D only.

- The long-run average cost (LRAC) curve is a graphical representation in economics that illustrates the lowest average cost per unit of output attainable when all factors of production, including capital, are variable.

- In other words, it shows the relationship between the scale of production and the average cost per unit in the long run.

Important Points

The long-run average cost curve (LAC) is a curve that shows the relationship between the average cost of producing a good or service and the quantity of output produced in the long run.

U-shape -

- The LAC curve is typically U-shaped, meaning that the average cost of production decreases as output increases to a certain point, and then begins to increase again.

- The LAC curve is U-shaped for a number of reasons. At low levels of output, firms may experience economies of scale.

- This means that the average cost of production decreases as output increases because the firm is able to spread its fixed costs over a larger number of units.

- However, at high levels of output, firms may experience diseconomies of scale.

- This means that the average cost of production increases as output increases because the firm becomes less efficient.

L-shape -

- The L-shaped LAC curve is a special case of the U-shaped LAC curve.

- It occurs when the firm reaches the minimum efficient scale of production.

- At this point, the average cost of production is the lowest possible and the LAC curve becomes horizontal.